Ur-Energy Inc. announced today the pricing of its underwritten public offering of 14,722,200 common shares and accompanying warrants to purchase up to 7,361,100 common shares, at a combined public offering price of $0.90 per common share and accompanying warrant. Each whole warrant will have an exercise price of $1.35 and will expire three years from the date of issuance. Ur-Energy has also granted the underwriters …

Ur-Energy Inc. (NYSE American:URG) (TSX:URE) (“Ur-Energy”) announced today the pricing of its underwritten public offering of 14,722,200 common shares and accompanying warrants to purchase up to 7,361,100 common shares, at a combined public offering price of $0.90 per common share and accompanying warrant. Each whole warrant will have an exercise price of $1.35 and will expire three years from the date of issuance. Ur-Energy has also granted the underwriters a 30-day option to purchase up to 2,208,330 additional common shares and warrants to purchase […]

Uranium Week: The Benefit Of Extending Usage of Nuclear Plants

As the weekly uranium spot price continues to move in a tight range, new research explores the effect of delaying nuclear plant closures on global uranium demand.

-The effect on uranium demand of delaying plant closures

-Fourth quarter results for Kazatomprom

-Uranium spot price falls marginallyIn the wake of President Biden’s inclusion of nuclear in his clean energy plan, new research from Bank of America (BofA) poses the question "what if expected US nuclear plant retirements over the next 10 years were postponed?"If expected closures in the period 2021-2030 were delayed to beyond 2030, then there would be "an additional 26mlbs of global uranium (U3O8) demand over that period."While this is just a 2% increase, it is of assistance and could lead to increased pressure on utilities to move forward new contracting, notes the analyst.In the US there are twelve nuclear reactors expected to shut down between […]

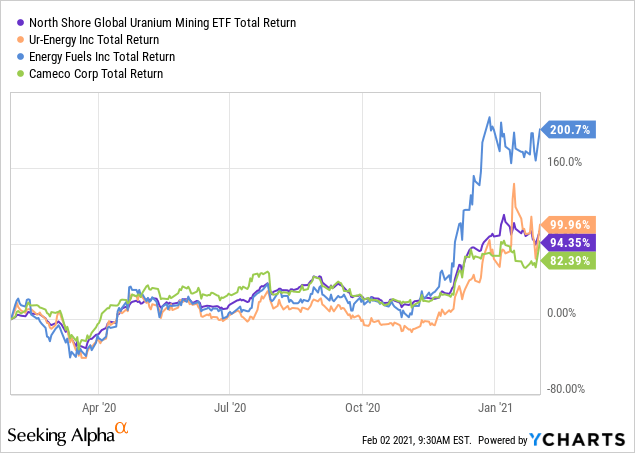

Ur-Energy: Uranium Catalysts Are Great, But Beware Of Speculative Fervor

Summary

Uranium miners have skyrocketed in value over the past few months due to a decline in global production and possible support for Nuclear from the Biden Administration.

Ur-Energy is my favorite North American producer since it rarely dilutes equity and has managed to control cash-flow drawdowns well.

URG may receive necessary permitting for a major growth project early this year and expand development. While Ur-Energy has many great growth catalysts, it is extremely expensive today with its price-to-sales ratio at a historical long-term peak. Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Get started today » Uranium miners have seen strong performance over the past few months. Prices initially jumped last spring as Cameco ( CCJ ) decided to reduce production at one of the world’s most productive uranium mines. The company temporarily suspended production again in December due to a […]

Ready-to-go uranium producer Ur-Energy benefitting from demand drivers in the U.S. market

Ur-Energy Inc. (NYSE American: URG | TSX: URE | FSE: U9T), a company engaged in uranium mining, recovery, and processing activities, is benefiting from demand drivers in the U.S. market that are set to help U.S. uranium producers.

Ur-Energy operates the Lost Creek In-Situ Recovery (ISR) uranium facility in Wyoming. The company has produced, packaged, and shipped more than 2.6 million pounds of uranium since the start of operations in 2013.

U.S. National Uranium Reserve

The current positive sentiment surrounding uranium stocks is a reflection of uranium energy being part of a clean-energy economy and the United States government moving forward in creating a uranium strategic reserve that should benefit domestic producers.In December 2020, the U.S. Congress passed a spending proposal that earmarked US$75 million in new funding for a national uranium stockpile . The Bill is awaiting the President’s signature to become a law. The Congressional funding of a […]

BofA – First silver, now uranium — fears of supply shortages drive up yellowcake share prices

(BofA) – First silver, now uranium — fears of supply shortages drive up yellowcake share prices

(BofA) .jpg” srcset=”https://smallcaps.com.au/wp-content/uploads/2021/02/Uranium-supply-shortage-yellowcake-share-prices-2021-Bank-of-America- (BofA) .jpg 640w, https://smallcaps.com.au/wp-content/uploads/2021/02/Uranium-supply-shortage-yellowcake-share-prices-2021-Bank-of-America- (BofA) -300×188.jpg 300w” sizes=”(max-width: 640px) 100vw, 640px” alt=”Uranium supply shortage yellowcake share prices 2021 Bank of America (BofA) ” title=”Uranium supply shortage yellowcake share prices 2021 Bank of America (BofA) “/>

While silver stocks on the ASX retreated after their exuberant buying spree on Monday, Tuesday was a day in the sun for their uranium counterparts.

The trigger for the yellowcake stocks was, unlike Reddit in the case of silver, a more establishment source, the Bank of America ( (BofA) ).As the Australian market opened on Tuesday, the uranium stocks tore out of the barrier gates and retained their vigour well into afternoon trading with several registering double-digit gains. (BofA) says the delays to planned nuclear plant closures in the US could increase uranium demand projections by 26 […]

Why Cameco Stock Rocketed as Much as 22% Today

What happened

Shares of uranium miner Cameco ( NYSE:CCJ ) rose as much as 22% in early trading on Monday. The big news doesn’t appear to be related to any Reddit board, but to a more mundane Wall Street phenomenon: an analyst update. So what

Pure-play uranium miners like Cameco have been struggling through a period of very low uranium prices, following the Fukushima reactor meltdown in Japan. Although the energy commodity’s price has picked up somewhat over the last year, it remains well below peak levels. A part of the problem is that, despite the fact that nuclear power does not produce carbon emissions, it is often maligned as an undesirable option. Large disasters, while rare, are the main culprit for that. Image source: Getty Images. However, Bank of America (NYSE: BAC) has suggested that the closure of U.S. nuclear power plants may be delayed past 2030. That […]

Boss Energy (ASX:BOE) takes key step towards securing project finance

The Honeymoon Uranium Project. Source: ABC Boss Energy (BOE) has started discussions with global lenders about funding an operations reboot at its Honeymoon Uranium Project in South Australia

The estimated capital expenditure requirements for Honeymoon total US$63.2 million (roughly A$82.8 million), one of the lowest funding requirements of any pre-production uranium project worldwide

Confidentiality agreements between Boss and several global lenders have been signed and formal indicative financing proposals are now being sought

Additionally, Boss is also on track to complete an enhanced feasibility study (EFS) on Honeymoon in the coming quarter The EFS aims to reduce costs and increase nameplate capacity by removing the existing solvent extraction columns at Honeymoon and replacing them with new NIMCIX columns Boss Energy is up 16.3 per cent, trading at 10 cents per share Boss Energy (BOE) has started discussions with global lenders about funding an operations reboot at its Honeymoon Uranium […]

Click here to view original web page at themarketherald.com.au

Fission Uranium Focuses on Resource Expansion and Project De-risking with 43-Hole Drill Program

Drill Program Highlights

Resource Indicated Expansion: R780E Zone (Winter 2021) Drilling expected to commence Q1, 2021

Drilling will focus on the eastern portion of the R780E, between lines 900E and 1125E where a large portion of the mineralization is presently classified as Inferred and the potential to intersect multiple stacked zones is high.

Drilling will include both infill and step-outs from known mineralization and at a spacing of ~15m x 20m (horizontal / vertical) to allow for conversion from Inferred to Indicated. Drill holes on and around line 900E have the potential to intersect the projected plunge of the high-grade core at R780E. Resource Indicated Expansion: R840W Zone (Summer 2021) Drilling expected to be completed in Q3, 2021 The R840W zone is located ~500m west of Patterson Lake. It is the 2 nd largest of the mineralized zones after the R780E zone and due to its predominantly Inferred […]

Click here to view original web page at www.juniorminingnetwork.com

Target Price Raised on U.S. Uranium Firm Advancing Texas Project

February 1, 2021 (Investorideas.com Newswire) ROTH Capital Partners report calls the advancement of the Burke Hollow project in Texas a "Positive Sign." In a Jan. 27 research note, analyst Joe Reagor reported that ROTH Capital Partners raised its target price on Uranium Energy Corp. (UEC:NYSE AMERICAN) to $2.90 per share from $2.40 after the company announced its plan to advance its Burke Hollow uranium project in Texas. The current share price is about $1.67.

"The Burke Hollow advancement is positive," Reagor added.

He explained why and described the 2021 work plan for the project, estimated to cost less than $2 million.

At Burke Hollow this year, Uranium Energy intends to install 45 more monitoring wells and do further exploration and infill drilling. This work, Reagor highlighted, should "bring the project for construction decision." Should the company choose to move forward, construction would take about 12–18 months, the analyst estimated.Also positive for Uranium […]

Click here to view original web page at www.investorideas.com

Top commodities: gold, cobalt, uranium

Those who were in gold about a year ago can look forward to an approximately 25 percent higher gold price. Many, such as Saxo Bank, believe that the end of the road has not yet been reached in terms of price. Saxo Bank expects a gold price of at least 2,200 U.S. dollars. The reason for this is a weakening

U.S. dollar, the cause of which is the rising national debt.Another raw material, uranium, is also forecast to have a bright future. This is because, thanks to many new nuclear reactors, demand for uranium is rising. And in recent years, a low uranium price has often prevented exploration and investment efforts. And a scarce raw material is always a raw material that becomes more expensive. As a result, uranium companies are also becoming more valuable and moving into the focus of investors.

The fight against emissions is not only […]

Click here to view original web page at www.resource-capital.ch

Uranium Hexafluoride Sales Market Share, Global Growth Opportunities, Driving Factors by Manufacturers, Regions, Type and Application, Revenue Market Forecast to 2026

Global Uranium Hexafluoride Sales Market (2021-2026) research report provides the Deep industry data and industry future trends, allowing you to identify the products and end users driving Revenue growth and profitability. The industry report lists the leading competitors and provides the insights strategic industry Analysis of the key factors influencing the market.Global Uranium Hexafluoride Sales Market give a descriptive analysis of the trends and potential factors of the upcoming future of Global Uranium Hexafluoride Sales Market during the forecast period. This markets competitive manufactures and the upcoming manufactures are studied with their research. Revenue, production, price, market share of these players is mentioned with detailed information.

Get a Sample Copy of report – https://www.marketreportsworld.com/enquiry/request-sample/16689817

Uranium Hexafluoride Sales Market Report provides sizing and growth opportunities for the period 2021-2026. Provides comprehensive insights on the latest industry trends, forecast, and growth drivers in the market. Report Includes a detailed analysis of […]

Click here to view original web page at murphyshockeylaw.net

Fission Focuses on Resource Expansion and Project De-risking with 43-Hole Drill Program

TSX SYMBOL: FCU OTCQX SYMBOL: FCUUF FRANKFURT SYMBOL: 2FU Fission Uranium Corp. is pleased to announce drilling plans for 2021, which include a 43-hole program at its PLS property host to the large, high-grade and near surface Triple R deposit in Saskatchewan, Canada . The fully funded program aims to increase the Indicated classified resource of the Triple R deposit’s R780E zone, and also upgrade to Indicated the …

TSX SYMBOL: FCU

OTCQX SYMBOL: FCUUF

FRANKFURT SYMBOL: 2FUFission Uranium Corp. (” Fission ” or ” the Company “) is pleased to announce drilling plans for 2021, which include a 43-hole ( 12,640 m ) program at its PLS property host to the large, high-grade and near surface Triple R deposit in Saskatchewan, Canada . The fully funded program aims to increase the Indicated classified resource of the Triple R deposit’s R780E zone, and also upgrade […]

Lotus Resources discovers high-grade rare earth oxides at Kayelekera Project in Malawi

Given the presence of high-grade neodymium-praseodymium oxide – an essential ingredient for multiple clean technologies – the company is considering additional work to determine the potential of this discovery. The company completed 17 trenches across an area of around 3 kilometres of strike at the Milenje Hills Rare Earth prospect Lotus Resources Ltd ( ASX:LOT ) has found high-grade rare earth oxide (REO) material up to 16% total REO and 3.4% critical REO at the Milenje Hills prospect, 2 kilometres from its Kayelekera Uranium Mine in Malawi, after a preliminary low-cost exploration program.

The rare-earth assemblage discovered by geophysics, mapping, and trenching at the prospect includes neodymium, europium, terbium, dysprosium, yttrium, and praseodymium – with neodymium and praseodymium oxides representing around 20% of the total REO content of the assayed samples.

These two elements, along with dysprosium and terbium are essential for the manufacture of permanent magnetics, which make-up around 90% […]

Click here to view original web page at www.proactiveinvestors.com.au

Blue Sky Uranium Raises C$5.46M; Looking to Expand Low-Cost District-Scale Amarillo Grande Uranium Project in Argentina Contributed Opinion

Ivana deposit; Rio Negro province, Argentina 1. Introduction

Last year has been a quiet year with the COVID-19 pandemic restricting most exploration activities in Argentina, but the situation has changed since November 2020, and Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTC) is back in business again, ready to advance its flagship Amarillo Grande uranium project. The company received a tailwind from positive sentiment for uranium companies in general, which has been fueled by several reasons. The most important one has been the U.S. Senate approving a bill which requires the U.S. holding a domestic reserve of uranium; another one has been the shutting down of operating mines like Cigar Lake, and reducing further development and production of mines in Kazakhstan. This and other causes resulted in a higher spot price for U3O8 in 2020, as is shown on this chart from the Cameco (CCO.TO) website: This in turn lifted uranium […]

