VANCOUVER, BC, Nov. 25, 2020 /CNW/ – International Consolidated Uranium Inc. (the " Company ") (TSXV: CUR ) is pleased to announce the formation of an advisory board (the " Advisory Board ") to provide advice and recommendations to the Company’s Board of Directors (the " Board ") and management. In conjunction with the formation of the advisory board, the Company is pleased to announce that it has appointed Dean T. (Ted) Wilton as its first member.

Philip Williams, CEO, commented "I am extremely pleased to welcome Ted to the newly formed advisory board. As we grow the Company, the opportunity to draw on Ted’s wealth of experience in the mineral exploration field, particularly for uranium in the United States, will be invaluable. The ultimate success of the Company will be directly tied to the quality of the people we are able to attract. Ted will be an excellent complement […]

Blue Sky Uranium Applies to Extend Warrants

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market (OTC): BKUCFVANCOUVER, BC, Nov. 25, 2020 /CNW/ – Blue Sky Uranium Corp. (TSXV: BSK ) (FSE: MAL2) (OTC: BKUCF) , ("Blue Sky" or the "Company") announces that the Company has made an application to the TSX Venture Exchange to extend the term of the outstanding warrants as follows: 5,940,064 warrants that are set to expire on December 19, 2020 to be extended to December 19, 2022. The warrants are also subject to an accelerator (see text below).

The exercise price of the warrants will remain at $0.30. Each whole warrant, when exercised, will be exchangeable for one common share of the Company.The Warrant exercise period may be accelerated if the volume weighted average price ("VWAP") for the Company’s common shares on the Exchange is $0.50 or greater for a period of 5 consecutive trading days, then […]

GoviEx Uranium Provides Status Report on Madaouela Updated PFS and Updates on Falea Polymetallic Exploration Program Underway

Over the past year, the Company’s technical team together with our feasibility study consultants, SRK Consulting (UK) Ltd (" SRK ") and SGS Bateman (Pty) Ltd (" SGS "), have been focused on metallurgical testing and engineering design work that have potential to significantly benefit the overall feasibility of the Madaouela Project. We have been working diligently to target areas that may reduce both operating and capital costs relative to the current technical report on the Madaouela Project(1) while at the same time working on reducing technical risk, with a focus on improving overall project economics.

Metallurgical test work has been ongoing at the technical teams’ offices in South Africa to verify initial results and to compare alternative trade-off options. Due to the novel logistical challenges associated with COVID-19 as well as transportation permit delays, the test work has taken longer than originally anticipated; however, we are pleased to report […]

Click here to view original web page at www.juniorminingnetwork.com

France aims to retain leadership in global uranium mining

France, the world’s leading country in nuclear power, plans to retain its leadership in the global market into the future through the acceleration of building of new nuclear power capacities throughout the world and development of uranium projects.

Since the early 1960s France has achieved success by developing its nuclear power industry. At present, the country operates more than 60 nuclear power units, which together produce more than 400 billion kWh annually, or more than 75% of the total electricity generated in France. The industry provides local customers with electricity at prices significantly lower than in any other country in the EU.

In addition to the domestic market, a significant of part of electricity produced by French nuclear power plants is exported to neighboring countries, including Italy, Switzerland, Belgium, the United Kingdom, Spain and others.

France’s nuclear success is also due to stable supplies of uranium for its power plants. As France […]

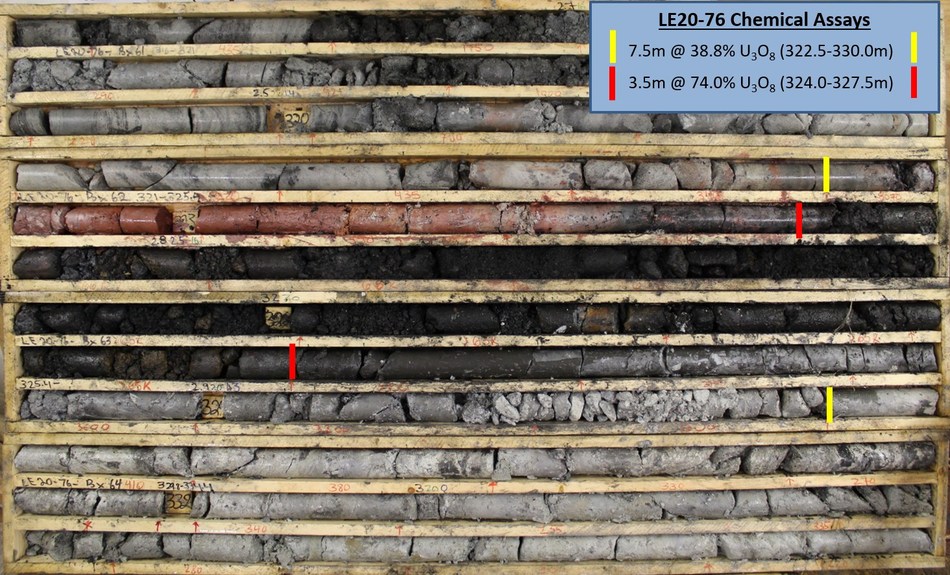

IsoEnergy Intersects 74.0% U3O8 Over 3.5m Within 38.8% U3O8 Over 7.5m in Drill Hole LE20-76

IsoEnergy Ltd. is pleased to report the final chemical assay results from the summer drilling program completed in late October at the Hurricane zone. The Hurricane zone is a recent discovery of high-grade uranium mineralization on the Company’s 100% owned Larocque East property in the Eastern Athabasca Basin of Saskatchewan . Highlights: South extension drill hole LE20-76 intersected 7.5m of uranium …

IsoEnergy Ltd. (” IsoEnergy ” or the ” Company “) ( TSXV: ISO ) (OTCQX: ISENF) is pleased to report the final chemical assay results from the summer drilling program completed in late October at the Hurricane zone. The Hurricane zone is a recent discovery of high-grade uranium mineralization on the Company’s 100% owned Larocque East property (the ” Property “) in the Eastern Athabasca Basin of Saskatchewan .

Highlights: South extension drill hole LE20-76 intersected 7.5m of uranium mineralization that averages 38.8% U 3 O 8 […]

Uranium Week: Have We Seen The Lows For Uranium?

As the spot price of uranium holds steady for the month, an investment firm details bright prospects for the sector.

-Are we past the cyclical downturn for uranium?

-Five investment ideas

-The monthly spot price is unchangedIn the view of Australian investment firm Shaw and Partners, uranium markets are past the cyclical downturn driven by the Fukushima earthquake.A recovery is evidenced by spot uranium prices having increased 25% to US$30/lb this year due to supply-side discipline and inventory drawdowns, notes Shaw. The inertia that took hold after the US Section 232 petition, which was compounded by covid-19, is finally ready to be dislodged. In addition, Russian Suspension Agreement and US election uncertainty is now over.US and European utilities have the clarity and bandwidth to think about procurement. Shaw believes utilities will have to act in 2021 to cover a shortage of term contacts from 2023, given the two […]

Purepoint Uranium Group Inc. Announces Private Placement

/NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES/ New Traders Swear By Benzinga Options

We sift through this volatile market for consistent trades so you don’t have to. Get Benzinga Options: Starter Edition to follow Benzinga’s high-conviction options trades.

Click here to get my trades!

TORONTO, Dec. 1, 2020 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (the "Company") announced a non-brokered private placement (the "Private Placement") of up to 20,000,000 flow-through units (the "Flow-Through Units") at a price of $0.05 per unit for aggregate gross proceeds up to $1,000,000.00. Each Flow-Through Unit consists of one common share in the capital of the Company to be issued on a "flow through" basis pursuant to the Income Tax Act (Canada) and one common share purchase warrant. Each warrant entitles its holder to purchase one common share in the capital of the Company at an […]

Uranium Energy Corp. (NYSE:UEC) – Analysts’ Revisions Show Sentiment Is Improving

Uranium Energy Corp. (NYSE:UEC) traded at $1.06 at close of the session on Monday, Nov 30, made a downturn move of -0.93% on its previous day’s price.

Looking at the stock we see that its previous close was $1.07 and the beta (5Y monthly) reads 2.14 with the day’s price range being $1.0300 – 1.0700. The company has a trailing 12-month PE ratio of 0. In terms of its 52-week price range, UEC has a high of $1.29 and a low of $0.35. The company’s stock has gained about 20.45% over that past 30 days. Decrease Anxiety and Be More Alert with TR CBD Tincture Many people lack focus due to anxiety but CBD can help. Add a couple of drops of Tyson Ranch Strawberry & Cream Full Spectrum CBD Tincture on the tongue to start feeling fast relief so you can focus.

Continue Reading Uranium Energy Corp. has […]

BNP Paribas Arbitrage SA Increases Stock Holdings in Uranium Energy Corp. (NYSEAMERICAN:UEC)

Uranium Energy logo BNP Paribas Arbitrage SA lifted its stake in shares of Uranium Energy Corp. (NYSEAMERICAN:UEC) by 398.1% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 45,835 shares of the basic materials company’s stock after buying an additional 36,633 shares during the period. BNP Paribas Arbitrage SA’s holdings in Uranium Energy were worth $46,000 at the end of the most recent quarter.

Several other large investors also recently made changes to their positions in the stock. Exchange Traded Concepts LLC boosted its position in shares of Uranium Energy by 183.2% during the third quarter. Exchange Traded Concepts LLC now owns 709,028 shares of the basic materials company’s stock valued at $707,000 after buying an additional 458,661 shares during the last quarter. Bridgeway Capital Management Inc. boosted its position in Uranium Energy by 26.2% in the […]

Click here to view original web page at www.modernreaders.com

IsoEnergy Intersects 74.0% U3O8 Over 3.5m Within 38.8% U3O8 Over 7.5m in Drill Hole LE20-76

VANCOUVER, BC, Dec. 1, 2020 /PRNewswire/ – IsoEnergy Ltd. (" IsoEnergy " or the " Company ") (TSXV: ISO) (OTCQX: ISENF ) is pleased to report the final chemical assay results from the summer drilling program completed in late October at the Hurricane zone. The Hurricane zone is a recent discovery of high-grade uranium mineralization on the Company’s 100% owned Larocque East property (the " Property ") in the Eastern Athabasca Basin of Saskatchewan.

Highlights: Figure 1 – LE20-76 Core Photo of High-Grade Uranium Mineralization (CNW Group/IsoEnergy Ltd.) Figure 2 – Hurricane Zone Drill Hole Location Map (CNW Group/IsoEnergy Ltd.) Figure 3 – Vertical Cross-Section 4435E (Drill Hole LE20-76) (CNW Group/IsoEnergy Ltd.) Figure 4 – Vertical Cross-Section 4460E (Drill Hole LE20-77) (CNW Group/IsoEnergy Ltd.) Figure 5 – Larocque East Property Map (CNW Group/IsoEnergy Ltd.) South extension drill hole LE20-76 intersected 7.5m of uranium mineralization that averages 38.8% U 3 […]

Thorium Market Research, Size, Growth And Trends 2020 to 2026| ARAFURA Resources, Blackwood, Crossland Uranium Mines, Kimberley Rare Earths Metal

United States of America:- Newly added research report representing current growth perspectives of the global Thorium market offers access to various actionable insights ready to be deployed as efficient COVID-19 management schemes that has significantly interrupted growth.

The report entices reader attention by unravelling crucial data on dominant trends, regional developments and competition spectrum. The report is poised to bode well with reader inclination towards dedicated data unravelling positioned to assist strategic business decisions to define customer inclination towards growth optimization as well as revenue generation.

Under COVID-19 Outbreak, how the Thorium Industry will develop is also analyzed in detail in COVID Impact Chapter of this report.

Access the PDF sample of the Thorium Market report(Including full TOC, Graphs, Sample Data, and Tables) @ https://www.marketreportexpert.com/report/Thorium/31505/sample Some of top players influencing the Global Thorium market: ARAFURA Resources, Blackwood, Crossland Uranium Mines, Kimberley Rare Earths Metal, Navigator Resources, Western Desert Resources, […]

Uranium Energy Corp. [UEC] gain 16.41% so far this year. What now?

Uranium Energy Corp. [AMEX: UEC] closed the trading session at $1.07 on 11/27/20. The day’s price range saw the stock hit a low of $1.04, while the highest price level was $1.13. The company report on November 25, 2020 that Uranium Energy Corp to Present at the H.C. Wainwright Virtual Mining Conference on Monday, November 30th.

Uranium Energy Corp. (NYSE American: UEC) “UEC” or the “Company”) is pleased to announce that the Company’s President and CEO, Amir Adnani, will present at the H.C. Wainwright Mining Conference on Monday, November 30, 2020 at 2:30 PM ET.

My #1 Stock Trade This Year (HINT: It’s a COVID-19 Play)

Get Ready for my next COVID-19 stock idea. I have been very fortunate in discovering biotech, therapeutic and diagnostic companies within the COVID-19 space, before wall street catches on. Our goal for our members is to get our Alert’s first before the crowd.SponsoredIn addition, […]

Uranium Market 2020: Potential Growth, Challenges, and Know the Companies List Could Potentially Benefit or Loose out From the Impact of COVID-19 | Key Players: Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, etc. | InForGrowth

Uranium Market Research Report covers the present scenario and the growth prospects of Uraniumd Market for 2015-2026. The report covers the market landscape and its growth prospects over the coming years and discussion of the Leading Companies effective in this market. Uranium Market has been prepared based on an in-depth market analysis with inputs from industry experts. To calculate the market size, the report considers the revenue generated from the sales of Uranium globally

This report will help you take informed decisions, understand opportunities, plan effective business strategies, plan new projects, analyse drivers and restraints and give you a vision on the industry forecast. Further, Uranium market report also covers the marketing strategies followed by top Uranium players, distributor’s analysis, Uranium marketing channels , potential buyers and Uranium development history.

Get Free Exclusive Sample Report on Uraniumd Market is available at https://inforgrowth.com/sample-request/6771784/uranium-market

Along with Uranium Market research analysis, buyer also […]

Uranium Energy Corp. (UEC) volume hits 1.31 million: A New Opening for Investors

Witnessing the stock’s movement on the chart, on November 27, 2020, Uranium Energy Corp. (AMEX: UEC) had a quiet start as it plunged -3.60% to $1.07. During the day, the stock rose to $1.13 and sunk to $1.04 before settling in for the price of $1.11 at the close. Taking a more long-term approach, UEC posted a 52-week range of $0.35-$1.29. Retired Millionaire to Make Shocking Gold Prediction Legendary investor Doug Casey just made a MASSIVE gold prediction. Doug calls it the most bullish sign he’s seen in 45 years’ And shares his #1 Gold Secret LIVE on Camera. Watch the Interview Now

Continue Reading Meanwhile, its Annual Earning per share during the time was 20.60%. Nevertheless, stock’s Earnings Per Share (EPS) this year is 18.20%. This publicly-traded company’s shares outstanding now amounts to $184.25 million, simultaneously with a float of $183.29 million. The organization now has a […]

Uranium Energy Corp. (UEC) can’t be written off after posting last 3-months Average volume of 1.43M

Uranium Energy Corp. (UEC) is priced at $1.07 after the most recent trading session. At the very opening of the session, the stock price was $1.12 and reached a high price of $1.13, prior to closing the session it reached the value of $1.11. The stock touched a low price of $1.04.

Recently in News on November 25, 2020, Uranium Energy Corp to Present at the H.C. Wainwright Virtual Mining Conference on Monday, November 30th. Uranium Energy Corp. (NYSE American: UEC) “UEC” or the “Company”) is pleased to announce that the Company’s President and CEO, Amir Adnani, will present at the H.C. Wainwright Mining Conference on Monday, November 30, 2020 at 2:30 PM ET. You can read further details here

My Next COVID-19 Stock Alert Poised For Triple Digit Moves

Get Ready for my next COVID-19 stock idea. I have been very fortunate in discovering biotech, therapeutic and diagnostic […]

Global Uranium Market 2020 Recovering From Covid-19 Outbreak | Know About Brand Players: Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, etc. | InForGrowth

Uranium Market Research Report provides analysis of main manufactures and geographic regions. Uranium Market report includes definitions, classifications, applications, and industry chain structure, development trends, competitive landscape analysis, and key regions distributors analysis. The report also provides supply and demand Figures, revenue, revenue and shares.

Uranium Market report is to recognize, explain and forecast the global market based on various aspects such as explanation, application, organization size, distribution mode, and region. The Market report purposefully analyses every sub-segment regarding the individual growth trends, contribution to the total market, and the upcoming forecasts.

Report Coverage: Uranium Market report provides a comprehensive analysis of the market with the help of up-to-date market opportunities, overview, outlook, challenges, trends, market dynamics, size and growth, competitive analysis, major competitor’s analysis.

Report recognizes the key drivers of growth and challenges of the key industry players. Also, evaluates the future impact of the propellants and […]

Uranium Energy Corp. (NYSE:UEC) Forecast to gain 118.69% to hit Consensus price target

Uranium Energy Corp. (NYSE:UEC) has a beta value of 2.14 and has seen 1,305,935 shares traded in the last trading session. The company, currently valued at $211.19 Million, closed the last trade at $1.07 per share which meant it lost -$0.04 on the day or -3.6% during that session. The UEC stock price is -20.56% off its 52-week high price of $1.29 and 67.29% above the 52-week low of $0.35. If we look at the company’s 10-day average daily trading volume, we find that it stood at 1.65 Million shares traded. The 3-month trading volume is 1.4 Million shares.

The consensus among analysts is that Uranium Energy Corp. (UEC) is a Buy stock at the moment, with a recommendation rating of 1.7. None of the analysts rate the stock as a Sell, while none rate it as Overweight. None out of 5 have rated it as a Hold, with 5 […]

Click here to view original web page at marketingsentinel.com

Enriched Uranium Market 2020 is predicted to rise with a CAGR of XX% by 2026 | Including Various Factors like Top Manufacturers, Market Size & Growth, Product Type, Focused Application

Enriched Uranium Market report would come handy to understand the competitors in the market and give an insight into sales, volumes, revenues in the Enriched Uranium Industry & will also assists in making strategic decisions. The report also helps to decide corporate product & marketing strategies. It reduces the risks involved in making decisions as well as strategies for companies and individuals interested in the Enriched Uranium industry. Both established and new players in Enriched Uranium industries can use the report to understand the Enriched Uranium market .

In Global Market, the Following Companies Are Covered:

Sinosteel

CNNC Sinohydro Jinduicheng Molybdenum JiangXi Copper Corporation Cameco Orano BHP Billiton Kazatomprom APM3 ERA AtomRedMetZoloto?ARMZ? Paladin Navoi Rio Tinto Group Centrus (USEC) Tenex Piketon AngarskGet a Sample Copy of the Report @ […]

SG Americas Securities LLC Sells 130,609 Shares of Uranium Energy Corp. (NYSEAMERICAN:UEC)

Uranium Energy logo SG Americas Securities LLC decreased its holdings in Uranium Energy Corp. (NYSEAMERICAN:UEC) by 14.6% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 762,642 shares of the basic materials company’s stock after selling 130,609 shares during the period. SG Americas Securities LLC’s holdings in Uranium Energy were worth $760,000 as of its most recent SEC filing.

Other institutional investors have also bought and sold shares of the company. Advisor Group Holdings Inc. increased its holdings in shares of Uranium Energy by 290.6% in the 2nd quarter. Advisor Group Holdings Inc. now owns 32,768 shares of the basic materials company’s stock worth $28,000 after purchasing an additional 24,379 shares in the last quarter. Bank of America Corp DE boosted its stake in shares of Uranium Energy by 145.1% in the 2nd quarter. Bank […]

Click here to view original web page at www.modernreaders.com

Uranium Energy Corp. (UEC) Upgraded Issued by Wall Street Gurus

Uranium Energy Corp. (AMEX:UEC) went up by 7.77% from its latest closing price compared to the recent 1-year high of $1.29. The company’s stock price has collected 15.63% of gains in the last five trading sessions. Press Release reported on 11/25/20 that Uranium Energy Corp to Present at the H.C. Wainwright Virtual Mining Conference on Monday, November 30th Is It Worth Investing in Uranium Energy Corp. (AMEX :UEC) Right Now?

Plus, the 36-month beta value for UEC is at 2.02. Opinions of the stock are interesting as 5 analysts out of 5 who provided ratings for Uranium Energy Corp. declared the stock was a “buy,” while 0 rated the stock as “overweight,” 0 rated it as “hold,” and 0 as “sell.” 5 Winning Stock Chart Patterns Stock trading expert, Christian Tharp, boils down his 20 years of experience into these 5 easy to follow charts that consistently point to […]

Where Do Hedge Funds Stand On Uranium Energy Corp. (UEC)?

In this article we will check out the progression of hedge fund sentiment towards Uranium Energy Corp. (NYSE: UEC ) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Uranium Energy Corp. (NYSE: UEC ) was in 3 hedge funds’ portfolios at the end of September. The all time high for this statistics is 11. UEC investors should pay attention to a decrease in hedge […]

Click here to view original web page at www.insidermonkey.com

Blue Sky Uranium Applies to Extend Warrants

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market (OTC): BKUCFVANCOUVER, BC, Nov. 25, 2020 /PRNewswire/ – Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF) , ("Blue Sky" or the "Company") announces that the Company has made an application to the TSX Venture Exchange to extend the term of the outstanding warrants as follows: 5,940,064 warrants that are set to expire on December 19, 2020 to be extended to December 19, 2022. The warrants are also subject to an accelerator (see text below).

The exercise price of the warrants will remain at $0.30. Each whole warrant, when exercised, will be exchangeable for one common share of the Company.The Warrant exercise period may be accelerated if the volume weighted average price ("VWAP") for the Company’s common shares on the Exchange is $0.50 or greater for a period of 5 consecutive trading days, then the […]

Baselode Energy Announces Flow-Through Private Placement

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES . Baselode Energy Corp. is pleased to announce a non-brokered private placement of up to 2,500,000 flow-through units of the Company at a price of C$0.40 per FT Unit for gross proceeds of up to C$1.0 million . Each FT Unit shall be comprised of one flow-through share in the capital of the Company and one half of one …

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES ./

Baselode Energy Corp. (” Baselode ” or the ” Company “) ( TSXV: FIND ) is pleased to announce a non-brokered private placement of up to 2,500,000 flow-through units (the “FT Units”) of the Company at a price of C$0.40 per FT Unit for gross proceeds of up to C$1.0 million (the “Offering”). Each FT Unit shall […]

Uranium Market Growth Opportunities by Regions, Type & Application; Trend Forecast to 2026

Uranium market research study provides an all-inclusive assessment of the market while propounding historical intelligence, actionable insights, and industry-validated & statistically-upheld market forecast. A verified and suitable set of assumptions and methodology has been leveraged for developing this comprehensive study. Information and analysis of key market segments incorporated in the report have been delivered in weighted chapters.

Global “ Uranium Market ” research report provides the historical, present & future situation of Market Size & Share, Revenue, the demand of industry and the growth prospects of the Uranium industry in globally. This Uranium Market report has all the important data and analysis of market advantages or disadvantages, the impact of Covid-19 analysis & revenue opportunities and future industry scope all stated in a very clear approach. Uranium market report also calculates the Market Impacting Trends, Strategic Analysis, Market DROC, PEST Analysis, Porter’s 5-force Analysis, Market News, sales channels, distributors and […]

Uranium Market Incredible Possibilities, Growth Analysis and Forecast To 2027

Reports Insights “ Overview Of Uranium Industry 2020-2027:

This has brought along several changes in This report also covers the impact of COVID-19 on the global market.

The Uranium Market analysis summary by Reports Insights is a thorough study of the current trends leading to this vertical trend in various regions. Research summarizes important details related to market share, market size, applications, statistics and sales. In addition, this study emphasizes thorough competition analysis on market prospects, especially growth strategies that market experts claim.

Uranium Market competition by top manufacturers as follow: ,Sinosteel,CNNC,Sinohydro,Jinduicheng Molybdenum,JiangXi Copper Corporation,Cameco,Areva,BHP Billiton,Kazatomprom,APM3,ERA,AtomRedMetZoloto?ARMZ?,Paladin,Navoi,Rio Tinto Group,, Get a Sample PDF copy of the report @ https://reportsinsights.com/sample/128661 The global Uranium market has been segmented on the basis of technology, product type, application, distribution channel, end-user, and industry vertical, along with the geography, delivering valuable insights. The Type Coverage in the Market are: Granite-Type Uranium Deposits Volcanic-Type […]