Summary

A supply crunch that built up over several years is starting to impact uranium prices.

As major investment banks initiate uranium coverage for the first time in a decade, more generalist investors will take an interest in the sector.

Environmentalists are changing their attitude towards nuclear power. URNM is still the best option for generalist investors seeking broad uranium exposure. Risk-reward of investing in URNM is highly favorable. Photo by vchal/iStock via Getty Images The case for uranium is a simple story of supply-demand imbalance. Over the last several years, the market narrative has ignored supply destruction, and underestimated new sources of demand. Yet there is a high probability that this imbalance will be resolved with higher uranium prices.The easiest way for generalists to position themselves for a potential uranium bull market is with the Exchange Traded Concepts – North Shore Global Uranium Mining ETF ( URNM ). […]

Category: Uranium

Guy on Rocks: Why the case for uranium has never looked stronger

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. Market ructions: Sovereign risk and supply disruptions are your friends?

Another compelling round of economic data has come out of China, with apparent steel consumption for the second month of 2021 (2M21) up 22 per cent year-over-year (YoY) (+10.1 per cent December) and net steel exports rising by 34 per cent YoY, according to Citi Research (24 March 2021).

2M21 iron ore imports increased 3 per cent YoY driven by strong growth in steel production, which was up 13 per cent YoY over the same period.

I anticipate China’s steel end-use demand to hold up over 2Q21 but […]

MiningNewsBreaks – Uranium Energy Corp. (NYSE American: UEC) Featured in Bell2Bell Podcast

Get inside Wall Street with StreetInsider Premium . Claim your 1-week free trial here .

Uranium Energy (NYSE American: UEC) , a Corpus Christi, Texas-based uranium mining and exploration company, was featured in The Bell2Bell Podcast , a part of InvestorBrandNetwork’s (“IBN”) sustained effort to provide specialized content distribution via widespread syndication channels. Uranium Energy’s CEO and President, Amir Adnani, joined the latest episode to discuss the company’s recent news and milestones, which include strengthening of its balance sheet that totals close to $95 million in cash and equity holdings, including approximately $61 million in cash. Adnani also discussed the company’s establishment of a physical uranium holding initiative. “This has really both resonated with the market and, in my opinion, is just sound business for us,” Adnani said in the interview. “We are, as a company, focused entirely on developing low-cost in-situ recovery uranium projects in the U.S., […]

Click here to view original web page at www.streetinsider.com

Uranium firms increase inventory from spot market

Uranium companies in Australia and Canada have announced purchases of physical uranium holdings. Boss Resources says its strategic uranium acquisition will strengthen its position as it moves forward towards the restart of the Honeymoon project in Western Australia. Vancouver, Canada-based Uranium Royalty Corp (URC) is to buy USD10 million of physical uranium through a supply agreement with Yellow Cake plc. The Honeymoon project (Image: Boss) Subiaco, Western Australia-based Boss has entered into binding agreements to purchase 1.25 million pounds U3O8 on the spot market at a weighted average price of USD30.15per pound, and is funding this by a "well-supported" AUD60 million share placement. Boss will acquire the first 0.25 million pounds by the end of April and the remainder by the end of June. The inventory is currently warehoused, at the ConverDyn’s facility in Metropolis, Illinois, where it will remain in storage.

"The stockpile will be highly valuable to us […]

Click here to view original web page at world-nuclear-news.org

Plateau Energy Metals Announces Break-through in Process Testing of Macusani Uranium Deposits

TORONTO, March 30, 2021 (GLOBE NEWSWIRE) — Plateau Energy Metals Inc . (“Plateau” or the “Company”) (TSX-V:PLU | OTCQB:PLUUF) is pleased to announce positive preliminary pre-concentration test results from the Colibri II-III and Corachapi uranium deposits at the Company’s Macusani Uranium Project (“Macusani”) in Peru. This process testing was completed by TECMMINE E.I.R.L. (“TECMMINE”), a metallurgical consulting company based in Lima, Peru, and also involved DRA Global in South Africa. These results build from, and improve on, previous work completed by the Cameco Corporation in 2013 when they were involved with the Tantamaco uranium deposit discovery. These results should substantially improve on the encouraging potential economics for Macusani reported in the previous 2016 Preliminary Economic Assessment (“PEA”) 1 and will help form the basis for an updated PEA, currently being contemplated.

Highlights: Colibri II-III Deposit – 81.6% of U retained in 35.3% of original mass passing 300 μm; Calculated […]

Click here to view original web page at www.globenewswire.com

InvestorBrandNetwork (IBN) Announces Latest Episode of The Bell2Bell Podcast featuring the Return of Amir Adnani, President & CEO of Uranium Energy Corp

LOS ANGELES, March 30, 2021 (GLOBE NEWSWIRE) — (via InvestorWire) InvestorBrandNetwork (“IBN”), a multifaceted communications organization engaged in connecting public companies to the investment community, is pleased to announce the release of the latest episode of The Bell2Bell Podcast as part of its sustained effort to provide specialized content distribution via widespread syndication channels.

The Bell2Bell Podcast delivers informative updates and exclusive interviews with executives operating in fast-moving industries. Bell2Bell’s latest podcast features the return of Amir Adnani, President and CEO of Uranium Energy Corp (NYSE American: UEC) , a U.S.-based uranium mining and exploration company. Under his guidance, Uranium Energy advanced from concept to U.S. production in its first five years of operation. The company has since developed an extensive pipeline of low-cost, near-term production projects and recently put into place a physical uranium holding initiative.

During the interview, Adnani provided an update on Uranium Energy’s recent news and milestones […]

Click here to view original web page at www.globenewswire.com

Purepoint Uranium Announces Corporate Update

TORONTO, March 30, 2021 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (" Purepoint " or the " Company ") today announced that plans are now underway to recommence exploration on some of the more advanced, 100% owned projects on the eastern side of the Athabasca Basin. The Company also announced an update on its flagship Hook Lake Project, a project owned jointly by Cameco Corp. (39.5%), Orano Canada Inc. (39.5%) and Purepoint Uranium Group Inc. (21%).

Chris Frostad, President and CEO stated: "In light of the success of our December financing, the current financing underway and the market’s signaling of a possible near-term correction in uranium prices, we felt it prudent to begin planning next stage work on our large portfolio of advanced, 100% owned projects in the Eastern Athabasca Basin. In tandem with the fundraising currently underway, we have secured permits and are preparing for aggressive drilling […]

Uranium Market including top key players Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation

North America, Europe, China, Japan, Rest of the World, September 2020,– – The Uranium Market research report includes an in-sight study of the key Global Uranium Market (COVID 19 Version) prominent players along with the company profiles and planning adopted by them. This helps the buyer of the Uranium report to gain a clear view of the competitive landscape and accordingly plan Uranium market strategies. An isolated section with top key players is provided in the report, which provides a complete analysis of price, gross, revenue(Mn), Uranium specifications, and company profiles. The Uranium study is segmented by Module Type, Test Type, And Region.

The market size section gives the Uranium market revenue, covering both the historic growth of the market and the forecasting of the future. Moreover, the report covers a host of company profiles, who are making a mark in the industry or have the potential to do so. […]

Denison Mines Reminds You to Keep Your Eyes Up Here

When you open a forum to review retail investor sentiment toward a publicly traded company and you are instead bombarded with questionable gifs of the female anatomy, you know something isn’t quite right. Well, that’s the experience behind uranium specialist Denison Mines (NYSEAMERICAN: DNN ) stock and its StockTwits profile. I’m not entirely sure what mammary glands have to do with DNN stock, but it poses a problem.

No, I’m not a prude – although I will say that it’s a basic courtesy to let people know about “NSFW” content ahead of time, geez! Some of us would like to stay married. Anyways, the issue with DNN stock is the guilt-by-association phenomenon that is surely brewing by now. When the only reason people are buying Denison shares is hormonal, that’s not a great advertisement for the investment thesis.

I’ll admit that I’m not entirely sure what the definition of a meme […]

Uranium Stocks Are Climbing: See Which Are Best To Buy

The demand for cleaner fuel alternatives is on the rise. As one of the world’s most abundant metals, uranium is a popular choice. A single pellet of uranium produces the same amount of electricity as: One ton of coal

Three barrels of oil

17,000 cubic feet of natural gas

Uses for Uranium Once uranium is depleted for energy use, it’s reusable for other applications since it’s less radioactive. Ships use it for counterweights, and it’s also applied as ammunition armor. Transition to Nuclear Power In 2020, the U.S. government began to invest heavily in uranium mining, contributing to an uptick in the stock market . Uranium fuels nuclear power, which represents approximately 10% of the world’s electricity.With 53 more nuclear reactors under construction and 110 planned, the world will see an increase of 45% capacity for nuclear energy. Of these reactors, 54 are in China. Good To Know While […]

Click here to view original web page at www.gobankingrates.com

Purepoint Uranium Announces Corporate Update

TORONTO, March 30, 2021 /PRNewswire/ – Purepoint Uranium Group Inc. (TSXV: PTU) (" Purepoint " or the " Company ") today announced that plans are now underway to recommence exploration on some of the more advanced, 100% owned projects on the eastern side of the Athabasca Basin. The Company also announced an update on its flagship Hook Lake Project, a project owned jointly by Cameco Corp. (39.5%), Orano Canada Inc. (39.5%) and Purepoint Uranium Group Inc. (21%).

Chris Frostad, President and CEO stated: "In light of the success of our December financing, the current financing underway and the market’s signaling of a possible near-term correction in uranium prices, we felt it prudent to begin planning next stage work on our large portfolio of advanced, 100% owned projects in the Eastern Athabasca Basin. In tandem with the fundraising currently underway, we have secured permits and are preparing for aggressive drilling on […]

MiningNewsBreaks – Uranium Energy Corp. (NYSE American: UEC) Receives ‘Buy’ Rating from H.C. Wainwright & Co.

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here .

Uranium Energy (NYSE American: UEC) , a U.S.-based uranium mining and exploration company, recently announced the close an offering of 10 million shares, resulting in an estimated $30.5 million for the company. According to the announcement, the company plans to use the funds to support its physical uranium purchase initiative as well as for general corporate and working capital requirements. Based on the company’s announcement, H.C. Wainwright & Co. released a target price revision; the report noted a price of $2.65 and a buy rating. “While the company remains focused on developing its low-cost, in-situ recovery (‘ISR’) mining capabilities, management has identified a unique opportunity to purchase drummed uranium at spot prices well below global industry mining costs,” the report stated. “As a result, UEC is […]

Click here to view original web page at www.streetinsider.com

Uranium Royalty Corp. Exercises Initial Tranche of 10-Year Supply Agreement to Acquire US$10 million of Physical Uranium at US$28.73 per pound

Highlights Uranium Royalty Corp (URC) is exercising its option to purchase US$10 million of physical uranium, secured under its strategic and foundational investment in the 2018 IPO of Yellow Cake plc (YCA);

Initial tranche to be exercised by URC to acquire 348,068 pounds of U 3 O 8 at US$28.73 per pound for delivery on or before April 30, 2021;

The acquisition provides URC with direct physical U 3 O 8 holdings at an opportunistic price, which is ~7% below the most recent spot price published by TradeTech on March 29, 2021 of US$30.75 per pound; and

