Gold witnessed some fresh selling on Wednesday and erased the overnight modest gains.

The set-up favours bearish traders and supports prospects for an extension of the downfall.

Sustained weakness below the $1850-48 region will add credence to the negative outlook.

Gold extended its intraday retracement slide from the $1884-85 region and refreshed daily lows during the early North American session. The commodity has now erased the previous day’s modest recovery gains and was last seen trading just below the $1860 level.The emergence of some fresh selling on Wednesday supports prospects for an extension of this week’s sharp pullback from the $1965 congestion zone. That said, bearish traders might still wait for a sustained weakness below the $1950-48 horizontal support before placing fresh bets.The mentioned region coincides with September monthly swing lows, which if broken decisively might prompt some aggressive technical selling. Meanwhile, technical indicators on the […]

Category: Gold

10 Top Central Bank Gold Holdings

Global central bank gold reserves top 33,000 tonnes, approximately one-fifth of all the gold ever mined. The vast majority of central bank gold holdings were acquired in the last decade, when national banks became net buyers of the yellow metal.

Central banks purchase gold for a number of reasons: to mitigate risk, to hedge against inflation and to promote economic stability. In its most recent annual survey , the World Gold Council (WGC), said that 88 percent of central bankers also cited negative interest rates as a factor in reserve management decisions.

COVID-19, and more specifically times of crisis, were also identified as a reason to hold gold by 79 percent of survey respondents, up from 59 percent in 2019.

Central banks added 668.5 tonnes of gold to their vaults in 2019, the most since the national financial institutes became net buyers of the yellow metal in 2010. Central bank gold […]

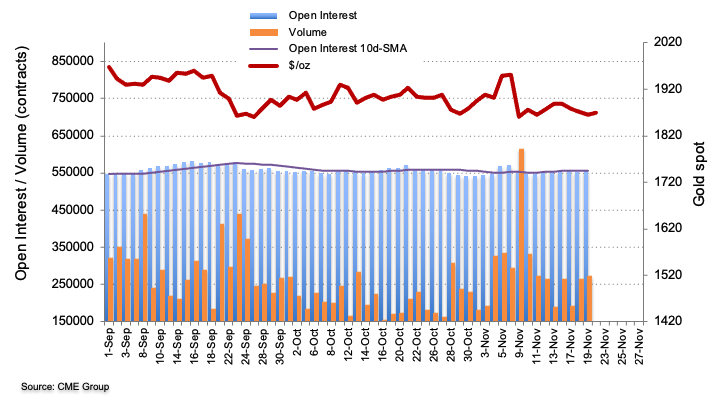

Gold Futures: Room for extra downside

Traders increased their open interest in gold futures markets by nearly 1.4K contracts on Thursday, extending the erratic performance and in light of preliminary readings from CME Group. In the same line, volume rose for the second session in a row, this time by around 7.2K contracts. Gold still sees a move to $1,850/oz

Thursday’s downtick in gold prices was amidst rising open interest and volume, opening the door to the continuation of the recent downtrend and exposing a move to the $1,850 mark per ounce and probably below. Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way […]

Why is gold is falling along with the dollar?

For the third consecutive day, gold futures have closed lower. Today gold opened at $1872.00, and as of 5:00 PM, EST is currently fixed at $1864.70 after factoring in today’s net decline of $9.20 (-0.49%).

Although the cumulative losses over the last three days equal only about $23.50, each day when compared to the prior day resulted in a lower high, and a lower low. Today’s low came in at approximately $1850 which closely matches the low achieved on Monday, November 9th, when market forces took the precious yellow metal roughly $100 lower. Concurrently the U.S. dollar has declined in value for the last six consecutive days. It fell from 92.95 a week ago on Thursday, November 12, and is currently fixed at 92.225. Over the last five trading days, the dollar has lost almost .75%.

It is a well-established fact that dollar weakness provides a tailwind that will usually move […]

Gold dips as Treasury Secretary Mnuchin recalls pandemic-related funds

An Argor-Heraeus SA branded two hundred and fifty gram gold bar, center, sits in this arranged photograph at Solar Capital Gold Zrt. in Budapest, Hungary.

Akos Stiller | Bloomberg | Getty Images

Gold prices fell on Friday after U.S. Treasury Secretary Steven Mnuchin called for an end to some of the Federal Reserve ’s pandemic lending, sparking uncertainty about stimulus programs that have played a key role in reassuring financial markets.

Spot gold slipped 0.2% to $1,864.54 per ounce by 0359 GMT and was headed for a second week of decline. U.S. gold futures were up 0.1% at $1,863.80.“If the Fed does start shrinking its assistance program that could be a bit of headwind for gold again … The monetary debasement argument that has supported gold could weaken,” said Lachlan Shaw, National Australia Bank’s head of commodity research.In a letter, Munchin told Fed Chairman Jerome Powell that $455 billion allocated to […]

“Not to own precious metals is to trust politicians, central bankers”

About 20 years ago, Swiss investor Marc Faber had correctly predicted a bull run in the oil and commodities market. Now, Faber expects gold prices to remain firm over the next few months. The author of the widely followed Gloom Boom & Doom Report tells ET Magazine , gold will outperform the equities market in the near- to medium-term. Edited excerpts of the interview:

Gold prices have firmed up over the past six to eight months. What reasons would you allocate for this trend?

Gold prices have been rising since December 2015, following price corrections between 2011 and 2015. This year, gold is up 26% and silver 33% in US dollars. The reason precious metals are up is endless money printing by the US Federal Reserve and exploding US fiscal deficits, which will continue forever. Not only the US Fed, central banks around the world are printing money […]

Click here to view original web page at economictimes.indiatimes.com

Gold falters on vaccine progress – Charles Schwab

Gold futures recent loss of luster continued on Thursday as investors weighed reported progress on multiple COVID-19 vaccines. The yellow metal had experienced a tremendous rally from the initial March 1450 pandemic low to the near 2100 August highs but the market has since consolidated wrapped around the 1900 mark while the December Gold contract (GC20) has drifted back down to test the 1850 low end of its recent price range. With the election in the rearview mirror and stimulus talks on the back burner, daily pandemic news continues to be front and center, Joe Schulte from Charles Schwab briefs. Key quotes

“After last week’s positive Pfizer study, Moderna reported encouraging results of their own this week. Progress on the vaccine front has precious metals on the defensive as the potential for an eventual return to economic stability and growth erodes the safe-haven attraction.”

“Profit-taking, and a surging equity market, […]

Gold Price Analysis: XAU/USD stuck in range below $1900, awaits fresh impetus

Gold remains buoyed by softer Treasury yields, rising virus fears.

Gold’s upside attempts capped by the US dollar bounce.

Risky-rally over vaccine optimism appears to fade, lifts USD.

Gold’s (XAU/USD) upside attempts continue to remain capped below the $1900 mark, as the metal extends its $20 range play in the European session.Despite the latest leg higher from session lows of $1887, the further upside in the spot appears elusive, as the US dollar stages a comeback across the board.The risk-rally driven by the optimism over the vaccine progress seems to fade amid resurfacing concerns over the surging coronavirus cases worldwide. The safe-haven demand for the greenback returns, lifting the US dollar index from four-day lows of 92.47 to 92.64, at the press time.However, fresh virus curbs announced in some of the US states and expectations of December restrictions in Germany threaten the global economic recovery and […]

Pancon Commences First Phase of 10,000-Meter Diamond Drilling Program at Flagship Brewer Gold Project in South Carolina

Toronto, Ontario–(Newsfile Corp. – November 5, 2020) – Pancontinental Resources Corporation (TSXV:PUC.VN) (OTCQB:PUCCF) ("Pancon" or the "Company") has commenced the first phase of a 10,000-meter diamond drill program at its flagship Brewer Gold Project. The Brewer Project covers nearly 1,000 acres on the gold-rich, underexplored Carolina Slate Belt in South Carolina, and is where a former mine produced 178,000 ounces of oxide gold between 1987-1995.

The first phase will consist of approximately 8 holes ranging from 300-600 meters each, for a total of approximately 3,500 meters. This phase is focused on coincident geochemical, geophysical and geological targets. Many of the targets are coincident resistivity and chargeability anomalies, with hole locations, angles and depths informed by the Company’s compilation of historic data together with its own recently produced data.

"We are testing priority targets outside and underneath the former mine, both nearby and further away from where we know gold and copper […]

Click here to view original web page at www.theglobeandmail.com

Are Gold and Silver the Sleeping Giants?

As Bitcoin makes newer and newer highs, it finally broke above $18,000 today and is a whisker within reach of its old peak of $20,000 back in 2017. At the time after falling down to sub $5000, it was labelled as doom and gloom. After two and half years, it has defied gravity and recaptured its upside momentum. We all know the demand vs. supply argument especially the halving that takes place every four years, diminishing the supply of Bitcoin more and more. Despite this, the demand side was the one that was never understood properly. Nor is it today to an extent as it is debated and dismissed by a whole generation of legendary traders who think it’s another hoax, a tool for the Millennials to gamble on the future. So, what changed?

Globally, central banks’ balance sheets have reached $86 trillion, and counting. The world is awash with […]

Click here to view original web page at realmoney.thestreet.com

Companies Implement Strategic Steps Forward as Investors Turn to Gold Amid Economic Uncertainty

NEW YORK, Nov. 19, 2020 /PRNewswire/ — Amid a global pandemic and economic uncertainty, investors are increasingly turning to gold. A recent MagnifyMoney survey reported that about one in six people have invested in gold or another metal in the past three months, with another 23% saying they’re seriously considering it. Companies operating in the precious metals sector are in an ideal position to benefit from this investment tide as they evaluate their offerings, increase their holdings and work to support the growing number of investors on the lookout for more stable options. For example, GoldHaven Resources Corp. (CSE: GOH) (OTCQB: ATUMF ) ( GOH Profile ) has completed options on some of the most promising properties in the highly productive Maricunga Gold Belt of Chile, including one yielding rock chip sample assays of 764 grams per tonne gold and 719 grams per tonne silver; the company is anticipating […]

3 Gold Miners to “Buy the Dip”

It’s been a turbulent couple of months for the sectors of the precious metals, and the Gold Miners Index (GDX) continues to massive underperform gold, down nearly 25% from its year-to-date highs. However, while the index has been busy correcting, gold miners are reporting their highest profits since 2011, and have hiked their dividend yields to just shy of 10-year highs.

Given that most gold producers are pulling the metal off the ground for less than $1,000/oz and still have massive margins despite the 12% correction in gold (GLD) , we could have a buying opportunity on our hands if this weakness continues. However, with over 50 names in the GDX to choose from, it’s not easy to separate the wheat from the chaff. Let’s take a look at which three are stand-outs in the sector currently: (Source: TC2000.com)

In a market where the S&P-500’s (SPY) dividend yield has dipped to […]

Gold price weighed down by resilient strength in Philly Fed Survey

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Better than expected data from the Philadelphia Federal Reserve showing resilient optimisms in the manufacturing sector is helping to keep pressure on gold prices.

Thursday, the regional central bank said its manufacturing business outlook fell to a reading of 26.3 in November, down from October’s reading of 32.2; however, the data significantly beat expectations as consensus forecasts were calling for a reading around 22.

"The survey’s current indicators for general activity, new orders, and shipments remained positive for the sixth consecutive month but fell from their readings in October," the report said. "The survey’s future indexes also moderated this month but suggest that growth is expected to continue over the next six months."Shifting investor […]

Gold Miner ETFs Discover Key Chart Support

Gold mining companies have tracked the price of the yellow metal lower over the past two weeks after risk-on assets received a double-dose boost of positive vaccine news from Pfizer Inc. ( PFE ) and Moderna, Inc. ( MRNA ). However, as COVID-19 infections continue to rise and the complexities of administering a shot to large portions of the population begin to surface, investors may once again turn to the safety of gold to hedge against a winter of uncertainty. Gold mining exchange-traded funds (ETFs) offer a hedge against uncertainty about the rollout of COVID-19 vaccines.

The VanEck Vectors Gold Miners ETF ( GDX ) has oscillated within a descending channel over the past four months to establish clear support and resistance areas.

The VanEck Vectors Junior Gold Miners ETF ( GDXJ ) finds a confluence of support from the lower trendline of a descending channel and the 200-day […]

Click here to view original web page at www.investopedia.com

Gold prices fall over 1% as appetite for havens dull despite rise in COVID cases

Gold slips early Thursday A stronger greenback can influence trading in assets pegged to the monetary unit, making prices of assets like gold relatively more expensive to those using other currencies.

But some commodity experts say that gold’s inability to gather momentum substantially this week, even as the dollar has weakened, signals that the path higher for bullion may be eroding.

“ In terms of gold prices, we see more selloff for the precious metal. This comes at a time when the dollar index is already quite weak. This shows that investors have started to move away from safe-haven assets, and they are more motivated to deploy their capital in riskier assets,” said Naeem Aslam, chief market analyst at AvaTrade in a research note.

On Thursday. December gold GCZ20, -0.83% was trading $23.40, or 1.3%, lower at $1,850.70 an ounce, following a 0.6% decline. Gold prices were headed for its lowest intraday […]

Degussa sees gold price rising to $2,500 by mid-2021 as central banks continue to print money

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – The gold market continues to hold on to critical support above $1,850 an ounce, but shifting investor sentiment following positive vaccine news in the last two weeks created significant pressure for the precious metal. However, one European precious metals firm does not expect a vaccine for the COVID-19 virus to significantly change the course of the global economy.

"No doubt, there is a great deal of uncertainty about the future course of the world’s economic and financial developments. However, it appears that the savvy investor has quite some reason to expect that interest rates will remain very low in the foreseeable future, simply because overall indebtedness has become too high. Central banks are […]

Gold prices remain down as U.S. existing home sales rise 4.3% in October

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – The U.S. housing market continues to be a bright spot in the U.S. economy as more consumers are buying homes according to the latest data from the National Association of Realtors (NAR).

Thursday, the NAR said Existing home sales increased 4.3%% last month to a seasonally adjusted and annualized rate of 6.85 million units, compared to September’s annualized rate of 6.54 million homes. Economists were expecting to see a sales rate of 6.45 million homes.

For the year home sales are up a whopping 26.6%, the report said."Considering that we remain in a period of stubbornly high unemployment relative to pre-pandemic levels, the housing sector has performed remarkably well this year," said Lawrence Yun, […]

‘Massive ETF selling’ is hurting gold price, say analysts

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) A significant wave of selling in gold-backed exchange-traded funds (ETF) has been weighing on the precious metal, which continued to lose ground Thursday.

At the time of writing, December Comex gold futures were down nearly 1% on the day and trading at $1,857.20 an ounce.

"Gold came under pressure once again yesterday evening after having previously recouped earlier losses. This morning sees it trading at only $1,860 per troy ounce. Massive ETF selling is continuing to weigh on gold: gold ETFs tracked by Bloomberg registered further outflows of 10 tons yesterday," said Commerzbank analyst Carsten Fritsch.

Risk-on sentiment has been encouraging the ETF outflows, noted BMO Capital Markets commodities analyst Colin Hamilton."Gold ETF holdings continue to fall as potential vaccines […]

Bitcoin no match for gold in coronavirus world

Bitcoin could reach over $300K by end of 2021: INX Limited CMO INX Limited CMO Douglas Borthwick discusses the future of Bitcoin. The recent surge in bitcoin ’s price has created some new believers, but the cryptocurrency will never supplant gold as a store of value or medium of exchange, some Wall Street investors say.

The cryptocurrency’s price has soared more than 70% over the past six weeks to more than $18,000 a coin and is 11% below its all-time peak of $20,089 an ounce. At the same time, gold’s price has traded in a tight range between $1,850 and $1,950 an ounce.

“To try to act like bitcoin is some kind of improved version of gold, it’s going to disrupt gold because it’s a better store of value, it’s a better medium of exchange, all that is pure nonsense,” said Peter Schiff, CEO of Westport, Conn.-based Euro Pacific Capital. “It’s […]

BBB Tip: Selling your gold pieces

(KVOA) – The Better Business Bureau (BBB) said that many people think selling gold is a common way to bring in quick cash but figuring out the right time to sell gold can be both a personal and financial decision. Regardless of your motivation, there are several factors the BBB recommended people consider when looking to sell gold pieces. Choose items wisely. Don’t be in a rush to sell. After picking out your potential items, wait a few days to re-evaluate your decision. Selling items that are mismatched, have broken pieces, or outdated items are a great start. Also, consider items that have no/low emotional attachment.

Know your items. It is rare to have items made of 24-karat gold, the maximum karat reading, as it too soft for use in most jewelry. In the U.S., most jewelry is either 10-, 14- or 18-karat gold. Jewelry stamped with a “GP” […]

Gold Price Analysis: XAU/USD ticks up to $1,860 after testing $1,850 support

XAU/USD extends losses for the fourth day in a row to test $1,850 support.

Gold weakens on risk aversion as COVID-19 cases remain on the rise.

Breach of $1,850 might accelerate gold’s near-time downtrend.

Gold futures have headed south for the fourth consecutive day on Thursday, to test key support at $1,850, which, so far, remains intact as the pair bounced up to $1,860 area. XAU/USD extends losses on a risk-off market The unremitting growth of the second COVID-19 wave has returned to the spotlight after the US reported a death toll of 250,000 on Wednesday and New York City decided to close schools to curb the increase of contagions.This news has offset investors’ optimism about the promising trial results of some coronavirus vaccines, reactivating concerns about the economic consequences of further lockdown measures and dampening the moderate risk appetite seen over the previous days.The US […]

2020-W $50 Uncirculated American Gold Eagle Release

Today, Nov. 19th, the United States Mint introduces its 2020-W $50 Uncirculated American Gold Eagle and offers it for sale to the public at noon ET. Each uncirculated Gold Eagle is encapsulated for protection and mounted in a burgundy presentation case. A U.S. Mint Certificate of Authenticity is also included. The 7,000-limited gold piece is the last in the series to showcase the inaugural reverse design which first appeared in 1986. The coin is struck in 22-karat gold and features an uncirculated collector grade finish created by using burnished coin blanks and special coin dies.

American Gold Eagles debuted more than three decades ago. Originally available in bullion and proof versions, this uncirculated variety was added in 2006. All have born the same basic designs.

Coin Designs

Found on coin obverses (heads side) is Augustus Saint-Gaudens’ full-length figure of Liberty. She is shown with flowing hair and holding a torch […]

Gold Price Prediction – Prices Consolidate Following Strong Housing Data

Gold prices continue to trade sideways edging slightly lower on Thursday. The US dollar moved lower but this failed to buoy the yellow metal. Gold implied volatility climbed for the first time in near 2-months as investors might be getting concerned about the sideways gold price action. Implied volatility measures how much options traders believe the markets will move on an annualized basis. US existing home sales rose for a 5 th straight month but failed to buoy US yields.

Trade gold with FXTM Technical analysis

Gold prices edged lower sandwiched between resistance near the 10-day moving average at 1,882. The weekly chart of gold is forming a bull flag continuation pattern which is a pause that refreshes higher. Support is seen near the October lows at 1,850. Short-term momentum has turned negative as the fast stochastic generated a crossover sell signal. Medium-term momentum is neutral to negative as the […]

It’s going to be a tough winter so hold some gold – Randy Smallwood

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The gold market continues to struggle below $1,900 an ounce, and although time is running out for the market to hit $2,000 an ounce by year-end, one mining executive said that it is more important to look at the long-term trend rather than any short-term target.

In a telephone interview with Kitco News, Randy Smallwood, president and CEO of Wheaton Precious Metals, said it is difficult for him to see a scenario where gold prices go materially lower.

Although investor optimism has picked up following positive news regarding potential vaccines for the COVID0-19 virus, Smallwood said more stimulus is needed to undo the damage that has already been inflicted on the global economy.

"We are looking at a tough […]

How to buy gold to diversify your portfolio and help shield against market downturns

Bullion coins and bars are the "purest" way to invest in gold, but can be costly to own and slow to sell. lionvision/Getty Images Physical gold can be bought for investment in two basic ways: bullion bars or coins.

Buying physical gold involves researching reputable dealers, understanding pricing, and shouldering storage costs.

Alternatives to physical gold include gold stocks and funds — less "pure," but more liquid, investments.

Visit Business Insider’s Investing Reference library for more stories . You often hear folks talk about investing in gold . Which begs the question: Exactly how do you buy gold? And perhaps more importantly, why would anyone want to?The short answer is that gold can be a smart way to diversify a portfolio — especially one filled with the usual investment suspects: stocks, bonds, and funds.Not only is gold largely immune to inflation, instead hewing closely to the cost of […]

Click here to view original web page at www.businessinsider.com