VANCOUVER, BC, July 28, 2022 /CNW/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE ) (NYSE: NXE) (ASX: NXG) is pleased to announce drill assays from 2021 confirm discovery of a uranium mineralized zone below the known Arrow Deposit and at Camp East: Below Arrow – multiple intersections of uranium mineralization were made significantly below Arrow, including 0.10% U 3 O 8 over 7.0 m in AR-21-268 from 1128 m to 1135 m down hole;

Camp East – uranium concentration of 0.10% U 3 O 8 in RK-21-140 from 166 m to 167 m down hole in association with brittle structure and hydrothermal alteration.

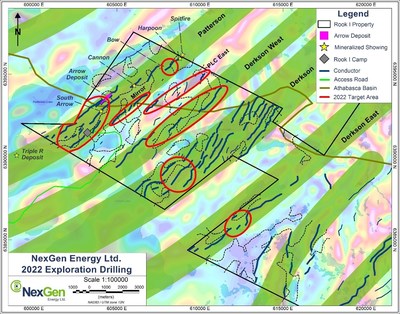

Figure 1: 2022 Exploration Target Areas (CNW Group/NexGen Energy Ltd.) Figure 2: 2021 Exploration Drilling (CNW Group/NexGen Energy Ltd.) Figure 3: 2021 Below Arrow Exploration – Drill holes Completed – Plan View (left) and Cross Section looking Northeast (right) (CNW Group/NexGen Energy Ltd.) […]

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Uranium miner Cameco posts C$84 million in quarterly net income, flags shipping delays from Inkai

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! (Kitco News) – Uranium miner Cameco (TSX: CCO ) today reported that the company produced 2.8 million pounds of uranium (the company’s share) in Q2 2022, up 115% compared to 1.3 million pounds produced in Q2 2021.

The company said it has been successful in catching up on development work at the Cigar Lake mine in Saskatchewan that had been deferred from 2021 and now expects to produce 18 million pounds at Cigar Lake (100% basis) in 2022, with Cameco’s share – including its increased ownership – of approximately 9.5 million pounds.

Cameco also reported net earnings of C$84 million in Q2 2022, compared to a net loss of C$37 million in Q2 2021.

According to the company’s statement, its […]

Uranium Royalty Files Annual Report

VANCOUVER, BC, July 27, 2022 /CNW/ – Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (" URC " or the " Company ") announces that it has published its annual information form, management’s discussion and analysis, and annual consolidated financial statements for the year ended April 30, 2022, which are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov .

As at April 30, 2022, the Company had approximately C$132 million in cash, marketable securities and physical uranium holdings.

Physical uranium holdings at April 30, 2022 were 1,448,068 pounds U 3 O 8 , which were acquired by URC at a weighted average cost of US$41.19 per pound. Based on the most recent daily spot price published by TradeTech LLC of US$47.00 on July 26, 2022, the net realizable value of such holdings has increased by approximately US$8 million since the balance sheet date.

The Company also recorded an increase in the fair […]

Click here to view original web page at www.juniorminingnetwork.com

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Uranium Energy Announces Results of Annual General Meeting

Amir Adnani, Spencer Abraham, Vincent Della Volpe, David Kong, Ganpat Mani and Gloria Ballesta were elected to the Board of Directors of the Company;

PricewaterhouseCoopers LLP, Chartered Professional Accountants, were appointed as the Company’s independent registered accounting firm;

the Company’s 2022 Stock Incentive Plan was approved; and

the Company’s executive compensation was approved Each of the above proposals were approved by not less than 90% of Company stockholders who voted at the AGM and, in most cases, by not less than 95% of UEC’s stockholders; the exact details of which will be provided by the Company in a Form 8-K Current Report filing to be made shortly.Following the AGM the following Executive Officers of the Company were re-appointed by the Board of Directors of the Company:Amir Adnani: President and Chief Executive Officer;Pat Obara: Secretary, Treasurer and Chief Financial Officer; andScott Melbye: Executive Vice President.Uranium Energy Corp is America’s leading, […]

Click here to view original web page at www.juniorminingnetwork.com

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Click here to view original web page at au.finance.yahoo.com

Cameco Announces Second Quarter Results, Continued Disciplined Execution of Strategy; Well-Positioned as Multi-Asset Nuclear Fuel Supplier Across the Fuel Cycle

SASKATOON, Saskatchewan–( BUSINESS WIRE )–Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated financial and operating results for the second quarter ended June 30, 2022 in accordance with International Financial Reporting Standards (IFRS).

