Commodities investors see uranium as a rising star, a material needed for nuclear power in a world moving away from fossil fuels. For the U.S. Securities and Exchange Commission , investing in it is another story.

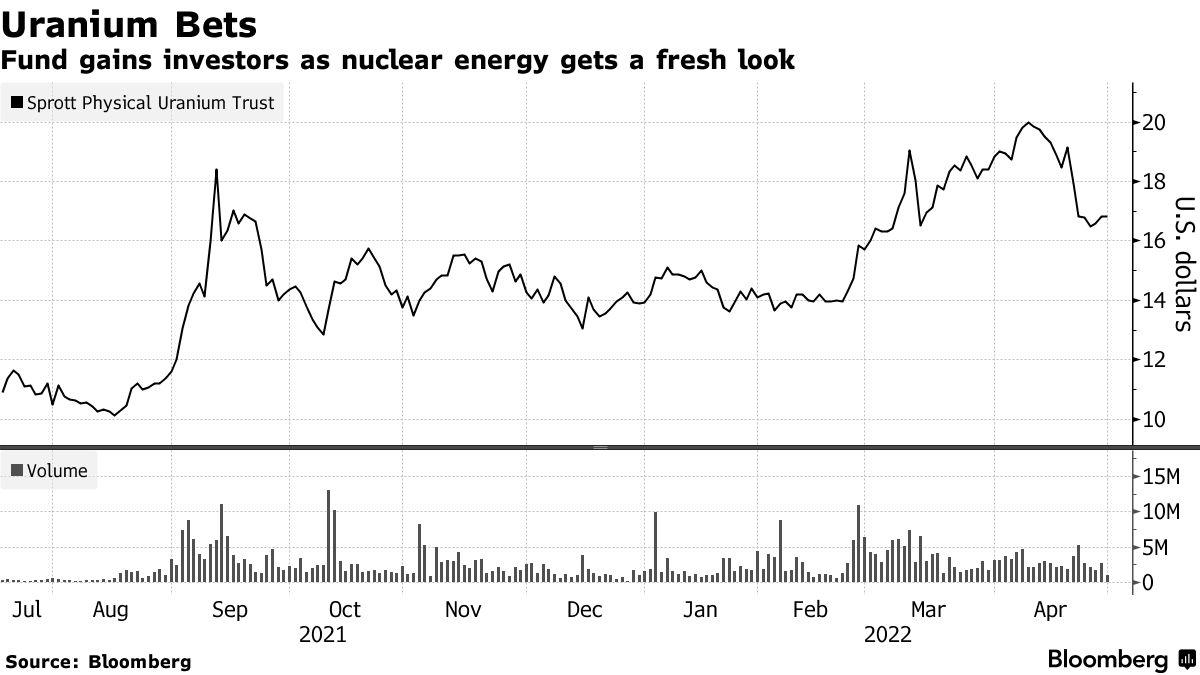

The SEC this week rejected an application by the Sprott Physical Uranium Trust to become the first such fund to trade on U.S. exchanges, the company said, citing a failure to meet listing standards. A Sprott statement pointed to challenges including the structure of the trust “and the nature of the physical uranium market.”

Think about it: how would redemption and delivery of radioactive material work?

Usually a failed U.S. listing is cause for concern. Not so for Sprott, or investors and analysts tracking the company’s Canadian-listed physical uranium trust, started in July and now at $3 billion in assets.“We’ve been very clear to our investors from the start that this would be treated as a […]

Click here to view original web page at www.bloomberg.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments