The entry gate to a uranium prospecting area in the Uravan mineral belt in Utah, in the western USA. Credit: File TNT Mines is preparing to drill test its key, high-grade uranium targets at the East Canyon project in Utah. The company is in the process of paying the requisite bonds to the US government and entering the final phase of the drill permitting process. Exploration is currently being designed to test various targets across the company’s holdings, with initial drilling likely to focus on a nest of historical workings in the north of TNT’s tenure, including the None Such and Bonanza targets.

The company says despite the outstanding results from sampling and the broad zones of uranium mineralisation outlined across its East Canyon holdings, the move to drilling has taken longer than expected due to the approvals process. TNT is now in the final stages of receiving its permits […]

Tag: uranium

Skyharbour’s Partner Company Azincourt Energy Reports 2021 Winter Drill Program Shut Down Due to Warm Weather on The East Preston Uranium Project

VANCOUVER, British Columbia, March 23, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy Corp. (“Azincourt”) is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdfUnseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of the diamond drill program approximately two weeks earlier than expected. Daytime temperatures above zero with only mild freezing temperatures at night is resulting in the rapid deterioration of ice crossings over rivers and swamps. In the interest of crew safety and environmental responsibility, the decision was taken to defer the remaining meterage in the program until later in the year.

The 2021 exploration program was planned […]

Click here to view original web page at www.globenewswire.com

Smaller uranium companies buy up material atop global hype for nuclear power

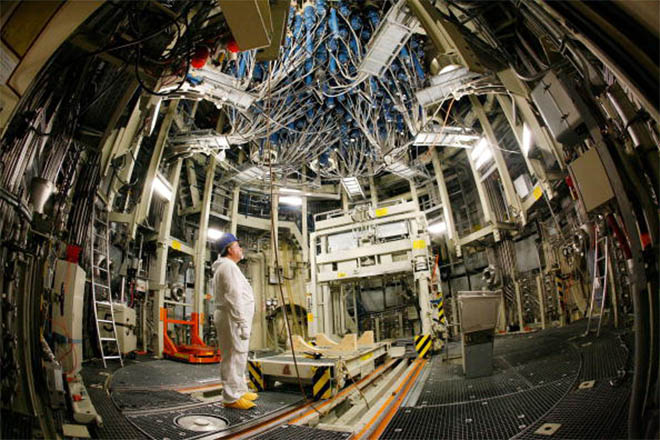

An employee assesses the control rods unit for fuel elements while the reactor is turned off for a routine inspection at a nuclear power plant in Kruemmel, Germany, on Aug. 15, 2007. Recent plays in the uranium spot market have occurred amid a torrent of change in the nuclear power space.

Source: Krafft Angerer /Getty Images News via Getty Images Uranium juniors faced with the prospects of a nuclear renaissance and prices below the cost of production are trying to capitalize on their dilemma with a simple strategy: buy, buy, buy.U.K.-based uranium purchaser Yellow Cake PLC elected March 15 to fully exercise its $100 million uranium purchase option for 2021 with JSC National Atomic Co. Kazatomprom and agreed to purchase another 440,000 pounds from the Kazakh uranium major. The move may prompt Kazatomprom, which is the largest uranium producer in the world, to purchase material on the spot […]

Skyharbour’s Partner Company Azincourt Energy Reports 2021 Winter Drill Program Shut Down Due to Warm Weather on The East Preston Uranium Project

Skyharbour Resources Ltd. partner company Azincourt Energy Corp. is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada. Project Location – Western Athabasca Basin, Saskatchewan, Canada: Unseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy Corp. (“Azincourt”) is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdf

Unseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of the diamond drill program approximately two weeks earlier than expected. Daytime temperatures above […]

Denison Mines Is a Uranium Mining Stock That Requires Too Much Care

Denison Mines (NYSEAMERICAN: DNN ) is a Canadian uranium mining company with an outsized valuation and penny stock status. As such, investors should be careful about investing in DNN stock, as it is likely to be quite volatile. The Toronto-based company has a major prospective uranium mining project in northern Saskatchewan called the Wheeler River project . A Seeking Alpha analyst says that this project has a “ positive net present value at the current spot uranium prices .” However, he believes that DNN stock is still overvalued. Recent Capital Raises

Nevertheless, Denison Mines has astutely raised capital at several price points recently. On Feb. 11, the company raised $25 million before broker greenshoe options, as well as 8 million CAD in “flow-through” shares and warrants with a $2.00 per share exercise price.

This is after DNN stock shot up from 33 cents per share in November 2020, to as […]

Centrus Provides Update on Construction of America’s First HALEU Production Facility

BETHESDA, Md., March 23, 2021 /PRNewswire/ — Centrus Energy Corp. (NYSE American: LEU) is providing an update on construction of the nation’s first production facility for High-Assay, Low-Enriched Uranium (HALEU) in Piketon, Ohio.

"Despite the impact of the pandemic and the extraordinary steps we have taken to protect our workforce – including limiting the number of people who can be on the construction site at any one time – we have kept construction on track and expect to begin producing HALEU by next year," said Centrus President and CEO Daniel B. Poneman. "We believe this first-of-a-kind facility can play a critical role in meeting both government and commercial requirements for HALEU, powering America’s nuclear leadership as the world turns to a new generation of advanced reactors and advanced nuclear fuels."

Under a 2019 contract with the U.S. Department of Energy’s Office of Nuclear Energy, Centrus is licensing and constructing a cascade […]

Uranium Has That Healthy Glow Again

The last time Cameco saw year-over-year net income growth was 2015, when the spot price of uranium oxide hovered above $35 a pound for most of the year. Since then, the commodity’s price has mostly stayed below $30 a pound, though it seems to be recovering quickly. As of Monday, the spot price was $29.60 a pound, up 7.3% in one week, according to data from nuclear fuel market research firm UxC. Uranium is mostly sold on contracts with utilities rather than via the spot market. Jonathan Hinze, president of UxC, notes that among nonsubsidized mines, the all-in cost of production can range anywhere from $10 a pound up to $38 a pound.

The supply-demand picture appears unchanged from last year, but this masks the underlying dynamics of an opaque and long-cycle industry . In 2021 global uranium demand is expected to shrink slightly to 178 million pounds from 2020’s […]

What’s going on with ASX uranium share Marenica Energy’s (ASX:MEY) share price today?

The Marenica Energy Ltd (ASX: MEY) share price was on the move earlier today. However, after posting gains of 3.3% in afternoon trading, the share price is currently flat. This comes after the ASX uranium explorer reported successful early results at one of its projects in Namibia. In addition, Marenica currently holds the largest area of uranium exploration leases in the African nation. What uranium exploration results did Marenica Energy report?

Marenica’s shares moved higher earlier today after the company reported it had discovered an extensive palaeochannel system during its maiden geophysical exploration program at its Namib IV prospect.

The exploration program is intended to reveal uranium mineralisation zones. Additionally, the company said the system it has discovered extends for more than 19 kilometres. Management commentary

Commenting on the exploration results, Marenica’s managing director, Murray Hill said: The structure of this palaeochannel system at Namib IV is extremely promising […]

Energy Fuels helping to restore US rare earth production

The company supplies uranium (U3O8) to major nuclear utilities and can also produce vanadium from some projects as market conditions allow → Largest producer of uranium in the US

Leading producer of vanadium used in batteries, steel, and chemical industries

Recovering rare earth elements (REEs) at White Mesa mill in Utah

What Energy Fuels does: Energy Fuels Inc ( TSE:EFR ) ( NYSEMKT:UUUU ), headquartered in Colorado, is a fully integrated producer of both uranium and vanadium, and owner of the only operating conventional uranium mill at White Mesa in Utah.It supplies uranium (U3O8) to major nuclear utilities and can also produce vanadium from some projects as market conditions allow.The firm’s White Mesa mill has a licensed capacity to produce over eight million pounds of uranium a year, and can generate vanadium when market conditions warrant. The mill is also licensed for the production of other minerals, including tantalum, […]

Click here to view original web page at www.proactiveinvestors.com

MiningNewsBreaks – Uranium Energy Corp. (NYSE American: UEC) Secures $30.5M in Registered Direct Offering

Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here .

