“ Overview Of Enriched Uranium Industry 2020-2028:

This has brought along several changes in This report also covers the impact of COVID-19 on the global market.

The Enriched Uranium Market analysis summary by Reports Insights is a thorough study of the current trends leading to this vertical trend in various regions. Research summarizes important details related to market share, market size, applications, statistics and sales. In addition, this study emphasizes thorough competition analysis on market prospects, especially growth strategies that market experts claim.

Enriched Uranium Market competition by top manufacturers as follow: Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, Cameco, Areva, BHP Billiton, Kazatomprom, APM3, ERA, AtomRedMetZoloto?ARMZ?, Paladin, Navoi, Rio Tinto Group, Centrus (USEC), Tenex, Piketon, Angarsk, Get a Sample PDF copy of the report @ https://reportsinsights.com/sample/191499 The global Enriched Uranium market has been segmented on the basis of technology, product type, application, distribution channel, end-user, and […]

Category: Uranium

The Global X Uranium ETF Product Is A Bet On An Alternative Energy Commodity

Summary

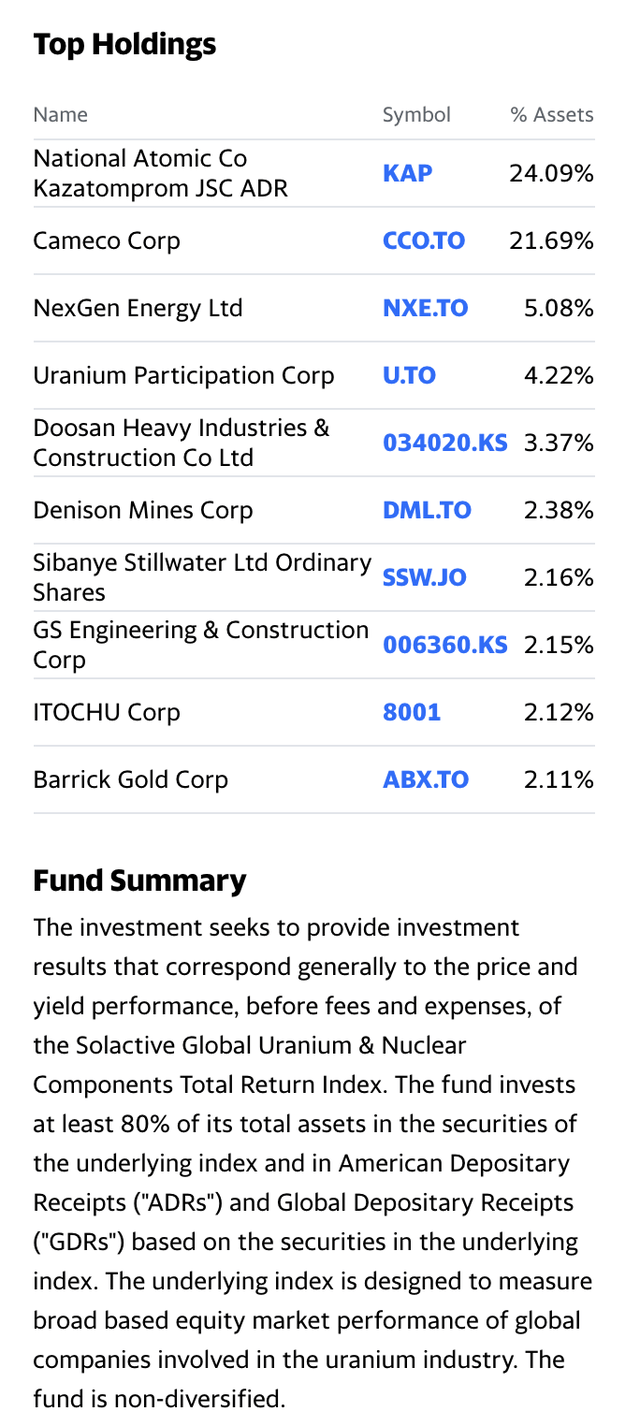

URA holds shares of the leading uranium producers.

Uranium’s price has been under pressure for years.

A shift in US energy policy could support uranium.A cheap and diversified ETF to position for a recovery in uranium.A bullish trend in URA since March. Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Get started today » Uranium is a chemical element with the symbol U and atomic number 92. It is a silvery-grey metal in the actinide series of the periodic table. A uranium atom has 92 protons and 92 electrons, of which six are valence electrons. A valence electron is an outer shell electron that can form a chemical bond if the outer shell is not closed.Uranium is a primary ingredient in nuclear fuel used to generate electricity in nuclear power stations. Uranium is one of the most common elements in the earth’s crude, as […]

Guy on Rocks: Uranium is starting to spark. These 3 small caps should be on the radar

Kyle Busch, driver of #18, drives down on the apron throwing sparks on Brad Keselowski, driver of the #2 Miller Lite Dodge, during the NASCAR Budweiser Shootout at Daytona International Speedway. Pic: Getty. share

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. Market ructions

There’s lots of news this week driving commodities prices.Iron ore continues its run up, reaching $US136 ($183) a tonne. And, as I said a couple of weeks back , the arrival of the cyclone season will likely see stronger prices in the near term.I note that Vale’s 2021 iron ore production guidance has come in around 315-335 million tonnes […]

Appia Energy Announces Closing of Non-Brokered Private Placement

Toronto, Ontario–(Newsfile Corp. – December 3, 2020) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") is pleased to announce that it will be closing a non-brokered private placement (the " Offering ") of 1,000,000 flow-through units (the " FT Units ") at $0.40 per FT Unit for proceeds of $400,000 on December 4, 2020.

Each FT Unit is priced at $0.40 and consists of one (1) common share and one-half (0.5) of a share purchase warrant. Each full warrant (" Warran t") entitles the holder to purchase one (1) common share (a " Warrant Share ") at a price of $0.50 per Warrant Share June 4, 2022.

A finder will be paid $24,000 in cash and issued 60,000 broker warrants. Each broker warrant entitles the holder to acquire one (1) common share of the Company at a price of $0.40 until […]

Click here to view original web page at www.juniorminingnetwork.com

Global Atomic To Present at OTC VirtualInvestorconferences.com December 8, 2020

– Global Atomic Corporation (“Global Atomic” or the “Company”; TSX: GLO; Frankfurt : G12; OTCQX: GLATF) announced today that Stephen G. Roman President & CEO, will present live at VirtualInvestorConferences.com on Tuesday, December 8 th . (PRNewsfoto/OTC Markets Group (Investor Con) This will be a live, interactive online event where investors are invited to ask the company questions in real-time. If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available after the event.

The presentation will focus on the Company’s high-grade Dasa Uranium Project development in the Republic of Niger, West Africa , as well as the BST Zinc operation in Turkey. Highlights include:

DASA The highest-grade uranium project currently being developed in Africa

Assuming a uranium price of $35 /lb, the May 2020 PEA calculated a 26.6% after-tax rate of return Low capital […]

UEX Announces Closing of Upsized C$6.0 Million Bought Deal Private Placement

(TheNewswire)

Saskatoon, Saskatchewan TheNewswire – December 2, 2020 UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that it has closed its previously announced “bought deal” private placement of an aggregate of 18,498,665 units of the Company (the “Units”) at a price of C$0.12 per Unit and 27,001,144 common shares of the Company that qualify as “flow-through shares (the “FT Shares”) at a price of C$0.14 per FT Share for gross proceeds of C$6,000,000, including the full exercise of the underwriters’ overallotment option (the “Offering”). The Units and FT Shares were offered and sold through a syndicate of underwriters led by Red Cloud Securities Inc. and included Sprott Capital Partners.

Each Unit is comprised of one common share in the capital of the Company (each a “Common Share”) and one half of one Common Share purchase warrant (each a “Warrant”). Each whole Warrant is exercisable into one […]

Appia Energy Reports on Significant Price Increases in Rare Earth Oxides as China Announces New Export Control Law

Toronto, Ontario–(Newsfile Corp. – December 3, 2020) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") today reported that in November, 2020 there were significant price increases in the Rare Earth Elements ("REEs") . In their Oxide form ("REO") , the largest price increases have been in the costliest top six Oxides ranging from over 16% to over 47% by month end. The six include Neodymium, Holium, Neodymium-Praseodymium, Terbium, Praseodymium and Dysprosium.

On December 1, China announced the imposition of export controls, widely seen to be in retaliation for recent actions taken by the USA restricting the supply of electronic materials to China and for the ban on Huawei’s G5 broadband equipment.

The trade war between the USA and China is jeopardizing the availability of critical REEs and the Company’s Alces Lake project contains some of the highest-grade total critical REE mineralization […]

Click here to view original web page at www.juniorminingnetwork.com

Leigh Curyer Appointed to the International Consolidated Uranium Advisory Board and John Jentz Appointed to the Board of Directors

Leigh Curyer commented "Todays changes reflect the next step in the planned progression of International Consolidated Uranium. Trevor and myself have overseen the transition of the Company into a leading consolidator of uranium projects globally and, now that it is firmly on that path, it’s time for the new board to oversee the business going forward. This coincides with NexGen moving through final feasibility and permitting in developing the world’s largest uranium project. I look forward to providing advice to the Company from my new role as a member of the Advisory Board."

Philip Williams, CEO commented "On behalf of all shareholders, I would like to thank both Leigh and Trevor for their dedication and contribution over the past years. Both were instrumental in the formation of the Company and were champions of the new business model, providing tremendous vision and tireless effort during the transition process. As a […]

Click here to view original web page at www.juniorminingnetwork.com

Skyharbour Expands High Grade Maverick East Zone with Drill Results of 0.72% U3O8 over 17.5m including 1.00% U3O8 over 10.0m; Additional Assays Pending

VANCOUVER, British Columbia, Dec. 03, 2020 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce initial results from its recent 2020 fall diamond drilling program at its 100% owned, 35,705 hectare Moore Uranium Project, located 15 kilometres east of Denison Mine’s Wheeler River project and proximal to regional infrastructure for Cameco’s Key Lake/McArthur River operations in the Athabasca Basin of Saskatchewan. Drill hole ML20-09 confirmed the continuity of the Maverick East Zone by intersecting a discrete zone of predominantly basement-hosted uranium mineralization at 271.5 metres to 289.0 metres downhole, the longest continuous drill intersection of uranium mineralization discovered to date at the project. This interval returned 0.72% U 3 O 8 over 17.5 metres and contained a basal high grade basement interval of 1.00% U 3 O 8 over 10.0 metres.

Moore Uranium Project Claims Map:

[…]

Click here to view original web page at www.globenewswire.com

Global Atomic : To Present at OTC VirtualInvestorconferences.com December 8, 2020

TORONTO, Dec. 2, 2020 /PRNewswire/ — Global Atomic Corporation ("Global Atomic" or the "Company"; TSX: GLO; Frankfurt: G12; OTCQX: GLATF) announced today that Stephen G. Roman, President & CEO, will present live at VirtualInvestorConferences.com on Tuesday, December 8 th . (PRNewsfoto/OTC Markets Group (Investor Con) This will be a live, interactive online event where investors are invited to ask the company questions in real-time. If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available after the event.

The presentation will focus on the Company’s high-grade Dasa Uranium Project development in the Republic of Niger, West Africa, as well as the BST Zinc operation in Turkey. Highlights include:

DASA The highest-grade uranium project currently being developed in Africa

Assuming a uranium price of $35/lb, the May 2020 PEA calculated a 26.6% after-tax rate of return […]

Click here to view original web page at www.marketscreener.com

IsoEnergy Announces $3 Million Bought Deal Private Placement of Flow-Through Shares

In addition, the Company has granted the Underwriter an option (the " Underwriter’s Option ") to purchase up to an additional number of FT Shares (the " Additional FT Shares ") equal to 15% of the FT Shares sold pursuant to the Offering, at a price per Additional FT Share equal to the Issue Price, by providing notice to the Company at any time up to 48 hours prior to the Closing Date (as defined herein).

The gross proceeds received by the Company from the sale of the FT Shares will be used to incur Canadian exploration expenses that are "flow-through mining expenditures" (as such terms are defined in the Income Tax Act (Canada)) on the Company’s properties in Saskatchewan (the " Qualifying Expenditures "). The Qualifying Expenditures will be renounced to the subscribers with an effective date no later than December 31, 2020, in the aggregate amount of not […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Royalty Corp. to Present at the H.C. Wainwright Virtual Mining Conference on Monday, November 30th, at 4:30 pm ET

VANCOUVER, BC, Nov. 25, 2020 /PRNewswire/ – Uranium Royalty Corp. (TSX-V: URC) (" URC " or the " Company ") invites investors and shareholders to attend the Company’s presentation at the H.C. Wainwright Mining Conference on Monday, November 30th, 2020 at 4:30 PM ET.

President and CEO, Scott Melbye, will provide an update on the Company and answer investors questions during his live webcast.

Mr. Melbye will also be available to participate in one-on-one meetings with investors who are registered to attend the conference via Zoom. If you are an investor and would like to schedule a meeting with Uranium Royalty Corp, please register for the conference at www.hcwevents.com/mining and request a meeting with URC.

About Uranium Royalty Corp. Uranium Royalty Corp. is a pure-play uranium royalty company focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity investments in […]

Uranium Company Receives Final Federal Permits for U.S. Project Research Report

In a Nov. 25 research note, Haywood analyst Colin Healey reported that Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB) received Environmental Protection Agency permits, the last of the required major federal permits, for its Dewey Burdock in situ recovery (ISR) uranium project in South Dakota.

"With full federal level permitting complete, Azarga significantly derisks its position as the next potential U.S. uranium producer and increases its attractiveness as a mergers and acquisitions tuck-in candidate as it puts major impediments and milestones behind it," Healey wrote.

Healey reviewed the next steps for Dewey Burdock. The first is Azarga receiving the state permits it needs, and that process may resume now that the federal permit process is complete. Already the South Dakota Department of Environmental & Natural Resources has recommended the state permits be approved.

Once Azarga has the requisite state permits, indicated Healey, Dewey Burdock will be fully permitted and, thus, Azarga can make a […]

Click here to view original web page at www.streetwisereports.com

Comprehensive Report on Uranium Market 2020 | Size, Growth, Demand, Opportunities & Forecast To 2026 | Sinosteel, Jinduicheng Molybdenum, GoviEx, Sinohydro, CNNC

Uranium Market research report is the new statistical data source added by A2Z Market Research .

“Uranium Market is growing at a High CAGR during the forecast period 2020-2026. The increasing interest of the individuals in this industry is that the major reason for the expansion of this market”.

Uranium Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Get the PDF Sample Copy (Including FULL TOC, Graphs and Tables) of this report @: https://www.a2zmarketresearch.com/sample?reportId=355314 Note – In order to provide more accurate market forecast, all our reports […]

UEX Corporation Announces Closing of Upsized C$6.0 Million Bought Deal Private Placement

Saskatoon, Saskatchewan – TheNewswire – December 2, 2020 – UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that it has closed its previously announced “bought deal” private placement of an aggregate of 18,498,665 units of the Company (the “Units”) at a price of C$0.12 per Unit and 27,001,144 common shares of the Company that qualify as “flow-through shares (the “FT Shares”) at a price of C$0.14 per FT Share for gross proceeds of C$6,000,000, including the full exercise of the underwriters’ overallotment option (the “Offering”). The Units and FT Shares were offered and sold through a syndicate of underwriters led by Red Cloud Securities Inc. and included Sprott Capital Partners.

Each Unit is comprised of one common share in the capital of the Company (each a “Common Share”) and one half of one Common Share purchase warrant (each a “Warrant”). Each whole Warrant is exercisable into […]

Click here to view original web page at www.juniorminingnetwork.com

How Uranium Hexafluoride Market Will Dominate In Coming Years? Report Covering Products, Financial Information, Developments, Swot Analysis And Strategies | Industry Growth Insights

A new research study has been presented by Industrygrowthinsights.com offering a comprehensive analysis on the Global Uranium Hexafluoride Market where user can benefit from the complete market research report with all the required useful information about this market. This is a latest report, covering the current COVID-19 impact on the market. The pandemic of Coronavirus (COVID-19) has affected every aspect of life globally. This has brought along several changes in market conditions. The rapidly changing market scenario and initial and future assessment of the impact is covered in the report. The report discusses all major market aspects with expert opinion on current market status along with historic data. This market report is a detailed study on the growth, investment opportunities, market statistics, growing competition analysis, major key players, industry facts, important figures, sales, prices, revenues, gross margins, market shares, business strategies, top regions, demand, and developments.

The Uranium Hexafluoride Market […]

International Consolidated Uranium Forms Advisory Board and Appoints Dean T. (Ted) Wilton as Inaugural Member

VANCOUVER, BC, Nov. 25, 2020 /CNW/ – International Consolidated Uranium Inc. (the " Company ") (TSXV: CUR ) is pleased to announce the formation of an advisory board (the " Advisory Board ") to provide advice and recommendations to the Company’s Board of Directors (the " Board ") and management. In conjunction with the formation of the advisory board, the Company is pleased to announce that it has appointed Dean T. (Ted) Wilton as its first member.

Philip Williams, CEO, commented "I am extremely pleased to welcome Ted to the newly formed advisory board. As we grow the Company, the opportunity to draw on Ted’s wealth of experience in the mineral exploration field, particularly for uranium in the United States, will be invaluable. The ultimate success of the Company will be directly tied to the quality of the people we are able to attract. Ted will be an excellent complement […]

Blue Sky Uranium Applies to Extend Warrants

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market (OTC): BKUCFVANCOUVER, BC, Nov. 25, 2020 /CNW/ – Blue Sky Uranium Corp. (TSXV: BSK ) (FSE: MAL2) (OTC: BKUCF) , ("Blue Sky" or the "Company") announces that the Company has made an application to the TSX Venture Exchange to extend the term of the outstanding warrants as follows: 5,940,064 warrants that are set to expire on December 19, 2020 to be extended to December 19, 2022. The warrants are also subject to an accelerator (see text below).

The exercise price of the warrants will remain at $0.30. Each whole warrant, when exercised, will be exchangeable for one common share of the Company.The Warrant exercise period may be accelerated if the volume weighted average price ("VWAP") for the Company’s common shares on the Exchange is $0.50 or greater for a period of 5 consecutive trading days, then […]

GoviEx Uranium Provides Status Report on Madaouela Updated PFS and Updates on Falea Polymetallic Exploration Program Underway

Over the past year, the Company’s technical team together with our feasibility study consultants, SRK Consulting (UK) Ltd (" SRK ") and SGS Bateman (Pty) Ltd (" SGS "), have been focused on metallurgical testing and engineering design work that have potential to significantly benefit the overall feasibility of the Madaouela Project. We have been working diligently to target areas that may reduce both operating and capital costs relative to the current technical report on the Madaouela Project(1) while at the same time working on reducing technical risk, with a focus on improving overall project economics.

Metallurgical test work has been ongoing at the technical teams’ offices in South Africa to verify initial results and to compare alternative trade-off options. Due to the novel logistical challenges associated with COVID-19 as well as transportation permit delays, the test work has taken longer than originally anticipated; however, we are pleased to report […]

Click here to view original web page at www.juniorminingnetwork.com

France aims to retain leadership in global uranium mining

France, the world’s leading country in nuclear power, plans to retain its leadership in the global market into the future through the acceleration of building of new nuclear power capacities throughout the world and development of uranium projects.

Since the early 1960s France has achieved success by developing its nuclear power industry. At present, the country operates more than 60 nuclear power units, which together produce more than 400 billion kWh annually, or more than 75% of the total electricity generated in France. The industry provides local customers with electricity at prices significantly lower than in any other country in the EU.

In addition to the domestic market, a significant of part of electricity produced by French nuclear power plants is exported to neighboring countries, including Italy, Switzerland, Belgium, the United Kingdom, Spain and others.

France’s nuclear success is also due to stable supplies of uranium for its power plants. As France […]

IsoEnergy Intersects 74.0% U3O8 Over 3.5m Within 38.8% U3O8 Over 7.5m in Drill Hole LE20-76

IsoEnergy Ltd. is pleased to report the final chemical assay results from the summer drilling program completed in late October at the Hurricane zone. The Hurricane zone is a recent discovery of high-grade uranium mineralization on the Company’s 100% owned Larocque East property in the Eastern Athabasca Basin of Saskatchewan . Highlights: South extension drill hole LE20-76 intersected 7.5m of uranium …

IsoEnergy Ltd. (” IsoEnergy ” or the ” Company “) ( TSXV: ISO ) (OTCQX: ISENF) is pleased to report the final chemical assay results from the summer drilling program completed in late October at the Hurricane zone. The Hurricane zone is a recent discovery of high-grade uranium mineralization on the Company’s 100% owned Larocque East property (the ” Property “) in the Eastern Athabasca Basin of Saskatchewan .

Highlights: South extension drill hole LE20-76 intersected 7.5m of uranium mineralization that averages 38.8% U 3 O 8 […]

Uranium Week: Have We Seen The Lows For Uranium?

As the spot price of uranium holds steady for the month, an investment firm details bright prospects for the sector.

-Are we past the cyclical downturn for uranium?

-Five investment ideas

-The monthly spot price is unchangedIn the view of Australian investment firm Shaw and Partners, uranium markets are past the cyclical downturn driven by the Fukushima earthquake.A recovery is evidenced by spot uranium prices having increased 25% to US$30/lb this year due to supply-side discipline and inventory drawdowns, notes Shaw. The inertia that took hold after the US Section 232 petition, which was compounded by covid-19, is finally ready to be dislodged. In addition, Russian Suspension Agreement and US election uncertainty is now over.US and European utilities have the clarity and bandwidth to think about procurement. Shaw believes utilities will have to act in 2021 to cover a shortage of term contacts from 2023, given the two […]

Purepoint Uranium Group Inc. Announces Private Placement

/NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES/ New Traders Swear By Benzinga Options

We sift through this volatile market for consistent trades so you don’t have to. Get Benzinga Options: Starter Edition to follow Benzinga’s high-conviction options trades.

Click here to get my trades!

TORONTO, Dec. 1, 2020 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (the "Company") announced a non-brokered private placement (the "Private Placement") of up to 20,000,000 flow-through units (the "Flow-Through Units") at a price of $0.05 per unit for aggregate gross proceeds up to $1,000,000.00. Each Flow-Through Unit consists of one common share in the capital of the Company to be issued on a "flow through" basis pursuant to the Income Tax Act (Canada) and one common share purchase warrant. Each warrant entitles its holder to purchase one common share in the capital of the Company at an […]

Uranium Energy Corp. (NYSE:UEC) – Analysts’ Revisions Show Sentiment Is Improving

Uranium Energy Corp. (NYSE:UEC) traded at $1.06 at close of the session on Monday, Nov 30, made a downturn move of -0.93% on its previous day’s price.

Looking at the stock we see that its previous close was $1.07 and the beta (5Y monthly) reads 2.14 with the day’s price range being $1.0300 – 1.0700. The company has a trailing 12-month PE ratio of 0. In terms of its 52-week price range, UEC has a high of $1.29 and a low of $0.35. The company’s stock has gained about 20.45% over that past 30 days. Decrease Anxiety and Be More Alert with TR CBD Tincture Many people lack focus due to anxiety but CBD can help. Add a couple of drops of Tyson Ranch Strawberry & Cream Full Spectrum CBD Tincture on the tongue to start feeling fast relief so you can focus.

Continue Reading Uranium Energy Corp. has […]

BNP Paribas Arbitrage SA Increases Stock Holdings in Uranium Energy Corp. (NYSEAMERICAN:UEC)

Uranium Energy logo BNP Paribas Arbitrage SA lifted its stake in shares of Uranium Energy Corp. (NYSEAMERICAN:UEC) by 398.1% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 45,835 shares of the basic materials company’s stock after buying an additional 36,633 shares during the period. BNP Paribas Arbitrage SA’s holdings in Uranium Energy were worth $46,000 at the end of the most recent quarter.

Several other large investors also recently made changes to their positions in the stock. Exchange Traded Concepts LLC boosted its position in shares of Uranium Energy by 183.2% during the third quarter. Exchange Traded Concepts LLC now owns 709,028 shares of the basic materials company’s stock valued at $707,000 after buying an additional 458,661 shares during the last quarter. Bridgeway Capital Management Inc. boosted its position in Uranium Energy by 26.2% in the […]

Click here to view original web page at www.modernreaders.com