Gold prices edged higher but remain rangebound. The US dollar moved higher along with US long-term yields but this did not impact the movement of the yellow metal. Gold implied volatility eased after rallying slightly on Thursday. JP Morgan is now forecasting that US growth will contract in the Q1 of 2021, as the virus continues to spread. Technical analysis

Gold prices edged higher but ran into resistance near the 10-day moving average at 1,875. For the week prices declined by 0.84%. Support is seen near the October lows at 1,850. Short-term momentum has turned negative as the fast stochastic generated a crossover sell signal. The current reading on the fast stochastic is 17, below the oversold trigger level of 20, which could foreshadow a correction. Medium-term momentum is neutral to negative as the MACD (moving average convergence divergence) histogram prints in the red with a declining trajectory which […]

Bullish on Dr.Copper and Gold for 2021

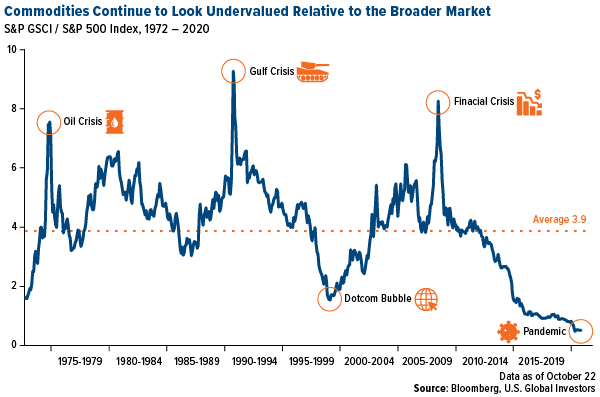

Commodities in general, in fact…

JET REGRADE – the relative strength of jet fuel prices versus diesel – looks primed for a bull market in 2021 as flight demand continues to increase, according to Goldman Sachs, writes Frank Holmes at US Global Investor .

By next summer, jet fuel demand is expected to be higher by 3.9 million barrels per day than where it stands right now.

Among other commodities that could also surge next year, the investment bank says, are silver, copper, gold, natural gas and Brent crude oil.In a note to clients, Goldman analysts cited a weaker Dollar, inflation and additional monetary and fiscal stimulus as reasons for a potential rally in commodity prices. A 12-month return of 30% is forecast for the S&P GSCI, which tracks 24 commodities from all commodity sectors. Industrial metals, including copper, could increase 5.5%; precious metals, 18%; and energy, more than […]

Click here to view original web page at www.bullionvault.com

Gold Miners Will Rush to this New Cost-Saving Tech

(Image via EnviroLeach Technologies Inc.) New technology is emerging as a potential standard to address two market sectors totaling $193 billion, through eco-friendly methods for the hydrometallurgical extraction of precious metals ….

Pioneered by EnviroLeach Technologies Inc. ( CSE: ETI , OTCQB: EVLLF , Forum ) , this innovation treats materials in the primary and secondary metals sectors. Using its proprietary non-cyanide, water-based, neutral pH treatment process, the Company extracts precious metals from ores, concentrates, and E-waste.

The Gold mining sector is dominated by the use of cyanide and smelting as the leading extraction methods.

Cyanide’s toxicity creates a significant environmental risk for mine operators and local communities. Smelting is predominantly used to process gold concentrates today but is an off-site process that delays payment for the miners and causes extensive CO2 emissions. EnviroLeach’s technology provides an effective and cost-competitive alternative to these methods in a world where attitudes to sustainability are […]

Will More Bearishness Cause Gold Prices to Crumble to DUST?

Gold has had an amazing run in 2020, but as the year winds down, will those price increases crumble to dust? Or will they feed into gains for the bears via the Direxion Daily Gold Miners Index Bear 2X Shares (DUST) .

DUST seeks daily investment results before fees and expenses of 200% of the inverse of the daily performance of the NYSE Arca Gold Miners Index. The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets.

The index is a modified market capitalization weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, to a lesser extent, silver.

The bulls have obviously been winning the majority of the war versus […]

What’s the gold standard, and why does the US benefit from a dollar that isn’t tied to the value of a glittery hunk of metal?

The phrase “the gold standard” means, in common parlance, the best available benchmark – as in double-blind randomized trials are the gold standard for determining the efficacy of a vaccine.

Its meaning likely comes from my world of economics and refers to what was once the centerpiece of the international monetary system , when the value of most major currencies, including the U.S. dollar, was based on the price of gold.

Some economists and others , including President Donald Trump and his Federal Reserve Board of Governors nominee Judy Shelton , favor a return to the gold standard because it would impose new rules and “discipline” on a central bank they view as too powerful and whose actions they consider flawed.

This is among several reasons Shelton’s nomination is controversial in the Senate, which voted against confirming her on Nov. 17 – though her Republican supporters may have an opportunity to […]

Gold’s path to $2,300: Renewed investment flows from lower stocks, ‘bitcoin’s demise’

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) Gold’s path to new record highs is still intact despite November’s disappointing price action, said OANDA senior market analyst Edward Moya, who is looking towards the $2,300 an ounce price target during the first half of 2021.

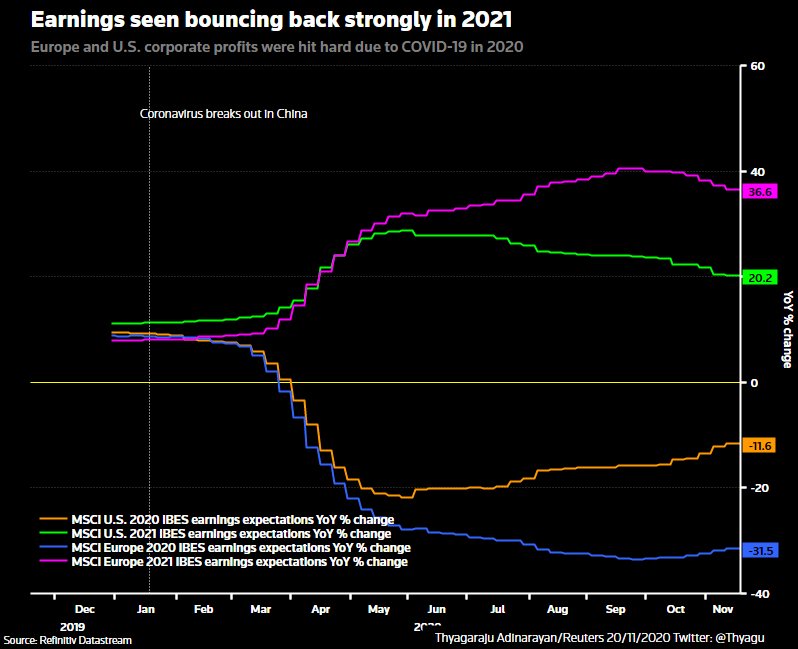

Positive vaccine news triggered a selloff in the precious metals space as investors start to price in a stronger economic recovery, Moya told Kitco News on Wednesday.

"Gold has been a very difficult trade in the sense of explaining some of these daily moves. The main driver for people has been that safe haven play. We saw all these vaccine announcements these past two Mondays, which are just great news for the hope that we’re turning the corner," Moya said. "That really […]

Investors rush to buy equities, dump gold in vaccine euphoria

LONDON (Reuters) – Investors stormed into riskier assets last week, pumping $27 billion into equity funds as positive COVID-19 vaccine updates led to euphoric buying of shares in worst-hit sectors such as banks, travel and leisure, and oil, BofA said on Friday.

Citing data from EPFR, the bank said inflows into global stocks in the last two weeks soared to $71.4 billion, the biggest ever. The flows were led by U.S. and emerging market stocks.

Still, investors were not ready to pull the plug on high-flying technology stocks, which saw $2.4 billion inflows last week. BofA said the feedback was “we’re on it (the rotation to value stocks), but we ain’t selling tech”.

Value stocks, typically companies that are more sensitive to economic cycles, have been soaring since Pfizer’s announcement earlier this month of positive data from its vaccine trial, raising hopes of an economic recovery.BofA said it expected 2021 to be […]

Gold prices aim to snap 3-session skid, but set for 2nd weekly slide in a row

Gold takes a leg higher to end the week On Thursday, Senate Minority Leader Chuck Schumer, D-NY., said Majority Leader Mitch McConnell, R-Ky., had agreed to restart negotiations over a new coronavirus aid relief package. Up to now, Republicans and Democrats were disputing the size and scope of a potential aid bill.

It isn’t clear if discussions will restart in earnest but commodity investors may find the recent reports sufficient reason to buy gold on the back of more funds being expended by governments to limit the harm from the spread of the deadly pathogen.

“Gold pared losses following Schumer’s stimulus restart announcement. If stimulus negotiations continue to head in the right direction, gold should start to rally again,” wrote Edward Moya, senior market analyst at Oanda, in a research note.

Precious metals have been facing some headwinds, lately, as news on successful therapies and potential cures have served to undercut appetite […]

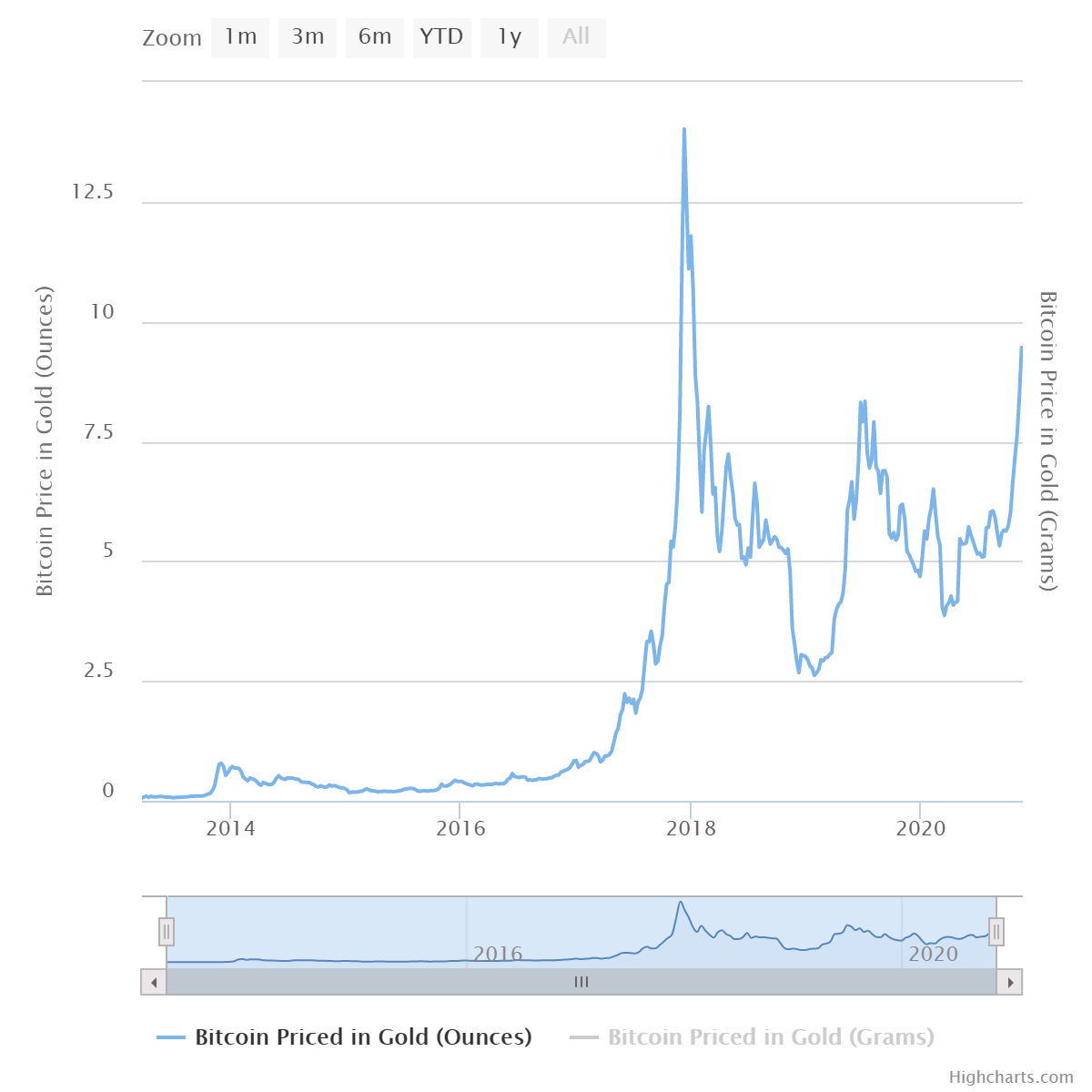

BlackRock CIO says ‘Bitcoin will take the place of gold to a large extent’

A senior executive at BlockRock, the world’s largest asset manager, admits that Bitcoin ( BTC ) has become a permanent fixture in the global financial system, offering yet another tangible sign that the narrative surrounding digital currency has changed.

Rick Rieder, BlackRock’s CIO of Fixed Income, told CNBC on Friday that, “Bitcoin is here to stay.”

While conceding that he is not a Bitcoin bull, Rieder said the flagship currency “will take the place of gold to a large extent [because] it is so more functional than passing a bar of gold around.”

Bitcoin is sometimes referred to as “digital gold” for its unique store-of-value characteristics. Bitcoin’s most ardent proponents believe that it will eventually take a sizable portion of gold’s market cap as more investors realize its utility.Priced in gold, 1 Bitcoin is currently worth 9.961 ounces. Bitcoin priced in gold via buybitcoinworldwide.com 2020 could go down as the year that […]

