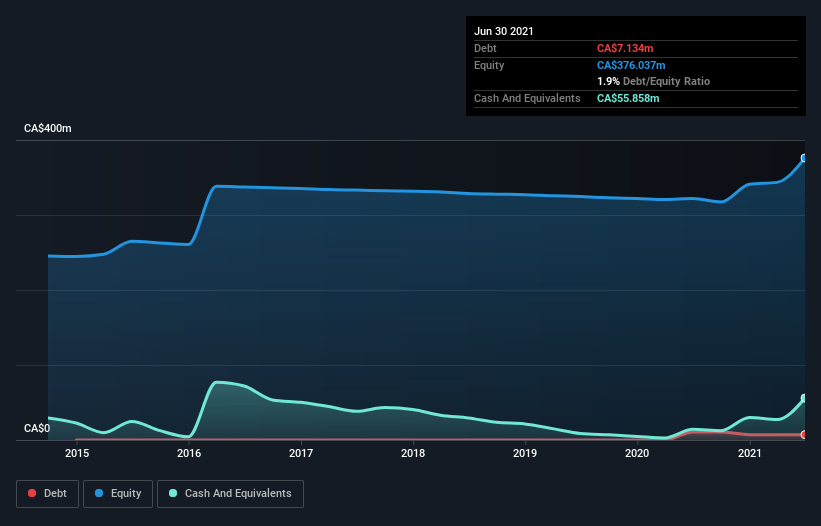

Results include major holes such as 57.5m of continuous mineralization, with 19.15m of total composite >10,000 cps

This includes PLS21-624 (line 630W), which intersected 57.5m of continuous mineralization, including 19.15m of total composite radioactivity >10,000 cps (with a peak of 62,400 cps) . Assays are still pending and will be released when received. The goal of the summer resource drilling is to upgrade the majority of the R840W zone by decreasing the spacing between drill hole mineralized intercepts with the goal of upgraded to Indicated classification, for potential use in the Feasibility Study . The resource upgrade drilling was conducted in conjunction with the on-going Phase 1 Feasibility work at PLS, focusing on drilling for geotechnical, hydrogeological, geochemical and metallurgical data (see News Release June 10, 2021).

Ross McElroy, President and CEO for Fission, commented, "Our summer resource drilling at the R840W zone has been very successful. The goal […]

Click here to view original web page at www.juniorminingnetwork.com