NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES Denison Mines Corp. is pleased to announce that it has closed its bought deal private placement of common shares that qualify as “flow-through shares” for purposes of the Income Tax Act previously announced on February 11, 2021 . View … Denison Mines (CNW Group/Denison Mines Corp.) /NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES /

Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML) (NYSE American: DNN) is pleased to announce that it has closed its bought deal private placement of common shares that qualify as “flow-through shares” for purposes of the Income Tax Act ( Canada ) (the “Flow-Through Shares”), […]

Category: Uranium

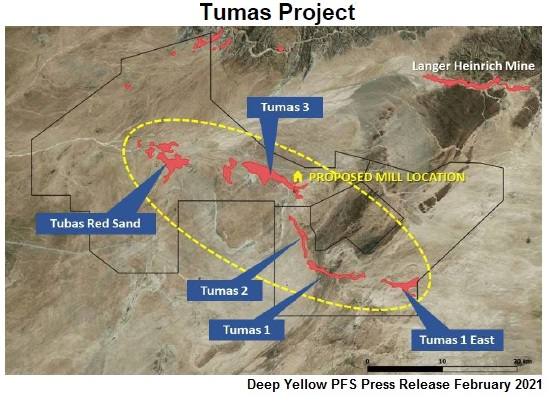

Deep Yellow Limited Releases Positive PFS with Maiden Reserve on Tumas Project; Board Approves Proceeding Directly to a DFS

OTC:DYLLF | ASX:DYL.AX

Deep Yellow (OTC:DYLLF) (ASX:DYL.AX) has achieved several highly significant milestones over the last few weeks concerning the company’s advancement toward becoming a Tier I multi-jurisdictional uranium producer during the current uranium up cycle.

1) A positive Pre-Feasibility Study (PFS) on the Tumas Project aka the Reptile Project, including a Maiden Reserve for the Project

2) The completion of a AUD$ 40.8 million private placement to help fund management’s dual-pillar growth strategy, namely advancing the Tumas Project to production and becoming a multi-jurisdictional producera. The net proceeds plus cash on hand will be utilizedi. to complete the DFS on the Tumas Projectii. to fund drilling programs to upgrade and expand the Resources at Tumas andiii. to pursue acquisitions/ mergers3) Having reviewed the PFS, the Board approved the immediate pursuit of a Definitive Feasibility Study (DFS). Work of the DFS commenced in February 2021 with an expected completion date by the […]

Uranium stocks rally as nations tighten emissions targets

Uranium stocks are on the rise as demand grows with nuclear power touted as essential to meeting zero emissions goals by 2050. The uranium industry is setting up for an accelerated rise in prices with a supply deficit looming and demand growing as governments target ‘cleaner and greener’ energy sources – a sector in which nuclear power didn’t seem to be considered until now.

Nuclear power has been sidelined by governments for years, hampered by its dangerous association with the atomic bomb and radioactive disasters. However, it is recently regaining attraction for its low emissions, ability to reliably provide baseload electricity around the clock and its relatively low cost as a generation fuel.

One of the first tasks new US President Joe Biden undertook in January was the country’s reinstatement to the Paris climate agreement and while it’s not clear as yet what he’ll do to meet the pact’s emissions goals, […]

Appia Proposes Corporate Name Change to Highlight Its Rare Earth Element and Uranium Focus

March 3, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) today announced that it will seek shareholder approval to change its name to “APPIA RARE EARTHS & URANIUM CORP.” in order to better identify the Company’s focus on the Alces Lake Project and the Athabasca Basin uranium prospects. The Property hosts some of the highest-grade total and critical rare earth elements (“ CREE “) and gallium mineralization in the world. CREE is defined here as those rare earth elements that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines, (i.e: neodymium (Nd), praseodymium (Pr) dysprosium (Dy), and terbium (Tb)).

In the oxide form, the Shanghai Metals Market quoted February 28 prices per kg in US$ are: Nd $105, up over 100% year over year […]

Royalty Round up, February 2021 – Important battery metals and uranium deals announced but majors and juniors still take a knock

February is the shortest month and a lot of royalty companies saw their share price performance come up short during the month February 2021 did not live up to expectations with the average share price for mining royalty and streaming companies down 3.4%; 76% of mining royalty and streaming companies had a negative or neutral share price movement compared to the start of the previous month.