“Our results reflect the very deliberate execution of our strategy of full-cycle value capture. And, we are benefiting from higher average realized prices in both our uranium sales and our fuel services sales as the market continues to transition and geopolitics continue to highlight concentration of supply concerns,” said Tim Gitzel, Cameco’s president and CEO.

“In the drive for a clean energy profile, policy makers and business leaders must recognize that there is a need to balance affordability and security. Too much focus on intermittent, weather dependent, renewable energy, has left some jurisdictions struggling with power shortages and spiking energy prices, or dependence on Russian energy supplies. The good news for us is that many are turning to […]

Click here to view original web page at www.businesswire.com

China owns the Green revolution with falling prices of critical technology minerals

Why haven’t the world’s senior miners (aka, the actual producers of non-fuel minerals as well as of oil, gas, and coal) alerted the global manufacturing industry to the limitations on the annual production of the critical mineral resources needed for any Green transformation of the world’s energy economy away from fossil fuels? The simple answer is that they’re making too much money with the nonsensical distortions of the fossil fueled energy economy led by natural resource production illiterates.

Buying back their stock to raise the share prices, so that the insiders (aka management and its bankers) seems to be the most common use of earnings among the seniors.

The seniors are, of course, the world’s suppliers of energy fuels and of structural metals, such as iron and aluminum, and infrastructure metals, such as copper. Those three metals constitute 95% of all the metals produced annually, and iron constitutes 95% of that […]

UEC Stock Pops as Investors Warm Up to Uranium

Shares of Uranium Energy ( UEC ) are up more than 10% as sentiment shifts in the uranium and nuclear power space.

Investors are growing bullish on calls for greater adoption of nuclear energy, particularly in Europe.

Japan’s plans to bring on four more plants has further increased interest in this space and UEC stock today.

Source: engel.ac / Shutterstock Today’s price movements in the energy sector have been quite remarkable. News that Russian energy giant Gazprom has reduced natural gas flows on its Nord Stream-1 pipeline to 20% capacity following a review of a Siemens engine, which was refurbished in Canada, has sent shockwaves through the industry. However, for investors in uranium plays such as Uranium Energy (NYSEARCA: UEC ) and UEC stock, this news is turning out to be bullish today.The thesis is relatively simple. If European economies want to wean off of Russian oil and gas, […]

Cameco: Canaccord Anticipates Mixed Results For Q2 2022

Cameco (TSX: CCO) is expected to report its second quarter financial results on July 27 before the market opens. In Canaccord’s preview, they reiterate their buy rating and C$43 12-month price target, saying, “we remain fundamentally bullish on the outlook for uranium, we remain cautious going into Cameco’s Q2 results.”

There are currently 13 analysts covering the stock with an average 12-month price target of C$43.40, or an upside of 44%. Out of the 13 analysts, 3 have strong buy ratings, 8 have buy ratings, and 1 analyst has a hold rating on the stock. The street high price target sits at C$48, which comes from two analysts and represents an upside of 60%.

For the results, Canaccord expects Cameco to report mixed results and believes investors might have too high of hopes on the contracting volumes. Even with this, they expect Cameco to highlight the positives that have happened over […]

Yellow Cake capitalises on higher uranium demand as company awaits nuclear power transition

Yellow Cake shares gained 2% to 357.4p in late afternoon trading on Friday after the group announced continued market improvement for U3O8, with the spot price increasing 89% from $30.65 per pound on 31 March 2021 to $57.90 per pound on 31 March 2022.

The uranium-specialised company reported a 203% rise in the value of its holding in U3O8 across the financial year to $916.7 million at 31 March 2022 on the back of the increased price of uranium.