Click here to view original web page at www.streetwisereports.com

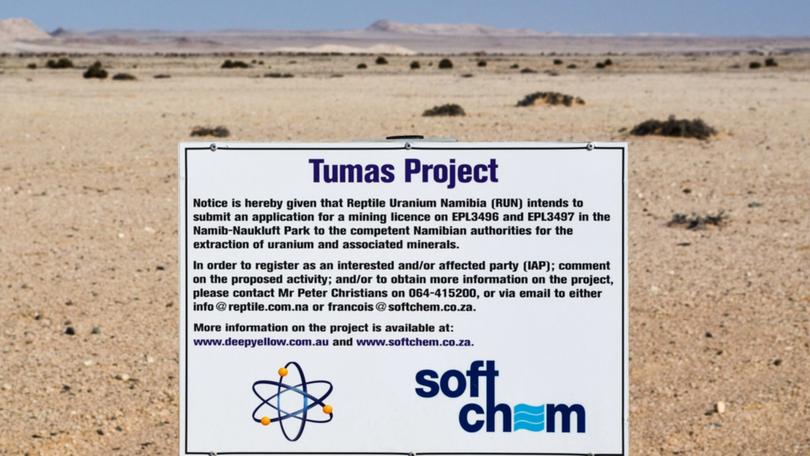

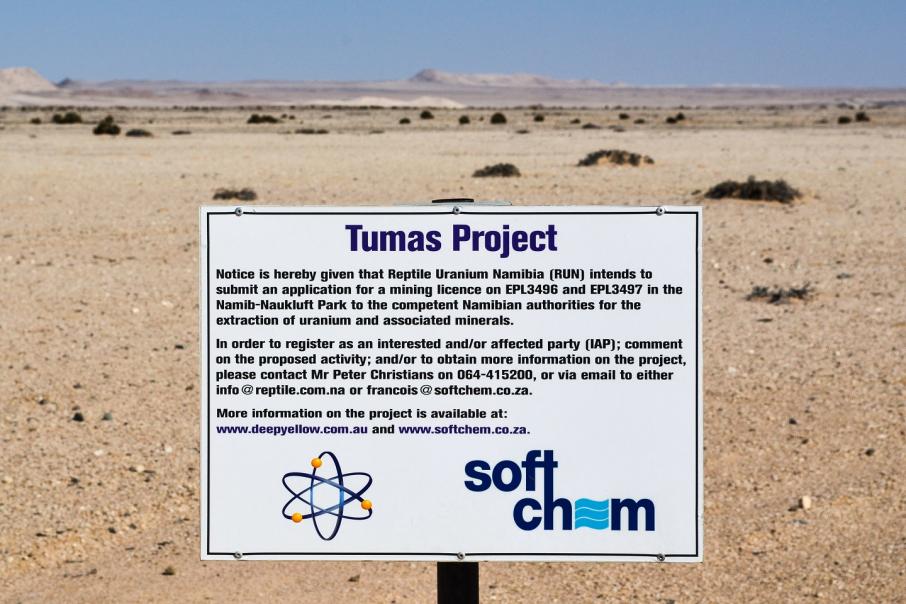

Deep Yellow recognised for 2020 performance

Signage for Deep Yellow’s tenement applications east of Walvis Bay in Namibia. Deep Yellow has been recognised by OTC Markets as one of the premier performers on its OTCQX platform in 2020. The aspiring uranium producer made OTCQX’s Top 50 listing, which acknowledges the company’s annual share price performance and its commitment of international regulatory and compliance standards. Deep Yellow joins a star-studded cast of internationally listed companies on the OTCQX list including Anaconda Mining, Neo Lithium and Midas Gold Corporation.

The company posted a more than four-fold increase in its share price over the course of 2020, from a COVID-low of $0.11 in March before climbing to a high of $0.51 in mid-December. Since that time, the stock has barely paused for breath, extending its run into 2021 hitting $0.79 in the middle of January before settling back to $0.58 today.

Deep Yellow joined OTC Market Group’s OTCQB platform in […]

Deep Yellow recognised for 2020 performance

Deep Yellow has been recognised by OTC Markets as one of the premier performers on its OTCQX platform. The aspiring uranium producer made OTCQX’s Top 50 listing, which acknowledges the company’s annual share price performance and its commitment to international regulatory and compliance standards. Deep Yellow continues to develop the Tumas uranium project in Namibia with its PFS for the project set to be delivered in the coming weeks. Signage for Deep Yellow’s tenement applications east of Walvis Bay in Namibia. Credit: File Deep Yellow has been recognised by OTC Markets as one of the premier performers on its OTCQX platform in 2020. The aspiring uranium producer made OTCQX’s Top 50 listing, which acknowledges the company’s annual share price performance and its commitment to international regulatory and compliance standards. Deep Yellow joins a star-studded cast of internationally listed companies on the OTCQX list including Anaconda Mining, Neo Lithium and […]

Click here to view original web page at www.businessnews.com.au

What Do You Know About Uranium?

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. Ruth Saldanha: If you’re closely watching the markets in 2020, you may have noticed that uranium has been steadily rising. Morningstar analyst Kristoffer Inton believes that because of the pandemic and because of the results of the 2020 presidential election, the prices of the commodity have risen. But can that continue? He’s here today to share his thoughts.

Kris, thank you so much for being here today.

Kristoffer Inton: Thanks for having me.

Saldanha: First up, the price of uranium rose sharply at the beginning of the pandemic. It fell a little and then it rose again. What was the reason for this first initial price fluctuation? Inton: At the start of the pandemic, what we saw was some temporary production cuts by major producing companies, Canadian-based Cameco and […]

Target Price Raised on U.S. Uranium Firm Advancing Texas Project Research Report

ROTH Capital Partners report calls the advancement of the Burke Hollow project in Texas a "Positive Sign." In a Jan. 27 research note, analyst Joe Reagor reported that ROTH Capital Partners raised its target price on Uranium Energy Corp. (UEC:NYSE AMERICAN) to $2.90 per share from $2.40 after the company announced its plan to advance its Burke Hollow uranium project in Texas. The current share price is about $1.67.

"The Burke Hollow advancement is positive," Reagor added.

He explained why and described the 2021 work plan for the project, estimated to cost less than $2 million.

At Burke Hollow this year, Uranium Energy intends to install 45 more monitoring wells and do further exploration and infill drilling. This work, Reagor highlighted, should "bring the project for construction decision." Should the company choose to move forward, construction would take about 12–18 months, the analyst estimated.Also positive for Uranium Energy, Reagor pointed out, is […]

Click here to view original web page at www.streetwisereports.com

Uranium Royalty Corp. to Present at the TD Securities Mining Conference

VANCOUVER, BC, Jan. 28, 2021 /CNW/ – Uranium Royalty Corp. (TSXV: URC ) (" URC " or the " Company ") invites investors and shareholders to attend the Company’s presentation at the TD Securities Mining Conference today at 3:40pm EST. President and CEO, Scott Melbye, will provide an update on the Company and answer investors’ questions during his live webcast.

Interested investors can register to attend URC’s presentation on January 28, 2021 via the TD Mining Conference registration link: https://bit.ly/3t5HhFS

The presentation will be recorded and made available on the Company’s website after the conference.

About Uranium Royalty Corp. Uranium Royalty Corp. is a pure-play uranium royalty company focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity investments in uranium companies, as well as through holdings of physical uranium. The Company’s strategy recognizes the inherent cyclicality of valuations based […]

U.S. Firm Ready to Produce, ‘Support National Uranium Reserve’

January 28, 2021 (Investorideas.com Newswire) Uranium Energy Corp.’s favorable position and the reasons for a target price raise on the company are covered in an H.C. Wainwright & Co. report. In a Jan. 26 research note, analyst Heiko Ihle reported that H.C. Wainwright & Co. increased its target price on Uranium Energy Corp. (UEC:NYSE AMERICAN) to $3.60 per share from $3.30. This compares to $1.64, the current per share price.

The higher target price, Ihle explained, resulted from the financial institution lowering its discount rate on Uranium Energy’s asset base (to 7.5% from 8%) due to various positive industry developments and raising its per-pound valuation of the company’s ex-Texas assets (to $3.50 from $3.15).

Also of note is that Uranium Energy "remains well positioned to leverage its low-cost in-situ recovery (ISR) operations to support a recently enacted bill that is set to create a U.S. uranium reserve during 2021," Ihle indicated.

He […]

Click here to view original web page at www.investorideas.com

Uranium Mining Market Size Prognosticated to Perceive a Thriving Growth by 2026 interpreted by a new report

A research study on Uranium Mining Market has been added by Report Ocean , which extends an in-depth analysis of the potential factors that fuel this industry’s revenue landscape. The study also includes valuable insights into Uranium Mining Market valuation, market share, profit forecast and regional outlook, while further illustrating the key challenges and opportunities that major players face.

Qualitative in-depth analysis include the identification and investigation of the following aspects: Market Structure Growth Drivers, Restrictions and Challenges, Emerging Product Trends & Market Opportunities, Porter’s Fiver Forces. The report also examines the financial position of the leading companies, including gross profit, revenue generation, sales volume, sales revenue, cost of production, individual growth rate, and other financial ratios. The report basically gives information about the Market trends, growth factors, limitations, opportunities, challenges, future forecasts, and details about all the key market players.

