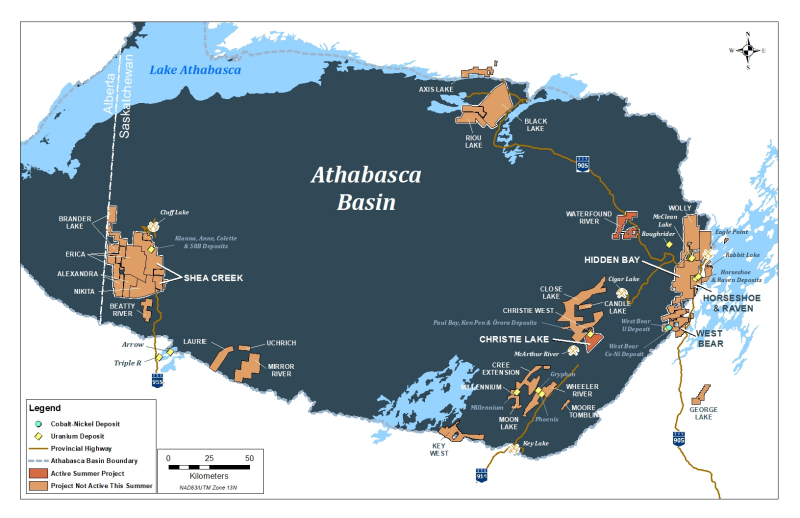

Vancouver, BC, July 19, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) ( SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce the closing of the previously reported Option Agreement with Rio Tinto Exploration Canada Inc. (“RTEC”), a wholly owned subsidiary of Rio Tinto Limited (“Rio Tinto”), to acquire up to 100% of the Russell Lake Uranium Project (the “Property” or “Project”), which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca Basin.

Russell Lake Project Location Map:

http://www.skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpgThe Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective target areas and […]

Ground Breakers: Yellowcake green light as Paladin approves Langer Heinrich uranium restart

The cake is yellow, the light is green. Picture: Alan Schein Photography/The Image Bank via Getty Images Whisper the word uranium in the wind and wait a short while.

The hordes of the believers, growing more numerous as a feverish mood of optimism has set in over the past couple years, will not be far away.

It is now up to the mining hopefuls, who have grown more glowing in their visions of the future of a long downtrodden sector, to show the faith has not been misplaced.

It is one thing to talk about the window of opportunity presented by a looming uranium shortage, the reclassification of nuclear power as green energy and the impact of rising spot prices .It is quite another to build and operate a successful and profitable mine.Two ASX companies now have the opportunity to prove it can be done, after Paladin Energy ( ASX:PDN ) joined […]

Click here to view original web page at www.theaustralian.com.au

Uranium Energy Corp. (UEC): Is this the Most Sought-After Stock Today?

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $3.55 to be very precise. The Stock rose vividly during the last session to $3.42 after opening rate of $3.37 while the lowest price it went was recorded $3.19 before closing at $3.37.Recently in News on July 13, 2022, Uranium Energy Corp Files S-K 1300 Technical Report Summary Disclosing a Total of 32M lbs of Indicated Resources for the Anderson Project in Arizona. (NYSE: UEC) (“UEC” or the “Company”) is pleased to announce that it has filed a Technical Report Summary (“TRS”) on EDGAR, disclosing mineral resources for the Company’s Anderson Project in Arizona (the “Project”). You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $6.60 on 04/13/22, with the lowest value […]

Puranium Energy Receives Approvals for the Transfer of Four EPLs from Namibian Government

Toronto, Ontario–(Newsfile Corp. – July 18, 2022) – Puranium Energy Ltd. ( CSE: UX ) (FSE: 2DK) (the " Company " or " Puranium ") is pleased to announce that the Company has received official government approvals from the Namibian Ministry of Mines and Energy for the transfer of licenses EPL-7394, EPL-7646, EPL-7907 and EPL-8084. Figure 1 – Puranium Property Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8575/131196_52a2516d645558eb_001full.jpgWhile the Company already has the ability to work on all of the EPLs, the official approval to transfer these four EPLs accounts for 88% of the recently purchased uranium exploration portfolio, which are now owned by Puranium’s 85%-owned Namibian subsidiaries. As per the purchase agreement, now that the EPLs have been transferred the Company has issued to the vendors 88% of the purchase price, being US$154,578 and 7,773,140 common shares, which included 706,640 common shares […]

enCore Energy appoints Gregory Zerzan as its chief administrative officer and general counsel, effective July 15, 2022

“We are thrilled to welcome Gregory to our executive team,” said William M. Sheriff, executive chairman at enCore Energy enCore Energy Corp has announced that Gregory Zerzan has been appointed as its chief administrative officer and general counsel, effective July 15, 2022.

The company noted that Zerzan is a proven executive and recognized legal expert on public and regulatory policies with more than 20 years of experience, most recently as the principal deputy solicitor of the United States Department of the Interior.

“We are thrilled to welcome Gregory to our executive team,” said William M. Sheriff, executive chairman at enCore Energy in a statement. “Gregory brings a wealth of experience and expertise in public affairs and legislative and regulatory relations, having worked successfully in both the public and private sectors with a specialty in the energy and natural resources industries."

Sheriff added: "At enCore, he will provide strong stewardship and navigation for […]

Click here to view original web page at ca.proactiveinvestors.com

Labrador Uranium Commences Drilling at Moran Lake and Announces Corporate Update

TORONTO, July 18, 2022 (GLOBE NEWSWIRE) — Labrador Uranium Inc. (“ LUR ” or “ Labrador Uranium ”) (CSE: LUR, OTCQB: LURAF and F:EI1) is pleased to announce the commencement of a minimum 4,000 metre summer drill program at the Moran Lake Deposit (the “Moran Lake Deposit”) and reconnaissance-style exploration and follow-up for priority areas within LUR’s larger Central Mineral Belt Project (the “CMB Project”), where LUR holds 139,000 ha of mineral rights. The CMB Project is 100% owned and operated by LUR.

Highlights: Camp construction is near completion and the field crew is preparing for mobilization.

Phase 1 exploration includes an inaugural exploration budget of $5.5 million.

Drilling will commence initially at the Moran Lake Deposit (Figure 1 and 2) to delineate a current mineral resource estimate based on historical data, with a view to extending the mineralization downdip in its southern extent of the current mineralized zone, […]

Click here to view original web page at www.globenewswire.com

5 Top Weekly TSX Performers: Uranium Stocks Move Up

Last week’s top-gaining stocks on the TSX were Gatos Silver, Kolibri Global, UEX, Freegold Ventures and Denison Mines.

The S&P/TSX Composite Index (INDEXTSI: OSPTX ) closed last Friday (July 15) at 18,391.96.

The index fell on the last day of trading in a week that saw the largest interest rate hike from the Bank of Canada since 1998. The central bank increased rates by 100 basis points on Wednesday (July 13), a move that caught many off guard as expectations were for an increase of 75 basis points.

“It’s great to see central banks finally waking up and trying to get ahead of this,” said Greg Taylor, chief investment officer at Purpose Investments, following the announcement. “This should be looked at as good news, but markets hate surprises and this caught a lot of people off guard.”The gold price continued its decline last week, falling to the US$1,700 per ounce […]

How Searchlight could rewrite the textbook for uranium discoveries in the Athabasca Basin

Uran Fässer; Foto: Depositphotos From everyday life, everyone knows that you only find what you know. This experience can be illustrated particularly well by the change in search criteria for uranium exploration in the Athabasca Basin in Saskatchewan over the past 70 years. It is well known Uranium grades in the Athabasca Basin are extremely high compared to the rest of the world. The two largest mines in the basin, Cigar Lake and MacArthur River, have uranium resources grading 18% and 17% U3O8, respectively.

These deposits were discovered at a time when the so-called "unconformity paradigm" was in effect, which states that uranium deposits form at the boundary between the crystalline basement rocks and the Athabasca Sandstone (see Figure 1; the English term is "unconformity"). According to this heuristic, quite several high-grade deposits have been found over the decades, mainly along the eastern margin of the Athabasca Basin. The disadvantage […]

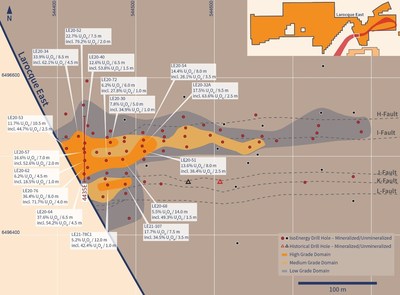

IsoEnergy Announces Initial Mineral Resource Estimate for the High-Grade Hurricane Uranium Deposit

Figure 1 – Plan view of Mineralized Domains with Selected Drilling Results (CNW Group/IsoEnergy Ltd.) Figure 2 – Cross Section 4435E Showing High-, Medium-, and Low-Grade Domains with Drilling Results (CNW Group/IsoEnergy Ltd.) Figure 3 – IsoEnergy Athabasca Projects (CNW Group/IsoEnergy Ltd.) Figure 4 – Larocque East Property Map (CNW Group/IsoEnergy Ltd.) Indicated Mineral Resources of 48.61 million lbs of U 3 O 8 based on 63,800 tonnes grading 34.5% U 3 O 8 , including 43.89 million lbs U 3 O 8 at an average grade of 52.1% U 3 O 8 within the high-grade domain

Inferred Mineral Resources of 2.66 million lbs of U 3 O 8 based on 54,300 tonnes grading 2.2% U 3 O 8

Indicated Mineral Resources are highly insensitive to cut-off grade due to the high-grade and compact nature of the Hurricane Deposit (refer Table 2)

Table 1 – Summary of Hurricane […]

Cameco: A Conservative Choice In A Uranium Market With Improving Fundamentals

Summary

We have over the last year seen several very positive developments in the nuclear and uranium industries.

Cameco is a relatively conservative option in the industry, which will likely do well once investment flows turn positive for the industry again.

There are however presently many other uranium stocks and companies in other industries that appear cheaper based on valuations. I do much more than just articles at Off The Beaten Path: Members get access to model portfolios, regular updates, a chat room, and more. Learn More » RHJ Investment Thesis Cameco (NYSE: CCJ ) is one of few western producers of uranium with sufficient size to attract institutional investors. I have covered the company several times in the past even if it has been more than a year since the last time. In this article, I will go over some recent developments in the industry, my thoughts […]

Sumitomo Mitsui Trust Holdings Inc. Raises Position in Cameco Co. (NYSE:CCJ)

→ One Stock Doubles Your Money, During Crisis? (Ad) Sumitomo Mitsui Trust Holdings Inc. raised its stake in shares of Cameco Co. ( NYSE:CCJ – Get Rating ) (TSE:CCO) by 0.6% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 957,154 shares of the basic materials company’s stock after purchasing an additional 5,828 shares during the period. Sumitomo Mitsui Trust Holdings Inc. owned 0.24% of Cameco worth $27,920,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. AdvisorNet Financial Inc purchased a new stake in Cameco during the first quarter valued at approximately $29,000. Bank of New Hampshire bought a new position in shares of Cameco during the first quarter valued at […]

Click here to view original web page at www.defenseworld.net

IsoEnergy Provides Update on Winter Results and Announces Summer Exploration Plans

Figure 1 – IsoEnergy Athabasca Projects (CNW Group/IsoEnergy Ltd.) Figure 2 – Larocque East Location Map (CNW Group/IsoEnergy Ltd.) Figure 3 – Larocque East Drilling Areas (CNW Group/IsoEnergy Ltd.) Figure 4 – Hurricane Winter 2022 Drilling Results (CNW Group/IsoEnergy Ltd.) Figure 5 – Hawk Survey Results (CNW Group/IsoEnergy Ltd.) Figure 6 – Ranger Survey Results (CNW Group/IsoEnergy Ltd.) Figure 7 – Geiger Drilling Areas (CNW Group/IsoEnergy Ltd.) Figure 8 – Trident Drilling Areas (CNW Group/IsoEnergy Ltd.) Chemical assays are summarized in Table 1 for the final two drill holes which intersected radioactivity >500 CPS during the winter of 2022. At the Hurricane zone, LE22-115A targeted the unconformity 75m west of LE21-101 and intersected 2.0m averaging 1.0% U 3 O 8 between 335.0m and 337.0m which includes a 0.5m subinterval averaging 3.3% U 3 O 8 from 335.5 to 336.0m. Approximately 3.8km to the east-northeast, LE22-116 intersected 0.5m averaging 0.4% […]

Standard Uranium Announces Closing of Brokered Private Placement for C$3.6 Million in Aggregate Proceeds

Each Unit consists of one common share of the Company (each a “ Unit Share ”) and one half of one common share purchase warrant (each whole warrant, a “ Warrant ”). Each FT Unit consists of one common share of the Company to be issued as a “flow-through share” within the meaning of the Income Tax Act (Canada) (each, a “ FT Share ”) and one half of one Warrant. Each whole Warrant shall entitle the holder to purchase one common share of the Company (each, a “ Warrant Share ”) at a price of C$0.17 at any time on or before that date which is 24 months after the issue date. The Unit Shares, FT Shares and Warrant Shares issued from the second tranche will have a hold period ending on November 15, 2022.

The net proceeds raised from the Offering will be used for the exploration of […]

Click here to view original web page at www.juniorminingnetwork.com

Canadian Nuclear Safety Commission Approves NexGen Draft EIS to Proceed to Technical Review

VANCOUVER, BC, July 15, 2022 /PRNewswire/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE) (ASX: NXG) is pleased to announce that on July 12, 2022, the Canadian Nuclear Safety Commission ("CNSC") announced their acceptance of the draft Environmental Impact Statement (the "EIS") which the Company completed submission of in June 2022 (see News Release dated June 21, 2022). The acceptance of the draft EIS for NexGen’s 100% owned Rook I Project ("Rook I" or the "Project") located in Saskatchewan’s southwestern Athabasca Basin follows a 30-day period during which the CNSC conducted a conformance review of the draft EIS submission and confirmed no comments or conditions. Further, the acceptance marks the formal commencement of the 90-day period during which the CNSC will coordinate both the Federal technical and public review of the draft EIS.

Leigh Curyer, Chief Executive Officer commented: "The CNSC’s acceptance of the Rook […]

Okapi gets aerial view of Canada uranium play

Okapi Resources has launched an aerial assault on its Canadian uranium ground. Credit: File Okapi Resources has launched a helicopter-supported review at its wholly owned Newnham Lake and Perch projects, part of its larger Athabasca Basin uranium tenements in Canada. The work is part of a maiden exploration program including prospecting, outcrop sampling and vegetation analysis to help identify favourable structural settings for uranium mineralisation.

Okapi’s campaign comes after a comprehensive analysis of satellite images and historical exploration data acquired across the two project areas generated a swarm of compelling targets calling for a second look.

It will initially cast its gaze towards a pair of underexplored priority areas in the north-eastern perimeter of Newnham Lake, in addition to an area further north at Perch. The company says the zones house exposed unconformity contacts in Archean-aged rocks that demonstrate alteration and oxidation characteristics coherent with potential uranium mineralisation.

Okapi has its foot […]

GoviEx Uranium Provides Madaouela Surface Area Tax Update

Daniel Major, CEO, commented: "Once again the government of Niger has proven to be an excellent partner and willing to work with GoviEx. We welcome the deferment and look forward to further progress with the development of Madaouela. Our feasibility study is due in Q3 and it represents another step towards Madaouela becoming a producing asset."

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

About GoviEx Uranium Inc.

GoviEx is a mineral resource company focused on the exploration and development of uranium properties in Africa. GoviEx’s principal objective is to become a significant uranium producer through the continued exploration and development of its flagship mine-permitted Madaouela project in Niger, its mine-permitted Mutanga project in Zambia, and its multi-element Falea project in Mali. Contact Information Isabel Vilela Head of Investor Relations and Corporate […]

Click here to view original web page at www.juniorminingnetwork.com

Canadian Nuclear Safety Commission Approves NexGen Draft EIS to Proceed to Technical Review

NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE) (ASX: NXG) is pleased to announce that on July 12, 2022 the Canadian Nuclear Safety Commission ("CNSC") announced their acceptance of the draft Environmental Impact Statement (the "EIS") which the Company completed submission of in June 2022 (see News Release dated June 21, 2022 ). The acceptance of the draft EIS for NexGen’s 100% owned Rook I Project ("Rook I" or the "Project") located in Saskatchewan’s southwestern Athabasca Basin follows a 30-day period during which the CNSC conducted a conformance review of the draft EIS submission and confirmed no comments or conditions. Further, the acceptance marks the formal commencement of the 90-day period during which the CNSC will coordinate both the Federal technical and public review of the draft EIS.

Leigh Curyer, Chief Executive Officer commented: "The CNSC’s acceptance of the Rook I Project’s draft EIS is a […]

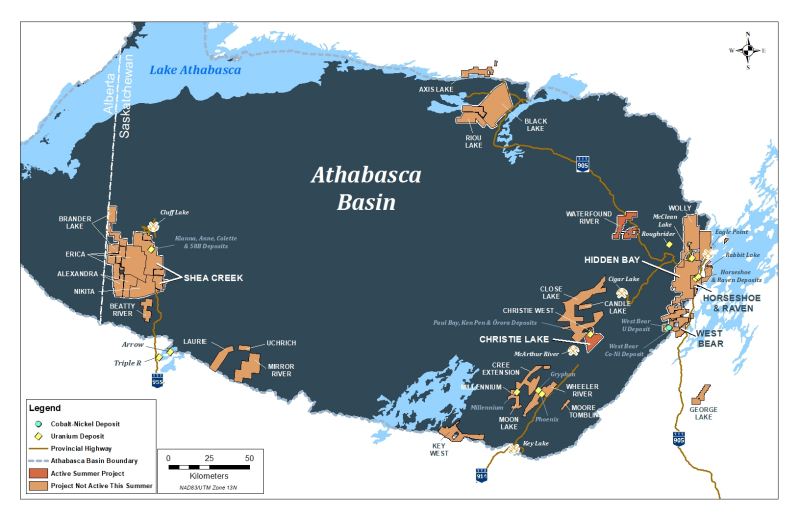

UEX Commences Summer Christie Lake Drill Program

Drilling also underway at JCUs Waterfound River Project

is pleased to announce the commencement of the 2022 summer exploration drilling program at its Christie Lake Project located in the Athabasca Basin of northern Saskatchewan (see Figure 1).

A summer drilling program also commenced on the Waterfound River Project, in which the Company’s 50% owned subsidiary JCU Canada Exploration Company, Limited (“JCU”) is a minority owner.

Christie Lake ProjectSummer exploration drilling is planned in three target areas at Christie Lake using two drill rigs. The summer program will consist of approximately 12 holes for an anticipated total of about 8,000 m of drilling (see Figure 2) following up on the encouraging results of the winter drilling program. Priority drilling will focus on testing for basement-hosted uranium near the Paul Bay, Ken Pen and Ōrora Deposits, down-dip of existing mineralized holes that are located in the gap areas between the three deposits along the […]

Click here to view original web page at www.juniorminingnetwork.com

Okapi gets aerial view of Canada uranium play

Okapi Resources has launched a helicopter-supported review at its wholly owned Newnham Lake and Perch projects, part of its larger Athabasca Basin uranium tenements in Canada. The work is part of a maiden exploration program including prospecting, outcrop sampling and vegetation analysis to help identify favourable structural settings for uranium mineralisation. Okapi Resources has launched an aerial assault on its Canadian uranium ground. Credit: File Okapi Resources has launched a helicopter-supported review at its wholly owned Newnham Lake and Perch projects, part of its larger Athabasca Basin uranium tenements in Canada. The work is part of a maiden exploration program including prospecting, outcrop sampling and vegetation analysis to help identify favourable structural settings for uranium mineralisation.

Okapi’s campaign comes after a comprehensive analysis of satellite images and historical exploration data acquired across the two project areas generated a swarm of compelling targets calling for a second look.

It will initially cast […]

Click here to view original web page at www.businessnews.com.au

Bullish Runs Continues for Canada Mining Companies as Uranium Prices and Demand are Increasing

PALM BEACH, Fla., July 12, 2022 /PRNewswire/ — FinancialNewsMedia.com News Commentary – From cleaner energy to cancer treatments, Canadian mining companies have been producing the uranium that advances global needs through modern tech. For minerals and metals that come with strong environmental and social standards, Canada’s approach is winning friends, followers, and customers. A move towards sustainable mining is a Canadian made, globally recognized sustainability program that supports mining companies in managing key environmental and social responsibilities, enabling mining companies to turn high-level commitments into action on the ground. A recent article in Mined In Canada.ca said that: Towards Sustainable Mining (TSM) is a Canadian made, globally recognized sustainability program that supports mining companies in managing key environmental and social responsibilities, enabling mining companies to turn high-level commitments into action on the ground. "The mining sector will play a critical role in supplying the minerals and metals for batteries […]

Click here to view original web page at www.prnewswire.co.uk

Standard Uranium Announces Closing of Brokered Private Placement for C$3.6 Million in Aggregate Proceeds

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, July 14, 2022 (GLOBE NEWSWIRE) — Standard Uranium Ltd. (“ Standard Uranium ” or the “ Company ”) (TSX-V: STND) (OTCQB:STTDF) is pleased to announce that it has closed the second and final tranche of the fully marketed private placement as announced by the Company on June 6, 2022 (the “ Offering ”). Under the second tranche, the Company sold 3,177,116 flow-through units of the Company (each, a “ FT Unit ”) at a price of C$0.13 per FT Unit for gross proceeds of C$413,025.08. Combined with the first tranche of the Offering, the Company sold 7,306,900 units of the Company (each, a “ Unit ”, and collectively with the FT Units, the “ Offered Securities ”) and 21,242,962 FT Units for aggregate gross proceeds of C$3,565,344.06. The Offering was led by […]

Click here to view original web page at www.globenewswire.com

UEX Commences Summer Christie Lake Drill Program

(TheNewswire)

Drilling also underway at JCUs Waterfound River Project

Saskatoon, Saskatchewan TheNewswire – July 14, 2022 UEX Corporation (TSX:UEX) ("UEX" or the "Company") is pleased to announce the commencement of the 2022 summer exploration drilling program at its Christie Lake Project located in the Athabasca Basin of northern Saskatchewan (see Figure 1).

A summer drilling program also commenced on the Waterfound River Project, in which the Company’s 50% owned subsidiary JCU Canada Exploration Company, Limited ("JCU") is a minority owner.Christie Lake ProjectSummer exploration drilling is planned in three target areas at Christie Lake using two drill rigs. The summer program will consist of approximately 12 holes for an anticipated total of about 8,000 m of drilling (see Figure 2) following up on the encouraging results of the winter drilling program. Priority drilling will focus on testing for basement-hosted uranium near the Paul Bay, Ken Pen and Ōrora Deposits, down-dip of existing mineralized […]

Tribeca Global Natural Resources : June 2022 – NTA Statement

onlyASX Market Announcements ASX Limited

20 Bridge Street Sydney NSW 2000

BY ELECTRONIC LODGEMENT

useMonthly NTA Statement and Investment Update as at 30 June 2022In accordance with ASX Listing Rule 4.12, please find attached statement of TGF’s net tangible asset backing of its quoted securities as at 30 June 2022.For any enquiries please contact TGF at TGFinvestors@tribecaip.com.auor by calling +61 2 9640 2600.personalAuthorised for release by the Board of Tribeca Global Natural Resources Limited. Ken LiuCompany SecretaryTribeca Global Natural Resources LimitedFor Sydney Singapore Web: www.tribecaip.com/lic Level 23, 1 O’Connell Street Level 16, Singapore Land Tower Email: TGFinvestors@tribecaip.com Sydney NSW 2000 Australia 50 Raffles Place, Singapore 048623 ABN: 16 627 596 418 T +61 2 9640 2600 T +65 6320 7718 Monthly NTA StatementInvestment Update as at 30 June 2022onlyPerformance SummaryAfter recording seven consecutive quarters of positive performance which saw the Company’s NTA increase by 76.9%on a post-tax basis, the Company finished the […]

Click here to view original web page at www.marketscreener.com

Platinum and uranium are important raw materials in the energy sector

Energy is the topic of the moment. Uranium is used to generate energy and platinum is used in fuel cells. Receive up-to-date information about the company directly via push notification

Now that uranium has been declared sustainable and uranium is back in the spotlight in the face of looming energy shortages, investors should not disregard this raw material. In the case of electric mobility with power supply, uranium is important as a feedstock for nuclear power plants. This is because worldwide electricity generation is likely to continue to be powered to a certain extent by nuclear energy for a long time to come. When it comes to climate change, nuclear energy scores highly, and the fact that it has regained its reputation can also be seen from the way the price of uranium has developed in recent times. Platinum is not important on the production side, but more in […]

Click here to view original web page at www.resource-capital.ch

Uranium Energy Corp Announces Acquisition of UEX Corporation to Create the Largest Diversified North American Focused Uranium Company

PR Newswire

Acquisition Rationale and Highlights: Accretive transaction, doubling of UEC’s uranium resources in world-class, politically stable, uranium mining jurisdictions at only a 13.7% dilution to UEC’s outstanding shares (1)

Pro forma UEC will have the largest uranium portfolio focused exclusively in the Americas, located in proven and stable jurisdictions, and combining diversified U.S. production and Canadian development assets

Recent global events have set in motion long-term structural changes in the supply chains of energy commodities where security of supply and reduction of geopolitical and transportation risk will be key strategic differentiators On the demand side, there is a growing trend by Western utilities to secure supplies from uranium projects in politically stable jurisdictions UEX portfolio is comprised of 29 uranium projects covering key areas of the producing eastern side and development western side of prolific Athabasca basin 5 of the 29 projects are […]