The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week. The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431. Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. 92E 92Energy 0.51 65 21968331 GLA Gladiator Resources 0.032 23 14899941 ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.

Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%.

Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click […]

ASX uranium shares are booming this week. Here’s why.

ASX uranium shares are surging across the board this week, as uranium spot prices lift to 6-year highs of US$34.25/lb.

The largest of the ASX uranium shares, Paladin Energy Ltd (ASX: PDN) has rallied 56% over the past week to an 8-year high of 78 cents.

Explorers including Deep Yellow Limited (ASX: DYL) , Boss Energy Ltd (ASX: BOE) , Energy Resources of Australia Limited (ASX: ERA) and Peninsula Energy Ltd (ASX: PEN) have also experienced a flurry of buying activity, surging between 20% and 40% this week. The newest of all ASX uranium shares, 92 Energy Ltd (ASX: 92E) is another big winner, surging 104% this week to 51 cents. The uranium explorer was successfully listed on the ASX on 15 April at a listing price of 20 cents. Uranium prices lift to 6-year highs

Uranium prices have been in a prolonged bear market after spot prices peaked at […]

Centrus Energy Still A Buy, Continues To Focus On HALEU Project

Summary

Since the last article, the company posted good quarterly results and interesting updates on HALEU project.

In June 2021, they received the final approval for HALEU production in the US, the first license ever for this special nuclear fuel.

Management looks quite conservative on estimates on both LEU and HALEU segments but is optimistic about economies of scale on the new Ohio enrichment facility. The stock moved considerably higher since the last article but it is still a buy and represents a bet on the future of the nuclear industry. vchal/iStock via Getty Images General overview and updates on the business Centrus Energy ( LEU ) is a US-based nuclear fuel seller. It provides LEU (Low Essay Uranium) for traditional reactors and is on track to start the production of HALEU (High-essay-low-enriched-uranium), which will be used in the next generation of nuclear reactors in the US (more on […]

14 out of 15 ASX uranium stocks are riding the spot price higher today

Pic: John M Lund Photography (DigitalVision) via Getty Images. share

Uranium is going gangbusters right now.

The spot uranium price has pushed past $35/lb for first time in six years thanks to the Sprott Physical Uranium Trust (SPUT) sparking the lift when it started buying up and storing physical uranium. Stocks are responding. How are uranium stocks on the ASX tracking today?

A whopping 14 out of the 15 ASX uranium stocks on out list enjoyed a share price lift today, averaging around 14%. BIGGEST MOVERS The freshly listed uranium explorer has a market cap of $18million and wants to unlock the potential of its tenements in Canada’s Athabasca Basin, just 11km from Cigar Lake — one of the world’s largest and highest-grade uranium deposits.A recent survey over its ‘Tower’ and ‘Gemini’ projects has identified multiple conductors prospective for high-grade, unconformity-type uranium.The company has just intersected a zone of elevated […]

Uranium Energy Corp. (AMEX:UEC) trade information

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 10.83 million, with the beta value of the company hitting 2.42. At the end of the trading day, the stock’s price was $2.84, reflecting an intraday gain of 10.94% or $0.28. The 52-week high for the UEC share is $3.67, that puts it down -29.23 from that peak though still a striking 71.13% gain since the share price plummeted to a 52-week low of $0.82. The company’s market capitalization is $623.49M, and the average intraday trading volume over the past 10 days was 3.41 million shares, and the average trade volume was 4.56 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.60. UEC has a Sell rating from 0 analyst(s) out of 3 analysts who have looked at this stock. […]

Click here to view original web page at marketingsentinel.com

GoviEx Uranium taps Isabel Vilela as head of investor relations and corporate communications

CEO Daniel Major said Vilela’s “experience and insights make her ideally suited” to support the firm’s investor relations program and grow the shareholder base as the company advances its uranium projects Vilela will work closely with the management team to develop the company’s internal and external communications with a focus on strategy, branding, social media presence and investor communications GoviEx Uranium Inc. announced that it has appointed Isabel Vilela as Head of Investor Relations and Corporate Communications to grow the company’s shareholder base as it advances its uranium projects in a strengthening uranium market.

The Vancouver-based mineral resource company, focused on the exploration and development of uranium properties in Africa, noted that Vilela brings with her over ten years of experience in investor relations, having previously worked as head of IR for Hochschild Mining PLC and Cookson Group PLC. She also has a wealth of experience in Environmental, Social, and […]

Click here to view original web page at www.proactiveinvestors.com

ASX uranium shares are booming this week. Here’s why.

ASX uranium shares are surging across the board this week, as uranium spot prices lift to 6-year highs of US$34.25/lb.

The largest of the ASX uranium shares, Paladin Energy Ltd (ASX: PDN) has rallied 56% over the past week to an 8-year high of 78 cents.

Explorers including Deep Yellow Limited (ASX: DYL) , Boss Energy Ltd (ASX: BOE) , Energy Resources of Australia Limited (ASX: ERA) and Peninsula Energy Ltd (ASX: PEN) have also experienced a flurry of buying activity, surging between 20% and 40% this week. The newest of all ASX uranium shares, 92 Energy Ltd (ASX: 92E) is another big winner, surging 104% this week to 51 cents. The uranium explorer was successfully listed on the ASX on 15 April at a listing price of 20 cents. Uranium prices lift to 6-year highs

Uranium prices have been in a prolonged bear market after spot prices peaked at […]

Closing Bell: ASX closes the week 1.4pc higher, led by uranium

The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week. The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431. Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. 92E 92Energy 0.51 65 21968331 GLA Gladiator Resources 0.032 23 14899941 ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.

Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%.

Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click […]

Closing Bell: ASX closes the week 1.4pc higher, led by uranium

Yeap there’s uranium all right Pic: Family Guy/Fox Television share

The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week.

The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431.

Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS Scroll or swipe to reveal table. Click headings to sort. ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%. Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click headings to sort. […]

Skyharbour Partner Company Valor Announces High-grade Sample Results from Hook Lake Project Field Program

VANCOUVER, British Columbia, Aug. 31, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that partner company Valor Resources Limited (“Valor”) has provided an update on results from the recently completed on-ground field program at the Hook Lake Project. A total of 57 samples were taken from across the Hook Lake Project with assay results now having been received. The results are highlighted by the assays from the Hook Lake (or Zone S) prospect which confirmed the reported historical high-grade uranium mineralization. A total of seven rock chip samples were taken from a historical trench located at the Hook Lake prospect, with four of these samples returning high-grade uranium assays (>6% U3O8) as well as highly elevated rare earth (>0.5% TREO*), silver (>50ppm) and lead (> 1.8%) assays. The samples are selective in nature with a […]

Uranium Mine Market Research On Present State & Future Growth Prospects to 2028

The Global Uranium Mine Market analysis report is the outcome of incessant efforts guided by knowledgeable forecasters, innovative analysts and brilliant researchers. With the specific and state-of-the-art information provided in this report, businesses can get idea about the types of consumers, consumer’s demands and preferences, their perspectives about the product, their buying intentions, their response to particular product, and their varying tastes about the specific product which is already present in the market. By providing an absolute overview of the market, Uranium Mine Market report covers various aspects of market analysis, product definition, market segmentation, key developments, and the existing vendor landscape.

This in-depth study helps corporate organizations and others in the industry. As a result of the uncertainty caused by COVID-19, this issue is much more urgent today. the study will be utilized to prevent future interruptions, and was done in order to deal with previous problems This organizational […]

Click here to view original web page at www.unlvrebelyell.com

Fission Uranium Resource Expansion Drilling on R840W Zone Hits High-Grade Mineralization in 19 Holes

Results include major holes such as 57.5m of continuous mineralization, with 19.15m of total composite >10,000 cps

This includes PLS21-624 (line 630W), which intersected 57.5m of continuous mineralization, including 19.15m of total composite radioactivity >10,000 cps (with a peak of 62,400 cps) . Assays are still pending and will be released when received. The goal of the summer resource drilling is to upgrade the majority of the R840W zone by decreasing the spacing between drill hole mineralized intercepts with the goal of upgraded to Indicated classification, for potential use in the Feasibility Study . The resource upgrade drilling was conducted in conjunction with the on-going Phase 1 Feasibility work at PLS, focusing on drilling for geotechnical, hydrogeological, geochemical and metallurgical data (see News Release June 10, 2021).

Ross McElroy, President and CEO for Fission, commented, "Our summer resource drilling at the R840W zone has been very successful. The goal […]

Click here to view original web page at www.juniorminingnetwork.com

Why Energy Fuels, Uranium Energy, and Ur-Energy Stocks Just Popped

What happened

Shares of uranium mining companies are red-hot Thursday. As of 12:40 p.m. EDT, both Energy Fuels (NYSEMKT: UUUU) and Uranium Energy (NYSEMKT: UEC) stocks are up 6.9% apiece, while Ur-Energy (NYSEMKT: URG) is leading the pack higher with a 9.1% gain.

And you can probably thank GLJ Research for all of that. So what

In a short note posted on Twitter yesterday, you see, GLJ raised its price target on yet another uranium mining company. The analyst’s positive comments (and 38 Canadian dollar price target) on uranium miner Cameco (NYSE: CCJ) nonetheless seems to have gotten a lot of investors excited throughout the uranium sector.GLJ cited the creation of the Sprott Physical Uranium Trust — a commodity fund that buys and holds physical uranium as an "alternative for investors," and indeed "the world’s largest" such fund — as its reason for optimism. As the analyst explained, Sprott’s "aggressive […]

Back to the Future of Sourcing Uranium for Reliable Energy with Fission 3.0

It’s hard to envision the world getting all its electricity from renewable assets (solar, wind, geothermal, possibly hydro depending on how you classify it) any time soon. Sure Swanson’s Law and Moore’s Law would suggest that the cost-effectiveness and technology behind solar cells is improving at a very rapid pace but the reality is, we aren’t getting even close to our climate targets and reducing or possibly even eliminating the burning of fossil fuels for electricity unless we include nuclear power in the mix. There certainly seems to be ebb and flow around the perception of nuclear power as a green alternative. Nevertheless, it is a very efficient source of electricity that has a very low carbon footprint . In fact, it produces zero carbon emissions in the electricity generation process, but mining and refining uranium ore and making reactor fuel all require energy.

I’m a firm believer that nuclear […]

Uranium just hit six-year highs. What’s next?

Boom time. Pic: Columbia Pictures, 1956 share

The spot uranium price has punched through $35/lb for first time in six years.

The spark for this price rise is the Sprott Physical Uranium Trust (SPUT), which started buying up and storing physical uranium a few weeks back. Big day as #Uranium spot breaks through $35 to set a new 6-year high. Happy to be doing our part as Sprott Physical Uranium Trust added another 400k lbs of U308. #Nuclear #U3O8 #lowcarbon #SPUT $U.UN $U.U For more information and disclosures, visit: https://t.co/LAsp4rJkmP — Sprott Asset Management (@Sprott) September 1, 2021 A gigawatt-class reactor uses around 450,000 pounds per year, so this is no small amount. SPUT is removing it from market circulation for the long term, and they aren’t the only ones.

Two other companies have already declared their intent to build ATM offering programs and “I doubt they will be the last […]

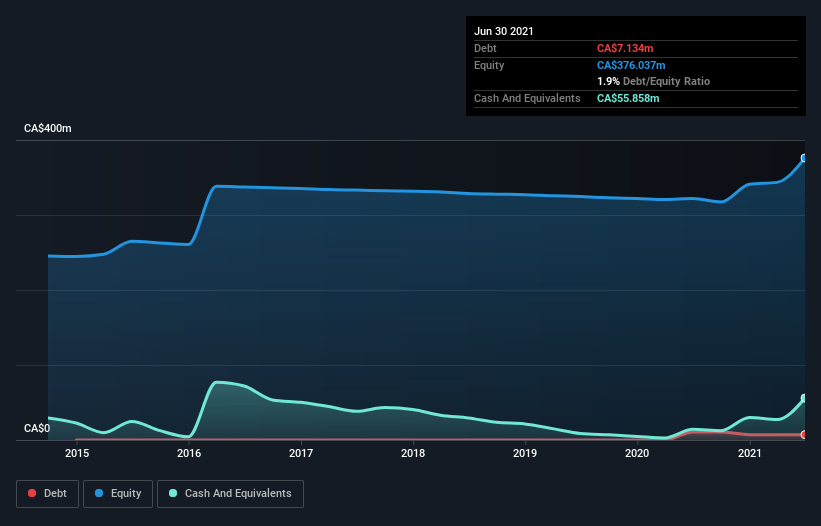

Fission Uranium (TSE:FCU) Has Debt But No Earnings; Should You Worry?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, ‘The possibility of permanent loss is the risk I worry about… and every practical investor I know worries about.’ When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Fission Uranium Corp. ( TSE:FCU ) does use debt in its business. But the more important question is: how much risk is that debt creating? Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute […]

Energy Fuels Issues Reminder Regarding Expiration of Warrants

LAKEWOOD, Colo., Sept. 2, 2021 /PRNewswire/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (" Energy Fuels " or the " Company ") today reminds holders of its outstanding common share purchase warrants (CUSIP: 292671179 / ISIN: CA2926711797) (the " Warrants ") that the Warrants will expire at 5:00 p.m. Toronto time on Monday, September 20, 2021 (" Time of Expiry "). The corresponding Warrant Indenture dated as of September 20, 2016 (the " Indenture ") by and among Energy Fuels, CST Trust Company (the " Canadian Warrant Agent " or " AST ") and American Stock Transfer & Trust Company, LLC (the " U.S. Warrant Agent ") may be viewed on the U.S. Securities and Exchange Commission’s Electronic Document Gathering and Retrieval System (" EDGAR ") at https://www.sec.gov/Archives/edgar/data/1385849/000106299316011518/exhibit4-1.htm , as summarized in a Form 51-102F3 Material Change Report filed September 20, 2016 with the System for Electronic […]

Deep Yellow boosts uranium resources in Namibia

Drilling at Deep Yellow’s Tumas uranium project in Namibia. Credit: File Aspiring uranium producer Deep Yellow has delivered a key cog in its push to bring the Tumas uranium project in Namibia into production with a cracking 102 per cent conversion of inferred resources to the higher “indicated” category at its Tumas 1 East deposit. Management says the company is now in good shape to meet its objective of a 20 year or more mine life for the multi-deposit project.

The maiden indicated resource for Tumas 1 East takes in an impressive 36.27 million tonnes at 245 parts per million uranium oxide for 19.6 million pounds of contained yellow cake, using a 100ppm uranium oxide cut-off grade.

Tumas 1 East now totals 55.69Mt at 235ppm uranium oxide for nearly 29 million pounds of the sometimes controversial commodity, including the remaining inferred resources.

Curiously, management says so far only around 65 per cent […]

Boss Energy to trial new seismic survey technique at Honeymoon uranium project

Boss Energy ASX BOE seismic survey technique Honeymoon uranium project Australian explorer Boss Energy (ASX: BOE) has confirmed it will trial a seismic reflection program as part of a strategy to grow the inventory at its Honeymoon uranium project in South Australia.

The program is designed to identify likely uranium-bearing sediments within known mineralised palaeochannels at the project ahead of a drilling campaign scheduled to start in the coming quarter.

While reportedly ubiquitous in oil exploration, seismic surveying is relatively novel in the exploration of shallow mineral deposits. Low cost and low impact

Boss recognised the potential advantages offered by seismic methods in 2019 and began adopting them due to their low cost, low impact and speedy approach to exploration.Utilising seismic datasets with existing geoscientific information, the company plans to reduce the number of drill holes required to locate additional resources within pre-defined exploration targets at Honeymoon, allowing for streamlining of […]

why Uranium Energy Corp. [UEC] is a Good Choice for Investors After New Price Target of $3.91

Uranium Energy Corp. [AMEX: UEC] stock went on an upward path that rose over 4.58% on Tuesday, amounting to a one-week price increase of more than 10.09%. The company report on August 3, 2021 that Uranium Energy Corp Announces Results of Annual General Meeting.

NYSE American symbol – UEC.

Uranium Energy Corp (NYSE American: UEC) (the “Company” or “UEC”) is pleased to announce that, in conjunction with the holding of the Company’s recent annual general meeting of stockholders on July 30, 2021, the following matters were duly ratified by the Company’s stockholders and have now been implemented by the Board of Directors in the following manner:.

Over the last 12 months, UEC stock rose by 118.26%. The one-year Uranium Energy Corp. stock forecast points to a potential upside of 35.81. The average equity rating for UEC stock is currently 1.60, trading closer to a bullish pattern in the stock market.The market cap […]

Will a uranium recovery stick this time?

Morgan Stanley is tipping a short-term (spot market) uranium price of $US48.50/lb in 2024, with long term contracts far higher. A fresh wave of optimism is washing across Australian uranium explorers as nuclear power stakes a claim in the drive to decarbonise the world, but a second wave of genuine demand from power utilities is required to make the recovery stick.

There’s a lot in that opening comment which is based on the sharp share price rises by most uranium explorers with stocks such as Deep Yellow, Boss Energy, Elevate Uranium and Lotus Resources up by more than 50% since January.

The first point to consider is that the uranium industry has been here before, tantalising investors with spectacular price rises, such as the three-year boom from 2005 to 2008 when the price rocketed up by more than 400% from US$34 a pound to US$140/lb.

Then, a crisis in Japan dented confidence […]

Top Uranium Stock in the World Could Be Greatly Undervalued

Cameco (TSX:CCO) (NYSE:CCO) is one of the largest uranium producers in the world based out of Canada and could be significantly undervalued at current market prices.. Well-positioned to benefit from the global commodity boom

The COVID-19 pandemic has disrupted global uranium production , adding to the supply curtailments that have occurred in the industry for many years. The duration and extent of these disruptions are still not fully known. However, Cameco appears very well-positioned to benefit from the global commodity boom. Increasing focus on electrification

The average uranium spot price ended fiscal 2020 at $30.20 per pound more than 20% higher than the average uranium spot price at the end of 2019. Across the globe, there appears to be an increasing focus on electrification for various reasons. Some countries looking to install baseload power, while others are looking for a reliable replacement for fossil fuel sources. Need for nuclear […]

Analysts Mean recommendation for Uranium Energy Corp. (UEC) was 1.60: Is this the key time?

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $2.51 to be very precise. The Stock rose vividly during the last session to $2.52 after opening rate of $2.44 while the lowest price it went was recorded $2.37 before closing at $2.40.Recently in News on August 2, 2021, Uranium Energy Corp Announces Results of Annual General Meeting. NYSE American symbol – UEC. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $3.67 on 03/16/21, with the lowest value was $1.51 for the same time period, recorded on 01/21/21.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are […]

Uranium Energy Corp. (AMEX:UEC) trade information

In the last trading session, 3.45 million shares of the Uranium Energy Corp. (AMEX:UEC) were traded, and its beta was 2.42. Most recently the company’s share price was $2.40, and it changed around $0.02 or 0.84% from the last close, which brings the market valuation of the company to $526.90M. UEC currently trades at a discount to its 52-week high of $3.67, offering almost -52.92% off that amount. The share price’s 52-week low was $0.82, which indicates that the current value has risen by an impressive 65.83% since then. We note from Uranium Energy Corp.’s average daily trading volume that its 10-day average is 3.3 million shares, with the 3-month average coming to 4.60 million.

Uranium Energy Corp. stock received a consensus recommendation rating of a Buy, based on a mean score of 1.60. If we narrow it down even further, the data shows that 0 out of 3 analysts […]

Click here to view original web page at marketingsentinel.com

What Do Analysts Think About Uranium Energy Corp.’s (AMEX:UEC) Future?

The trading price of Uranium Energy Corp. (AMEX:UEC) floating higher at last check on Tuesday, August 31, closing at $2.44, 1.67% higher than its previous close.

Traders who pay close attention to intraday price movement should know that it has been fluctuating between $2.36 and $2.49. In examining the 52-week price action we see that the stock hit a 52-week high of $3.67 and a 52-week low of $0.82. Over the past month, the stock has gained 10.60% in value.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks […]