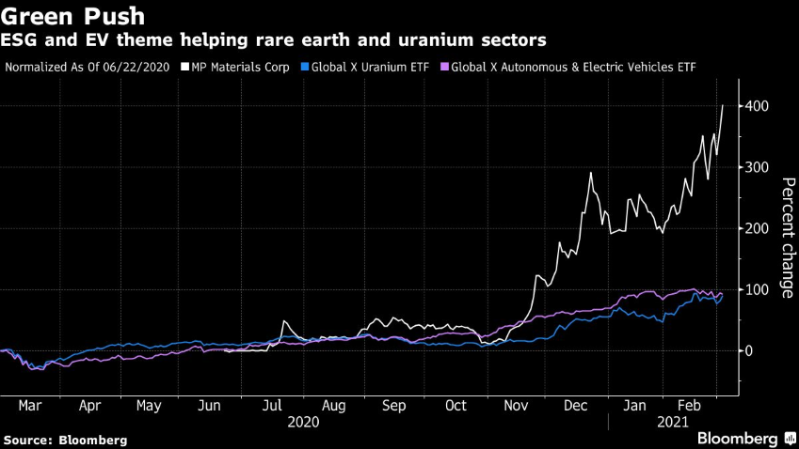

(Bloomberg) — Rare earth miners and uranium producers are reaping rewards from the flood of money pouring into electrification and ESG investing themes. Lithium producers have been more traditional beneficiaries of EV and the green energy push. But more recently, rare earth producers have also started to garner investors attention amid enthusiasm about electric vehicles.

Shares of MP Materials Corp., the largest U.S. based miner of rare earths, is up more than fourfold since Biden won the election four months ago, compared with an 86% gain in VanEck Vectors Rare Earth/Strategic Metals ETF.

Shares in the company, which went public via a SPAC deal in July, rose for a third day and were up 0.7% to $49.8 on Wednesday. Morgan Stanley initiated research on the stock on Tuesday, with a price target of $57.

MP is “a play on accelerating adoption of electric vehicles and electrification trends in wind turbines,” Morgan Stanley […]

Click here to view original web page at www.msn.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments