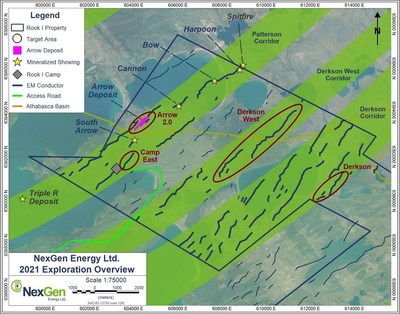

VANCOUVER, BC, July 26, 2021 /PRNewswire/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE ) (ASX: NXG) is pleased to announce commencement of field programs focused on detailed geotechnical site confirmation studies on the Project and regional exploration drilling at the 100% owned, Rook I property (the "Property"), in the Athabasca Basin, Saskatchewan.

Focus of the 2021 Regional Exploration Drilling Program: Figure 1: Rook I Property 2021 Exploration Target Areas (CNW Group/NexGen Energy Ltd.) Figure 2: Arrow 2.0 Target Area (CNW Group/NexGen Energy Ltd.) Figure 3: Dravitic Breccias present at Camp East exhibit similar characteristics to mineralized dravitic breccias intersected at Arrow. (CNW Group/NexGen Energy Ltd.) Figure 3: Dravitic Breccias present at Camp East exhibit similar characteristics to mineralized dravitic breccias intersected at Arrow. (CNW Group/NexGen Energy Ltd.) Figure 4: Conceptualized Arrow Mine Surface Design Exhibiting Minimal Surface Disturbance (CNW Group/NexGen Energy Ltd.) The Rook […]

5 Top Weekly TSX Stocks: Uranium Stocks Dominate

The S&P/TSX Composite Index (INDEXTSI: OSPTX ) opened higher last Friday (July 23), trading at 20,159.59. It closed the five day period slightly higher at 20,190.09.

The index was on track to post a weekly gain on the back of a surge in tech stocks.

On Friday, gold and silver pulled back and were set for a weekly fall as the US dollar strengthened.

Last week’s five TSX-listed mining stocks that saw the biggest gains are as follows: Forsys Metals (TSX: FSY ) Laramide Resources (TSX: LAM ) Fission Uranium (TSX: FCU ) Global Atomic (TSX: GLO ) Journey Energy (TSX: JOY ) Here’s a look at those companies and the factors that moved their share prices last week. 1. Forsys Metals Forsys Metals is focused on developing uranium projects on the African continent. The explorer currently owns the Norasa project, which includes the fully permitted Valencia uranium project, and it […]

Canadian Nuclear Safety Commission to Investigate Lung Cancer Rates Among Uranium Workers

This story was originally published by Canada’s National Observer and is reproduced here as part of the Climate Desk collaboration.

The Canadian Nuclear Safety Commission (CNSC) is leading a national study examining incidences of lung cancer in uranium workers from across the country.

The Canadian Uranium Workers Study (CANUWS) will examine health data from 80,000 past and present employees at Canada’s uranium mines, mills and processing and fabrication facilities. The study, which is now underway and set to end in 2023, is the largest examination of lung cancer in Canadian uranium workers to date.

Rachel Lane, one of the lead researchers on the new study, told Canada’s National Observer she believes it will reassure workers they face less risk than before from lung cancer arising from exposure to radon, an odorless, colorless, radioactive gas. Lane is a radiation and health scientist specialist at the CNSC in Ottawa and holds a PhD […]

Skyharbour’s Partner Company Valor Resources Announces Airborne Survey Highlights Targets at Hook Lake Project, Athabasca Basin, Canada

(OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that partner company Valor Resources Limited (“Valor”) has received the results and interpretation from the airborne magnetic and very low frequency electromagnetic (VLF-EM) geophysical survey completed over the Hook Lake Project in April. The purpose of the survey was to gather data that would help identify areas of shallow structural complexity, known to be favorable for the deposition of uranium in basement lithologies, and determine the geophysical signature of known occurrences.

Hook Lake (Formally North Falcon) Project: https://skyharbourltd.com/_resources/projects/Falcon-Point-Project.jpg

The Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. Skyharbour signed a Definitive Agreement with Valor Resources on the Hook Lake (previously North Falcon Point) Uranium Project whereby Valor can earn-in 80% of the project through $3,500,000 in total exploration expenditures, $475,000 […]

Click here to view original web page at www.juniorminingnetwork.com

Azarga Uranium Corp.: Azarga Uranium Included in Index Composition for Global X Uranium ETF

GLOBAL X URANIUM ETF Chart 1 Jahr GLOBAL X URANIUM ETF 5-Tage-Chart VANCOUVER, BC / ACCESSWIRE / July 23, 2021 / AZARGA URANIUM CORP. (TSX:AZZ)(OTCQB:AZZUF)(FSE:P8AA) ("Azarga Uranium" or the "Company") is pleased to announce that further to an ordinary rebalance in the Solactive Global Uranium & Nuclear Components Total Return Index (the "Index"), the Company will be included in the Index composition for the Global X Uranium ETF. The ordinary rebalance of the Index will be implemented effective August 2, 2021 and occurs semi-annually.

With net assets of approximately US$640 million, the Global X Uranium ETF is the largest Exchange Traded Fund ("ETF") in the uranium sector and the Index tracks the price movements in shares of companies involved in uranium mining and the production of nuclear components.

Azarga Uranium is already included in the index composition for the North Shore Global Uranium Mining ETF and the Horizons Global Uranium Index […]

Click here to view original web page at www.finanznachrichten.de

Uranium mining shows resilience during the COVID-19 crisis – Schneider

Uranium mining has proven to be one of sectors of the local economy that has shown resilience during the COVID-19 crisis, an executive said.

The long-term positive outlook of the uranium industry allowed Namibia to successfully manage a long period of depressed uranium prices.

The executive director of the Namibian Uranium Institute Dr. Gabi Schneider reiterated that the uranium industry has indeed proven to be resilient during the pandemic, as mining continued and the production figures for 2020 are only marginally lower than in 2019 before the pandemic.

She said uranium exploration also continued unabated, adding that after an initial period of minimal operations and maintenance during Namibia’s first lock-down, the mining industry was allowed to return to full production.However, this was obviously subject to the various regulations that have been published by Government ever since. However, even before regulations were gazetted, the industry had compiled elaborate protocols themselves, which ensure that […]

Azarga Uranium Included in Index Composition for Global X Uranium ETF

VANCOUVER, BC / ACCESSWIRE / July 23, 2021 / AZARGA URANIUM CORP. (TSX:AZZ)(OTCQB:AZZUF)(FSE:P8AA) ("Azarga Uranium" or the "Company") is pleased to announce that further to an ordinary rebalance in the Solactive Global Uranium & Nuclear Components Total Return Index (the "Index"), the Company will be included in the Index composition for the Global X Uranium ETF. The ordinary rebalance of the Index will be implemented effective August 2, 2021 and occurs semi-annually.

With net assets of approximately US$640 million, the Global X Uranium ETF is the largest Exchange Traded Fund ("ETF") in the uranium sector and the Index tracks the price movements in shares of companies involved in uranium mining and the production of nuclear components.

Azarga Uranium is already included in the index composition for the North Shore Global Uranium Mining ETF and the Horizons Global Uranium Index ETF.

Blake Steele, Azarga Uranium President and CEO, stated: "We are pleased to […]

The Big Reason Uranium Stocks Soared Today

Uranium stocks were on fire today. While Uranium Energy (NYSEMKT: UEC) and Denison Mines (NYSEMKT: DNN) had popped 12.5% each by 3:35 p.m. EDT, NexGen Energy (NYSEMKT: NXE) and Energy Fuels (NYSEMKT: UUUU) were up 5.2% and 6.5%, respectively, by that time. Thank a potentially game-changing new uranium exchange traded fund (ETF) that began trading on Canada’s Toronto Stock Exchange. So what

The Sprott Physical Uranium Trust fund, which was formed by Sprott Asset Management after it took over uranium asset investment manager Uranium Participation, started trading on the Toronto Stock Exchange on July 19.

Here’s why it’s such a big deal: The Sprott Physical Uranium Trust is the world’s largest uranium fund that invests in physical uranium. The entry of such a large, actively managed fund could prove to be a game changer for the uranium market as the fund will provide investors looking for exposure to uranium with […]

We’re Hopeful That GoviEx Uranium (CVE:GXU) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you’d have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we’d take a look at whether GoviEx Uranium ( CVE:GXU ) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its ‘cash runway’. Does GoviEx Uranium Have A Long Cash Runway?

A company’s cash runway is calculated […]

Azarga Uranium Included in Index Composition for Global X Uranium ETF

Azarga Uranium CORP. is pleased to announce that further to an ordinary rebalance in the Solactive Global Uranium & Nuclear Components Total Return Index the Company will be included in the Index composition for the Global X Uranium ETF. The ordinary rebalance of the Index will be implemented effective August 2, 2021 and occurs semi-annuallyWith net assets of approximately US$640 million, the Global X Uranium ETF is …

Azarga Uranium CORP. ( TSX:AZZ )(OTCQB:AZZUF)(FSE:P8AA) (“ Azarga Uranium ” or the “Company”) is pleased to announce that further to an ordinary rebalance in the Solactive Global Uranium & Nuclear Components Total Return Index (the “Index”), the Company will be included in the Index composition for the Global X Uranium ETF. The ordinary rebalance of the Index will be implemented effective August 2, 2021 and occurs semi-annually

With net assets of approximately US$640 million, the Global X Uranium ETF is the largest […]

Market Call Norman Levine’s Top Picks

Norman Levine’s Past Picks Norman Levine, managing director at Portfolio Management Corp.

Focus: Global stocks

MARKET OUTLOOK:

As the market whipsaw we witnessed earlier this week showed, trying to predict short-term stock market movement is at best a mug’s game. Don’t waste your time. Think long-term. As to that, we believe that as global economies recover from COVID-19 lockdowns (and they are not recovering in a synchronized fashion as many believed they would) earnings, stock prices and, yes, interest rates will be going higher.That doesn’t mean it will be in any ways a guaranteed smooth ride and we expect corrections and pauses along the way as world stock markets have come a very long way since bottoming in March 2020 without more than just a brief pause along the way. We would not panic and sell during those corrections, when they come, but use them as buying […]

Uranium Energy Corp. (AMEX: UEC) Slashes 0.00%: Is This A Sign Of Things To Come?

Uranium Energy Corp. (AMEX:UEC) shares, rose in value on Friday, July 23, with the stock price down by 0.00% to the previous day’s close as strong demand from buyers drove the stock to $2.20.

Actively observing the price movement in the recent trading, the stock is buoying the session at $2.20, falling within a range of $2.12 and $2.34. The value of beta (5-year monthly) is 2.44. Referring to stock’s 52-week performance, its high was $3.67, and the low was $0.82. On the whole, UEC has fluctuated by -22.26% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert […]

Uranium Energy Corp. (AMEX:UEC) trade information

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 3.53 million, with the beta value of the company hitting 2.43. At the end of the trading day, the stock’s price was $2.20, reflecting an intraday loss of -3.51% or -$0.08. The 52-week high for the UEC share is $3.67, that puts it down -66.82 from that peak though still a striking 62.73% gain since the share price plummeted to a 52-week low of $0.82. The company’s market capitalization is $541.07M, and the average intraday trading volume over the past 10 days was 5.22 million shares, and the average trade volume was 5.40 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.70. UEC has a Sell rating from 0 analyst(s) out of 2 analysts who have looked at this stock. […]

Click here to view original web page at marketingsentinel.com

Uranium mining shows resilience during the COVID-19 crisis – Schneider

Uranium mining has proven to be one of sectors of the local economy that has shown resilience during the COVID-19 crisis, an executive said.

The long-term positive outlook of the uranium industry allowed Namibia to successfully manage a long period of depressed uranium prices.

The executive director of the Namibian Uranium Institute Dr. Gabi Schneider reiterated that the uranium industry has indeed proven to be resilient during the pandemic, as mining continued and the production figures for 2020 are only marginally lower than in 2019 before the pandemic.

