Nuclear energy has a bad reputation. Say “Chernobyl” or “Three Mile Island” and many remember dangerous and costly incidents that had negative effects for years to come.

But with the consequences of fossil fuels becoming more apparent every day, some are touting nuclear energy as a zero-emission clean energy source worth considering. And this change of heart has boosted assets and returns for nuclear energy ETFs over the past year.

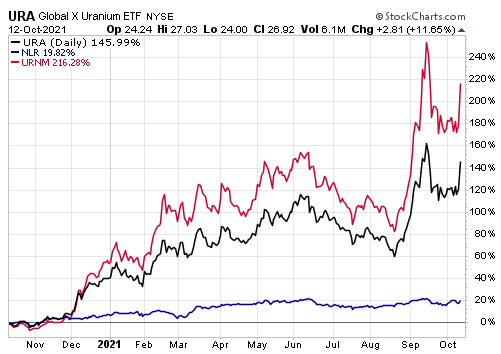

On Tuesday alone, uranium-linked ETFs had an explosive day. The North Shore Global Uranium Mining ETF (URNM) rose by 13.5% while the Global X Uranium ETF (URA) gained 11.7%.

This rise adds to both funds’ strong gains over the trailing year. As with most thematic ETFs, there is considerable dispersion among the three ETFs that fall into the nuclear energy ETFs.The two uranium ETFs have significantly outperformed the VanEck Uranium+Nuclear Energy ETF (NLR) , which takes a wider view of the nuclear […]

Category: Uranium

Global X Funds – Global X Uranium ETF (URA) falls 2.89% in Active Trading on October 14

Today, Global X Funds – Global X Uranium ETF Inc’s (NYSE: URA) stock fell $0.83, accounting for a 2.89% decrease. Global X Funds – Global X Uranium ETF opened at $28.49 before trading between $28.55 and $27.44 throughout Thursday’s session. The activity saw Global X Funds – Global X Uranium ETF’s market cap fall to $1,117,525,831 on 3,286,792 shares -above their 30-day average of 2,526,394.

Visit Global X Funds – Global X Uranium ETF’s profile for more information. The Daily Fix

JPMorgan Misses on Third Quarter Revenue, Beats Earnings Estimates With One-Time Items

JPMorgan Chase posted a 24% jump in third-quarter profits on Wednesday, largely driven by one-time items that boosted its results, as the bank struggled to grow revenues with interest rates at near-zero levels.The nation’s largest bank by assets said it earned a profit of $11.69 billion, or $3.74 per share, compared with a profit of $9.44 billion, […]

Selling Your Uranium Energy Corp. (AMEX:UEC) Stock? Here’s What You Need To Know

Uranium Energy Corp. (AMEX:UEC) shares, rose in value on Thursday, 10/14/21, with the stock price down by -3.39% to the previous day’s close as strong demand from buyers drove the stock to $3.42.

Actively observing the price movement in the last trading, the stock closed the session at $3.54, falling within a range of $3.33 and $3.62. The value of beta (5-year monthly) was 2.43. Referring to stock’s 52-week performance, its high was $3.77, and the low was $0.82. On the whole, UEC has fluctuated by -7.32% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to […]

Thinking Of Selling Uranium Royalty Corp. (NASDAQ: UROY) Stock? Check This Out First

Uranium Royalty Corp. (NASDAQ:UROY) shares, rose in value on Thursday, 10/14/21, with the stock price down by -4.86% to the previous day’s close as strong demand from buyers drove the stock to $4.70.

Actively observing the price movement in the last trading, the stock closed the session at $4.94, falling within a range of $4.60 and $5.07. Referring to stock’s 52-week performance, its high was $5.60, and the low was $0.81. On the whole, UROY has fluctuated by -12.80% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the […]

URA: The Thrill Of The Uranium Chase

Summary

URA provides investors with diversified exposure to the uranium sector.

We look at the holdings and the longer-term performance.

We examine the valuation and give you our verdict. I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More » JacobH/iStock via Getty Images While investors have been observing that oil and gas equities are not dead, there are some areas of the energy market that are actually delivering even bigger returns. We are referring to the Global X Uranium ETF ( URA ) which has almost doubled the price returns of the Energy Select Sector SPDR ETF ( XLE ). Data by YCharts We take a look at this fund today to see what it does and whether we can get behind this one for an investment. The Fund URA provides […]

Purepoint Uranium Announces Participation in Red Cloud’s 2021 Oktoberfest Fall Mining Show Case and the 2021 New Orleans Investment Conference

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here .

Toronto, Ontario–(Newsfile Corp. – October 14, 2021) – Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF ) ("Purepoint" or the "Company" ) announced that the Company will be presenting at the Red Cloud’s 2021 Virtual Oktoberfest Fall Mining Showcase, taking place from October 18-20, 2021 and at the 2021 New Orleans Investment Conference from October 19-22, 2021.

Chris Frostad, President and CEO, will be presenting virtually at the Red Cloud’s 2021 Virtual Oktoberfest Fall Mining Showcase on Wednesday, October 20, 2021 at 2:45 pm ET . To register for the conference, please visit: https://www.redcloudfs.com/oktoberfest2021/ .

Chris Frostad will also be hosting a luncheon presentation at the 2021 New Orleans Investment Conference on Friday, October 22, 2021 at 12:30 pm local time . During this presentation, Chris will be sharing […]

Click here to view original web page at www.streetinsider.com

VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF (NLR) gains 1.68% on Strong Volume October 13

VanEck ETF Trust – VanEck Uranium Nuclear Energy ETF (NYSE: NLR) shares gained 1.68%, or $0.9187 per share, to close Wednesday at $55.74. After opening the day at $55.51, shares of VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF fluctuated between $55.85 and $54.74. 6,394 shares traded hands an increase from their 30 day average of 4,431. Wednesday’s activity brought VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF’s market cap to $30,193,276.

Visit VanEck ETF Trust – VanEck Uranium Nuclear Energy ETF’s profile for more information. The Daily Fix

BlackRock Beats Q3 Profit Estimates, But Asset Growth Flattens

BlackRock Inc topped third-quarter profit estimates helped by robust performance fees and strong demand for its actively managed and sustainable funds, even as volatile markets hindered the world’s largest money manager from growing its assets under management.Asset managers have benefited from rising global financial markets in recent quarters as investors […]

The Uranium Energy Corp. (AMEX: UEC) Stock Jumped 9.26% In A Single Month – Are There Any Hopes For A Gain?

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 14.05 million, with the beta value of the company hitting 2.23. At the end of the trading day, the stock’s price was $3.54, reflecting an intraday gain of 5.67% or $0.19. The 52-week high for the UEC share is $3.77, that puts it down -6.5 from that peak though still a striking 76.84% gain since the share price plummeted to a 52-week low of $0.82. The company’s market capitalization is $862.66M, and the average intraday trading volume over the past 10 days was 6.74 million shares, and the average trade volume was 6.37 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.50. UEC has a Sell rating from 0 analyst(s) out of 3 analysts who have looked at this stock. […]

Click here to view original web page at marketingsentinel.com

Global X Funds – Global X Uranium ETF (URA) gains 6.84% in Active Trading on October 13

Global X Funds – Global X Uranium ETF (NYSE: URA) gained to close at $28.76 Wednesday after gaining $1.84 (6.84%) on volume of 6,272,948 shares. The stock ranged from a high of $29.39 to a low of $26.72 while Global X Funds – Global X Uranium ETF’s market cap now stands at $1,137,793,514.

Visit Global X Funds – Global X Uranium ETF’s profile for more information. The Daily Fix

Emerson Electric To Merge Industrial Software Businesses With Aspen Technology

Industrial software maker Emerson Electric Co ( NYSE: EMR ) will merge two of its businesses with smaller rival, Aspen Technology Inc ( Nasdaq:AZPN ), in a deal worth $11 billion.The cash-and-stock transaction announced Monday values AspenTech at about $160 per share, a 27% premium to its Oct. 6 close, before Bloomberg News first reported on talks between the two companies.[ More ] JPMorgan Misses on Third Quarter Revenue, Beats Earnings […]

ASX uranium shares are surging this week. Here’s why

ASX uranium shares are surging across the board for a second day following a tsunami of capital inflow into the sector. Let’s take a closer look at what’s going on today. ASX uranium shares extend winning streak

Yesterday, ASX uranium shares rallied double-digits across the board from the largest, most established players like Paladin Energy Ltd (ASX: PDN) all the way through to speculative explorers like 92 Energy Ltd (ASX: 92E) .

The bullish performance continues on Thursday, with the Paladin Energy share price opening 5.2% to 91.5 cents this morning.

More advanced explorers such as Boss Energy Ltd (ASX: BOE) and Deep Yellow Limited (ASX: DYL) also opened a respective 5.4% and 2.3% higher at the morning bell.On the more speculative end of town, ASX uranium shares including Bannerman Energy Ltd (ASX: BMN) , Lotus Resources Ltd (ASX: LOT) , Peninsula Energy Ltd (ASX: PEN) , and Alligator Energy Ltd […]

Lotus Resources ups uranium resource in Malawi with purchase of 6Mlb deposit

Lotus Resources ASX LOT uranium resource Malawi deposit Livingstonia project Lotus Resources (ASX: LOT) , which is working to reopen the mothballed Kayelekera uranium mine in Malawi, has increased the size of its other project in the central African country, adding six million pounds of uranium oxide for an outlay of US$25,000 ($33,850).

That equates to US$0.004 per pound, against a spot futures price overnight hitting US$46.50/lb — up 16.25% in one session — and now bounding closer to the US$60/lb figure widely quoted as a trigger for global new mine development to begin.

The newly acquired Livingstonia project is located in Northern Malawi lies 90km southeast of Kayelekera.

Livingstonia is hosted in the prospective Karoo-equivalent sedimentary sequence which is also host to the main deposit associated with Kayelekera, the company says. Potential for satellite uranium production This new ground is directly along trend from Lotus’ Livingstonia North project,Drilling at the northern […]

Why Uranium Stocks Jumped Wednesday

What happened

Uranium stocks are back in action after taking a breather last month, with stocks across the board surging in the past two days. Here’s how much some of the notable uranium stocks had gained on Wednesday by market close: Ur-Energy (NYSEMKT: URG): Up 5.1%.

Denison Mines (NYSEMKT: DNN): Up 5.6%.

Energy Fuels (NYSEMKT: UUUU): Up 4.9%. Uranium Energy (NYSEMKT: UEC): Up 5.7%. Cameco Corp (NYSE: CCJ): Up 4.7%. So what Uranium stocks were on fire until about a month ago when uranium prices reversed course after a torrid run up, driven by aggressive spot uranium purchases by Sprott Physical Uranium Trust (OTC: SRUU.F) since the exchange-traded fund ‘s inception mid-July. After an update about uranium purchases on Sept. 17, Sprott went silent, triggering fears among investors about a potential crack in uranium prices.Sprott’s dry spell ended in October, with the fund announcing it had purchased 400,000 pounds […]

ASX Update: Uranium, infant formula shine in sluggish session

The share market marked time ahead of risk events in the US as gains in growth and defensive stocks were largely offset by declines in heavyweight banks and iron ore producers.

The S&P/ASX 200 traded both sides of break-even before reaching mid-session six points or less than 0.1 per cent in the red.

Tech stocks, gold miners and real estate trusts rose. CBA and Bank of Queensland declined after market updates. Uranium stocks surged after several European countries asked the EU to recognise nuclear power as green energy. What’s driving the market

Buying interest was kept in check by a third straight decline on Wall Street. The S&P 500 eased 0.24 per cent overnight as investors continued to reduce exposure ahead of several potential market-moving events.All eyes will be on tonight’s US September consumer prices update, the minutes from the last Federal Reserve meeting and the launch of a new corporate […]

Click here to view original web page at themarketherald.com.au

Blue Sky Uranium Announces Warrant Exercise Incentive Program

VANCOUVER, BC, Oct. 7, 2021 /PRNewswire/ – Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF), "Blue Sky" or the "Company") announces that it intends to implement a warrant exercise incentive program (the " Incentive Program "). The Company has applied for TSX Venture Exchange (the " TSXV ") approval for the Incentive Program.

As announced on October 23, 2019, the Company completed a private placement offering of 5,793,333 units (" Units ") at a subscription price of $0.15 per Unit. Each unit was comprised of one common share and one common share purchase warrant for two years at $0.25 from the date of issuance (the " Placement Warrants "). All of the Placement Warrants remain outstanding expiring October 23, 2021 (the " Expiry Date ").

The Incentive Program will commence on the date of receipt of conditional acceptance by the TSXV and will expire at 4:00 p.m. (Vancouver time) […]

Resources Top 5: Uranium price jumps, stocks follow

share

Uranium stock surge as spot prices arrest recent slide

Recent IPO Cannon hits thick nickel sulphides at ‘Fisher East

PVW picks up rocks containing up to 12.45% total rare earths (TREO) Here are the biggest small cap resources winners in early trade, Wednesday October 13. ALL THE URANIUM STOCKS The uranium spot price has arrested a recent slide, jumping +$US3 to above $US40/lb overnight after Sprott stacked another 400,000lb. And as the power crisis continues to wreak havoc in Europe, France – which gets ~70% of its electricity from nuclear — has announced plans to develop and export SMR’s (small modular reactors) to its energy-starved neighbours. This assortment of good news sparked big ETF buying overseas, with big money also pouring into individual US and Canadian uranium stocks. Today Global X #Uranium (70%) & #Nuclear (30%) ETF $URA had both its highest single day Upside […]

Ground Breakers: Uranium fever is back and investors are frothing for yellowcake large caps this morning

You can get it mining uranium. Pic: Victoria Bitter. share

Uranium prices got back on the move overnight ( here’s why ), and there was some feverish buying this morning in the headline uranium stocks, with Paladin Energy (ASX:PDN) gaining more than a fifth of its value. Spot #uranium 4025/4075 USc/Lb #U3O8 (Delivery at CMO , Chg +275c, +6.79%) CMO = CVD 0c/Lb, CMO = CMX 0c/Lb See https://t.co/oK6SEbp4ad — numerco (@numerco) October 12, 2021 The recapitalised Paladin, which owns the mothballed Langer-Heinrich uranium mine in Namibia, is now a ~$2 billion company.

That is a far cry from its lowly status at the start of 2021, with the stock up a mere 250% year to date.

Uranium stocks have been seemingly impervious to bad news during 2021’s recovery run.Case in point Rio Tinto-backed Energy Resources of Australia (ASX:ERA) , which stopped processing uranium from its Ranger mine in the Northern […]

Gear up for the change! Uranium Royalty Corp. (UROY) has hit the volume of 1246132

At the end of the latest market close, Uranium Royalty Corp. (UROY) was valued at $4.07. In that particular session, Stock kicked-off at the price of $4.00 while reaching the peak value of $4.16 and lowest value recorded on the day was $3.9969. The stock current value is $4.46.Recently in News on October 4, 2021, Uranium Royalty Corp. to Present at the TD Virtual Uranium Roundtable. Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (“URC” or the “Company”) invites investors and shareholders to attend the Company’s presentation at the TD Securities Virtual Uranium Roundtable, on Thursday, October 7, 2021, at 3:40 PM ET. You can read further details here

Uranium Royalty Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $5.60 on 09/16/21, with the lowest value was $1.04 for the same time period, recorded on […]

Here’s why ASX uranium shares are booming double digits across the board on Wednesday

ASX uranium shares are surging across the board on Wednesday following a bullish overnight session for uranium. ASX uranium shares jump double-digits on open

The largest ASX-listed uranium player, Paladin Energy Ltd (ASX: PDN) is currently up 18.4% to 87 cents. After ceasing operations at its “globally significant” Langer Heinrich mine in 2018, the company is looking to restart operations to take advantage of the improving uranium market. Advanced uranium explorer Deep Yellow Limited (ASX: DYL) is up 16.2% to $1.05. The company has been carrying out exploration activities at it Tumas Project since 2016, and during that time, has expanded its resource by more than threefold. Deep Yellow is targeting the completion of its definitive feasibility study in the latter part of 2022.

On the speculative end of town, players such as Bannerman Energy Ltd (ASX: BMN) , Lotus Resources Ltd (ASX: LOT) , Vimy Resources Ltd (ASX: […]

Uranium Energy : A new bull market is in sight for uranium

(PresseBox) (Herisau) The uranium price has jumped. Investors should think about an entry.

Uranium has many advantages. Nuclear energy compared to other forms of electricity generation is efficient, reliable and clean. Compared to other forms of energy, nuclear energy produces the lowest CO2 equivalent emissions, so good for global decarbonisation targets. Uranium has a high energy density, which is positive for extraction and transport. For example, a nuclear fuel pellet is only the size of a gummy bear. The unbeatable capacity factor of nuclear power compared to conventional or alternative energy sources comes into play when solving global energy needs.

Uranium share prices have moved strongly recently. This is a potential indicator for higher uranium prices. The uranium price is influenced on the one hand by a growing production and demand imbalance and on the other hand by future supply contracts. This is because as more nuclear power plants are built […]

Click here to view original web page at www.marketscreener.com

THE Uranium Project Generator with the Right Projects in the Right Place

When Stockhouse Editorial last caught up with Fission 3.0 Corp. ( TSX-V.FUU , OTC: FISOF , Forum ) back in August and its CEO Dev Randhawa, we were just introducing our audience to this uranium value play that really is truly unlike any other. In this exclusive and intriguing video podcast interview, Stockhouse Media’s Dave Jackson caught up with Mr. Randhawa to get investors and company shareholders completely up to date with Fission 3.0 and its vision looking forward. (Click image to play video)

TRANSCRIPT BELOW:

SH: To start off with, can you tell us a little bit about yourself and the history of the company ?

