The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

Tag: uranium

New High-Grade Cobalt-Nickel Discovered at Michael Lake

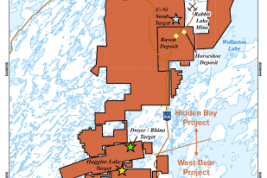

Hole grades 2.08% Co and 3.58% Ni over 4.5 metres within broader interval UEX Corporation is pleased to announce that a new zone of cobalt-nickel mineralization was intersected at Michael Lake with the fourth hole of its 2021 winter uranium-cobalt exploration drill program on the West Bear Property . Drill hole MIC-004 intersected mineralization that grades 0.52% Co and 1.01% Ni over 23.5 m from 44.0 to 67.5 m …

(TheNewswire) Hole grades 2.08% Co and 3.58% Ni over 4.5 metres within broader interval

UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that a new zone of cobalt-nickel mineralization was intersected at Michael Lake with the fourth hole of its 2021 winter uranium-cobalt exploration drill program on the West Bear Property (see Figure 1) . Drill hole MIC-004 intersected mineralization that grades 0.52% Co and 1.01% Ni over 23.5 m from 44.0 to 67.5 […]

Cameco Stock is the Real Deal Uranium Play

Uranium producer Cameco Corporation (NYSE: CCJ) stock has been breaking out through multi-year highs on the renewed interest in clean energy spurring uranium demand. Uranium is used to fuel nuclear power plants that provide 20% of the electricity and up to 55% of all clean energy in the U.S. The U.S. uranium reserves plan coupled with the Biden administration’s clean energy agenda has changed the sentiment for nuclear energy. Nuclear is clean but not renewable like solar or wind , thus require a continued source of uranium . Unlike junior and developmental companies like Energy Fuels (NASDAQ: UUUU) and Dennison Mines (NYSE: DNN) , Cameco is already processing and selling uranium, making them the real deal for investors looking for exposure in this industry. Cameco has 43 projects in the works and will implement those that enable them to capture demand and provide leverage for higher prices in 2021. […]

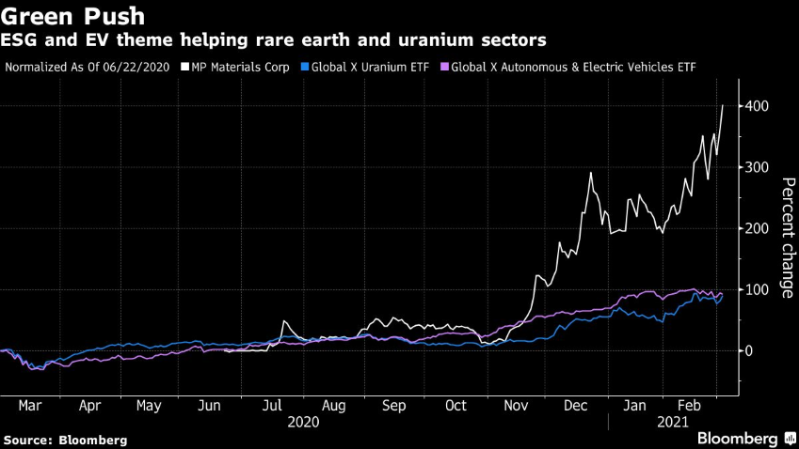

Rare Earth, Uranium Miners Benefit From EV Mania and Dash of ESG

(Bloomberg) — Rare earth miners and uranium producers are reaping rewards from the flood of money pouring into electrification and ESG investing themes. Lithium producers have been more traditional beneficiaries of EV and the green energy push. But more recently, rare earth producers have also started to garner investors attention amid enthusiasm about electric vehicles.

Shares of MP Materials Corp., the largest U.S. based miner of rare earths, is up more than fourfold since Biden won the election four months ago, compared with an 86% gain in VanEck Vectors Rare Earth/Strategic Metals ETF.

Shares in the company, which went public via a SPAC deal in July, rose for a third day and were up 0.7% to $49.8 on Wednesday. Morgan Stanley initiated research on the stock on Tuesday, with a price target of $57.

MP is “a play on accelerating adoption of electric vehicles and electrification trends in wind turbines,” Morgan Stanley […]

Rare Earth, Uranium Miners Benefit From EV Mania and Dash of ESG

(Bloomberg) — Rare earth miners and uranium producers are reaping rewards from the flood of money pouring into electrification and ESG investing themes. Lithium producers have been more traditional beneficiaries of EV and the green energy push. But more recently, rare earth producers have also started to garner investors attention amid enthusiasm about electric vehicles.

Shares of MP Materials Corp., the largest U.S. based miner of rare earths, is up more than fourfold since Biden won the election four months ago, compared with an 86% gain in VanEck Vectors Rare Earth/Strategic Metals ETF.

Shares in the company, which went public via a SPAC deal in July, rose for a third day and were up 0.7% to $49.8 on Wednesday. Morgan Stanley initiated research on the stock on Tuesday, with a price target of $57.

MP is “a play on accelerating adoption of electric vehicles and electrification trends in wind turbines,” Morgan Stanley […]

Rare Earth, Uranium Miners Benefit From EV Mania and Dash of ESG

BC-Rare-Earth-Uranium-Miners-Benefit-From-EV-Mania-and-Dash-of-ESG , Aoyon Ashraf (Bloomberg) — Rare earth miners and uranium producers are reaping rewards from the flood of money pouring into electrification and ESG investing themes.

Lithium producers have been more traditional beneficiaries of EV and the green energy push. But more recently, rare earth producers have also started to garner investors attention amid enthusiasm about electric vehicles.

Shares of MP Materials Corp., the largest U.S. based miner of rare earths, is up more than fourfold since Biden won the election four months ago, compared with an 86% gain in VanEck Vectors Rare Earth/Strategic Metals ETF.

Shares in the company, which went public via a SPAC deal in July, rose for a third day and were up 0.7% to $49.8 on Wednesday. Morgan Stanley initiated research on the stock on Tuesday, with a price target of $57.MP is “a play on accelerating adoption of electric vehicles and electrification trends in wind […]

Why ASX uranium shares could run even hotter in 2021

There’s no arguing with the numbers. The past year (and then some) has seen the leading ASX uranium shares truly light up.

The Paladin Energy Ltd (ASX: PDN) share price, for example, is up 415% over the past 12 months. ASX uranium miner Deep Yellow Ltd (ASX: DYL) ’s share price is up 246% over that same time.

Things have continued apace in 2021, with Deep Yellow shares up 24% in the calendar year and Paladin shares up 54%.

That more than handily outpaces the one-year 7% gains posted by the broader All Ordinaries Index (ASX: XAO), not to mention the 0.4% loss on the All Ords so far in 2021.But the run higher for ASX uranium shares like these could only just be getting started. Why ASX uranium shares may have a bright future Australia may not opt to use uranium for its own power sources. Though Australia – both fortuitously […]

Is Denison Mines a Good Uranium Stock to Buy?

The uranium exploration and development company Denison Mines Corp ( DNN ), which is known for its Wheeler River uranium project, rallied 55.1% over the past month to close yesterday’s trading session at $1.14. The unusually cold weather in the United States this winter is driving a huge demand for electricity. This is being met in-part by nuclear power plants that require uranium to generate electricity.

Nevertheless, DNN has declined 23.2% since hitting its 52-week high of $1.81 on February 17, 2021. This can be primarily attributed to the company’s weak financials. Also, DNN’s projects are still in their early stages. Its flagship project, the Wheeler River, is still in its evaluation and environmental assessment stage.

Here are the factors that we think could influence DNN’s performance in the near term:

Selling Shares to Fund Developmental Activities DNN announced on March 3, 2021 that it had closed its private placement of […]

North Shore Global Uranium Mining ETF – Surpasses $125 Million in Assets; Baseload, Carbon-Free Nuclear Gains Attention in Climate Debate

NEW YORK, March 4, 2021 /PRNewswire/ — The North Shore Global Uranium ETF (NYSE: URNM ) has surpassed $125 million in assets under management (AUM) as of 3/1/21. Launched on 12/4/19, the fund has produced a cumulative return of over 119% (on a price basis) since its inception through 2/28/21.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Shares are bought and sold at market price and not individually redeemed from the fund. Brokerage commissions will reduce returns. Returns for periods of less than one year are not annualized. For performance current to the most recent month end, visit https://urnmetf.com/urnm . High short-term performance of the fund is unusual and investors should not expect such performance […]

Nuclear Power Finds a New Role in Renewable Energy. That Will Boost Uranium Prices.

Employees of the Tokyo Electric Power Company stand next to a sea wall at the company’s Fukushima Daiichi nuclear power plant which was badly damaged in the 2011 earthquake and tsunami. It has been a decade since the Japan nuclear disaster caused the energy industry to rethink the safety of the power source. But the event hasn’t led to the destruction of the market or uranium demand.

Instead, it may have highlighted the importance of nuclear-power generation in the world’s efforts to provide clean energy

.

“It would be far from accurate to say that Fukushima was the death knell for the nuclear industry,” says Jonathan Hinze, president at nuclear-fuel consultancy UxC.On March 11, 2011, Japan suffered from a 9.0-magnitude earthquake , the largest ever recorded in the country. The massive tsunamis created by the quake flooded the Fukushima Daiichi power plant and led to the worst nuclear disaster in a […]

Denison Completes Bought Deal Private Placement of Flow-Through Shares for Proceeds of $8 Million

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES Denison Mines Corp. is pleased to announce that it has closed its bought deal private placement of common shares that qualify as “flow-through shares” for purposes of the Income Tax Act previously announced on February 11, 2021 . View … Denison Mines (CNW Group/Denison Mines Corp.) /NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES /

Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML) (NYSE American: DNN) is pleased to announce that it has closed its bought deal private placement of common shares that qualify as “flow-through shares” for purposes of the Income Tax Act ( Canada ) (the “Flow-Through Shares”), […]

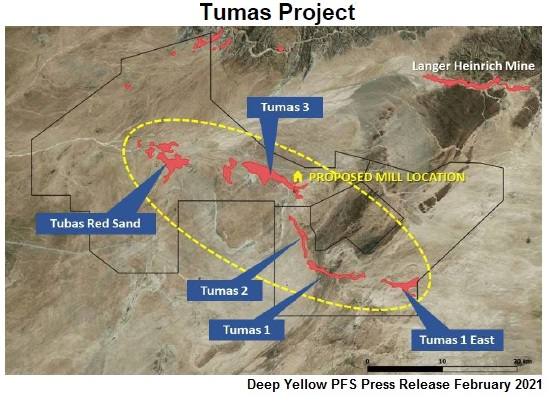

Deep Yellow Limited Releases Positive PFS with Maiden Reserve on Tumas Project; Board Approves Proceeding Directly to a DFS

OTC:DYLLF | ASX:DYL.AX

Deep Yellow (OTC:DYLLF) (ASX:DYL.AX) has achieved several highly significant milestones over the last few weeks concerning the company’s advancement toward becoming a Tier I multi-jurisdictional uranium producer during the current uranium up cycle.

1) A positive Pre-Feasibility Study (PFS) on the Tumas Project aka the Reptile Project, including a Maiden Reserve for the Project

2) The completion of a AUD$ 40.8 million private placement to help fund management’s dual-pillar growth strategy, namely advancing the Tumas Project to production and becoming a multi-jurisdictional producera. The net proceeds plus cash on hand will be utilizedi. to complete the DFS on the Tumas Projectii. to fund drilling programs to upgrade and expand the Resources at Tumas andiii. to pursue acquisitions/ mergers3) Having reviewed the PFS, the Board approved the immediate pursuit of a Definitive Feasibility Study (DFS). Work of the DFS commenced in February 2021 with an expected completion date by the […]

Uranium stocks rally as nations tighten emissions targets

Uranium stocks are on the rise as demand grows with nuclear power touted as essential to meeting zero emissions goals by 2050. The uranium industry is setting up for an accelerated rise in prices with a supply deficit looming and demand growing as governments target ‘cleaner and greener’ energy sources – a sector in which nuclear power didn’t seem to be considered until now.

Nuclear power has been sidelined by governments for years, hampered by its dangerous association with the atomic bomb and radioactive disasters. However, it is recently regaining attraction for its low emissions, ability to reliably provide baseload electricity around the clock and its relatively low cost as a generation fuel.

One of the first tasks new US President Joe Biden undertook in January was the country’s reinstatement to the Paris climate agreement and while it’s not clear as yet what he’ll do to meet the pact’s emissions goals, […]

Appia Proposes Corporate Name Change to Highlight Its Rare Earth Element and Uranium Focus

March 3, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) today announced that it will seek shareholder approval to change its name to “APPIA RARE EARTHS & URANIUM CORP.” in order to better identify the Company’s focus on the Alces Lake Project and the Athabasca Basin uranium prospects. The Property hosts some of the highest-grade total and critical rare earth elements (“ CREE “) and gallium mineralization in the world. CREE is defined here as those rare earth elements that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines, (i.e: neodymium (Nd), praseodymium (Pr) dysprosium (Dy), and terbium (Tb)).

In the oxide form, the Shanghai Metals Market quoted February 28 prices per kg in US$ are: Nd $105, up over 100% year over year […]

Royalty Round up, February 2021 – Important battery metals and uranium deals announced but majors and juniors still take a knock

February is the shortest month and a lot of royalty companies saw their share price performance come up short during the month February 2021 did not live up to expectations with the average share price for mining royalty and streaming companies down 3.4%; 76% of mining royalty and streaming companies had a negative or neutral share price movement compared to the start of the previous month.

This is despite major developments last month with deals in the battery metals and uranium royalties space. These deals demonstrate that the royalty market is starting to change, with the importance of royalties over large mining and metals projects that are not in the traditional precious metals space increasing. This could well be the pivotal moment in the short history of royalty companies, where we start to see the rise of non-precious metals and diversified royalty companies.

The majors were worst off last month down […]

Click here to view original web page at www.proactiveinvestors.co.uk

Resources Top 5(ish): Punters line up for uranium, lithium, gold and nickel plays

(Brooklyn 99/NBC) share

Carawine and Accelerate hit thick high grade gold at their respective projects

Uranium plays Bannerman and Alligator ride surging sentiment into solid gains

Hawkstone exceeds 99.5 per cent battery grade lithium benchmark in early testing Here are the top resources stocks in morning trade, Wednesday March 3. The Big Sandy lithium project in Arizona, USA “ can help President Biden deliver on his Green dream for net-zero emission by 2050 ”, Hawkstone says.Early test work produced battery grade lithium at 99.7 per cent purity from Big Sandy — exceeding the 99.5 per cent purity benchmark for battery grade lithium.Lithium recoveries of 90 per cent were also “demonstrated with minimal downstream losses”.Now it’s all about ramping up. Design of the bench scale (lab scale) and pilot-scale (smol plant scale) phases is currently underway, with bench scale testing due to kick off in March 2021, […]

UEX Presenting at the Red Cloud Pre-PDAC Mining Showcase on March 3rd

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – March 2, 2021 UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that its President and CEO Roger Lemaitre will present at 2:40 pm ET on March 3, 2021 with a follow-up question and answer period at the Red Cloud’s Virtual 2021 Pre-PDAC Mining Showcase Conference.

UEX’s presentation will begin at 2:40 pm ET on Wednesday March 3, 2021.

UEX invites individual and institutional investors, as well as advisors and analysts, to attend. If you would like to participate in the conference, please register at http://www.redcloudfs.com/prepdac2021/ Registered participants can request 1 on 1 meetings with UEX to learn more about our unique portfolio of projects during the Showcase from March 3 rd through March 5 th .

Recent Company Highlights – UEX recently announced that the Company’s winter 2021 exploration drill program testing targets on the Hidden […]

Western Uranium & Vanadium : Closes Final Tranche of Non-Brokered Private Placement

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado – Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) ("Western" or the "Company") is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the "Private Placement") (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the "Units") at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a "Share") plus one common […]

Click here to view original web page at www.marketscreener.com

Why Energy Fuels Stock Jumped 12% at the Open Today

What happened

Shares of uranium miner Energy Fuels ( NYSEMKT:UUUU ) rose a quick 12% in early trading on March 2. The most likely cause for the stock price move was the company’s news release after the close on March 1 announcing that it had signed a new deal outside of the uranium space. So what

Although Energy Fuels’ core business is mining for uranium, it has been looking to expand its reach into the rare earth metals space. To that end, in November 2020 the company announced that it had produced a rare earth element carbonate concentrate from material provided by a third party. Rare earth metals are integral to modern technology like electric vehicles but most of the rare earth metals available come from China. Recently China has floated the idea that it might limit exports of rare earth metals. That’s increased the demand for alternative sources […]

Skyharbour’s Partner Company Valor Initiates Phase I Work at Hook Lake Uranium Project; Skyharbour to Participate in Red Cloud’s 2021 Pre-PDAC Mining Showcase and Exhibiting at PDAC 2021 Convention

VANCOUVER, British Columbia, March 02, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) announced that partner company Valor Resources Limited (“Valor”) has entered into an Agreement with TerraLogic Exploration Inc. (“TerraLogic”) to provide mineral exploration services on its Hook Lake (previously called North Falcon Point) uranium project located in the eastern Athabasca Basin area of Saskatchewan. The first phase of exploration work will be an airborne geophysical survey over the Hook Lake Project. TerraLogic is currently finalizing the flight grid and technical parameters for the survey and soliciting quotes from airborne contractors with contracts anticipated to be finalized in March.

Hook Lake (North Falcon Point) Property Location

https://skyharbourltd.com/_resources/maps/hooklakeproject.pngThe Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The property hosts over […]

Click here to view original web page at www.globenewswire.com

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

Toronto, Ontario and Nucla, Colorado , March 01, 2021 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) (“ Western ” or the ” Company ”) is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the “ Private Placement ”) (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the ” Units ”) at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a " Share ") […]

Click here to view original web page at www.globenewswire.com

Skyharbour’s Partner Company Valor Initiates Phase I Work at Hook Lake Uranium Project; …

VANCOUVER, British Columbia, March 02, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) announced that partner company Valor Resources Limited (“Valor”) has entered into an Agreement with TerraLogic Exploration Inc. (“TerraLogic”) to provide mineral exploration services on its Hook Lake (previously called North Falcon Point) uranium project located in the eastern Athabasca Basin area of Saskatchewan. The first phase of exploration work will be an airborne geophysical survey over the Hook Lake Project. TerraLogic is currently finalizing the flight grid and technical parameters for the survey and soliciting quotes from airborne contractors with contracts anticipated to be finalized in March.

Hook Lake (North Falcon Point) Property Location

https://skyharbourltd.com/_resources/maps/hooklakeproject.pngThe Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The property hosts over half […]

Boss Energy pushes ahead with Honeymoon mine plans as uranium shortage unfolds

Boss Energy plans on becoming one of the lowest cost uranium producers globally. With predictions of an emerging uranium shortage in the near-term, Boss Energy (ASX: BOE) is a South Australian uranium explorer ready to take full advantage of the situation with its advanced Honeymoon uranium project in South Australia.

Uranium supplies were in a deficit last year compounded by the delay of new mines due to the ongoing subdued spot price and production constraints due to COVID-19.

However, with trade tensions easing particularly between the US and China, its expected utilities will re-enter the market in 2021 in search of long-term supplies.

Although the spot price remains below US$30 per pound, analysts are predicting eroding supplies and the dry project pipeline will spur uranium prices upward again past the US$50/lb which is the estimated “magic number” to incentivise new mines.Boss is poised to take advantage of the optimistic uranium outlook, while […]

Fission Uranium CEO, Ross McElroy, to Present at the BMO Global Metals and Mining Conference (Virtual)

KELOWNA, BC, March 1, 2021 /CNW/ – FISSION URANIUM CORP. ("Fission" or the "Company") is pleased to announce that President and CEO, Ross McElroy, will present at the BMO Metals and Mining Conference, which will take place virtually from March 1 – 5, 2021.

Mr. McElroy will provide an overview of Fission’s completed transition from explorer to developer, as well as the current activity and next steps for the Company’s advanced, high-grade and near surface uranium project in Saskatchewan. He will be participating in the Rapid Fire, Fireside Chat on March 3 at 3:00pm EST.

Fireside Chat Details Spokesperson : Ross McElroy, President and CEO

Investors interested in attending the Fission Uranium webcast at the event can register here bmo.qumucloud.com/view/2021-gmm-fission . Drilling Update Fission is also pleased to announced that core drilling has now commenced at its PLS property – host to the large, high-grade and near surface Triple R […]

Click here to view original web page at www.juniorminingnetwork.com

2021: A Breakout Year for Uranium Investments?

(Image via Anfield Energy Inc.) The Athabasca Basin is perhaps best known as the world’s leading source of high-grade uranium and currently supplies about 20% of the world’s uranium. It is a region in the Canadian Shield that encompasses northern Saskatchewan to Alberta across its 100,000 km2 area.

The basin is the home of both uranium producers and explorers such as Anfield Energy Inc. ( TSX-V: AEC , OTCQB: ANLDF , Forum ) .

This uranium and vanadium development Company is involved in near-term production that working to become one of the top-tier energies-related fuel suppliers as it creates value through the sustainable and efficient growth.

Anfield’s flagship uranium operation is the Charlie Project located in the Pumpkin Buttes Uranium District in Johnson County, Wyoming. Charlie consists of a 2.9 sq. km. (720-acre) uranium lease, which had a Preliminary Economic Assessment (PEA) completed in 2019.The Company’s other key asset is the […]