Together with our recently announced proposed acquisitions of royalty interests in the McArthur River and Cigar Lake mines, URC is ideally positioned to benefit from improving uranium prices. VANCOUVER, BC, March 30, 2021 /PRNewswire/ – Uranium Royalty Corp. (TSXV: URC) ("URC" or the "Company") announces the exercise of its […]

Global Atomic Announces 2020 Results

Highlighting Significant Progress on its Dasa Uranium Project and a Positive Outlook for its Zinc Recycling Business Global Atomic Corporation announced today its operating and financial results for the year ended December 31, 2020 . HIGHLIGHTS Dasa Uranium Project A Preliminary Economic Assessment of the Phase 1 Development Plan for the Dasa Uranium Project was completed, indicating an initial, Phase 1, 12-year …

Highlighting Significant Progress on its Dasa Uranium Project and a Positive Outlook for its Zinc Recycling Business

Global Atomic Corporation (“Global Atomic” or the “Company”), (TSX: GLO) (FSE: G12) (OTCQX: GLATF) announced today its operating and financial results for the year ended December 31, 2020 . Global Atomic Corporation (CNW Group/Global Atomic Corporation) HIGHLIGHTS

Dasa Uranium Project A Preliminary Economic Assessment (“PEA”) of the Phase 1 Development Plan for the Dasa Uranium Project was completed, indicating an initial, Phase 1, 12-year mine schedule to produce […]

Ur-Energy Receives Approval of License Amendment for Lost Creek Expansion

Ur-Energy Inc. is pleased to announce that the Wyoming Uranium Recovery Program has approved the LC East and KM amendments to the Lost Creek license allowing expansion of mining activities within the existing Lost Creek Project and in the adjacent LC East projectThis license approval grants the Company access to six planned mine units in addition to the already licensed three mine units at Lost Creek. The approval …

Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the “Company” or “Ur-Energy”) is pleased to announce that the Wyoming Uranium Recovery Program (“URP”) has approved the LC East and KM amendments to the Lost Creek license allowing expansion of mining activities within the existing Lost Creek Project and in the adjacent LC East project

This license approval grants the Company access to six planned mine units in addition to the already licensed three mine units at Lost Creek. The approval also increases the license limit for […]

Uranium Week: Nuclear’s Role For Climate Goals

As uranium prices continue to rally, the spotlight falls on efficient nuclear technologies as part of a low-carbon energy mix.

-New and more efficient nuclear technologies

-Another mining company buys physical uranium

-Spot uranium price climbs nearly 3%In a key speech last week, Nuclear Energy Institute (NEI) President and CEO Maria Korsnick stressed that nuclear energy is the key to achieving the Biden administration’s ambitious climate goals."While we need to scale up every carbon-free source available, no other source can match nuclear energy’s unique combination of attributes," said Korsnick. The value of nuclear energy’s reliability has become even more apparent over the past year, with US nuclear power plants working on through the "unprecedented" conditions of the pandemic and devastating winter storms across the southern US.Nuclear has become the second-largest source of electricity in the US overall and surpassed coal for the first time ever, Korsnick added, […]

Guy on Rocks: Why the case for uranium has never looked stronger

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. Market ructions: Sovereign risk and supply disruptions are your friends?

Another compelling round of economic data has come out of China, with apparent steel consumption for the second month of 2021 (2M21) up 22 per cent year-over-year (YoY) (+10.1 per cent December) and net steel exports rising by 34 per cent YoY, according to Citi Research (24 March 2021).

2M21 iron ore imports increased 3 per cent YoY driven by strong growth in steel production, which was up 13 per cent YoY over the same period.

I anticipate China’s steel end-use demand to hold up over 2Q21 but […]

Uranium Energy Corp. (UEC) market price of $3.05 offers the impression of an exciting value play

At the end of the latest market close, Uranium Energy Corp. (UEC) was valued at $2.76. In that particular session, Stock kicked-off at the price of $2.85 while reaching the peak value of $3.06 and lowest value recorded on the day was $2.78. The stock current value is $3.05.

