Saskatoon, Saskatchewan TheNewswire – January 27, 2021 UEX Corporation is pleased to announce that Phase I of the Company’s winter 2021 exploration drill program testing targets on the Hidden Bay and West Bear Projects is now underway. The Hidden Bay and West Bear Projects are both located in the eastern Athabasca Basin of northern Saskatchewan . The Phase I drilling program will be targeting the Huggins Lake …

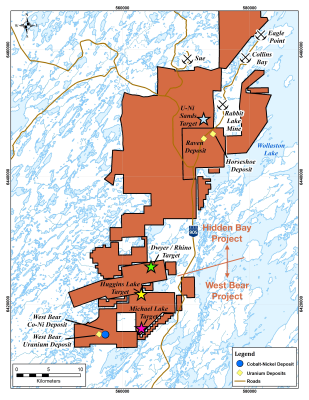

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – January 27, 2021 UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that Phase I of the Company’s winter 2021 exploration drill program testing targets on the Hidden Bay and West Bear Projects is now underway. The Hidden Bay and West Bear Projects are both located in the eastern Athabasca Basin of northern Saskatchewan (see Figure 1).

The Phase I drilling program will be targeting the Huggins Lake and Michael Lake areas […]

U.S. Firm Ready to Produce, ‘Support National Uranium Reserve’ Research Report

Uranium Energy Corp.’s favorable position and the reasons for a target price raise on the company are covered in an H.C. Wainwright & Co. report. In a Jan. 26 research note, analyst Heiko Ihle reported that H.C. Wainwright & Co. increased its target price on Uranium Energy Corp. (UEC:NYSE AMERICAN) to $3.60 per share from $3.30. This compares to $1.64, the current per share price.

The higher target price, Ihle explained, resulted from the financial institution lowering its discount rate on Uranium Energy’s asset base (to 7.5% from 8%) due to various positive industry developments and raising its per-pound valuation of the company’s ex-Texas assets (to $3.50 from $3.15).

Also of note is that Uranium Energy "remains well positioned to leverage its low-cost in-situ recovery (ISR) operations to support a recently enacted bill that is set to create a U.S. uranium reserve during 2021," Ihle indicated.

He reiterated that the legislation appropriated […]

Click here to view original web page at www.streetwisereports.com

Here’s How Your Trade Uranium Energy Corp. (UEC) Aggressively Right Now

Uranium Energy Corp. (AMEX:UEC) went up by 3.55% from its latest closing price compared to the recent 1-year high of $2.17. The company’s stock price has collected 6.71% of gains in the last five trading sessions. Press Release reported 15 hours ago that (PR) Uranium Energy Corp Commences 2021 Production Area Development at its Burke Hollow ISR Project in South Texas Is It Worth Investing in Uranium Energy Corp. (AMEX :UEC) Right Now?

Plus, the 36-month beta value for UEC is at 2.22. Opinions of the stock are interesting as 5 analysts out of 5 who provided ratings for Uranium Energy Corp. declared the stock was a “buy,” while 0 rated the stock as “overweight,” 0 rated it as “hold,” and 0 as “sell.”

The average price from analysts is $2.49, which is $0.83 above the current price. UEC currently public float of 184.82M and currently shorts hold a 9.64% […]

UEX’s 2021 Drill Program Commences in the Eastern Athabasca Basin Underway at the Huggins Lake and Michael Lake Targets

Saskatoon, Saskatchewan – TheNewswire – January 27, 2021 – UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that Phase I of the Company’s winter 2021 exploration drill program testing targets on the Hidden Bay and West Bear Projects is now underway. The Hidden Bay and West Bear Projects are both located in the eastern Athabasca Basin of northern Saskatchewan (see Figure 1).

The Phase I drilling program will be targeting the Huggins Lake and Michael Lake areas (see Figure 2) on the West Bear Project, which are considered prospective for both uranium and cobalt-nickel deposits in basement rocks. Phase II will target the Uranium-Nickel Sands and Dwyer Lake areas on the Hidden Bay Project (see UEX’s news release dated December 21, 2020) that will commence upon receipt of long-awaited exploration permits from the provincial government.

West Bear Project

Huggins LakeThe drilling program at Huggins Lake will be approximately […]

If You Only Buy 1 Uranium Stock, This Should Be It

Cameco (NYSE:CCJ) (TSX:CCO) is one of the world’s largest providers of uranium fuel . The company’s head office is in Saskatoon, Canada. Cameco’s uranium segment is involved in the mining, and sale of uranium concentrate. The company’s fuel services segment engages in the refining, conversion, and fabrication of uranium concentrate. This segment also produces fuel bundles and reactor components for nuclear reactors . Cameco also sells uranium and fuel services to nuclear utilities.

The company has a price-to-book ratio of 1.32, dividend yield of 0.51% and market capitalization of $6.42 billion. Debt is very sparingly used at Cameco as evidenced by a debt-to-equity ratio of just 0.21. The company has excellent performance metrics with an operating margin of 8.32% .

Cameco controls the world’s largest high-grade reserves and low-cost uranium operations. Utilities around the world rely on the company’s nuclear fuel products to generate power in safe, carbon-free nuclear reactors. The […]

Uranium Hexafluoride Market Share, Growth Factors 2020 Industry Overview by Demand and Supply Chain Analysis, Manufacturing Technology, Geographical Segmentation Forecast To 2026

“ Uranium Hexafluoride Market Data and Acquisition Research Study with Trends and Opportunities 2019-2024,The study of Uranium Hexafluoride market is a compilation of the market of Uranium Hexafluoride broken down into its entirety on the basis of types, application, trends and opportunities, mergers and acquisitions, drivers and restraints, and a global outreach. The detailed study also offers a board interpretation of the Uranium Hexafluoride industry from a variety of data points that are collected through reputable and verified sources. Furthermore, the study sheds a lights on a market interpretations on a global scale which is further distributed through distribution channels, generated incomes sources and a marginalized market space where most trade occurs.

Along with a generalized market study, the report also consists of the risks that are often neglected when it comes to the Uranium Hexafluoride industry in a comprehensive manner. The study is also divided in an analytical space […]

Blue Sky Uranium Closes Final Tranche of Non-Brokered Private Placement

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market (OTC): BKUCF/NOT FOR DISTRIBUTION TO THE UNITED STATES/

VANCOUVER, BC, Jan. 26, 2021 /CNW/ – Blue Sky Uranium Corp. (TSXV: BSK ) (FSE: MAL2) (OTC: BKUCF), "Blue Sky" or the "Company") is pleased to announce it has closed the final tranche of the non-brokered private placement financing announced on December 29, 2020 and increased on January 5, 2021 consisting of 19,086,500 units in this tranche for a total of 42,000,077 units at a price of $0.13 per unit for total gross proceeds of $5,460,010.Each unit consists of one common share and one transferrable common share purchase warrant (the " Warrant "). Each Warrant will entitle the holder thereof to purchase one additional common share in the capital of the Company at $0.25 per share for three years from the date of issue, expiring on January […]

Appia Energy Intersects up to 11.035 wt% Total Rare Earth Oxide and 0.025 wt% Gallium Oxide over 2.8 Metres and Discovers New Uranium Mineralization on the High Grade Alces Lake Property

Toronto, Ontario–(Newsfile Corp. – January 25, 2021) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") is pleased to announce the lithogeochemical assay results from the diamond drilling program (the " Program ") completed on the Company’s Alces Lake high-grade rare earth element (" REE "), gallium and uranium property (the " Property "), northern Saskatchewan.

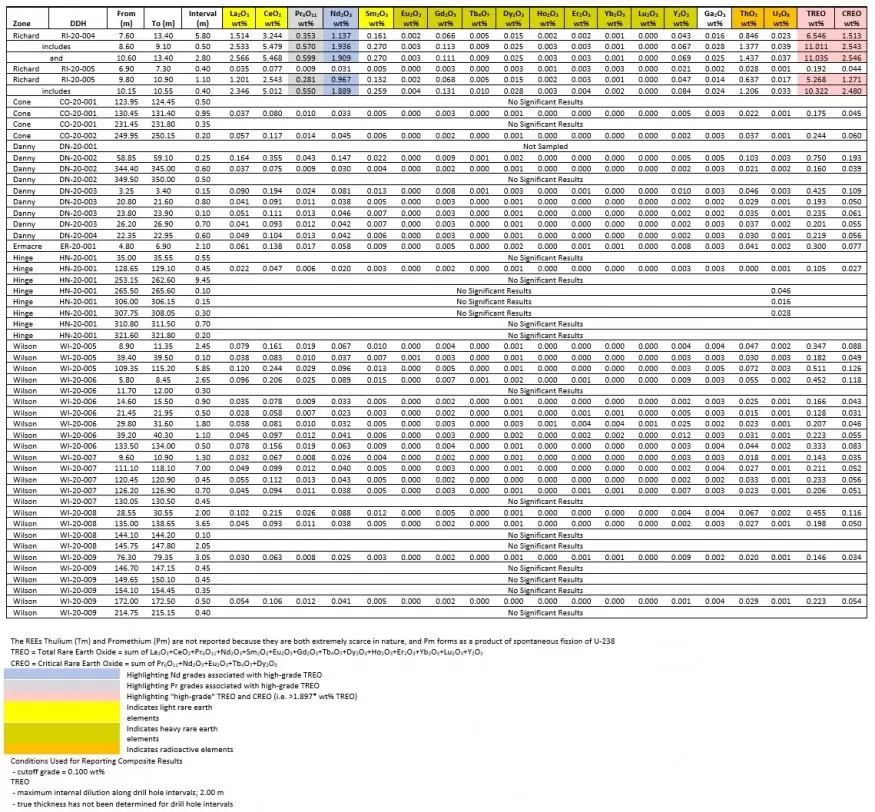

Appia completed 2,506.8 m in 18 drill holes, with 15 of those drill holes intersecting the REE minerals system (the " System ", see News Release dated October 1, 2020). Drill hole assay results are reported in Table 1. Individual drill hole highlights include; RI-20-004 (Richard zone) : 6.546 wt% total rare earth oxide (" TREO ") and 0.016 wt% gallium oxide (" Ga 2 O 3 ") over 5.80 metres (" m ") core length starting at 7.60 m down hole depth, including 11.035 […]

Click here to view original web page at www.juniorminingnetwork.com

Westwater Resources Announces Conference Call to Discuss Year-End 2020 Results & Business Update

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here .

Company Will Discuss the Coosa Graphite Project as U.S. Source of Natural Graphite

Pilot Plant Program Now Operating in Germany and the USA

CENTENNIAL, Colo.–(BUSINESS WIRE)– Westwater Resources, Inc. (Nasdaq: WWR ) , a battery graphite development company, will hold a conference call to discuss its financial results for the year ended December 31, 2020, and the business outlook for the 2021 year. The conference call will be held on Tuesday, February 16, 2021 at 11:00 a.m. Eastern time (9:00 a.m. Mountain Time). DIAL-IN NUMBERS 1-800-319-4610 (US and Canada) 1-604-638-5340 (International) Conference ID: Westwater Resources Conference Call Hosting the call will be Christopher M. Jones, President and Chief Executive Officer of Westwater Resources, who will be joined by Jeffrey L. Vigil, […]

Click here to view original web page at www.streetinsider.com

Uranium Market Key Trends And Opportunity Areas |Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, etc

“ Uranium Market Report Coverage: Key Growth Factors & Challenges, Segmentation & Regional Outlook, Top Industry Trends & Opportunities, Competition Analysis, COVID-19 Impact Analysis & Projected Recovery, and Market Sizing & Forecast.

A detailed report on Global Uranium market providing a complete information on the current market situation and offering robust insights about the potential size, volume, and dynamics of the market during the forecast period, 2021-2027. The research study offers complete analysis of critical aspects of the global Uranium market, including competition, segmentation, geographical progress, manufacturing cost analysis, and price structure. We have provided CAGR , value, volume, sales, production, revenue, and other estimations for the global as well as regional markets.

Major Key players profiled in the report include: Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, Cameco, Areva, BHP Billiton, Kazatomprom, APM3, ERA, AtomRedMetZoloto?ARMZ?, Paladin, Navoi, Rio Tinto Group and More…

Download Free Sample PDF […]

Plateau Energy Metals Extends Uranium Trend with Positive Results

TORONTO, Jan. 26, 2021 (GLOBE NEWSWIRE) — Plateau Energy Metals Inc . (“Plateau” or the “Company”) (TSX-V:PLU | OTCQB:PLUUF) is pleased to announce positive uranium prospecting and sampling results extending existing drilled deposit trends and identifying new anomalies for future exploration drill testing at the Company’s Macusani Uranium Project area located approximately 25 kilometers from its Falchani Lithium Project.

Highlights: Uranium prospecting and sampling work identifies extensions to seven existing deposits and 3 new anomalies

>80 sample results ranging from background U levels to in excess of 40% U 3 O 8 , average of all samples collected and analyzed is 2.3% U 3 O 8

Drill targets identified for potential extensions to the Colibri II deposit on strike for 1.2-1.5 km NE/NNE based on radiometric prospecting Radiometric prospecting and grab sampling suggest mineralized links between deposits in the main Macusani mineralized trends on the Kihitian, Isivilla and […]

Click here to view original web page at www.globenewswire.com

Westwater Resources Announces Conference Call to Discuss Year-End 2020 Results & Business Update

CENTENNIAL, Colo.–( BUSINESS WIRE )– Westwater Resources, Inc. (Nasdaq: WWR) , a battery graphite development company, will hold a conference call to discuss its financial results for the year ended December 31, 2020, and the business outlook for the 2021 year. The conference call will be held on Tuesday, February 16, 2021 at 11:00 a.m. Eastern time (9:00 a.m. Mountain Time).

DIAL-IN NUMBERS

1-800-319-4610 (US and Canada)

1-604-638-5340 (International)

Conference ID: Westwater Resources Conference Call

Hosting the call will be Christopher M. Jones, President and Chief Executive Officer of Westwater Resources, who will be joined by Jeffrey L. Vigil, Vice President-Finance and Chief Financial Officer, and Dain McCoig, Vice President of Operations. Mr. Jones will present an overview of the Company’s business position, including an update on the Coosa Graphite Project and the status of the operation of its pilot plant. Mr. Vigil will review […]

Click here to view original web page at www.businesswire.com

Perfect Conditions For Uranium To Shine?

Hopes are high that 2021 will confirm the start of a new bull market in uranium.

Many people are predicting that in the near to mid-term the nuclear fuel could see plenty of screens glowing green in the best way possible.

Fans of the heavy metal are quietly confident that the classic combination of reduced supply and increasing demand will be a winning formula for both the element’s spot price and the wider uranium industry.

The high expectations for the uranium market come amid gains in the wider mining and commodities sector with Mining.com proposing that a ‘post-pandemic supercycle in commodities demand’ had contributed to a new record high of $1.3 trillion market capitalisation for the world’s 50 most valuable mining companies.There are encouraging signs that conditions are ripe for uranium to lead the commodities pack. In a wide ranging YouTube interview , Justin Huhn, founder of Uranium Insider Pro , […]

Click here to view original web page at www.valuethemarkets.com

Tired of Plague and Politics? How About Some Good News!

Enough already. Enough about politics. Enough about the deadly virus. Enough about complaining. Today, folks, this column will be totally devoted to GOOD NEWS. And there is plenty of it.

First of all, the days are getting longer. Our long winter of discontent is over in many ways. And our dawns and sunsets are spectacular with brilliant reds. Stop and take in these wonderful and colorful marvels.

The weather this winter has been relatively mild in most parts of the state. Interstate 80 has not been closed as much as last year. This is great news for all of us.

As I write this on Jan. 24, Wyoming’s Josh Allen and the Buffalo Bills have had an amazing run in the National Football League. Boy, is he fun to watch. Dang it, I wish the Broncos could have had him. But keep in mind the only NFL team named after a Wyoming […]

GoviEx to Join Solactive Global Uranium and Nuclear Index ETF

Robert Friedland increases shareholding in GoviEx to 18 millionGoviEx Uranium Inc. is pleased to announce that further to the announcement of an ordinary rebalancing in the Solactive Global Uranium & Nuclear Components Total Return Index effective February 1, 2021, the Company will be included in the Index composition for the Global X Uranium ETF.The Global X Uranium ETF tracks the Index. In addition, GoviEx will …

Robert Friedland increases shareholding in GoviEx to 18 million

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx” or “Company”), is pleased to announce that further to the announcement of an ordinary rebalancing in the Solactive Global Uranium & Nuclear Components Total Return Index (the “Index”), effective February 1, 2021, the Company will be included in the Index composition for the Global X Uranium ETF.

The Global X Uranium ETF tracks the Index. In addition, GoviEx will also be included in the Solactive Global Uranium Pure-Play.GoviEx is […]

GoviEx Uranium to Join Solactive Global Uranium and Nuclear Index ETF

Robert Friedland increases shareholding in GoviEx to 18 million

Vancouver, British Columbia–(Newsfile Corp. – January 25, 2021) – GoviEx Uranium Inc. (TSXV: GXU ) (OTCQB: GVXXF ) (" GoviEx " or " Company "), is pleased to announce that further to the announcement of an ordinary rebalancing in the Solactive Global Uranium & Nuclear Components Total Return Index (the " Index "), effective February 1, 2021, the Company will be included in the Index composition for the Global X Uranium ETF.

