The holdings rose by $3.6 billion, or 0.62 percent, from October 30 to November 6. The growth was supported by “positive exchange rate revaluation and higher gold prices,” according to the regulator.

The country’s international reserves are highly liquid foreign assets comprising stocks of monetary gold, foreign currencies, and Special Drawing Right (SDR) assets, which are at the disposal of the Central Bank of Russia and the government. The holdings have surpassed the target level of $500 billion set by the regulator in June 2019 and remained above the threshold ever since.

Despite the impact of the coronavirus pandemic on the country’s economy, forcing the government to increase spending to support businesses and households, Russia has continued to boost its gold and foreign currency reserves this year.

The assets have increased by $31.6 billion over the past ten months, though the pace of growth has slowed since 2019. According to the bank’s […]

Central banks will continue to buy gold to diversify their holdings – Invesco survey

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – In the third quarter, for the first time in nearly a decade, central banks became net sellers of gold . However, according to a report from Invesco, central banks are expected to maintain a firm grip on their gold reserves.

The international investment firm conducted a central bank survey between August and September as gold prices pushed to an all-time high above $2,000 an ounce.

According to the results survey, participants expect to see that central bank gold reserves will continue to increase during the next 12 months.

At the same time, the survey noted that the COVID-19 pandemic had not impacted central banks’ views on gold . Around 25% of respondents said they view gold as a more […]

Gold Price Analysis: XAU/USD awaits fresh clues to break the monotony below $1,900

Gold prices trade mixed near the September lows, probed on Monday.

Risk catalysts remain mostly sluggish as virus woes combat vaccine hopes.

Expectations of further monetary easing, absence of a push towards negative rates and rising US treasury yields keep buyers hopeful.

Economic calendar welcomes the return of the US data, challenges to trading sentiment will be the key. Gold prices extend corrective bounce off $1,856 while taking rounds to $1,865 amid the initial Asian session on Thursday. Following a heavy drop on Monday, to September month low, the yellow metal consolidated gains to $1,890, before marking the latest move around $1,856.34. The reason for the mixed trading could be traced from a lack of clear market direction amid mixed signals concerning the coronavirus (COVID-19) and the US election results, not to forget about the global monetary policy moves. Virus, vaccine regains market attention… With […]

Gold prices rise Thursday ahead of inflation report, but sit on sharp weekly loss

The U.S. reported more than 144,000 new cases for Wednesday, up about 4,000 from the day before, according to data compiled by Johns Hopkins University. The total number of confirmed cases nationwide topped 10.4 million.

Still, the precious metal is off 4.6% so far this week, according to FactSet data, after its worst daily drop in seven years was prompted by news from Pfizer PFE, -0.46% and BioNTech BNTX, -2.93% of an effective coronavirus vaccine.

“Gold has not yet managed to recover after the $100 collapse which followed Pfizer’s vaccine announcement as investors moved to riskier assets,” wrote Carlo Alberto De Casa, chief analyst at ActivTrades in a daily note.

“The bullion price is stagnating at $1,870 without being able to achieve significant and stable recoveries,” the commodity strategist wrote. “The main scenario remains risk on, even if it seems likely that some traders will take home some profits over the next […]

Gold price holding steady following weak consumer inflation data

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold prices are holding some gains as consumer inflation pressures were weaker than expected last month

Thursday, the U.S. Labor Department said its U.S. Consumer Price Index was unchanged in October, after a 0.2% rise in September. The data were weaker than consensus forecasts, calling for a rise of 0.1%

The report said that annual inflation data rose 1.2%, missing expectations calling for a 1.3% rise.Stripping out volatile food and energy prices, core inflation also did not rise last month, following September’s rise of 0.2%. Economists were expecting to see a 0.2% rise.For the year, inflation is up 1.6%; economists were expecting to see a 1.7% rise.December gold futures are seeing little reaction to […]

Gold price ignores significant drop in U.S. weekly jobless claims

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold prices are holding firm as the U.S. labor market continues to see significant improvement as fewer American worker applied for weekly unemployment benefits. Although gold is holding firm support, prices remain well below the critical psychologically important level of $1,900 an ounce.

Thursday the U.S. Labor Department said that weekly jobless claims fell by 48,000 to 709,000. The data were better than expected; market consensus called for initial claims to be round 730,000.

The four-week moving average for new claims – often viewed as a more reliable measure of the labor market since it flattens week-to-week volatility – fell to 755,250, down by 33,250 claims from the previous week.Continuing jobless claims, which represent […]

Don’t Believe the Hype When It Comes to Oil and Gold, Commodities Expert Larry Williams Says

Veteran commodities trader Larry Williams offers advice for investing in oil and gold. Commodities traders have been bombarded by a constant flow of market-moving news this year, from the U.S.-China trade deal to the pandemic and the U.S. presidential elections. But veteran trader Larry Williams has some sound advice: don’t get sucked in by the news of the day, and focus on the fundamentals.

The commodities market is “influenced largely by supply and demand,” says Williams, author of several books on trading, including Long-Term Secrets to Short-Term Trading . He’s also the developer of the Williams %R , a momentum indicator, which can determine if a market is overbought or oversold, and he runs the website IReallyTrade.com, which offers stock-trading and investing courses.

Williams says you really “need to study fundamentals in these markets to get a longer-term view of them.” In other words, tune out the noise and you’ll get […]

Gold, sees good gains as risk aversion returns

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold futures prices are solidly up in midday U.S. trading Thursday. Safe-haven demand is featured late this week as the early-week stock market rallies are now becoming suspect amid the spike in Covid-19 cases in the U.S. and Europe. The precious metals are also seeing some support from a weaker U.S. dollar index on this day. December gold futures were last up $19.60 at $1,881.30 and December Comex silver was last up $0.173 at $24.44 an ounce.

Global stock markets were mixed overnight, while U.S. stock indexes are mixed to lower at midday. The U.S. has seen over 240,000 deaths and more than 10.3 million confirmed Covid-19 infections, with new cases soaring to […]

Gold Price Prediction – Prices Edge Higher on Flat CPI

Gold prices edged higher and are consolidating just above support levels. The 10-year US treasury yield reversed course as riskier assets such as stocks moved lower. The dollar moved higher but failed to put downward pressure on gold. US CPI was flat and was the tamest it’s been in 2020. US jobless claims continued to move lower.

Trade gold with FXTM Technical analysis

Gold prices edged higher near support levels which coincides with the September lows at 1,848. Resistance is seen near the 10-day moving average at 1,896 and then the 50-day moving average at 1,908. Short-term momentum is negative as the fast stochastic generated a crossover sell signal. The fast stochastic has stopped accelerating lower and is currently printing a reading of 19, below the oversold trigger level of 20 which could foreshadow a correction. Medium-term momentum has turned negative as the MACD (moving average convergence divergence) index generated […]

Gold Price Futures (GC) Technical Analysis – Consolidating Inside Retracement Zone at $1889.70 to $1842.60

Gold futures are trading higher late in the session on Thursday on concern over the logistics of a potential COVID-19 vaccine roll-out as U.S. case continued to surge, while hopes of more fiscal and monetary stimulus offered support to the precious metal.

Gold was generally supported by a plunge in U.S. Treasury yields that drove the U.S. Dollar lower. The drop in the greenback made dollar-denominated gold a more attractive investment.

Daily December Comex Gold Daily Swing Chart Technical Analysis

The main trend is down according to the daily swing chart. A trade through $1848.00 will signal a resumption of the downtrend. The main trend will change to up on a move through $1966.10.The main range is $1690.10 to $2089.20. The market is in a position to close inside its retracement zone at $1889.70 to $1842.60 for the fourth straight session. This tells us that this zone is controlling the near-term […]

Endeavour Silver Continues to Intersect High-Grade Gold-Silver Mineralization at Guanacevi, Durango, Mexico

VANCOUVER, British Columbia, Nov. 12, 2020 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) announces that exploration drilling continues to intersect high-grade gold-silver mineralization in the Santa Cruz vein on the El Curso property at the Guanacevi mine in Durango, Mexico. Drilling was suspended for four months, April through July, due to the COVID-19 pandemic. A total of 11 holes were drilled since the end of July, 8 of which hit high grades over mineable widths (view longitudinal section here ).

Drilling highlights of the 11 core holes include the following intersections: 2,307 gpt silver and 3. 1 5 grams per tonne ( gpt ) gold over 3.2 met re s (m) true width in hole UCM-29 (2,559 gpt or 74.6 oz per ton (opT) silver equivalents (AgEq) over 10.5 feet (ft) using an 80:1 silver:gold ratio)

1,409 gpt silver and 3.13 gpt gold over 3 .1 m […]

Click here to view original web page at www.globenewswire.com

Dhanteras shopping kicks off; high prices of gold, silver may dent sales

Pre-Diwali Dhanteras sales of gold and silver kicked off on Thursday but overall business is likely to be a muted affair in view of sharp rise in prices and subdued demand due to the COVID-19 induced economic hardship, according to jewellers and industry experts. Although the buying sentiment has improved after the COVID-19 curbs were relaxed, consumers are still wary of investing in precious metal at current high rates, they said.

Jewellers also said they are recycling old jewellery stock to meet the festive and wedding season demand. Besides, a caution still prevails among people while coming out of their homes for shopping amid rising COVID-19 cases in key consuming markets across the country, and consumers in view of the pandemic have made advanced booking through online jewellery platforms, they added.

Dhanteras, considered the most auspicious day in Hindu calendar for buying items, ranging from precious metals like gold and silver […]

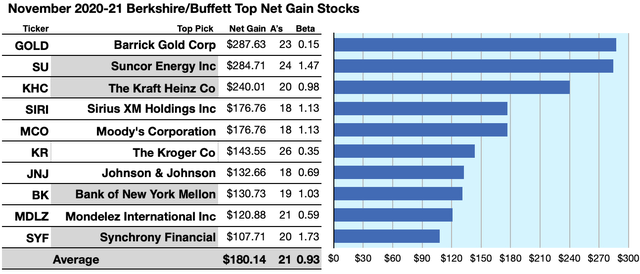

Gold & Energy Top Warren Buffett’s Hoard In November

Summary

This Buffett holdings list from Kiplinger first appeared 8/17/20 on line. YCharts and Dogs of The Dow also tracks this Buffett/Berkshire Batch. Here is your update as of 11/10/20.

28 of 44 Berkshire-Hathaway-owned-stocks pay dividends. As of 11/10/20 the top-ten ranged 2.97%-5.25% by annual yield and ranged 21.07%-118.69% per broker-estimated price-target-upsides.

Top ten of 28 Buffett-held dividend stocks ranged 10.77% to 28.76% in net gains calculated from broker targets, plus dividends, less broker fees.$5k invested in the lowest-priced five top-yield Buffett/Berkshire-held November dividend dogs showed 68.48% more net-gain than from $5k invested in all ten. Little low-priced Buffett-collected dogs dominated his November portfolio. Looking for a portfolio of ideas like this one? Members of The Dividend Dog Catcher get exclusive access to our model portfolio. Get started today » Foreword James Brumley says in Kiplinger Investing :"Rich people often get perpetually richer for a reason, so it could be worthwhile […]

Gold hold steady ahead of EU session

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) -Once again overnight gold (0.29%) managed to tread water above the support level at $1848.84 per ounce. The level still looks vulnerable for a break but at the moment bulls are holding off after Monday’s heavy decline. Silver has not been as firm as the precious metal trades -0.26% lower leading into the EU open. The sentiment was mixed overnight after the US public holiday. Japan’s Nikkei traded 0.68% higher while the ASX dropped nearly half a percent and the Shanghai Composite fell -0.11%.

In terms of news, the OPEC group are reportedly looking to extend current output cuts for another 3-6 months. Adding to this, Saudi Arabia’s Salman says has, and is still, […]

Why onion has become the “new gold” in Nigeria

The price of household food items has recorded tremendous spike in recent weeks, with consumers and households particularly complaining about the price of Onions, which they now call the “new gold”.

The persistent increase and scarcity of onions in major markets have become a rather interesting topic in recent times as the price of a big bag of dry Onions sells for an average of N80,000, while some markets sell for as high as N85,000 in Lagos State.

Some traders have termed the increase as just a seasonal fluctuation, while some have blamed it on the #EndSARS protest. However, there is more to it than meets the eye, which is why Nairalytics, a research arm of Nairametrics which tracks the prices of major food items in Lagos, Nigeria, visited the Onion Section of Mile-12 market in Lagos State to get insights into the root cause of the irregular trend in price.

Below […]

Gold, silver prices rise on Dhanteras, traders hope for decent buying season

The gold price has seen sharp fall in the Diwali week, of about Rs 2,000 per 10 gram. This is going to boost the demand for the precious metal in the festive season.

A vendor shows gold stud earrings at a jewellery showroom in Sri Lanka.(Reuters File Photo) Gold prices edged higher on Thursday, when the country celebrates Dhanteras. The auspicious day, which comes just ahead of Diwali, is marked by buying of precious metal.

On MCX, gold futures rose 0.35% to Rs 50,339 per 10 gram while silver futures gained 0.38% to Rs 62,780 per kg. In the previous session, gold futures had declined 0.6% or Rs 310 per 10 gram while silver rates had tumbled 1% or Rs 600 per kg.

The gold price has seen sharp fall in the Diwali week, of about Rs 2,000 per 10 gram. This is going to boost the demand for the precious […]

Click here to view original web page at www.hindustantimes.com

Gold continues to drift lower, as traders favor risk-on assets and dollar strength

Gold futures continued to drift lower, continuing the sharp decline that traders witnessed on Monday of this week. Although yesterday gold was able to recover slightly gaining $18 off of Monday sharp selloff, today traders took gold pricing back to erase those advances made on Tuesday. As of 4:55 PM EST, the most active December contract is currently fixed at $1863.50 which is a net decline of $12.90 on the day. Considering that gold futures opened at $1956 on Monday, the cumulative damage over the last three days have been almost $100 decline per ounce. A combination of strong U.S. equities (risk-on) performance, dollar strength, and modestly higher bond yields have all dampened the bullish market sentiment in the precious metals. Ever since the first week of August when gold futures reached a new record high price at $2088, gold prices have been steadily forming a series of lower […]

Candente Gold advises that the previously announced Private Placement is Fully Subscribed

VANCOUVER, British Columbia, Nov. 12, 2020 (GLOBE NEWSWIRE) — Candente Gold Corp. (TSXV:CDG) ("Candente Gold” and/or the “Company”) is pleased to advise that the previously announced (Nov 5 th , 2020) non-brokered private placement (the “Private Placement”) of 4,000,000 common shares (“Shares”) at a price of $0.05 per Share for a total of $200,000 has been fully subscribed.

Joanne Freeze, President and CEO, a control person of Candente Gold Corp., has subscribed for 53.75% of the Private Placement. In addition to Ms. Freeze there are three other subscribers. Closing of the Private Placement is expected to be completed within one week.

The Company intends to use the net proceeds of the Private Placement to advance development of its near term gold production and near surface exploration opportunities while advancing drill targets on the El Oro project, its flagship asset, and for general working capital purposes. The Shares issued pursuant to the […]

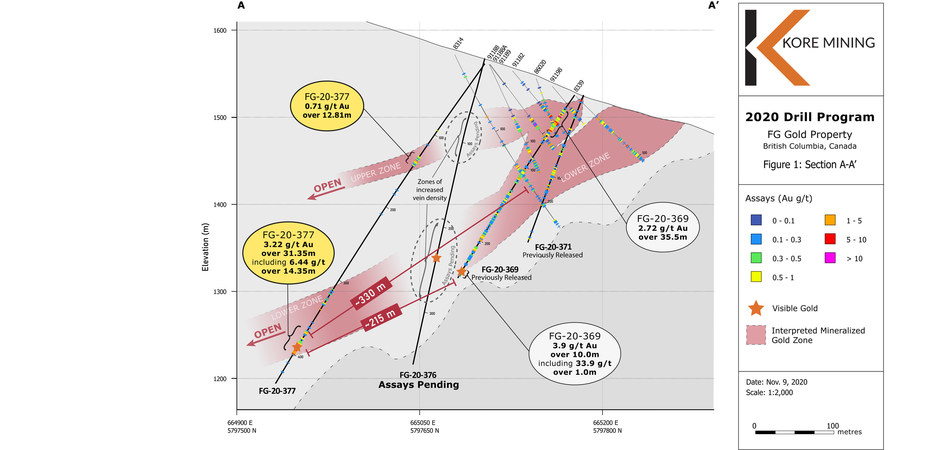

/R E P E A T — KORE Mining Drills 31.3 Meters of 3.2 g/t Gold Including 14.3 Meters of 6.4 g/t Gold in Large 215 Meter Step-Out at FG Gold Project/

Investor Webinar Thursday November 12 at 8:30AM EST

VANCOUVER, BC, Nov. 11, 2020 /PRNewswire/ – KORE Mining Ltd. (TSXV: KORE) (OTCQX: KOREF ) (" KORE " or the " Company ") announces that drill hole FG-20-377 intercepted 31.3 meters of 3.2 g/t gold, including 14.3 meters of 6.4 g/t gold, starting at 369 meters downhole in the Lower Zone of the FG Gold Project (" Project " or " FG Gold ") in the Cariboo Region of British Columbia. This news release reports assays from drill hole FG-20-377, part of the 15-hole, 5,746 meter summer drill program at FG Gold with assays from 14 additional holes pending.

Highlights Figure 1 – Cross Section Showing Hole FG-20-369, FG-20-371, FG-20-376 and FG-20-377 (CNW Group/Kore Mining) Figure 2 – Long Section of FG Gold Main Zone Showing Lower Zone Intersections and Visible GoldFigure 2 – Long Section of FG Gold Main Zone […]

Price gains for gold as risk appetite recedes a bit

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold futures prices are firmer in early U.S. trading Thursday. The precious metals are seeing some support from a weaker U.S. dollar index on this day and a pause in the global equity markets’ rallies, as traders and investors focus more on the present Covid-19 grim conditions. December gold futures were last up $7.50 at $1,869.10 and December Comex silver was last down $0.002 at $24.265 an ounce.

Global stock markets were mixed overnight, while U.S. stock indexes are also mixed ahead of the New York day session. The U.S. has seen over 240,000 deaths and more than 10.3 million confirmed Covid-19 infections, with new cases soaring to all-time highs of well over […]

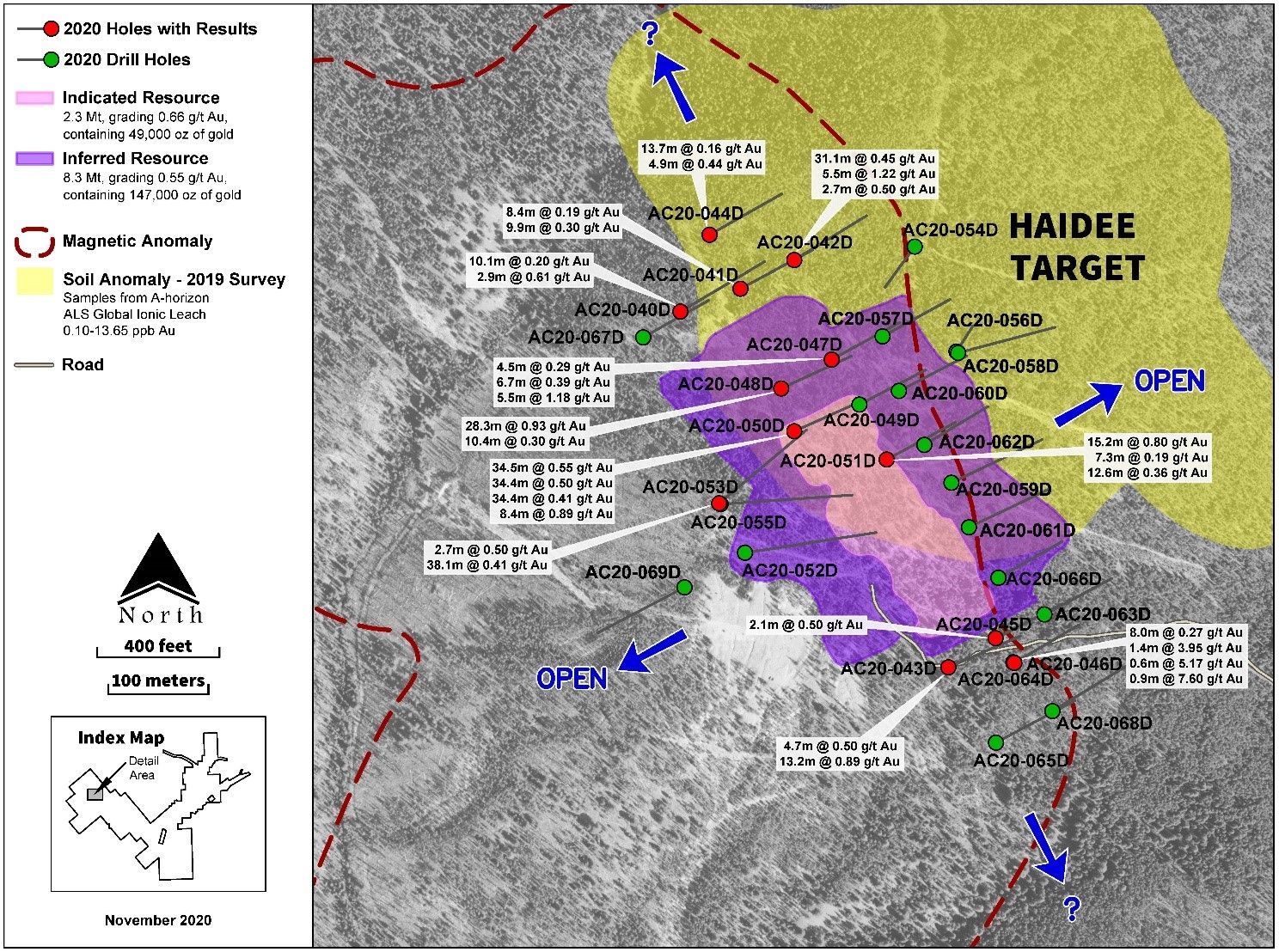

Revival Gold Releases Additional Drill Results and Provides Exploration Update

Figure 1

Haidee Target Area 2020 Drilling Program Haidee Target Area 2020 Drilling Program

TORONTO, Nov. 12, 2020 (GLOBE NEWSWIRE) — Reviva l Gold Inc. (TSXV: RVG, OTCQB: RVLGF) (“Revival Gold” or the “Company”), a growth‐focused gold exploration and development company, announces results from an additional five drill holes along with partial results from a sixth drill hole from the Company’s 2020 drilling program on the past-producing Beartrack-Arnett Gold Project (“Beartrack-Arnett”) located in Idaho, USA.

Five of the six holes released today are infill core holes drilled in the Haidee target area at Beartrack-Arnett. The holes were drilled to confirm projections of resource blocks from the 2020 Mineral Resource estimate (see Technical Report on the Beartrack-Arnett Gold Project, Lemhi County, Idaho, USA dated February 21 st , 2020) and to upgrade resources from the Inferred category to the Indicated category. All five holes intersected near-surface leachable mineralization and mineralized intervals […]

Aurelia Metals strikes gold with $200m M&A deal, raising

Aurelia Metals has caught the gold M&A bug and is set to pitch a chunky acquisition and equity raising to investors.

It is understood Aurelia Metals is closing in on NSW-based Dargues Gold Mine and its nearby tenements, which are owned by shareholders and associates of underground mining services contractor PYBAR Mining Services. Aurelia Metals will make about 70 per cent of its earnings from gold should it acquire Dargues Gold Mine as expected. AFR Aurelia Metals is expected to pay $200 million for the mine and tenements, including $176 million cash and $24 million scrip, and fund the deal with an underwritten equity raising.

Investment bank UBS is understood to have started lining up support for the equity raising, which would be done by way of a placement and rights issue.

Aurelia Metals has secured a $65 million commitment from lending banks Investec and BNP Paribas, which would be partly used […]

Bellevue Gold (ASX:BGL) share price sinks lower: Is this a buying opportunity?

The Bellevue Gold Ltd (ASX: BGL) share price is out of form on Thursday and is sinking lower again.

At the time of writing the gold-focused mineral exploration company’s shares are down 6% to $1.32.

This latest decline means the Bellevue Gold share price is now down over 11% since hitting a record high of $1.49 on Monday. Why is the Bellevue Gold share price sinking lower?

Investors have been selling the company’s shares over the last few days after a meaningful pullback in the gold price.This has been driven by news of a potentially effective COVID-19 vaccine being developed by Pfizer, which has given risk sentiment a boost and put pressure on safe haven assets.The impact has been so great that it has overshadowed a positive update by the company this week in relation to its resource estimate at its Bellevue Gold Project in Western Australia.According to the release, the […]

$1 PER WEEK FOR THE FIRST 12 WEEKS

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Gold Inching Toward Record Levels

gold bullion bar Gold prices fell on Monday when news of the Pfizer-BioNTech coronavirus vaccine broke and investors turned their attention — and dollars — to the stock market, but the precious metal hasn’t lost its shine. As of late day Wednesday, gold was valued at $1,866 an ounce, not too far below its all-time highs north of $2,000 earlier this year.

Gold reached a record-smashing high of $2,080 an ounce in early August, spurred by central banks’ monetary easing, which created negative real yields, Citi economists told CNBC. Gold has a tendency to rise when the stock market is volatile, which was the case over the summer when the price of gold surged. Even with an invigorated stock market, some analysts think that gold will remain a hot commodity. Under the imminent Joe Biden presidency, Americans might be able to expect another round of COVID-19 relief stimulus payments , […]