DR: I have been in the uranium space since about 1996, when a very smart guy named Rick Rule and encouraged by another fine man, Lukas Lundin, were saying that they knew uranium was a great place to be. I could barely spell […]

Okapi Resources Ltd (ASX:OKR) Acquires Additional High-Grade Uranium Pounds

Okapi Acquires Additional High-Grade Uranium Pounds Okapi Resources Executive Director David Nour commented:

"Okapi is pleased to have acquired additional strategically located high-grade pounds on very sensible terms. The upfront cost of US$62,000 represents an acquisition cost of less than US$0.025 per pound. This represents yet another highly value-accretive acquisition for Okapi shareholders."

Okapi has secured a 100% interest in the 640 acre landholding through the execution of a mining lease with the State of Colorado. The New Project Area is contiguous with Okapi’s existing mining claims at the High Part Uranium deposit located 25km northeast of the Company’s flagship Tallahassee Uranium Project. Okapi has the right to explore, prospect, develop and mine uranium within the New Project Area. The New Project Area was previously drilled out on 30 metre centres with approximately 550 holes drilled for 26,000m completed in the late 1970’s. The New Project Area was previously held by […]

Weekly Performance Analysis for Uranium Energy Corp. (UEC)

Uranium Energy Corp. (AMEX:UEC) saw a downside of -4.29% to close Friday at $2.90 after subtracting -$0.13 on the day. The 5-day average trading volume is 5,544,440 shares of the company’s common stock. It has gained $3.22 in the past week. An average of 9,529,580 shares of the company has been traded in the last 20 days, and the 50-day average volume stands at 6,713,124.

UEC’s 1-month performance is 0.00% or -$0.03 on its low of $2.78 reached on 09/29/21. The company’s shares have touched a 52-week low of $0.82 and high of $3.77, with the stock’s rally to the 52-week high happening on 09/16/21. YTD, UEC has achieved 64.77% or $1.14. However, the current price is down -23.08%% from the 52-week high price. Insider Transactions

On Sep 24, 17 days have gone by since the last insider trading activity for Uranium Energy Corp. (UEC). Ballesta Moya Gloria L (Director) […]

Sprott CEO Rick Rule says the easy money in uranium has been made and the next big contrarian play is gold

share

Rick Rule, well-known mining investor and president & CEO of Sprott US Holdings, began his career in the securities business in 1974 and has been principally involved in natural resource stock investments ever since.

He has financed numerous exploration and mining companies over his 45-year career.

Last week, Rule spoke to Stockhead’s Oriel Morrison about his investment strategies as a contrarian investor, why the easy money in uranium has been made, and why gold is the next big contrarian play.Here are the highlights. Scroll to the bottom to watch the full interview. What is contrarian investing? “To quote Buffet – ‘Be fearful when others are greedy, and greedy when other are fearful’,” Rule says.“Most people prefer to buy commodities when they are already popular.“Contrarian investing is looking for out-of-favour opportunities or better yet, opportunities in sectors that are hated.“Natural resources provides such a wonderful opportunity to do that because […]

Uranium Royalty Corp. (NASDAQ:UROY) trade information

Uranium Royalty Corp. (NASDAQ:UROY)’s traded shares stood at 0.41 million during the last session. At the close of trading, the stock’s price was $3.83, to imply a decrease of -4.25% or -$0.17 in intraday trading. The UROY share’s 52-week high remains $5.60, putting it -46.21% down since that peak but still an impressive 78.85% since price per share fell to its 52-week low of $0.81. The company has a valuation of $299.99M, with an average of 0.85 million shares in intraday trading volume over the past 10 days and average of 660.57K shares over the past 3 months.

After registering a -4.25% downside in the last session, Uranium Royalty Corp. (UROY) has traded red over the past five days. The stock hit a weekly high of 4.43 this Friday, 10/08/21, dropping -4.25% in its intraday price action. The 5-day price performance for the stock is -2.79%, and 20.82% over 30 […]

Click here to view original web page at marketingsentinel.com

Uranium rally is a high-stakes bet on nuclear energy’s future

After languishing at historical lows for the better part of the last decade, uranium suddenly came back from the dead.

Prices have surged about 40 percent just in September, outpacing all other major commodities. In just a few weeks, millions of pounds of supply were scooped up by the Sprott Physical Uranium Trust. It’s a massive bet on nuclear energy’s prominence in a carbon-free future. The problem is—at least for the investors who poured more than $240 million into the fund—the debate is still raging over whether and how nuclear can come to the forefront.

Atomic energy became somewhat taboo after the Fukushima disaster in Japan, with opponents saying the 2011 meltdown was only the most recent accident to demonstrate that reactors are too dangerous. And while nuclear power is carbon-free, it has drawn opposition from some progressives and environmentalists who have qualms about radioactive waste. There are now only 51 […]

Click here to view original web page at businessmirror.com.ph