Gold Remains The Best Pandemic Insurance

Summary

The role of insurance in dealing with the Covid-19 fallout has been underrated.

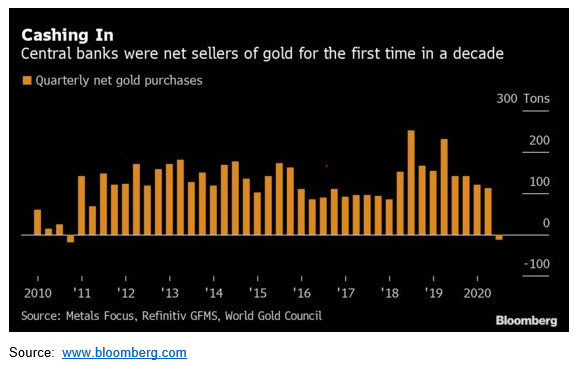

Not all nations have the same flexibility to take on debt, and that may turn to their advantage as inflation ramps up.

Some emerging economies have resorted to selling gold to help fund fiscal shortfalls.We should all look to gold as the ultimate way of self-insuring.Bailouts and stimulus are not the best solution to the Covid pandemic.What is? Insurance, perhaps.I know it’s far from perfect, but I think it could still be the best overall option.On some level, it’s surprising that the role of insurance has gotten so little attention in this crisis.After all, us and future generations will have to pay for all these massive bailouts.Of course, most of that responsibility has fallen on government so far.Some have resorted to printing, while others have turned to selling a portion of their gold reserves.In my view, that points […]

Gold prices are closing in on buy range after pulling back from record high, charts suggest

watch now

It may soon be safe to buy gold .

That’s according to Mark Newton, founder of Newton Advisors, who says the precious metal could be a buy on a pullback.

“On the intermediate term basis, the charts look pretty compelling.” Newton said on CNBC’s “ Trading Nation ” on Thursday. “The weekly trend still looks quite bullish, and one would want to really buy into any sort of pullback we see over the next month.”Gold fell below $1,865 on Thursday despite a bullish note from Citi. Analysts forecast an average price of $2,500 next year as part of their bull case for gold. Newton says the time is coming to dip into the safe-haven asset.“We did move back to all-time high territory over the last two years. We moved from August of 2018 into August of this past year. … I’m looking at about $100 lower, $1,750 down to $1,650, […]

Gold Price Analysis: XAU/USD remains confined in a range, bearish bias persists

Gold lacked any firm directional bias and was seen oscillating in a range around $1865 region.

This week’s sustained breakthrough an upward sloping trend-channel favours bearish traders.

Attempted recovery might be seen as a selling opportunity and remain capped near $1900 mark.

Gold extended its sideways consolidative price action through the mid-European session and remained confined in a narrow trading band, around the $1865 region.The precious metal’s inability to gain any meaningful traction comes on the back of this week’s break below a short-term ascending trend-channel, which constituted the formation of a bearish flag pattern. Meanwhile, technical indicators on the daily chart maintained their bearish bias and are still far from being in the oversold territory, adding credence to the negative set-up.That said, bearish traders might still wait for some follow-through selling below the $1850-48 strong horizontal support before positioning for any further depreciating move. The […]

Gold Price Analysis: XAU/USD plummets to lows, fast approaching $1850-48 key support

Gold witnessed some fresh selling on Wednesday and erased the overnight modest gains.

The set-up favours bearish traders and supports prospects for an extension of the downfall.

Sustained weakness below the $1850-48 region will add credence to the negative outlook.

Gold extended its intraday retracement slide from the $1884-85 region and refreshed daily lows during the early North American session. The commodity has now erased the previous day’s modest recovery gains and was last seen trading just below the $1860 level.The emergence of some fresh selling on Wednesday supports prospects for an extension of this week’s sharp pullback from the $1965 congestion zone. That said, bearish traders might still wait for a sustained weakness below the $1950-48 horizontal support before placing fresh bets.The mentioned region coincides with September monthly swing lows, which if broken decisively might prompt some aggressive technical selling. Meanwhile, technical indicators on the […]

10 Top Central Bank Gold Holdings

Global central bank gold reserves top 33,000 tonnes, approximately one-fifth of all the gold ever mined. The vast majority of central bank gold holdings were acquired in the last decade, when national banks became net buyers of the yellow metal.

Central banks purchase gold for a number of reasons: to mitigate risk, to hedge against inflation and to promote economic stability. In its most recent annual survey , the World Gold Council (WGC), said that 88 percent of central bankers also cited negative interest rates as a factor in reserve management decisions.

COVID-19, and more specifically times of crisis, were also identified as a reason to hold gold by 79 percent of survey respondents, up from 59 percent in 2019.

Central banks added 668.5 tonnes of gold to their vaults in 2019, the most since the national financial institutes became net buyers of the yellow metal in 2010. Central bank gold […]

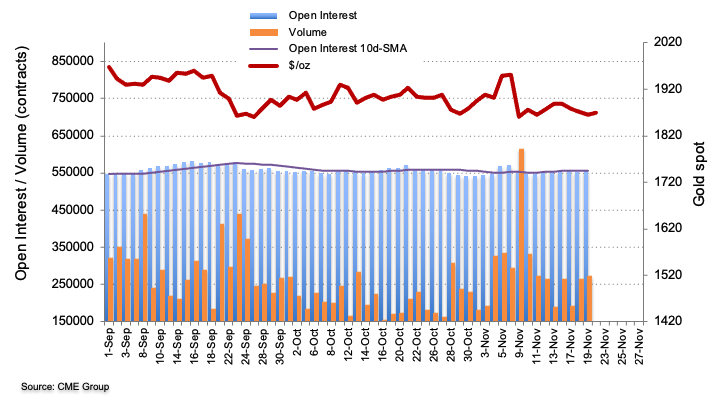

Gold Futures: Room for extra downside

Traders increased their open interest in gold futures markets by nearly 1.4K contracts on Thursday, extending the erratic performance and in light of preliminary readings from CME Group. In the same line, volume rose for the second session in a row, this time by around 7.2K contracts. Gold still sees a move to $1,850/oz

Thursday’s downtick in gold prices was amidst rising open interest and volume, opening the door to the continuation of the recent downtrend and exposing a move to the $1,850 mark per ounce and probably below. Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way […]

Why is gold is falling along with the dollar?

For the third consecutive day, gold futures have closed lower. Today gold opened at $1872.00, and as of 5:00 PM, EST is currently fixed at $1864.70 after factoring in today’s net decline of $9.20 (-0.49%).

