A strong pickup in the USD demand exerted fresh pressure on the dollar-denominated commodity.

A selloff in the equity markets might lend some support to the safe-haven gold and help limit losses.

Bearish traders might wait for a sustained break below 100-day SMA before placing aggressive bets.

Gold edged lower during the first half of the European trading session and was last seen trading near daily lows, just above the $1900 level.The precious metal witnessed some fresh selling on Wednesday and reversed the previous day’s positive move, albeit remained well within a four-day-old trading range. A strong pickup in the US dollar demand was seen as a key factor exerting some pressure on the dollar-denominated commodity.The alarming pace of growth in new coronavirus cases and the imposition of fresh lockdown restrictions fueled concerns that the economic growth will weaken again. This, along with the uncertainty about […]

Category: Gold

Gold, The Dollar, And The 10-Year Rate

Summary

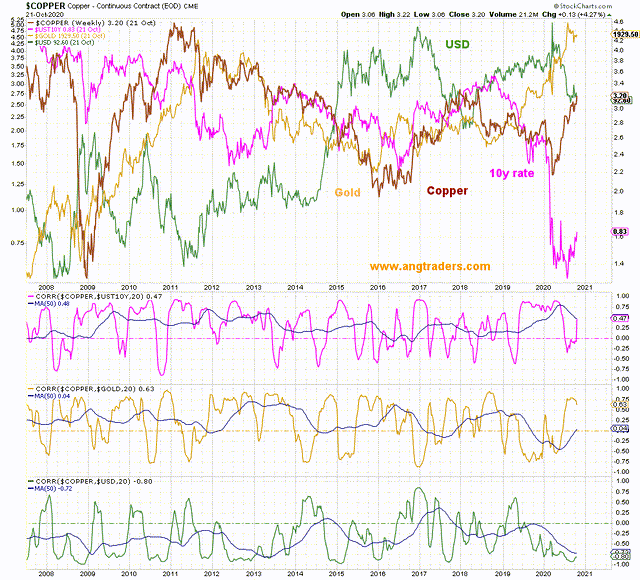

We investigate several correlations of gold with a variety of parameters.

Copper, the dollar, and the 10-year rates are all connected to the gold market.

We summarize the balance of probabilities for gold, the dollar, and the 10-year bond rate going forward.In this piece, we investigate several correlations of gold with a variety of parameters, including copper, the dollar, inflation, and the 10-year rates. Copper Copper correlates: Strongly positive with the 10-year rate Positively with gold Negatively with the dollar Copper has been rising throughout the recovery and is likely to continue moving higher. This implies gold and the 10-year rate are likely to go higher and the dollar is likely to move lower. Pring Inflation Index Gold has a positive correlation with the Pring Inflation index, but on occasion, the correlation spikes negative. Half the negative spikes were followed by rallies in gold and half by drops in the gold […]

This Dhanteras buy gold at price as low as Re 1 –Check out BharatPe’s digital gold service

This Dhanteras buy gold at price as low as Re 1 –Check out BharatPe's digital gold service New Delhi: This Dhanteras, purchasing gold can be started as low as Re 1. Merchant payment platform BharatPe in association with Safegold, has introduced digital gold product on its platform for merchants.

Merchants will get an entire gamut of financial products with the launch of digital gold on BharatPe.

Minimum investment limit

BharatPe Gold merchant can start investment for as low as Re 1. The choice of payment is either via BharatPe balance or UPI. BharatPe has said that in the near future, it will be adding credit and debit cards as payment options. What is Safegold? Safegold is a digital platform allowing customers to buy, sell and take delivery of 24k physical gold, at low ticket sizes. The services are available around the clock. SafeGold has appointed IDBI Trusteeship Services to protect […]

A New Gold Rush Is Set To Take Place Here

LONDON, Oct. 28, 2020 /PRNewswire/ — By the end of next year, Australia is expected to become the #1 country in gold production, knocking China from the pedestal during today’s gold bull market. It’s been home to some of the biggest gold bonanzas in the world, like the Mount Morgan mine which has produced over 8 million ounces of gold to date. Mentioned in today’s commentary includes: Teck Resources (NYSE: TECK ), Wheaton Precious Metals Corp . (NYSE: WPM ), First Majestic Silver (NYSE: AG ), Turquoise Hill Resources (NYSE: TRQ ), Endeavor Silver (NYSE: EXK ).

