Suncor has signed agreements with eight Indigenous communities to acquire TC Energy’s 15 per cent stake in the Northern Pipeline Limited Partnership. Courtesy of TC Energy. Welcome back to your weekly mining news recap, where we catch you up on some of the news you may have missed. This week’s headlines include a partnership between Suncor and eight Indigenous communities, Epiroc acquiring FVT Research, and some proposed solutions for the underrepresentation of women in the industry.

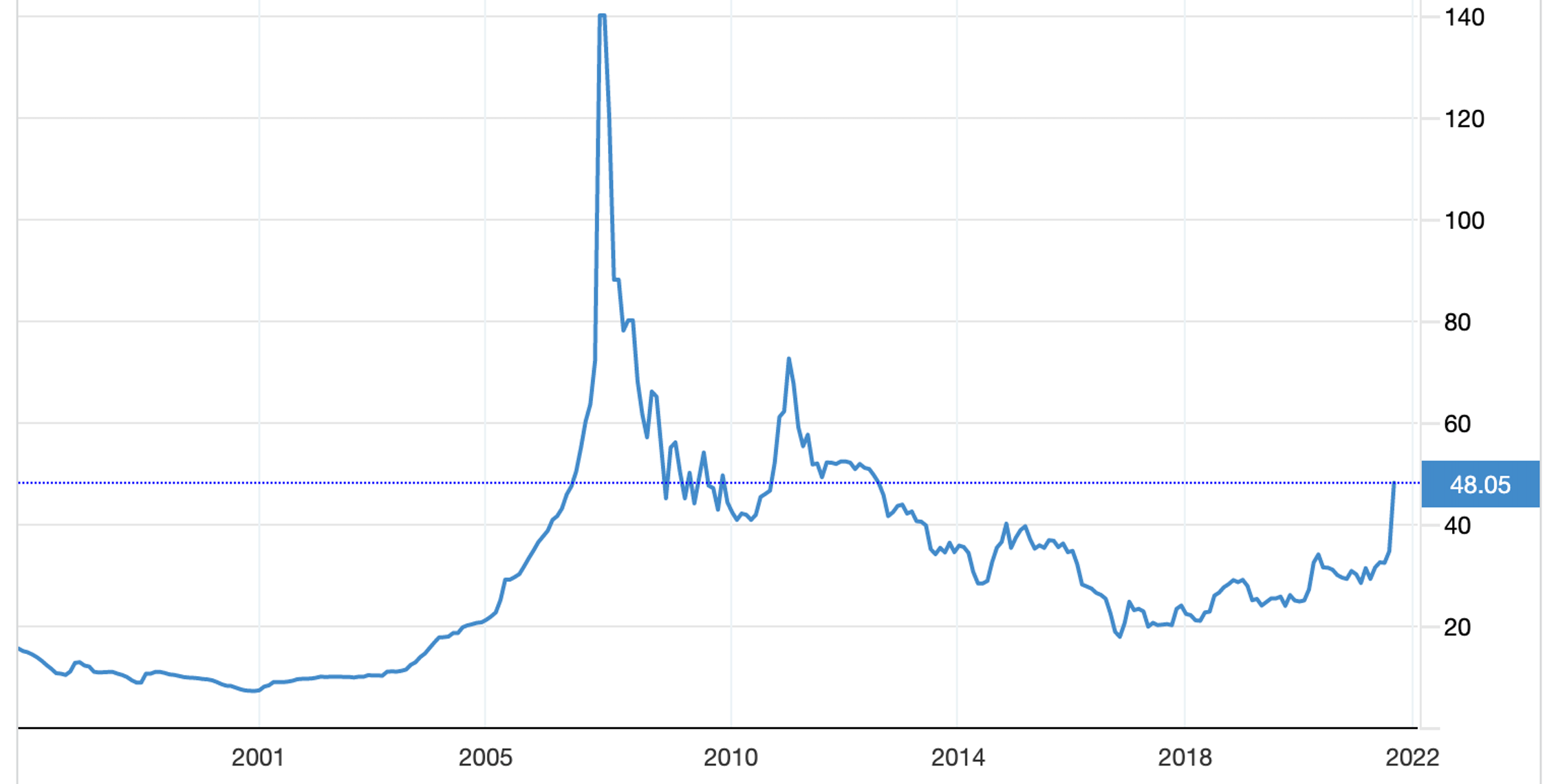

The price of uranium continues to climb after Sprott Physical Uranium Trust was approved to acquire up to US$1 billion in additional uranium in the coming months, as reported by S&P Global . On Sept. 15, the spot U3O8 price of US$48/lb was the highest it has been since September 2012. The increasing demand for uranium is coming from a variety of financial investors and uranium producers during what many groups are saying […]

Uranium Royalty Corp. (NASDAQ: UROY): Making Its Way Up The Stock Market

Uranium Royalty Corp. (NASDAQ:UROY) shares, rose in value on Thursday, September 23, with the stock price down by -2.35% to the previous day’s close as strong demand from buyers drove the stock to $4.15.

Actively observing the price movement in the last trading, the stock closed the session at $4.25, falling within a range of $4.00 and $4.3299. Referring to stock’s 52-week performance, its high was $5.60, and the low was $0.81. On the whole, UROY has fluctuated by 66.00% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of […]

Uranium: what the explosion in prices means for the nuclear industry

It is a year since Horizon Nuclear Power, a company owned by Hitachi , confirmed it was pulling out of building the £20 billion Wylfa nuclear power plant on Anglesey in north Wales. The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward.

Hitachi’s share price duly went up 10% , reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants. With governments reluctant to subsidise nuclear power because of the high costs, particularly since the 2011 Fukushima disaster , the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.

Uranium prices long reflected this reality. The primary fuel for nuclear plants were sliding for much of the 2010s, with no […]

NA Proactive news snapshot: Blue Sky Uranium, Todos Medical, Gold Resource, Levitee Labs, Altiplano Metals, MGX Minerals UPDATE…

A glance at some of the day’s highlights from the Proactive Investors US and Canada newswires Your daily round-up from the world of Proactive Blue Sky Uranium Corp received a positive report from Globe Small Cap Research LLC, citing the growth in the global nuclear industry and business relations with the Argentinian government as catalysts to continued success for the uranium developer. Another tailwind for the company is the rising price of uranium. Spot U3O8 values have skyrocketed to a 12-year high this year – US$50.25 per pound) – and are anticipated to continue this trajectory as more countries build out their nuclear fleets and small modular reactors become more prevalent. “[Blue Sky] operates in a hot space with stellar growth opportunities and deserves consideration by risk adverse micro and small cap-oriented investors,” the report stated.

Todos Medical Ltd, a medical diagnostics company, posted second-quarter results that saw its revenue […]

Click here to view original web page at www.proactiveinvestors.com

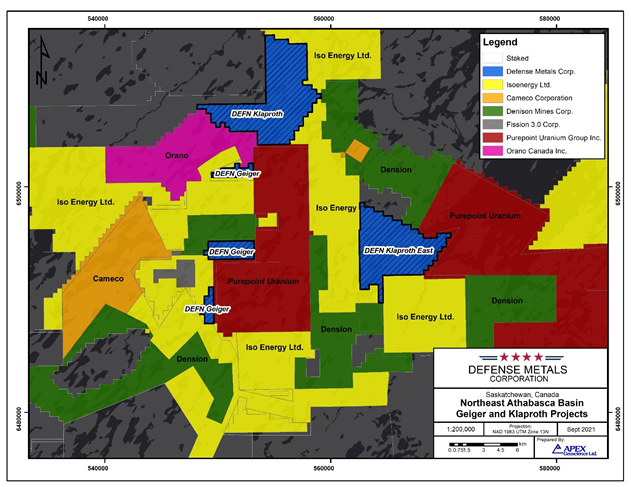

Uranium Stocks in the News: Defense Metals (TSX-V: $DEFN.V) (OTCQB: $DFMTF) Revaluates Its Athabasca Basin Uranium Projects

Vancouver, British Columbia – September 24, 2021 (Investorideas.com Newswire, MiningSectorStocks.com and RenewableEnergyStocks.com) Mining / Metals / Green Energy Stock News – Defense Metals Corp. ( TSX-V: DEFN / OTCQB: DFMTF / FSE:35D) is pleased to announce that in light of renewed and sustained uranium interest which has driven uranium spot prices to multi-year highs, it has commenced an updated internal technical review of its Athabasca Basin uranium project holdings.

During 2018, Defense Metals acquired 100% of the Geiger North and Klaproth projects for a combination of cash and share payments; with Geiger North being subject to a 2% net smelter return royalty. The projects comprise a total of five mineral claims totalling 9,363 hectares (ha) located in the northeast Athabasca Basin, with the Geiger North claims (1,233 ha) being in good standing until summer-fall 2022, and Klaproth (8,130 ha) in good standing until early 2023. Figure 1. Defense Metals Athabasca […]

Click here to view original web page at www.investorideas.com

Why Uranium Stocks Exploded This Week

What happened

Shares of uranium stocks were on fire this week as uranium spot prices continued a steady rise. According to data by Markets Insider, the spot price of uranium is up 65.5% so far this year and has risen from $42.40 per pound to close last week to $49.65 as I’m writing. This has suddenly become a hot commodity in the energy industry .

Uranium Royalty ( NASDAQ:UROY ) led the way by climbing 36.6% from the close of trading last Friday to the market close Thursday night. Ur-Energy ( NYSEMKT:URG ) jumped 9% over the same time frame and Energy Fuels ( NYSEMKT:UUUU ) was up 6.9%. The three stocks had a maximum intra-week gain of 52%, 17.5%, and 17.8%, but gave back some of that by the end of the week. Image source: Getty Images. So what

The Sprott Physical Uranium Trust ( OTC:SRUU.F ) got […]

4 Uranium Stocks to Buy on Retail Investors’ Hype

Uranium prices recently hit a nine-year high . It’s therefore not surprising that uranium stocks have surged.

Let’s first discuss the factors that have driven the so-called yellowcake higher.

Besides some improvement in fundamentals, there are two reasons for the uranium surge.

In July , RBC opined that social media activity has boosted uranium prices. According to RBC’s report, “uranium market fundamentals have improved only modestly in the past 6 months compared to the sharp rise in equity values.” Sprott Asset Management’s aggressive buying of uranium is another reason that has boosted prices in the recent past. The Financial Times reports that Sprott holds more than 28 million pounds of uranium , which it says is enough to power France for a year.Coming back to fundamentals, there seems to be a fear that the demand-supply gap will widen. Data from Statista indicates a potential demand of 209 million pounds of uranium concentrate […]

Click here to view original web page at markets.businessinsider.com

Why Are Uranium Stocks Surging in 2021?

Uranium stocks have been the big thing over the last few months. Many have doubled or more in a very short period of time. Cameco (TSX:CCO) (NYSE:CCJ) , for example, is up 100% in the last year, and Denison Mines (TSX:DML) (NYSE:DNN) is up an incredible 240% as of writing. Yet this comes on the heels of a pretty substantial pullback, and it should have Motley Fool investors worried. But does that mean you should give up on uranium stocks all together? Let’s dig in and take a look. What happened?

Uranium stocks exploded this year due to two factors. First, there was the announcement from President Joe Biden back in January that billions would be put towards clean energy initiatives. This included using current clean energy assets, such as nuclear reactors. This sent uranium prices higher after a decade of almost no growth, as it was tied to […]

Drilling kicks off and uranium analysis planned at Benmara battery metals project

Are you ready for this? Pic: giphy.com share

Resolution Minerals has started drilling at its Benmara battery metals project in the Northern Territory.

The 2,500m RC drilling program is focused on the highest priority targets of 4km and 2km strike length derived from a VTEM survey – and new Geoscience Australia research which identified prospective rock types previously mis-mapped.

The large-scale targets are prospective for sediment hosted battery metals including copper, silver, lead, zinc, and cobalt.Plus, the targets are on the margin of the South Nicholson Basin and Murphy Inlier on the Fish River fault which is analogous and along strike from Aeon Metal’s (ASX:AML) polymetallic Walford Creek deposits (40 million tonnes at 2% copper equivalent).It presents the company with strong exposure to the strengthening demand for battery metals – and a tightening market for copper.And because the targets have no prior drilling, Resolution Minerals (ASX:RML) is confident this underpins […]

LIVE MARKETS-Another slice of “yellowcake” – Sprott intends to keep buying uranium

* Major U.S. indexes advance; DJI posting ~1.7% gain

* Energy leads among S&P 500 sectors; real estate sole loser

* Dollar, gold fall; crude, bitcoin gain

* U.S. 10-Year Treasury yield ~1.40%; highest since mid-July Welcome to the home for real-time coverage of markets brought to you by Reuters reporters. You can share your thoughts with us at markets.research@thomsonreuters.comANOTHER SLICE OF "YELLOWCAKE" – SPROTT INTENDS TO KEEP BUYING URANIUM (1415 ETF/1815 GMT)Clean energy plays have been a strong investor focus this year, but an increasingly popular way to play this theme has been through the uranium market.Uranium prices <UX-U3O8-SPT> have leapt over 60% to $50.25 a pound, the highest levels since 2012.But of those yearly gains, the nuclear fuel has jumped 55% since the inception of the Sprott Physical Uranium Trust in July .The trust, physically backed by uranium, has stockpiled 28.4 million pounds of U3O8 (triuranium octoxide), adding 10 million […]

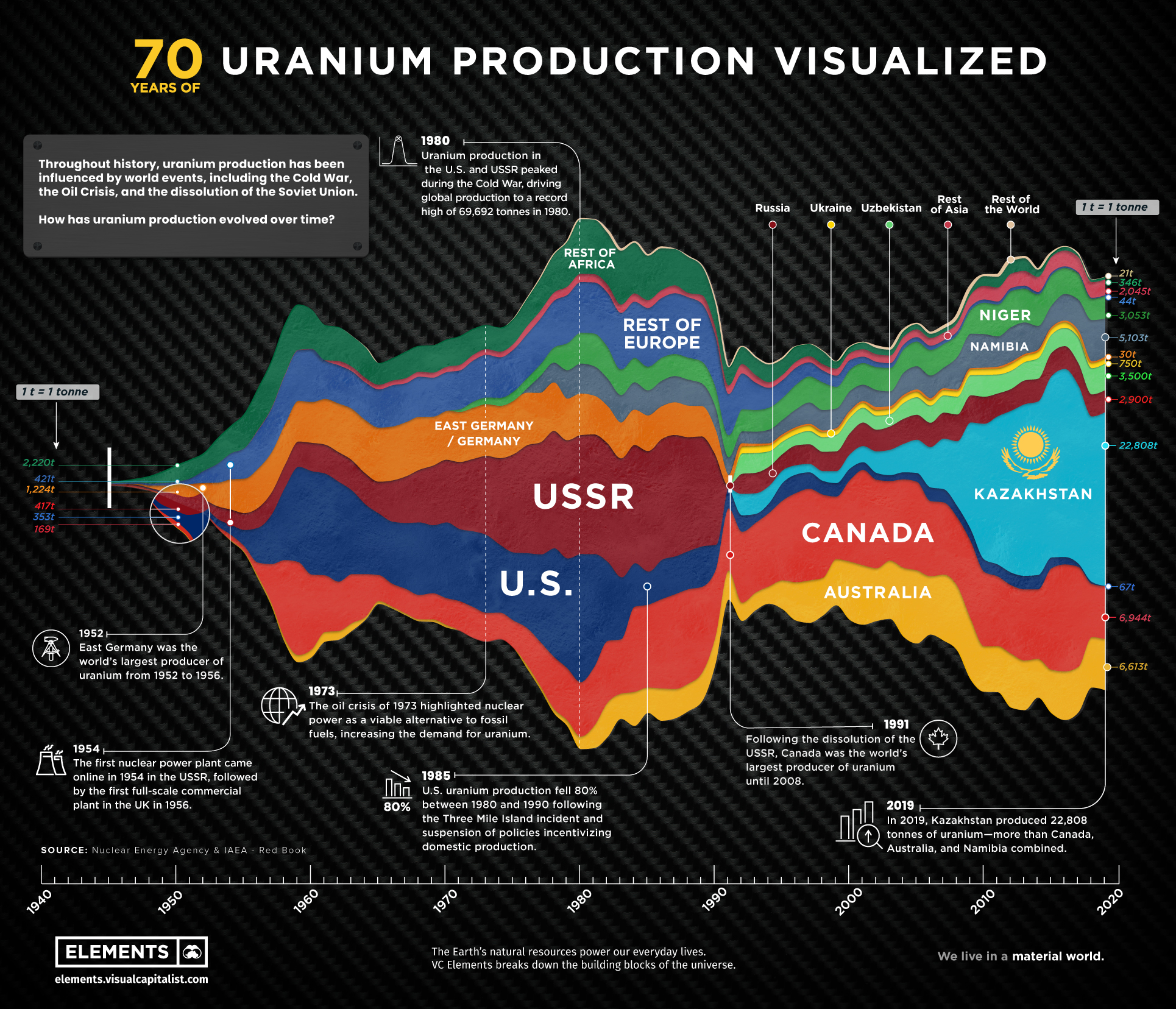

70 years of global uranium production by country

The above infographic visualizes over 70 years of uranium production by country using data from the Nuclear Energy Agency . The Pre-nuclear Power Era

The first commercial nuclear power plant came online in 1956. Before that, uranium production was mainly dedicated to satisfying military requirements.

In the 1940s, most of the world’s uranium came from the Shinkolobwe Mine in the Belgian Congo. During this time, Shinkolobwe and Canada’s Eldorado Mine also supplied uranium for the Manhattan Project and the world’s first atomic bomb.

Related Article: Uranium price rally is a high-stakes bet on future of nuclear power However, the end of World War II marked the beginning of two events that changed the uranium industry—the Cold War and the advent of nuclear energy. Peak Uranium Between 1960 and 1980, global uranium production increased by 53% to reach an all-time high of 69,692 tonnes. Here’s a breakdown of the top uranium […]

Uranium Royalty Corp. (NASDAQ:UROY) trade information

During the recent session, Uranium Royalty Corp. (NASDAQ:UROY)’s traded shares were 0.67 million. At the last check today, the stock’s price was $4.14, reflecting an intraday loss of -2.70% or -$0.11. The 52-week high for the UROY share is $5.60, that puts it down -35.27 from that peak though still a striking 80.43% gain since the share price plummeted to a 52-week low of $0.81. The company’s market capitalization is $332.89M, and the average trade volume was 547.73K shares over the past three months.

Uranium Royalty Corp. (UROY) registered a -2.70% downside in the last session and has traded in the red over the past 5 sessions. The stock plummet -2.70% in intraday trading to $4.14 this Wednesday, 09/22/21, hitting a weekly high. The stock’s 5-day price performance is -21.15%, and it has moved by 76.35% in 30 days. Based on these gigs, the overall price performance for the year […]

Click here to view original web page at marketingsentinel.com

Cameco, GE Hitachi, GEH SMR Canada and Synthos Green Energy to Collaborate on Potential Deployment of BWRX-300 Small Modular Reactors in Poland

Cameco GE Hitachi Nuclear Energy GEH SMR Technologies Canada, Ltd. and Synthos Green Energy a member of the Synthos Group S.A., have entered into a Memorandum of Understanding to evaluate the potential establishment of a uranium fuel supply chain in Canada capable of servicing a potential fleet of BWRX-300 small modular reactors in Poland. Synthos, a manufacturer of synthetic rubber and one of the biggest producers …

Cameco (TSX: CCO; NYSE: CCJ), GE Hitachi Nuclear Energy (GEH), GEH SMR Technologies Canada, Ltd. (GEH SMR Canada) and Synthos Green Energy (SGE), a member of the Synthos Group S.A., have entered into a Memorandum of Understanding (MOU) to evaluate the potential establishment of a uranium fuel supply chain in Canada capable of servicing a potential fleet of BWRX-300 small modular reactors (SMRs) in Poland.

Synthos, a manufacturer of synthetic rubber and one of the biggest producers of chemical raw materials in Poland, is […]

Blistering uranium rally reignites debate over nuclear’s future

After languishing at historical lows for the better part of the last decade, uranium suddenly came back from the dead.

Prices have surged about 40% just in September, outpacing all other major commodities. In just a few weeks, millions of pounds of supply was scooped up by the Sprott Physical Uranium Trust. It’s a massive bet on nuclear energy’s prominence in a carbon-free future. The problem is — at least for the investors who poured more than $240-million into the fund — the debate is still raging over whether and how nuclear can come to the forefront. Atomic energy became somewhat taboo after the Fukushima disaster in Japan, with opponents saying the 2011 meltdown was only the most recent accident to demonstrate that reactors are too dangerous. And while nuclear power is carbon-free, it has drawn opposition from some progressives and environmentalists who have qualms about radioactive waste. There are […]

Click here to view original web page at www.miningweekly.com

ALX Resources Corp. Stakes Javelin Uranium Project, Athabasca Basin, Saskatchewan

ALX Resources Corp. is pleased to announce that it has acquired by staking the Javelin Uranium Project in northern Saskatchewan, Canada. Javelin consists of nine mineral claims encompassing 23,652 hectares located near the eastern margin of the Athabasca Basin about 65 kilometres southeast of the McArthur River Uranium Mine. The Javelin claims are 100% owned by ALX with no underlying royalties.Javelin was …

ALX Resources Corp. ( TSXV: AL ) (FSE: 6LLN) (OTC: ALXEF) (“ALX” or the “Company”) is pleased to announce that it has acquired by staking the Javelin Uranium Project (“Javelin”, or the “Project”) in northern Saskatchewan, Canada. Javelin consists of nine mineral claims encompassing 23,652 hectares (61,073 acres), located near the eastern margin of the Athabasca Basin about 65 kilometres (40 miles) southeast of the McArthur River Uranium Mine. The Javelin claims are 100% owned by ALX with no underlying royalties.

Javelin was acquired during a recent […]

Defense Metals Revaluates Its Athabasca Basin Uranium Projects

VANCOUVER, BC, Sept. 23, 2021 /PRNewswire/ – Defense Metals Corp. (" Defense Metals " or the " Company ") (TSXV: DEFN) (OTCQB: DFMTF ) (FSE: 35D) is pleased to announce that in light of renewed and sustained uranium interest which has driven uranium spot prices to multi-year highs, it has commenced an updated internal technical review of its Athabasca Basin uranium project holdings. Figure 1. Defense Metals Athabasca Basin Uranium Projects (CNW Group/Defense Metals Corp.) During 2018, Defense Metals acquired 100% of the Geiger North and Klaproth projects for a combination of cash and share payments; with Geiger North being subject to a 2% net smelter return royalty. The projects comprise a total of five mineral claims totalling 9,363 hectares (ha) located in the northeast Athabasca Basin, with the Geiger North claims (1,233 ha) being in good standing until summer-fall 2022, and Klaproth (8,130 ha) in good standing until […]

Uranium Energy Corp. (AMEX: UEC): A Look At Its Value

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 5.82 million, with the beta value of the company hitting 2.33. At the end of the trading day, the stock’s price was $3.11, reflecting an intraday gain of 0.97% or $0.03. The 52-week high for the UEC share is $3.77, that puts it down -21.22 from that peak though still a striking 73.63% gain since the share price plummeted to a 52-week low of $0.82. The company’s market capitalization is $794.79M, and the average intraday trading volume over the past 10 days was 14.9 million shares, and the average trade volume was 5.96 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.50. UEC has a Sell rating from 0 analyst(s) out of 3 analysts who have looked at this stock. […]

Click here to view original web page at marketingsentinel.com

Resources Top 5: Uranium stocks hit the bourse with a bang

share

Long-suspended uranium stock Aura re-joins the ASX with a bang in morning trade

Small cap explorer Adavale also re-joins the uranium rush

Miramar hits gold, Kingsgate eyes mine restart Here are the biggest small cap resources winners in early trade, Thursday September 23. This long-suspended uranium stock has re-joined the ASX with a bang in morning trade, potentially egged on by pump and group groups .Aura’s focus is the advanced ‘Tiris’ project in Mauritania, which the company calls “one of the most compelling uranium development projects in the world today”.The company says it has executed an offtake agreement for the project, with financing discussions currently advancing.Highlights of recent DFS include low start-up costs of $US74.8 million and a low All-In Sustaining Cost (AISC) of US$29.81/lb – well below current prices.Vanadium by-product recovery may lower costs further, Aura says. Small cap explorer Adavale has also re-joined […]

Adavale Resources (ASX:ADD) share price surges 42% on uranium update

The Adavale Resources Limited (ASX: ADD) share price has soared into the green today after the company announced a key uranium license update . The Adavale share price is currently 7.9 cents, up 19.7% on the previous close of 6.6 cents. In early trade, the Adavale share price skyrocketed to 9.4 cents, which was a 42% gain. Here’s what we know. What did Adavale announce?

Adavale advised that planned work will commence in October at the company’s Lake Surprise uranium project in South Australia.

The Adavale share price jumped immediately at the market open following the news.

There is a selection of works to commence involving high tech mining assessments and sampling regimes. For instance, there is “1,100 line kilometres of ultra high resolution gamma surveying” that is planned at the site to “define known surface anomalies”.Adavale will also conduct geological sampling and analysis of samples to follow up on “historic […]

The future of uranium: A story of supply and demand

The Future of Uranium: A Story of Supply and Demand

The uranium market is at a tipping point.

Since the Fukushima accident in 2011, uranium prices have been on a downtrend, forcing several miners to suspend or scale back operations. But nuclear’s growing role in the clean energy transition, in addition to a supply shortfall, could turn the tide for the uranium industry.

The above infographic from Standard Uranium outlines how uranium’s demand and supply fundamentals stack up, and how that balance could change the direction of the market in the future. The Uranium Supply Chain The supply of uranium primarily comes from mines around the world, in addition to secondary sources like commercial stockpiles and military stockpiles.Although uranium is relatively abundant in the Earth’s crust, not all uranium deposits are economically recoverable. While some countries have uranium resources that can be mined profitably when prices are low, others do not.For […]

Blistering Uranium Rally Reignites Debate Over Nuclear’s Future

After languishing at historical lows for the better part of the last decade, uranium suddenly came back from the dead.

Prices have surged about 40% just in September, outpacing all other major commodities. In just a few weeks, millions of pounds of supply was scooped up by the Sprott Physical Uranium Trust. It’s a massive bet on nuclear energy’s prominence in a carbon-free future. The problem is — at least for the investors who poured more than $240 million into the fund — the debate is still raging over whether and how nuclear can come to the forefront.

Atomic energy became somewhat taboo after the Fukushima disaster in Japan, with opponents saying the 2011 meltdown was only the most recent accident to demonstrate that reactors are too dangerous. And while nuclear power is carbon-free, it has drawn opposition from some progressives and environmentalists who have qualms about radioactive waste. There are […]

Why Investors Are Flocking to Uranium

Nuclear energy has long been a bête noire of environmentalists fretting about the generating plants’ safety and radioactive waste disposal problems. But now the price of uranium, the fuel for the nukes, is swelling.

Oddly, the chief reason for uranium’s newfound popularity is that nuclear plants give out zero carbon emissions, which are the greens’ main worry. It’s not that environmentalists are embracing atomic power. But enough other people are, chiefly outside the West, which for years has been spooked by the industry—since the 1979 accident at Pennsylvania’s Three Mile Island and the 1986 catastrophe at Chernobyl in Ukraine, then a part of the Soviet Union. Not to mention the 2011 Fukushima disaster in Japan.

Once again, new nukes are coming online. Today, about 50 reactors are under construction in 19 countries, according to the World Nuclear Association trade group. That’s a big increase for the industry, which now has some […]

Wheeler River JV Approves Feasibility Study for Phoenix Deposit

Saskatoon, Saskatchewan – TheNewswire – September 22, 2021 – UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that its 50% owned subsidiary, JCU (Canada) Exploration Company, Limited (“JCU”) and Denison Mines Corp. (“Denison”) have approved the initiation of an independent Feasibility Study (“FS”) for the In-Situ Recovery mining operation proposed for the Phoenix uranium deposit on their Wheeler River Joint Venture (“WRJV”). The WRJV has also appointed leading global consulting and engineering firm Wood PLC to lead and author the FS in accordance with Canadian Securities National Instrument 43-101.

The Wheeler River Joint Venture is 10% owned by JCU and 90% by Denison, who is the operator of the WRJV. JCU is 50% owned by UEX and 50% by Denison.

Key objectives of the FS are expected to include an updated estimate of mineral resources, mine design optimization, processing plant optimization, and a Class 3 capital […]

Uranium price rally is a high-stakes bet on future of nuclear power

Credit: Wikimedia Commons Atomic energy became somewhat taboo after the Fukushima disaster in Japan, with opponents saying the 2011 meltdown was only the most recent accident to demonstrate that reactors are too dangerous. And while nuclear power is carbon-free, it has drawn opposition from some progressives and environmentalists who have qualms about radioactive waste. There are now only 50 reactors under construction worldwide, a 20-year low, according to Chris Gadomski, lead nuclear analyst for BloombergNEF.

Gadomski’s view of the red-hot uranium rally? “Everybody is getting played,” he said.

Indeed, just as quickly as uranium skyrocketed, prices now seem to be hitting the brakes. Futures traded in New York on Tuesday fell as much as 9.8%, before paring the losses to close the day 0.3% lower at $49.75 a pound. Investor demand has been so strong that the Sprott fund earlier this month amended its at-the-market program to be able to raise […]

Uranium Is Gaining Interest On Reddit’s Most Notorious Investment Forum

Nuclear advocates point out that the much-maligned form of energy production is actually one of the safest out there. And, importantly, nuclear energy production has a virtually nonexistent carbon footprint. It’s a highly efficient form of climate-friendly energy production, and yet it’s still a hard sell. Nuclear power plants are being decommissioned around the world, and have particularly fallen out of favor in the United States. But nuclear still has a lot of fans who make a lot of compelling points, and they are intent on making themselves heard.

While high-profile nuclear disasters like Chernobyl, Fukushima Daiichi, and Three Mile Island loom large in the public consciousness, and the long half-life of radioactive nuclear waste is a hard pill to swallow, nuclear energy actually kills far fewer people than fossil fuels. “Coal power is estimated to kill around 350 times as many people per terawatt-hour of energy produced, mostly from […]