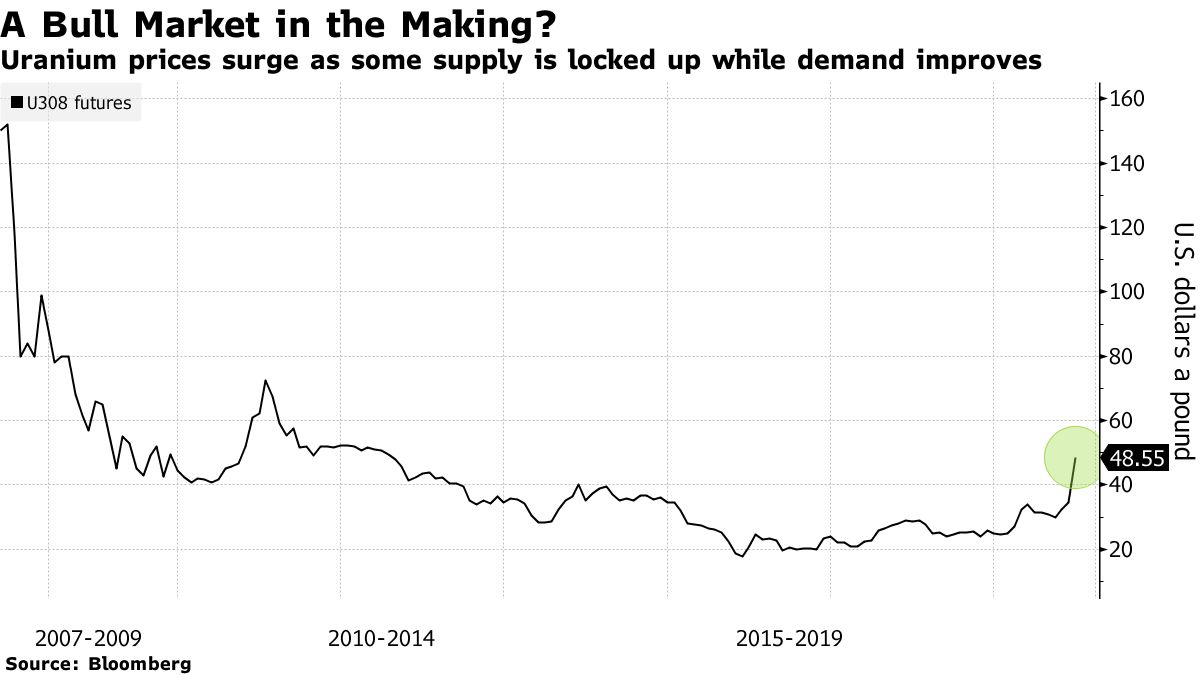

DigitalGlobe Uranium prices have climbed 60% in four weeks as an investment fund embarked on a buying spree.

Morgan Stanley commodity strategists say it may be hard to maintain robust investment demand into 2022.

The Sprott Physical Uranium Trust has purchased a massive 1.45 million pounds since mid-August.

Uranium prices have shot up about 60% over the past month on the back of big purchases of the nuclear-energy element by an investment fund, but the rally is likely to lose steam next year, Morgan Stanley said this week.Spot prices for uranium were at 2021 lows in August before they started advancing toward what’s become a 58% gain in four weeks. The price traded above $47 on Friday and this week touched $50 for the first time since 2012, according to S&P Global Platts. Morgan Stanley’s commodity strategists in Europe said the Sprott Physical Uranium Trust is […]

Click here to view original web page at markets.businessinsider.com