Uranium Energy (NYSE American: UEC) , a Corpus Christi, Texas-based uranium mining and exploration company, has closed its previously announced offering of an aggregate of 10,000,000 shares of common stock of the company. Per an update released today, Uranium Energy secured gross proceeds of $30,500,000 in the registered direct offering, with each of the shares sold at a purchase price of $3.05. The company offered and sold the shares per a securities purchase agreement, dated March 17, 2021, with certain institutional investors. UEC intends to use the net proceeds for additional uranium purchases and for general corporate and working capital purposes. The company has approximately $95 million in cash and equity holdings, which includes $61M in cash, following the closing of this offering. In addition, UECs physical uranium initiative […]

Click here to view original web page at www.streetinsider.com

Uranium Energy : Completes Financing to Expand Physical Uranium Initiative

(NYSE: UEC), (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 10,000,000 shares of common stock of the Company (each, a "Share") at a purchase price of $3.05 per Share and for gross proceeds of $30,500,000 in a registered direct offering (the "Offering")

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated March 17, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering the Company has approximately $95 million in cash and equity holdings, which includes $61M in cash.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 1.4 million pounds of U.S. warehoused uranium with 1,000,000 pounds delivered by May 2021 and another 400,000 pounds delivered […]

Click here to view original web page at www.marketscreener.com

Uranium Week: Uranium Price Drivers

A jump in the weekly spot price focuses the minds of uranium participants on both short and medium-term price catalysts.

-Increasing short-term transaction volumes

-Bullish 12 month view

-Spot uranium rises over 8% to $US29.65/lbThe weekly spot uranium price showed renewed volatility this week, spiking 8% to US$29.65/lb.Industry consultant TradeTech cites increased transaction volumes driven primarily by producer and investor activity as one catalyst for the short-term rise. When combined with cuts and reductions to primary production, there is potential for considerable influence on the uranium market.Investor interest from funds has undergone a recent resurgence with Uranium Participation Corp (UEC) and Yellow Cake plc acting as first movers to take physical positions in the uranium market, by sequestering uranium concentrates. This may be termed a “buy and hold” strategy.In addition, select emerging producers have supplemented this strategy with a “buy and deliver” revenue model, notes TradeTech. By way […]

Energy Fuels Announces 2020 Results, Including Robust Balance Sheet, Market Leading U.S. Uranium Production & Upcoming Commencement of Rare Earth Production; Webcast on Tuesday, March 23, 2021

LAKEWOOD, Colo., March 22, 2021 /PRNewswire/ – Energy Fuels Inc. (NYSE: UUUU ); (TSX: EFR) ("Energy Fuels" or the "Company") today reported its financial results for the year ended December 31, 2020. The Company’s annual report on Form 10-K has been filed with the U.S. Securities and Exchange Commission (" SEC ") and may be viewed on the Electronic Document Gathering and Retrieval System (" EDGAR ") at www.sec.gov/edgar.shtml , on the System for Electronic Document Analysis and Retrieval (" SEDAR ") at www.sedar.com , and on the Company’s website at www.energyfuels.com . Unless noted otherwise, all dollar amounts are in U.S. dollars.

Highlights: Working capital at December 31, 2020 was $40.2 million, a $19.7 million increase over the Company’s $20.5 million working capital balance at December 31, 2019. The Company’s December 31, 2020 working capital balance of $40.2 million included $22.4 million of cash and marketable securities and […]

Uranium Energy Corp Completes Financing to Expand Physical Uranium Initiative

CORPUS CHRISTI, TX, March 22, 2021 /PRNewswire/ – Uranium Energy Corp (NYSE: UEC ), (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 10,000,000 shares of common stock of the Company (each, a "Share") at a purchase price of $3.05 per Share and for gross proceeds of $30,500,000 in a registered direct offering (the "Offering")

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated March 17, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering the Company has approximately $95 million in cash and equity holdings, which includes $61M in cash.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 1.4 million pounds of U.S. warehoused uranium […]

Denison Announces Closing of US$86.3 Million Financing in Support of Strategic Acquisition of Physical Uranium

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES/

TORONTO, March 22, 2021 /CNW/ – Denison Mines Corp. ("Denison" or the "Company") (TSX: DML ) (NYSE American: DNN) is pleased to announce that it has closed its previously announced bought deal public offering of units (the "Offering"). The Company issued 78,430,000 units of the Company at US$1.10 per unit for aggregate gross proceeds of US$86,273,000, which included 10,230,000 units through the full exercise of the underwriters’ over-allotment option. View PDF View PDF Denison Announces Closing of US$86.3 Million Financing in Support of Strategic Acquisition of Physical Uranium (CNW Group/Denison Mines Corp.) Each unit consists of one common share and one-half of one transferable common share purchase warrant of the Company. Each full warrant is exercisable to acquire one Company common […]

Analyst Highlights that Texas Company Makes ‘Strategic Acquisition of Physical Uranium’

Source: Streetwise Reports 03/18/2021

A Canaccord Genuity report notes that Uranium Energy Corp. is “well funded to advance development and eventual

construction in South Texas” and increases its target price on the company.In a March 16 research note, analyst Katie Lachapelle reported that Canaccord Genuity increased its target price on Uranium Energy Corp. (UEC:NYSE AMERICAN) following its release of Q2/21 results and its announced commitment to building a uranium inventory.

Canaccord Genuity’s new target price on Uranium Energy is $3.50 per share, up from its previous $2.15 per share target. Currently, the stock is trading at about $2.90 per share. Get our Weekly Commitment of Traders Reports: – See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis. Get Our Free Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you […]

Click here to view original web page at www.countingpips.com

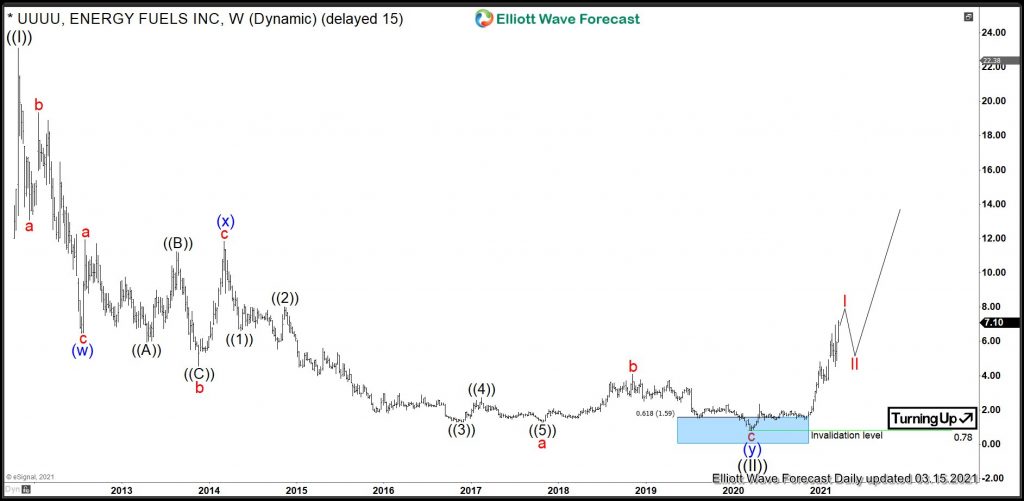

$UUUU : Uranium Miner Energy Fuels Turning Impulsively Higher

Energy Fuels is the largest US miner of the uranium. It produces the uranium both in form of triuranium octoxide and uranium hexafluoride. Besides the core business, the secondary products of Energy Fuels are rare earth elements and vanadium. Founded in 2006, the company has its headquarters in Lakewood, Colorado. One can trade it under the ticker $UUUU at the New York Stock Exchange. Investors in shares of the mining company are participating, therefore, in the company success story on the one hand and in the price development of the uranium commodity on the other.

Currently, we see the ongoing price appreciation within the energy commodities like oil, gas, coal and others. Consequently, uranium is expected to turn higher after 13 years of weak prices as well. Besides the market correlation in the energy group, the pattern of $UUUU on its own demonstrates an impulsive bullish behavior. Therefore, investors in […]

Click here to view original web page at elliottwave-forecast.com

Uranium Energy Corp. (NYSEAMERICAN:UEC) Shares Acquired by BlackRock Inc.

Uranium Energy logo BlackRock Inc. raised its stake in shares of Uranium Energy Corp. (NYSEAMERICAN:UEC) by 9.8% in the 4th quarter, Holdings Channel reports. The fund owned 13,359,092 shares of the basic materials company’s stock after acquiring an additional 1,188,677 shares during the quarter. BlackRock Inc. owned 0.07% of Uranium Energy worth $23,512,000 as of its most recent filing with the Securities & Exchange Commission.

Several other large investors also recently added to or reduced their stakes in UEC. Bank Julius Baer & Co. Ltd Zurich acquired a new position in Uranium Energy in the 3rd quarter valued at $30,000. BNP Paribas Arbitrage SA grew its position in Uranium Energy by 398.1% during the third quarter. BNP Paribas Arbitrage SA now owns 45,835 shares of the basic materials company’s stock worth $46,000 after buying an additional 36,633 shares during the period. Transcend Wealth Collective LLC purchased a new stake in […]

Click here to view original web page at theenterpriseleader.com

Energy Fuels Can’t Make American Uranium Great Again

Summary

The company owns several uranium projects and processing facilities in the U.S., including the White Mesa mill in the state of Utah.

However, the uranium mining sector in the country has been slowly dying and there are much better projects in Canada, Kazakhstan, and Africa.

Energy Fuels is bleeding money and I think its assets are close to worthless. The main risk for the bear thesis is a disconnect between uranium prices and the share prices of uranium miners, that emerged a few months ago. Photo by RHJ/iStock via Getty Images You just heard The Prayer for the Dead, my fellow stockholders, and you didn’t say, "Amen." This company is dead. I didn’t kill it. Don’t blame me. It was dead when I got here. It’s too late for prayers. For even if the prayers were answered, and a miracle occurred, and the yen did this, and the […]

Fitch Affirms JSC National Atomic Company Kazatomprom at ‘BBB-‘; Outlook Stable

Fitch Ratings – Warsaw – 19 Mar 2021: Fitch Ratings affirmed Kazakhstan-based JSC National Atomic Company Kazatomprom’s (Kazatomprom) Long-Term Issuer Default Rating (IDR) at ‘BBB-‘ with Stable Outlook.

The rating affirmation reflects Kazatomprom’s continuing strong financial profile, benefiting from higher uranium spot prices and demand. Kazatomprom maintains its strong global market position, as well as its first quartile low-cost production position in the global cost curve and continues to see fairly stable demand from the utilities sector. However, its ratings are constrained by limited diversification and integration, small scale based on revenue size, exposure to uranium-price volatility and potential for substantial dividend payments.

Fitch rates Kazatomprom based on its Standalone Credit Profile (SCP) of ‘bbb-‘, as the agency views its links with its ultimate shareholder, Kazakhstan (BBB/Stable), as limited under Fitch’s Government-Related Entities Rating Criteria. KEY RATING DRIVERS

Low Financial Leverage: Fitch expects the company to maintain a conservative financial profile, […]

Click here to view original web page at www.fitchratings.com

Ride the Uranium Bull with a Stake in Denison Mines

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

If you’re in the market for a pure uranium play that won’t cost you an arm and a leg, check out Canadian exploration and development company Denison Mines (NYSEAMERICAN: DNN ). It appears that DNN stock has been in breakout mode over the past several months and could be headed higher. Source: Shutterstock Denison focuses on what’s known as the Athabasca Basin, a region in northern Saskatchewan and Alberta. It supplies “ about 20% of the world’s uranium.”

The company is aggressively advancing its operations in this region. Moreover, uranium sector investors should appreciate Denison’s vast project portfolio, which covers some 280,000 hectares.

What makes Denison Mines relatively low-risk in the uranium-mining space? Investors have a right to know, so we’ll definitely explore that topic. First, though, we should look at the recent price action of the stock. DNN Stock at […]

Thor Mining readies to drill promising targets at US uranium project

Uranium exploration company Thor Mining has pinpointed several new promising targets for drilling at its Wedding Bell and Radium Mountain project in the US. The targets – Section 23, Groundhog, and Rim Rock – were detected after Thor Mining (ASX:THR) carried out field sampling that returned assay results for high-grade uranium of up to 1.25 per cent, and for vanadium of up to 3.47 per cent.

“With uranium prices at current levels, we are pleased to be in a position to commence drilling at our Colorado uranium-vanadium project once permitting is complete,” executive chairman, Mick Billing, said.

Uranium is trading at $US30 per pound and is up 25 per cent from its market low of $US24 per pound a year ago.

Drilling at the target sites is expected to begin in May once official permits are issued.The three exploration targets identified for drilling are within a historic high-grade uranium-vanadium mining district in […]

Uranium Energy Corp. (NYSE:UEC) On Wednesday – Up 86.44 Percent From Lows, What To Expect Going Ahead?

During the last session, Uranium Energy Corp. (NYSE:UEC)’s traded shares were 16,798,796, with the beta value of the company hitting 2.42. At the end of the trading day, the stock’s price was $2.95, reflecting an intraday loss of -8.67% or -$0.28. The 52-week high for the UEC share is $3.67, that puts it down -24.41% from that peak though still a striking +86.44% gain since the share price plummeted to a 52-week low of $0.4. The company’s market capitalization is $632.61 Million, and the average intraday trading volume over the past 10 days was 9.32 Million shares, and the average trade volume was 5.4 Million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of Buy from analysts. That translates to a mean rating of 1.7. UEC has a Sell rating from none of the analyst(s) out of 5 analysts who have looked at this […]

Click here to view original web page at marketingsentinel.com

Ride the Uranium Bull with a Stake in Denison Mines

If you’re in the market for a pure uranium play that won’t cost you an arm and a leg, check out Canadian exploration and development company Denison Mines (NYSEAMERICAN: DNN ). It appears that DNN stock has been in breakout mode over the past several months and could be headed higher. Denison focuses on what’s known as the Athabasca Basin, a region in northern Saskatchewan and Alberta. It supplies “ about 20% of the world’s uranium.”

The company is aggressively advancing its operations in this region. Moreover, uranium sector investors should appreciate Denison’s vast project portfolio, which covers some 280,000 hectares.

What makes Denison Mines relatively low-risk in the uranium-mining space? Investors have a right to know, so we’ll definitely explore that topic. First, though, we should look at the recent price action of the stock. DNN Stock at a Glance

If you want to see a textbook example of what […]

Uranium companies announce strategic purchase plans

Uranium companies have separately announced plans to make strategic purchases of physical uranium. Denison is aiming to buy about 2.5 million pounds U3O8 (962 tU) through the spot market as a long-term investment, while Uranium Energy Corp (UEC) has entered into agreements to purchase 400,000 pounds. UK-based Yellow Cake plc has also announced further purchase plans under its agreement with Kazatomprom. (Image: Kazatomprom)

Toronto-based Denison said yesterday it had entered into a strategic financing agreement with Cantor Fitzgerald Canada Corporation to raise about USD$75 million, which will be used to fund the strategic purchase of uranium concentrates to be held by Denison as a long-term investment intended to support the potential future financing of the advancement and/or construction of its 90%-owned Wheeler River uranium project in Saskatchewan, Canada. The purchase is expected to strengthen the company’s balance sheet and enhance its ability to access future project financing.

The purchased uranium could […]

Click here to view original web page at world-nuclear-news.org