Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are solidly higher in midday U.S. trading Monday, on safe-haven demand just one day before the U.S. elections and all of the uncertainty and anxiousness surrounding the matter. December gold futures were last up $15.00 at $1,894.90 and December Comex silver was last up $0.474 at $24.12 an ounce.

It’s a huge trading week as the U.S. election is Tuesday. Joe Biden has a sizeable lead over President Donald Trump in most polls. However, the polls were wrong in the last U.S. presidential election in 2016. Also, Covid-19 cases continue to rise in the U.S. and Europe, with the U.K. joining France in having to lock down many […]

Investors holding record levels of gold for fifth consecutive month – LBMA

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – Gold maybe be caught in a tightening consolidation pattern around $1,900 an ounce, but according to the latest trade data from the London Bullion Market Association (LBMA), investors continue to see value in precious metals.

For the fifth consecutive month, a record amount of gold was held in London vaults in September, the LBMA said in its monthly clearing statistics report. As of the end of September, there were a record 9,069 tonnes of gold held in London, valued at $550.2 billion. Meanwhile, UK vaults held 33,508 tonnes of silver, valued at $25.6 billion.

Although gold investors continue to increase their holding in gold and silver, trading activity actually slowed in September.

According to the report, the volume of […]

Gold Price Futures (GC) Technical Analysis – Facing Wall of Resistance Between $1889.70 and $1917.40

Gold futures are holding steady late in the session on Monday despite a firmer U.S. Dollar and strong demand for higher risk assets. Some traders are saying a spike in global coronavirus cases is helping to underpin the dollar-denominated assets because of their potential to weaken the global economic recovery. This could lead to additional monetary stimulus from the central banks and fore fiscal stimulus from the U.S. government.

At 18:53 GMT, December Comex gold futures are trading $1893.30, up $13.40 or +0.71%.

Traders are also monitoring the polls before the U.S. presidential election on Tuesday. Democrat Joe Biden is leading U.S. President Donald Trump in national opinion polls, but the race is tight in several battleground states, with mounting fears the results may not be clear on Tuesday night as ballot counting could take days.

Daily December Comex Gold Daily Swing Chart Technical Analysis The main trend is down according to […]

Gold Price Prediction – Prices Rise Ahead of US General Election

Gold prices moved higher for the second consecutive trading session. This comes despite a rising dollar. US yields moved lower on Monday, despite a stronger than expected US ISM manufacturing report which paved the way for lower gold prices. Riskier assets were mixed. With the general election in the US on Tuesday, markets will remain on edge. A Biden victory is priced into the markets, but given the results of the 2016 election, it’s impossible to tell.

Trade gold with FXTM Technical analysis

Gold prices moved higher on Monday testing resistance seen near the 10-day moving average at 1,896. Support on the yellow metal is seen near the September lows at 1,848. Short-term momentum is positive as the fast stochastic generated a crossover buy signal. The current reading on the fast stochastic is 28, up from 17 which reflects accelerating positive momentum. Medium-term momentum is negative as the MACD (moving […]

If Inflation Is The Trick, Gold Is The Treat

U.S. Global Investors Want to hear something really scary? Inflation, the scourge of the modern economy, may be running much faster than we’re led to believe.

I’ll use consumer spending on Halloween as an example of what I mean.

Total Halloween spending has fallen for the past three years and was projected to fall yet again this season, to $8 billion from $8.8 billion last year, according to recent data from the National Retail Federation (NRF).

No surprise there. With many people still avoiding large gatherings due to the pandemic, and health officials calling trick-or-treating a “high-risk activity,” less is going to be spent on candy, costumes, party decorations and other Halloween-related items.Indeed, spending on costumes was forecast to plunge a not insignificant $600 million compared to last year, from $3.2 billion to $2.6 billion.Given this, you might suppose that on a per-person basis, Halloween spending would also be down. And yet […]

Gold price ahead of U.S. election: ‘We cannot be certain of a clear result on Wednesday’ – StoneX

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) Markets might not get clear results from the U.S. election on Tuesday, according to StoneX.

After all the electoral votes have all been cast on Tuesday, it is not a given that markets will receive a clear answer on the night of or even on the next day, said Rhona O’Connell, StoneX head of market analysis for EMEA and Asia regions.

“The coming days may well see a contested U.S. election and it is possible that postal votes will take time to count so we cannot be certain of a clear result on Wednesday,” O’Connell said on Monday. “This would almost certainly keep gold steady for a while at least.”

Gold prices plunged below the critical psychological $1,900 an ounce […]

Gold Coast mansion for sale at almost $19 million

A private-equity executive put his Burton Place mansion up for sale Friday at $18.75 million, a month after the one next door hit the market at $13.5 million.

The neighbors are the highest-priced homes on the Gold Coast, but not the highest in the city. A Lincoln Park mansion on seven city lots on Burling Street has been priced at $45 million since early 2019.

The highest sale price for a Gold Coast home in recent years is $7.5 million, paid in 2017 for a rehabbed 10,000-square-footer.

The $18.75 million offering on Burton Place is being sold by John “Jay” Jordan, head of New York private-equity firm the Jordan Company, and his wife, Gretchen. They could not be reached for comment. It’s represented by Katherine Malkin of Compass.Jay Jordan bought the building in 1996 for $1.8 million, according to the Cook County Recorder of Deeds. At the time, it was […]

Click here to view original web page at www.chicagobusiness.com

Warren Buffett: It’s Time to Hedge: Buy Gold!

Warren Buffett, aka the Oracle of Omaha, has a reputation for being a legendary investor over several decades of a successful stock market investing career. It’s therefore no surprise that investors always look to Buffett when they are uncertain about what action to take.

When COVID-19 came along, investors sought the wise investor’s investment decisions so they could get guidance on how to make more savvy money moves during the pandemic. While COVID-19 destabilized the world economy, Buffett remained uncharacteristically quiet during the market crash and recovery.

However, the latest 13F filing by his conglomerate, Berkshire Hathaway , revealed that Buffett made a very interesting move . He is betting on gold!

Today I will discuss Buffett’s investment in gold and whether you should consider hedging your bets on the safe-haven asset as well. Gold miner A gold bull is in progress right now. Gold has a current price of around US$1,900, […]

Gold, silver see price advances ahead of U.S. elections

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are moderately higher in early U.S. trading Monday, on some more safe-haven demand just one day before the U.S. elections and all of the uncertainty and anxiousness surrounding them. December gold futures were last up $9.40 at $1,889.30 and December Comex silver was last up $0.429 at $24.075 an ounce.

Global stock markets were mostly higher overnight, boosted by upbeat purchasing managers reports out of Asia and Europe. U.S. stock indexes are set to open the New York day session solidly higher. It’s a huge trading week as the U.S. election is Tuesday. Joe Biden has a sizeable lead over President Donald Trump in most polls. However, the […]

Magna Gold Corp. Provides Mine Performance and Operational Update as at September 30, 2020

TORONTO, Nov. 2, 2020 /PRNewswire/ – Magna Gold Corp. (TSXV: MGR) (OTCQB: MGLQF ) (" Magna " or the " Company ") is pleased to provide results of its operating activities at the San Francisco Mine located in Sonora, Mexico (" San Francisco ") for the period between May 7 and September 30, 2020, in addition to an update on its ongoing mine development and optimization efforts.

Magna remains focused on its stated strategy of establishing San Francisco as a stable and profitable operation, while also protecting the Company’s balance sheet as it advances the mine towards production targets outlined in the Pre-Feasibility Study (" PFS ") recently completed and dated August 28, 2020. Since acquiring the mine in May 2020, Magna has been pre-stripping both the San Francisco and La Chicharra open pits. In parallel, the Company has also been processing lower grade stockpile material and, more recently, fresh […]

Gold, oil and silver price forecast – All eyes turn to November’s US Presidential election [Video]

The most highly anticipated trading month of the year is finally here…

November will not only see the biggest trading event of the year – the U.S Presidential Election, but also the Federal Reserve and Bank of England’s latest interest rate decisions alongside U.S Non-Farm Payroll data as well as new wave of major global lockdowns across UK, Europe and the U.S.

On Tuesday, U.S voters will head to the polls in what is expected to be ‘the most controversial U.S Presidential Election’ ever in history.

According to polling data, there are growing expectations of a blue wave in Washington with the Democrats taking control of Congress and the White House, however memories of 2016 continue to loom large on the horizon, so at this point, anything is still possible.Enviably, there will be huge volatility in the lead up to the election on Monday and Tuesday, which will setup […]

Gold Price Analysis: XAU/USD teases inverses head-and-shoulders on 1H below $1,900

Gold picks up the bids, keeps Friday’s recovery moves.

200-HMA, eight-day-old resistance line offers tough resistance following the confirmation of a bullish chart pattern.

September lows can entertain short-term bears before highlighting early-July top.

Gold prices print mild gains of 0.16% on a day while taking rounds to $1,882 during the pre-European session trading. In doing so, the yellow metal portrays an inverse head and shoulders bullish chart pattern on the hourly (1H) formation.With the MACD flashing bullish signals, even if milder, odds of the quote’s upside break to the pattern’s neckline, at $1,887.60 now, become brighter.However, a confluence of 200-HMA and a falling trend line from October 21 can challenge gold buyers around $1,892 afterward. During the metal’s sustained run-up past-$1,892, the $1,900 threshold holds the key to further upside.Alternatively, $1,873 and the previous month’s low near $1,860 can act as immediate supports ahead of […]

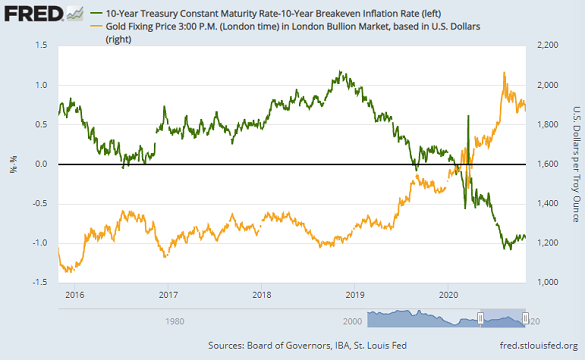

Gold Prices Rally, Silver Halves 8% Plunge But Real Interest Rates Surge Fastest Since March Covid Crisis Ahead of US Election

GOLD PRICES rallied Friday in London, cutting this week’s drop to less than 1% as the Dollar eased back ahead of next week’s US election and Eurozone GDP came in stronger than expected, but inflation data and expectations across Western markets weakened as more countries imposed new anti-Covid rules.

Paris’ streets were jammed last night as drivers tried to leave France’s capital ahead of its new national lockdown began, while Nottingham in the English Midlands saw crowds partying in fancy-dress as new ‘Tier 3’ restictions came into place.

The EuroStoxx 600 rallied on the single currency’s GDP data today, edging higher from a new 5-month low, but London’s FTSE100 fell again, heading for its lowest close since start-April and erasing more than one-third of the spring’s rebound from the first-wave Covid Crash.

Silver rallied with gold prices, halving the week’s earlier 8% plunge to reach $23.73 per ounce, but industrial commodities slipped […]

Click here to view original web page at www.bullionvault.com

How ‘one nation, one gold price’ could soon become a reality

Many jewellers also undercut the market by selling at lower rates by evading taxes, industry insiders said. Gold is an imported commodity and, therefore, the import price is the same across the country. But jewellery associations in different parts of the country fix different board rates, leading to multiple prices.

Kolkata: The demand for a uniform gold rate across the country is gathering pace. Jewellery chain Malabar Gold & Diamonds has introduced uniform pricing of gold across all its stores in the country, and some other jewellers plan to follow suit.Gold is an imported commodity and, therefore, the import price is the same across the country. But jewellery associations in different parts of the country fix different board rates, leading to To Read the Full Story, Become an ET Prime Member

Access the exclusive Economic Times stories, Editorial and Expert opinion

Click here to view original web page at economictimes.indiatimes.com

Daily Gold News: Gold Gaining Ahead of U.S. Presidential Election

The gold futures contract gained 0.64% on Friday, as it retraced some of its recent declines after bouncing from $1,860 price level. Gold continues to fluctuate following September’s decline off August 7 record high at $2,089.20 to around $1,850. The yellow metal has been bouncing from the support level marked by mid-August local low of around $1,875, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 0.6% higher this morning, as it is extending Friday’s advance. What about the other precious metals? Silver gained 1.22% on Friday and today it is 1.6% higher. Platinum lost 0.13% and today it is 1.2% higher. Palladium gained 0.85% on Friday and today it’s 0.3% lower. So precious metals’ prices are generally higher this morning .

Friday’s Personal Income/ Personal Spending releases have been better than expected at +0.9%/ +1.4%. The Chicago PMI and Consumer Sentiment […]

Gold Standard Ventures: A Look At The Valuation After The Drop

Summary

Gold Standard has had a slow year on the exploration front with just 16,000 meters of drilling completed on the property, a fraction of what the busiest juniors are drilling.

While the company’s Pre-Feasibility Study at Railroad-Pinion displayed solid economics with industry-leading costs, the recent share dilution continues to weigh on long-term upside.

Currently, the stock is trading at an enterprise value per ounce of $65.17, a large premium to its North American peers, which are trading closer to US$50.00/oz.Based on the slight premium and likelihood of further dilution in the next 12 months, I see better opportunities elsewhere in the sector.It’s been a busy year for the Gold Juniors Index ( GDXJ ), with some juniors like De Grey Mining ( OTCPK:DGMLF ) and Freegold Ventures ( OTCPK:FGOVF ) soaring by as much as 1000% with excitement about a record gold ( GLD ) price reinvigorating interest in the sector. […]

TSX futures climb lifted by strong gold prices

(Reuters) – Strong gold prices boosted Canada’s main stock index futures on Monday, as caution ahead of the U.S. presidential election bolstered demand for the precious metal. Gold prices rose 0.47% to $1888.7 per ounce.

December futures on the S&P/TSX index were up 0.9% at 7:00 a.m. ET.

Canada’s October manufacturing activity data is due at 09:30 a.m. ET.

The Toronto Stock Exchange’s S&P/TSX composite index ended 0.57% lower at 15,580.64 on Friday.Dow Jones Industrial Average e-mini futures were up 1.66% at 7:00 a.m. ET, while S&P 500 e-mini futures were up 1.38% and Nasdaq 100 e-mini futures were up 1.05%.ANALYST RESEARCH HIGHLIGHTSAtco Ltd: National Bank of Canada cuts target price to C$45 from C$46Mav Beauty Brands Inc: Canaccord Genuity raises rating to "buy" from "hold"SNC-Lavalin Group Inc: ATB Capital Markets cuts target price to C$41 from C$42(Reporting by Amal S in Bengaluru; Editing by Amy Caren Daniel)

Tietto Minerals’ gold resource growth has exceeded our total size expectation: Canaccord Genuity

The higher-grade core of the AG deposit has grown to 1.6 million ounces at 2.18 g/t gold which will underpin the pre-feasibility study (PFS) in the March quarter of 2021. Canaccord has retained its speculative buy recommendation. Tietto Minerals Limited ( ASX:TIE ) recently upgraded the overall gold resource at its Abujar project in central west Côte D’Ivoire, West Africa, by 40% or 870,000 ounces, to 3.02 million ounces with further resource growth likely due to continued strong drilling results.

The overall resource now stands at 81.2 million tonnes at 1.2 g/t for 3.02 million ounces, an increase from the previous estimate of 2.15 million ounces, and the all-in exploration cost is just US$5.20 per additional ounce.

Most of the increase comes from the Abujar-Gludehi (AG) deposit gold resource which has grown by 490,000 ounces to 2.3 million ounces at 1.5 g.t gold.

Canaccord Genuity , the global capital markets division […]

Click here to view original web page at www.proactiveinvestors.com.au

Barrick Gold Corp (GOLD) Sees Hammer Chart Pattern: Time to Buy?

Barrick Gold Corporation GOLD has been struggling lately, but the selling pressure may be coming to an end soon. That is because GOLD recently saw a Hammer Chart Pattern which can signal that the stock is nearing a bottom. What is a Hammer Chart Pattern?

A hammer chart pattern is a popular technical indicator that is used in candlestick charting. The hammer appears when a stock tumbles during the day, but then finds strength at some point in the session to close near or above its opening price. This forms a candlestick that resembles a hammer, and it can suggest that the market has found a low point in the stock, and that better days are ahead. Other Factors

Plus, earnings estimates have been rising for this company, even despite the sluggish trading lately. In just the past 60 days alone 5 estimates have gone higher, compared to none […]

Price of Gold Fundamental Weekly Forecast – Short-Term Volatile; Long-Term Up Trend Supported by Central Banks

Gold futures closed lower last week as traders shifted their focus from possible U.S. fiscal stimulus to the Tuesday’s presidential election. The catalyst behind the price action was the movement in the U.S. Dollar.

As much as the brokers and some of the news services put it out there, gold is not a safe-haven asset. It’s an investment and a store of value. Nearly all the way down from its summer top, they have been pushing the agenda of gold being a safe-haven. This has led to a few short-term technical bounces, but the overall trend has been determined and controlled by the movement in the greenback.

Last week, December Comex gold settled at $1879.90, down $25.30 or -1.33%. Long-Term Bullish Monetary Stimulus

Monetary stimulus comes from the central banks or in the United States, the Federal Reserve. They are committed to holding interest rates near zero for the next three […]

Know these 6 watchouts before opting for gold jewellery schemes this festive season

If you are buying gold by weight, you can benefit if gold prices rise, but given the high prevailing rates, it’s unlikely to happen. As top jewellery brands come out with festive discounts, they also continue to offer advance payment plans— an easy way to amass money and buy jewellery. ET Wealth finds out all about these schemes and the downsides you need to know of before opting.

The festive season of an otherwise not so celebratory year is here, as are tons of festive season deals, offers and discounts, which are heavier this time to give a push to consumers’ low-laying demand. Goodies such as gold and jewellery are symbolic of the festive season cheer in India. As top brands like Tanishq by Tata Group, Joy Alukkas and others launch their respective festive discounts, they continue to offer their advance payment plans—

Access the exclusive Economic Times stories, […]

Click here to view original web page at economictimes.indiatimes.com

Gold Coast mansion lists for $18.75 million, the highest current residential asking price in Chicago

Gold Coast 6-bedroom mansion lists for $18.75 million A massive, six-bedroom mansion in the Gold Coast neighborhood was listed Friday for $18.75 million — Chicago’s highest residential asking price at present.

According to public records, the 20,002-square-foot vintage stone mansion’s owner is John “Jay” Jordan Jr., who founded the private equity firm The Jordan Company and is a philanthropist. The home was built in the late 1880s or early 1890s and designed by the architectural firm Jenney & Mundie.

The house appears to have been originally built for banker John A. Lynch, who cofounded the Old National Bank of the Republic and died in 1938.

After buying the mansion in 1996 for $1.8 million, Jordan set about renovating the interiors. The home has eight bathrooms and five half-bathrooms. Along with four fireplaces, a theater room, a central courtyard and a gallery, the home also touts an exercise room, a wood-paneled library and […]

Click here to view original web page at www.chicagotribune.com

Yamana Gold Expands Its Footprint in the Abitibi Region With Friendly Acquisition of Monarch

TORONTO, Nov. 02, 2020 (GLOBE NEWSWIRE) — YAMANA GOLD INC. (TSX:YRI; NYSE:AUY) (“Yamana” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) with Monarch Gold Corporation (“Monarch”) whereby Yamana will acquire the Wasamac property and the Camflo property and mill (the “Acquisition Properties”) through the acquisition of all of the outstanding shares of Monarch not owned by Yamana under a plan of arrangement for consideration, including cash and shares, of approximately C$152 million. In connection with the plan of arrangement, Monarch will complete a spin-out (the “Spin-Out”) to its shareholders, through a newly-formed company (“SpinCo”) of its other mineral properties and certain other assets and liabilities of Monarch (collectively, the “Transaction”).

Highlights of the Transaction Adds the Wasamac project to Yamana’s Canadian e xploration p ortfolio Monarch’s principal asset is the Wasamac gold underground project, located 15 kilometres west of Rouyn-Noranda […]

Click here to view original web page at www.globenewswire.com

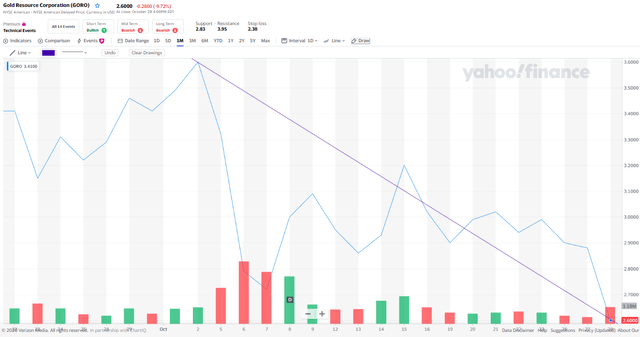

Gold Resource: A Tale Of Two Mines

Summary

Analysis of Recent Preliminary Production Numbers translate into record top and bottom-line cash flows.

SEC filings show recent spinoff announcement nearing completion and reveal key data regarding new Nevada SpinCo entity.

Concerns from investment community are unwarranted and recent drops in share price are resulting from unfounded investor fears and temporary headwind from divesting institutional shareholders facing OTC restrictions.Based on existing valuation estimates, Gold Resource has the potential to unlock over 100%+ in shareholder returns through a combination of trading multiple expansion and achieving record financial performance. It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity…” Source: Charles Dickens, A Tale of Two Cities This opening quote seems to capture the emotional rollercoaster that Gold Resource Corporation (NASDAQ: GORO ) investors have been on […]

Declines likely in price of gold and silver futures

The price has to move past $1,980 to indicate resumption of the long-term uptrend.

The consolidation in price witnessed in September spilled over to October, with precious metals being confined to a narrow trading range. The firm trend in the U.S. dollar, along with the news flow pertaining to the spread of COVID-19 and the hopes for an economic stimulus in the U.S., played a key role in influencing the price of precious metals in October.

Comex gold closed 0.8% lower in October to settle at $1,879.9 an ounce. Comex silver eked out a marginal gain of 0.7% to settle at $23.65 an ounce. In the domestic market, MCX gold futures rose 0.7% to ₹50,699 per 10 gm. MCX silver futures climbed 1.6% to ₹60,685 per kg.

Comex gold was confined to a narrow trading range. There is no change to the short-term outlook for gold. Comex gold is expected […]

![Gold, oil and silver price forecast – All eyes turn to November's US Presidential election [Video]](https://stockmarket.ezistreet.com/wp-content/uploads/2020/11/gold-bars-50657756_Large.jpeg)