What happened

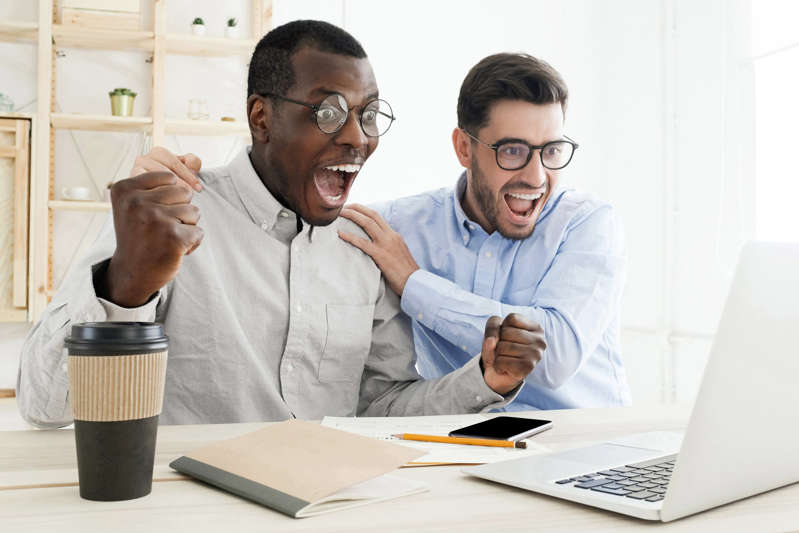

Uranium stocks took off yet again on Wednesday, with some stocks rallying to dizzying heights during the day. Here’s how the top performers closed Sept. 15: Uranium Royalty (NASDAQ: UROY): Up 25.4%

Denison Mines (NYSEMKT: DNN): Up 10.6%

Uranium Energy (NYSEMKT: UEC): Up 14.5% Energy Fuels (NYSEMKT: UUUU): Up 11.4% Ur-Energy (NYSEMKT: URG): Up 11.4% One move from Uranium Royalty and a big analyst upgrade on Cameco (NYSE: CCJ) shares sent stocks across the board surging. So what On Sept. 15, Uranium Royalty announced it had entered into three contracts to purchase 300,000 pounds of key uranium compound in the spot market at an average price of $38.17 per pound for cash, with deliveries expected in September-October. Uranium spot price was hovering around $45 per pound on Sept. 14.Why is that good news for the uranium market then, you may ask, if Uranium Royalty will buy uranium […]

Megawatt Lithium and Battery Metals: Uranium Potential to be Developed at Arctic Fox and Isbjorn Properties in Australia

VANCOUVER, BC, Sept. 15, 2021 /CNW/ – Megawatt Lithium and Battery Metals Corp. (CSE: MEGA) (FSE: WR20) (OTC PINK: WALRF) (the " Company " or " Megawatt ") has decided to accelerate developing the uranium potential at its Artic Fox and Isbjorn Projects in Northern Territory, Australia. This follows the receipt of an interim report from the geology team highlighting the significant uranium potential within both properties based on reconciling high-grade historical surface readings with observations following the recent field reconnaissance and sampling program (refer to Megawatt Completes Fieldwork at Arctic Fox and Isbjorn Rare Earth Element;

The Board has decided that developing the uranium and rare earth element potential of both properties concurrently can potentially create significant incremental shareholder value. Moreover, this decision is timely as it coincides with rapidly improving fundamentals for the uranium sector which has propelled the contract price to multi-year highs. Further, the Northern Territory […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Stocks: Why CCJ, UUUU, UEC, URG, DNN and NXE Are Glowing Up Today

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Uranium stocks are on the move today and it doesn’t have anything to do with specific news from any of the companies in the space. Source: Shutterstock Instead, we have Reddit to thank for uranium stock running higher on Monday. Traders over on WallStreetBets and other forums are hyping up uranium companies as the next big investment. This has investors’ interest in them increasing and with that comes more trading and higher prices.

Let’s take a look at how some of the top uranium stocks are performing today below! Uranium Stocks on the Rise

Cameco (NYSE: CCJ ) stock is rising 2.5% as some 15 million shares change hands. The company’s daily average trading volume is about 4.8 million shares. Energy Fuels (NYSEAMERICAN: UEC ) stock is climbing roughly 4.2% higher with some 12 million shares traded. The company’s daily […]

Uranium Potential to be Developed at Arctic Fox and Isbjorn Properties in Australia

VANCOUVER, BC, Sept. 15, 2021 /PRNewswire/ – Megawatt Lithium and Battery Metals Corp. (CSE: MEGA) (FSE: WR20) (OTC PINK: WALRF) (the " Company " or " Megawatt ") has decided to accelerate developing the uranium potential at its Artic Fox and Isbjorn Projects in Northern Territory, Australia. This follows the receipt of an interim report from the geology team highlighting the significant uranium potential within both properties based on reconciling high-grade historical surface readings with observations following the recent field reconnaissance and sampling program (refer to Megawatt Completes Fieldwork at Arctic Fox and Isbjorn Rare Earth Element; September 9, 2021). FIGURE 1: PHOTOS FROM SITE VISIT TO ARTIC FOX & ISBJORN PROJECTS – Note: Stream sediment sampling northwest end of the Artic Fox Project (Source: Megawatt geology team) (CNW Group/MegaWatt Lithium and Battery Metals Corp.) FIGURE 1: PHOTOS FROM SITE VISIT TO ARTIC FOX & ISBJORN PROJECTS – Note: […]

Guy on Rocks: Running the Rule over uranium, and… he’s right

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. A volatile week on the precious metals front with gold off 2.1% closing at US$1,789/ounce on the back of a stronger US$.

PGMs took an even bigger hit with platinum down US$70 to close at US$951/ounce and palladium (figure 1), the big mover down US$295 for the week to close at US$2,070/ounce. Base metals had a good week as China released stockpiles.

Copper finished at US$4.39/lb (it was up to US$4.44/lb at one stage during the week) and remains at strong contango around 3-4 cents.

Aluminium hit a 13-year high, nickel (figure 2), one of my favourite picks, hit a […]

Top 10 ASX Uranium Stocks to Watch in 2021

Uranium prices hit 5-year high in September

Uranium prices have run wild in the last month, with the commodity trading 36.3% higher in that period, last hovering around the $44.90 mark. That marks a five year high for the often overlooked commodity, which traded below the $20 mark in 2016.

This has corresponded to significant buying activity in global and in particular, ASX-listed uranium stocks, with the likes of Paladin Energy gaining 112% in the last month alone.

What’s the catalyst behind this latest surge? According to IG’s Senior Market Analyst, Joshua Mahony:‘This largely illiquid market has been influenced heavily by the Sprott Physical Uranium Trust, which is providing major demand into a market that takes little to move price. The sheer size of Sprott’s other precious metal trusts highlights the potential impact it could have upon uranium prices.’Looking ahead, Mr Mahony pointed out that that:‘In total the Sprott trusts total […]

Strategic Uranium Opportunity – Athabasca Basin

15 September 2021

Power Metal Resources PLC

("Power Metal" or the "Company")

Strategic Uranium Opportunity – Athabasca BasinPower Metal Acquires by Staking Four 100% Owned Uranium Properties in Saskatchewan’s Athabasca Basin in CanadaPower Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces the acquisition by claim staking of four 100% owned uranium exploration properties (the "Properties") comprising 7 licences surrounding the Athabasca Basin, located in northern Province of Saskatchewan, Canada.The claim staking was completed through Power Metal’s wholly-owned Canadian subsidiary, Power Metal Resources Canada Inc ("Power Canada").The PropertiesThe four 100% owned Properties cover a combined 10,869-hectares (109km 2 ) giving Power Canada a strong foothold in the prolific Athabasca Basin (for property details see table 1 below).The properties include the Clearwater Uranium Property ("Clearwater"); Tait Hill Uranium Property ("Tait Hill"); Thibaut Lake Uranium Property ("Thibaut Lake"); and the Soaring Bay Uranium Property […]

Bank of America – Why BofA Is Raising Its 2022 Uranium price Forecast By 41%

Bank of America – Why (BofA) Is Raising Its 2022 Uranium price Forecast By 41%

Uranium stocks are the latest to grab the attention of Reddit’s WallStreetBets community, and surging uranium futures prices have prompted one Wall Street analyst to raise his triuranium octoxide price targets.

The Analyst: On Tuesday, Bank of America analyst Lawson Winder reiterated a Neutral rating on Cameco Corp (NYSE: CCJ) and raised the price target from $20 to $29.

Related Link: The Case For A Stock Market Bubble: ‘Speculation Pervading Society’ The Thesis: Winder increased his 2021 triuranium octoxide price target by 18% to $36.30. He also raised his 2022 target by 41% to $53.50 and his 2023 target by 18% to $48.50.In the last month, the price of uranium futures has jumped about 40% to around $42.40, roughly a seven-year high.In that same stretch, Cameco shares are up 47.1%, and Winder said Tuesday […]

Uranium Royalty Corp Expands Physical Uranium Holdings to 648,068 Pounds of U3O8 at a Weighted Average Cost of US$33.10 per pound U3O8

and will be accomplished through book transfers to URC’s storage account at Cameco Corporation’s Fuel Services facilities in Ontario, Canada. This acquisition is fully funded with cash on hand. As of September 14, 2021, URC has C$80 million in cash, marketable securities and physical uranium.

Following completion of these deliveries, URC will hold a physical inventory of 648,068 pounds U 3 O 8 at a weighted average cost of US$33.10 per pound. The latest Trade Tech daily spot price is at US$45.00 per pound as of September 14, 2021, leading to an increase in the net realizable value of URC’s physical uranium holdings by US$7.7 million.

It is within URC’s mandate to make periodic purchases of physical uranium to provide attractive commodity price exposure to shareholders, especially in these early stages of a bull market in uranium. The global mega-trend towards de-carbonization is providing a major catalyst for carbon-free, safe, and […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Heats Up, and Hedge Funds Score

The turnaround in the nuclear fuel, whose price declined sharply after the 2011 nuclear meltdowns at Fukushima, Japan, has bolstered shares of miners including Cameco Corp. CCJ -0.57% and Denison Mines Corp. DNN -1.23% of Canada, and Texas-based Uranium Energy Corp. UEC -1.82% That boost has benefited hedge funds including Segra Capital Management and Sachem Cove Partners, which have been betting that uranium would bounce back.

Traders say the surge in uranium, an element that when enriched is manufactured into rods that fuel nuclear power plants, in some respects echoes the 2021 rise in shares of GameStop Corp. and AMC Entertainment Holdings Inc. Hedge funds and family offices are among those to have invested in the newly listed trust. Traders say interest from individual investors is also helping to drive prices in a market that largely comprises private agreements between buyers and sellers, rather than the open price discovery of […]

Why Ur-Energy and Energy Fuels Stocks Popped 11% Today

What happened

Uranium stocks Energy Fuels ( NYSEMKT:UUUU ) and Ur-Energy ( NYSEMKT:URG ) popped on Tuesday, extending the broader rally in uranium stocks from yesterday. Energy Fuels and Ur-Energy popped 11% each by 2 p.m. EDT before closing the day up around 3% each.

If you look carefully at their price performances in recent weeks, these stocks have been among the laggards in the industry, presenting traders and investors with a good opportunity to bet on them even as uranium prices continue to rally. Investors in Energy Fuels also see value beyond uranium. So what

Uranium stocks jumped on Sept. 13 after uranium prices hit multi-year highs and uranium stocks became the hottest topic of discussion on Reddit’s WallStreetBest forum.Today morning, though, Morgan Stanley issued a warning on uranium stocks saying the current rally may not sustain into 2022. That put some pressure on uranium stocks early in trading […]

Rick Rule says uranium stocks frothy, less attractive than last bull market

Monday was wild for ASX uranium stocks, with 21 ending the day on double digit percentage gains. Uranium investor sentiment is sky high. Every #ASX stock on our list, except one, is making gains in morning trade Monday. — Stockhead (@StockheadAU) September 13, 2021 The ASX uranium frenzy took a slight breather Tuesday, even as spot prices leapt another $US2/lb to +$US44/lb overnight. That’s a nine-year high.

We are rapidly closing in on $US60/lb – the magic number many of the next crop of producers need to be viable.

Legendary investor and Sprott director and shareholder Rick Rule is bullish on uranium.

Uranium stocks? Not so much, especially in the short term.In a September 1 interview – prior to the latest share price explosion – Rule says he timed the market badly.“I got the uranium equity market exactly wrong,” he told BABY Investments .“I had expected the market to be flat. Instead, […]

Guy on Rocks: Running the Rule over uranium, and… he’s right

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. A volatile week on the precious metals front with gold off 2.1% closing at US$1,789/ounce on the back of a stronger US$.

PGMs took an even bigger hit with platinum down US$70 to close at US$951/ounce and palladium (figure 1), the big mover down US$295 for the week to close at US$2,070/ounce. Base metals had a good week as China released stockpiles.

Copper finished at US$4.39/lb (it was up to US$4.44/lb at one stage during the week) and remains at strong contango around 3-4 cents.

Aluminium hit a 13-year high, nickel (figure 2), one of my favourite picks, hit a […]

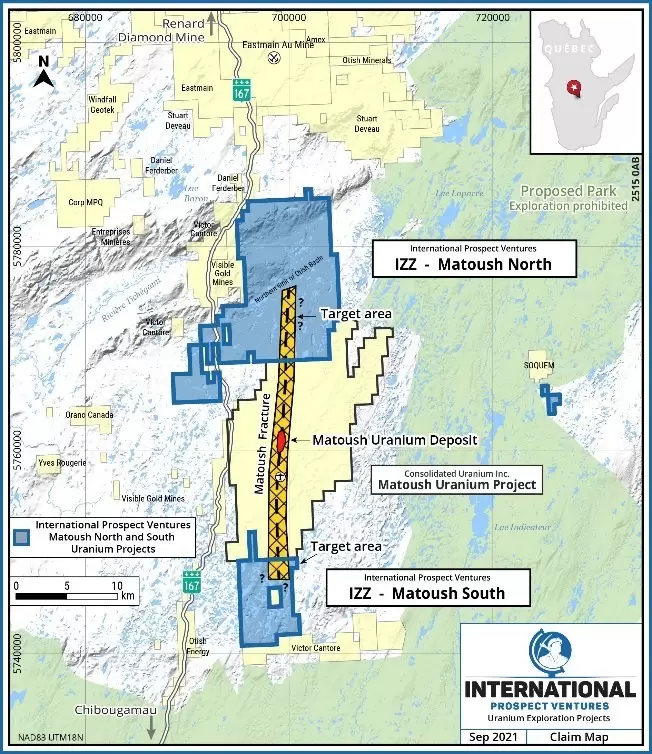

International Prospect Ventures Expands its Matoush-Otish Uranium Exploration Projects, Quebec, Canada

Val-d’Or, Quebec–(Newsfile Corp. – September 14, 2021) – International Prospect Ventures Ltd. (TSXV: IZZ) (the "Company" or "IZZ") is pleased to announce that it has significantly expanded its land position at its Québec Matoush-Otish Mountain Uranium Project (the "Project"), which it has managed since 2007. The renewed interest in the Company’s uranium projects that lie along strike of the well-known Matoush Uranium Deposit and Project, controlled by Consolidated Uranium Inc. ("Consolidated Uranium"), comes from the very recent increase in the uranium spot price and renewed interest in the uranium sector.

Martin Walter, CEO of IZZ, commented, "Our team is very happy to have had the opportunity to increase, through staking, the size of our uranium projects in Québec, which now cover a large area of the prospective Otish Basin. Our first priority is to obtain a social license to operate in order to begin responsible and environmentally responsible exploration […]

Click here to view original web page at www.juniorminingnetwork.com

Sprott Physical Uranium Trust Announces Updated “At-The-Market” Equity Program

TORONTO, Sept. 13, 2021 (GLOBE NEWSWIRE) — Sprott Asset Management LP (“Sprott Asset Management”), on behalf of the Sprott Physical Uranium Trust (TSX: U.UN) (TSX: U.U) (the “Trust” or “SPUT”), a closed-ended trust created to invest and hold substantially all of its assets in physical uranium, today announced that it has updated its at-the-market equity program (the “ATM Program”) to issue up to an additional US$1.0 billion of units of the Trust (“Units”) in Canada.

Distributions under the ATM Program, if any, will be completed in accordance with the terms of an amended and restated sales agreement (the “Sales Agreement”) dated September 13, 2021 between Sprott Asset Management (as the manager of the Trust), the Trust, Cantor Fitzgerald Canada Corporation and Virtu ITG Canada Corp. (collectively, the “Agents”). The Sales Agreement is available at www.sedar.com.

Sales of Units through the Agents, acting as agent, will be made through “at the market” […]

Click here to view original web page at www.globenewswire.com

Cameco shares rise with increased uranium prices while Shopify drops on a market-wide correction — here are the past week’s corporate winners and losers

Winners

Cameco Corporation (CCO.TO) +13.1%

Cameco produces and sells uranium to companies around the world. Cameco’s share price has benefitted from rising uranium prices, closing more than four per cent higher Thursday compared to market open Tuesday. In its second-quarter 2021 results ended June 30, the company reported revenues of $359 million, down 32 per cent from $525 million the prior year. Cameco reported a loss of $37 million for the quarter, an improvement over the $53 million loss the prior year.

Sprott Inc. (SII.TO) +6.5% Sprott is an asset management firm specializing in precious metals. The company has been purchasing large quantities of uranium, which has pushed up prices of the nuclear fuel. As of July 31, the company’s physical trust has $623 million (U.S.) worth of uranium in its possession. In its second-quarter 2021 results ended June 30, the company reported total revenue of $36 million, […]

Warning: the uranium-stock rally might decay quickly

Companies around the world tied to the commodity have charged higher, but the excitement might be short-lived Shares of uranium mining companies saw a boost Monday as a rally in the radioactive metal gave retail traders a new sector to be excited about .

As reported by the Wall Street Journal , Sydney-listed uranium miners Peninsula Energy, Energy Resources of Australia, and Bannerman Energy all closed the day more than 25% up from where they started. Aura Energy, which is listed in London, saw its share jump more than 35%. Yellow Cake PLC, a London-listed company that’s effectively a fund that gives investors uranium exposure, climbed 13%.

SwaggyStocks, a website that monitors WallStreetBets for mentions of ticker symbols, also detected an uptick in chatter around Cameco, a Canadian company listed on the New York exchange, which at one point became the third most-discussed company in the notorious Reddit forum after Apple […]

Click here to view original web page at www.wealthprofessional.ca

Is Denison Mines a Good Uranium Stocks to Add to Your Portfolio?

Denison Mines Corp. ( DNN ) is a leading uranium exploration and production company based in Canada, with mining interests in several regions across the country. Shares of DNN have surged 252.2% in price over the past nine months and 30.6% over the past month to close Friday’s trading session at $1.41.

The penny stock has been gaining momentum due to rising retail trader interest as social media platforms continue to target uranium stocks to precipitate a uranium squeeze.

However, DNN’s weak fundamentals are reflected in its poor fiscal second quarter (ended June 30) results. Its net loss widened 126% year-over-year to CAD2.36 million ($1.88 million), while its net operating cash outflow increased 88.7% in the first half of 2021 to CAD12.84 million ($10.25 million). In addition, analysts expect the company’s loss per share to rise slightly in its fiscal year 2021. We think these factors combined could make DNN’s current […]

3 Uranium Stocks Wall Street Predicts Will Rally by More Than 30%

With rising global demand for nuclear energy and increasing nuclear reactor capacity, uranium is witnessing a surge in demand. Furthermore, the resumption of production and rising demand have resulted in an optimistic prognosis for the industry’s growth prospects, leading August’s total spot market volume to 13.2 million pounds, the highest monthly volume in the uranium spot market since 1996.

The surging demand for and dependency on nuclear energy, growing awareness for decarbonization, oil price fluctuations, and the economic advantage of uranium production are projected to drive the industry’s growth. The global uranium market is expected to reach 92.3kt by 2027, registering a CAGR of 2%.

Given this backdrop, Wall Street Analysts expect uranium stocks Energy Fuels Inc. ( UUUU ), Uranium Energy Corp. ( UEC ), and Ur-Energy Inc. ( URG ) to rally by more than 30% in the upcoming months.

Energy Fuels Inc. ( UUUU ) UUUU engages […]

Skyharbour Intersects High Grade Uranium Mineralization at Maverick East Zone with Drill Results of 2.54% U3O8 over 6.0m including 6.80% U3O8 over 2.0m; Additional Assays Pending and Drilling to Continue

Skyharbour Resources Ltd. is pleased to announce the initial set of diamond drill results from its 2021 summer diamond drilling program at its 100% owned, 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and proximal to regional infrastructure for Cameco’s Key Lake and McArthur River operations in the Athabasca Basin, Saskatchewan. Drillhole …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce the initial set of diamond drill results from its 2021 summer diamond drilling program at its 100% owned, 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and proximal to regional infrastructure for Cameco’s Key Lake and McArthur River operations in the Athabasca Basin, Saskatchewan. Drillhole ML21-03 intersected additional high grade, basement hosted uranium mineralization at the Maverick East Zone. This hole returned […]

Like GameStop but radioactive: Uranium next in line for meme-stock treatment

Retail traders from Reddit’s WallStreetBets flocked to uranium mining companies on Monday amid a price rally in the radioactive material, as investors bet that the nuclear fuel would become a central tool in the decarbonization of the world’s energy systems. In Australia, Sydney-listed uranium miners Peninsula Energy, Energy Resources of Australia and Bannerman Energy, jumped by 40% over the last several days. In London, miner Aura Energy jumped more than 75% and Yellow Cake, a company that acts as an exchange-traded fund for uranium, rose 15%. Over in New York, uranium futures have been at their highest level in seven years, surging 40% over the past month to $42.40. And in Asia, shares in Japanese utilities TEPCO, Kansai and Shikoku Electric Power rose sharply after Fumio Kishida, the leading contender to become the country’s next prime minister, U-turned on his position on nuclear power and noted the energy source […]

Morgan Stanley says the latest rally that has caught the eye of Wall Street Bets won’t last. Here’s why.

The entrance of a mothballed mine of Energy Files Resources pictured on October 27, 2017 outside Ticaboo, Utah. Investors may want to move fast to catch those gains, warns our call of the day from Morgan Stanley.

“While coal and natural gas prices are driven up by actual market tightness, uranium’s underlying supply-demand fundamentals haven’t meaningfully changed over the last few months to warrant this price surge,” commodity strategists Marius van Straaten and Susan Bates told clients in a note. “Although the current rally is likely to have further to run, we are not yet convinced that it can be sustained into next year.”

Joining a “wider energy rally,” uranium’s spot price has gained 20% since August at $39, the highest since 2015. The strategists acknowledge uranium buying by the Sprott Physical Uranium Trust CA:U — to keep it away from nuclear power plants — has played a key role .

[…]

Resources Top 5: Takeover bids, more uranium, and explorer goes parabolic on nickel discovery

Pic: X-Men: Apocalypse (2016) share

Metal Hawk +250% after revealing a Kambalda style nickel discovery in maiden drilling

Battery metals-uranium explorer A-Cap now +170% over past month

Metalicity makes off-market, all share takeover bid for JV partner Nex Metals Here are the biggest small cap resources winners in early trade, Tuesday September 14. Metal Hawk gained +250% in early trade after uncovering a Kambalda style nickel discovery in maiden drilling at the ‘Berehaven’ project near Kalgoorlie.The explorer, which only listed November last year, hit 2m of massive (best stuff) and semi-massive (second best stuff) nickel sulphides from 144m to 146m at the ‘Commodore’ prospect.Assays are due in about 3-4 weeks.Upside abounds, because this area has never been drilled for nickel before, the company says. This is partially because of a thick layer of iron-rich laterite which has made surface EM surveys – a useful tool for […]

Why Uranium Royalty, Uranium Energy, and Ur-Energy Stocks Are SkyrocketingToday

What happened

Uranium stocks are absolutely crushing the market today, extending their gains from last week. Here’s how the top-performing uranium stocks were faring as of noon today:

Interest in uranium stocks is so high right now that Cameco ( NYSE:CCJ ) has surpassed AMC Entertainment Holdings and GameStop today to become the most discussed stock on Reddit’s WallStreetBets forum. Cameco is among the world’s largest uranium producers and the largest uranium stock in the U.S. with a market capitalization of $10 billion as of this writing. Its stock was up 3% as of noon today after jumping nearly 9% earlier in the day. So what

The story for commodity stocks often boils down to commodity prices. For uranium stocks, the story building up is a pretty strong one, what with uranium prices skyrocketing to multiyear highs.Rick Rule, the CEO of the world’s largest uranium fund, believes this could be […]

3 Powerful Uranium Stocks to Buy on Dips

All of this means it might make sense to explore some of the most interesting names that offer exposure to uranium at this time, which is why we’ve pu…

It’s safe to say there are a lot of different moving parts impacting financial markets at this time. For example, investors are trying to process the impacts of inflation, the Federal Reserve’s position on tapering, and whether or not the economic recovery is progressing. Then you have some truly eye-catching moves in the commodities market that are providing strong opportunities for profits. Surprisingly, gold isn’t a standout in this uncertain market environment. Instead, renewed interest in the radioactive metal uranium is providing some nuclear moves up for stocks that are involved in mining and producing the commodity.

Uranium, which is used to fuel nuclear power plants, is currently reaching the highest price levels since 2014 and could deliver additional upside in the […]

Click here to view original web page at www.entrepreneur.com