Summary

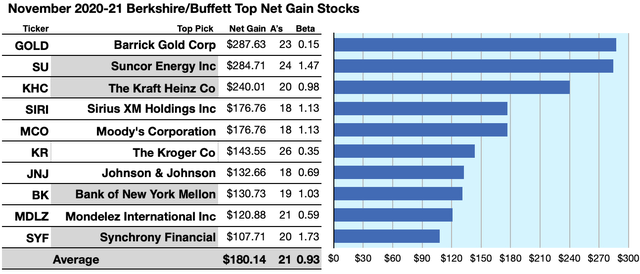

This Buffett holdings list from Kiplinger first appeared 8/17/20 on line. YCharts and Dogs of The Dow also tracks this Buffett/Berkshire Batch. Here is your update as of 11/10/20.

28 of 44 Berkshire-Hathaway-owned-stocks pay dividends. As of 11/10/20 the top-ten ranged 2.97%-5.25% by annual yield and ranged 21.07%-118.69% per broker-estimated price-target-upsides.

Top ten of 28 Buffett-held dividend stocks ranged 10.77% to 28.76% in net gains calculated from broker targets, plus dividends, less broker fees.$5k invested in the lowest-priced five top-yield Buffett/Berkshire-held November dividend dogs showed 68.48% more net-gain than from $5k invested in all ten. Little low-priced Buffett-collected dogs dominated his November portfolio. Looking for a portfolio of ideas like this one? Members of The Dividend Dog Catcher get exclusive access to our model portfolio. Get started today » Foreword James Brumley says in Kiplinger Investing :"Rich people often get perpetually richer for a reason, so it could be worthwhile […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments