Those who were in gold about a year ago can look forward to an approximately 25 percent higher gold price. Many, such as Saxo Bank, believe that the end of the road has not yet been reached in terms of price. Saxo Bank expects a gold price of at least 2,200 U.S. dollars. The reason for this is a weakening

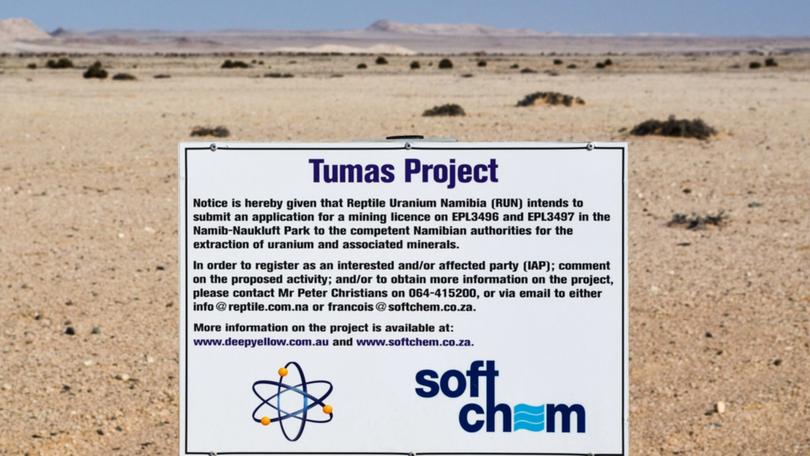

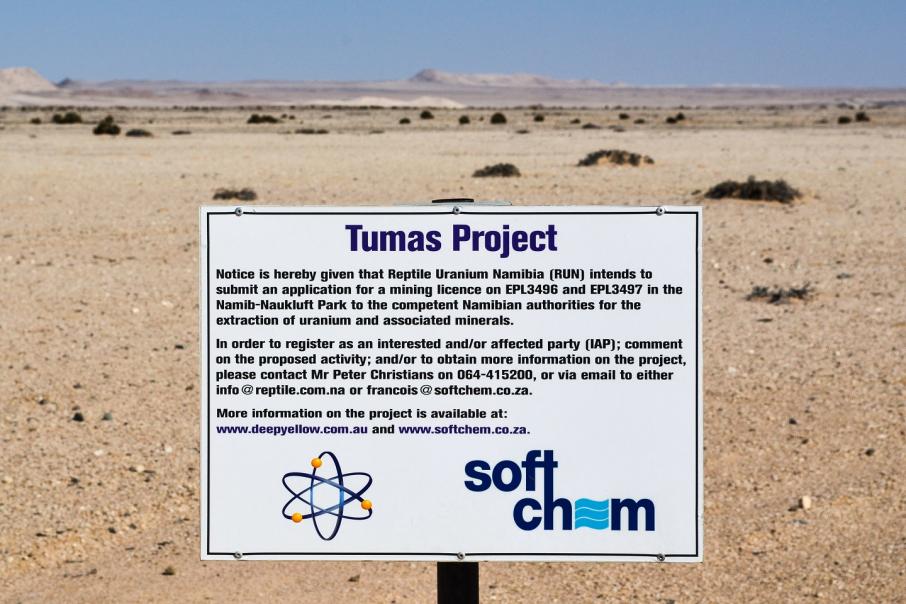

U.S. dollar, the cause of which is the rising national debt.Another raw material, uranium, is also forecast to have a bright future. This is because, thanks to many new nuclear reactors, demand for uranium is rising. And in recent years, a low uranium price has often prevented exploration and investment efforts. And a scarce raw material is always a raw material that becomes more expensive. As a result, uranium companies are also becoming more valuable and moving into the focus of investors.

The fight against emissions is not only […]

Click here to view original web page at www.resource-capital.ch