“ Nuclear Fuels Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis. It also provides market information in terms of development and its capacities.

Get Sample Copy of this report with latest Industry Trend and COVID-19 Impact @: https://www.a2zmarketresearch.com/sample-request/592017

Some of the Top companies Influencing in this Market includes:

ARMZ Uranium Holding Company, Cameco, Energy Resources of Australia, BHP Billiton, Canalaska Uranium, KazAtomProm, Berkeley Energia, Globex Mining Enterprises, International Montoro Resources, China National Nuclear Corporation, Japan, Oil, Gas and Metals National Corporation, China General Nuclear Power, Denison Mines.Various factors are […]

Category: Uranium

Consolidated Uranium Announces C$15.0 Million Bought Deal Private Placement

Consolidated Uranium Inc. is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. to act as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters pursuant to which the Underwriters will purchase for resale 5,660,500 units of the Company at a price of C$2.65 per Unit on a “bought deal” private placement basis for gross proceeds of C$15,000,325 . Each …

Not for distribution to United States Newswire Services or for dissemination in the United States

Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. to act as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (collectively, the “ Underwriters ”) pursuant to which the Underwriters will purchase for resale 5,660,500 units of the […]

NA Proactive news snapshot: DRDGOLD, Water Tower Research, Marvel Discovery, Wishpond Technologies, Gold Resource, Blue Sky Uranium UPDATE …

Your daily round-up from the world of Proactive DRDGOLD Limited said it has concluded definitive feasibility studies for a ‘huge’ tailings retreatment investment at its Far West Gold Recoveries (FWGR) project west of Johannesburg. Together with power generation and storage projects at its Ergo Mining Operations on the eastern Witwatersrand, the South Africa-focused mine tailings specialist told investors that the economies of its operations will improve, while reducing its carbon footprint. “The company continues to literally change the face of South Africa,” chairman Geoff Campbell said in the company’s 2021 annual integrated report. “We operate some of the biggest tailing facilities in the world to contain the material that we treat,” he added. The company said its short-term strategic outlook will continue to focus on Ergo and FWGR to set the operations up for the next growth phase.

Water Tower Research has published an update on Chandler, Arizona-based education […]

Click here to view original web page at www.proactiveinvestors.com

Consolidated Uranium Announces C$15.0 Million Bought Deal Private Placement

Not for distribution to United States Newswire Services or for dissemination in the United States

TORONTO, Oct. 29, 2021 (GLOBE NEWSWIRE) — Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. to act as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (collectively, the “ Underwriters ”) pursuant to which the Underwriters will purchase for resale 5,660,500 units of the Company (the “ Units ”) at a price of C$2.65 per Unit (the “ Unit Price ”) on a “bought deal” private placement basis for gross proceeds of C$15,000,325 (the “ Offering ”). Each Unit shall be comprised of one common share in the capital of the Company (each, a “ Unit Share ”) and one half of one common share purchase warrant […]

Click here to view original web page at www.globenewswire.com

Evolving Gold to Acquire Elephant Capital and Cebolleta Uranium Project

VANCOUVER, British Columbia, Oct. 29, 2021 (GLOBE NEWSWIRE) — Evolving Gold Corp. (the “ Company ”) (CSE: EVG) is pleased to announce that it has entered into a letter of intent (the “ Letter ”), dated effective October 26, 2021, pursuant to which it proposes to acquire (the “ Transaction ”) all of the outstanding share capital of Elephant Capital Corp. (“ Elephant Capital ”).

Elephant Capital is an arms’-length resource exploration company, established under the laws of the Province of British Columbia. Elephant Capital holds the rights to acquire all of the outstanding share capital of Cibola Resources LLC., which itself controls the rights to a lease of a mineral property comprising approximately 6,700 acres of mineral rights and 5,700 acres of surface rights located in west-central New Mexico and commonly referred to as the “Cebolleta Uranium Project” (the “ Project ” or “ Cebolleta ”). Cebolleta is an […]

Click here to view original web page at www.globenewswire.com

Uranium Royalty Corp. (UROY) Outlook: Looking Back For Insights

Uranium Royalty Corp. (NASDAQ:UROY) price on Friday, October 29, fall -7.72% below its previous day’s close as a downside momentum from buyers pushed the stock’s value to $4.66.

A look at the stock’s price movement, the level at last check in today’s session was $5.05, moving within a range at $5.00 and $5.22. Turning to its 52-week performance, $5.95 and $0.81 were the 52-week high and 52-week low respectively. Overall, UROY moved 31.17% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big […]

Uranium Hexafluoride Market to See Huge Growth by 2026 | Arkema, Asahi Glass, Saint-Gobain

The Worldwide Uranium Hexafluoride Market has witnessed continuous growth in past few years and is projected to grow at good pace during the forecast period of 2021-2026. The exploration provides a 360° view and insights, highlighting major outcomes of Worldwide Uranium Hexafluoride industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. Additionally, the study helps venture or emerging players in understanding the businesses to make well-informed decisions. Some of the major and emerging players within the market are Arkema, Asahi Glass & Saint-Gobain.

If you are part of Worldwide Uranium Hexafluoride market, then benchmark how you are perceived in comparison to your competitors; Get an accurate view of your business in Worldwide Uranium Hexafluoride Marketplace with latest released study by HTF MI

Avail sample copy before purchase: https://www.htfmarketreport.com/sample-report/3555692-worldwide-uranium-hexafluoride-market

By end users/application, market is sub-segmented as: Nuclear Fuel & Others Breakdown […]

Uranium Market 2021-2027: Major Trends and Key Developments | Granite-Type Uranium Deposits, Volcanic-Type Uranium Deposits, Sandstone-Type Uranium Deposits, Carbonate-Siliceous-Pelitic Rock Type Uranium Deposits

New Jersey, United States,- The Uranium market research report gives an overview about Uranium with product description, application, classification, leading manufacturers, capacity, price. The significant growth opportunities of the fastest growing Specialty integrated circuits market with the best regions are covered in this report. The report includes the market rate Uranium , the gross, statistics, sales rate, value, is for various types, applications and area is involved in the pursuit. Industry consumption Uranium for the main areas as well as intake figures by type and application are also shown.

Get | Download Sample Copy with TOC, Graphs & List of Figures@ https://www.marketresearchintellect.com/download-sample/?rid=480232

Important questions answered: What is the growth potential of the Uranium market?

What companies are currently leading the Uranium market? Will the company continue to hold the lead during the forecast period 2021-2027? What are the best strategies players expect to adopt over the next few […]

Wheeler River JV Completes Successful 2021 Phoenix ISR Field Testing Program

Saskatoon, Saskatchewan TheNewswire – October 29, 2021 UEX Corporation is pleased to announce that its 50% owned subsidiary, JCU Exploration Company, Limited and Denison Mines Corp. have completed a successful 2021 In-Situ Recovery Field Test Program. The program was completed within the commercial-scale ISR test pattern installed in the Phase 1 area of the high-grade Phoenix uranium deposit on the Wheeler River …

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – October 29, 2021 UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“ UEX ” or the “ Company ”) is pleased to announce that its 50% owned subsidiary, JCU (Canada) Exploration Company, Limited (“ JCU ”) and Denison Mines Corp. (“ Denison ”) have completed a successful 2021 In-Situ Recovery (“ISR”) Field Test Program. The program was completed within the commercial-scale ISR test pattern installed in the Phase 1 area of the high-grade Phoenix uranium deposit on the Wheeler River Project.

The Wheeler River […]

Uranium Energy Corp Files Annual Report, Strengthens Balance Sheet, Expands Physical Portfolio and Launches ESG Program

[PDF] Press Rease: Uranium Energy Corp Files Annual Report, Strengthens Balance Sheet, Expands Physical Portfolio and Launches ESG Program Corpus Christi, TX, 29.10.2021 (PresseBox) – Balance Sheet, Physical Portfolio, ESG and Project Development Highlights as of October 26, 2021:

$235.4 million of cash and liquid assets comprised of $96.4 million in cash, $82.3 million in equity holdings and $56.7 million in physical inventories, positioning UEC with a leading balance sheet in the uranium sector.

Expanded physical portfolio of U.S. warehoused uranium (“Physical Portfolio”) to 4.1 million pounds, resulting in an average cost of $32 per pound with various delivery dates through December 2025.

Current delivered inventories stand at 1.2 million pounds in the Physical Portfolio with a market value of $56.7 million based on a current spot price of $47.25 per pound (UxC Price October 26, 2021 – ConverDyn U.S. delivery).Launched formal development of an Environmental, Social and Governance (“ESG”) program to […]

Low-Cost Domestic Uranium Producer Positioned to Meet Rising Demand in Argentina

Share on Facebook

Tweet on Twitter

In an October 15 research note, Fundamental Research Corp.’s

Head of Research Sid Rajeev, B.Tech, CFA, MBA and equity analyst

Nina Rose Coderis, BSc (Geology) commented that uranium and vanadium explorer Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTCQB; MAL2:FSE) is well positioned to provide a solution to the rising demand for uranium in Argentina.The report pointed out that currently there are three operating nuclear reactors in Argentina. A fourth reactor is now being built and two more are planned for construction. At present, there are not any domestic sources of uranium, and the country must import 100% of the uranium it consumes.The analysts remarked that this creates a solid opportunity for domestic uranium producer Blue Sky Uranium which holds a 100% interest a portfolio of four uranium assets in Argentina. Fundamental Research added that the company’s management team has a […]

Uranium Energy Corp Files Annual Report, Strengthens Balance Sheet, Expands Physical Portfolio and Launches ESG Program

NYSE American Symbol – UEC

Balance Sheet, Physical Portfolio, ESG and Project Development Highlights as of October 26, 2021: $235.4 million of cash and liquid assets comprised of $96.4 million in cash, $82.3 million in equity holdings and $56.7 million in physical inventories, positioning UEC with a leading balance sheet in the uranium sector.

Expanded physical portfolio of U.S. warehoused uranium ("Physical Portfolio") to 4.1 million pounds, resulting in an average cost of $32 per pound with various delivery dates through December 2025.

Current delivered inventories stand at 1.2 million pounds in the Physical Portfolio with a market value of $56.7 million based on a current spot price of $47.25 per pound (UxC Price October 26, 2021 – ConverDyn U.S. delivery). Launched formal development of an Environmental, Social and Governance ("ESG") program to build on the Company’s robust safety, health, and environmental protection systems in place while identifying […]

Low-Cost Domestic Uranium Producer Positioned to Meet Rising Demand in Argentina

October 28, 2021 (Investorideas.com Newswire) Fundamental Research Corp. reported it is initiating coverage on Blue Sky Uranium Corp. with a "Buy" rating. According to the research firm, Blue Sky could become Argentina’s first domestic uranium producer well-suited to meet the rising demand for uranium needed to fuel nuclear energy plants in that country. In an October 15 research note, Fundamental Research Corp.’s

Head of Research Sid Rajeev, B.Tech, CFA, MBA and equity analyst

Nina Rose Coderis, BSc (Geology) commented that uranium and vanadium explorer Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTCQB; MAL2:FSE) is well positioned to provide a solution to the rising demand for uranium in Argentina.The report pointed out that currently there are three operating nuclear reactors in Argentina. A fourth reactor is now being built and two more are planned for construction. At present, there are not any domestic sources of uranium, and the country must […]

Click here to view original web page at www.investorideas.com

InvestorNewsBreaks Uranium Energy Corp. (NYSE American: UEC) Releases Annual Report, Notes Balance Sheet Strength and ESG Development

Share on Facebook

Tweet on Twitter

Uranium Energy (NYSE American: UEC) , a U.S.-based uranium mining and exploration company, has filed its annual report, for the period ended July 31, 2021, with the U.S. Securities and Exchange Commission. Highlights include the company’s reported $235.4 million of cash and liquid assets comprised of $96.4 million in cash, $82.3 million in equity holdings and $56.7 million in physical inventories, which establishes UEC with a leading balance sheet in the uranium sector; an expanded physical portfolio of U.S. warehoused uranium; and delivered inventories of 1.2 million pounds in the physical portfolio with a current market value of $56.7 million. In addition, UEC noted that it has begun the development of an environmental, social and governance (“ESG”) program to enhance and strengthen its existing safety, health and environmental protection systems.“Our balance sheet strength, low-cost physical uranium portfolio, permitted ISR project pipeline […]

Overview

This Purepoint Uranium profile is part of a paid investor education campaign. *

Often regarded as the of the world, the Athabasca Basin in Saskatchewan presents exceptional discovery and exploration opportunities for companies looking to enter the thriving uranium market.

According to leading strategists, uranium is still one of the best-performing commodities in the resource industry, despite a year of disruptions from COVID-19. With new reactors continually coming online to meet demand and a limited number of suppliers to fill it, looking to high-valued mining jurisdictions for uranium is one of the best strategies for companies trying to get ahead of the crowd.

Purepoint Uranium Group (TSXV:PTU,OTCQB:PTUUF) has been a major player in the Athabasca Basin for some time now, actively acquiring and operating an exploration pipeline of 12 advanced projects including its flagship Hook Lake project and Red Willow, Smart Lake, Turnor Lake, Henday Lake, Umfreville and the Tabbernor Block […]

There Has Been A -6.47% Decline For Uranium Energy Corp. (AMEX: UEC). So What’s Next?

Uranium Energy Corp. (AMEX:UEC)’s traded shares stood at 7.24 million during the last session, with the company’s beta value hitting 2.29. At the close of trading, the stock’s price was $3.76, to imply a decrease of -6.47% or -$0.26 in intraday trading. The UEC share’s 52-week high remains $4.28, putting it -13.83% down since that peak but still an impressive 78.19% since price per share fell to its 52-week low of $0.82. The company has a valuation of $876.98M, with average of 6.96 million shares over the past 3 months.

Analysts have given a consensus recommendation of a Buy for Uranium Energy Corp. (UEC), translating to a mean rating of 1.50. Of 3 analyst(s) looking at the stock, 0 analyst(s) give UEC a Sell rating. 0 of those analysts rate the stock as Overweight while 0 advise Hold as 3 recommend it as a Buy. 0 analyst(s) have given it […]

Click here to view original web page at marketingsentinel.com

URANIUM ENERGY CORP Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K)

The following management’s discussion and analysis of the Company’s financial condition and results of operations contain forward-looking statements that involve risks, uncertainties and assumptions including, among others, statements regarding our capital needs, business plans and expectations. In evaluating these statements, you should consider various factors, including the risks, uncertainties and assumptions set forth in reports and other documents we have filed with or furnished to the SEC and, including, without limitation, this Form 10-K filing for the fiscal year ended July 31, 2021, including the consolidated financial statements and related notes contained herein. These factors, or any one of them, may cause our actual results or actions in the future to differ materially from any forward-looking statement made in this document. Refer to "Cautionary Note Regarding Forward-looking Statements" and Item 1A. Risk Factors herein. Introduction The following discussion summarizes the results of operations for each of our fiscal years […]

Click here to view original web page at www.marketscreener.com

Uranium Royalty Corp. (NASDAQ:UROY) trade information

Uranium Royalty Corp. (NASDAQ:UROY)’s traded shares stood at 1.76 million during the last session. At the close of trading, the stock’s price was $5.17, to imply a decrease of -5.83% or -$0.32 in intraday trading. The UROY share’s 52-week high remains $5.95, putting it -15.09% down since that peak but still an impressive 84.33% since price per share fell to its 52-week low of $0.81. The company has a valuation of $404.95M, with an average of 1.47 million shares in intraday trading volume over the past 10 days and average of 932.89K shares over the past 3 months.

After registering a -5.83% downside in the last session, Uranium Royalty Corp. (UROY) has traded red over the past five days. The stock hit a weekly high of 5.95 this Wednesday, 10/27/21, dropping -5.83% in its intraday price action. The 5-day price performance for the stock is -10.55%, and 20.51% over 30 […]

Click here to view original web page at marketingsentinel.com

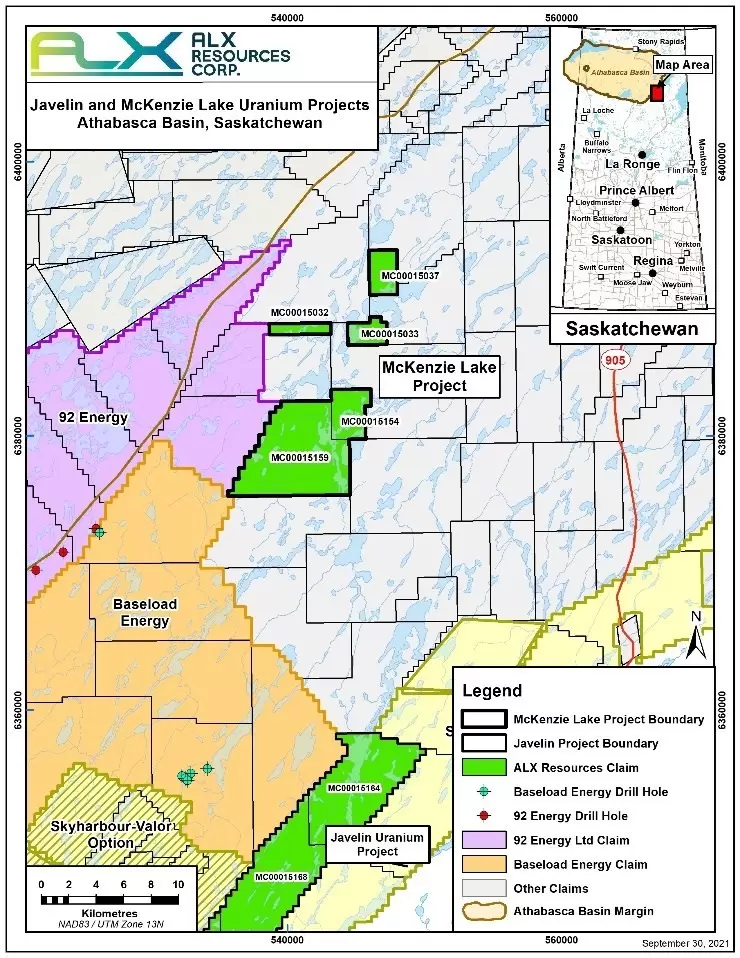

ALX Resources Corp. Mobilizes Geological Crew to Javelin and McKenzie Lake Uranium Projects, Athabasca Basin, Saskatchewan

Vancouver, British Columbia–(Newsfile Corp. – October 26, 2021) – ALX Resources Corp. (TSXV: AL) (FSE: 6LLN) (OTC: ALXEF) ("ALX" or the "Company") is pleased to announce that it has commenced a helicopter-supported ground prospecting program at the Javelin and McKenzie Lake Uranium Projects ("Javelin", or the "Project") in northern Saskatchewan, Canada. Javelin and McKenzie Lake are located near the eastern margin of the Athabasca Basin within 65 kilometres (40 miles) southeast of the McArthur River Uranium Mine. The ground prospecting program is targeting radioactive anomalies identified from a high-resolution airborne radiometric and magnetic survey just completed on ALX’s claims.

Javelin and McKenzie were each acquired during a recent staking rush that began in mid-September 2021, both by staking and by acquisition from an arm’s-length vendor. Recent exploration in the region has produced multiple new uranium discoveries – by Valor Resources Limited, by 92 Energy Ltd. and by Baseload Energy Corp. […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium for the green revolution

"I think the green movement has become much more powerful and important globally than it used to be," said Simon Popple of the Brookville Capital Intelligence Report in a recent interview on INN. "The more governments embrace nuclear, green energy (and) electric vehicles, I think the more demand there will be for uranium," he said in the interview. "The demand for electricity is going to be very high, and that electricity has to come from somewhere." In fact, the new cycle for nuclear power, and therefore uranium demand, has already begun. This can be read in the price of the energy source. Uranium on the spot market now costs more than 48 US dollars per pound (454 grams) again. Companies with fundamentally good uranium projects can already live with this. Older and largely dismantled projects, on the other hand, are having problems and will not yet stimulate supply again […]

Click here to view original web page at www.resource-capital.ch

October 27, 2021 Consolidated Uranium Closes Acquisition and Strategic Alliance with Energy Fuels

• Strategic Alliance with Energy Fuels, the Leading U.S. Uranium Producer – With the toll-millingagreement now executed, CUR becomes the only current U.S. uranium company (other than Energy Fuels) with guaranteed access to Energy Fuels’ White Mesa Mill, which is the only permitted and operating conventional uranium mill in the U.S. Further, the operating agreement allows the Projects to continue to be managed by the experienced team at Energy Fuels.

Tony M Mine – Located in the Henry Mountains area of southeastern Utah, the Project is a large-scale, fully-developedand permitted underground mine that operated most recently in 2008.

Daneros Mine – Located in the White Canyon District, the Project is a fully-developedand permitted underground mine that was most recently in production in 2013.

Rim Mine – Located in the East Canyon portion of the Uravan Mineral Belt, the Project is a fully-developedand permitted underground mine that was most recently in production• Unlocks […]

Click here to view original web page at www.marketscreener.com

Appia Rare Earths & Uranium Announces Upsizing of Bought Deal Private Placement to C$7.0 Million

flow-through units of the Company (each, a " FT Unit ") at a price of C$0.90 per FT Unit; and

FT Units to be sold to charitable purchasers (the " Charity FT Units ") at a price of C$1.00 per Charity FT Unit, subject to the minimum purchase for resale of 5,000,000 Charity FT Units for minimum gross proceeds of C$5,000,000.

The FT Units and Charity FT Units shall collectively be referred to as the " Offered Securities. "

Each FT Unit and Charity FT Unit will consist of one common share of the Company to be issued as a "flow-through share" within the meaning of the Income Tax Act (Canada) (each, a " FT Share ") and one half of one common share purchase warrant (each whole warrant, a " Warrant "). Each whole Warrant shall entitle the holder to purchase one Warrant Share at a price of C$1.10 […]

Click here to view original web page at www.juniorminingnetwork.com

Low-Cost Domestic Uranium Producer Positioned to Meet Rising Demand in Argentina

In an October 15 research note, Fundamental Research Corp.’s

Head of Research Sid Rajeev, B.Tech, CFA, MBA and equity analyst

Nina Rose Coderis, BSc (Geology) commented that uranium and

vanadium explorer Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTCQB; MAL2:FSE) is well positioned to provide a solution to the rising demand for uranium in Argentina.The report pointed out that currently there are three operating nuclear reactors in Argentina. A fourth reactor is now being built and two more are planned for construction. At present, there are not any domestic sources of uranium, and the country must import 100% of the uranium it consumes.

The analysts remarked that this creates a solid opportunity for domestic uranium producer Blue Sky Uranium which holds a 100% interest a portfolio of four uranium assets in Argentina. Fundamental Research added that the company’s management team has a solid track record and has been operating […]

Click here to view original web page at www.streetwisereports.com

Top Uranium Stocks To Watch Before November

Before November begins, which uranium stocks will you watch? When it comes to mining companies, uranium stocks are sometimes disregarded by investors. Many investors are unaware that uranium is a massive industry with activities all over the world. COVID-19 has also had an impact on the uranium stock market. COVID led Uranium stocks to reach levels not seen since the Fukushima Daiichi nuclear disaster in Japan in 2011. Some feel that Reddit is responsible for some of the uranium hysteria. Retail investors have become extremely influential in the stock market in the last year, as you may have seen. In February, a subreddit called r/UraniumSqueeze was launched for uranium retail investors. So far, the subreddit has amassed over 18,200 members. But how can you know which uranium stocks are the best to buy? Perhaps you’ve discovered a uranium firm in which you’d want to invest, but you’re unfamiliar with […]

Click here to view original web page at markets.buffalonews.com

Uranium Mine Sales Market 2021 Growth Drivers, Investment Opportunity and Product Developments 2027 | Kazatomprom, Orano, Cameco, Uranium One

New Jersey, United States,- Uranium Mine Sales market research report gives an overview about Uranium Mine Sales with product description, application, classification, major manufacturers, capacity, price. The significant growth opportunities of the fastest growing Uranium Mine Sales market with the best regions are covered in this report. The report includes Uranium Mine Sales market rate, gross, statistics, sales rate, value, is for various types, applications and area is involved in the lawsuit. Uranium Mine Sales industry consumption for major areas as well as admission figures by type and application are also shown.

The main goal of Uranium Mine Sales Market is to help the user understand the market in terms of definition, segmentation, market potential, influential trends and challenges facing the market. Extensive research and analysis was carried out during the preparation of the report. Readers will find this report very useful for understanding the market in depth.

Data and information […]