LONDON (Reuters) – Investors stormed into riskier assets last week, pumping $27 billion into equity funds as positive COVID-19 vaccine updates led to euphoric buying of shares in worst-hit sectors such as banks, travel and leisure, and oil, BofA said on Friday.

Citing data from EPFR, the bank said inflows into global stocks in the last two weeks soared to $71.4 billion, the biggest ever. The flows were led by U.S. and emerging market stocks.

Still, investors were not ready to pull the plug on high-flying technology stocks, which saw $2.4 billion inflows last week. BofA said the feedback was “we’re on it (the rotation to value stocks), but we ain’t selling tech”.

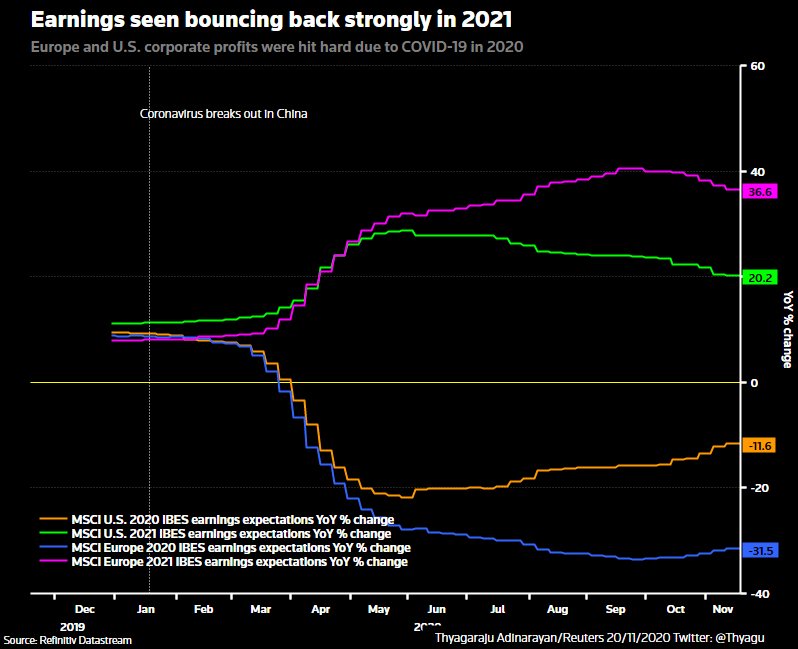

Value stocks, typically companies that are more sensitive to economic cycles, have been soaring since Pfizer’s announcement earlier this month of positive data from its vaccine trial, raising hopes of an economic recovery.BofA said it expected 2021 to be […]

Click here to view original web page at www.kitco.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments