Higher uranium confidence and a maiden vanadium resource are on the cards for Aura. Pic: The Road to El Dorado, Dreamworks Studios (2000). share

After a massive year of buildup at the already viable Tiris Uranium Project, Aura Energy shareholders are staring down first half returns as AEE readies for a regional exploration program aimed at enhancing resources as the company continues to transition from a uranium explorer to producer.

Aura Energy’s (ASX:AEE) fully permitted Tiris Uranium Project is now positioned to upgrade Inferred resources to the Measured and Indicated categories by reducing drillhole spacing within the Tiris East project area.

Drilling is set to commence in the first half of the year on areas of the current Inferred resource within the catchment area of the proposed plant site, as the company leans into its transition towards becoming a fully-fledged uranium producer.The previous resource drilling programme in 2017 focused […]

Category: Uranium

Quadrature Capital Ltd Purchases Shares of 10,200 Uranium Energy Corp. (NYSEAMERICAN:UEC)

Uranium Energy Quadrature Capital Ltd purchased a new stake in Uranium Energy Corp. (NYSEAMERICAN:UEC) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 10,200 shares of the basic materials company’s stock, valued at approximately $31,000.

Several other hedge funds and other institutional investors have also made changes to their positions in the business. The Manufacturers Life Insurance Company lifted its stake in shares of Uranium Energy by 1.6% during the third quarter. The Manufacturers Life Insurance Company now owns 126,387 shares of the basic materials company’s stock valued at $385,000 after buying an additional 1,966 shares during the period. HighTower Advisors LLC lifted its stake in shares of Uranium Energy by 2.1% during the third quarter. HighTower Advisors LLC now owns 99,672 shares of the basic materials company’s stock valued at $304,000 after buying an additional […]

Blue Sky Uranium Applies to Extend Warrants

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market: BKUCFVANCOUVER, BC, Feb. 14, 2022 /PRNewswire/ – Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF) , ("Blue Sky" or the "Company") announces that the Company has made an application to the TSX Venture Exchange (" TSXV ") to extend the term of the outstanding warrants as follows: Blue Sky Uranium Corp. Logo (CNW Group/Blue Sky Uranium Corp.) 7,258,500 that are set to expire on February 28, 2022 to be extended to February 28, 2023. These warrants were originally issued on March 1, 2018 and originally set to expire on February 28, 2020 as part of the units issued under a private placement completed by the Company in February 2018. On January 23, 2020, the Company received TSXV approval to extend the expiry date to February 28, 2022. The warrants are also subject to an accelerator (see […]

Click here to view original web page at www.marketscreener.com

3 Top Penny Stocks for 2022

As their name implies, penny stocks are stocks that trade below $1 per share. However, in a broader scope, the term can also refer to stocks trading below $5 per share.

Among the benefits of penny stocks, investors can buy large quantities of them with little money and can generate large valuations quickly due to their high volatility and generally little Wall Street coverage.

However, be aware that penny stocks also represent an investment considered high risk because it is very much based on speculation.

Below, we list some companies with good potential in their markets that currently have a share price below $5. ( Read more from Wall Street Memes: ARK Innovation ETF: Have The Discipline To Limit Losses ) Sundial Growers – $SNDL Worth half a dollar, Sundial Growers ( SNDL ) – Get Sundial Growers Inc. Report enjoys enormous popularity among Reddit users because of its cannabis-oriented business. Figure […]

Nuclear Materials Market Size Expected to be Reach $94.8 Billion by 2027

Increased Investment in the Space Industry Across the World Is Acting as a Driver for the Growth of the Nuclear Materials Market.

Nuclear materials market size is forecast to reach US$94.8 billion by 2027, after growing at a CAGR of 3.5% during 2022-2027, owing to the rising demand for nuclear materials such as plutonium isotopes, thorium, and uranium from various end-use industries such as medical, energy & power, aerospace, oil and gas, and others. The nuclear materials industry is driven by an increase in demand for electricity generation across the world. In addition, the demand for the nuclear materials market is been accelerated with the growing demand for its use in the aircraft and marine industry. Furthermore, the rapid growth of the defense sector has also increased its demand, thereby, enhancing the growth of the nuclear materials market. All these factors accumulatively are driving the growth of the nuclear […]

Click here to view original web page at www.digitaljournal.com

4 Hot Energy Penny Stocks To Watch As ENPH Stock Surges On Earnings

Penny stocks are some of the highest risk types of stocks you can find. With that risk can come opportunity for big rewards, so it doesn’t hurt to search for trends that can help. Today, energy stocks seem to have gotten recharged after Enphase Energy ( NASDAQ: ENPH ) reported earnings. But there’s more to this than just an earnings beat. Are Penny Stocks Worth It? – ENPH Case Study

Believe it or not, Enphase was a penny stock not that long ago. Even throughout the pandemic, it has managed to experience explosive gains. Anyone holding shares from the start of 2019 when it was still considered a penny stock is probably pretty happy. That’s because on January 2, 2019, ENPH stock traded under $5 a share. This week, ENPH stock hit new 2022 highs of $180.50 during early premarket trading on February 9th.

The energy technology company’s shares skyrocketed […]

ALX Resources Corp. Provides Winter Exploration Update for Saskatchewan and Ontario Projects

Vancouver, British Columbia–(Newsfile Corp. – February 9, 2022) – ALX Resources Corp. (TSXV: AL) (FSE: 6LLN) (OTC: ALXEF) ("ALX" or the "Company") is pleased to update its shareholders on the status of its mineral exploration programs, both planned and underway, in Saskatchewan and Ontario, Canada.

Alligator Lake, SK

The Alligator Lake Gold Project ("Alligator") is located approximately 165 kilometres (103 miles) northeast of La Ronge, SK, Canada. The Project consists of five claims totaling 2,973 hectares (7,347 acres) and is prospective for high-grade gold mineralization.

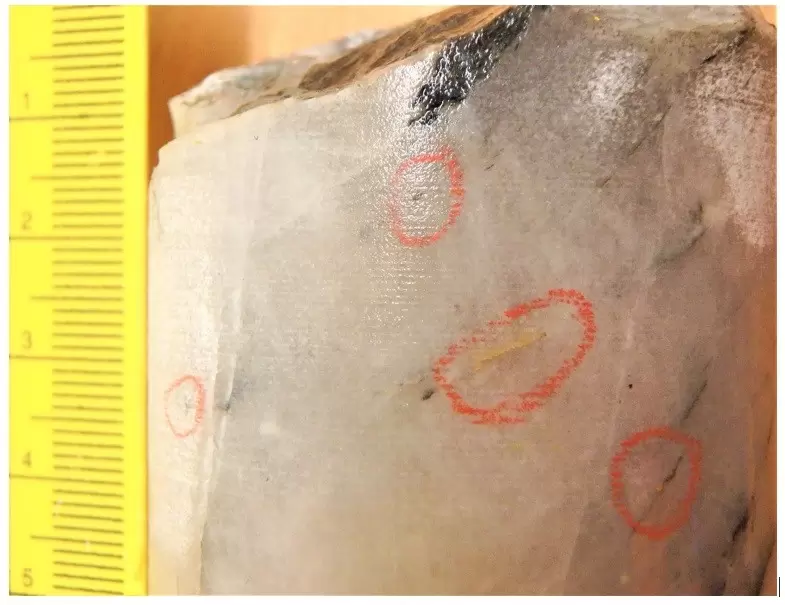

ALX commenced the 2022 exploration in mid-January 2022, projected to consist of 8 drill holes totaling approximately 1,000 metres. To date, three diamond drill holes have been completed for a total of approximately 530 metres, with a fourth hole underway. Visible gold was observed in hole AL22-01, the first hole of the program, at a depth of 99.48 metres in a series of fine fractures […]

Click here to view original web page at www.juniorminingnetwork.com

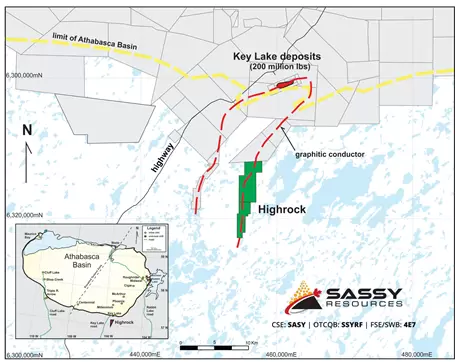

Sassy Resources Completes Definitive Option Agreement for Highrock Uranium Project

VANCOUVER, BC / ACCESSWIRE / February 10, 2022 / Sassy Resources Corporation ("Sassy" or the "Company") (CSE:SASY) (FSE:4E7) (OTCQB:SSYRF) has completed the definitive option agreement (the "Agreement") for the Highrock Uranium Project in Saskatchewan, south of Cameco’s Key Lake site, with project operator

Mobilization for access to the Highrock drill sites by a winter haul road is in progress with the start of drilling anticipated this month.

Mr. Mark Scott, Sassy CEO, commented, "We are very pleased to have completed the definitive option agreement for the Highrock Project, following up on the terms laid out in the original Letter of Intent signed with Forum Energy Metals in early January. We have high quality drill targets at Highrock, offering shareholders excellent leverage to a potential new discovery and uranium market upside this year and beyond."

As announced January 6, 2022, Sassy signed a binding Letter of Intent (the "LOI") with Forum […]

Click here to view original web page at www.juniorminingnetwork.com

2022 Uranium Stocks List | The Top 3 Uranium Stocks Now

Uranium plays a pivotal role in producing nuclear power. As a result, investors looking to capitalize on the long-term growth potential of nuclear energy, might be interested in learning more about uranium stocks.

To be sure, uranium stocks are highly risky–most have low market caps below $1 billion, and only a few pay dividends to shareholders.

However, like many commodities sectors, uranium stocks could provide attractive long-term growth, as demand for nuclear power rises around the world.

With this in mind, we created a list of 40 uranium stocks. You can download a copy of the uranium stocks list (along with important financial metrics such as dividend yields and P/E ratios) by clicking on the link below: Click here to download my Uranium Stocks Excel Spreadsheet now . Keep reading this article to learn more.This article will give an overview of the uranium industry, and the top 3 uranium stocks now. Table […]

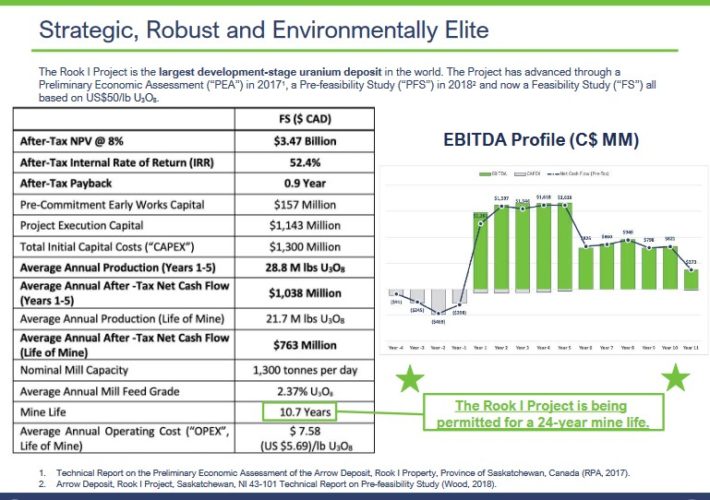

Cameco restarts Canadian uranium operation

Cameco has announced plans to restart uranium production at McArthur River/Key Lake, idled since 2018. The company plans to ramp up production at the operation in northern Saskatchewan to produce 15 million pounds U3O8 (5770 tU) per year starting in 2024, but aims to maintain "supply discipline", reducing production at Cigar Lake to 25% below its licensed capacity. McArthur River (Image: Cameco)

"We see a market where fundamentals are shifting in our favour," Cameco President and CEO Tim Gitzel told investors in the company’s conference call. Cameco’s planned and unplanned production cuts, inventory reduction and market purchases, have since 2016 removed more than 190 million pounds U3O8 from the spot market, he said. The company has added 70 million pounds of long-term contracts to its portfolio since the start of 2021.

Coupled with increasing recognition around the world that nuclear energy will play a key role in achieving decarbonisation goals, it […]

Click here to view original web page at www.world-nuclear-news.org

Uranium Market 2022 Industry Development Growth, Share, Outlook, Size, Trends, Manufacturers Analysis and 2027

( MENAFN – The Express Wire)

‘ ‘

A new report has been added by Market Growth Reports on the Global Uranium Market that shed light on the effective examination techniques. It provides a detailed description on the dynamic view of the market which has different perspectives. This Global Uranium Market report summarizes about the technologies, which can help to scale up the growth of the businesses in the near future.

“Get Sample PDF of report, please connect with our sales team below.“ Name: Mr. Ajay MoreEmail: sales [@] marketgrowthreports [.] comPhone: US +1 424 253 0946Due to the pandemic, we have included a special section on the Impact of COVID 19 on the Global Uranium Market which would mention How the Covid-19 is affecting the Industry, Market Trends and Potential Opportunities in the COVID-19 Landscape, Covid-19 Impact on Key Regions and Proposal for the Global Uranium Market Players to Combat […]

Global Nuclear Fuels Sales Market In- Depth Research, Industry Statistics 2022 | ARMZ Uranium Holding Company, Cameco, Energy Resources of Australia, BHP Billiton, Canalaska Uranium, KazAtomProm, B…

The Nuclear Fuels Sales Market report covers the entire scenario of the global market including key players, their future campaigns, preferred suppliers, market shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate market-improving factors. Its goal is to rationalize the company’s costs. You can also find current income interest and expense points here. The best thing about the Nuclear Fuels Sales market report is the provision of guidelines and strategies that are followed by leading market participants. The investment opportunities in the market that are highlighted here will go a long way in driving the business forward. Knowing the current market situation is the most important thing discussed here to help major players survive in the murderous market.

This Nuclear Fuels Sales market study describes the economic catastrophe caused by the covid-19 outbreak, which has affected all sectors of the […]

Click here to view original web page at thetalkingdemocrat.com

First Quantum to hunt for copper and gold at Boss’ Honeymoon uranium project

Deal with global giant comes as Cameco fuels uranium bulls with decision to restart two mines. Plus, Coda’s corporate action puts spotlight on its upside and Caspin likens its find to Chalice’s Gonneville.

Last week’s suggestion that Boss Energy (BOE) must be close to deciding what to do with the hidden copper-gold-zinc potential of the tenements covering its Honeymoon uranium project in South Australia’s Curnamona province was on the mark.

The suggestion was based on a diary entry from February last year which noted Boss had completed a comprehensive desktop review of all historical geoscientific information acquired since exploration began in the area in the late 1960s.

The review highlighted uranium upside which was nice. But it also highlighted the region’s untapped copper-gold-zinc exploration potential, prompting the idea that a year on, Boss must have been close to capturing value for the non-uranium potential.As luck would have it, the diary note […]

Click here to view original web page at www.livewiremarkets.com

Monsters of Rock: Back by popular demand, one of the world’s largest uranium mines

Pic: Formation, Beyonce (2016) share

Canadian uranium giant Cameco has announced the biggest shift in uranium supply in several years, revealing plans to stage the recovery of its giant McArthur River mine and Key Lake mill in Canada.

The mine, which previously produced around 12% of the world’s supply of yellowcake, has been on ice since 2018.

Reporting its 2021 results yesterday, Cameco says the Saskatchewan mine will be progressively brought back online in light of improvements in both the spot and term contract markets for uranium.From 25% of its licenced capacity in 2021, when it delivered a net loss of US$103 million, Cameco aims to inch up to 60% by 2024.Despite the promise of all this production coming back online junior uranium miners have been in a buoyant mood today.That’s probably because Cameco is embracing a level of unbridled optimism it hasn’t in years about the state of the nuclear […]

Cameco restarts Canadian uranium operation

Cameco has announced plans to restart uranium production at McArthur River/Key Lake, idled since 2018. The company plans to ramp up production at the operation in northern Saskatchewan to produce 15 million pounds U3O8 (5770 tU) per year starting in 2024, but aims to maintain "supply discipline", reducing production at Cigar Lake to 25% below its licensed capacity. McArthur River (Image: Cameco)

"We see a market where fundamentals are shifting in our favour," Cameco President and CEO Tim Gitzel told investors in the company’s conference call. Cameco’s planned and unplanned production cuts, inventory reduction and market purchases, have since 2016 removed more than 190 million pounds U3O8 from the spot market, he said. The company has added 70 million pounds of long-term contracts to its portfolio since the start of 2021.

Coupled with increasing recognition around the world that nuclear energy will play a key role in achieving decarbonisation goals, it […]

Click here to view original web page at world-nuclear-news.org

Energy Fuels is now producing uranium, vanadium, and mixed rare earths, a first in the world accomplishment

Earlier this week I discussed a rare earths and uranium ‘junior’ ; but today I take a look at a uranium/vanadium and rare earths ‘producer’ that continues to do well over the years by navigating successfully the market’s highs and lows and more recently expanding into rare earths processing/production.

The Company is Energy Fuels Inc. (NYSE American: UUUU | TSX: EFR). Energy Fuels is the number one uranium producer in the U.S. and has the potential to become one of the lowest-cost, non-Chinese rare earth producers in the world. In its latest move the Company is looking at commercially developing a newly applied (to rare earths) technology to produce rare earth metals and alloys, a step down the supply chain and higher up the value-add chain.

Below is their stock price chart which is quite impressive given the uranium bear market from 2014 to 2021, when many uranium miners went out […]

Blue Sky Uranium Announces First Ivana Main Drill Results Contributed Opinion

Ivana deposit; Rio Negro province, Argentina During times of relative stock market unrest, caused by more hawkish Fed policies regarding potential interest rate hikes and reduction of bond buying programs, Volume: 149,976

Market Cap: 35.24m

PE Ratio: -3.90

Year High: $0.37

Year Low: $0.16

Shares Out: 185,455,307

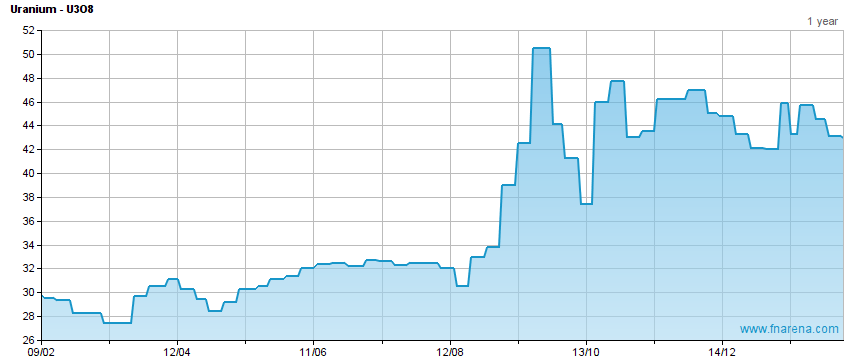

Float: 181,853,112 Institute Hold’gs: 0.50% (as of 01/31/22) Institutions Bought Prev 3 Mo: 0Blue Sky Uranium Corp. (BSK:TSX; BKUCF:OTC; MAL2:FSE) is busy drilling several Ivana targets at their flagship Amarillo Grande uranium project in Argentina.Nowadays uranium is a relatively hot market to be in, as the Sprott Uranium Trust is trying to kickstart the utility buying of long term contracts by more or less cornering the spot market for uranium oxide in my view, buying huge amounts with their budget of over $1.3B since September 2021: All moves of the uranium oxide spot price are represented nicely on this […]

Click here to view original web page at www.streetwisereports.com

Nuclear Fuels Market Size, Scope, Growth, Competitive Analysis – ARMZ Uranium Holding Company, Cameco, Energy Resources of Australia, BHP Billiton

New Jersey, United States,- The Nuclear Fuels Market report covers the whole scenario of the global market including key players, their future promotions, preferred vendors, market shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate market improving factors. It aims to rationalize the expenses of the company. You can also find the current revenue generation rate and spend score here. The best thing about the Nuclear Fuels market report is the provision of guidelines and strategies followed by major market players. The investment opportunities in the market highlighted here will be of great help in moving the business forward. Knowing the current state of the market is the most important thing covered here to help big players survive in the cutthroat market.

This Nuclear Fuels market research depicts the economic catastrophe induced by the COVID-19 epidemic, which impacted every company […]

Click here to view original web page at www.conradrecord.com

Uranium Snapshot: Eight juniors of interest

As the world slowly moves away from fossil fuels, here are eight juniors on the hunt for what may be this century’s greenest metal . Appia Rare Earths and Uranium

Appia Rare Earths and Uranium (CSE: API; US-OTC: APAAF) as the name suggests is hunting rare earth elements (REEs) as well as uranium in both the Athabasca Basin of Saskatchewan and Elliot Lake in Ontario. The company recognizes not only the potential importance of uranium in a decarbonized world, but also the fact that it frequently occurs with rare earths, another source of critical metals. Aerial view, Alces Lake property in Saskatchewan Appia’s Elliot Lake uranium-REE property includes 101 claims 3 km north of Elliot Lake. The property is also only 58 km northeast of Blind River, Ontario, where Cameco operates the world’s largest commercial uranium refinery.

Spurred by the necessities of the Cold War, uranium mines in Elliot Lake […]

Uranium Week: Clean And Green

This story features ENERGY RESOURCES OF AUSTRALIA LIMITED, and other companies. For more info SHARE ANALYSIS: ERA

The European Commission has decided nuclear is a “green” transition energy.

-Volatile uranium market in January

-EC decides nuclear and gas-fired power are green in transition

-Analysts see upside to prices ahead The month of January proved to be a very volatile one for the spot uranium market. The earlier part of the month was dominated by speculative buying from the Sprott Physical Uranium Trust, which acquired 2.7mlbs U3O8 in the period. Canaccord Genuity estimates the SPUT has some $2.4bn of buying power left in its US$3.5bn at-the-market facility.But SPUT’s buying came to a screaming halt in the latter half of the month, as the Fed set off extreme financial market volatility in switching to a hawkish monetary policy stance. The entry of the SPUT and other speculative-only players in the market […]

Uranium Energy Corp. (UEC): Ready for an explosive trading day

For the readers interested in the stock health of Uranium Energy Corp. (UEC). It is currently valued at $2.83. When the transactions were called off in the previous session, Stock hit the highs of $2.72, after setting-off with the price of $2.55. Company’s stock value dipped to $2.52 during the trading on the day. When the trading was stopped its value was $2.70.Recently in News on February 3, 2022, Uranium Energy Corp Becomes Debt Free After Paying Off Credit Facility. NYSE American Symbol – UEC. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $4.29 on 01/05/22, with the lowest value was $2.34 for the same time period, recorded on 01/28/22.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a […]

Standard Uranium Begins Winter Exploration Program at Sun Dog Project, Announces Staffing Update and Granting of Stock Options

VANCOUVER, British Columbia, Feb. 07, 2022 (GLOBE NEWSWIRE) — Standard Uranium Ltd. (“Standard Uranium” or the “Company”) (TSX-V: STND) (OTCQB:STTDF) (Frankfurt: FWB:9SU) is pleased to announce that exploration activities have commenced on the Company’s Sun Dog Project, (“Sun Dog” or the “Project”) located in the northwestern Athabasca Basin, Saskatchewan. High-resolution geophysical surveys are currently underway on the Project, with the Standard Uranium team and drill crews scheduled to mobilize in three weeks. The Project is comprised of 6 mineral claims over 15,770 hectares and is highly prospective for basement-hosted and unconformity-related uranium deposits.

Inaugural Sun Dog Drill Program Summary : High-resolution ground gravity and UAV magnetic surveys will refine specific drill targets;

Approximately 3,000 metres in ten (10) diamond drill holes planned, subject to weather and ice conditions, to follow up on known high-grade* uranium mineralization;

Drilling to commence first week of March 2022; Inaugural drilling by Standard […]

Click here to view original web page at www.globenewswire.com

What are the best uranium stocks?

There are many factors that favor the uranium industry in the current market environment. The Sprott fund is buying substantial amounts of uranium, so it is clear that nuclear power is considered a viable option.

Nuclear power’s potential for using uranium as fuel has long been touted. Hence, our choice of uranium stock is exciting under the present market conditions. Think about investing in them.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns. Click here for full details and to join for free .SponsoredThe […]

Adavale Resources : Lake Surprise Uranium Geochemistry Results

For personal use only

Lake Surprise Uranium Geochemistry

Results Uranium Assay results received from ALS Laboratories

Assay summary: 11 of 28 rock chip samples returned values over 100ppm uranium, 7 of which are greater than 200ppm uranium > Maximum uranium value of 356ppm > Sample values are greater than 20 times the background values estimated from the spectrometer survey > Elevated values of uranium coincident with elevated gamma mapped from the spectrometer survey Planning of next phase of exploration underway Adavale Resources Limited (ASX:ADD) ("Adavale" or "the Company") is pleased to announce geochemistry results from the work program in the final quarter of 2021 on its 100% owned Lake Surprise Uranium Project tenements in South Australia.Adavale geologist Patrick Harvey commented:"The uranium content in the rock samples is significantly above the spectrometer estimated background reading levels ~2 to 3ppm.The elevated uranium in the rock […]

Click here to view original web page at www.marketscreener.com

ALX Resources Corp. Closes Athabasca Basin Properties Transaction with Okapi Resources Ltd

The Six Properties

ALX has agreed to sell to Okapi its current interests in the Six Properties as described in the table below: Property Name ALX’s

Interest No.

of Claims Project Area

(ha) Newnham Lake 100% 1 14 16,940.03 Kelic Lake 100% 2 12 13,620.25 Argo 100% 3 6,974.53 Lazy Edward Bay 100% 3 42 11,263.15 Perch 100% 4 1 1,681.71 Cluff Lake 80% 5 3 4,832.84 1 Two claims are subject to an underlying 1.0% gross overriding royalty ("GOR") in favour of an arm’s length vendor with a 0.5% buydown provision for CAD$1.0 million, and five claims are subject to an underlying 2.5% net smelter returns royalty ("NSR") in favour of a non-arm’s length vendor with a 1.0% buydown provision for CAD$1.5 million;

2 Five claims are subject to an underlying 2.5% NSR in favour of a non-arm’s length vendor with a 1.0% buydown […]

Click here to view original web page at www.juniorminingnetwork.com