The trading price of Uranium Energy Corp. (AMEX:UEC) floating higher at last check on Monday, July 19, closing at $2.16, 10.77% higher than its previous close.

Traders who pay close attention to intraday price movement should know that it has been fluctuating between $1.89 and $2.02. In examining the 52-week price action we see that the stock hit a 52-week high of $3.67 and a 52-week low of $0.82. Over the past month, the stock has lost -34.12% in value.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks […]

Uranium Energy Corp. (AMEX:UEC) trade information

In the last trading session, 7.96 million shares of the Uranium Energy Corp. (AMEX:UEC) were traded, and its beta was 2.43. Most recently the company’s share price was $1.95, and it changed around -$0.07 or -3.47% from the last close, which brings the market valuation of the company to $479.58M. UEC currently trades at a discount to its 52-week high of $3.67, offering almost -88.21% off that amount. The share price’s 52-week low was $0.82, which indicates that the current value has risen by an impressive 57.95% since then. We note from Uranium Energy Corp.’s average daily trading volume that its 10-day average is 4.18 million shares, with the 3-month average coming to 5.40 million.

Uranium Energy Corp. stock received a consensus recommendation rating of a Buy, based on a mean score of 1.70. If we narrow it down even further, the data shows that 0 out of 2 analysts […]

Click here to view original web page at marketingsentinel.com

BHP to cash in on record Olympic Dam production

BHP Olympic Dam Asset President Jennifer Purdie in front of the new Olympic Dam refinery crane. The company also increased its iron ore production, chiefly out of Western Australia, as booming Chinese demand continued to drive record prices.

The publicly-listed company released its Quarterly Activities Report to the Australian Securities Exchange this morning, which is likely to point to a strong financial result for the year.

Olympic Dam copper production increased by 20 per cent to 205,000 tonnes for the year, reflecting improved smelter stability and strong underground mine performance, the company said.

This was up from 172 kilotons of copper in the 2020 financial year, which was 7 per cent up on 2019.It also achieved record gold production of 146,000 ounces in FY21.“This strong performance is a reflection of the capability and commitment of our employees and contractors, the strength of our systems and the support of our business partners,” BHP […]

Deep Yellow advances DFS for Tumas uranium project, makes new executive appointments

Deep Yellow uranium ASX DYL Tumas definitive feasibility study Namibia 2021 A definitive feasibility study for the Tumas uranium project in Namibia is advancing towards completion by year end for owner Deep Yellow (ASX: DYL) .

The study is targeting an annual production rate of up to 3 million pounds uranium underpinned by a mine life of more than 20 years.

To achieve this, Deep Yellow has commenced resource upgrade drilling to convert the remaining inferred resources at the Tumas-3 and Tumas-1 East deposits to indicated.

A total 755 reverse circulation holes were drilled for 14,955 metres during the June quarter to complete the Tumas-3 infill program, comprising 911 holes for 17,697m.Approximately 46% returned uranium mineralisation greater than 100 parts per million uranium equivalent over 1m.Drilling at Tumas-1 East is due for completion by month end.Potential to further expand the project’s operating life beyond the study’s current scope could exist once untested […]

Why Cameco Stock Rocketed 43% in the First Half of 2021

What happened

After a heady run-up in the last month of 2020, shares of uranium mining giant Cameco ( NYSE:CCJ ) continued their momentum into 2021 and gained a whopping 43.1% in the first half of the year, according to data provided by S&P Global Market Intelligence .

A general sense of optimism in the uranium market and a new emerging trend in the industry that’s helping support uranium prices were some of the biggest factors driving Cameco shares higher. So what

In early February, Bank of America suggested that the U.S. may not close aging nuclear plants before 2030 as it plans. As that could mean greater demand for the key nuclear fuel uranium, uranium stocks soared on the speculation, with Cameco shares gaining big given its leadership position in the industry. Days later, Cameco reported strong fourth-quarter numbers and decided to keep production suspended at its key mine, […]

Gear up for the change! Uranium Energy Corp. (UEC) has hit the volume of 3554167

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $1.93 to be very precise. The Stock rose vividly during the last session to $2.17 after opening rate of $2.14 while the lowest price it went was recorded $2.00 before closing at $2.02.

Recently in News on June 25, 2021, Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio. NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”. You can read further details here

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off! Get the Top 5 Stocks […]

Strong Growth And Abundant Potential: Uranium Energy Corp. (UEC) and Ur-Energy Inc. (URG)

In the most recent purchasing and selling session, Uranium Energy Corp. (UEC)’s share price decreased by -5.16 percent to ratify at $2.02. A sum of 5666586 shares traded at recent session and its average exchanging volume remained at 5.37M shares. The 52-week price high and low points are important variables to concentrate on when assessing the current and prospective worth of a stock. Uranium Energy Corp. (UEC) shares are taking a pay cut of -44.96% from the high point of 52 weeks and flying high of 146.34% from the low figure of 52 weeks.

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off!

SponsoredUranium Energy Corp. (UEC) shares reached a […]

International Consolidated Uranium Enters the U.S. Uranium Sector with Transformational Acquisition and Strategic Alliance with Energy Fuels

– Acquires Portfolio of Projects in the U.S., including Three Past Producing Mines; Enters into Toll-Milling and Operating Agreements –

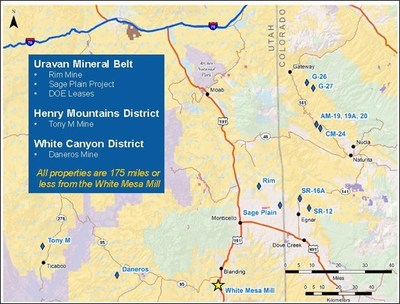

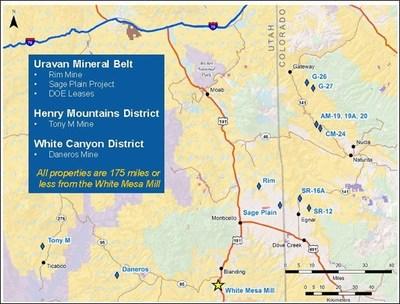

VANCOUVER, BC and LAKEWOOD, Colo., July 15, 2021 /CNW/ – International Consolidated Uranium Inc. (" CUR ") (TSXV: CUR ) (OTCQB: CURUF) and Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR ) (" Energy Fuels ") are pleased to announce that CUR has entered into a definitive asset purchase agreement (the " Purchase Agreement ") with certain wholly-owned subsidiaries of Energy Fuels (collectively, the " EF Parties ") whereby CUR will acquire a portfolio of conventional uranium projects located in Utah and Colorado (the " Projects ") from the EF Parties (collectively, the " Transaction "). In connection with the closing of the Transaction, the companies have also agreed to enter into toll-milling and operating agreements with respect to the Projects which positions CUR as a potential near-term US […]

June 2021 Global Uranium Mining Market Report PDF 2021 Key Players Kazatomprom, Cameco, ARMZ, Areva, BHP Billiton

Newly Report on Uranium Mining Market 2021, Growth, Share Types and Key Players | Kazatomprom, Cameco, ARMZ, Areva, BHP Billiton, CNNC, Paladin, Navoi, Rio Tinto Group

COVID-19 Impact on Global Uranium Mining Market Research Report 2021-2028

The global Uranium Mining market report examines the market position and viewpoint of the market worldwide, from various angles, such as from the key player’s point, geological regions, types of product and application. This Uranium Mining report highlights the key driving factors, constraint, opportunities, challenges in the competitive market. It also offers thorough Uranium Mining analysis on the market stake, classification, and revenue projection. The Uranium Mining market report delivers market status from the reader’s point of view, providing certain market stats and business intuitions. The global Uranium Mining industry includes historical and futuristic data related to the industry. It also includes company information of each market player, capacity, profit, Uranium Mining product information, price, […]

International Consolidated Uranium Enters the U.S. Uranium Sector with Transformational Acquisition and Strategic Alliance with Energy Fuels

– Acquires Portfolio of Projects in the U.S., including Three Past Producing Mines; Enters into Toll-Milling and Operating Agreements –

VANCOUVER, BC and LAKEWOOD, Colo., July 15, 2021 /CNW/ – International Consolidated Uranium Inc. (" CUR ") (TSXV: CUR) (OTCQB: CURUF) and Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (" Energy Fuels ") are pleased to announce that CUR has entered into a definitive asset purchase agreement (the " Purchase Agreement ") with certain wholly-owned subsidiaries of Energy Fuels (collectively, the " EF Parties ") whereby CUR will acquire a portfolio of conventional uranium projects located in Utah and Colorado (the " Projects ") from the EF Parties (collectively, the " Transaction "). In connection with the closing of the Transaction, the companies have also agreed to enter into toll-milling and operating agreements with respect to the Projects which positions CUR as a potential near-term US Uranium producer […]

Click here to view original web page at ca.finance.yahoo.com

MiningNewsBreaks – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR), International Consolidated Uranium Inc. (TSX.V: CUR) (OTCQB: CURUF) Announce Acquisition, Strategic Alliance

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here .

Energy Fuels (NYSE American: UUUU) (TSX: EFR) and International Consolidated Uranium Inc. (TSX.V: CUR) (OTCQB: CURUF) today announced that CUR has entered into a definitive asset purchase agreement with certain wholly owned subsidiaries of Energy Fuels (collectively, the “EF parties”). Under the agreement, CUR will acquire a portfolio of conventional uranium projects located in Utah and Colorado (the “projects”) from the EF parties (collectively, the “transaction”). In connection with the closing of the transaction, the companies have also agreed to enter into toll-milling and operating agreements with respect to the projects, which positions CUR as a potential near-term U.S. Uranium producer subject to an improvement in uranium market conditions and/or CUR entering into acceptable uranium supply agreements.

“This transaction has all the hallmarks of a true win-win […]

Click here to view original web page at www.streetinsider.com

Utah uranium mines being eyed by Australian company

East Canyon • On the flank of a remote mesa in San Juan County, where the abandoned shafts of the None Such uranium mine cut into the hillside amid a yellowing juniper forest, Utah’s uranium boom days seem part of a distant past. Rusting metal machinery and other trash protrude from eroding, unfenced tailings piles left by operators in the 1970s. Small Bureau of Land Management signs warn passersby — mostly adventurous all-terrain vehicle riders braving washed-out roads — it’s unsafe to enter the mines.

But a few scattered survey stakes along the mesa, located 14 miles north of Monticello, provide a subtle indication that the area’s rich uranium and vanadium deposits may soon be tapped once again. In May, TNT Mines — an Australian zinc, gold and uranium mining company — acquired dozens of mining claims in the East Canyon uranium-vanadium project area, and according to a recent presentation […]

Uranium Participation Corporation and Sprott Asset Management Announce Closing Date for Arrangement

TORONTO, July 15, 2021 (GLOBE NEWSWIRE) — Uranium Participation Corporation (TSX: U) (“UPC”) and Sprott Asset Management LP (“Sprott Asset Management”), announced today that, following the satisfaction of the conditions to closing, UPC has filed articles of arrangement under the Business Corporations Act (Ontario) and a certificate of arrangement was issued in connection with the previously announced plan of arrangement involving UPC, Sprott Asset Management, the Sprott Physical Uranium Trust, and 2834819 Ontario Inc. (the “Transaction”), which will close and be effective at 12:01 a.m. (Toronto time) on July 19, 2021.

With the closing of the Transaction on July 19, 2021, trading of the units of the newly-established Sprott Physical Uranium Trust is expected to commence on the Toronto Stock Exchange under the symbol “U.UN” in Canadian dollars and “U.U” in U.S. dollars on such date. Trading of the common shares of UPC on the Toronto Stock Exchange will be […]

Uranium Energy Corp. (AMEX:UEC) trade information

Uranium Energy Corp. (AMEX:UEC)’s traded shares stood at 4.33 million during the last session, with the company’s beta value hitting 2.44. At the close of trading, the stock’s price was $2.13, to imply a decrease of -0.47% or -$0.01 in intraday trading. The UEC share’s 52-week high remains $3.67, putting it -72.3% down since that peak but still an impressive 61.5% since price per share fell to its 52-week low of $0.82. The company has a valuation of $477.40M, with average of 5.40 million shares over the past 3 months.

Analysts have given a consensus recommendation of a Buy for Uranium Energy Corp. (UEC), translating to a mean rating of 1.70. Of 2 analyst(s) looking at the stock, 0 analyst(s) give UEC a Sell rating. 0 of those analysts rate the stock as Overweight while 0 advise Hold as 2 recommend it as a Buy. 0 analyst(s) have given it […]

Click here to view original web page at marketingsentinel.com

Uranium Participation Corporation and Sprott Asset Management Announce Closing Date for Arrangement

GlobeNewswire

TORONTO, July 15, 2021 (GLOBE NEWSWIRE) — Uranium Participation Corporation (TSX: U) (“UPC”) and Sprott Asset Management LP (“Sprott Asset Management”), announced today that, following the satisfaction of the conditions to closing, UPC has filed articles of arrangement under the Business Corporations Act (Ontario) and a certificate of arrangement was issued in connection with the previously announced plan of arrangement involving UPC, Sprott Asset Management, the Sprott Physical Uranium Trust, and 2834819 Ontario Inc. (the “Transaction”), which will close and be effective at 12:01 a.m. (Toronto time) on July 19, 2021.

With the closing of the Transaction on July 19, 2021, trading of the units of the newly-established Sprott Physical Uranium Trust is expected to commence on the Toronto Stock Exchange under the symbol “U.UN” in Canadian dollars and “U.U” in U.S. dollars on such date. Trading of the common shares of UPC on the Toronto Stock Exchange will […]

Energy Fuels to unlock value of assets through sale and strategic alliance with International Consolidated Uranium

Energy Fuels CEO Mark Chalmers said the transaction has “all the hallmarks of a true win-win for both parties” CUR will acquire 100% of Energy Fuels’ Tony M, Daneros and Rim mines in Utah, as well as the Sage Plain property and eight DOE Leases in Colorado Energy Fuels Inc (NYSEAMERICAN:UUUU) ( TSE:EFR ) said that International Consolidated Uranium Inc (CVE:CUR) (OTCQB: CURUF) has struck a definitive asset purchase agreement with its subsidiaries to acquire a portfolio of conventional uranium projects in Utah and Colorado.

In connection with the transaction, the companies have agreed to enter into toll-milling and operating agreements, which positions CUR as a potential near-term US uranium producer.

“With the toll-milling agreement for production from the projects to be executed on closing of the transaction, CUR will become the only current US uranium developer (other than Energy Fuels) with guaranteed access to Energy Fuels’ White Mesa Mill, which […]

Click here to view original web page at www.proactiveinvestors.com

Global Uranium Hexafluoride Market 2021 Key Indicators 2021| Arkema, Asahi Glass, Saint-Gobain

“A SWOT Analysis of Uranium Hexafluoride , Professional Survey Report Including Top Most Global Players Analysis with CAGR ” .The Uranium Hexafluoride Market Report is an authentic source of access to research information that is estimated to significantly grow your business. The report offers data such as economic scenarios, earnings, limits, current and future trends, market growth rates, and numbers. A SWOT study of the Uranium Hexafluoride market and Porter’s Five analysis also serves in the report. Staying informed of Uranium Hexafluoride market present trends and drivers is vital for decision-makers to take benefit of this emerging opportunity. The study offers information on trends and advancement in the Uranium Hexafluoride market, drivers, capabilities, technologies, and the dynamic investment structure of the market. In a present competitive world, you need to think a step forward to chase your Uranium Hexafluoride industry competitors, as our research offers reviews on top players, […]

International Consolidated Uranium Enters the U.S. Uranium Sector with Transformational Acquisition and Strategic Alliance with Energy Fuels

– Acquires Portfolio of Projects in the U.S., including Three Past Producing Mines; Enters into Toll-Milling and Operating Agreements –

VANCOUVER, BC and LAKEWOOD, Colo., July 15, 2021 /PRNewswire/ – International Consolidated Uranium Inc. (" CUR ") (TSXV: CUR) (OTCQB: CURUF ) and Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (" Energy Fuels ") are pleased to announce that CUR has entered into a definitive asset purchase agreement (the " Purchase Agreement ") with certain wholly-owned subsidiaries of Energy Fuels (collectively, the " EF Parties ") whereby CUR will acquire a portfolio of conventional uranium projects located in Utah and Colorado (the " Projects ") from the EF Parties (collectively, the " Transaction "). In connection with the closing of the Transaction, the companies have also agreed to enter into toll-milling and operating agreements with respect to the Projects which positions CUR as a potential near-term US Uranium […]

CanAlaska Uranium Appoints Nathan Bridge As New Vice President Exploration

Nathan Bridge appointed VP to work with Dr. Karl Schimann

Saskatchewan Technical Team Expands with senior geologists Carey Galeschuk and Greg Gudmundson

Appointments Support Renewed Investment Interest in Carbon-Free Energy Metals

Vancouver, British Columbia–(Newsfile Corp. – July 15, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV) ( OTCQB: CVVUF) (FSE : DH7N ) ("CanAlaska" or the "Company") is pleased to announce the appointment of Mr. Nathan Bridge to Vice President of Exploration of the Company effective July 12, 2021. Dr. Karl Schimann will continue as Senior Exploration Consultant to CanAlaska, working closely with Nathan in transition to execute on the Company’s exploration plans. The Company’s activities are accelerating rapidly in a renewed investment environment for carbon-free energy metals, the core of CanAlaska’s portfolio.Mr. Nathan Bridge has over a decade of experience managing exploration, delineation, and geotechnical drilling programs at Cameco Corporation. He was senior Geologist on Cameco’s […]

Click here to view original web page at www.juniorminingnetwork.com

Alligator Energy : 14th July 2021 – Alligator featured in Mining Journal – Uranium Outlook

URANIUM

OUTLOOK

Ready for lift off at last

In association with:URANIUM OUTLOOK | CREDITSEditorialMining Journal staffGroup Managing Editor Chris CannE-mail: chris.cann@mining-journal.comEditor of Mining Journal Tom HoskynsE-mail: tom.hoskyns@mining-journal.comEditorial enquiriesTel: +44 (0) 208 187 2330E-mail: editorial@mining-journal.comDesignGroup digital & creative director Abisola ObasanyaAdvertisingSales Director Nathan Wayne Tel: +61 (08) 6263 9126E-mail: nathan.wayne@aspermontmedia.comSubscriptions and circulation enquiriesSales director: Roger CookeTel: +44 20 8187 2329 E-mail:roger.cooke@mining-journal.comSenior global subscriptions manager: Emily RobertsTel: +61 (0) 432 245 404 Email: emily.roberts@mining-journal.comFor Mining Journal Subscriptions, please contactTel: +44 20 8187 2330 E-mail:subscriptions@mining-journal.comwww.aspermont.comPublished by Aspermont Media, 1 Poultry, London, EC2R 8EJ, UK.Printed by Stephens & George Magazines, Merthyr Tydfil, UK.Subscription records are maintained at Aspermont Media Ltd, 21 Southampton Row,London, WC1B 5HAChairman Andrew KentManaging director Alex KentGroup chief operating officer Ajit PatelGroup chief financial officer Nishil KhimasiaChief commercial officer Matt SmithAspermont Media, publisher and owner of the Gold Outlook (‘the publisher’) and each of its directors, officers, employees, advisers and agents and related […]

Click here to view original web page at www.marketscreener.com

Trump-era policies entice Australian company to consider opening uranium mines in Utah

East Canyon • On the flank of a remote mesa in San Juan County, where the abandoned shafts of the None Such uranium mine cut into the hillside amid a yellowing juniper forest, Utah’s uranium boom days seem part of a distant past. Rusting metal machinery and other trash protrude from eroding, unfenced tailings piles left by operators in the 1970s. Small Bureau of Land Management signs warn passersby — mostly adventurous all-terrain vehicle riders braving washed-out roads — it’s unsafe to enter the mines.

But a few scattered survey stakes along the mesa, located 14 miles north of Monticello, provide a subtle indication that the area’s rich uranium and vanadium deposits may soon be tapped once again. In May, TNT Mines — an Australian zinc, gold and uranium mining company — acquired dozens of mining claims in the East Canyon uranium-vanadium project area, and according to a recent presentation […]

Global Uranium Hexafluoride Market to Witness Huge Growth by 2028– Arkema, Asahi Glass, Saint-Gobain, Gujarat Fluorochemicals

Overview for “Uranium Hexafluoride Market” Helps in providing scope and definitions, Key Findings, Growth Drivers, and Various Dynamics

Deep researches and analysis were done during the preparation of the Uranium Hexafluoride report. The readers will find this report very helpful in understanding the market Uranium Hexafluoride report in depth .The Global Market report statistical studies provides market facts and figures to understand the current and future growth of the global Uranium Hexafluoride market. The Uranium Hexafluoride Market report conducts extensive study about different market segments and regions. The Market research document highlights the worldwide key manufacturers to define, describe and analyze the market competition landscape via SWOT analysis. This report aids to specialize in the important aspects of the market like what the recent market trends are or what buying patterns of the consumers are. The market is meant to point out a substantial growth during the forecast period of […]

Fission Uranium Resource Upgrade Drilling Successful; High-Grade Hits in Multiple Areas

All 20 holes of Winter program intersect wide mineralization

69.5m of total composite uranium mineralization in multiple stacked intervals, including intervals such as 4.5m @ 18.63% U 3 O 8 in 14.5m @ 6.11% U 3 O 8 .

Ross McElroy, President and CEO for Fission, commented, "These successful, robust drill results are a strong validation of our growth strategy for the deposit. Specifically, they have the potential to expand the size and quality of the resource from the R780E zone to be used in our upcoming feasibility study. "

Program Details and Assay Highlights Include: PLS21-602 (line 915E) 69.5m of total composite uranium mineralization with key Intercepts including: PLS21-600 (line 900E) 62.5m of total composite uranium mineralization with key Intercepts including: PLS21-597 (line 900E) 70.0m of total composite uranium mineralization with key Intercepts including: PLS21-607 (line 1065E) 40.0m of total composite uranium mineralization with […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Energy Corp. (AMEX: UEC) Is The Hottest Stock Right Now.

Uranium Energy Corp. (AMEX:UEC) price closed lower on Tuesday, July 13, dropping -1.36% below its previous close.

A look at today’s price movement shows that the recent level at last check reads $2.21, with intraday deals fluctuating between $2.21 and $2.32. The company’s 5Y monthly beta was ticking 2.44. Taking into account the 52-week price action we note that the stock hit a 52-week high of $3.67 and 52-week low of $0.82. The stock subtracted -29.39% on its value in the past month.

Uranium Energy Corp., which has a market valuation of $495.33 million, is expected to release its quarterly earnings report Dec 15, 2020. Analysts tracking UEC have forecast the quarterly EPS to shrink by 0 per share this quarter, while the same analysts predict the annual EPS to hit -$0.06 for the year 2021 and up to $0.01 for 2022. In this case, analysts estimate an annual EPS growth […]

Okapi has the power with transformational uranium acquisition

Pic: The Simpsons. Gracie Films/20th Century Fox. share

When Okapi Resources announced a transformational acquisition in US uranium on Monday, the market responded in overwhelming favour.

Okapi’s (ASX:OKR) share price closed up 45% that day , a clear sign that the market sees the same potential in the move as the company’s management.

The overarching uranium narrative is that nuclear will be an essential baseload power source in a green energy future.That story is driven by a number of factors, not least that the US Government is building a strategic uranium reserve and that the world is setting highly ambitious climate targets of great importance as we move toward a goal of carbon neutrality.It’s a great backdrop against which to purchase a uranium project, according to Okapi executive director Leonard Math.“With the US Government, Europe and now Australia pushing towards clean energy and electric vehicles, the world needs to […]