The trading price of Uranium Energy Corp. (AMEX:UEC) closed lower on Monday, November 22, closing at $4.10, -4.43% lower than its previous close.

Traders who pay close attention to intraday price movement should know that it fluctuated between $4.08 and $4.44. In examining the 52-week price action we see that the stock hit a 52-week high of $5.79 and a 52-week low of $0.94. Over the past month, the stock has gained 4.59% in value.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns. Click […]

Tag: uranium

Uranium Energy Corp. [UEC] stock Initiated by Canaccord Genuity analyst, price target now $1.50

Uranium Energy Corp. [AMEX: UEC] stock went on a downward path that fall over -12.45% on Friday, amounting to a one-week price decrease of less than -21.57%. The company report on November 9, 2021 that Uranium Energy Corp Creates America’s Largest Uranium Mining Company with the Acquisition of Uranium One Americas.

Uranium Energy Corp. (NYSE American: UEC) (the “Company” or “UEC”) is pleased to announce the Company has entered into a definitive share purchase agreement with Uranium One Investments Inc., a subsidiary of Uranium One Inc. (“Uranium One”), to acquire all the issued and outstanding shares of Uranium One Americas, Inc. (“U1A”) for a total purchase price comprised of $112 million in cash and the replacement (with corresponding payments to the seller) of $19 million in reclamation bonding (the “Acquisition”). Uranium One is the world’s fourth largest uranium producer and part of Russia’s State Atomic Energy Corporation, Rosatom.

3 Tiny […]

Sprott Physical Uranium Trust Announces Filing of Second Amended and Restated Base Shelf Prospectus and Updated “At-The-Market” Equity Program

TORONTO, Nov. 23, 2021 (GLOBE NEWSWIRE) — Sprott Asset Management LP (“Sprott Asset Management”), on behalf of the Sprott Physical Uranium Trust (TSX: U.UN) (TSX: U.U) (the “Trust” or “SPUT”), a closed-ended trust created to invest and hold substantially all of its assets in physical uranium, today announced that the Trust has filed and obtained a receipt from securities regulatory authorities in each of the provinces and territories of Canada for its second amended and restated short form base shelf prospectus (the “Second Amended and Restated Shelf Prospectus”) amending and restating its amended and restated short form base shelf prospectus dated September 9, 2021. The Second Amended and Restated Shelf Prospectus allows the Trust to issue up to US$3.5 billion of units of the Trust (“Units”) in Canada during the 25-month period that commenced on August 10, 2021.

The Trust has also updated its at-the-market equity program (the “ATM Program”) […]

Click here to view original web page at www.globenewswire.com

WESTERN URANIUM & VANADIUM CORP. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q)

Forward-Looking Statements

The information disclosed in this quarterly report, and the information incorporated by reference herein, include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions, or strategies regarding the future. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "possible," "potential," "predict," "project," "should," "would," and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained or incorporated by reference in this quarterly report are based […]

Click here to view original web page at www.marketscreener.com

Top Stories This Week: Gold’s Path After Tapering News, Talking Uranium with Sprott

Catch up and get informed with this week’s content highlights from Charlotte McLeod, our editorial director. Top Stories This Week: Gold’s Path After Tapering News, Talking Uranium with Sprott

The US Federal Reserve was in focus in the gold space this past week as investors waited for comments from its latest meeting, held from Tuesday (November 2) to Wednesday (November 3).

The Fed was anticipated to announce plans to ease its bond-buying program, and that is in fact what happened .

The central bank is now buying US$120 billion worth of bonds a month, but said that in the coming weeks it will start cutting that amount by US$15 billion a month. If it keeps up that pace, bond buying would end in June 2022.Speaking directly after the news, Gareth Soloway of InTheMoneyStocks.com told me that this flexibility from the Fed is something the market loves because it indicates […]

Consolidated Uranium : November 15, 2021 Consolidated Uranium Announces Closing of C$8.0 Million Private Placement by Labrador Uranium Inc.

Consolidated Uranium Announces Closing of C$8.0 Million Private

Placement by Labrador Uranium Inc.

