Scott Buffon/Arizona Daily Sun via AP ust 10 miles south of the entrance to the South Rim of the Grand Canyon is a giant hole in the ground where miners are hoping to strike it big with one of Earth’s rarest but deadliest elements—uranium. Despite it only being about 17 acres in size, the Canyon Mine extends over 1,400 feet down into the Earth’s surface and critics worry it could scar the Grand Canyon itself and pollute a nearby tribe’s water.

Mining has been prevalent in the region surrounding the Grand Canyon since the early 1900s. During the atomic era of the 1950s, it was a little bit like the Wild West—interest in uranium mining soared and it evolved into a highly unregulated industry, where people were walking around with Geiger counters and shovels, hoping to sell it to the government for profit.

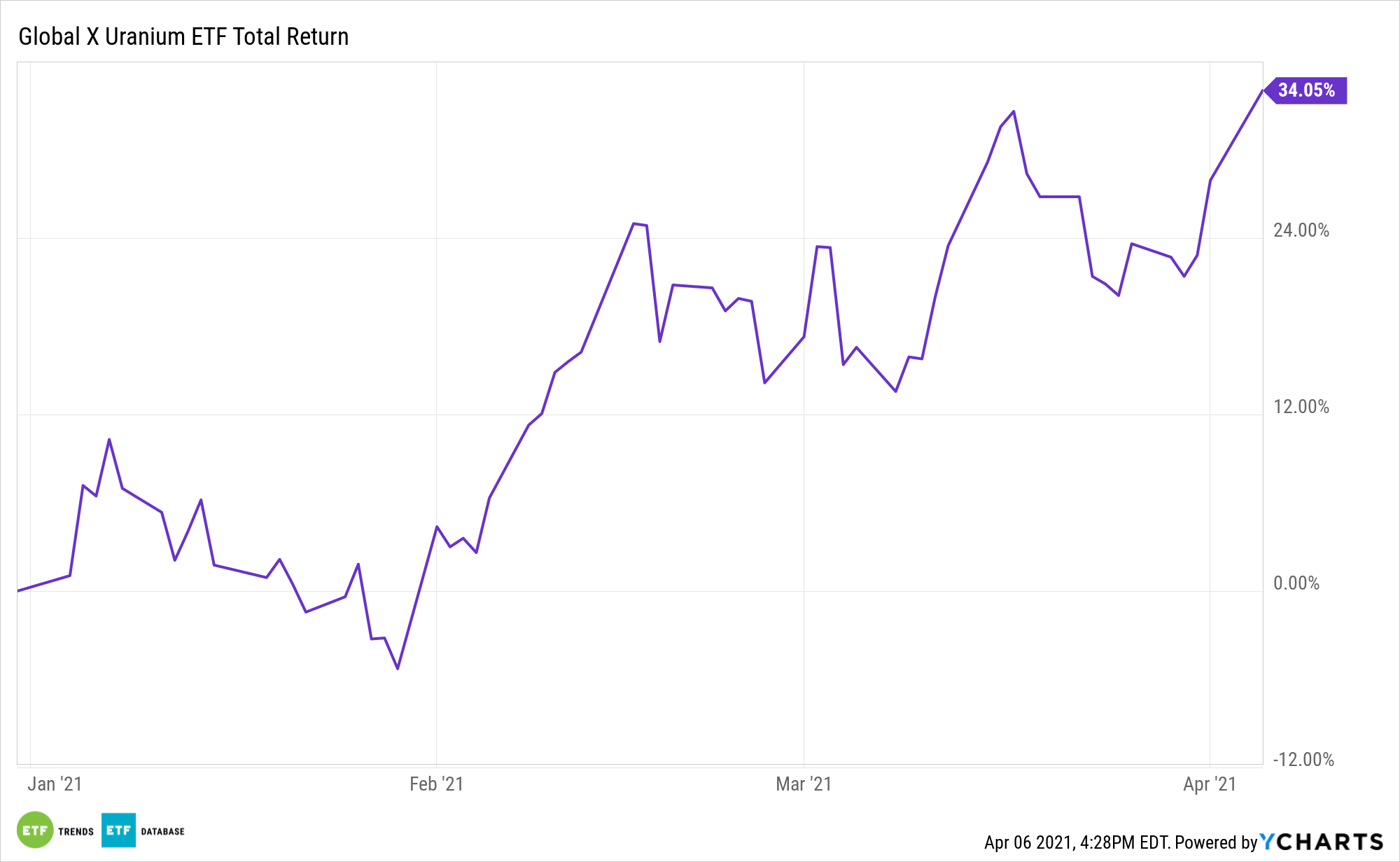

As the price of uranium plummeted, so did […]

Click here to view original web page at www.thedailybeast.com