This is despite major developments last month with deals in the battery metals and uranium royalties space. These deals demonstrate that the royalty market is starting to change, with the importance of royalties over large mining and metals projects that are not in the traditional precious metals space increasing. This could well be the pivotal moment in the short history of royalty companies, where we start to see the rise of non-precious metals and diversified royalty companies.

The majors were worst off last month down […]

Click here to view original web page at www.proactiveinvestors.co.uk

Resources Top 5(ish): Punters line up for uranium, lithium, gold and nickel plays

(Brooklyn 99/NBC) share

Carawine and Accelerate hit thick high grade gold at their respective projects

Uranium plays Bannerman and Alligator ride surging sentiment into solid gains

Hawkstone exceeds 99.5 per cent battery grade lithium benchmark in early testing Here are the top resources stocks in morning trade, Wednesday March 3. The Big Sandy lithium project in Arizona, USA “ can help President Biden deliver on his Green dream for net-zero emission by 2050 ”, Hawkstone says.Early test work produced battery grade lithium at 99.7 per cent purity from Big Sandy — exceeding the 99.5 per cent purity benchmark for battery grade lithium.Lithium recoveries of 90 per cent were also “demonstrated with minimal downstream losses”.Now it’s all about ramping up. Design of the bench scale (lab scale) and pilot-scale (smol plant scale) phases is currently underway, with bench scale testing due to kick off in March 2021, […]

UEX Presenting at the Red Cloud Pre-PDAC Mining Showcase on March 3rd

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – March 2, 2021 UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that its President and CEO Roger Lemaitre will present at 2:40 pm ET on March 3, 2021 with a follow-up question and answer period at the Red Cloud’s Virtual 2021 Pre-PDAC Mining Showcase Conference.

UEX’s presentation will begin at 2:40 pm ET on Wednesday March 3, 2021.

UEX invites individual and institutional investors, as well as advisors and analysts, to attend. If you would like to participate in the conference, please register at http://www.redcloudfs.com/prepdac2021/ Registered participants can request 1 on 1 meetings with UEX to learn more about our unique portfolio of projects during the Showcase from March 3 rd through March 5 th .

Recent Company Highlights – UEX recently announced that the Company’s winter 2021 exploration drill program testing targets on the Hidden […]

Western Uranium & Vanadium : Closes Final Tranche of Non-Brokered Private Placement

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado – Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) ("Western" or the "Company") is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the "Private Placement") (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the "Units") at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a "Share") plus one common […]

Click here to view original web page at www.marketscreener.com

Why Energy Fuels Stock Jumped 12% at the Open Today

What happened

Shares of uranium miner Energy Fuels ( NYSEMKT:UUUU ) rose a quick 12% in early trading on March 2. The most likely cause for the stock price move was the company’s news release after the close on March 1 announcing that it had signed a new deal outside of the uranium space. So what

Although Energy Fuels’ core business is mining for uranium, it has been looking to expand its reach into the rare earth metals space. To that end, in November 2020 the company announced that it had produced a rare earth element carbonate concentrate from material provided by a third party. Rare earth metals are integral to modern technology like electric vehicles but most of the rare earth metals available come from China. Recently China has floated the idea that it might limit exports of rare earth metals. That’s increased the demand for alternative sources […]

Skyharbour’s Partner Company Valor Initiates Phase I Work at Hook Lake Uranium Project; Skyharbour to Participate in Red Cloud’s 2021 Pre-PDAC Mining Showcase and Exhibiting at PDAC 2021 Convention

VANCOUVER, British Columbia, March 02, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) announced that partner company Valor Resources Limited (“Valor”) has entered into an Agreement with TerraLogic Exploration Inc. (“TerraLogic”) to provide mineral exploration services on its Hook Lake (previously called North Falcon Point) uranium project located in the eastern Athabasca Basin area of Saskatchewan. The first phase of exploration work will be an airborne geophysical survey over the Hook Lake Project. TerraLogic is currently finalizing the flight grid and technical parameters for the survey and soliciting quotes from airborne contractors with contracts anticipated to be finalized in March.