She said uranium exploration also continued unabated, adding that after an initial period of minimal operations and maintenance during Namibia’s first lock-down, the mining industry was allowed to return to full production.However, this was obviously subject to the various regulations that have been published by Government ever since. However, even before regulations were gazetted, the industry had compiled elaborate protocols themselves, which ensure that […]

Canadian Nuclear Safety Commission to investigate lung cancer rates among uranium workers

The Miner’s Memorial, a tribute to the mining history of Elliot Lake, Ont., includes a section honouring those who died as a result of working in the uranium mines. Photo by Luc Rivet / Wikimedia Commons (CC BY-SA 3.0) The Canadian Nuclear Safety Commission (CNSC) is leading a national study examining incidences of lung cancer in uranium workers from across the country.

The Canadian Uranium Workers Study (CANUWS) will examine health data from 80,000 past and present employees at Canada’s uranium mines, mills and processing and fabrication facilities. The study, which is now underway and set to end in 2023, is the largest examination of lung cancer in Canadian uranium workers to date.

Rachel Lane, one of the lead researchers on the new study, told Canada’s National Observer she believes it will reassure workers they face less risk than before from lung cancer arising from exposure to radon, an odourless, colourless, […]

Click here to view original web page at www.nationalobserver.com

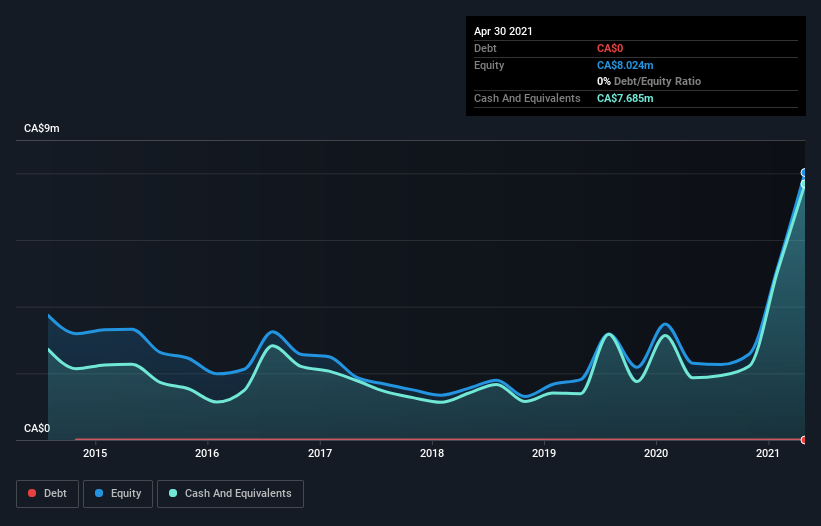

Companies Like CanAlaska Uranium (CVE:CVV) Can Afford To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. Indeed, CanAlaska Uranium ( CVE:CVV ) stock is up 182% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So notwithstanding the buoyant share price, we think it’s well worth asking whether CanAlaska Uranium’s cash burn is too risky. In this report, we will consider the company’s annual negative free cash flow, henceforth referring to it as the ‘cash burn’. First, we’ll determine its cash runway by comparing its cash burn with its cash reserves. Does CanAlaska Uranium Have A Long Cash Runway?

A cash runway is defined as the length of time it would take a company to run out of money if it kept […]

Hudson Provides Update on Niobium Metallurgical Program and Proposed Legislative Changes in Greenland

VANCOUVER, British Columbia, July 22, 2021 (GLOBE NEWSWIRE) — HUDSON RESOURCES INC. (“ Hudson ” or the “ Company ”) (TSX Venture Exchange “HUD”; OTC “HUDRF”) would like to provide an update on the niobium metallurgical program on the Company’s Nukittooq niobium-tantalum project and provide comments on the legislation being proposed for uranium extraction by the recently elected Government in Greenland.

Legislative Update

The Government of Greenland recently prepared a draft Bill to ban uranium prospecting, exploration, and exploitation. The draft Bill has been introduced to seek a zero-tolerance policy on the mining and sale of uranium. The ban does not cover other radioactive elements such as thorium, although the proposed Bill gives the Government the option to extend this to other radioactive elements. The draft Bill provides that it is at the Government’s discretion as to whether they approve a project based on how uranium waste is handled. […]

Click here to view original web page at www.globenewswire.com

Uranium Energy Corp. [UEC] Is Currently 10.26 above its 200 Period Moving Avg: What Dose This Mean?

Uranium Energy Corp. [AMEX: UEC] closed the trading session at $2.15 on 07/20/21. The day’s price range saw the stock hit a low of $1.96, while the highest price level was $2.24. The company report on June 25, 2021 that Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio.

NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”.

To hear the AudioPressRelease, please visit: The NetworkNewsAudio News Podcast.

The stocks have a year to date performance of 22.16 percent and weekly performance of 0.00 percent. The stock has been moved at 31.10 percent over the last six months. The stock has performed -25.61 percent around the most recent 30 days and changed -16.99 percent over the most recent 3-months.If compared to the average trading volume of 5.44M shares, UEC reached to a volume of 5574785 in […]

Why Uranium Stocks Were Heading for the Sky Today

What happened

Shares of junior uranium miners shot through the roof today. As of the market’s close on Wednesday, Uranium Energy (NYSEMKT: UEC), Energy Fuels (NYSEMKT: UUUU), and Ur-Energy (NYSEMKT: URG) were up 6.1%, 9.5%, and 8.2%, respectively. As if the emergence of the world’s first exchange-traded fund (ETF) that invests in physical uranium wasn’t enough to stir up frenzied buying in uranium stocks, big nuclear energy news from Japan this morning added fuel to the enthusiasm. So what

Miners’ profitability depends a great deal on uranium prices. After a lull that lasted years, uranium spot prices crossed $30 per pound in 2020, only to give up some gains as 2021 kicked off. Prices have bounced back by double digits since, though, triggering hopes of better days ahead for uranium miners.

The enthusiasm hit a whole new level when the Sprott Physical Uranium Trust Fund started trading on the Toronto […]

The Big Reason Uranium Stocks Soared Today

Uranium stocks were on fire today. While Uranium Energy ( NYSEMKT:UEC ) and Denison Mines and Energy Fuels ( NYSEMKT:UUUU ) were up 5.2% and 6.5%, respectively, by that time. Thank a potentially game-changing new uranium exchange traded fund (ETF) that began trading on Canada’s Toronto Stock Exchange. So what

The Sprott Physical Uranium Trust fund, which was formed by Sprott Asset Management after it took over uranium asset investment manager Uranium Participation, started trading on the Toronto Stock Exchange on July 19.

Here’s why it’s such a big deal: The Sprott Physical Uranium Trust is the world’s largest uranium fund that invests in physical uranium. The entry of such a large, actively managed fund could prove to be a game changer for the uranium market as the fund will provide investors looking for exposure to uranium with an easy, liquid option to park their money into. That should spur […]

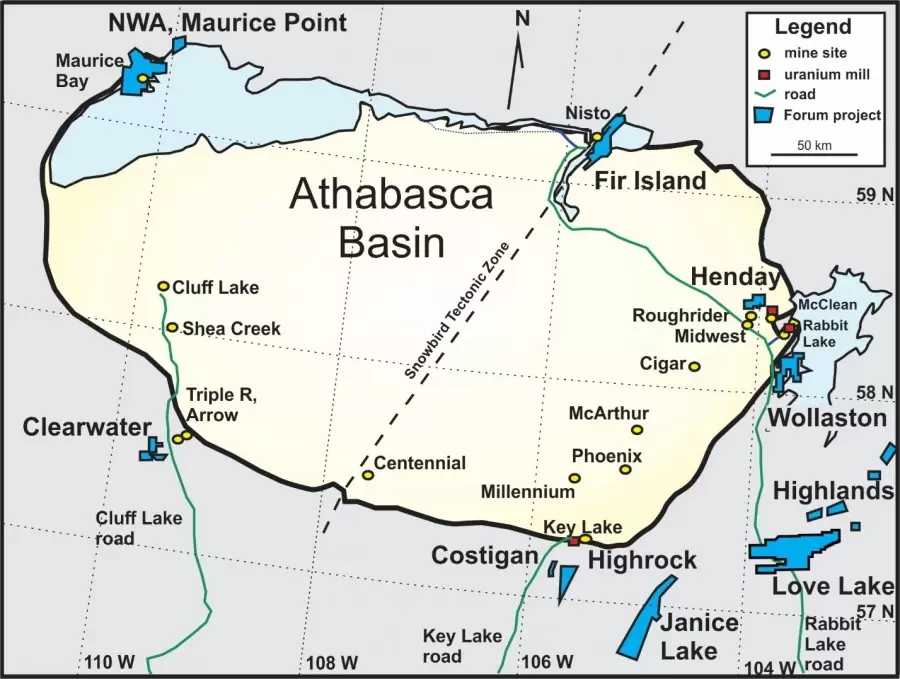

Forum Provides Mid-Year Update and Plans for 2021

Forum Energy Metals Corp. is pleased to update shareholders with a mid-year review of the Company’s current exploration activities and exploration plans for the remainder of 2021 on its copper, uranium, nickel, cobalt and palladium projects in Saskatchewan and Idaho .Janice Lake CopperSilver Rio Tinto Exploration Canada continues drilling at the 2.6 km Rafuse target, the fourth target drilled by RTEC over a six …

Forum Energy Metals Corp. ( TSXV: FMC ) (OTCQB: FDCFF) (“Forum” or “the Company”) is pleased to update shareholders with a mid-year review of the Company’s current exploration activities and exploration plans for the remainder of 2021 on its copper, uranium, nickel, cobalt and palladium projects in Saskatchewan and Idaho (Figure 1).

Janice Lake Copper/Silver (Rio Tinto Option to Earn 80%)

Rio Tinto Exploration Canada (“RTEC”) continues drilling at the 2.6 km Rafuse target, the fourth target drilled by RTEC over a six kilometre […]

Can Uranium Energy Corp. (UEC) survive current economic conditions?

Canaccord Genuity raised the price target for the Uranium Energy Corp. (AMEX:UEC) stock to “a Speculative buy”. The rating was released on October 14, 2020. The research report from H.C. Wainwright has resumed the stock to Buy, with a price target set at $4.20. The stock was reiterated by RBC Capital Mkts, who disclosed in a research note on March 14, 2013, to Underperform and set the price objective to $1.25. In their research brief published June 05, 2012, Dahlman Rose analysts initiated the Uranium Energy Corp. stock to Buy with a price target of $3.25.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve […]

Forum Energy Metals Provides Mid-Year Update and Plans for 2021

Janice Lake Copper/Silver (Rio Tinto Option to Earn 80%)

Rio Tinto Exploration Canada ("RTEC") continues drilling at the 2.6 km Rafuse target, the fourth target drilled by RTEC over a six kilometre strike length. Four holes have been drilled to date following up on the nine hole drill program completed this winter and drilling will continue through the summer. Field crews have been mapping and sampling for the past month in the area of the 3.8% copper boulder discovered in 2020.

Love Lake Nickel/Copper/Palladium (100% Forum)

Forum has received results from the airborne electromagnetic survey announced May 10, 2021 over the Love Lake mafic/ultramafic complex. The Company is finalizing drill targets from the survey as well as targeting the surface copper/nickel/platinum/palladium showings. A 3,000 metre drill program is planned to commence in the first week of August. Quartz Gulch Cobalt/Copper (100% Forum) Forum plans a prospecting, mapping and sampling […]

Click here to view original web page at www.juniorminingnetwork.com

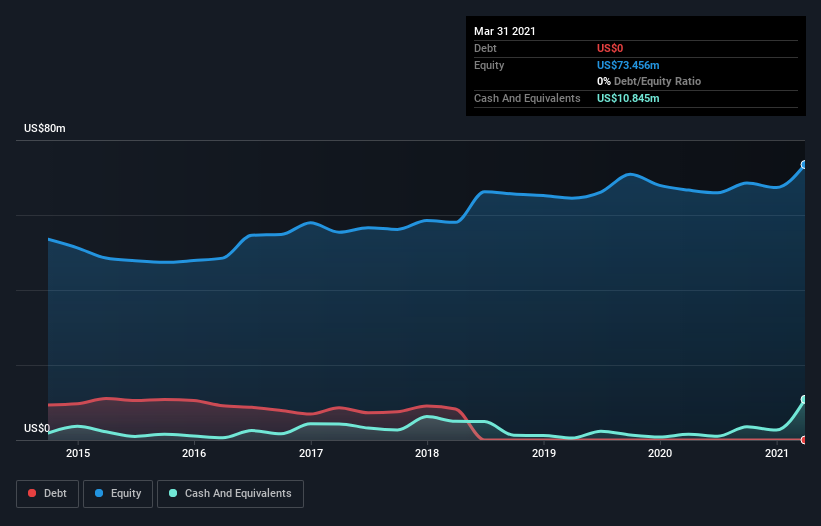

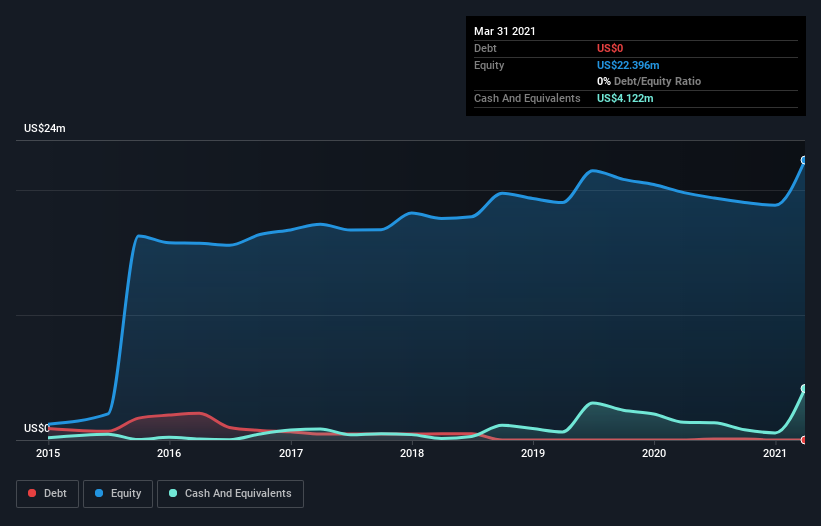

Western Uranium & Vanadium (CSE:WUC) Is In A Strong Position To Grow Its Business

There’s no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Western Uranium & Vanadium ( CSE:WUC ) stock is up 317% in the last year, providing strong gains for shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it’s well worth asking whether Western Uranium & Vanadium’s cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we’ll determine its cash runway by comparing its cash burn with its cash reserves. Does Western Uranium & Vanadium Have A Long Cash Runway?

A company’s cash runway is the amount of time it would take to burn through its cash reserves at its […]

The Big Reason Uranium Stocks Soared Today

Uranium stocks were on fire today. While Uranium Energy (NYSEMKT: UEC) and Denison Mines (NYSEMKT: DNN) had popped 12.5% each by 3:35 p.m. EDT, NexGen Energy (NYSEMKT: NXE) and Energy Fuels (NYSEMKT: UUUU) were up 5.2% and 6.5%, respectively, by that time. Thank a potentially game-changing new uranium exchange traded fund (ETF) that began trading on Canada’s Toronto Stock Exchange. So what

The Sprott Physical Uranium Trust fund, which was formed by Sprott Asset Management after it took over uranium asset investment manager Uranium Participation, started trading on the Toronto Stock Exchange on July 19.

Here’s why it’s such a big deal: The Sprott Physical Uranium Trust is the world’s largest uranium fund that invests in physical uranium. The entry of such a large, actively managed fund could prove to be a game changer for the uranium market as the fund will provide investors looking for exposure to uranium with […]