The Global X Uranium ETF tracks the Index. In addition, GoviEx will also be included in the Solactive Global Uranium Pure-Play.

GoviEx is already included in the index composition for the North Shore Global Uranium Mining ETF. "The inclusion of our shares in both of these key uranium and nuclear indices is a vote of confidence in our Company and our assets. With our recently completed financing, GoviEx is very […]

Click here to view original web page at www.juniorminingnetwork.com

Appia Intersects up to 11.035 wt% Total Rare Earth Oxide and 0.025 wt% Gallium Oxide over 2.8 Metres and Discovers New Uranium Mineralization on the High Grade Alces Lake Property

January 25, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) is pleased to announce the lithogeochemical assay results from the diamond drilling program (the “ Program “) completed on the Company’s Alces Lake high-grade rare earth element (“ REE “), gallium and uranium property (the “ Property “), northern Saskatchewan.

Appia completed 2,506.8 m in 18 drill holes, with 15 of those drill holes intersecting the REE minerals system (the “ System “, see News Release dated October 1, 2020). Drill hole assay results are reported in Table 1. Individual drill hole highlights include; RI-20-004 (Richard zone) : 6.546 wt% total rare earth oxide (“ TREO “) and 0.016 wt% gallium oxide (“ Ga 2 O 3 “) over 5.80 metres (“ m “) core length starting at 7.60 m down hole depth, including 11.035 wt% […]

50 Years Ago: Tribe explores new directions in mining leases

It turns out one of the problems the new chairman will have to look into is the tribe’s mineral leases with outside companies.

The Navajo Times never reported any real news about the tribe’s mineral reserves during Raymond Nakai’s eight years in office with the exception of reports put out by the BIA about new contracts bringing in millions of dollars to the tribe. But there were no new contracts signed during the last three years and neither the tribe nor the BIA ever made public information about how the tribe was faring in selling rights to its natural resources.

But now that has changed probably because one of the promises that Peter MacDonald made during his campaign was to make the government more transparent. He provided the Times with an opportunity to bring readers up to date on this issue.

In an article written by P.K. Hurlbut, a tribal minerals supervisor, […]

Skyharbour Resources Grants Incentive Stock Options

VANCOUVER, British Columbia, Jan. 20, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH )

(OTC QB : SYHBF ) (Frankfurt: SC1P ) (the “Company”) announces that the Company has granted 1,550,000 incentive stock options (the “Options”) to officers, directors and consultants of the Company. The Options are exercisable at $0.28 per share for a period of five years from the date of grant. The Options have been granted under and are governed by the terms of the Company’s Incentive Stock Option Plan.About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of uranium and thorium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market fundamentals with six drill-ready projects. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River […]

Uranium Hexafluoride Market 2020: Potential Growth, Challenges, and Know the Companies List Could Potentially Benefit or Loose out From the Impact of COVID-19 | Key Players: E.I. Dupont De, Arkema, 3M, Gujarat Fluorochemicals, Asahi Glass, etc. | InForGrowth

Uranium Hexafluoride Market Research Report provides analysis of main manufactures and geographic regions. Uranium Hexafluoride Market report includes definitions, classifications, applications, and industry chain structure, development trends, competitive landscape analysis, and key regions distributors analysis. The report also provides supply and demand Figures, revenue, revenue and shares.

Uranium Hexafluoride Market report is to recognize, explain and forecast the global market based on various aspects such as explanation, application, organization size, distribution mode, and region. The Market report purposefully analyses every sub-segment regarding the individual growth trends, contribution to the total market, and the upcoming forecasts.

Report Coverage: Uranium Hexafluoride Market report provides a comprehensive analysis of the market with the help of up-to-date market opportunities, overview, outlook, challenges, trends, market dynamics, size and growth, competitive analysis, major competitor’s analysis.

Report recognizes the key drivers of growth and challenges of the key industry players. Also, evaluates the future impact […]

GoviEx to Join Solactive Global Uranium and Nuclear Index ETF

Robert Friedland increases shareholding in GoviEx to 18 million

Vancouver, January 25, 2021 – GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) ("GoviEx" or "Company"), is pleased to announce that further to the announcement of an ordinary rebalancing in the Solactive Global Uranium & Nuclear Components Total Return Index (the "Index"), effective February 1, 2021, the Company will be included in the Index composition for the Global X Uranium ETF.

The Global X Uranium ETF tracks the Index. In addition, GoviEx will also be included in the Solactive Global Uranium Pure-Play.

GoviEx is already included in the index composition for the North Shore Global Uranium Mining ETF."The inclusion of our shares in both of these key uranium and nuclear indices is a vote of confidence in our Company and our assets. With our recently completed financing, GoviEx is very well positioned for the continued advancement of our project pipline," noted Executive Chairman, Govind […]

Russia Industry & Trade Ministry, ARMZ & Alrosa cooperating on advancing domestic nextgen mining equipment & technology

A multilateral cooperation agreement was recently signed between the Ministry of Industry and Trade of the Russian Federation, ARMZ Mining Machinery, LLC and diamond mining giant Alrosa. The document is aimed at developing partnerships for creation of domestic modern technologies, machinery and equipment used in opencast and underground mining, as well as developing the mining industry and heavy engineering in Russia.

“Our country has all the necessary conditions for the development of certain areas of mining machinery production: from growing domestic demand of the largest mining companies to machine-building facilities capable of satisfying it. The active work of the Ministry of Industry and Trade of the Russian Federation is aimed precisely at the consolidation of these resources,” noted Deputy Minister Mikhail Ivanov.

“Among other things, the signed agreement stimulates the creation of new models of mining machinery under the ARGO trademark. We already have a successful experience in providing battery-powered load-haul-dumpers […]

Tapping into uranium’s future potential

As a vital commodity for countries that use nuclear power, Australia’s next wave of uranium miners are hoping to launch themselves into the export market to capitalise on the potential of a revival in prices.

Australia has the largest uranium resource in the world at 1.174 million tonnes or 34 per cent of the global total.

While it is the third largest producer of the commodity, there are currently only three active uranium mines in Australia as 2021 begins.

The fuel for nuclear power reactors, uranium is a cleaner source of power compared with fossil fuels such as coal and oil.According to the World Nuclear Association, the energy density of uranium means that one kilogram of the commodity is the power equivalent to one tonne of coal, with nuclear power contributing to 10.5 per cent of the world’s electricity.Australia, however, is the only G20 country with a federal government ban on […]

Click here to view original web page at www.australianmining.com.au

Global Enriched Uranium Market (2020-2026) | Latest COVID19 Impact Analysis | Know About Brand Players: Low Enriched Uranium (LEU), Highly Enriched Uranium (HEU), Enriched Uranium Breakdown Data by Application, Military, Electricity, etc. | InForGrowth

Enriched Uranium Market report analyses the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, and market demand and supply scenarios. The report covers the present scenario and the growth prospects of the global Enriched Uranium market for 2020-2025.

The “Enriched Uranium Market Report” further describes detailed information about tactics and strategies used by leading key companies in the Enriched Uranium industry. It also gives an extensive study of different market segments and regions.

Download Exclusive Free Sample PDF along with few company profiles

https://inforgrowth.com/sample-request/6895079/enriched-uranium-market

The Top players are Low Enriched Uranium (LEU) Highly Enriched Uranium (HEU) Enriched Uranium Breakdown Data by Application Military Electricity Medical Industrial Others. Market Segmentation: By Product Type: Low Enriched Uranium (LEU) Highly Enriched Uranium (HEU) On the basis of the end users/applications, Military Electricity […]

Click here to view original web page at murphyshockeylaw.net

Investors react well to the Global X Uranium ETF

The Global X Uranium ETF [URA] is expected to glow brightly once more in 2021.

The ETF ended 2020 at $15.33 before rising 0.9% to $15.47 on 19 January. On the same date last year, it stood at $10.71, sliding to $6.94 on 18 March as the coronavirus pandemic battered markets.

The fund reported cumulative year-to-date performance gains of 41.44 to the end of December 2020, while its net assets currently stand at $272.34m.

This compares with both the VanEck Vectors Uranium & Nuclear Energy ETF [NLR], which has $18.09m total assets and had a year-to-date total daily return of 3.5% on 31 December 2020, and the North Shore Global Uranium Mining ETF [URNM], with $47.71m of assets and a YTD total daily return of 7.66%.The Global X Uranium ETF was launched on 4 November 2010 and provides investors access to a broad range of companies involved in uranium mining and the […]