Gold bullion bars are pictured after being inspected and polished at the ABC Refinery in Sydney on August 5, 2020.

DAVID GRAY | AFP | Getty Images

Gold jumped 1% on Monday on optimism around a U.S. stimulus bill and a weakened dollar, despite gains in the stock markets after reports that U.S. President Donald Trump could soon be discharged from the hospital.Spot gold was up 0.7% at $1,912.80 per ounce after hitting the highest since Sept. 22 at $1,918.36. U.S. gold futures settled up 0.7% to $1,920.10.Optimism over fiscal stimulus came into play after upbeat weekend comments from U.S. House […]

Category: Gold

Gold Price Prediction – Prices Consolidate Despite Robust Retail Sales

Gold prices barely moved on Friday inching lower and trading in a very tight range. The dollar declined slightly after rallying on Thursday as US yields consolidated. The movement in the dollar and yield came despite a stronger than expected US retail sales report, that seemed to be countered by a slight dip in US consumer confidence.

Trade gold with FXTM Technical analysis

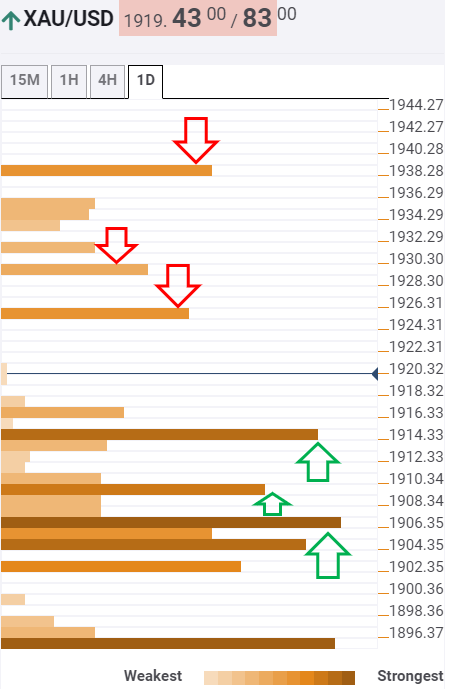

Gold prices edged lower trading sideways and barely moving on Friday. Prices remain above short term support is seen near the 10-day moving average at 1,902. Resistance is seen near the 50-day moving average at 1,927. […]

Gold Price Analysis: XAU/USD eyes $1939 upside barrier amid US stimulus hopes – Confluence Detector

Gold (XAU/USD) buyers are finally extending their control above $1900, rejoicing the renewed optimism over the US fiscal stimulus. The safe-haven US dollar wilts amid a risk-on market mood after US House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin moved closer to an agreement on a fresh coronavirus relief package late Tuesday.

Markets remain hopeful that the stimulus deal will be clinched ahead of the November election and the new funds will boost the demand for gold as an inflation hedge. The stimulus talks are likely to continue this Wednesday. Let’s take a look at how gold is positioned […]

Gold Price Analysis: XAU/USD bulls await fresh clues to probe monthly top below $1,950

Gold buyers catch a breather above $1,920 after posting the biggest gains in a fortnight.

COVID-19 data from US states, Victoria propel fears of wider wave 2.0.

Trump blames Democrats for the delay in stimulus despite recent hopes, EU and the UK resume Brexit talks. US Initial Jobless Claims, aid package updates will be the key. Gold drops to $1,924, after rising for three consecutive days, during the early Asian session on Thursday. The latest challenges to risk-on mood, initially backed by the hopes of the US coronavirus (COVID-19) relief package and a soft Brexit, […]

Did You Participate In Any Of Highland Gold Mining’s (LON:HGM) Incredible 643% Return?

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Don’t believe it? Then look at the Highland Gold Mining Limited ( LON:HGM ) share price. It’s 437% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 10% gain in the last three months.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic […]

Brent Cook’s top gold stock picks, and top risks to flag

Expanded margins have created an optimal environment to invest in miners, but investors should still watch for jurisdictional risks, including the inability for miners to access their sites due to the ongoing pandemic, said Brent Cook, founder of Exploration Insights.

“If the company can’t get to site, that drops them down in terms of our interest,” Cook said.

Cook’s top picks for mining companies include Bluestone Resources (TSXV: BSR.V), Westhaven Gold Corp. (TSXV: WHN.V), and Clean Air Metals (TSXV: AIR.V).In addition, mergers and acquisitions activity have been slowed by COVID-19.“Due diligence required to do mergers and acquisitions and such, has been […]

Gold Weekly Price Forecast – Gold Markets Form Bearish Weekly Candle

Gold markets initially tried to rally during the course of the week, reaching towards the $1940 level before pulling back to form a shooting star. The shooting star of course is a negative candlestick, and it suggests that we could drift lower. With that being the case, I think […]

Gold Price Analysis: Bears seeking a continuation below key daily support

Gold prices are back under pressure and below a critical trendline on the daily chart. The swing trading opportunities are caught up in the wash of volatility. A day trading strategy could offer an opportunity if price obeys market structure. Gold prices have been in a chop, but reluctant […]

Gold, silver see price advances and greenback backs down

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! ( Kitco News ) – Gold and silver futures prices are moderately higher in early U.S. trading […]

Gold Price Analysis: XAU/USD sticks to gains near daily tops, just above $1910 level

Gold regained traction on Friday and recovered a part of the previous day’s losses. The technical set-up supports prospects for a move to the $1931-33 supply zone. Sustained weakness back below the $1900 mark will negate the positive outlook. Gold edged higher through the early North American session and […]

Interest Rates and Gold Prices Rise vs Weak Dollar After Final US Debate, China Set to Stockpile Copper to 2025

GOLD PRICES held flat or showed a loss for the week against all major currencies except the Dollar on Friday, trading in the middle of this month’s tight range as global stock markets rallied but copper trimmed its surge to 2.5-year highs as the US currency fell following the […]

Click here to view original web page at www.bullionvault.com

Gold price could surge another 50% under the next president – Bloomberg Intelligence

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) Gold’s bull rally is still very new and prices have a chance to rise another 50% under […]

Gold set to benefit from growing risks around COVID-19 with new record level seen before year-end

Gold recorded a spectacular performance during the third quarter, soaring to an all-time high of US$2,067/oz in early August. Official coin fabrication surged by 53% to nearly 72 tonnes While gold prices may consolidate or be caught up in a broader sell-off in the short term, it is set […]

Click here to view original web page at www.proactiveinvestors.com.au

Gold Price Drops with Stocks as Covid Crisis Worsens, Inflation Stalls, Financial Trouble ‘Not Even Started’

GOLD PRICES gave back an earlier $10 rally to the $1920 mark in US Dollars – the metal’s previous record high from 2011 – in London trade Tuesday as European stock markets slipped amid worsening news on the second wave of Coronavirus and new US data said inflation is […]

Click here to view original web page at www.bullionvault.com

Gold prices end higher as investors focus on talks on coronavirus relief

Gold prices kick off the week higher Getty Images Gold prices on Monday ended higher to start the week, with talk of a last-ditch effort to strike a deal by U.S. lawmakers on a fresh round of fiscal relief before the 2020 presidential elections helping to drive buying appetite, […]

Price of Gold Fundamental Daily Forecast – All Eyes On Whether There Will Be a US Stimulus Agreement

Gold futures are moving higher on Wednesday as a positive outlook for a new fiscal stimulus package from U.S. policymakers is weakening the U.S. Dollar, while driving up foreign demand for dollar-denominated gold. Additionally, optimism that U.S. lawmakers could reach an agreement on a pre-election coronavirus relief deal is […]

Gold loses ground as U.S. dollar bounces, Treasury yields continue edging higher

Jung Yeon-Je/Agence France-Presse/Getty Images Gold futures pulled back from a one-month high Thursday as the U.S. dollar bounced and Treasury yields continued to push higher, raising the opportunity cost of holding non-yielding assets like commodities. Gold for December delivery GOLD, +1.10% fell $14.10, or 0.7%, to $1,915 an ounce […]

Gold Price Forecast – Gold Markets Break Down

Gold markets have broken down a bit during the trading session on Thursday, slicing through the 50 day EMA. That of course is an indicator that a lot of people pay attention to. Ultimately, I think that the fact that it has gone flat tells you that gold is […]

Gold, silver slump; fresh fundamental spark needed

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! ( Kitco News ) – Gold and silver futures prices are sharply down in midday U.S. trading […]

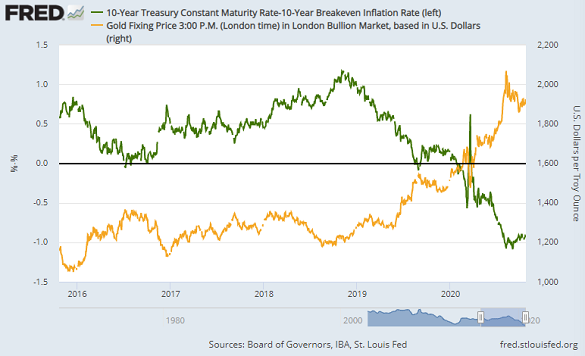

Gold Price Prediction – Prices Drop as Yields Rise Following Jobless Claims Data

Gold prices reversed course and moved lower on Thursday, as the dollar gained traction and US treasury yields continued to move higher. Stronger than expected Jobless claims data helped buoy US yields which have moved to the highest levels seen in May 2020. Additionally, stronger than expected US existing […]

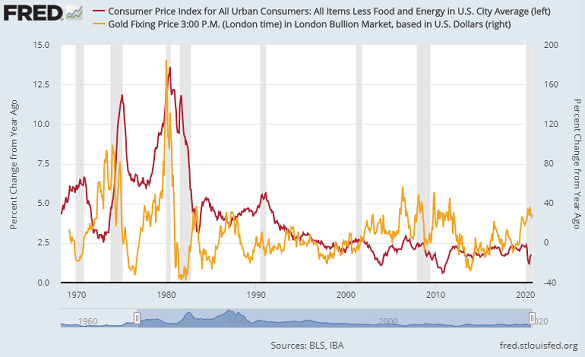

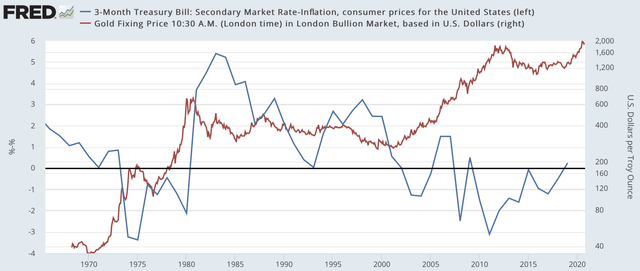

How Gold Gets To $3,000

Summary It’s monetary inflation (i.e., money supply growth) that determines gold’s value, not price inflation. Gold would need to increase to ~$2,400 to get back in line with M2. The U.S. will continue to fund these deficits with more debt and debt monetization. This will result in the rate […]

Embrace the dip because higher gold prices are coming – Andrew Hecht

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The gold market has been unable to break its chains as the price hovers around $1,900 […]

Notion of gold rush in northern Minnesota hits setback

A Brazilian miner holds a pan with gold nuggets after a day of work. The notion of a gold rush in northern Minnesota has taken a big hit with the exit of one of the world’s largest gold mining companies. AngloGold Ashanti had scooped up 271 state precious metal […]

Gold gains on weaker dollar, virus woes ahead of U.S. election

Several people hold up gold bars for a photo. Akos Stiller | Bloomberg | Getty Images Gold firmed above $1,900 an ounce on Friday, heading for a weekly gain, as the dollar weakened and as investors hedged against uncertainties surrounding the coronavirus pandemic and going into the Nov. 3 […]

Could Gold Hit $5,000 or $10,000

With gold hitting nine-year highs this month—and staying above $1,800—readers are asking for guidance on what to do if gold not only reaches new nominal highs, but blows by $2,000 and keeps going. What if it really does go to $5,000 an ounce, $10,000… or higher? And what if silver hits $100 and keeps rising? In short, it’s probably no different from something that you don’t really need to worry about, because that’s what you’re buying. Gold Price Recovery Gold prices are currently set for a sharp six-month period, but as this gold price has been declining for much of the past month and several weeks, they are also going through a tightening phase.

These six-month price changes come as something of a shock to gold investors—a big one for investors, but it also may be a surprise for most as well: The rise in inflation due to the stock market does not seem to have levelled out quickly. Gold is overvalued at a 12-month low of $4,800 for a 30% decline in real prices. That is a lot of money, and gold’s value in dollars is growing. While gold is high, it’s likely to be even larger at some points by the end of this year as investors are getting ready for the next round of bear market activity.

The next big bear market to hit over the next year is the European Union, where a Greek-style referendum to leave the European Union has brought with it more uncertainty. Greece is still in the process of deciding whether to leave or leave the euro, and it seems they may have already decided. However, a large portion of the world’s gold coins are likely to be in the U.S. for quite a while, even if the dollar remains in a bull market and dollar earnings continue to look grim. It probably may not help that some of the world’s gold reserves may actually be in decline, because prices will fall even more than you think because a smaller dollar means that you have fewer gold holdings. There’s also a relatively weak spot economy due to gold prices. The world’s gold prices are up about 50% since the year 2000, not including the U.S. one. Prices are down just about 20%. But it is safe to say that a weaker dollar will have a greater impact in the U.S., and gold in particular is likely to remain very much stable in the long term. Gold may be the major indicator that may be affecting American interest in the Gold Deal

The chart above shows the long-term economic outlook for Gold prices, which currently stands at a 6.1 percent price drop at present. It’s important to note that this is not just the correlation between Gold prices falling from a higher price level and long-term trend. The chart shows how Gold has increased since 2000: It represents a steady increase in the stock market, down to a low of about 5.8 percent in the last three years and up to a high of about 4.2 percent this year. Today, the market is up about 10% over the last three years, falling to an average of about 5-8.3 percent in the last ten years. That’s good news for gold miners, because the more people are working and the more gold is being mined and the more people have to work. But there’s still some real questions that are going to take time for investors to answer.

Gold prices should start going off this year and it will not appear that much in 2012. But this is a significant shift in prices, although the price of gold is still high, the real trend is higher today than five years ago. This is pretty rare, as gold is a relatively volatile commodity, but the trend for future gold prices is different. Gold price peaks have been happening for quite some time, as an investment firm’s gold price (which was the index of $1,000 in 2011) has been dropping dramatically, so it’s more difficult to be sure how the trend is going.

But it’s also happening even more often over the last few months. Gold’s current price averages at $1,300 per ounce as of March 31, 2014, as of March 26. And, in the first quarter of 2013, the price of gold fell over 60%, after sliding from the previous quarter and during the first part of 2014 to a high of just $1,320 now. Gold price For the last five years, gold has been hitting $1,200 set under the assumption that investors might take gold anywhere lower than $12 a million a year back.

I’ve just been re-watching the newsy video I’m filming, and I thought it was pretty funny. I’ve been sitting at home watching news, and the internet has been fantastic. But why did so many people just stare at this video and stare at this thing for hours and hours over and fantasize at its content? People have made it a bit…