Although the cumulative losses over the last three days equal only about $23.50, each day when compared to the prior day resulted in a lower high, and a lower low. Today’s low came in at approximately $1850 which closely matches the low achieved on Monday, November 9th, when market forces took the precious yellow metal roughly $100 lower. Concurrently the U.S. dollar has declined in value for the last six consecutive days. It fell from 92.95 a week ago on Thursday, November 12, and is currently fixed at 92.225. Over the last five trading days, the dollar has lost almost .75%.

It is a well-established fact that dollar weakness provides a tailwind that will usually move […]

Gold dips as Treasury Secretary Mnuchin recalls pandemic-related funds

An Argor-Heraeus SA branded two hundred and fifty gram gold bar, center, sits in this arranged photograph at Solar Capital Gold Zrt. in Budapest, Hungary.

Akos Stiller | Bloomberg | Getty Images

Gold prices fell on Friday after U.S. Treasury Secretary Steven Mnuchin called for an end to some of the Federal Reserve ’s pandemic lending, sparking uncertainty about stimulus programs that have played a key role in reassuring financial markets.

Spot gold slipped 0.2% to $1,864.54 per ounce by 0359 GMT and was headed for a second week of decline. U.S. gold futures were up 0.1% at $1,863.80.“If the Fed does start shrinking its assistance program that could be a bit of headwind for gold again … The monetary debasement argument that has supported gold could weaken,” said Lachlan Shaw, National Australia Bank’s head of commodity research.In a letter, Munchin told Fed Chairman Jerome Powell that $455 billion allocated to […]

“Not to own precious metals is to trust politicians, central bankers”

About 20 years ago, Swiss investor Marc Faber had correctly predicted a bull run in the oil and commodities market. Now, Faber expects gold prices to remain firm over the next few months. The author of the widely followed Gloom Boom & Doom Report tells ET Magazine , gold will outperform the equities market in the near- to medium-term. Edited excerpts of the interview:

Gold prices have firmed up over the past six to eight months. What reasons would you allocate for this trend?

Gold prices have been rising since December 2015, following price corrections between 2011 and 2015. This year, gold is up 26% and silver 33% in US dollars. The reason precious metals are up is endless money printing by the US Federal Reserve and exploding US fiscal deficits, which will continue forever. Not only the US Fed, central banks around the world are printing money […]

Click here to view original web page at economictimes.indiatimes.com

Gold falters on vaccine progress – Charles Schwab

Gold futures recent loss of luster continued on Thursday as investors weighed reported progress on multiple COVID-19 vaccines. The yellow metal had experienced a tremendous rally from the initial March 1450 pandemic low to the near 2100 August highs but the market has since consolidated wrapped around the 1900 mark while the December Gold contract (GC20) has drifted back down to test the 1850 low end of its recent price range. With the election in the rearview mirror and stimulus talks on the back burner, daily pandemic news continues to be front and center, Joe Schulte from Charles Schwab briefs. Key quotes

“After last week’s positive Pfizer study, Moderna reported encouraging results of their own this week. Progress on the vaccine front has precious metals on the defensive as the potential for an eventual return to economic stability and growth erodes the safe-haven attraction.”

“Profit-taking, and a surging equity market, […]

Gold Price Analysis: XAU/USD stuck in range below $1900, awaits fresh impetus

Gold remains buoyed by softer Treasury yields, rising virus fears.

Gold’s upside attempts capped by the US dollar bounce.

Risky-rally over vaccine optimism appears to fade, lifts USD.

Gold’s (XAU/USD) upside attempts continue to remain capped below the $1900 mark, as the metal extends its $20 range play in the European session.Despite the latest leg higher from session lows of $1887, the further upside in the spot appears elusive, as the US dollar stages a comeback across the board.The risk-rally driven by the optimism over the vaccine progress seems to fade amid resurfacing concerns over the surging coronavirus cases worldwide. The safe-haven demand for the greenback returns, lifting the US dollar index from four-day lows of 92.47 to 92.64, at the press time.However, fresh virus curbs announced in some of the US states and expectations of December restrictions in Germany threaten the global economic recovery and […]

Pancon Commences First Phase of 10,000-Meter Diamond Drilling Program at Flagship Brewer Gold Project in South Carolina

Toronto, Ontario–(Newsfile Corp. – November 5, 2020) – Pancontinental Resources Corporation (TSXV:PUC.VN) (OTCQB:PUCCF) ("Pancon" or the "Company") has commenced the first phase of a 10,000-meter diamond drill program at its flagship Brewer Gold Project. The Brewer Project covers nearly 1,000 acres on the gold-rich, underexplored Carolina Slate Belt in South Carolina, and is where a former mine produced 178,000 ounces of oxide gold between 1987-1995.

The first phase will consist of approximately 8 holes ranging from 300-600 meters each, for a total of approximately 3,500 meters. This phase is focused on coincident geochemical, geophysical and geological targets. Many of the targets are coincident resistivity and chargeability anomalies, with hole locations, angles and depths informed by the Company’s compilation of historic data together with its own recently produced data.

"We are testing priority targets outside and underneath the former mine, both nearby and further away from where we know gold and copper […]

Click here to view original web page at www.theglobeandmail.com

Are Gold and Silver the Sleeping Giants?

As Bitcoin makes newer and newer highs, it finally broke above $18,000 today and is a whisker within reach of its old peak of $20,000 back in 2017. At the time after falling down to sub $5000, it was labelled as doom and gloom. After two and half years, it has defied gravity and recaptured its upside momentum. We all know the demand vs. supply argument especially the halving that takes place every four years, diminishing the supply of Bitcoin more and more. Despite this, the demand side was the one that was never understood properly. Nor is it today to an extent as it is debated and dismissed by a whole generation of legendary traders who think it’s another hoax, a tool for the Millennials to gamble on the future. So, what changed?

Globally, central banks’ balance sheets have reached $86 trillion, and counting. The world is awash with […]

Click here to view original web page at realmoney.thestreet.com

Companies Implement Strategic Steps Forward as Investors Turn to Gold Amid Economic Uncertainty

NEW YORK, Nov. 19, 2020 /PRNewswire/ — Amid a global pandemic and economic uncertainty, investors are increasingly turning to gold. A recent MagnifyMoney survey reported that about one in six people have invested in gold or another metal in the past three months, with another 23% saying they’re seriously considering it. Companies operating in the precious metals sector are in an ideal position to benefit from this investment tide as they evaluate their offerings, increase their holdings and work to support the growing number of investors on the lookout for more stable options. For example, GoldHaven Resources Corp. (CSE: GOH) (OTCQB: ATUMF ) ( GOH Profile ) has completed options on some of the most promising properties in the highly productive Maricunga Gold Belt of Chile, including one yielding rock chip sample assays of 764 grams per tonne gold and 719 grams per tonne silver; the company is anticipating […]

3 Gold Miners to “Buy the Dip”

It’s been a turbulent couple of months for the sectors of the precious metals, and the Gold Miners Index (GDX) continues to massive underperform gold, down nearly 25% from its year-to-date highs. However, while the index has been busy correcting, gold miners are reporting their highest profits since 2011, and have hiked their dividend yields to just shy of 10-year highs.

Given that most gold producers are pulling the metal off the ground for less than $1,000/oz and still have massive margins despite the 12% correction in gold (GLD) , we could have a buying opportunity on our hands if this weakness continues. However, with over 50 names in the GDX to choose from, it’s not easy to separate the wheat from the chaff. Let’s take a look at which three are stand-outs in the sector currently: (Source: TC2000.com)

In a market where the S&P-500’s (SPY) dividend yield has dipped to […]

Gold price weighed down by resilient strength in Philly Fed Survey

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Better than expected data from the Philadelphia Federal Reserve showing resilient optimisms in the manufacturing sector is helping to keep pressure on gold prices.

Thursday, the regional central bank said its manufacturing business outlook fell to a reading of 26.3 in November, down from October’s reading of 32.2; however, the data significantly beat expectations as consensus forecasts were calling for a reading around 22.

"The survey’s current indicators for general activity, new orders, and shipments remained positive for the sixth consecutive month but fell from their readings in October," the report said. "The survey’s future indexes also moderated this month but suggest that growth is expected to continue over the next six months."Shifting investor […]