Nuclear energy has a bad reputation. Say “Chernobyl” or “Three Mile Island” and many remember dangerous and costly incidents that had negative effects for years to come.

But with the consequences of fossil fuels becoming more apparent every day, some are touting nuclear energy as a zero-emission clean energy source worth considering. And this change of heart has boosted assets and returns for nuclear energy ETFs over the past year.

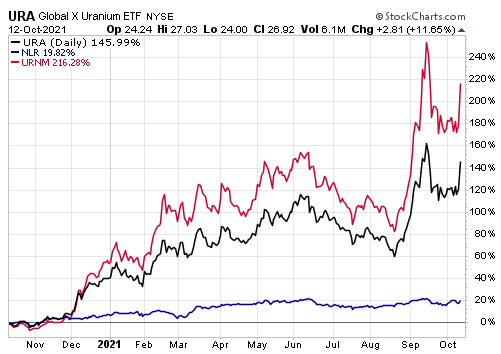

On Tuesday alone, uranium-linked ETFs had an explosive day. The North Shore Global Uranium Mining ETF (URNM) rose by 13.5% while the Global X Uranium ETF (URA) gained 11.7%.

This rise adds to both funds’ strong gains over the trailing year. As with most thematic ETFs, there is considerable dispersion among the three ETFs that fall into the nuclear energy ETFs.The two uranium ETFs have significantly outperformed the VanEck Uranium+Nuclear Energy ETF (NLR) , which takes a wider view of the nuclear […]

Click here to view original web page at wmleader.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments