The S&P/TSX Composite Index (INDEXTSI: OSPTX ) opened higher last Friday (September 3), trading at 20,809.25 by midday. It closed the five day period at 20,819.98.

Commodities prices pushed mining stocks up, which supported gains for the index.

On Friday, gold and silver climbed following a US jobs report that came in well below expectations . Meanwhile, uranium saw a price surge to a six year high, with junior mining stocks also going up. Uranium Price Forecasts and Top Uranium Stocks to Watch Uranium Soared Last Year While Other Resources Tumbled

What’s In Store For Uranium This Year? Find Out In Our Exclusive FREE 2021 Uranium Outlook Report featuring trends, forecasts, expert interviews and more! Last week’s five TSX-listed mining stocks that saw the biggest gains are as follows: Fission Uranium (TSX:FCU) Mega Uranium (TSX: MGA ) Global Atomic (TSX: GLO ) Forsys Metals (TSX: FSY ) Laramide Resources […]

Hot Money Monday: Uranium runs hot; helium runs hotter

Just like when the recent lithium frenzy saw the Running Hot list populated by junior lithium plays, this week saw ASX uranium stocks make their move. But it was the $6.5m oil & gas minnow Grand Gulf Energy (ASX:GGE) which ran hottest this week with an RSI of 92. Each week, Stockhead recaps ASX stocks that are “running hot” as deduced by the Relative Strength Index (RSI).

The RSI is a technical gauge which measures how trading momentum is affecting the price action.

A reading of 70 is seen as the level at which a company may have been overbought. If a stock has a reading of 30 or below, it could be undervalued.

Click here for a more detailed rundown of what the RSI does and how it’s used.While there’s usually a pretty good reason if a given stock is running hot (or cold), investors are also on the lookout […]

Engineering firm enters Kazakhstan uranium industry

The GJC uranium packaging plant headed to Kazakhstan this week. GJC has been involved in the uranium industry for more than 20 years and has previously exported packaging plants to Africa, but the Kazakhstan sale is the company’s first export to the region, which has produced most of the world’s uranium in the last decade.

The fully automated plant, which is built to fit inside a shipping container to allow for shipping ease and has taken a year to complete, was manufactured and constructed in Adelaide using many components also locally produced.

It is GJC’s third-generation unit that is used to remove the human element of packaging the radioactive yellowcake produced from uranium mining into drums before it is transported.

GJC has exported the packaging plants to developing countries since 2007 due to the shortage of resources and skilled tradespeople in the regions making it difficult for quality products to be engineered […]

Hot Money Monday: Uranium runs hot; helium runs hotter

Pic: Giphy.com share

Just like when the recent lithium frenzy saw the Running Hot list populated by junior lithium plays, this week saw ASX uranium stocks make their move.

But it was the $6.5m oil & gas minnow Grand Gulf Energy (ASX:GGE) which ran hottest this week with an RSI of 92.

Each week, Stockhead recaps ASX stocks that are “running hot” as deduced by the Relative Strength Index (RSI).The RSI is a technical gauge which measures how trading momentum is affecting the price action.A reading of 70 is seen as the level at which a company may have been overbought. If a stock has a reading of 30 or below, it could be undervalued. Click here for a more detailed rundown of what the RSI does and how it’s used.While there’s usually a pretty good reason if a given stock is running hot (or cold), investors are also on the […]

Where Fundamentals Meet Technicals: TCEHY, TWTR, CCJ

This issue of “Where Fundamentals Meet Technicals” looks at two growth stocks and one commodity stock.

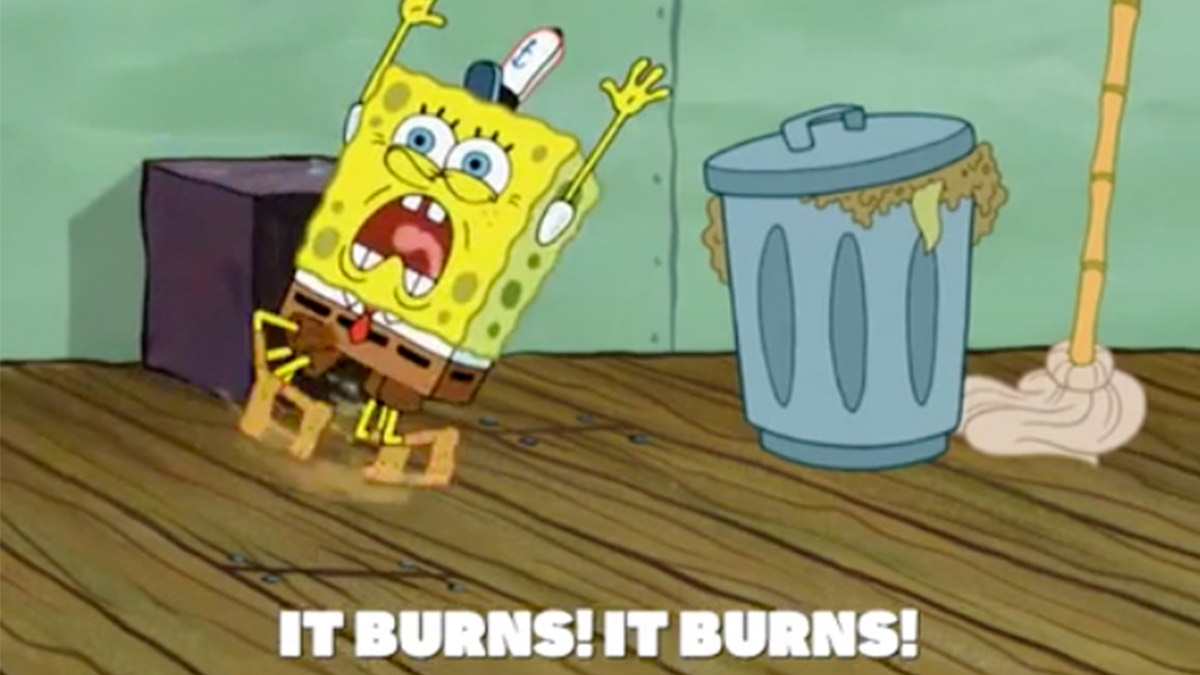

Tencent: Decision Time

Tencent (TCEHY) is a diversified corporation that operates China’s biggest social networks, one of the two main Chinese payment platforms, and a global gaming business. They hold stakes in companies like JD (JD) and Sea Ltd (SE), as well as many other companies around the world.

And like most Chinese companies, especially tech/media companies, their stock has been utterly destroyed by a major government crackdown on the industry, along with a downturn in China’s credit cycle. Sentiment on China is about as bad as it gets.In terms of valuation, the stock bounced off the all-time low valuation level that it reached a few years ago when the Chinese government stopped approving its games for a year: The F.A.S.T. Graph shows either 1) analysts are wrong about their earnings forecasts, or 2) […]

Click here to view original web page at www.elliottwavetrader.net

Q&A: Orano Conversion & Enrichment CEO Jacques Peythieu

Jacques Peythieu, Chief Executive Officer of Orano Conversion & Enrichment, discusses the company’s recovery from the impacts of the pandemic and industrial action, 2020 results, production ramp up at its Philippe Coste plant in France, and possible transformation of the conversion market due to the recently announced restart of Honeywell’s conversion plant at Metropolis in the USA. He also assesses the prospects of enrichment market and the expected requirements for HALEU (high-assay low-enriched uranium), as well as potential hurdles to supply capabilities or to transportation of this material. A multinational nuclear fuel cycle company headquartered in Hauts-de-Seine, France, Orano has an order book worth EUR26 billion (USD31 billion). Jacques Peythieu (Image: Orano)

How has Orano managed the disruption caused by COVID-19 and what are the lessons learned from the strikes at the Malvési conversion plant?

Given the situation in Wuhan we decided as soon as January 2020 to revisit […]

Click here to view original web page at www.world-nuclear-news.org

Europe Enriched Uranium Market [ PDF ] To Witness Significant Growth By 2021-2028

Media releases are provided as is by companies and have not been edited or checked for accuracy. Any queries should be directed to the company itself.

Enriched Uranium Market Size By Regional(Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2021 – 2028

" Enriched Uranium Market 2021-2028:

The Global Enriched Uranium market exhibits comprehensive information that is a valuable source of insightful data for business strategists during the decade 2015-2028. On the basis of historical data, Enriched Uranium market report provides key segments and their sub-segments, revenue and demand & supply data. Considering technological breakthroughs of the market Enriched Uranium industry is likely to appear as a commendable platform for emerging Enriched Uranium market investors.The complete value chain and downstream and upstream essentials are scrutinized in this report. Essential trends like globalization, growth progress boost fragmentation regulation […]

Why Shares of Uranium Miner Cameco Rocketed 24% This Week

What happened

Uranium mining stock Cameco ( NYSE:CCJ ) was on fire this week, gaining 24.2% as of 2:30 p.m. EDT Friday, making it one of the biggest weekly gains for the stock so far this year.

There’s so much happening in the uranium industry that bulls in Cameco haven’t been this excited in a long time. So what

To start, Cameco shares won two big analyst upgrades this week. Image source: Getty Images. RBC Capital raised its price target on Cameco significantly to 26 Canadian dollars ($21) per share from CA$17 ($14) per share, backed by rising uranium spot prices and improving sentiment in the uranium industry.Just days ago, GLJ Research increased its price target on Cameco stock to CA$38 ($30) a share from CA$27 ($21) a share. GLJ believes entry of exchange-traded fund (ETF) The Sprott Physical Uranium Trust Fund ( OTC:SRUU.F ) into the industry is a […]

Why Shares of Uranium Miner Cameco Rocketed 24% This Week

What happened

Uranium mining stock Cameco (NYSE: CCJ) was on fire this week, gaining 24.2% as of 2:30 p.m. EDT Friday, making it one of the biggest weekly gains for the stock so far this year.

There’s so much happening in the uranium industry that bulls in Cameco haven’t been this excited in a long time. So what

To start, Cameco shares won two big analyst upgrades this week. RBC Capital raised its price target on Cameco significantly to 26 Canadian dollars ($21) per share from CA$17 ($14) per share, backed by rising uranium spot prices and improving sentiment in the uranium industry. Just days ago, GLJ Research increased its price target on Cameco stock to CA$38 ($30) a share from CA$27 ($21) a share. GLJ believes entry of exchange-traded fund (ETF) The Sprott Physical Uranium Trust Fund (OTC: SRUU.F) into the industry is a massive potential catalyst.I second the […]

Closing Bell: ASX closes the week 1.4pc higher, led by uranium

The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week. The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431. Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. 92E 92Energy 0.51 65 21968331 GLA Gladiator Resources 0.032 23 14899941 ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.

Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%.

Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click […]

ASX uranium shares are booming this week. Here’s why.

ASX uranium shares are surging across the board this week, as uranium spot prices lift to 6-year highs of US$34.25/lb.

The largest of the ASX uranium shares, Paladin Energy Ltd (ASX: PDN) has rallied 56% over the past week to an 8-year high of 78 cents.

Explorers including Deep Yellow Limited (ASX: DYL) , Boss Energy Ltd (ASX: BOE) , Energy Resources of Australia Limited (ASX: ERA) and Peninsula Energy Ltd (ASX: PEN) have also experienced a flurry of buying activity, surging between 20% and 40% this week. The newest of all ASX uranium shares, 92 Energy Ltd (ASX: 92E) is another big winner, surging 104% this week to 51 cents. The uranium explorer was successfully listed on the ASX on 15 April at a listing price of 20 cents. Uranium prices lift to 6-year highs

Uranium prices have been in a prolonged bear market after spot prices peaked at […]

Centrus Energy Still A Buy, Continues To Focus On HALEU Project

Summary

Since the last article, the company posted good quarterly results and interesting updates on HALEU project.

In June 2021, they received the final approval for HALEU production in the US, the first license ever for this special nuclear fuel.

Management looks quite conservative on estimates on both LEU and HALEU segments but is optimistic about economies of scale on the new Ohio enrichment facility. The stock moved considerably higher since the last article but it is still a buy and represents a bet on the future of the nuclear industry. vchal/iStock via Getty Images General overview and updates on the business Centrus Energy ( LEU ) is a US-based nuclear fuel seller. It provides LEU (Low Essay Uranium) for traditional reactors and is on track to start the production of HALEU (High-essay-low-enriched-uranium), which will be used in the next generation of nuclear reactors in the US (more on […]

14 out of 15 ASX uranium stocks are riding the spot price higher today

Pic: John M Lund Photography (DigitalVision) via Getty Images. share

Uranium is going gangbusters right now.

The spot uranium price has pushed past $35/lb for first time in six years thanks to the Sprott Physical Uranium Trust (SPUT) sparking the lift when it started buying up and storing physical uranium. Stocks are responding. How are uranium stocks on the ASX tracking today?

A whopping 14 out of the 15 ASX uranium stocks on out list enjoyed a share price lift today, averaging around 14%. BIGGEST MOVERS The freshly listed uranium explorer has a market cap of $18million and wants to unlock the potential of its tenements in Canada’s Athabasca Basin, just 11km from Cigar Lake — one of the world’s largest and highest-grade uranium deposits.A recent survey over its ‘Tower’ and ‘Gemini’ projects has identified multiple conductors prospective for high-grade, unconformity-type uranium.The company has just intersected a zone of elevated […]

Uranium Energy Corp. (AMEX:UEC) trade information

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 10.83 million, with the beta value of the company hitting 2.42. At the end of the trading day, the stock’s price was $2.84, reflecting an intraday gain of 10.94% or $0.28. The 52-week high for the UEC share is $3.67, that puts it down -29.23 from that peak though still a striking 71.13% gain since the share price plummeted to a 52-week low of $0.82. The company’s market capitalization is $623.49M, and the average intraday trading volume over the past 10 days was 3.41 million shares, and the average trade volume was 4.56 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.60. UEC has a Sell rating from 0 analyst(s) out of 3 analysts who have looked at this stock. […]

Click here to view original web page at marketingsentinel.com

GoviEx Uranium taps Isabel Vilela as head of investor relations and corporate communications

CEO Daniel Major said Vilela’s “experience and insights make her ideally suited” to support the firm’s investor relations program and grow the shareholder base as the company advances its uranium projects Vilela will work closely with the management team to develop the company’s internal and external communications with a focus on strategy, branding, social media presence and investor communications GoviEx Uranium Inc. announced that it has appointed Isabel Vilela as Head of Investor Relations and Corporate Communications to grow the company’s shareholder base as it advances its uranium projects in a strengthening uranium market.

The Vancouver-based mineral resource company, focused on the exploration and development of uranium properties in Africa, noted that Vilela brings with her over ten years of experience in investor relations, having previously worked as head of IR for Hochschild Mining PLC and Cookson Group PLC. She also has a wealth of experience in Environmental, Social, and […]

Click here to view original web page at www.proactiveinvestors.com

ASX uranium shares are booming this week. Here’s why.

ASX uranium shares are surging across the board this week, as uranium spot prices lift to 6-year highs of US$34.25/lb.

The largest of the ASX uranium shares, Paladin Energy Ltd (ASX: PDN) has rallied 56% over the past week to an 8-year high of 78 cents.

Explorers including Deep Yellow Limited (ASX: DYL) , Boss Energy Ltd (ASX: BOE) , Energy Resources of Australia Limited (ASX: ERA) and Peninsula Energy Ltd (ASX: PEN) have also experienced a flurry of buying activity, surging between 20% and 40% this week. The newest of all ASX uranium shares, 92 Energy Ltd (ASX: 92E) is another big winner, surging 104% this week to 51 cents. The uranium explorer was successfully listed on the ASX on 15 April at a listing price of 20 cents. Uranium prices lift to 6-year highs

Uranium prices have been in a prolonged bear market after spot prices peaked at […]

Closing Bell: ASX closes the week 1.4pc higher, led by uranium

The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week. The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431. Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. 92E 92Energy 0.51 65 21968331 GLA Gladiator Resources 0.032 23 14899941 ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.

Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%.

Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click […]

Closing Bell: ASX closes the week 1.4pc higher, led by uranium

Yeap there’s uranium all right Pic: Family Guy/Fox Television share

The ASX closed the week on a positive note, gaining 0.50% to close 1.4% higher than last week.

The ASX 200 closed at 7,523 while the ASX Emerging Companies Index rose 2.09% to close at 2,431.

Most sectors closed positive with materials the best sector gaining 1.17% while tech was the only major laggard, retreating 0.76%. TODAY’S BIGGEST WINNERS Scroll or swipe to reveal table. Click headings to sort. ASX investors woke this morning to news that the spot uranium price went above US$37/lb for the first time in six years.Literally all of the ASX’s uranium stocks gained with the best being 92Energy (ASX:92E) which gained over 60%. Ballymore Resources (ASX:BMR) , a Queensland focused gold and base metals exploration company, rose 75% on its ASX debut . TODAY’S BIGGEST LOSERS Scroll or swipe to reveal table. Click headings to sort. […]

Skyharbour Partner Company Valor Announces High-grade Sample Results from Hook Lake Project Field Program

VANCOUVER, British Columbia, Aug. 31, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that partner company Valor Resources Limited (“Valor”) has provided an update on results from the recently completed on-ground field program at the Hook Lake Project. A total of 57 samples were taken from across the Hook Lake Project with assay results now having been received. The results are highlighted by the assays from the Hook Lake (or Zone S) prospect which confirmed the reported historical high-grade uranium mineralization. A total of seven rock chip samples were taken from a historical trench located at the Hook Lake prospect, with four of these samples returning high-grade uranium assays (>6% U3O8) as well as highly elevated rare earth (>0.5% TREO*), silver (>50ppm) and lead (> 1.8%) assays. The samples are selective in nature with a […]

Uranium Mine Market Research On Present State & Future Growth Prospects to 2028

The Global Uranium Mine Market analysis report is the outcome of incessant efforts guided by knowledgeable forecasters, innovative analysts and brilliant researchers. With the specific and state-of-the-art information provided in this report, businesses can get idea about the types of consumers, consumer’s demands and preferences, their perspectives about the product, their buying intentions, their response to particular product, and their varying tastes about the specific product which is already present in the market. By providing an absolute overview of the market, Uranium Mine Market report covers various aspects of market analysis, product definition, market segmentation, key developments, and the existing vendor landscape.

This in-depth study helps corporate organizations and others in the industry. As a result of the uncertainty caused by COVID-19, this issue is much more urgent today. the study will be utilized to prevent future interruptions, and was done in order to deal with previous problems This organizational […]

Click here to view original web page at www.unlvrebelyell.com

Fission Uranium Resource Expansion Drilling on R840W Zone Hits High-Grade Mineralization in 19 Holes

Results include major holes such as 57.5m of continuous mineralization, with 19.15m of total composite >10,000 cps

This includes PLS21-624 (line 630W), which intersected 57.5m of continuous mineralization, including 19.15m of total composite radioactivity >10,000 cps (with a peak of 62,400 cps) . Assays are still pending and will be released when received. The goal of the summer resource drilling is to upgrade the majority of the R840W zone by decreasing the spacing between drill hole mineralized intercepts with the goal of upgraded to Indicated classification, for potential use in the Feasibility Study . The resource upgrade drilling was conducted in conjunction with the on-going Phase 1 Feasibility work at PLS, focusing on drilling for geotechnical, hydrogeological, geochemical and metallurgical data (see News Release June 10, 2021).

Ross McElroy, President and CEO for Fission, commented, "Our summer resource drilling at the R840W zone has been very successful. The goal […]

Click here to view original web page at www.juniorminingnetwork.com

Why Energy Fuels, Uranium Energy, and Ur-Energy Stocks Just Popped

What happened

Shares of uranium mining companies are red-hot Thursday. As of 12:40 p.m. EDT, both Energy Fuels (NYSEMKT: UUUU) and Uranium Energy (NYSEMKT: UEC) stocks are up 6.9% apiece, while Ur-Energy (NYSEMKT: URG) is leading the pack higher with a 9.1% gain.

And you can probably thank GLJ Research for all of that. So what

In a short note posted on Twitter yesterday, you see, GLJ raised its price target on yet another uranium mining company. The analyst’s positive comments (and 38 Canadian dollar price target) on uranium miner Cameco (NYSE: CCJ) nonetheless seems to have gotten a lot of investors excited throughout the uranium sector.GLJ cited the creation of the Sprott Physical Uranium Trust — a commodity fund that buys and holds physical uranium as an "alternative for investors," and indeed "the world’s largest" such fund — as its reason for optimism. As the analyst explained, Sprott’s "aggressive […]

Back to the Future of Sourcing Uranium for Reliable Energy with Fission 3.0

It’s hard to envision the world getting all its electricity from renewable assets (solar, wind, geothermal, possibly hydro depending on how you classify it) any time soon. Sure Swanson’s Law and Moore’s Law would suggest that the cost-effectiveness and technology behind solar cells is improving at a very rapid pace but the reality is, we aren’t getting even close to our climate targets and reducing or possibly even eliminating the burning of fossil fuels for electricity unless we include nuclear power in the mix. There certainly seems to be ebb and flow around the perception of nuclear power as a green alternative. Nevertheless, it is a very efficient source of electricity that has a very low carbon footprint . In fact, it produces zero carbon emissions in the electricity generation process, but mining and refining uranium ore and making reactor fuel all require energy.

I’m a firm believer that nuclear […]

Uranium just hit six-year highs. What’s next?

Boom time. Pic: Columbia Pictures, 1956 share

The spot uranium price has punched through $35/lb for first time in six years.

The spark for this price rise is the Sprott Physical Uranium Trust (SPUT), which started buying up and storing physical uranium a few weeks back. Big day as #Uranium spot breaks through $35 to set a new 6-year high. Happy to be doing our part as Sprott Physical Uranium Trust added another 400k lbs of U308. #Nuclear #U3O8 #lowcarbon #SPUT $U.UN $U.U For more information and disclosures, visit: https://t.co/LAsp4rJkmP — Sprott Asset Management (@Sprott) September 1, 2021 A gigawatt-class reactor uses around 450,000 pounds per year, so this is no small amount. SPUT is removing it from market circulation for the long term, and they aren’t the only ones.

Two other companies have already declared their intent to build ATM offering programs and “I doubt they will be the last […]

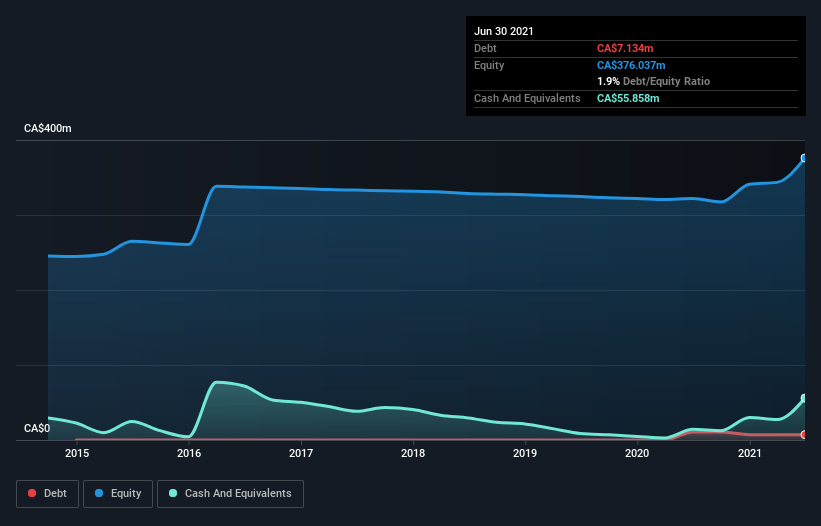

Fission Uranium (TSE:FCU) Has Debt But No Earnings; Should You Worry?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, ‘The possibility of permanent loss is the risk I worry about… and every practical investor I know worries about.’ When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Fission Uranium Corp. ( TSE:FCU ) does use debt in its business. But the more important question is: how much risk is that debt creating? Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute […]