Specialised ASX uranium shares are having a bumper start to 2021. For example, Paladin Energy Ltd (ASX: PDN) , Boss Energy Ltd (ASX: BOE) , and Deep Yellow Limited (ASX: DYL) are currently trading around 93%, 79%, and 57% higher, respectively, since the first trading day of the year. The only exception is Energy Resources of Australia Ltd (ASX: ERA) , an ASX-listed company 68% owned by Rio Tinto Limited (ASX: RIO) . This company shut down its only uranium operation , the Ranger Uranium Mine, in January this year. Subsequently, its share price has decreased by around 35% in 2021.

So, why are shareholders of operating ASX uranium miners seeing an incredible return on investment (ROI) in 2021? Let’s take a look. Uranium and green energy

Nuclear power is a zero-emissions generator. According to the website Trading Economics, it’s being increasingly considered by governments such as the United […]

Uranium Participation Corporation Announces Upsize to Bought Deal Financing

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES./

TORONTO, May 4, 2021 /CNW/ – Uranium Participation Corporation ("UPC" or the "Company") (TSX: U ) has entered into an agreement with Cormark Securities Inc. and Cantor Fitzgerald Canada Corporation (the "Co-Lead Underwriters") on behalf of a syndicate of underwriters including Canaccord Genuity Corp., Sprott Capital Partners LP, Haywood Securities Inc., Raymond James Ltd., Scotia Capital Inc. and TD Securities Inc. (collectively, the "Underwriters") pursuant to which the Company and the Underwriters have agreed to increase the size of the previously announced $50 million bought deal offering. Pursuant to the upsized deal terms, the Underwriters have agreed to purchase on a bought deal basis 13,462,000 common shares of the Company (the "Shares") at a price of $5.20 per Share, representing total […]

Value Investors: 1 Precious Metals Stock Set to Outperform

Uranium Participation (TSX:U) is a company whose primary purpose is to invest in uranium such that the common shares of the company represents an indirect interest in physical uranium . An investment in the common shares of the company provides investors with exposure to increases or decreases in the value of the company’s underlying assets. Exposure to precious uranium

In the case of Uranium Participation Corp. (UPC), the value of the company’s underlying assets is largely derived from UPC’s holdings of physical uranium. As a result, investors in UPC indirectly invest in physical uranium, without being exposed to the risks associated with investments in companies that engage in the exploration, mining, and processing of uranium.

The strategy of UPC is to invest in holdings of uranium and not to actively speculate on changes in uranium prices by entering exchange or investment contracts or derivative arrangements. The intent is for UPC […]

Uranium Royalty Corp. Announces C$37 Million Financing Package Comprised of C$25 Million Bought Deal and C$12 Million Margin Loan

Not for distribution to U.S. news wire services or dissemination in the United States.

VANCOUVER, British Columbia, May 04, 2021 (GLOBE NEWSWIRE) — Uranium Royalty Corp (TSX-V: URC, NASDAQ: UROY, ”URC” or the “Company”) is pleased to announce that it has entered into an agreement with a syndicate of underwriters, led by BMO Capital Markets, under which the underwriters have agreed to purchase, on a bought deal basis, 6,100,000 common shares (the “Common Shares”), at a price of C$4.10 per Common Share, for gross proceeds of approximately C$25 million (the “Offering”). The Company has granted the Underwriters an option, exercisable at the offering price for a period of 30 days following the closing of the Offering, to purchase up to an additional 15% of the Offering to cover over-allotments, if any. The offering is expected to close on or about May 20, 2021 and is subject to the Company […]

Click here to view original web page at markets.businessinsider.com

Is uranium coming back in vogue?

Last week, Anthony Milewski, a director of International Consolidated Uranium, made the case to our readers that uranium sentiment is finally improving and the nuclear fuel is now having its day in the sun after years in the darkness following the Fukushima nuclear disaster in 2011. Milewski noted that there seems to be a shift in the willingness of governments to discuss nuclear energy openly now in the context of controlling greenhouse gas emissions and fighting climate change. “Nuclear is one of the cleanest forms of energy available, period,” he wrote, and when it comes to carbon emissions, “it equals, and in some cases, outperforms renewable energy sources.” It is also “a great deal more reliable.” In addition, Milewski pointed to the most recent World Nuclear Association’s Fuel Report, which forecast a 26% increase in uranium demand over the next decade, and stats from the World Nuclear Association, which […]

Click here to view original web page at www.northernminer.com

Uranium Energy Corp. (UEC) is set for a tempting yields with an average volume of 7.19M

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $3.32 to be very precise. The Stock rose vividly during the last session to $3.32 after opening rate of $2.99 while the lowest price it went was recorded $2.93 before closing at $2.90.

Recently in News on April 22, 2021, Uranium Energy Corp. (NYSE American: UEC) Ready, Eager to Provide Much-Needed Fuel. NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “New Focus on Clean Energy Boon for Uranium.”. You can read further details here

Even if you’re not actively in crypto, you deserve to know what’s actually going on…

Because while leading assets such as Bitcoin (BTC) and Ethereum (ETH) are climbing in value, a select group of public “crypto stocks” are surging right along with them. More importantly, these stocks are outpacing the returns these leading crypto assets […]

Uranium Participation Corporation Announces Upsize to Bought Deal Financing

If you are looking to learn how to properly analyze stocks before trading them in order to consistently find winners, then click here to see how you can earn while you learn.

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES./

New Traders Swear By Benzinga Options

★★★★★ "9 out of 10 trades are winners!" – Cameron W. Houston, TXWe sift through this volatile market for consistent trades so you don’t have to. Get Benzinga Options: Starter Edition to follow Benzinga’s high-conviction options trades. Click here to get my trades! TORONTO, May 4, 2021 /CNW/ – Uranium Participation Corporation ("UPC" or the "Company") (TSX: U ) has entered into an agreement with Cormark Securities Inc. and Cantor Fitzgerald Canada Corporation (the "Co-Lead Underwriters") on behalf of a […]

Denison Delivers Offer to Acquire 100% Ownership of JCU (Canada) Exploration Company, Limited

TORONTO, May 4, 2021 /PRNewswire/ – Denison Mines Corp. ("Denison" or the "Company") (TSX: DML) (NYSE American: DNN) announces that it has delivered a binding offer (the "Denison Offer") to Overseas Uranium Resources Development Co., Ltd. ("OURD") to acquire 100% ownership of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited ("JCU"). PDF Version

JCU holds a portfolio of uranium project joint venture interests in Canada, including a 10% interest in Denison’s 90% owned Wheeler River uranium project.

The Denison Offer includes the following features: Consideration including cash payments of up to CAD$40.5 million and the assumption of JCU’s existing liabilities (see below). The cash payments include a CAD$10.0 million refundable deposit on signing of a definitive agreement, an additional CAD$28.0 million on closing, and a further amount of up to CAD$2.5 million, which is expected to be paid within 45 days of the closing date and is subject to adjustment […]

Uranium ETF Sees Strong Move, Is There Lurking Risk?

Global Energy Metals Corporation President and CEO Mitchell Smith presented at the Benzinga Cleantech Small Cap Conference on April 22, 2021, highlighting the company’s investment exposure to the electrified future through its growing portfolio of jurisdictionally-safe, battery metals projects. Vancouver, B.C.,-based Global Energy Metals (TSXV:GEMC | OTC:GBLEF | FSE: 5GE1) continues to develop a strong diversified portfolio of strategic battery mineral projects and in doing so, is expanding its global mining opportunities. The company has signed a definitive agreement to acquire a strategic interest in the Råna Nickel-Copper-Cobalt project including the past-producing Bruvann Nickel Mine in the Råna mafic-ultramafic intrusion in northern Norway. It has also permitted the first-ever drill program to be conducted on the Lovelock Mine Project in the Cottonwood Canyon area of the Stillwater Range in Nevada. The proactive moves by Global Energy Metals meets the renewed interest in the battery minerals sector as price fundamentals […]

Uranium Participation Corporation Announces $50 Million Bought Deal Financing

The Underwriters also have an option to purchase up to an additional 1,442,400 Shares at the offering price (representing 15% of the Offering) on the Closing Date for market stabilization purposes and price to cover over-allotments for a period of 10 days after the Closing Date.

The net proceeds of the Offering will be used by the Company to fund future purchases of U 3 O 8 and/or UF 6 and for general corporate purposes.

The Shares to be issued under the Offering will be offered by way of a short form prospectus in each of the provinces of Canada, except Quebec, pursuant to National Instrument 44-101 – Short Form Prospectus Distributions and in the United States on a private placement basis pursuant to an exemption from the registration requirements of the United States Securities Act of 1933 , as amended, and such other jurisdictions as may be agreed upon by […]

Click here to view original web page at www.juniorminingnetwork.com

Deep Yellow Limited to Webcast Live at VirtualInvestorConferences.com May 6th

SUBIACO, Western Australia, May 3, 2021 /PRNewswire/ — Deep Yellow Limited (OTCQX: DYLLF ) (ASX: DYL), based in Subiaco, Western Australia, focused on uranium exploration and development, today announced that Mr John Borshoff, Managing Director/CEO will present live at VirtualInvestorConferences.com on May 6 th .

DATE: May 6 th , 2021

TIME: 11:00am ET / 11:00pm Perth

LINK: https://bit.ly/3exE6AHThis will be a live, interactive online event where investors are invited to ask the company questions in real-time. If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available after the event.It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates.Learn more about the event at www.virtualinvestorconferences.com . Recent Company Highlights Successful completion of Tumas PFS January 2021, which confirmed or improved on Scoping Study (January […]

Uranium Participation Corporation Announces $50 Million Bought Deal Financing

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES./

TORONTO, May 3, 2021 /CNW/ – Uranium Participation Corporation ("UPC" or the "Company") (TSX: U ) has today entered into an agreement with Cormark Securities Inc. and Cantor Fitzgerald Canada Corporation (the "Co-Lead Underwriters") on behalf of a syndicate of underwriters (the "Underwriters") pursuant to which the Underwriters have agreed to purchase on a bought deal basis 9,616,000 common shares of the Company (the "Shares") at a price of $5.20 per Share, representing total gross proceeds of $50,003,200 (the "Offering"). Closing is expected on or about May 26, 2021 (the "Closing Date"), and is subject to regulatory approval including that of the Toronto Stock Exchange.

The Underwriters also have an option to purchase up to an additional 1,442,400 Shares at the offering […]

Uranium ETF Sees Strong Move, Is There Lurking Risk?

Some 15% of the American public owns some form of cryptocurrency – and a large part of that group jumped on the bandwagon in the last two years. The digital currencies – Bitcoin is the most famous, but there are scores of others – offer users a distinct set of advantages, based on their blockchain technology. First, the crypto coins are secure – as a digital technology, blockchain is notoriously difficult to break. Second, the coins have the chief attribute of any store of value: scarcity. There is a mathematical limit to how many Bitcoin, for example, will ever exist – and that limit gives them their value. People want a secure online currency, are willing to pay for it, and the relatively scarce (compared to traditional fiat currencies) crypto coins offer both attributes. The result, in recent years, has been a boom as investors have started looking seriously […]

Hot Penny Stocks On Robinhood to Watch This Week

This story originally appeared on PennyStocks Are These Top Penny Stocks Worth Buying?

May is here, and thus, so is another month for penny stocks. Because speculation is standard with the territory, any factors including something as simple as the beginning of a new month can have a positive or negative effect on penny stocks .

Now, why are penny stocks so speculative? Well, the short answer is that due to their low price (any stocks under $5 ), values tend to shift very quickly. In addition, most investors tend to swing trade these stocks, which in turn, adds to their high volatility.

[Read More] Tech Penny Stocks to Buy in 2021? Check These 3 Out Lastly, most cheap stocks tend to move very quickly when news is announced. This includes everything from balance sheets to corporate filings and company updates. So, while none of this should serve to incite fear, […]

Click here to view original web page at www.entrepreneur.com

Uranium Hexafluoride Market Trend Shows A Rapid Growth By 2028 | IndustryAndResearch

The information used to estimate the market size and forecast for various segments at the global, regional, and country level is derived from the most credible published sources and through interviews with the right stakeholders. Uranium Hexafluoride Market report With 100+ number of study pages included in this market report, it provides or gives proper information which is written and composed to understand market terminologies.

The Global Uranium Hexafluoride Market Report 2021 presents the worldwide Uranium Hexafluoride market size (value, production and consumption), splits the breakdown (data status 2021 and forecast to 2028), by manufacturers, region, Type (U235, U226, U240) and Application (Nuclear Fuel, Others) . Uranium Hexafluoride Market Research Report presents a detailed analysis based on the thorough research of the overall market, particularly on questions that border on the market size, growth scenario, potential opportunities, operation landscape, trend analysis, and competitive analysis of Uranium Hexafluoride Market. The […]

Riding The Stock Waves: Technical Update On Cameco

Summary

CCJ is one of the larger players in the uranium mining space.

Global demand for uranium is increasing.

There’s likely to be insufficient supply for future demand based on current construction plans for reactors in Asia and the Middle East. Looking for more investing ideas like this one? Get them exclusively at Stock Waves. Learn More » Photo by Evgeny Gromov/iStock via Getty Images “Uranium miners like Cameco (NYSE: CCJ ) are well-positioned as bullish investments over the next 3-5 years in my view, and are not strongly correlated with other asset classes. “ —Lyn Alden Schwartzer from her 3/23 Where Fundamentals Meet Technicals updateUranium formed a major bottom in 2016, and steadily, much of the developing world is investing in nuclear power.In the same article from March 23, of this year, Lyn Alden Schwartzer referred to uranium as “… an under-owned commodity. It’s not one of […]

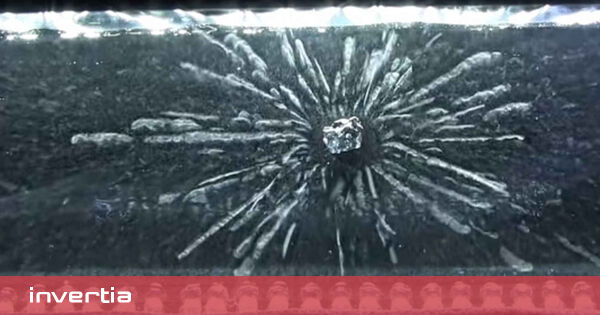

The controversial role of uranium in the energy transition drives its price

There is no doubt that the future of the energy sector it will be fully linked to the development around ESG factors, acronym for environmental, social and governance sustainability. In the end, it seems that the Greenpeace ‘geeks’ were indeed right and fossil fuels cause a greenhouse effect and pollute both the air and the soil of our planet.

To protect future generations, or simply attract money from investors, countries began to develop ‘green plans’ that theoretically should help reduce global pollution. Among them, we find the European Green Deal, which allegedly seeks to make the Union’s economy more sustainable and achieve a climate neutral continent by 2050 .

In the case of China , an ‘action plan’ was announced for CO2 emissions of the Asian country reach their peak before 2030 and, afterwards, achieve carbon neutrality in 2060. The question is how they are going to achieve it: By closing […]

Fission Uranium Corp. Announces $30 Million Bought Deal Public Offering of Units

Fission Uranium Corp. is pleased to announce that it has entered into an agreement with Eight Capital and Sprott Capital Partners LP, as co-lead underwriters on behalf of a syndicate of underwriters pursuant to which the Underwriters have agreed to buy, on a bought deal basis, 50,000,000 units of the Company, at a price of $0.60 per Unit for gross proceeds of $30 million . Each Unit will be comprised of one common …

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES.

Fission Uranium Corp. (“FISSION” or the “Company”) is pleased to announce that it has entered into an agreement with Eight Capital and Sprott Capital Partners LP, as co-lead underwriters on behalf of a syndicate of underwriters (collectively, the “ Underwriters ”), pursuant to which the Underwriters have agreed to buy, on a bought deal basis, 50,000,000 units (the “ Units […]

Africa Snapshot: Eight companies with promising projects

The study forecast the post-tax net present value at a 5% discount rate would be C$266 million with an internal rate of return of 41.1% at a gold price of $1,530 per ounce. The mine would produce 100,000 oz. gold per year for the first five years and a total of 728,654 oz. over a 9.4-year mine life. Over the life of the mine, all-in sustaining costs would be $784 per oz. gold. A drill crew in front of a drill rig at African Gold Group’s Kobada gold project in Mali. Credit: African Gold Group Kobada’s proven and probable reserves are estimated at 27.1 million tonnes averaging 0.87 grams gold per tonne, containing 754,800 oz. gold.

African Gold is currently updating the definitive feasibility study to add tonnage to reserves and expand resources. The company says considerable work will also be done to optimize mining and scheduling, refine the mineral […]

New Report of Uranium Hexafluoride Market with Size, Growth Drivers, Market Opportunities, Business Trends and Forecast to 2026

COVID19 Impact on Uranium Hexafluoride Market Report 2021 Size, Share, Price, Trend, and Forecast is a professional and in-depth study on the current state of the global Uranium Hexafluoride industry. The report provides key statistics on the market status of Uranium Hexafluoride and gives a valuable source of guidance and direction for companies and individuals interested in the industry with a basic overview of the industry including its definition, applications, and development strategy.

The Uranium Hexafluoride market research report is further divided by company, by country, and by application and product type for the competitive landscape analysis.

Uranium Hexafluoride Market Report Covers Major Market Players: Arkema

Asahi Glass Saint-Gobain Gujarat Fluorochemicals An avail sample copy of the report before purchase @ https://www.inforgrowth.com/sample-request/6666772/Uranium Hexafluoride-market The information for each competitor includes: Company Profile Main Business Information SWOT Analysis Sales, Revenue, Price and Gross Margin Market Share Geographically, […]

Appia Increases Previously Announced Bought Deal Financing to $5 Million

April 29, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “ Appia “) , is pleased to announce that it has entered into a revised agreement with Research Capital Corporation as sole underwriter and sole bookrunner (the “ Underwriter ”), to increase the size of the previously announced “bought-deal” private placement offering of securities of the Company (the “ Securities ”) to an aggregate of approximately $5 million (the “ Offering ”). The Offering shall consist of a combination of: (i) units of the Company (each, a “ Unit “) at a price of $0.60 per Unit; and (ii) flow-through units of the Company (each, a “ FT Unit ”) at a price of $0.70 per FT Unit.

Each Unit shall consist of one common share of the Company (“ Common Share ”) and one Common Share […]

Uranium Participation Corporation Announces Agreement with Sprott Asset Management to Modernize Business Structure and Pursue U.S. Listing

TSX Trading symbol: U

TORONTO, April 28, 2021 /CNW/ – Uranium Participation Corporation ("UPC" or the "Corporation") (TSX: U ) is pleased to announce that it has entered into an arrangement agreement (the "Arrangement Agreement") with Sprott Asset Management LP ("Sprott Asset Management"), a wholly owned subsidiary of Sprott Inc. ("Sprott") (NYSE/TSX: SII ), pursuant to which UPC shareholders will become unitholders of the Sprott Physical Uranium Trust (the "Trust"), a newly formed entity to be managed by Sprott Asset Management (the "Transaction"). View PDF version

Transaction Highlights View PDF Uranium Participation Corporation Announces Agreement with Sprott Asset Management to Modernize Business Structure and Pursue U.S. Listing (CNW Group/Uranium Participation Corporation) Modernized business structure with lower corporate operating costs – The trust structure offers lower annual corporate costs and aligns UPC’s business with the world’s leading physical commodity investment vehicles.

Sprott Physical Uranium Trust to seek a US […]

Top Stories This Week: Case for Uranium Builds, Palladium Breaks Records

It was a week of bumpy trading action for the gold price, which moved between about US$1,760 and US$1,790 per ounce during the period.

Market participants were eyeing Wednesday’s (April 28) US Federal Reserve meeting, but there were no major surprises — the central bank left interest rates unchanged and will keep its bond-buying program steady. Gold dropped initially on the news, but then quickly rebounded.

While it’s always good to keep an eye on gold, it’s also worth noting that palladium reached yet another all-time high this week, rising above the US$3,000 per ounce mark for the first time.

Did You Know That Uranium Was A Top Commodity In 2020? Don’t Miss Out This Year With Our Exclusive FREE 2021 Uranium Outlook Report! The metal is key in catalytic converters, which are used to reduce vehicle emissions, and its price is being affected by both demand- and supply-side issues.With […]

Appia Announces $4 Million Bought Deal Private Placement Financing

April 29, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) , is pleased to announce that it has entered into an agreement with Research Capital Corporation as sole underwriter and sole bookrunner (the “ Underwriter ”), whereby the Underwriter will purchase, on a bought-deal basis, securities of the Company (the “ Securities ”) for aggregate gross proceeds to the Company of $4,000,000 (the “ Offering ”). The Offering shall consist of a combination of: (i) units of the Company (each, a “ Unit “) at a price of $0.60 per Unit; and (ii) flow-through units of the Company (each, a “ FT Unit ”) at a price of $0.70 per FT Unit.

Each Unit shall consist of one common share of the Company (“ Common Share ”) and one Common Share purchase warrant (a “ Warrant […]

Uranium Energy Corp. (NYSE:UEC)Metrics You Need to Know Right Now

Uranium Energy Corp. (NYSE:UEC) shares, dropped in value on Thursday, Apr 29, with the stock price down by -0.82% to the previous day’s close as weak demand from buyers trailed the stock to $3.02.

Actively observing the price movement in the recent trading, the stock is buoying the session at $3.04, falling within a range of $2.9599 and $3.1500. The value of beta (5-year monthly) is 2.44 whereas the PE ratio is 0 over 12-month period. Referring to stock’s 52-week performance, its high was $3.67, and the low was $0.82. On the whole, UEC has fluctuated by 4.11% over the past month.

With the market capitalization of Uranium Energy Corp. currently standing at about $661.72 Million, investors are eagerly awaiting this quarter’s results, scheduled for Jun 2021. The company’s Forward Dividend Ratio is 0, with its dividend yield at 0%. As a result, investors may see a weakening in the stock’s […]