Few sectors have experienced the image transformation that the nuclear energy market has undergone over the last five years.

Once a concept that conjured images of nuclear fallout and radioactive wastelands, uranium is now a resource that’s considered paramount in decarbonization.

While solar and wind garner a lot of buzz for their green potential, uranium has been silently powering national grids and supplying electricity around the globe since 1951. Uranium Price Forecasts and Top Uranium Stocks to Watch Uranium Soared Last Year While Other Resources Tumbled

What’s In Store For Uranium This Year? Find Out In Our Exclusive FREE 2021 Uranium Outlook Report featuring trends, forecasts, expert interviews and more! As it becomes increasingly clear that an arsenal of tools must be used to fight climate change, nuclear energy is moving to the fore. Producing zero emissions, it currently provides 10 percent of the world’s electricity, and is slated to […]

NexGen Energy (NXE Stock) rallies impulsively in bullish uranium market

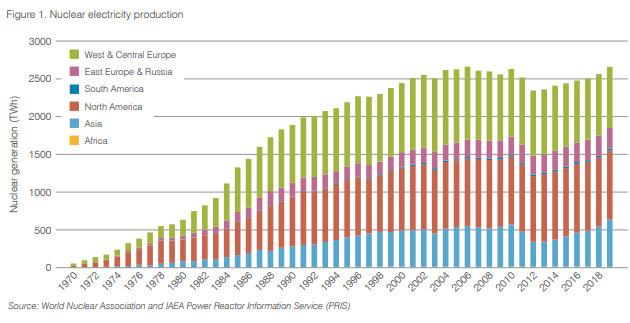

NexGen Energy (NXE) is a Canada-based company with a focus on acquisition, exploration, and development of Canadian uranium projects. The company owns a portfolio of prospective uranium exploration assets in Athabasca Basin, which are some of the largest in the world. The stock has dropped 80% from its 2017 high to $0.50 / share at the March 2020 low. However, since then it has rallied 10x higher. It is speculative as it’s not yet producing uranium, but its potential and also the bullish uranium market prove to be supportive of the stock. Nuclear energy production

The chart above shows 50 years of nuclear energy production which is a good proxy for uranium demand. After the Fukushima disaster in 2011, many nuclear power plants came offline. However, we have seen a pickup in the demand again. Most of the growth in nuclear power plants came from emerging markets as the […]

Eclipse review serves up shallow NT uranium mineralisation

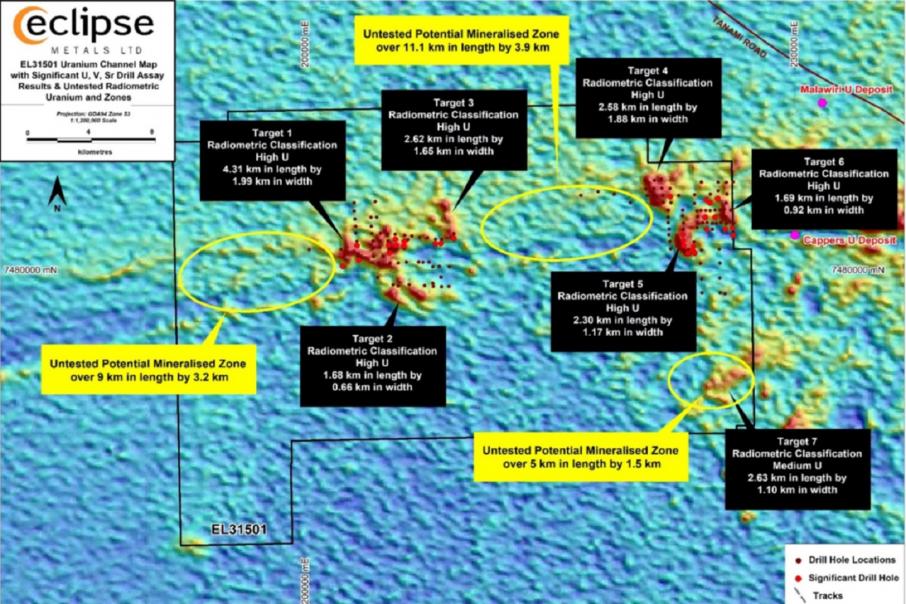

A review of historical drilling at its Ngalia Basin project in the Northern Territory has served up shallow uranium, vanadium and strontium mineralised zones for Eclipse Metals. Intercepts including 0.5m going 960 parts per million uranium and 570 ppm strontium from just 1m depth and a zone stretching over 11km of strike caught the eye. Seven untested radiometric target areas were also delineated. Uranium channel map highlighting untested radiometric anomalies and potential mineralised zones at Ngalia Basin in the Northern Territory. Credit: File An extensive review of historical drilling at its Ngalia Basin project in the Northern Territory has served up several shallow uranium, vanadium and strontium mineralised zones for Eclipse Metals . Intercepts including 0.5m going 960 parts per million uranium and 570 ppm strontium from just 1m depth and a zone stretching over 11km of strike caught the eye. Seven untested radiometric target areas were also delineated.

Eclipse […]

Click here to view original web page at www.businessnews.com.au

Marenica Energy transforms into Elevate Uranium as sector grows and money flows

Marenica’s stock is now trading under the new name Elevate Uranium and ticker code ‘EL8’. In November 2020, Marenica Energy (ASX: MEY) raised $5.4 million at $0.088 per share.

On Friday, just over six months later, that same stock closed at $0.35 per share — just one more uranium company that is experiencing renewed investor enthusiasm after years of low levels of interest in what for a long time was a beaten down sector.

For those who had faith last November, that faith has been amply rewarded.

Today, the stock began trading under the new name Elevate Uranium (ASX: EL8) , a change of title that reflects how the company has grown beyond its original Marenica project in Namibia — plus, using “uranium” in a company name is now a positive.Managing director Murray Hill says the company’s name change is in recognition of the “significant” geographically diverse uranium assets it now owns.‘Elevate’ […]

Skyharbour Resources Ltd: Skyharbour’s Partner Company Azincourt Energy’s Drilling Returns Elevated Uranium at the East Preston Uranium Project

VANCOUVER, British Columbia, June 08, 2021 ) (the "Company") partner company Azincourt Energy ("Azincourt") is pleased to announce results have been received from the recent diamond drill program at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdfAs previously reported, the winter 2021 drill program was cut short due to an earlier than expected spring break-up. As a result, only 1,195 m were completed in five diamond drill holes (Figure 3). 36 geochemical samples were collected from three holes and were sent to SRC Geoanalytical Laboratories in Saskatoon for analysis and the results have been received. Azincourt is pleased to report that anomalous and elevated uranium levels were encountered in three of the five holes completed.

Figure 1: Target corridors at the East Preston Uranium Project https://skyharbourltd.com/_resources/maps/nr-20210118-figure1.png Drill hole […]

Click here to view original web page at www.finanznachrichten.de

Uranium Energy Corp. (NYSE:UEC)’s stock boosts 6.04%, but it may be a worthy investment

The trading price of Uranium Energy Corp. (NYSE:UEC) floating higher at last check on Monday, Jun 07, closing at $3.31, 6.04% higher than its previous close.

Traders who pay close attention to intraday price movement should know that it has been fluctuating between $3.3000 and $3.5700. The company’s P/E ratio in the trailing 12-month period was 0, while its 5Y monthly beta was 2.45. In examining the 52-week price action we see that the stock hit a 52-week high of $3.67 and a 52-week low of $0.82. Over the past month, the stock has suffered 0% in value.

Uranium Energy Corp., whose market valuation is $738Million at the time of this writing, is expected to release its quarterly earnings report in Jul 2021. Investors’ optimism about the company’s current quarter earnings report is understandable. Analysts have predicted the quarterly earnings per share to grow by $0 per share this quarter, however […]

Global uranium output tipped for growth as spot prices tick up – report

Credit: Energy Fuels Inc GlobalData expects uranium output to grow at a compound annual growth rate of 6.2% between 2021 to 2025 to 62,200 tonnes. “Global uranium production has been limited in recent years, mainly due to a sluggish market,” says associate project manager Vinneth Bajaj in a news release. “The covid-19 pandemic further impacted this from early 2020,” the analyst says.

Global uranium production fell by 9.2% to 49,700 tonnes in 2020, the lowest level since 2008. The most significant declines were observed in Canada (43.9%) and Kazakhstan (14.6%) – globally, almost 60% of uranium originates from these two countries. In March 2020, Cameco’s Cigar Lake mine, in Canada’s Athabasca Basin of northern Saskatchewan, which accounts for 12% to 13% of global production, was suspended to contain the covid outbreak. The suspension stayed until September 2020 but was later halted again in mid-December because of the increasing risks. It […]

Millionaire-Maker Stock: Could This Uranium Bull Market Give You 20x Your Money?

After a long bear market in uranium shown via the Global X Uranium ETF chart below, it’s showing signs of a potential turnaround. The ETF’s top 10 holdings include Cameco (TSX:CCO) (NYSE:CCJ) , NexGen Energy (TSX:NXE) , and Denison Mines . URA Total Return Level data by YCharts.

Some investors believe a uranium bull market has just begun this year. One of the largest global providers of uranium is Cameco. The stock has appreciated more than 50% year to date.

As the world population grows, energy demand is expected to persistently increase. Uranium as a source of energy is a part of that solution. The usage of uranium supports the world’s shift to carbon-free energy. While the U.S. is the largest nuclear power generator, accounting for about a third of global nuclear power, China and Japan are the fastest-growing nuclear power markets.

Cameco outlined nuclear power’s role in taking part in […]

Fission Uranium Provides Community Engagement Update

The processes covered by the agreement include: Prepare, facilitate and coordinate Project information sharing meetings between CRDN and Fission;

Facilitate and conduct community information meeting on status of the Project;

Draft, contribute to, review, and provide comments on draft documents leading to Environmental Impact Statement;

CRDN Comments on draft project description and final project description; Joint review and concurrence on target information to be addressed via Engagement Activities; and Joint work and collaboration on scope of Engagement Activities and supporting budget. To achieve the outcomes of these processes in a meaningful and collaborative way, Fission and CRDN have established open lines of communication, and connect regularly by phone, email, and/or meeting. This active, open approach has been paired with a shared communications and commitment tracking log, requested by CRDN, to create a consistent, transparent, and accountable way to raise and address questions, information requests, and concerns, in a timely […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Energy Corp. (NYSE:UEC): Trading Information

In the last trading session, 3,724,433 shares of the Uranium Energy Corp.(NYSE:UEC) were traded, and its beta was 2.45. Most recently the company’s share price was $3.31, and it changed around $0.14 or 0.04% from the last close, which brings the market valuation of the company to $770.6 Million. UEC currently trades at a discount to its 52-week high of $3.67, offering almost -10.88% off that amount. The share price’s 52-week low was $0.82, which indicates that the current value has risen by an impressive 75.23% since then. We note from Uranium Energy Corp.’s average daily trading volume that its 10-day average is 4.71 Million shares, with the 3-month average coming to 6.7 Million.

Uranium Energy Corp. stock received a consensus recommendation rating of Buy, based on a mean score of 1.7. If we narrow it down even further, the data shows that none out of 4 analysts rate the […]

Click here to view original web page at marketingsentinel.com

10 Best Uranium Stocks to Buy Now

In this article we discuss the 10 best uranium stocks to buy now. If you want to skip our detailed analysis of these companies, go directly to the 5 Best Uranium Stocks to Buy Now .

The long-term demand for uranium has been on an upward trajectory as developing and emerging economies opt for nuclear fuel to solve their energy problems, primarily because renewable solutions like solar and wind are unreliable base sources for electrical grids and drive up prices, hurting consumers who subsequently influence energy policymaking in this regard. As a result, the global demand for uranium was close to 180 million pounds in 2020. Market experts believe that this figure is set to grow to almost 200 million pounds within the next five years.

Some of the companies that can ride this nuclear fuel boom are the Rio Tinto Group (NYSE: RIO ), BHP Group (NYSE: BHP ) […]

Click here to view original web page at www.insidermonkey.com

Reason’s why Uranium Energy Corp. (UEC) is an asset to your trade with current Target Price of $3.91

At the end of the latest market close, Uranium Energy Corp. (UEC) was valued at $3.17. In that particular session, Stock kicked-off at the price of $3.29 while reaching the peak value of $3.30 and lowest value recorded on the day was $3.14. The stock current value is $3.16.

Recently in News on May 20, 2021, Uranium Energy Corp Increases Physical and Equity Uranium Holdings. NYSE American Symbol – UEC. You can read further details here

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off! Get the Top 5 Stocks Now! SponsoredUranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year […]

Mega Uranium Announces Further Investments in Toro Energy Ltd. and International Consolidated Uranium Inc.

Mega Uranium Ltd. is pleased to announce that it has participated in the recently closed equity financings of Toro Energy Limited and International Consolidated Uranium Inc. two publicly-listed issuers engaged in uranium exploration and development activities. Mega’s AUD$1.5M investment in Toro Energy formed part of Toro Energy’s AUD$15M aggregate equity financing, that, together with and subject to completion …

Mega Uranium Ltd. (MGA: TSX) is pleased to announce that it has participated in the recently closed equity financings of Toro Energy Limited (ASX: TOE; “Toro Energy”) and International Consolidated Uranium Inc. (TSXV: CUR; “Consolidated Uranium”), two publicly-listed issuers engaged in uranium exploration and development activities.

Mega’s AUD$1.5M investment in Toro Energy formed part of Toro Energy’s AUD$15M aggregate equity financing, that, together with and subject to completion of its proposed AUD$6.7M debt conversion transaction (which requires shareholder approval), would position Toro Energy as debt-free and well-funded for its ongoing development and […]

Barclay’s bull or Pearce take? 3 ASX uranium stocks to watch

Each Friday, corporate advisory firm Barclay Pearce highlights the key trading themes of the week, along with which companies and sectors Stockhead readers should be keeping their eye on. Uranium stocks moved back on the investor radar last month, with a couple of ASX plays booking big gains in May.

And in this week’s interview, Barclay’s Head of Trading Trent Primmer flagged it as a sector to watch within his broader commodities thesis. Market mechanics

Spot prices for uranium edged above US$30/pound this week — a 10-month high — after trading in a range between US$25-30/pound through the first half of this year.

At those prices, the economics still don’t stack up for a lot of junior uranium producers so further catalysts will be required for longer-term growth.Assessing the recent price action, Primmer said uranium prices have remained in a state of flux for the past decade since the Fukushima […]

Etango project suited to meet current and future uranium deficits

ASX-listed Bannerman Resources CEO Brandon Munro says the company offers investors an “outstanding” opportunity with its Swakopmund, Namibia-based Etango uranium project as supply of the commodity has grown into an expanding deficit over the past few years.

Speaking during the Junior Indaba , in a session that showcased junior mining companies, projects and investment opportunities, on June 2, he pointed out that global uranium consumption was about 180-million pounds a year and that there was a 20-million-pound-a-year deficit in the market at present. He noted that Covid-19 disruptions had affected two of the largest uranium-producing provinces of the world – Kazakhstan and Canada.

These disruptions resulted in about a doubling of the deficit, leading to the tightening of the uranium sector at a time when the sector was coming out of a ten-year, deep bear-market cycle, he added. Adding to the deficit are Covid-19-related disruptions extending into this year, the largest […]

Click here to view original web page at www.miningweekly.com

Standard Uranium Announces Summer Drill Program Has Begun and Assay Highlights from Phase II Winter Drill Program at Flagship Davidson River Project

Standard Uranium Ltd. is pleased to announce that the Phase II summer 2021 diamond drill program has officially begun at the Company’s flagship 25,886 hectare Davidson River Project, located in the Southwest Athabasca Uranium District of Saskatchewan 25 km to 30 km to the west of Fission Uranium’s Triple R and NexGen’s Arrow deposits. The Company is also happy to announce a summary of results from the Phase II …

Standard Uranium Ltd. (“ Standard Uranium ” or the “Company”) (TSX-V: STND) (OTCQB:STTDF) (Frankfurt: FWB:9SU) is pleased to announce that the Phase II summer 2021 diamond drill program has officially begun at the Company’s flagship 25,886 hectare Davidson River Project, (the “Project” or “Davidson River”) located in the Southwest Athabasca Uranium District of Saskatchewan 25 km to 30 km to the west of Fission Uranium’s Triple R and NexGen’s Arrow deposits. The Company is also happy to announce a […]

OTC Markets Group Welcomes Paladin Energy Limited to OTCQX

OTC Markets Group Inc. operator of financial markets for 11,000 U.S. and global securities, today announced Paladin Energy Limited a company which develops and operates uranium mines and also owns a large global portfolio of uranium exploration and development assets, has qualified to trade on the OTCQX® Best Market. Paladin Energy Ltd. upgraded to OTCQX from the Pink® market. Paladin Energy Limited begins trading …

OTC Markets Group Inc. (OTCQX: OTCM), operator of financial markets for 11,000 U.S. and global securities, today announced Paladin Energy Limited (ASX: PDN; OTCQX: PALAF), a company which develops and operates uranium mines and also owns a large global portfolio of uranium exploration and development assets, has qualified to trade on the OTCQX® Best Market. Paladin Energy Ltd. upgraded to OTCQX from the Pink® market.

Paladin Energy Limited begins trading today on OTCQX under the symbol “PALAF.” U.S. investors can find current financial disclosure and Real-Time […]

ASX uranium shares are surging today

ASX uranium shares are breaking out today, with some of producers and explorers making multi-year highs. Why is uranium in the hot seat?

Uranium is mainly used as fuel for nuclear power reactors for electricity generation. Nuclear power isn’t exactly a “renewable” source of energy, but it generates near zero emissions. Uranium is expected to play a significant role in the global shift move to lower emissions over the next 30 years.

If you look at the 10-year charts of many ASX uranium shares, it isn’t uncommon for valuations to have declined by more than 90%. This is because the spot price of uranium has tumbled from peaks of US$137/lb in 2007 to lows of US$20/lb, sending many ASX uranium stocks out of business or into hibernation.

There has been recent resurgence in both investor interest in uranium as a green source of energy and an uptick in spot prices […]

Western Uranium & Vanadium Announces Strategic Acquisition of Physical Uranium

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado, June 02, 2021 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) (“Western” or the ”Company”) is pleased to announce that the Company has executed a binding agreement to purchase 125,000 pounds of natural uranium concentrate at the current market price. The triuranium octoxide (U 3 O 8 ) delivery will take place before June 2022 on a delivery date specified by Western.

This uranium purchase is among several value-added opportunities the company is pursuing. The transaction has the potential to enhance the balance sheet beyond the purchase cost through uranium price appreciation. This strategic uranium inventory could be held as a long-term investment, used for the 2022 delivery under Western’s existing supply agreement, or facilitate the negotiation of future supply agreements.

The basis for this purchase is an acquisition cost substantially below average global uranium production costs. Western first evaluated […]

Click here to view original web page at www.globenewswire.com

Uranium Energy Corp. (AMEX: UEC) Continues To Decline

Uranium Energy Corp. (AMEX:UEC) price closed higher on Tuesday, 06/01/21, jumping 5.75% above its previous close.

A look at the daily price movement shows that the last close reads $3.13, with intraday deals fluctuated between $3.21 and $3.46. Taking into account the 52-week price action we note that the stock hit a 52-week high of $3.67 and 52-week low of $0.82. The stock added 14.14% on its value in the past month.

Uranium Energy Corp., which has a market valuation of $802.01 million. It is understandable that investor optimism is growing ahead of the company’s current quarter results. Analysts tracking UEC have forecast the quarterly EPS to shrink by 0 per share this quarter, while the same analysts predict the annual EPS to hit -$0.07 for the year 2021 and up to $0.01 for 2022. In this case, analysts estimate an annual EPS growth of 12.50% for the year and 114.30% […]

ASX uranium shares are surging today

ASX uranium shares are breaking out today, with some of producers and explorers making multi-year highs. Why is uranium in the hot seat?

Uranium is mainly used as fuel for nuclear power reactors for electricity generation. Nuclear power isn’t exactly a “renewable” source of energy, but it generates near zero emissions. Uranium is expected to play a significant role in the global shift move to lower emissions over the next 30 years.

If you look at the 10-year charts of many ASX uranium shares, it isn’t uncommon for valuations to have declined by more than 90%. This is because the spot price of uranium has tumbled from peaks of US$137/lb in 2007 to lows of US$20/lb, sending many ASX uranium stocks out of business or into hibernation.

There has been recent resurgence in both investor interest in uranium as a green source of energy and an uptick in spot prices […]

NA Proactive news snapshot: Else Nutrition, Nextleaf Solutions, Tribe Property Technologies, TRACON Pharmaceuticals, Standard Uranium UPDATE …

Your daily round-up from the world of Proactive Else Nutrition Holdings Inc ( CVE:BABY ) (OTCMTKS:BABYF) (FRA:0YL) posted first-quarter results that saw its revenue rocket 282% year-over-year on the back of plant-based, non-diary, non-soy nutritional products. For the period ended March 31, 2021, the Israel-based food and nutrition company reported revenue of C$1,135,000, up from C$297,000 in the same quarter a year earlier. There was a 90% sequential growth in revenue from C$598,000 in the 4Q of 2020. During the 1Q, Else Nutrition clocked up formula revenue of C$862,000, up 149% from C$346,000 in the 4Q of 2020. Else had a strong cash position C$22,085,000 as of March 31, including restricted cash and short-term bank deposits.

Nextleaf Solutions Ltd ( CSE:OILS ) ( OTCQB:OILFF ) (FRA:L0MA) told shareholders that it had completed the second wholesale order from its recently announced customer, a Nasdaq-listed cannabis company. The Vancouver-based cannabis processor said […]

Click here to view original web page at www.proactiveinvestors.com

Coverage Initiated on Canadian Uranium Junior with ‘Aggressive Exploration Drill Program’

June 1, 2021 (Investorideas.com Newswire) A Red Cloud Securities report calls Skyharbour Resources "one of the more established junior uranium exploration companies." In a May 13 research note, analyst David Talbot reported that Red Cloud Securities initiated coverage on Skyharbour Resources Ltd. (SYH:TSX.V; SA:NYSE.MKT) , "a maverick in basement exploration," with a Speculative Buy rating and a CA$0.95 per share target price. The stock’s current share price is about CA$0.51 per share.

Talbot described the Vancouver-based uranium explorer and what makes it an attractive investment opportunity.

Skyharbour owns 100% of the Moore uranium project, on which it is currently focusing its efforts, but it also owns 100% of the Hook Lake, South Falcon Point and Mann Lake properties, along with 15% of the Preston project, Talbot noted. Recent drilling at Preston by the option partner showed anomalous uranium intercepts and indicator minerals.

"While Skyharbour does have a pipeline of projects and considers […]

Click here to view original web page at www.investorideas.com

Uranium Week: Investment Vehicle Concludes Raising

As the uranium spot price continues a four-week winning streak, Uranium Participation Corp concludes an equity raising to fund future purchases of uranium

-Uranium Participation Corp raises C$80m

-Exelon seeks nuclear plant reprieve

-Uranium spot price rises by 0.8% for the week and 10% for MayIn a good sign for interest in the uranium sector, Canadian-listed Uranium Participation Corp has closed its capital raising with proceeds of approximately C$80.5m/US$66.8 million. The original raising announced 3 May was for C$50m and it was upsized the next day to C$70m.The company invests nearly all of its assets in uranium, in the form of uranium oxide or uranium hexafluoride, with the primary objective of achieving capital appreciation. Consequently, net proceeds of the offering will be used by the company to fund such future purchases as well as an allocation toward general corporate purposes. After deducting fees, that should give the company […]

Analyzing Zero-Carbon Goals, Power Infrastructure, The Role Of Nuclear Energy, And How To Invest In Uranium

Summary

We’ll discuss the carbon neutrality targets of the UK, Europe 27, and US.

For the carbon neutrality targets, we discuss the current progress, the electrical grid, and the electrical storage required to meet those goals.

The carbon neutrality targets are not only attainable with stable base loads and nuclear energy is the best option for developed and especially emerging countries. The rise of nuclear energy offers investors a unique opportunity to invest in uranium to profit from the upcoming 10-year uranium bull market. Lastly, we’ll talk about how to invest in the nuclear energy market, especially the uranium market as this is the most important factor. Photo by ilbusca/E+ via Getty Images Developed countries are phasing out fossil fuels for energy generation and implementing laws, policies, and plans to prepare for the green-energy era.The goal of the Paris Climate Agreement is to reduce greenhouse gas emissions (GHG) to […]