These penny stocks trading at a discount have the potential for a big reversal in the coming quarters.

Mullen Automotive ( MULN ): The company has an agreement with Amazon’s delivery partner for cargo vans and positive developments related to the solid-state battery.

Hive Blockchain ( HIVE ): There’s sustained growth in mining capacity, a strong balance sheet with Bitcoin and Ethereum assets and strategic investment in decentralized finance.

Borr Drilling ( BORR ): It’s got a quality offshore drilling rig fleet, though equity dilution is a concern in the near-term. EBITDA margin expansion is likely if oil sustains around $100 per barrel. Tilray ( TLRY ): The company has a strong presence in all key markets coupled with presence in recreational and medicinal cannabis. Kinross Gold ( KGC ): It has a stable production profile with positive free cash flow visibility and financial flexibility for organic and acquisition […]

Tag: uranium

Oil vs. Uranium vs. Fertilizer: Which Is the Best Commodity Play?

Commodities are among the most widely traded assets in the world. The size of the commodity service market is US$5.059 trillion , and it grows bigger every year.

This year, the commodity sector is getting more attention than it’s gotten in past years. Earlier this year, Russia invaded Ukraine, which resulted in supply disruptions. For example, Europe’s power supply was challenged when Russia threatened to cut gas shipments. The oil and gas shortages led to very high prices. At one point this year, WTI crude — the kind of oil produced in the U.S. — traded for $123 per barrel, its highest price in years. Since then, crude oil prices have fallen to $95, which is relatively high but not unprecedented.

Still, the debate about commodities rages on. People have been very concerned about oil prices this year, and they may continue to be. On top of that, fertilizer prices have […]

Yellow Cake pleased with June quarter performance

Sharecast graphic / Josh White Yellow Cake

Long-term uranium investor Yellow Cake reported an estimated net asset value of 434p per share, or $964.5m, at the end of its second quarter on Thursday, consisting of 18.81 million pounds of triuranium octoxide valued at a spot price of $50.50 per pound, and cash and other current assets and liabilities of $14.8m.

The AIM-traded firm said that during the three months ended 30 June, it took delivery of 2.97 million pounds of triuranium octoxide, funded with cash at bank that was already earmarked.

It exercised its option with Kazatomprom to buy back 2,022,846 pounds of triuranium octoxide from Kazatomprom at a cost of $43.25 per pound, or $87.5m in total.That was received by the company at the Cameco storage facility in Canada on 19 May, in accordance with the agreed delivery schedule.Under Kazatomprom’s offer of 26 October 2021, the firm also entered […]

Utilities starting to weigh origin risk, says Canadian uranium major

Cameco CEO Tim Gitzel Energy utilities are beginning to pivot towards uranium procurement strategies that more carefully weigh origin risks, uranium major Cameco CEO Tim Gitzel said this week, noting that it was good news for the Canadian company.

He reported that this year had been a contracting success for Cameco, with more than 45-million pounds added to its portfolio of long-term uranium contracts. “We continue to have a significant and growing pipeline of contract discussions,” said Gitzel, but added that the group was “strategically patient”.

“We have significant leverage to market improvements with unencumbered pounds in the ground. Additionally, we are focusing our efforts on capturing conversion business as conversion prices are at record-highs,” he said. Many jurisdictions, which previously placed “too much focus on weather-dependent renewable energy" and are now "struggling with power shortages and spiking prices", were also turning to nuclear for electricity.

But Cameco remained committed to its […]

Click here to view original web page at www.miningweekly.com

Alligator Energy : Quarterly Activities Report and App 5B Cashflow – June 2022

For personal use only

QUARTERLY REPORT

FOR THE PERIOD ENDING

30 June 2022ASX: AGEQuarter HighlightsAlligator Energy Limited ("Alligator", "AGE" or the "Company") is pleased to release the 30 June 2022 Quarterly Activities Report.For personal use onlyUranium Receipt of final assay results from the Blackbush Deposit Phase 1 sonic core drilling program continue to confirm high-grade uranium over anticipated intervals and authenticate uranium grades obtained from the downhole PFN tool in AGE’s rotary-mud holes (drilled in March 2022) in addition to grades reported from historical drilling. AMC Consultants (Perth) commenced resource re-estimation of the Blackbush Deposit based on the additional infill drilling results and review of historical results. This has the objective of confirming a JORC-compliant indicated portion (plus a revised inferred potion) of the previous global 32.7mlb1 inferred resource, targeting areas amenable to In-Situ Recovery (ISR) at a higher cut-off grade. Wallbridge Gilbert Aztec (Adelaide) has commenced a Scoping Study […]

Click here to view original web page at www.marketscreener.com

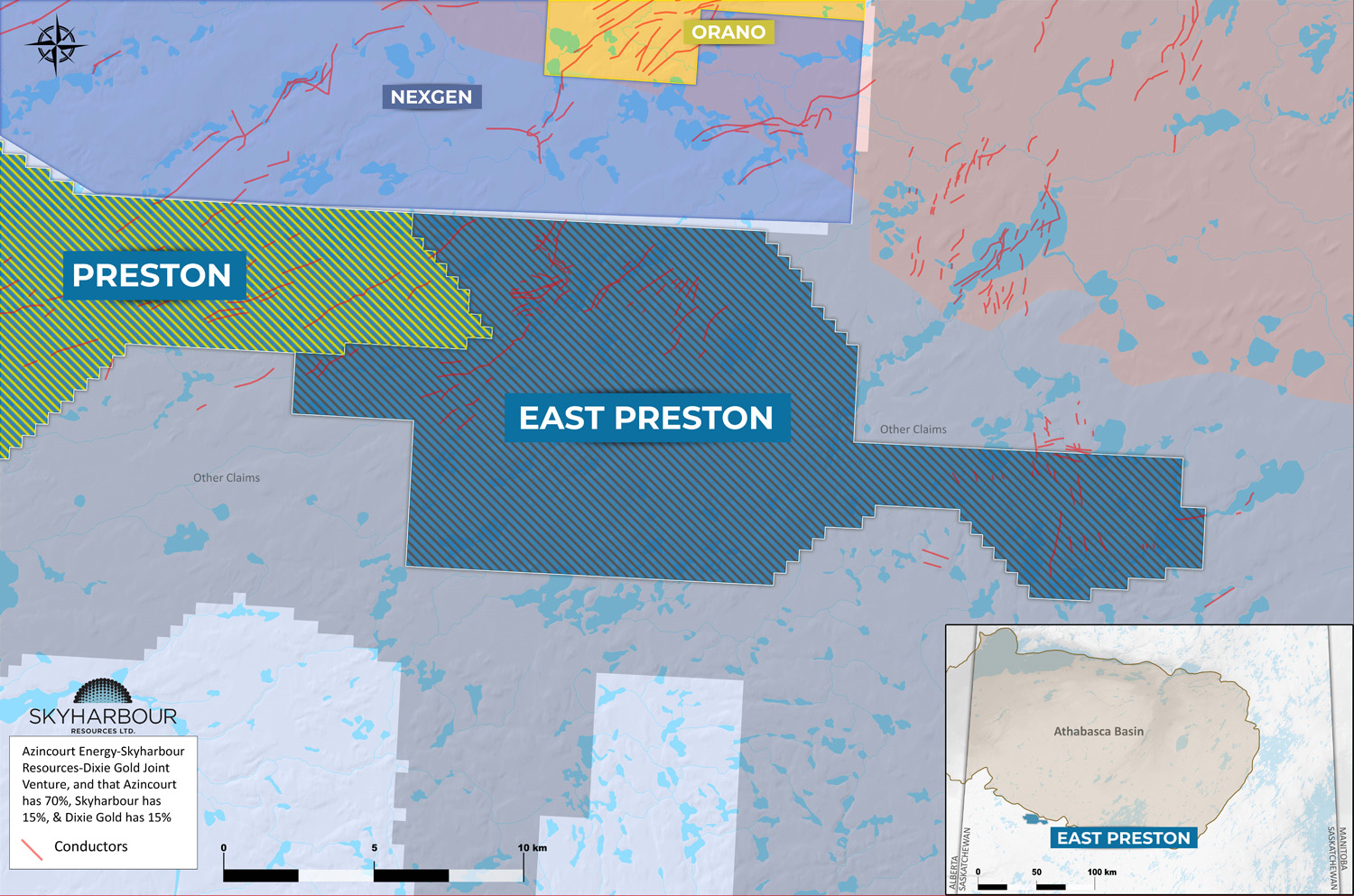

Skyharbour’s Partner Company Azincourt Energy Provides Update on Exploration and Drilling Plans for the East Preston Uranium Project

Vancouver, BC, July 28, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt) is pleased to provide an update on its plans for its fully funded upcoming fall and winter field season at the East Preston Project in the Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://www.skyharbourltd.com/_resources/maps/Sky_EastPreston_20211209.jpgThe primary target area on the East Preston Project is the conductive corridors from the A-Zone through to the G-Zone (A-G Trend) and the K-Zone through to the H and Q-Zones (K-H-Q Trend). Drilling to date has confirmed that identified geophysical conductors comprise structurally disrupted zones that are host to accumulations of graphite, sulphides, and carbonates. Hydrothermal alteration, anomalous radioactivity, and elevated uranium have been demonstrated to exist within these structurally disrupted conductor zones.

Azincourt is planning an extensive drill program for the […]

Click here to view original web page at www.globenewswire.com

3 Best Uranium Stocks to Buy Now

Mention nuclear energy as a viable investment category and chances are, you’ll eventually encounter some hesitation from your audience. While the best uranium stocks to buy now offer myriad opportunities, controversy clouds the sector. With incidents ranging from Three Mile Island to Chernobyl to most recently Fukushima, going nuclear has long been a tough pill to swallow.

However, the best uranium stocks to buy now may have received a cynical boost from one Vladimir Putin. As you know, the Russian president ordered the invasion of Ukraine, which has completely unsettled the modern global order. Now, international policymakers are scrambling to find acceptable alternatives to Russian hydrocarbons. Unfortunately, no other power source features the energy density of nuclear facilities.

What’s more, European countries who are highly dependent on Russian natural gas have over the years taken down many their nuclear powerplants . This unfortunate move in hindsight makes western nations even more […]

Denison Mines : Investor Update – July 2022

Corporate Update

July 2022

Uranium Development & Exploration

The Athabasca Basin, Northern SaskatchewanCautionary Statements & ReferencesThis presentation and the information contained herein is designed to help you understand management’s current views, and may not be appropriate for other purposes. This presentation contains information relating to the uranium market, third party and provincial infrastructure, and the plans and availability thereof, derived from third-party publications and reports which Denison believes are reliable but have not been independently verified by the Company.Certain information contained in this presentation constitutes "forward-looking information", within the meaning of the United States Private Securities Litigation Reform Act of 1995 and similar Canadian legislation concerning the business, operations and financial performance and condition of Denison. Generally, these forward-lookingstatements can be identified by the use of forward-lookingterminology such as "plans", "expects", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes", or the negatives and / or variations of such words and phrases, or […]

Click here to view original web page at www.marketscreener.com

NexGen Energy 2021 Drilling Assay Results Confirm Uranium Mineralization Below Arrow At Depth and Commencement of 2022 Regional Exploration Program

Below Arrow – multiple intersections of uranium mineralization were made significantly below Arrow, including 0.10% U 3 O 8 over 7.0 m in AR-21-268 from 1128 m to 1135 m down hole;

Camp East – uranium concentration of 0.10% U 3 O 8 in RK-21-140 from 166 m to 167 m down hole in association with brittle structure and hydrothermal alteration.

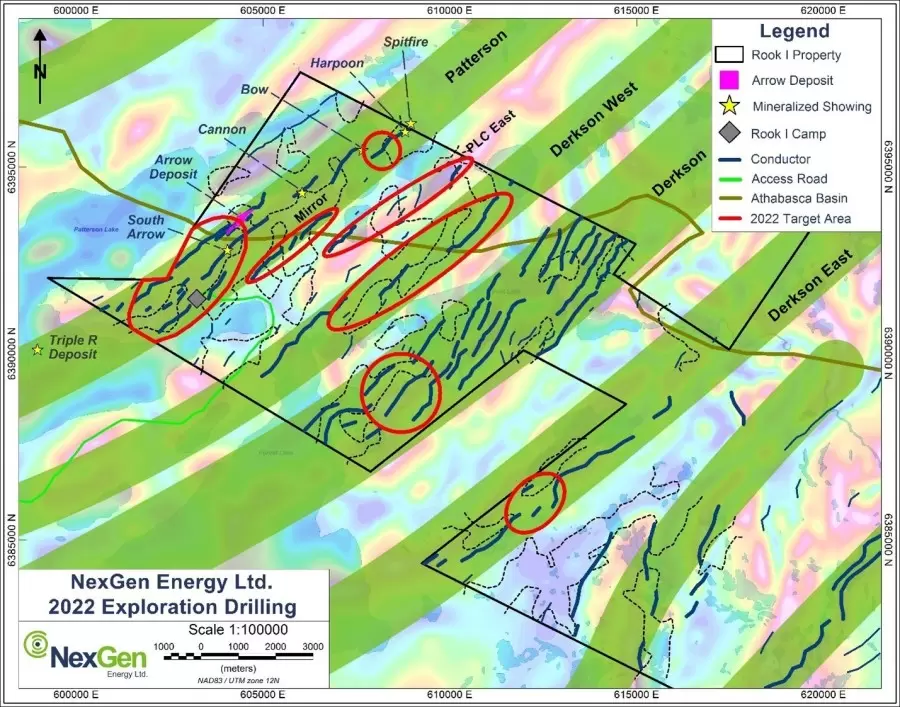

Further, NexGen has commenced 2022 drilling focused on regional exploration targets at the 100% owned Rook I project (the "Project"); and an extensive geophysical program over high priority areas of NexGen’s mineral tenure in the southwest Athabasca Basin, Saskatchewan.

Leigh Curyer, Chief Executive Officer, commented: "The intersection of mineralization below the known Arrow Deposit and along trend at Camp East highlights the extent and potential for additional significant discoveries at Rook I. The geology team led by Grant Greenwood are well positioned for the 2022 drilling season which […]

Click here to view original web page at www.juniorminingnetwork.com

Skyharbour’s Partner Company Azincourt Energy Provides Update on Exploration and Drilling Plans for the East Preston Uranium Project

Skyharbour Resources Ltd Vancouver, BC, July 28, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt) is pleased to provide an update on its plans for its fully funded upcoming fall and winter field season at the East Preston Project in the Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://www.skyharbourltd.com/_resources/maps/Sky_EastPreston_20211209.jpgThe primary target area on the East Preston Project is the conductive corridors from the A-Zone through to the G-Zone (A-G Trend) and the K-Zone through to the H and Q-Zones (K-H-Q Trend). Drilling to date has confirmed that identified geophysical conductors comprise structurally disrupted zones that are host to accumulations of graphite, sulphides, and carbonates. Hydrothermal alteration, anomalous radioactivity, and elevated uranium have been demonstrated to exist within these structurally disrupted conductor zones.

Azincourt is planning an extensive drill […]

Click here to view original web page at nz.finance.yahoo.com

Boss Energy poised to capitalise on decarbonisation trend and global energy crisis with Honeymoon uranium project

Boss Energy ASX BOE decarbonisation trend global energy crisis Honeymoon uranium project Emerging producer Boss Energy (ASX: BOE) has reported a strong June quarter of activity during which it ramped up construction and generated new exploration success at the $113 million Honeymoon uranium project in South Australia.

Managing director Duncan Craib said the company’s progress was underpinned by a strategy which will see it become the country’s newest uranium producer by the end of next year.

“This was a pivotal quarter for us which demonstrated that we are executing our strategy on every level,” he said.

“We made a final investment decision to develop Honeymoon and we are now ramping up construction , ordering key equipment and refurbishing the campsite.”The period was driven by global energy utilities keen to secure uranium supplies amid the energy crisis and ongoing push towards decarbonisation.“There has been a notable increase in the level of enquiries we […]

Skyharbour’s Partner Company Azincourt Energy Provides Update on Exploration and Drilling Plans for the East Preston Uranium Project

(Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt) is pleased to provide an update on its plans for its fully funded upcoming fall and winter field season at the East Preston Project in the Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

The primary target area on the East Preston Project is the conductive corridors from the A-Zone through to the G-Zone (A-G Trend) and the K-Zone through to the H and Q-Zones (K-H-Q Trend). Drilling to date has confirmed that identified geophysical conductors comprise structurally disrupted zones that are host to accumulations of graphite, sulphides, and carbonates. Hydrothermal alteration, anomalous radioactivity, and elevated uranium have been demonstrated to exist within these structurally disrupted conductor zones.

Azincourt is planning an extensive drill program for the fall and winter of 2022-2023. The planned program will consist of approximately 6,000 metres of drilling in 20+ diamond […]

Click here to view original web page at www.juniorminingnetwork.com

NexGen 2021 Drilling Assay Results Confirm Uranium Mineralization Below Arrow At Depth and Commencement of 2022 Regional Exploration Program

VANCOUVER, BC, July 28, 2022 /CNW/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE ) (NYSE: NXE) (ASX: NXG) is pleased to announce drill assays from 2021 confirm discovery of a uranium mineralized zone below the known Arrow Deposit and at Camp East: Below Arrow – multiple intersections of uranium mineralization were made significantly below Arrow, including 0.10% U 3 O 8 over 7.0 m in AR-21-268 from 1128 m to 1135 m down hole;

Camp East – uranium concentration of 0.10% U 3 O 8 in RK-21-140 from 166 m to 167 m down hole in association with brittle structure and hydrothermal alteration.

Figure 1: 2022 Exploration Target Areas (CNW Group/NexGen Energy Ltd.) Figure 2: 2021 Exploration Drilling (CNW Group/NexGen Energy Ltd.) Figure 3: 2021 Below Arrow Exploration – Drill holes Completed – Plan View (left) and Cross Section looking Northeast (right) (CNW Group/NexGen Energy Ltd.) […]

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Uranium miner Cameco posts C$84 million in quarterly net income, flags shipping delays from Inkai

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! (Kitco News) – Uranium miner Cameco (TSX: CCO ) today reported that the company produced 2.8 million pounds of uranium (the company’s share) in Q2 2022, up 115% compared to 1.3 million pounds produced in Q2 2021.

The company said it has been successful in catching up on development work at the Cigar Lake mine in Saskatchewan that had been deferred from 2021 and now expects to produce 18 million pounds at Cigar Lake (100% basis) in 2022, with Cameco’s share – including its increased ownership – of approximately 9.5 million pounds.

Cameco also reported net earnings of C$84 million in Q2 2022, compared to a net loss of C$37 million in Q2 2021.

According to the company’s statement, its […]

Uranium Royalty Files Annual Report

VANCOUVER, BC, July 27, 2022 /CNW/ – Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (" URC " or the " Company ") announces that it has published its annual information form, management’s discussion and analysis, and annual consolidated financial statements for the year ended April 30, 2022, which are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov .

As at April 30, 2022, the Company had approximately C$132 million in cash, marketable securities and physical uranium holdings.

Physical uranium holdings at April 30, 2022 were 1,448,068 pounds U 3 O 8 , which were acquired by URC at a weighted average cost of US$41.19 per pound. Based on the most recent daily spot price published by TradeTech LLC of US$47.00 on July 26, 2022, the net realizable value of such holdings has increased by approximately US$8 million since the balance sheet date.

The Company also recorded an increase in the fair […]

Click here to view original web page at www.juniorminingnetwork.com

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Uranium Energy Announces Results of Annual General Meeting

Amir Adnani, Spencer Abraham, Vincent Della Volpe, David Kong, Ganpat Mani and Gloria Ballesta were elected to the Board of Directors of the Company;

PricewaterhouseCoopers LLP, Chartered Professional Accountants, were appointed as the Company’s independent registered accounting firm;

the Company’s 2022 Stock Incentive Plan was approved; and

the Company’s executive compensation was approved Each of the above proposals were approved by not less than 90% of Company stockholders who voted at the AGM and, in most cases, by not less than 95% of UEC’s stockholders; the exact details of which will be provided by the Company in a Form 8-K Current Report filing to be made shortly.Following the AGM the following Executive Officers of the Company were re-appointed by the Board of Directors of the Company:Amir Adnani: President and Chief Executive Officer;Pat Obara: Secretary, Treasurer and Chief Financial Officer; andScott Melbye: Executive Vice President.Uranium Energy Corp is America’s leading, […]

Click here to view original web page at www.juniorminingnetwork.com

Western Uranium & Vanadium Market Update

Western Uranium & Vanadium Corp. July 27, 2022

Toronto, Ontario and Nucla, Colorado, July 27, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is providing the following market updates:

Mine Tour – Sunday Mine Complex

On Saturday September 17 th , Western is conducting an underground mine tour at its Sunday Mine Complex in Western Colorado. The Company will be able to accommodate a limited number of shareholders, investors, potential customers and industry professionals. If interested, please email the Company’s Investor Relations at ir@western-uranium.com in order to reserve a tour spot. Mining Operations – Sunday Mine Complex In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex. The Company is continuing to acquire […]

Click here to view original web page at au.finance.yahoo.com

Cameco Announces Second Quarter Results, Continued Disciplined Execution of Strategy; Well-Positioned as Multi-Asset Nuclear Fuel Supplier Across the Fuel Cycle

SASKATOON, Saskatchewan–( BUSINESS WIRE )–Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated financial and operating results for the second quarter ended June 30, 2022 in accordance with International Financial Reporting Standards (IFRS).

“Our results reflect the very deliberate execution of our strategy of full-cycle value capture. And, we are benefiting from higher average realized prices in both our uranium sales and our fuel services sales as the market continues to transition and geopolitics continue to highlight concentration of supply concerns,” said Tim Gitzel, Cameco’s president and CEO.

“In the drive for a clean energy profile, policy makers and business leaders must recognize that there is a need to balance affordability and security. Too much focus on intermittent, weather dependent, renewable energy, has left some jurisdictions struggling with power shortages and spiking energy prices, or dependence on Russian energy supplies. The good news for us is that many are turning to […]

Click here to view original web page at www.businesswire.com

China owns the Green revolution with falling prices of critical technology minerals

Why haven’t the world’s senior miners (aka, the actual producers of non-fuel minerals as well as of oil, gas, and coal) alerted the global manufacturing industry to the limitations on the annual production of the critical mineral resources needed for any Green transformation of the world’s energy economy away from fossil fuels? The simple answer is that they’re making too much money with the nonsensical distortions of the fossil fueled energy economy led by natural resource production illiterates.

Buying back their stock to raise the share prices, so that the insiders (aka management and its bankers) seems to be the most common use of earnings among the seniors.

The seniors are, of course, the world’s suppliers of energy fuels and of structural metals, such as iron and aluminum, and infrastructure metals, such as copper. Those three metals constitute 95% of all the metals produced annually, and iron constitutes 95% of that […]

UEC Stock Pops as Investors Warm Up to Uranium

Shares of Uranium Energy ( UEC ) are up more than 10% as sentiment shifts in the uranium and nuclear power space.

Investors are growing bullish on calls for greater adoption of nuclear energy, particularly in Europe.

Japan’s plans to bring on four more plants has further increased interest in this space and UEC stock today.

Source: engel.ac / Shutterstock Today’s price movements in the energy sector have been quite remarkable. News that Russian energy giant Gazprom has reduced natural gas flows on its Nord Stream-1 pipeline to 20% capacity following a review of a Siemens engine, which was refurbished in Canada, has sent shockwaves through the industry. However, for investors in uranium plays such as Uranium Energy (NYSEARCA: UEC ) and UEC stock, this news is turning out to be bullish today.The thesis is relatively simple. If European economies want to wean off of Russian oil and gas, […]

Cameco: Canaccord Anticipates Mixed Results For Q2 2022

Cameco (TSX: CCO) is expected to report its second quarter financial results on July 27 before the market opens. In Canaccord’s preview, they reiterate their buy rating and C$43 12-month price target, saying, “we remain fundamentally bullish on the outlook for uranium, we remain cautious going into Cameco’s Q2 results.”

There are currently 13 analysts covering the stock with an average 12-month price target of C$43.40, or an upside of 44%. Out of the 13 analysts, 3 have strong buy ratings, 8 have buy ratings, and 1 analyst has a hold rating on the stock. The street high price target sits at C$48, which comes from two analysts and represents an upside of 60%.

For the results, Canaccord expects Cameco to report mixed results and believes investors might have too high of hopes on the contracting volumes. Even with this, they expect Cameco to highlight the positives that have happened over […]

Yellow Cake capitalises on higher uranium demand as company awaits nuclear power transition

Yellow Cake shares gained 2% to 357.4p in late afternoon trading on Friday after the group announced continued market improvement for U3O8, with the spot price increasing 89% from $30.65 per pound on 31 March 2021 to $57.90 per pound on 31 March 2022.

The uranium-specialised company reported a 203% rise in the value of its holding in U3O8 across the financial year to $916.7 million at 31 March 2022 on the back of the increased price of uranium.

Yellow Cake also highlighted the net growth in the volume of uranium held from 9.8 million pounds of U3O8 to 15.8 million pounds.

The firm mentioned a post-tax profit of $417.3 million for FY 2022 from $29.9 million in FY 2021. Yellow Cake confirmed $236.6 million raised over the period through share placings in June and October 2021, after it raised $138.5 million in March 2021.The company said it applied the proceeds of […]

Click here to view original web page at ukinvestormagazine.co.uk

Integrated Advisors Network LLC Takes $53,000 Position in Uranium Royalty Corp. (NASDAQ:UROY)

→ This One Last Idea From Steve Jobs May Transform Apple Once More (Ad) Uranium Royalty Integrated Advisors Network LLC acquired a new stake in shares of Uranium Royalty Corp. ( NASDAQ:UROY – Get Rating ) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 13,500 shares of the company’s stock, valued at approximately $53,000.

Several other large investors also recently made changes to their positions in UROY. Mirae Asset Global Investments Co. Ltd. boosted its holdings in shares of Uranium Royalty by 24.4% in the fourth quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,215,742 shares of the company’s stock worth $11,660,000 after buying an additional 631,738 shares during the period. Great Valley Advisor Group Inc. boosted its holdings in shares of Uranium Royalty by 216.2% in the fourth quarter. Great Valley Advisor Group […]

Click here to view original web page at www.defenseworld.net