Recently in News on March 26, 2021, Uranium Energy Corp’s Executive VP Scott Melbye Testifies at the U.S. Senate Committee on Energy & Natural Resources. Uranium Energy Corp (NYSE: UEC) (the “Company” or “UEC”) is pleased to report our Executive Vice President Scott Melbye, and current President of the Uranium Producers of America, presented testimony at the Full Committee Hearing on Nuclear Energy for the Senate Committee on Energy & Natural Resources on March 25, 2021. You can read further details here

A Backdoor Way To Profit From Today’s Crypto Bull Market

Even if you’re not actively in crypto, you […]

U3O8 Corp. Announces Start of Program to Test Efficiency of Membranes to Extract Battery Commodities and Uranium from a Multi-Commodity Deposit

Tweet Share E-mail

Get inside Wall Street with StreetInsider Premium . Claim your 1-week free trial here .

TORONTO, March 29, 2021 (GLOBE NEWSWIRE) — U3O8 Corp. ( NEX: UWE.H ) (“ U3O8 ” or the “ Company ”) announces that it has commenced staged test work to determine the efficiency of membranes to recover battery commodities from its Berlin Deposit in Colombia. The objective of the test work is to determine the cost-effectiveness of membrane separation to concentrate battery commodities such as nickel, vanadium and phosphate, among others, as well as uranium, after they have been leached from the mineralized host-rock.

Basic Membrane Technology Membranes operate like molecular sieves, allowing small molecules to pass through, while retaining larger molecules. The size of molecules that can pass through the membrane is determined by the pore size of the membrane. In potable water production, the general concept is that […]

Click here to view original web page at www.streetinsider.com

Uranium stocks in Australia

Australia is the third biggest uranium producer and holds around one third of the world’s uranium resources. There are several ASX-listed mining stocks with uranium exposure. Some have been actively mining for many years, such as Energy Resources of Australia ( ASX: ERA ), while others are exploring new uranium deposits alongside other resources such as gold or silver.

This commodity is best known for its use in nuclear energy production but has a destructive history. In recent years, uranium prices have fallen amid oversupply issues as Kazakstan has ramped up production and the Fukushima disaster led to plunging sentiment toward nuclear energy use.

Investors should explore how this material is mined and used before they invest.

Uranium is a radioactive heavy metal used to fuel nuclear reactors and craft nuclear weapons. It’s mined in a number of countries, but a majority of the world’s uranium supply comes from Kazakhstan, Canada and […]

How to profit as uranium prices head for a melt-up

Uranium mines can’t keep up with global demand And that has been the case during the pandemic. Cameco in Canada, the world’s second-largest producer, has shut every one of its uranium mines in Canada. Output at Kazatomprom, the world’s biggest producer, is at a multi-year low. The US produced a negligible amount of uranium in 2020. This sort of backdrop can trigger sudden surges: in 2007 prices increased fivefold in one year to $140 a pound (lb) as utilities panicked about scarcity of supply after a mine called Cigar Lake was flooded and another, Ranger, was damaged by a cyclone. More bullish news

There is one other issue worth mentioning. The increasing cost of supply has not necessarily been reflected in spot market prices. A recent panel of experts at an event hosted by investment bank Canaccord Genuity (CG) argued that marginal costs are well above current spot prices.

According […]

Top Stories This Week: Powell Compares Gold to Crypto, Uranium Companies Get Physical

Market watchers were eyeing this week’s testimonies from US Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, but ultimately their words did little to move gold.

The metal spent the week fairly rangebound , trading between about US$1,725 and US$1,745 per ounce.

More intriguing for some industry participants were Powell’s comments on gold and cryptocurrencies. Gold Outlook 2021! Introducing Our NEW Gold Outlook Report

BURSTING With Exclusive Information Not Found Anywhere Else. Don’t Get Left Behind! Grab Your FREE Gold Report Today! In a Monday (March 22) panel discussion hosted by the Bank for International Settlements, he described cryptocurrencies as “highly volatile” and therefore not a useful store of value; Powell added that they are “essentially a substitute for gold,” not the dollar. “(Cryptocurrencies are) highly volatile … and therefore not really useful as a store of value, and they’re not backed by anything. They’re more of […]

Denison Announces Closing of US$86.3 Million Financing in Support of Strategic Acquisition of Physical Uranium

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES Denison Mines Corp. is pleased to announce that it has closed its previously announced bought deal public offering of units . The Company issued 78,430,000 units of the Company at US$1.10 per unit for aggregate gross proceeds of …

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES /

Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML) (NYSE American: DNN) is pleased to announce that it has closed its previously announced bought deal public offering of units (the “Offering”). The Company issued 78,430,000 units of the Company at US$1.10 per unit for aggregate gross proceeds of US$86,273,000 which included 10,230,000 units […]

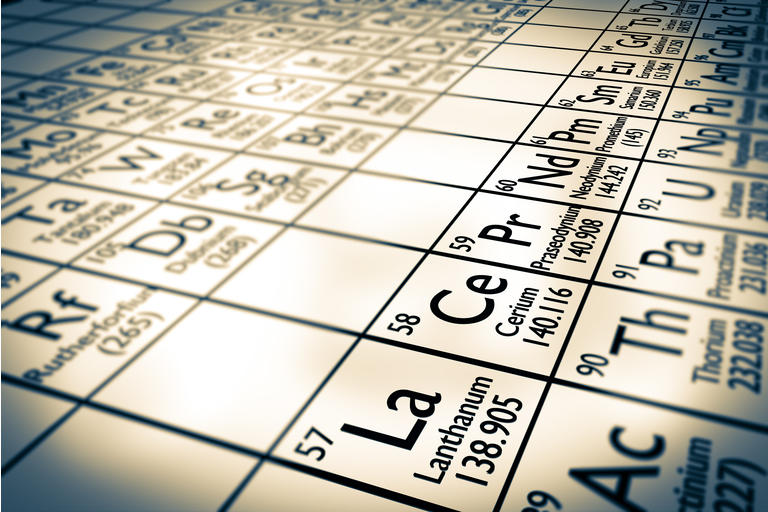

The REE Business Of Energy Fuels Seems Inconsequential To Challenge The Bear Case

Photo by Antoine2K/iStock via Getty Images Introduction

Earlier this month, I wrote an article about U.S. uranium company Energy Fuels (NYSEMKT: UUUU ), and one of the major criticisms in the comments was that I didn’t talk much about its new rare earth elements (REE) business.

Several people even argued that REE is the company’s main business now and its high valuation reflects this. Well, I’ve taken a look at this new venture of Energy Fuels, and I think it’s too small to make a difference. Overview of the REE operations of Energy Fuels

In February 2020, the company announced that it was approached by several parties to evaluate the potential to produce REE at its White Mesa uranium in Utah. In April 2020, Energy Fuels announced that it decided to enter the REE sector.White Mesa has a license to produce uranium and vanadium as well as other […]

Emerging Trends of Uranium Market with Growth Strategies, Market Dynamics and Competitive Landscape 2026

Uranium Market report examines all the essential factors promoting the growth of the global market, involving pricing structure, profit margins, value chain assessment, production value, demand as well as supply scenario, and various other significant parameters. Regional evaluation of the global Uranium market demonstrates a series of opportunities in regional as well as domestic industry places. Furthermore, this report makes use of graphical presentation techniques such as graphs, charts, tables, and pictures for better understanding.

The report has been separated into different categories, such as product type, application, end-user, and region. It also offers a deep analysis of the potential product segment that is expected to lead in the forthcoming years. Also, information on other product segments is given in the market report to help the competitors and customers get a clear picture of the market and details on the upcoming product. Every segment is evaluated based on the CAGR, […]