Avail sample copy before purchase https://reportocean.com/industry-verticals/sample-request?report_id=QY23817

Key […]

Impact Of Covid-19 on Uranium Mining Market 2021 Industry Challenges, Business Overview and Forecast Research Study 2026

Overview for “Uranium Mining Market” Helps in providing scope and definitions, Key Findings, Growth Drivers, and Various Dynamics. Uranium Mining Market Data and Acquisition Research Study with Trends and Opportunities 2019-2024

The study of Uranium Mining market is a compilation of the market of Uranium Mining broken down into its entirety on the basis of types, application, trends and opportunities, mergers and acquisitions, drivers and restraints, and a global outreach. The detailed study also offers a board interpretation of the Uranium Mining industry from a variety of data points that are collected through reputable and verified sources. Furthermore, the study sheds a lights on a market interpretations on a global scale which is further distributed through distribution channels, generated incomes sources and a marginalized market space where most trade occurs.Along with a generalized market study, the report also consists of the risks that are often neglected when it comes […]

Click here to view original web page at murphyshockeylaw.net

Uranium Royalty Corp. to Present at the TD Securities Mining Conference

VANCOUVER, BC, Jan. 28, 2021 /CNW/ – Uranium Royalty Corp. (TSXV: URC) (" URC " or the " Company ") invites investors and shareholders to attend the Company’s presentation at the TD Securities Mining Conference today at 3:40pm EST. President and CEO, Scott Melbye, will provide an update on the Company and answer investors’ questions during his live webcast.

Interested investors can register to attend URC’s presentation on January 28, 2021 via the TD Mining Conference registration link: https://bit.ly/3t5HhFS

The presentation will be recorded and made available on the Company’s website after the conference.

About Uranium Royalty Corp. Uranium Royalty Corp. is a pure-play uranium royalty company focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity investments in uranium companies, as well as through holdings of physical uranium. The Company’s strategy recognizes the inherent cyclicality of valuations based on uranium […]

Click here to view original web page at markets.businessinsider.com

Canaccord Genuity Boosts Uranium Energy (NYSEAMERICAN:UEC) Price Target to $2.15

→ Biden’s New Plan – What No One is Telling You (Ad) Uranium Energy Corp. logo Uranium Energy (NYSEAMERICAN:UEC) had its target price boosted by Canaccord Genuity from $2.00 to $2.15 in a research report sent to investors on Wednesday morning, The Fly reports. The brokerage currently has a buy rating on the basic materials company’s stock.

A number of other research firms have also recently weighed in on UEC. HC Wainwright upped their price target on Uranium Energy from $3.30 to $3.60 and gave the stock a buy rating in a report on Tuesday. Zacks Investment Research cut Uranium Energy from a buy rating to a hold rating in a report on Tuesday. Finally, Roth Capital reiterated a buy rating and set a $2.40 target price (down from $2.90) on shares of Uranium Energy in a research note on Thursday, November 12th.

UEC opened at $1.64 on Wednesday. The […]

Click here to view original web page at www.modernreaders.com

Uranium Market Trends & Opportunity 2021-2026 | Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, Cameco, Areva, and more | Affluence

In this report, we discuss the global industrial policies, economic environment, and the impact of covid-19 on the Uranium industry and its cost structure. Besides, this report covers the basic market dynamics, market size, and companies’ competition data (like Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, Cameco, Areva, etc). In addition, the report also conducts basic market research on major product type, market end-use, and regional trade. Global Uranium Market Report Overview:

Global Uranium market report presents an in-depth assessment of the market dynamics, opportunities, future roadmap, competitive outlook and discusses foremost trends. The report gives the most up-to-date industry statistics in the real marketplace situation and outlook in the Uranium market. The report includes historical data from 2015 to 2020. The report contains a granular evaluation of the present industry conditions, market demands, reveal facts on the market size, revenues, and provides forecasts through 2026. The report provides a […]