Yellow Cake also highlighted the net growth in the volume of uranium held from 9.8 million pounds of U3O8 to 15.8 million pounds.

The firm mentioned a post-tax profit of $417.3 million for FY 2022 from $29.9 million in FY 2021. Yellow Cake confirmed $236.6 million raised over the period through share placings in June and October 2021, after it raised $138.5 million in March 2021.The company said it applied the proceeds of […]

Click here to view original web page at ukinvestormagazine.co.uk

Integrated Advisors Network LLC Takes $53,000 Position in Uranium Royalty Corp. (NASDAQ:UROY)

→ This One Last Idea From Steve Jobs May Transform Apple Once More (Ad) Uranium Royalty Integrated Advisors Network LLC acquired a new stake in shares of Uranium Royalty Corp. ( NASDAQ:UROY – Get Rating ) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 13,500 shares of the company’s stock, valued at approximately $53,000.

Several other large investors also recently made changes to their positions in UROY. Mirae Asset Global Investments Co. Ltd. boosted its holdings in shares of Uranium Royalty by 24.4% in the fourth quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,215,742 shares of the company’s stock worth $11,660,000 after buying an additional 631,738 shares during the period. Great Valley Advisor Group Inc. boosted its holdings in shares of Uranium Royalty by 216.2% in the fourth quarter. Great Valley Advisor Group […]

Click here to view original web page at www.defenseworld.net

Labrador Uranium Commences Drilling at Moran Lake and Announces Corporate Update

TORONTO, July 18, 2022 (GLOBE NEWSWIRE) — Labrador Uranium Inc. (“ LUR ” or “ Labrador Uranium ”) (CSE: LUR, OTCQB: LURAF and F:EI1) is pleased to announce the commencement of a minimum 4,000 metre summer drill program at the Moran Lake Deposit (the “Moran Lake Deposit”) and reconnaissance-style exploration and follow-up for priority areas within LUR’s larger Central Mineral Belt Project (the “CMB Project”), where LUR holds 139,000 ha of mineral rights. The CMB Project is 100% owned and operated by LUR.

Highlights: Camp construction is near completion and the field crew is preparing for mobilization.

Phase 1 exploration includes an inaugural exploration budget of $5.5 million.

Drilling will commence initially at the Moran Lake Deposit (Figure 1 and 2) to delineate a current mineral resource estimate based on historical data, with a view to extending the mineralization downdip in its southern extent of the current mineralized zone, […]

Click here to view original web page at www.globenewswire.com

DevEx Resources : Quarterly Activities and Cashflow Report – June 2022

For personal use only

Activities Report for the Quarter Ended 30 June 2022

HIGHLIGHTS

Nabarlek Uranium Project, NT (100%) A diamond drilling (DD) programme commenced at Nabarlek subsequent to quarter end. A strong resurgence in the uranium spot price, with recent prices reaching 10-year highs (above US$50/lb U3O8), is providing strong justification for this rigorous campaign to test numerous high-quality targets at Australia’s highest-grade uranium province. The programme is designed to test priority targets surrounding the historical Nabarlek Uranium Mine (previous production of 24 Mlbs @ 1.84% U3O8). A second reverse circulation (RC) drill rig is expected to commence in August. Junee Copper-Gold Project, NSW (100%) Drilling at the Nangus Road Prospect was completed during the quarter. Assays from air-core (AC) and DD continue to identify significant near-surface gold mineralisation, with shallow intercepts including: o 4m @ 2.5g/t Au from 28m (AC) incl 1m @ 6.3g/t Au at […]

Click here to view original web page at www.marketscreener.com

SG Americas Securities LLC Has $2.27 Million Holdings in Cameco Co. (NYSE:CCJ)

→ The Only Stock That Could ROCKET in Today’s Market (Ad) SG Americas Securities LLC cut its holdings in Cameco Co. ( NYSE:CCJ – Get Rating ) (TSE:CCO) by 29.4% during the 1st quarter, HoldingsChannel reports. The fund owned 78,033 shares of the basic materials company’s stock after selling 32,521 shares during the quarter. SG Americas Securities LLC’s holdings in Cameco were worth $2,271,000 as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also modified their holdings of CCJ. Kestra Advisory Services LLC grew its stake in shares of Cameco by 13.7% in the fourth quarter. Kestra Advisory Services LLC now owns 53,301 shares of the basic materials company’s stock valued at $1,162,000 after acquiring an additional 6,439 shares in the last quarter. Van ECK Associates Corp grew its stake in Cameco by 18.3% during the fourth quarter. Van ECK Associates Corp […]

Click here to view original web page at www.defenseworld.net

Uranium Royalty Corp. (NASDAQ:UROY) trade information

In last trading session, Uranium Royalty Corp. (NASDAQ:UROY) saw 0.43 million shares changing hands with its beta currently measuring 0. Company’s recent per share price level of $2.28 trading at -$0.17 or -6.94% at ring of the bell on the day assigns it a market valuation of $210.12M. That closing price of UROY’s stock is at a discount of -160.96% from its 52-week high price of $5.95 and is indicating a premium of 7.89% from its 52-week low price of $2.10. Taking a look at company’s average trading volume for last 10-days demonstrates a volume of 0.31 million shares which gives us an average trading volume of 492.47K if we extend that period to 3-months.

Upright in the red during last session for losing -6.94%, in the last five days UROY remained trading in the green while hitting it’s week-highest on Thursday, 07/21/22 when the stock touched $2.28 price level, […]

Click here to view original web page at marketingsentinel.com

Oil Stocks vs. Nuclear Stocks: Which Is Better?

When it comes to energy, oil and nuclear are the two main options investors have to choose from. Oil is the well-known commodity used to power cars and manufacture plastics; nuclear is a green energy source that powers electric grids. Technically, nuclear energy is part of the utilities sector — not energy per se. But with the rise of the electric car, those two sectors are looking more and more similar.

Oil and gas stocks have stood the test of time. With +100 years of steady if volatile gains, they’ve enriched many investors. Nuclear stocks, however, stand to benefit more from up-and-coming trends in energy consumption. In this article, I’ll explore oil stocks and nuclear stocks, so you can decide which is right for you. The case for oil

Compared to uranium mining stocks, oil stocks are generally less speculative. Their earnings vary considerably with oil prices, but not as […]

Three Income Investments to Consider for Navigating Inflation and the Fed’s Rate Hikes

Three income investments to consider purchasing to protect against inflation and Fed rate hikes were highlighted during the annual Global Financial Summit at the FreedomFest conference held July 13-16 in Las Vegas.

The three income investments to consider purchasing to guard against inflation and Fed rate increases feature an infrastructure stock, a pension chairman’s choice and a dividend-paying uranium company. Those three investments to consider purchasing offer ways to pursue profits while also curbing potential downside as Russia continues its invasion of neighboring Ukraine and supply chain problems persist amid China’s lockdowns to enforce its so-called “zero-tolerance” policy of COVID-19 outbreaks.

Russia’s attacks have disrupted the supply of food, grain and fertilizer, while China’s strict COVID policy could be described as “crazy” for preventing people from shopping for food, picking up prescriptions or going outdoors for fresh air and exercise, said featured FreedomFest speaker and media mogul Steve Forbes. In America, […]

Click here to view original web page at www.dividendinvestor.com

Why Uranium Is Expected to Continue Its Bullish Run In 2022

FinancialNewsMedia.com News Commentary

PALM BEACH, Fla., July 20, 2022 /PRNewswire/ — According to Currency.com, in 2021 , the price of Uranium reached the highest levels since 2014, driven by numerous external factors. As a key component of nuclear energy, investors continue to bet on increasing demand for uranium as the world looks towards alternative energies. Throughout the year, the uranium spot price rose from around $30 to $42.05 a pound, an increase just shy of 40%. According to Yellow Cake , a company listed on AIM that provides investors with exposure to uranium: "Primary production has consistently fallen below market demand for uranium over recent years and the primary supply deficit reached a new record in 2020." The supply deficit is predicted to continue, despite speculative interest in uranium driven by a strong nuclear energy push. The article discussed forecasts for 2022, 2025 and 2030. It said: " InvestingNews.com […]

With 44.41% Distance From Low, Is Uranium Energy Corp. (AMEX:UEC) Still Renewed For Growth?