Not for distribution to United States Newswire Services or for dissemination in the United States

Toronto, ON, November 15, 2021 – Consolidated Uranium Inc. ("CUR" or the "Company") (TSXV: CUR) (OTCQB: CURUF) is pleased to announce that further to its press release on October 18, 2021 regarding the creation and planned spin-out (the "Spin-Out") of Labrador Uranium Inc. ("Labrador Uranium" or "LUR"), LUR has completed its previously announced fully marketed private placement (the "LUR Offering") for gross proceeds of C$8,000,000 from the sale of 11,428,571 subscription receipts of LUR (each, a "Subscription Receipt") at a price of C$0.70 per Subscription Receipt (the "Offering Price"). Red Cloud Securities Inc. acted as lead agent and sole bookrunner on behalf of a syndicate of agents including Haywood Securities Inc. and PI Financial Corp. (collectively, the "Agents") under the LUR Offering.Each Subscription Receipt […]

Click here to view original web page at www.marketscreener.com

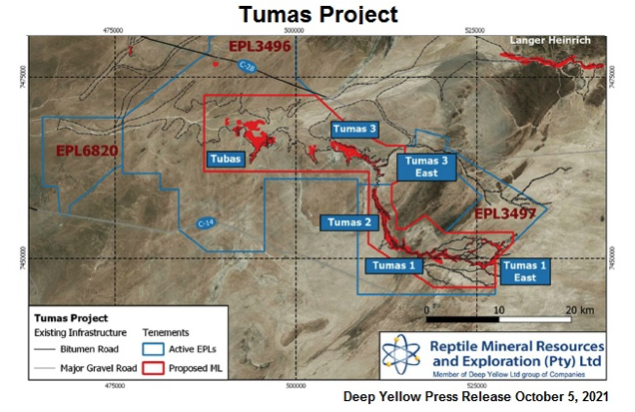

DYLLF: Infill RC Drilling Program at Tumas Uranium Project Increases the Estimated Mineral Resource by 50% and the Ore Reserve Estimate by 121%; on Track to Comple

OTC:DYLLF | ASX:DYL.AX

Management’s goal is develop Deep Yellow (OTC:DYLLF) (ASX:DYL.AX) into a Tier I, multi-jurisdictional uranium producer during the current uranium up-cycle. Currently, management is pursuing activities at an accelerated pace that will support the completion of a DFS on the Tumas Project with a 20+ year LOM operation , up from the 11 ½ years in the Pre-Feasibility Study (PFS) that was released in February 2021.

Since the beginning of 2021, Deep Yellow has achieved several highly significant milestones toward becoming a Tier I producer of uranium .

Tumas Project Infill drilling programs between February and August 2021 at Tumas 3, Tumas 1 & Tumas 1 East contributed to an updated Mineral Resource Estimate , primarily through converting over 100% of the existing Inferred Resources to the Indicated Resource category. This upgrade drilling campaign was successful in supporting management’s goal of expanding the LOM to over 20 years […]

Uranium Energy Corp. (UEC): Don’t disregard this ominous signal

At the end of the latest market close, Uranium Energy Corp. (UEC) was valued at $4.90. In that particular session, Stock kicked-off at the price of $4.80 while reaching the peak value of $4.81 and lowest value recorded on the day was $4.26. The stock current value is $4.29.Recently in News on November 9, 2021, Uranium Energy Corp Creates America’s Largest Uranium Mining Company with the Acquisition of Uranium One Americas. Uranium Energy Corp. (NYSE American: UEC) (the “Company” or “UEC”) is pleased to announce the Company has entered into a definitive share purchase agreement with Uranium One Investments Inc., a subsidiary of Uranium One Inc. (“Uranium One”), to acquire all the issued and outstanding shares of Uranium One Americas, Inc. (“U1A”) for a total purchase price comprised of $112 million in cash and the replacement (with corresponding payments to the seller) of $19 million in reclamation bonding (the […]

Uranium Week: US Infrastructure Bill Passed

This story features BOSS ENERGY LIMITED. For more info SHARE ANALYSIS: BOE

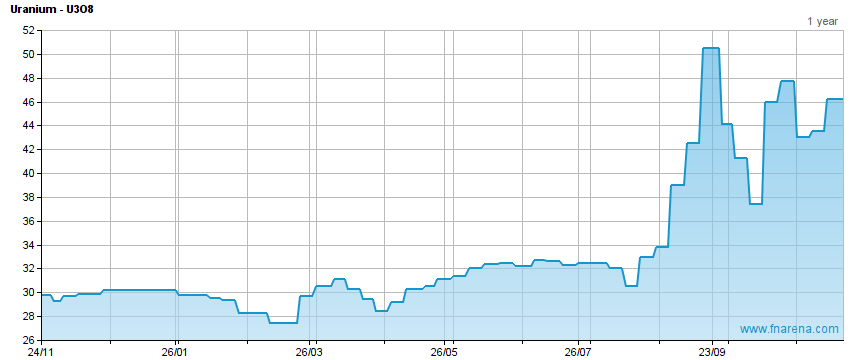

As the spot uranium price stayed relatively flat last week, support for the nuclear industry comes from one of the largest infrastructure packages in US history.

-US infrastructure bill support for threatened nuclear facilities

-Kazatomprom moves joint venture forward

-Who will be Australia’s next uranium producer? -Uranium spot price rises less than 1% for the week The US$1.2tr Infrastructure Investment and Jobs Act was signed into law last week.The bill provides US$6bn in US Department of Energy funding to support nuclear facilities that are under economic threat of premature closures.The new legislation also appropriates US$2.4bn of funding for micro reactors, small modular reactors (SMRs) and advanced reactors, while an additional US$3.2bn is authorised through to 2027. Company news Kazatomprom, the world’s largest producer of uranium, has approved a Life of Mine plan for the […]

MoneyTalks: Arlington’s Simon Catt says his top sector picks for 2022 are gold and uranium

Pic: Matthias Clamer (Stone) via Getty Images share

MoneyTalks is Stockhead ’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today, we hear from Simon Catt, director at Arlington Group Asset Management. Gold is hot right now

Catt said that his first pick for 2022 is Wiluna Mining Corporation (ASX:WMC) which has a market cap of $120 million.“Strategic shareholders from Russia and Germany seem to agree this is a very serious gold asset,” he said.“The Germans and Russians have backed Wiluna in a $53 million equity raise on the eve of commissioning its new 100,000 ounce pa underground gold mine and concentrator in the northeastern Australian goldfields.“Two high profile Russian gold industry players have joined German billionaire Thomas Zours at the top of the Wiluna share register.”Catt said that tier one global gold producer Polymetals – which will […]

How AI Is Fueling Renewable Energy & Electric Vehicles

With the push for more renewable sources of energy and electric vehicles comes the need for the materials needed to produce them. Demand for metals, such as cobalt, lithium, copper, and uranium is predicted to grow much faster than available supply.

Finding new sources of these minerals is going to take innovation and new types of technology, such as artificial intelligence (AI).

One company fueling the shift to electric power is KoBold Metals, a minerals explorer that is using AI to find the cobalt resources manufacturers need. Privately held, Kobold is funded in part by climate tech group Breakthrough Energy, which is backed by Bill Gates, Jeff Bezos, Richard Branson, and Michael Bloomberg, to name a few of Breakthrough’s heavy hitters. Founded in 2015 by Gates, Breakthrough Energy is “concerned about the impacts of accelerating climate change” and “supports the innovations that will lead the world to net-zero emissions." Investors also […]

Click here to view original web page at www.streetwisereports.com

Consolidated Uranium Announces Closing of C$20.0 Million Bought Deal Private Placement

Not for distribution to United States Newswire Services or for dissemination in the United States

TORONTO, Nov. 22, 2021 (GLOBE NEWSWIRE) — Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce the closing of its previously announced “bought deal” private placement (the “ Offering ”) for gross proceeds of C$20,000,750 from the sale of 7,547,453 units of the Company (the “ Units ”) at a price of C$2.65 per Unit (the “ Unit Price ”), which includes the full exercise of the over-allotment option. Due to significant demand, the Offering was upsized from its original gross proceeds of C$15.0 million. Red Cloud Securities Inc. acted as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters that included Haywood Securities Inc. and PI Financial Corp. (collectively, the “ Underwriters ”).

Philip Williams, President and CEO commented, “we are […]

Click here to view original web page at www.globenewswire.com

Today’s Market View – Castillo Copper, BlueRock Diamonds, Power Metal Resources and more…

Altus Strategies* (LON:ALS) – Portfolio of Moroccan exploration assets vended into Eastinco Atlantic Lithium* (LON:ALL) / IronRidge Resources* (IRR LN) – Change of name to Atlantic Lithium Aura Energy* (LON:AURA) – Realignment of the board in preparation for development of the of Tiris uranium project SP Angel . Morning View . Monday 22 11 21

Copper and nickel lead gains as oil prices pull back on Covid in Europe

Atome Energy Plc plans to produce green hydrogen and ammonia from its projects that access renewable energy from hydropower and geothermal sources

The company is planning to list on the AIM market – www.atomeplc.comInvestors may apply through their investment managers.Altus Strategies* ( Altus Strategies PLC (AIM:ALS, TSX-V:ALTS, OTCQX:ALTUF) ) – Portfolio of Moroccan exploration assets vended into EastincoAtlantic Lithium* ( Atlantic Lithium Limited (AIM:ALL) ) / IronRidge Resources* (IRR LN) – Change of name to Atlantic LithiumAura Energy* ( Aura Energy Ltd (ASX:AEE, […]

Click here to view original web page at www.proactiveinvestors.co.uk

FTSE Gains, Marks & Spencer Rises After Takeover Speculation

Global News Select Marks & Spencer Rises After Takeover Speculation

Marks & Spencer Group shares gain 3% after weekend news reports suggested U.S. private equity giant Apollo Global Management was considering a buyout of the U.K. retailer. The company’s food business and its tie-up with online retailer Ocado Group are likely to have sparked Apollo’s interest, particularly given M&S’s upbeat 1H results earlier this month, Hargreaves Lansdown says. "However, shares have surged more than 27% since those impressive results and if the price continues to climb, there is a chance Apollo may turn into more of a reluctant suitor," HL analyst Susannah Streeter says.

Companies News: Jersey Oil & Gas Appoints New Nonexecutive Chairman, CFO

Jersey Oil & Gas PLC said Monday that it has appointed a new nonexecutive chairman, chief financial officer and chief commercial officer, effective immediately.—Thruvision 1H Pretax Loss Widened on Lower Revenue; Confident for 2HThruvision Group PLC […]

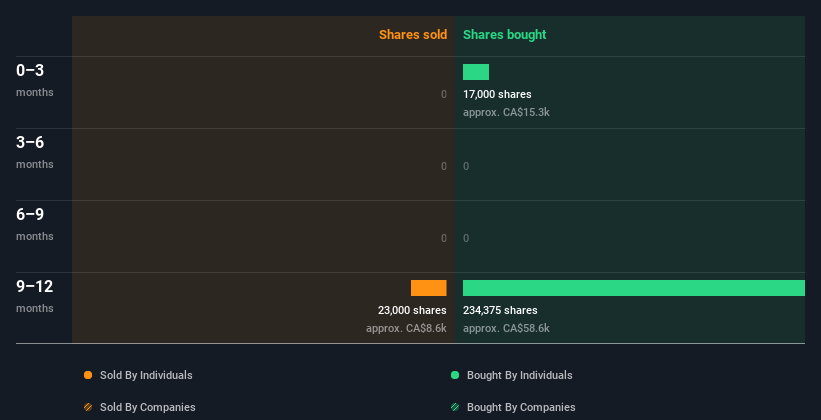

Even though Appia Rare Earths & Uranium Corp.’s (CSE:API) stock is down 15% this week, insiders who bought lately made a CA$79k profit

Insiders who bought Appia Rare Earths & Uranium Corp. ( CSE:API ) in the last 12 months may probably not pay attention to the stock’s recent 15% drop. Reason being, despite the recent loss, insiders original purchase value of CA$74k is now worth CA$153k.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing. The Last 12 Months Of Insider Transactions At Appia Rare Earths & Uranium

While there weren’t any large insider transactions in the last twelve months, it’s still worth looking at the trading.

Over the last year, we can see that insiders have bought 251.38k shares worth CA$74k. But insiders sold 23.00k shares worth CA$8.8k. In total, Appia Rare Earths & Uranium insiders bought more than they sold over the […]

VIDEO — Peter Grandich: General Equities Risky; Gold a Safe Bet, Uranium Has Room to Run

Peter Grandich of Peter Grandich & Co. said the general equities space is "as expensive, as complacent and as risky" as it’s been for his 40 years of involvement. Peter Grandich: General Equities Risky; Gold a Safe Bet, Uranium Has Room to Run

Sentiment surrounding gold may have dimmed this year with the price below 2020’s all-time high, but the yellow metal is still a much safer place to be than the general equities market.

That’s according to Peter Grandich of Peter Grandich & Co. Speaking to the Investing News Network, he said the general equities space is "as expensive, as complacent and as risky" as it’s been for his 40 years of involvement.

The question of course is when this major financial bubble may burst.Timing is tricky, but Grandich said investors should look at the market and consider whether they would enter it today. "If you’re hesitant or […]

How the U.S. Lost Ground to China:

WASHINGTON — Tom Perriello saw it coming but could do nothing to stop it. André Kapanga too. Despite urgent emails, phone calls and personal pleas, they watched helplessly as a company backed by the Chinese government took ownership from the Americans of one of the world’s largest cobalt mines.

It was 2016, and a deal had been struck by the Arizona-based mining giant Freeport-McMoRan to sell the site, located in the Democratic Republic of Congo, which now figures prominently in China’s grip on the global cobalt supply. The metal has been among several essential raw materials needed for the production of electric car batteries — and is now critical to retiring the combustion engine and weaning the world off climate-changing fossil fuels.

Mr. Perriello, a top U.S. diplomat in Africa at the time, sounded alarms in the State Department. Mr. Kapanga, then the mine’s Congolese general manager, all but begged the […]

UEX Corporation Files Updated Horseshoe-Raven Technical Report

Saskatoon, Saskatchewan – TheNewswire – November 17, 2021 – UEX Corporation (TSX:UEX) (“UEX” or the “Company”) is pleased to announce it has filed a technical report on the Horseshoe-Raven Project (the “Technical Report”) located in the eastern Athabasca Basin of northern Saskatchewan, prepared in accordance with National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI-43-101”).

In 2011 a Preliminary Economic Assessment titled “Preliminary Assessment Technical Report on the Horseshoe and Raven Deposits, Hidden Bay Project, Saskatchewan, Canada”) (the “2011 PEA”) was completed for the Horseshoe and Raven deposits. Due to the passage of time, the Company considers that the economic assessment of the 2011 PEA is no longer current and is no longer being relied upon by the Company. This 2021 Technical Report replaces the 2011 PEA with an updated estimate of mineral resources.

The Technical Report is entitled: “2021 Technical Report on the Horseshoe-Raven Project, Saskatchewan” and was prepared […]

Click here to view original web page at www.juniorminingnetwork.com

CanAlaska Uranium Grants Stock Options

Vancouver, British Columbia–(Newsfile Corp. – November 20, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N ) ("CanAlaska" or the "Company") announces that it has granted incentive stock options to certain directors, officers and consultants of the Company to purchase up to an aggregate of 1,760,000 common shares of the Company pursuant to the company’s share option plan. The options are exercisable for a period of three years at a price of $0.57 per share.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in […]

Click here to view original web page at www.juniorminingnetwork.com

Kalkine Group Opines Abundant Opportunities for Critical Metals

SAN FRANCISCO, Nov. 19, 2021 /PRNewswire/ — Global Clean Energy Transmission provides a big investment opportunity for Rare and Critical Metals such as uranium, aluminium, rare earth, copper, lithium, and graphite. These metals are geologically rare and economically crucial with wide usage in batteries, electric vehicles, and low emission technologies.

Ample Pay-off from Sustainable Investing

The bewildering green initiatives by the advanced economies such as whopping US$1.75 trillion investments by the US government (New Jersey Business & Industry Association press release dated October 28, 2021) towards climate change and infrastructure, and EUR 1 trillion by the EU government (World Economic Forum press release dated July 13, 2021) towards the sustainable investment plan are hard-charging the clean energy space.

The Australian market showcased ample natural resources with rare earth’s share of the global output touching high single-digit. The government’s big push with $2 billion liquidity support (as per the press release […]

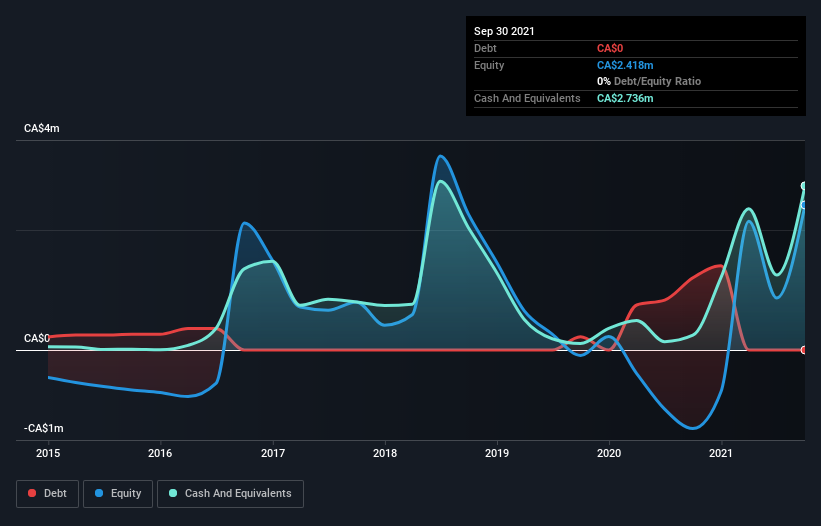

Is Blue Sky Uranium (CVE:BSK) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. For example, Blue Sky Uranium ( CVE:BSK ) shareholders have done very well over the last year, with the share price soaring by 148%. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given its strong share price performance, we think it’s worthwhile for Blue Sky Uranium shareholders to consider whether its cash burn is concerning. For the purpose of this article, we’ll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We’ll start by comparing its cash burn with its cash reserves in order to calculate its cash runway. How Long Is Blue Sky Uranium’s Cash Runway?

A cash runway is defined as the […]

Azarga Uranium Shareholders Approve Merger with enCore Energy

https://attendee.gotowebinar.com/register/5708536147519920651 .

"enCore is very pleased with the results of the Azarga Uranium shareholder vote and will be working closely with Azarga to complete the next steps to close this transaction," said William M. Sheriff, Executive Chairman. "Upon closing of this transaction, enCore Energy will have established itself as one of the leading in-situ recovery uranium development companies in the United States. The two licensed Texas production plants, now under revitalization, combined with over 90 million 43-101 compliant pounds of uranium resources across Wyoming, South Dakota and New Mexico 1 ideally position enCore to advance clean energy sources in the nuclear renaissance."

In addition, the Plan of Arrangement was approved by a simple majority of the votes cast by Azarga Uranium shareholders, excluding the votes cast in respect of the Azarga Uranium shares held by certain related parties (as defined by Multilateral Instrument 61-101 – Protection of Minority Security […]

Click here to view original web page at www.juniorminingnetwork.com

How the U.S. Lost Ground to China in the Contest for Clean Energy

WASHINGTON — Tom Perriello saw it coming but could do nothing to stop it. André Kapanga too. Despite urgent emails, phone calls and personal pleas, they watched helplessly as a company backed by the Chinese government took ownership from the Americans of one of the world’s largest cobalt mines.

It was 2016, and a deal had been struck by the Arizona-based mining giant Freeport-McMoRan to sell the site, located in the Democratic Republic of Congo, which now figures prominently in China’s grip on the global cobalt supply. The metal has been among several essential raw materials needed for the production of electric car batteries — and is now critical to retiring the combustion engine and weaning the world off climate-changing fossil fuels.

Mr. Perriello, a top U.S. diplomat in Africa at the time, sounded alarms in the State Department. Mr. Kapanga, then the mine’s Congolese general manager, all but begged the […]

New Okapi MD to drive North American uranium play

Okapi Resources has appointed highly experienced mining executive Andrew Ferrier as the company’s new Managing Director. Ferrier brings with him over 15 years’ experience in corporate finance, management and principal investment roles in the global mining sector. He previously spent over a decade at Pacific Road Capital – a mining and metals-focused private equity investment firm with interests across Australia, Canada and the US. Okapi has appointed Andrew Ferrier as the company’s new Managing Director. Okapi Resources has appointed highly experienced mining executive Andrew Ferrier as the company’s new Managing Director. Ferrier brings with him over 15 years’ experience in corporate finance, management and principal investment roles in the global mining sector. He previously spent over a decade at Pacific Road Capital, a mining and metals-focused private equity investment firm with interests across Australia, Canada and the US.

With significant experience in the North American uranium space, Okapi will be […]

Click here to view original web page at www.businessnews.com.au

Kalkine Group Opines Abundant Opportunities for Critical Metals

TORONTO, Nov. 19, 2021 /PRNewswire/ — Global Clean Energy Transmission provides a big investment opportunity for Rare and Critical Metals such as uranium, aluminium, rare earth, copper, lithium, and graphite. These metals are geologically rare and economically crucial with wide usage in batteries, electric vehicles, and low emission technologies.

Ample Pay-off from Sustainable Investing

The bewildering green initiatives by the advanced economies such as whopping US$1.75 trillion investments by the US government (New Jersey Business & Industry Association press release dated October 28, 2021) towards climate change and infrastructure, and EUR 1 trillion by the EU government (World Economic Forum press release dated July 13, 2021) towards the sustainable investment plan are hard-charging the clean energy space.

The Australian market showcased ample natural resources with rare earth’s share of the global output touching high single-digit. The government’s big push with $2 billion liquidity support (as per the press release from […]