Now, Sentinel Resources Corp. ( SNL ) ( SNLRF ) has brought together a team with over 90 years of combined experience to tap this historic region again in the ultimate low-risk, high-reward opportunity. Armed with valuable data on historic mines that some world-class geologists believe is worth over $30 million, Sentinel just […]

Steep price losses for gold, silver as greenback gains

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are solidly lower in early U.S. trading Wednesday. The precious metals are again being pressured by a stronger U.S. dollar index on this day. Much to the consternation of the bulls, the safe-haven metals can’t catch a bid at mid-week despite the keener risk aversion in the marketplace. Once again the shorter-term gold futures traders are paying more attention to the daily movements of the U.S. dollar index. December gold futures were last down $21.50 at $1,890.20 and December Comex silver was last down $0.62 at $23.97 an ounce.

Global stock markets were mixed but mostly lower overnight. U.S. stock indexes are set to open the New York […]

Gold Price Analysis: XAU/USD ticks up to $1,910 and turns positive on the day

Gold bounces from $1,900 support area and returns to $1,910.

XAU/USD appreciates moderately as risk aversion eases.

Gold futures have found support right below the $1,900 area earlier today before inching up to $1,910, turning positive on daily charts. The precious metal lost ground, with the US dollar building up during the European session on Tuesday, to appreciate during the North American session with market sentiment improving moderately. XAU/USD remains neutral around $1,900

From a wider perspective, bullion prices remain moving directionless within previous ranges, fluctuating both sides of the $1,900 level, with upside attempts capped around $1,910.Investor’s concerns about the consequences of the second COVID-19 wave, with infections soaring in the US and in the major European economies, have crushed appetite for risk, boosting demand for the US dollar and weighing on the dollar-denominated gold.Beyond that, renewed US-China tensions on the back of a potential sale […]

Gold is likely to win this election

Trump and Biden debated for the second and last time in this campaign. So, who will win, and why gold is likely to be the biggest winner of them all?

President Donald Trump and Democratic challenger Joe Biden met for the second and the last debate before the elections. Thankfully, this time things were less chaotic and with far fewer interruptions and insults. Perhaps Trump has acknowledged that his aggressive behavior was a liability and decided to change his approach – especially since this was his final opportunity to alter the presidential campaign dynamics.

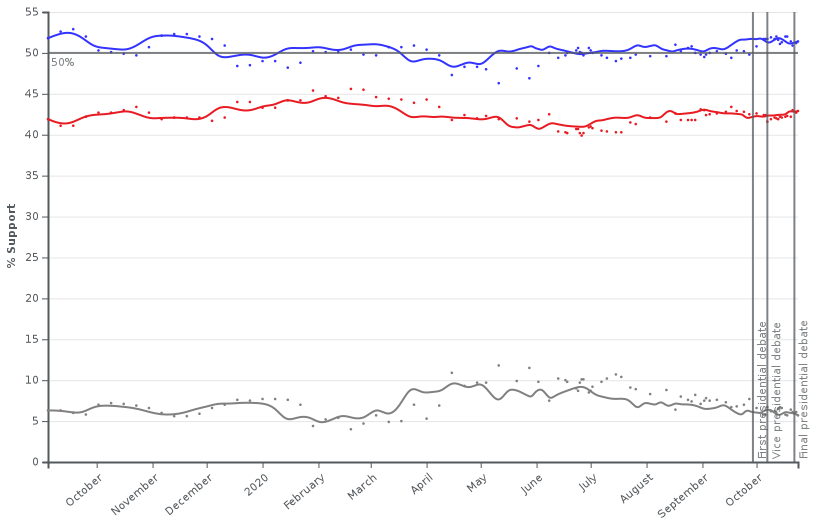

However, it might be too late now. According to both nation-wide and state-by-state polls, and market bets, Biden is still in a significant lead (as the chart below shows). Moreover, because of the postal voting, many votes are already locked in, as a record 47 million Americans have already cast their ballots. In addition to the above, […]

Gold and silver – don’t fear the wall of worry

Investors today seem to love jumping on whatever asset’s price is soaring. Tesla is going vertical? Buy Tesla. Gold is going vertical? Buy gold stocks. Already overvalued? No problem—it’s hot!

This sort of momentum-chasing is no “buy low, sell high” strategy. It can work if a greater fool comes along, but if one buys just as momentum falters, the losses are major.

All obvious, I know, but needed to set the stage.

Now, gold bugs enter the scene, stage right.We buy gold and silver whenever we can… but gold and silver stocks? Do we buy at the bottom in late 2015? After the failed rally in 2016? Or during the Crash of 2008?A few of us did—precious few. More were spooked out of the market. Many took huge losses in the process.I’ve seen evidence of this in the flow of reader correspondence over the years. Perhaps more telling is that subscriptions tend […]

Gold steady as coronavirus, U.S. elections uncertainty loom

An Argor-Heraeus SA branded two hundred and fifty gram gold bar, center, sits in this arranged photograph at Solar Capital Gold Zrt. in Budapest, Hungary.

Akos Stiller | Bloomberg | Getty Images

Gold prices were little changed on Wednesday, staying above the $1,900-mark, as uncertainties about U.S. elections and surging global Covid-19 cases countered pressure from a firmer dollar and fading hopes of an immediate U.S. stimulus package.

Spot gold was steady as $1,906.15 per ounce by 0329 GMT. U.S. gold futures were down 0.3% at $1,907.10.“Investors need a reason to buy more gold and the reason to buy gold will come from a policy signal,” said Stephen Innes, chief global market strategist at Axi.“With the virus raging all over, we are going to get stimulus at some point … This is also probably leaning towards more central bank intervention because the economic hit is going to be quite significant,” he […]

Gold Futures: Room for extra gains near-term

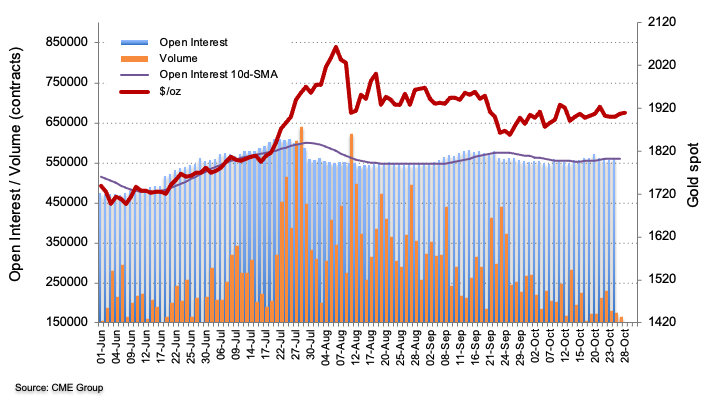

In light of preliminary figures for Gold futures markets from CME Group, open interest reversed three pullbacks in a row and went up by around 4.7K contracts on Tuesday. In the same line, volume extended the downtrend for the third consecutive session, this time by nearly 10.3K contracts. Gold meets initial hurdle at $1,920/oz

Prices of gold extends the upbeat momentum so far this week. Tuesday’s positive price action was in tandem with rising open interest, leaving the door open for the continuation of this move in the very near-term. That said, the 55-day SMA at $1,922 emerges as the initial interim hurdle. Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your […]

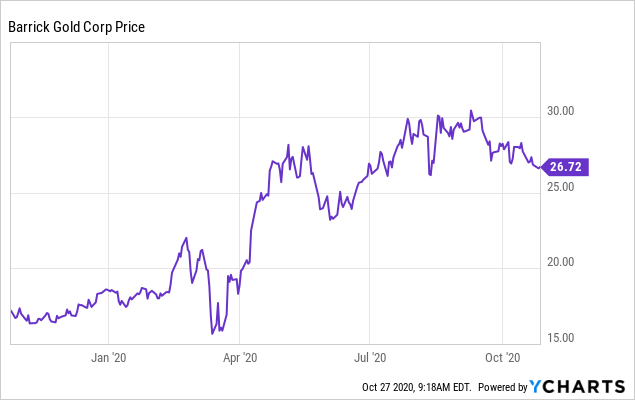

Barrick Gold: What To Expect Next

Summary

Barrick Gold reported Q3 production figures on Oct. 15 and will release Q3 results on Thursday, Nov. 5.

Barrick produced more gold in Q3 and earnings will benefit from a 10.3% rise in gold prices and a 17.9% rise in copper prices.

Barrick will likely report strong earnings and cash flow, and a drop in its net debt to $1 billion, with the potential for a dividend raise.Here’s what to expect from Barrick’s upcoming earnings report, a look at its valuation, and where the stock may be headed. Looking for more investing ideas like this one? Get them exclusively at The Gold Bull Portfolio. Get started today » Barrick Gold: What To Expect In Q3 YCharts Barrick Gold’s ( GOLD ) shares have been outperforming its peers year to date, returning 43.46% compared to a 30.70% gain in the VanEck gold miners index ( GDX ) and a 25.25% increase in […]

As gold surges, mining threatens one-fifth of Indigenous lands in the Amazon

Shutterstock Curioso.Photography Close Authorship Aerial view of Amazon River. For decades, the Yaigojé Apaporis Indigenous People in Colombia’s lower Apaporis River Basin worked to get their traditional lands formally recognized by the government and secured from outside threats. Initially protected as the Yaigojé Apaporis Reserve, it also was declared an Indigenous territory in 1988.

But in 2007, Cosigo Resources, a Canadian mining company, requested from the government a gold mining concession within the Yaigojé Apaporis Reserve. The Yaigojé Apaporis were alarmed, but unlike other Indigenous groups around the world, they had some legal options. Laws in Colombia recognize Indigenous peoples’ right of consultation, although not consent. They also provide Indigenous communities with the right of first refusal, meaning they are first offered the mineral rights before the government can grant a mining concession to a third party. And while national laws allow mining on Indigenous lands, it is not permitted […]

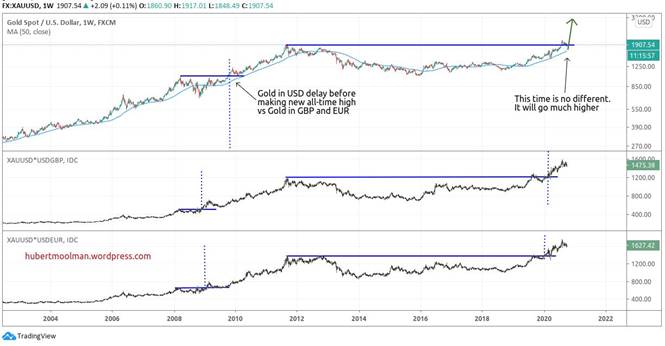

Gold is doing it again

Gold is trading really close to its 2011 all-time high. This is obviously a critical level for the future of gold prices.

Historically gold in US dollars often clears significant all-time highs only some time after significant currencies like the Euro and British pound.

This is mainly due to US dollar behaviour during times of significant risk aversion, like we’ve had this year and 2008, for example.

The following charts comparing gold in USD, in GBP and in Euro shows just that: Gold in USD only surpassed its significant March 2008 high about a year after gold in GBP and Euro did it. We have a similar setup where gold in GBP and Euro already hit their 2012 high around August 2019.Both GBP gold and Euro gold are sitting comfortably above their 2012 high. History strongly suggests that USD gold will follow and get comfortably above the 2012 high real soon.The US […]

Gold Bar Buying Rallies in China as ETF Investing ‘Plugs Covid Demand Gap’, Stocks Markets Slip

GOLD BARS traded in London ticked higher in quiet trade Tuesday, holding in a tight $10 range above $1900 per ounce as world stock markets extended yesterday’s US plunge as the Covid pandemic’s second wave worsened ahead of next week’s US presidential election.

US tech-stock index the Nasdaq struggled to rally from Monday’s 2.0% drop, led by German-based SAP (Nasdaq: SAP) plunging over 20% after it slashed 2020’s earnings outlook on falling sales amid the global virus crisis.

The EuroStoxx 600 index meantime slipped to trade 5.0% below the peak first reached in June, halving the spring’s Covid Crash.

Wholesale gold bars priced in Euros have added €100 per ounce since then, trading at €1611 in London on Tuesday. "Gold is continuing to lack support from physical gold demand in Asia," says Germany’s Commerzbank in a note. "Swiss trade data had revealed last week that gold demand in India and China was […]

Click here to view original web page at www.bullionvault.com

PRECIOUS-Gold gains as fresh virus wave looms over economic recovery

* Palladium to test $2,600/oz by mid-2021 -UBS * Interactive graphic tracking global spread of coronavirus: here (Updates prices) By Eileen Soreng Oct 27 (Reuters) – Gold prices rose on Tuesday as a weaker dollar and a fresh wave of coronavirus infections threatened to further slow down a global economic recovery from the COVID-19 pandemic, bolstering bullion’s safe-haven appeal. Spot gold was 0.1% higher at $1,903.16 per ounce by 0801 GMT. U.S. gold futures were steady at $1,906.50. "The resurgence of COVID-19 is leading to a broader risk-off sentiment in global markets and this is supportive of safe-haven assets," said Harshal Barot, senior research consultant for South Asia at Metals Focus. "Investors are clearly not bearish on gold at the moment… Long-term investors continue to hold gold amid the broader uncertainty, be it the U.S. elections or the pandemic," Barot added. Many countries, including the United States, Russia and […]

Gold and silver technicals leading into the US session

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold is still moving sideways into the US session. The histogram on the right-hand side of the chart shows the amount of volume that has been traded at what price and now a large peak is being formed near $1905.9 per ounce. As suggested yesterday the price is now finding resistance at the bottom of the flag type structure. There was not a significant test of the purple resistance line but if the bulls are to take control of this market it would need to be broken. On the downside, the next support remains at the blue line near $1885 per ounce. Silver is also struggling at the area where most contracts […]

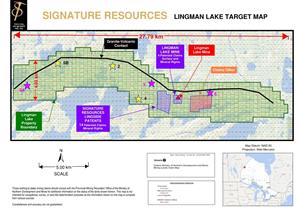

Signature Announces Significant Update to Its Gold Assay Results From Its Successful Lingman Lake Exploration Program

LINGMAN LAKE TARGET MAP TORONTO, Oct. 27, 2020 (GLOBE NEWSWIRE) — Signature Resources Ltd. (TSXV: SGU, OTCQB: SGGTF, FSE 3S3) ("Signature" or the "Company") is pleased to announce a significant update to its gold assay results from its Exploration program. The update details the relationship of the areas sampled from its Exploration program conducted in September, 2020, as reported in a press release dated October 21, 2020. “Given the known relationship of the Lingman Lake Mine gold zones to the north granite-volcanic contact, our exploration strategy was simple, stake this contact regardless and then explore later. We are excited that the results of this past summers field program have proved the significance of this contact. We now have target areas dispersed along 20.2 kilometers of strike length. With these results, we at Signature are confident that the potential for significant discoveries are extremely high with further exploration. Those areas […]

Click here to view original web page at www.globenewswire.com

Weaker-than-expected U.S. consumer confidence pushes gold price higher

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) Gold prices edged up after the U.S. consumer confidence index came in short of market expectations in October.

American consumer confidence index declined to 100.9 in October, from September’s downwardly revised reading of 101.30, the U.S. Conference Board reported Tuesday. Economists were expecting to see the index at a reading of 102.0.

Gold prices ticked up towards daily highs after the data release with the December Comex gold futures last trading at $1,909.80 an ounce, up 0.22% on the day.

Traders closely watch the consumer optimism survey as it is a potential leading indicator for economic growth. The more optimistic consumers feel, the more likely they are going to spend money and vice versa.The Present Situation Index, which describes consumers’ […]

Wait-and-see mode sets in on the gold market: TD Securities

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here!

(Kitco News) With the U.S. election seven days away, gold traders are now in the wait-and-see mode, says TD Securities. "Participants are also evaluating the potential for a fiscal stimulus deal to be struck in the lame duck session — which hinges on the election results," write TD Securities commodity strategists. A blue wave scenario at the polls is likely to offer support to the gold price in the long-term, the strategists add. "A Blue Wave has driven expectations of a lower dollar, as more stimulus fuels a global reflationary wave, but it has also fueled the bear steepening in the Treasury curve. While we think the Fed will mitigate these risks shortly after the election by extending […]

Gold ‘Steady As She Goes’ Ahead of Election

Attention in the capital markets is strictly focused on whether investors can count on more stimulus measures before the forthcoming U.S. presidential election. Gold is as steady as she goes pre-election, but with rising coronavirus cases, can it tick higher before voters head to the polls?

Per a Kitco News article , “Investor demand is holding relatively steady, in line with the recent price action, according to the latest trade data from the Commodity Futures Trading Commission (CFTC). Hedge funds remain active investors in the gold market; however, analysts have noted that nobody is making significant bullish or bearish bets ahead of the Nov. 3 U.S. General Election.”

“With a Biden win increasingly being priced in, some may have decided to step aside until after November 3. Not least considering the memory of 2016 when the Trump win helped trigger a 15% correction in the weeks following the election,” said Ole […]

World Bank sees stable gold price, 14% drop in silver in 2021

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The World Bank is not expecting to see major gold price moves in 2021 as the market has seen extraordinary gains this year, according to its latest commodity report.

Gold prices are stuck in a consolidation patter with prices hovering around $1,900 an ounce as the World Bank noted that prices rose 12% in the third quarter, its eighth consecutive quarter of gains.

"Prices are expected to average 27.5% higher in 2020 and remain broadly stable in 2021 as the global economy recovers," the World Bank analysts said in their October commodity report.

The analysts noted that the precious metals market is being driven entirely by investment demand, which has risen to historic levels so far this year. […]

Learn How The Pandemic Has Affected Miners in “Gold Rush”

When a global pandemic shut down the world in March 2020, markets crashed and rocked the U.S. economy. However, with economic uncertainty comes great opportunity for those who can seize upon the moment. And in the goldfields across North America, the opportunity of a lifetime awaited as gold prices spiked to record highs and the price of fuel, a miner’s biggest expense, bottomed out. In this all-new season of Discovery’s #1 Show, Gold Rush, seasoned gold miners are joined by greenhorn miners eager to forge their own destinies and gamble like never before in pursuit of the greatest pay day of their lives.

Gold miners Parker Schnabel, Tony Beets and Rick Ness take massive gambles this season as they face the worst time crunch ever as the gold fields opened two months late because of COVID-19. And joining Gold Rush this season is ex-special forces medic and greenhorn miner Fred […]

Gold Is Likely to Win This Election

President Donald Trump and Democratic challenger Joe Biden met for the second and the last debate before the elections. Thankfully, this time things were less chaotic and with far fewer interruptions and insults. Perhaps Trump has acknowledged that his aggressive behavior was a liability and decided to change his approach – especially since this was his final opportunity to alter the presidential campaign dynamics.

However, it might be too late now. According to both nation-wide and state-by-state polls, and market bets, Biden is still in a significant lead (as the chart below shows). Moreover, because of the postal voting, many votes are already locked in, as a record 47 million Americans have already cast their ballots.

In addition to the above, the epidemiological situation does not help Trump at all. People believe that he dealt poorly with the epidemic , and now we even have the resurgence in the number of […]

Gold Price Prediction – Prices Edge Higher as US Yields Fall

Gold prices moved higher but the price action continued to form a sideways range. The dollar moved lower along with US treasury yields which appear to have broken down below support near the 50-day moving average. A stronger than expected durable goods orders failed to lift yields which weighed on the greenback and paved the way for higher gold prices.

Trade gold with FXTM Technical analysis

Gold prices moved higher but continue to enjoy a consolidative tone. Gold prices edged above resistance near the 10-day moving average at 1,906, which is now seen as support. Additional support is seen near the October lows at 1,872. Resistance is seen near the 50-day moving average at 1,919. Short-term momentum has whipsawed turning negative as the fast stochastic generated a crossover sell signal on the upper end of the neutral range. Medium-term momentum remains neutral as the MACD histogram prints in the black […]

Gold investment demand continues to drive markets as physical demand continues to fall – Refinitiv

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – Investment demand, in an environment of low interest rates and unending uncertainty and turmoil, remains the singular driving force in the gold market, according to analysts at Refinitiv.

In a report last week, the research firm said that physical gold demand fell by 562 tonnes in the third quarter, down 30% compared to the third quarter of 2019. However, dismal physical demand has had little impact on prices as gold pushed to an all-time high above $2,000 in early August.

Commodity analysts at Refinitiv said that gold prices averaged $1,909 an ounce between July and September, up 27% from the second quarter and up 30% from last year.

Although physical demand is expected to continue to struggle, analysts at […]