In last trading session, Uranium Energy Corp. (AMEX:UEC) saw 7.46 million shares changing hands with its beta currently measuring 2.04. Company’s recent per share price level of $3.49 trading at -$0.21 or -5.68% at ring of the bell on the day assigns it a market valuation of $1.01B. That closing price of UEC’s stock is at a discount of -89.11% from its 52-week high price of $6.60 and is indicating a premium of 44.41% from its 52-week low price of $1.94. Taking a look at company’s average trading volume for last 10-days demonstrates a volume of 6.09 million shares which gives us an average trading volume of 13.77 million if we extend that period to 3-months.

For Uranium Energy Corp. (UEC), analysts’ consensus is at an average recommendation of a Buy while assigning it a mean rating of 2.00. Splitting up the data highlights that, out of 5 analysts covering […]

Click here to view original web page at marketingsentinel.com

Yellow Cake reports surge in full-year profits

(Sharecast News) – Uranium investor and long-term holder Yellow Cake reported a profit after tax of $417.3m for the year ended 31 March in its annual results on Friday, rocketing from $29.9m year-on-year.

The AIM-traded firm reported a "continued improvement" in the market for triuranium octoxide, with the spot price increasing 89% from $30.65 per pound on 31 March 2021, to $57.90 at the end of the 2022 financial year.

It reported a 203% increase in the value of its holding of triuranium octoxide during the financial year to $916.7m as at 31 March, as a result of the appreciation in the uranium price and a net increase in the volume of uranium held from 9.86 million pounds of triuranium octoxide to 15.83 million pounds.

The company raised $236.6m (£171.7m) during the financial year through share placings in June and October, after raising $138.5m in March last year.It said it applied the […]

Rio Tinto pays historic tax settlement, Kelsian walks from deal with Go-Ahead and BHP accelerates potash project

Rio Tinto will pay back close to $1 billion in unpaid taxes in a historic settlement with the ATO. Mining giant Rio Tinto (ASX: RIO) has agreed to hand over almost $1 billion in unpaid taxes in what is deemed to be one of the largest tax settlements in Australian history.

Rio Tinto will pay the Australian Tax Office (ATO) an additional $613 million to settle disputes over its financing arrangements and marketing hubs in Singapore, on top of the $378 million it has already paid over the same dispute.

The miner was using Singapore as a marketing hub of products, including aluminium and iron ore in an attempt to reduce Australian tax bills, commonly referred to as ‘transfer pricing’.

Rio Tinto chief financial officer Peter Cunningham said the company is pleased to resolve the ongoing disputes and welcomes the clarity on future tax outcomes in Singapore.“Rio Tinto remains committed to our […]

CanAlaska Grants Stock Options

CanAlaska Uranium Ltd. ( TSXV: CVV ) (OTCQB: CVVUF) (FSE: DH7N) ("CanAlaska" or the "Company") announces that it has granted incentive stock options to certain directors, officers, employees and consultants of the Company to purchase up to an aggregate of 2,170,000 common shares of the Company pursuant to the company’s share option plan. The options are exercisable for a period of three years at a price of $0.49 per share.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the […]

Uranium stocks

Nuclear energy is all the rage these days. The world is in an energy crisis, and countries are rushing to embrace nuclear in response to it. Just recently, the European Union (EU) voted to allow companies to describe nuclear energy as ‘green.’ It was a bold step toward nuclear adoption for a continent that, until recently, had largely abandoned it.

For investors, this situation presents interesting opportunities. There are many ways to invest in nuclear energy, both directly in Nuclear Power Plants, and indirectly in the form of Uranium. Last week, the research firm Breakthrough Institute put out a note touting Nuclear Energy’s ability to help the environment and enrich investors. In this article I will explore Uranium stocks and analyze whether they are worth investing in. Why nuclear is in vogue

Nuclear energy is in vogue right now because of the energy crisis the world is facing. There isn’t […]