Hook Lake (North Falcon Point) Property Location

https://skyharbourltd.com/_resources/maps/hooklakeproject.pngThe Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The property hosts over […]

Click here to view original web page at www.globenewswire.com

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

Toronto, Ontario and Nucla, Colorado , March 01, 2021 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) (“ Western ” or the ” Company ”) is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the “ Private Placement ”) (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the ” Units ”) at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a " Share ") […]

Click here to view original web page at www.globenewswire.com

Skyharbour’s Partner Company Valor Initiates Phase I Work at Hook Lake Uranium Project; …

VANCOUVER, British Columbia, March 02, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) announced that partner company Valor Resources Limited (“Valor”) has entered into an Agreement with TerraLogic Exploration Inc. (“TerraLogic”) to provide mineral exploration services on its Hook Lake (previously called North Falcon Point) uranium project located in the eastern Athabasca Basin area of Saskatchewan. The first phase of exploration work will be an airborne geophysical survey over the Hook Lake Project. TerraLogic is currently finalizing the flight grid and technical parameters for the survey and soliciting quotes from airborne contractors with contracts anticipated to be finalized in March.

Hook Lake (North Falcon Point) Property Location

https://skyharbourltd.com/_resources/maps/hooklakeproject.pngThe Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The property hosts over half […]

Boss Energy pushes ahead with Honeymoon mine plans as uranium shortage unfolds

Boss Energy plans on becoming one of the lowest cost uranium producers globally. With predictions of an emerging uranium shortage in the near-term, Boss Energy (ASX: BOE) is a South Australian uranium explorer ready to take full advantage of the situation with its advanced Honeymoon uranium project in South Australia.

Uranium supplies were in a deficit last year compounded by the delay of new mines due to the ongoing subdued spot price and production constraints due to COVID-19.

However, with trade tensions easing particularly between the US and China, its expected utilities will re-enter the market in 2021 in search of long-term supplies.

Although the spot price remains below US$30 per pound, analysts are predicting eroding supplies and the dry project pipeline will spur uranium prices upward again past the US$50/lb which is the estimated “magic number” to incentivise new mines.Boss is poised to take advantage of the optimistic uranium outlook, while […]

Fission Uranium CEO, Ross McElroy, to Present at the BMO Global Metals and Mining Conference (Virtual)

KELOWNA, BC, March 1, 2021 /CNW/ – FISSION URANIUM CORP. ("Fission" or the "Company") is pleased to announce that President and CEO, Ross McElroy, will present at the BMO Metals and Mining Conference, which will take place virtually from March 1 – 5, 2021.

Mr. McElroy will provide an overview of Fission’s completed transition from explorer to developer, as well as the current activity and next steps for the Company’s advanced, high-grade and near surface uranium project in Saskatchewan. He will be participating in the Rapid Fire, Fireside Chat on March 3 at 3:00pm EST.

Fireside Chat Details Spokesperson : Ross McElroy, President and CEO

Investors interested in attending the Fission Uranium webcast at the event can register here bmo.qumucloud.com/view/2021-gmm-fission . Drilling Update Fission is also pleased to announced that core drilling has now commenced at its PLS property – host to the large, high-grade and near surface Triple R […]

Click here to view original web page at www.juniorminingnetwork.com

2021: A Breakout Year for Uranium Investments?

(Image via Anfield Energy Inc.) The Athabasca Basin is perhaps best known as the world’s leading source of high-grade uranium and currently supplies about 20% of the world’s uranium. It is a region in the Canadian Shield that encompasses northern Saskatchewan to Alberta across its 100,000 km2 area.

The basin is the home of both uranium producers and explorers such as Anfield Energy Inc. ( TSX-V: AEC , OTCQB: ANLDF , Forum ) .

This uranium and vanadium development Company is involved in near-term production that working to become one of the top-tier energies-related fuel suppliers as it creates value through the sustainable and efficient growth.

Anfield’s flagship uranium operation is the Charlie Project located in the Pumpkin Buttes Uranium District in Johnson County, Wyoming. Charlie consists of a 2.9 sq. km. (720-acre) uranium lease, which had a Preliminary Economic Assessment (PEA) completed in 2019.The Company’s other key asset is the […]

UEX Participating in Fireside Chat at the BMO Conference on March 2nd

UEX Corporation is pleased to announce that its President and CEO, Roger Lemaitre will participate in a Fireside Chat with Alexander Pearce BMO Mining Analyst at 3:45 pm ET on March 2, 2021 at the BMO- Global Metals & Mining Conference UEX’s Fireside Chat will begin at 3:45 pm ET on Tuesday March 2, 2021. Registered delegates at the BMO Conference can attend live and can book a 1 on 1 meeting with UEX if you are …

(TheNewswire) UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that its President and CEO, Roger Lemaitre will participate in a Fireside Chat with Alexander Pearce BMO Mining Analyst at 3:45 pm ET on March 2, 2021 at the BMO- Global Metals & Mining Conference

UEX’s Fireside Chat will begin at 3:45 pm ET on Tuesday March 2, 2021.

Registered delegates at the BMO Conference can […]

Fission CEO, Ross McElroy, to Present at the BMO Global Metals and Mining Conference

TSX SYMBOL: FCU OTCQX SYMBOL: FCUUF FRANKFURT SYMBOL: 2FU Fission Uranium Corp. is pleased to announce that President and CEO, Ross McElroy will present at the BMO Metals and Mining Conference, which will take place virtually from March 1 5, 2021. Mr. McElroy will provide an overview of Fission’s completed transition from explorer to developer, as well as the current activity and next steps for the Company’s …

TSX SYMBOL: FCU

OTCQX SYMBOL: FCUUF

FRANKFURT SYMBOL: 2FUFission Uranium Corp. (“Fission” or the “Company”) is pleased to announce that President and CEO, Ross McElroy will present at the BMO Metals and Mining Conference, which will take place virtually from March 1 5, 2021. Fission Uranium Corp. Logo (CNW Group/Fission Uranium Corp.) Mr. McElroy will provide an overview of Fission’s completed transition from explorer to developer, as well as the current activity and next steps for the […]

#Uranium / #Lithium Junior, Athabasca Nuclear Corp.

Ryan Kalt is the CEO of Athabasca Nuclear Corp. Athabasca Nuclear has been on the uranium scene since early 2013, when it acquired a 50% interest in the Preston Uranium Project. The following interview of CEO, Mr. Ryan Kalt of Athabasca Nuclear Corp, was conducted by phone & email from May 20th to May 25th. Athabasca Nuclear has been on the uranium scene since early 2013, when it acquired a 50% interest in the Preston Uranium Project. Its location in the southwestern Athabasca basin (see map below), is proximal to two of the biggest uranium discoveries of the century, one by Fission Uranium (TSX: FU) the other by NexGen Energy (TSX-V: NXE).

More recently, the Company has taken a shine to lithium, the metal, not the drug, best known as a key component of Li-ion batteries. To that end, it’s accumulated 5 lithium projects spread across Canada, a few of […]

Gear up for the change! Uranium Energy Corp. (UEC) has hit the volume of 4990522

For the readers interested in the stock health of Uranium Energy Corp. (UEC). It is currently valued at $2.22. When the transactions were called off in the previous session, Stock hit the highs of $2.38, after setting-off with the price of $2.24. Company’s stock value dipped to $2.21 during the trading on the day. When the trading was stopped its value was $2.31.

Recently in News on February 10, 2021, InvestorBrandNetwork (IBN) Announces Latest Episode of The Bell2Bell Podcast featuring Amir Adnani, President & CEO of Uranium Energy Corp.. via InvestorWire — InvestorBrandNetwork (“IBN”), a multifaceted communications organization engaged in connecting public companies to the investment community, is pleased to announce the release of the latest episode of The Bell2Bell Podcast as part of its sustained effort to provide specialized content distribution via widespread syndication channels. You can read further details here

A Backdoor Way To Profit From Today’s […]

Trader’s should divert their intention on this Stock- Uranium Energy Corp. (AMEX:UEC) with the stream of -5.86%

On FRIDAY, shares of Uranium Energy Corp. (AMEX:UEC ) reached at $2.09 price level during last trade its distance from 20 days simple moving average was 0.14%, and its distance from 50 days simple moving average was 10.09% while it has a distance of 67.97% from the 200 days simple moving average.

Past 5 years growth of UEC observed at 20.60%, and for the next five years the analysts that follow this company are expecting its growth at 0. The average true range (ATR) is a measure of volatility introduced by Welles Wilder in his book, “New Concepts in Technical Trading Systems.” The true range indicator is the greatest of the following: current high less the current low, the absolute value of the current high less the previous close and the absolute value of the current low less the previous close. The average true range is a moving average, generally […]

Click here to view original web page at www.stocksequity.com

CanAlaska Uranium Announces up to $2,000,000 Private Placement Financing

Vancouver, British Columbia–(Newsfile Corp. – February 26, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV ) (OTCQB: CVVUF) (FSE: DH7N ) ("CanAlaska" or the "Company") announces that it proposes to undertake a non-brokered private placement of securities to raise total gross proceeds of up to $2,000,000 (the " Offering ").

The Offering will be comprised of a combination of: (i) non-flow-through units (the " NFT Units ") to be sold at a price of $0.50 per NFT Unit; (ii) flow-through units (the " FT Units ") to be sold at a price of $0.64 per FT Unit; and (iii) flow-through charity units (the " Charity Units ") to be sold at a price of $0.69 per Charity Unit. Each NFT Unit will be comprised of one non-flow-through common share and one-half (0.5) of one warrant. Each FT Unit and Charity Unit will be comprised of one flow-through common share and one-half […]

Click here to view original web page at www.juniorminingnetwork.com

Bacchus Capital Puts Together US$140 million Equity Capital Raising for its Uranium Venture, Yellow Cake plc

LONDON, Feb. 26, 2021 /PRNewswire/ — Bacchus Capital advised Yellow Cake on its oversubscribed international fundraising, with investors from Europe, Asia and North America

Proceeds to be used to acquire up to 3.5 million pounds of uranium ("U 3 O 8 ") under the Kazatomprom purchase option

Furthers Yellow Cake’s thesis of holding uranium for the long-term as the structural mispricing of the commodity moves to correction

Bacchus Capital Advisers Limited ("Bacchus Capital"), the independent investment and merchant bank specialising in cross border public market M&A, and natural resources sector ventures, is pleased to have arranged financing for the US$100 million purchase of physical uranium, by Yellow Cake Plc, pursuant to its option with Kazatomprom. The US$140 million oversubscribed equity fundraising was conducted by accelerated bookbuild, in which Canaccord Genuity Limited and Cantor Fitzgerald & Co. were appointed as Joint Bookrunners.Yellow Cake plc (AIM: YCA) ("Yellow Cake"), […]

How the largest producer of US uranium is on its way to becoming a major rare earths player

There hasn’t been much news from Energy Fuels Inc. (NYSE American: UUUU | TSX: EFR) since their announcement on December 14, 2020, for a new three-year supply agreement for monazite with The Chemours Company (NYSE: CC). However, in 2021 the company has presented at two investment conferences so far in 2021 in January (NobleCon 17 Virtual Conference) and in February (MI3/InvestorIntel Rare Earths Virtual Conference) as management updates the market on the company’s progress. Recall that Energy Fuels is one of our Top 5 Rare Earths companies for 2021.

Firstly, recall that Energy Fuels’ core business is uranium and the company is the largest US producer of uranium. Energy Fuels owns and operates the only fully licensed and operating conventional uranium mill in the US (the White Mesa Mill). They have a licensed capacity of 8 million pounds of U3O8 per year and this provides Energy Fuels with “significant production […]

Liberty Star Uranium & Metals Corp. (OTCMKTS:LBSR) Files An 8-K Material Modification to Rights of Security Holders

Liberty Star Uranium & Metals Corp. (OTCMKTS:LBSR) Files An 8-K Material Modification to Rights of Security Holders

Item 3.03. Material Modification to Rights of Security Holders.On November 24, 2020, Liberty Star Uranium & Metals Corp. (the “Company”) filed a Certificate of Change to NRS 78.209 with the Secretary of State of the State of Nevada to affect a reverse stock split (the “Reverse Stock Split”). to the Certificate of Change, the Reverse Stock Split was formally processed by FINRA’s OTC Corporate Actions Department on February 24, 2021 effective on February 25, 2021. The Company’s common stock will begin trading on a split-adjusted basis when the market opens on February 25, 2021.

to the Reverse Stock Split, outstanding shares of the Company’s common stock were automatically consolidated at a ratio of 1-for-500 without any further action on the part of the Company’s stockholders. Fractional shares will be rounded up to […]

Global Atomic Announces C$10 Million Bought Deal Private Placement

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES . Global Atomic Corporation is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. pursuant to which Red Cloud as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters shall purchase for resale 5,000,000 units of the Company at a price of C$2.00 per Unit on a …

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES ./

Global Atomic Corporation (“Global Atomic” or the “Company”) (TSX:GLO) (FRANKFURT: G12) (OTCQX: GLATF) is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. (“Red Cloud”) pursuant to which Red Cloud as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (the “Underwriters”) shall purchase for resale 5,000,000 units of the Company (the […]