Enthusiasm from individual traders is reshaping the market for nuclear fuel that generates a tenth of the world’s electricity and sending uranium-linked stocks higher.

After languishing for a decade after the Fukushima disaster led Japan and Germany to close nuclear reactors, spot uranium prices have shot to $47 a pound from $32.25 at the start of August. They remain below their peak of $137 in 2007, according to price-tracker UxC LLC.

U.S.-listed shares of Canadian uranium giant Cameco Corp. CCJ 5.92% have jumped more than 20% in October and almost doubled in 2021. Fellow Canadian miner Denison Mines Corp. DNN 12.73% has surged 27% this month and almost tripled this year. Texas-based Uranium Energy Corp. UEC 2.35% has climbed more than 14% in October.

Behind the rally: a run-up in uranium prices driven by individual traders, who have flocked to a new trust that gives a cheap and easy way of betting […]

Category: Uranium

Uranium Hexafluoride Market Witness Significant Growth by 2027 | Arkema, Asahi Glass, Saint-Gobain

“”””””””””” Latest report on the global Uranium Hexafluoride market suggests a positive growth rate in the coming years. Analysts have studied the historical data and compared it with the current market scenario to determine the trajectory this market will take in 2021-2027. The investigative approach taken to understand the various aspects of the market is aimed at giving the readers a holistic view of the global Uranium Hexafluoride market. The research report provides an exhaustive research report that includes an executive summary, definition, and scope of the market.

The study aims to provide a high-quality and reliable overview of the Uranium Hexafluoride Market, taking into account the current market situation, as COVID 19 has a major effect on the global economy as a whole. The study offers an in-depth analysis of developments in the parent market, macro-economic indicators and governing factors, along with segmental market attractiveness. The carefully shaped market […]

Best ETF Areas of Last Week

Wall Street was upbeat last week with the S&P 500 logging the biggest weekly rise since July as stocks rallied on earnings,

Wall Street was upbeat last week with the S&P 500 logging the biggest weekly rise since July as stocks rallied on earnings. The Dow Jones (up 1.58%) and the Nasdaq (up 2.18%) were also notable winners last week. Oil prices staged a rally last week, with United States Oil Fund LP USO adding about 1.8%. Oil prices crossed the $80-a-barrel mark amid the ongoing global power crisis. Retail sales in the United States unexpectedly increased 0.7% sequentially in September 2021, following an upwardly revised 0.9% surge in August, beating market forecasts of a 0.2% decline, in a sign of resilience from consumers.

No wonder, stocks remained upbeat in the week. The benchmark U.S. treasury yield started the week with 1.61% while it ended the week at 1.59%. Against this […]

Click here to view original web page at www.entrepreneur.com

Denison Mines shares surge on rising uranium prices, while The Valens Co. slumps on increased net losses. Here are the past week’s winners and losers

Denison Mines Corp. (DML.TO) +17.3%

Spot prices of uranium skyrocketed throughout the month of September, closing at $42.60 (U.S.) per pound on Sept. 30, compared to $34.25 per pound on Aug. 31. Denison Mines, a Canadian uranium exploration and development company, saw its share price increase almost 20 per cent from market open Tuesday to market close Thursday. In its second-quarter fiscal 2021 results, the company reported revenues of $4.6 million, up from $2.9 million the prior year with a net loss of $2.4 million, down from $1 million in 2020.

Aritzia Inc. (ATZ.TO) +16.9%

Vertically integrated fashion conglomerate Aritzia reported its second-quarter fiscal 2022 results on Wednesday. Revenues increased to $350 million from $200 million the prior year with a high gross profit margin of 45 per cent, compared to 35 per cent during the second-quarter fiscal 2021. The growth in the top line, coupled with a reduction […]

Click here to view original web page at www.northumberlandnews.com

Uranium Royalty Corp. (NASDAQ:UROY) trade information

Uranium Royalty Corp. (NASDAQ:UROY) has seen 0.87 million shares traded in the recent trading session. The company, currently valued at $371.27M, closed the recent trade at $5.02 per share which meant it gained $0.28 on the day or 5.95% during that session. The UROY stock price is -11.55% off its 52-week high price of $5.60 and 83.86% above the 52-week low of $0.81. The 3-month trading volume is 790.84K shares.

Sporting 5.95% in the green today, the stock has traded in the green over the last five days, with the highest price hit on Friday, 10/15/21 when the UROY stock price touched $5.02 or saw a rise of 3.28%. Year-to-date, Uranium Royalty Corp. shares have moved 313.47%, while the 5-day performance has seen it change 23.76%. Over the past 30 days, the shares of Uranium Royalty Corp. (NASDAQ:UROY) have changed -10.90%.

3 Tiny Stocks Primed to Explode The world’s greatest […]

Click here to view original web page at marketingsentinel.com

Why Uranium Stocks Are on Fire Today

What happened

Uranium stocks sizzled hot Monday morning after a huge development in the industry reignited heavy buying in stocks across the board. Here’s how much some of the top-performing uranium stocks had rallied at their highest point in trading on Oct. 18, as of this writing: Denison Mines (NYSEMKT: DNN): up 15.2%.

Uranium Royalty (NASDAQ: UROY): up 9.5%.

Centrus Energy (NYSEMKT: LEU): up 16.9. Energy Fuels (NYSEMKT: UUUU): up 8.6%. Cameco (NYSE: CCJ): up 8.4%. So what Uranium stocks were unstoppable until last month when the world’s first and largest physical uranium exchange-traded fund , Sprott Physical Uranium Trust (OTC: SRUU.F), seemingly slowed its pace of uranium purchased from the spot market after an unstoppable spree since its inception on Canada’s Toronto Stock Exchange in July. Aggressive purchases by the fund had sent uranium prices soaring.The Sprott Physical Uranium Trust fund, though, sprang back to action this month. […]

Uranium Energy Corp. (UEC) can’t be written off after posting last 3-months Average volume of 6.60M

Uranium Energy Corp. (UEC) is priced at $3.65 after the most recent trading session. At the very opening of the session, the stock price was $3.46 and reached a high price of $3.53, prior to closing the session it reached the value of $3.41. The stock touched a low price of $3.28.Recently in News on October 4, 2021, Uranium Energy Corp to Present at the TD Virtual Uranium Roundtable. NYSE American Symbol – UEC. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $3.77 on 09/16/21, with the lowest value was $1.51 for the same time period, recorded on 01/21/21.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys […]

Why ASX uranium shares are in focus on Tuesday

ASX uranium shares could be a mover on Tuesday after the world’s largest uranium producer, Kazatomprom, announced plans to participate in a physical uranium fund. Kazatomprom, the national atomic company of Kazakhstan, contributed approximately 23% of global primary uranium production in 2020.

According to World Nuclear News , Kazatomprom’s fund will hold physical uranium as a long-term investment, with an initial US$50 million of purchases financed by its founders.

Once the fund is operating, the company plans an additional public or private offering to raise up to US$500 million for additional uranium purchases.

The timing and details of this second development stage will be determined by market conditions, Kazatomprom said.The company believes the global transition towards clean energy and, more specifically, nuclear power, provides a “strong investment thesis” for the uranium industry.Opportunities for uranium exposure have been scarce, with two uranium funds being the Sprott’s Physical Uranium Trust listed on the Toronto […]

Kazatomprom announces physical uranium fund

Kazatomprom has announced it is to participate in a physical uranium fund, ANU Energy OEIC Limited, established on the Astana International Financial Centre (AIFC). The fund will hold physical uranium as a long-term investment, with its initial USD50 million of purchases financed by its founders and plans to raise USD500 million for additional uranium purchases in a second development stage. (Image: Kazatomprom)

The initial USD50 million is sourced from Kazatomprom at 48.5%, National Investment Corporation of the National Bank of Kazakhstan (NIC) at 48.5%, and UAE-based investment company Genchi Global Limited at 3%. Genchi is to be the fund manager. Once the fund is operating, an additional public or private offering is planned to raise capital of up to USD500 million from institutional and/or private investors, with the proceeds to be used for additional uranium purchases. The timing and details of this second development stage will be determined by market […]

Click here to view original web page at world-nuclear-news.org

Denison Mines shares surge on rising uranium prices, while The Valens Co. slumps on increased net losses. Here are the past week’s winners and losers

Winners

Denison Mines Corp. (DML.TO) +17.3%

Spot prices of uranium skyrocketed throughout the month of September, closing at $42.60 (U.S.) per pound on Sept. 30, compared to $34.25 per pound on Aug. 31. Denison Mines, a Canadian uranium exploration and development company, saw its share price increase almost 20 per cent from market open Tuesday to market close Thursday. In its second-quarter fiscal 2021 results, the company reported revenues of $4.6 million, up from $2.9 million the prior year with a net loss of $2.4 million, down from $1 million in 2020.

Aritzia Inc. (ATZ.TO) +16.9% Vertically integrated fashion conglomerate Aritzia reported its second-quarter fiscal 2022 results on Wednesday. Revenues increased to $350 million from $200 million the prior year with a high gross profit margin of 45 per cent, compared to 35 per cent during the second-quarter fiscal 2021. The growth in the top line, coupled with […]

Black Shield Acquires Mann Lake, Saskatchewan Uranium Property and Announces Proposed Name Change to Basin Uranium Corp

Vancouver, B.C. Canada – TheNewswire – October 18, 2021, BLACK SHIELD METALS CORP. (CSE:BDX) (CNSX:BDX.CN) (“Black Shield” or the “Company”) is pleased to announce it has entered into an option agreement (the “Option Agreement”) with Skyharbour Resources Ltd. (“Skyharbour” or the “Optionor”) to acquire up to a 75% (the “Option”) of the Mann Lake Uranium Project (“Mann Lake” or the “Property”) located in the Athabasca Basin, Northern Saskatchewan, Canada.

Skyharbour owns a 100% interest in the 3,473 hectare (8,582 acre) Mann Lake Uranium Project located in the eastern Athabasca Basin in northern Saskatchewan. It is strategically located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit. Skyharbour’s Mann Lake project is also adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%) with partners Denison Mines (30%) and […]

Scope of Uranium Mining Industry 2021-2026: Market Analysis with Trends and Opportunities | Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, Areva, and more | Affluence

The prime objective of the Uranium Mining market report is to provide insights on the post-COVID-19 impact which will help market players like Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, Areva, and more in this field evaluate their business approaches. Also, this report covers market segmentation by major market verdors, types, applications/end users, and geography (North America, East Asia, Europe, South Asia, Southeast Asia, Middle East, Africa, Oceania, South America). The Uranium Mining market is predicted to witness significant growth throughout the forecast from 2021 to 2027. It commits various factors affecting industry like market environment, various policies of the government, past data and market trends, technological advancements, upcoming innovations, market risk factors, market restraints, and challenges within the Uranium Mining industry.

Request for Sample Copy of Uranium Mining Market with Complete TOC and Figures & Graphs @ https://www.affluencemarketreports.com/industry-analysis/request-sample/17Uranium Mining53/

The Report Presents Profiles of Competitors in […]

Consolidated Uranium Announces Proposed Spin-Out of Labrador Uranium Inc., Creating a New Labrador Focused Uranium Explorer and Developer

Exercises Option on the Moran Lake Uranium and Vanadium Project

Labrador Uranium Enters Agreement with Altius Minerals to Acquire Land Position in the Central Mineral Belt

TORONTO, Oct. 18, 2021 (GLOBE NEWSWIRE) — Consolidated Uranium Inc. (“ CUR ”, the “ Company ” or “ Consolidated Uranium ”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce the creation and planned spin-out of Labrador Uranium Inc. (“ Labrador Uranium ” or “ LUR ”), currently a majority-controlled subsidiary of CUR focused on the consolidation, exploration and development of uranium projects in Labrador. In connection with the proposed spin-out of LUR, the Company has provided notice to exercise its option pursuant to the option agreement announced on November 18, 2020 (the “ Option Agreement ”) to acquire 100% of the Moran Lake project (the “ Moran Lake Project ”).

To effect the spin-out, the Company has entered into an […]

Click here to view original web page at www.globenewswire.com

Why ASX uranium shares are rallying on Monday

ASX uranium shares are posting broad-based gains as the bullish case for nuclear energy gathers momentum. ASX uranium shares surge on Monday

The largest ASX-listed uranium player, Paladin Energy Ltd (ASX: PDN) is up 8.64% to 88 cents.

Emerging producer Boss Energy Ltd (ASX: BOE) leads the charge, up 9.26% to 29.5 cents.

Advanced Namibia-based explorer Deep Yellow Limited (ASX: DYL) is lagging behind its peers, up 1.9% to $1.07.The most recently listed uranium explorer, 92 Energy Ltd (ASX: 92E) is also edging higher, up 6.9% to 77.5 cents.Elsewhere, speculative explorers such as Bannerman Energy Ltd (ASX: BMN) , Lotus Resources Ltd (ASX: LOT) , Vimy Resources Ltd (ASX: VMY) , Peninsula Energy Ltd (ASX: PEN) and Alligator Energy Ltd (ASX: AGE) are posting mixed gains, up between 2.8% and 14.5%. What’s driving the uranium sector? Surging oil and gas prices and an over-reliance on renewables is positioning nuclear […]

Black Shield Metals Acquires Mann Lake, Saskatchewan Uranium Property and Announces Proposed Name Change to Basin Uranium Corp

(CNSX:BDX.CN) (“Black Shield” or the “Company”) is pleased to announce it has entered into an option agreement (the “Option Agreement”) with Skyharbour Resources Ltd. (“Skyharbour” or the “Optionor”) to acquire up to a 75% (the “Option”) of the Mann Lake Uranium Project (“Mann Lake” or the “Property”) located in the Athabasca Basin, Northern Saskatchewan, Canada.

Skyharbour owns a 100% interest in the 3,473 hectare (8,582 acre) Mann Lake Uranium Project located in the eastern Athabasca Basin in northern Saskatchewan. It is strategically located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit. Skyharbour’s Mann Lake project is also adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%) with partners Denison Mines (30%) and AREVA (17.5%).Denison Mines acquired International Enexco and its 30% interest in the project after the […]

Click here to view original web page at www.juniorminingnetwork.com

U.S. nuclear power generation at historical heights as investors buy uranium

There has been a lot of talks lately about fossil fuel energy source prices rising, particularly coal and gas prices. But did you know that uranium prices are up 64% since the August low, and are now at US$47.20/lb?

Uranium prices are up 64% from the August 16, 2021 low (as on 18 October 2021)

The reason uranium prices are rising is that supply has reduced and demand is reviving with an upward trajectory.Uranium supply

In 2020, ~46Mlbs or ~35% of global supply of uranium production (annualized), was suspended due to low prices. Kazatomprom, the world’s largest uranium miner, announced a 20% reduction in production into 2023. Cameco shuttered McArthur River and (largest in Canada) Cigar Lake mines, and there are several others . Meanwhile, U.S uranium production is non-existent, or as Ur-Energy states : “2020 – 2021Q2: U.S. uranium production continues to be so low EIA unable […]

Purepoint Uranium Announces Participation in Red Cloud’s 2021 Oktoberfest Fall Mining Show Case and the 2021 New Orleans Investment Conference

Chris Frostad, President and CEO, will be presenting virtually at the Red Cloud’s 2021 Virtual Oktoberfest Fall Mining Showcase on Wednesday, October 20, 2021 at 2:45 pm ET . To register for the conference, please visit: https://www.redcloudfs.com/oktoberfest2021/ .

Chris Frostad will also be hosting a luncheon presentation at the 2021 New Orleans Investment Conference on Friday, October 22, 2021 at 12:30 pm local time . During this presentation, Chris will be sharing some background on the excitement we are currently experiencing in the uranium space as uranium prices hit their tipping point ( https://youtu.be/jASihpiyg5M ). To register for this year’s New Orleans conference, please visit: https://neworleansconference.com/2021-conference-registration/ .

About Purepoint

Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) actively operates an exploration pipeline of 12 advanced projects in Canada’s Athabasca Basin, the world’s richest uranium region. Purepoint’s flagship project is the Hook Lake Project, a joint venture with two of the […]

Click here to view original web page at www.juniorminingnetwork.com

Skyharbour Resources – Invitation to Red Cloud’s 2021 Oktoberfest Fall Mining Showcase and PI Financial’s Uranium Day 2.0

SYH ) (OTCQB: SYHBF) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that the company will be presenting at Red Cloud’s 2021 Oktoberfest Fall Mining Showcase and PI Financial’s “Uranium Day 2.0: The Emerging Uranium Opportunity”. We invite our shareholders and all interested parties to join us there.

Red Cloud’s 2021 Oktoberfest Fall Mining Showcase:

The annual conference will be a virtual event this year and will take place from October 18-20, 2021. Jordan Trimble, President and CEO will be presenting on Wednesday, October 20 th at 12:30PM PST (3:30PM EST).

For More Information and to Register for the Conference: https://www.redcloudfs.com/oktoberfest2021/ PI Financial’s Uranium Day 2.0: The Emerging Uranium Opportunity: PI’s conference will be a virtual event and will take place on October 27 th , 2021. Jordan Trimble will be presenting at 12:10pm PST (3:10pm EST). For More Information and to Register for the Conference: https://zoom.us/webinar/register/WN_v180HBQYTem4atpfZ2bG-A […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium ETFs Explode

Nuclear energy has a bad reputation. Say “Chernobyl” or “Three Mile Island” and many remember dangerous and costly incidents that had negative effects for years to come.

But with the consequences of fossil fuels becoming more apparent every day, some are touting nuclear energy as a zero-emission clean energy source worth considering. And this change of heart has boosted assets and returns for nuclear energy ETFs over the past year.

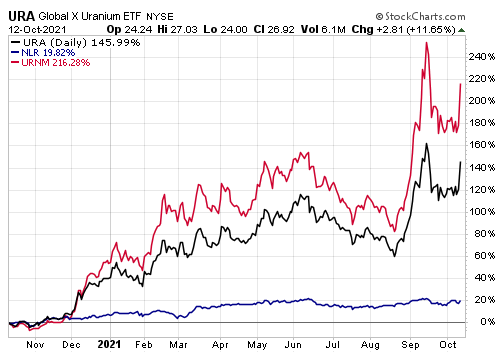

On Tuesday alone, uranium-linked ETFs had an explosive day. The North Shore Global Uranium Mining ETF (URNM) rose by 13.5% while the Global X Uranium ETF (URA) gained 11.7%.

This rise adds to both funds’ strong gains over the trailing year. As with most thematic ETFs, there is considerable dispersion among the three ETFs that fall into the nuclear energy ETFs.The two uranium ETFs have significantly outperformed the VanEck Uranium+Nuclear Energy ETF (NLR) , which takes a wider view of the nuclear […]

Click here to view original web page at sportsgrindentertainment.com

ALX Resources Corp. Completes Geochemical Survey at the Gibbons Creek Uranium Project, Athabasca Basin, Saskatchewan

Vancouver, British Columbia–(Newsfile Corp. – October 14, 2021) – ALX Resources Corp. (TSXV: AL) (FSE: 6LLN) (OTC: ALXEF) ("ALX" or the "Company") is pleased to announce the completion of a geochemical survey at its 100%-owned Gibbons Creek Uranium Project ("Gibbons Creek", or the "Project"). Gibbons Creek currently consists of seven mineral claims encompassing 13,864 hectares (34,259 acres), located along the northern margin of the Athabasca Basin immediately west of the community of Stony Rapids, Saskatchewan, in a region hosting multiple uranium occurrences.

2021-2022 Exploration at Gibbons Creek

In early October 2021, ALX commenced a Spatiotemporal Geochemical Hydrocarbons ("SGH") soil geochemistry survey at Gibbons Creek. SGH is an analytical method developed by Actlabs of Ancaster, Ontario, Canada that is designed to detect subtle geochemical anomalies emanating from a buried source. Three hundred and twenty-one (321) samples were collected from a 4.4 kilometre-long grid over a strong, untested geophysical conductor detected […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium miners believe they’re ‘on the cusp of a new Renaissance’

Pic: Yuri Arcus/E+ via Getty Images. share

Australia’s next uranium producer says the industry is “on the cusp of a new Renaissance” as nuclear utilities begin to engage with miners on the back of price spikes in the spot market.

Uranium miners have suffered from almost a decade of low spot prices that has seen investment leach from the sector.

Owners of nuclear reactors have been able to rely on low-priced material in the spot market to supplement their long-term contracts.That option is quickly closing up as feverish uranium buying from the North American-listed Sprott Physical Uranium Trust, hedge funds and mining companies has put a rocket under uranium prices.Dawdling in the low US$30s for each pound of yellowcake for most of the year, the price shot up to more than US$50/lb in quick time before hitting choppy waters a couple weeks ago.After sliding below US$40/lb it was back up to […]

VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF (NLR) falls 0.48% to Close at $55.68 on October 15

Today, VanEck ETF Trust – VanEck Uranium Nuclear Energy ETF Inc’s (NYSE: NLR) stock fell $0.2682, accounting for a 0.48% decrease. VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF opened at $56.11 before trading between $56.11 and $55.58 throughout Friday’s session. The activity saw VanEck Vectors ETF – VanEck Vectors Uranium+Nuclear Energy ETF’s market cap fall to $30,156,445 on 3,887 shares -below their 30-day average of 4,508.

Visit VanEck ETF Trust – VanEck Uranium Nuclear Energy ETF’s profile for more information. The Daily Fix

BlackRock Beats Q3 Profit Estimates, But Asset Growth Flattens

BlackRock Inc topped third-quarter profit estimates helped by robust performance fees and strong demand for its actively managed and sustainable funds, even as volatile markets hindered the world’s largest money manager from growing its assets under management.Asset managers have benefited from rising global financial markets in recent quarters as investors put money to work, making the […]

Exchange Traded Concepts – North Shore Global Uranium Mining ETF (URNM) falls 1.29% in Light Trading on October 15

Today, Exchange Traded Concepts Trust – North Shore Global Uranium Mining ETF Inc’s (NYSE: URNM) stock fell $1.18, accounting for a 1.29% decrease. Exchange Traded Concepts – North Shore Global Uranium Mining ETF opened at $91.19 before trading between $91.43 and $87.80 throughout Friday’s session. The activity saw Exchange Traded Concepts – North Shore Global Uranium Mining ETF’s market cap fall to $769,590,000 on 494,225 shares -below their 30-day average of 555,493.

Visit Exchange Traded Concepts Trust – North Shore Global Uranium Mining ETF’s profile for more information. The Daily Fix

BlackRock Beats Q3 Profit Estimates, But Asset Growth Flattens

BlackRock Inc topped third-quarter profit estimates helped by robust performance fees and strong demand for its actively managed and sustainable funds, even as volatile markets hindered the world’s largest money manager from growing its assets under management.Asset managers have benefited from rising global financial markets in recent quarters as investors […]

Everything you need to know about uranium

Uranium is one of the hottest commodities in the world right now, with most equities rallying by multiples over the last year. But what’s all the fuss about?

I recently penned a major article about the sector , with input from Brandon Munro, CEO of Bannerman Resources and co-Chair of the World Nuclear Association’s Nuclear Fuel Demand Working Group, Leigh Curyer, CEO of NexGen Energy, and Guy Keller , Portfolio Manager of the Tribeca Nuclear Opportunities Fund.

Despite the article’s considerable length, there was an awful lot that ended up on the cutting room floor. Given the incredible response I received for the article, I’ve edited the three interviews into a special podcast miniseries, so that you can get all the detail on the sector that your heart desires.

We hear about the history of the uranium market over the last 10 years and how we got here today, where future demand […]

Click here to view original web page at www.livewiremarkets.com

Form 6-K Uranium Royalty Corp. For: Oct 15

Tweet Share E-mail

Get inside Wall Street with StreetInsider Premium . Claim your 1-week free trial here .

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 FORM 6-K Report of Foreign Private Issuer Pursuant to Rule 13 a-16 or 15d-16 UNDER the Securities Exchange Act of 1934 For the month of October 2021 Commission File No.: 001-40359 Uranium Royalty Corp. (Translation of registrant’s name into English) Suite 1830, 1030 West Georgia Street Vancouver, British Columbia, V6E 2Y3, Canada (Address of principal executive office)Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.Form 20-F ☐ Form 40-F ☒Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐Indicate by check mark if the registrant is submitting the Form 6-K […]

Click here to view original web page at www.streetinsider.com