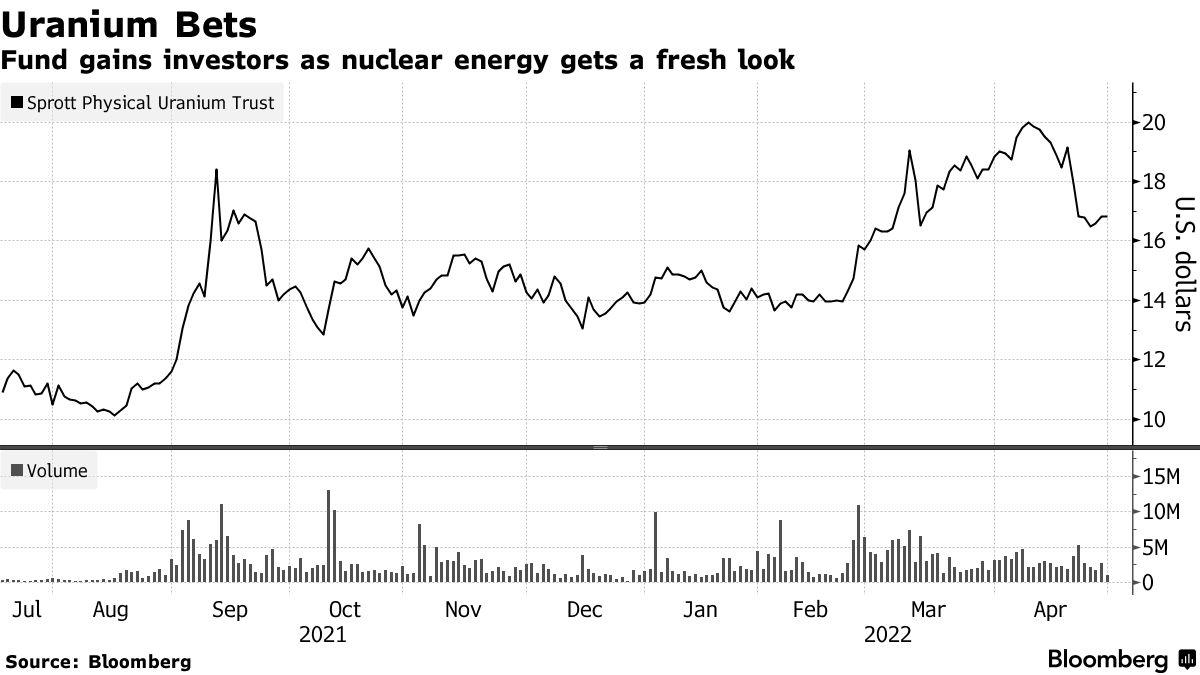

Uranium Royalty Uranium Royalty Corp. ( NASDAQ:UROY – Get Rating ) was the recipient of a large decline in short interest during the month of April. As of April 15th, there was short interest totalling 698,700 shares, a decline of 22.5% from the March 31st total of 901,600 shares. Based on an average daily volume of 712,500 shares, the days-to-cover ratio is presently 1.0 days. Currently, 0.9% of the company’s stock are short sold.

Separately, HC Wainwright reissued a “buy” rating and set a $5.00 price objective on shares of Uranium Royalty in a research report on Thursday, January 6th.

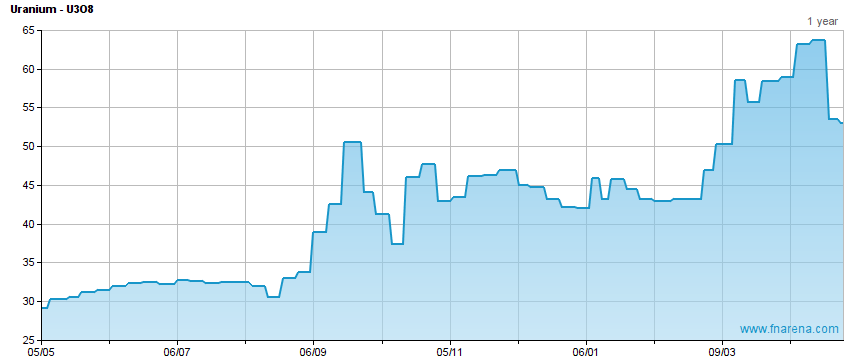

Shares of UROY opened at $3.25 on Tuesday. Uranium Royalty has a twelve month low of $2.25 and a twelve month high of $5.95. The firm’s 50 day moving average price is $4.14. The company has a quick ratio of 77.76, a current ratio of 188.20 and a debt-to-equity ratio of […]

Click here to view original web page at www.etfdailynews.com