Covid-19 torpedoes oil prices

The new lockdowns in German and France and the spiralling case numbers of Covid-19 cases in the US torpedoed oil prices below the waterline overnight. Concerns about the consumption outlook and an unexpected jump in official US crude inventories saw Brent crude fall 4.15% to USD39.00 a barrel. WTI fell by 4.10% to USD37.35 a barrel.

The stabilisation of equity markets in Asia has provided a brief respite for oil today, with both contracts edging 15 cents higher this morning. The consumption risks in Europe especially, and the technical picture on both contracts, makes for grim reading today still.

Brent crude failed to recapture its 200-DMA at USD40.90 a barrel overnight and now sits just above monthly support between USD38.75 and USD39.00 a barrel. Further losses to USD37.00 a barrel beckon if that support zone fails.WTI has resistance at its overnight high of USD39.00 a barrel but […]

Central Banks Sell Gold for First Time in a Decade

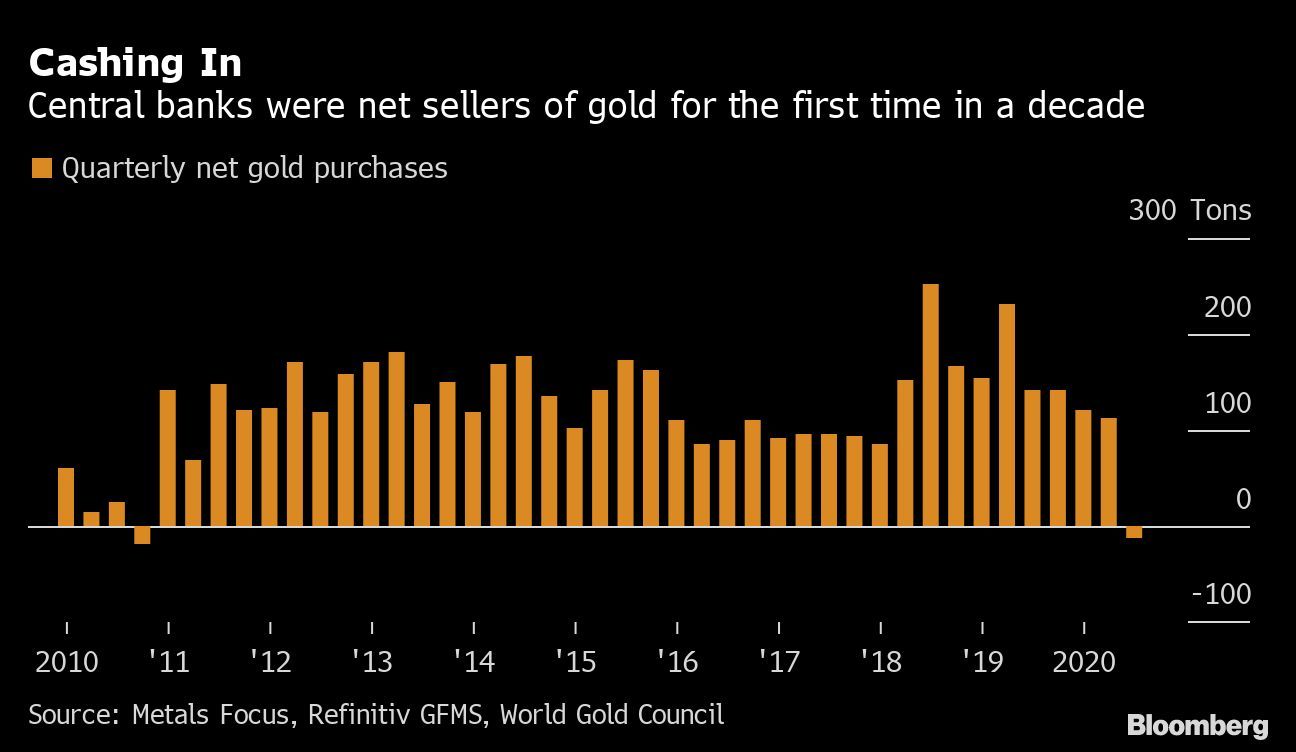

(Bloomberg) — Central banks became gold sellers for the first time since 2010 as some producing nations exploited near-record prices to soften the blow from the coronavirus pandemic.

Net sales totaled 12.1 tons of bullion in the third quarter, compared with purchases of 141.9 tons a year earlier, according to a report by the World Gold Council. Selling was driven by Uzbekistan and Turkey, while Russia’s central bank also posted its first quarterly sale in 13 years.

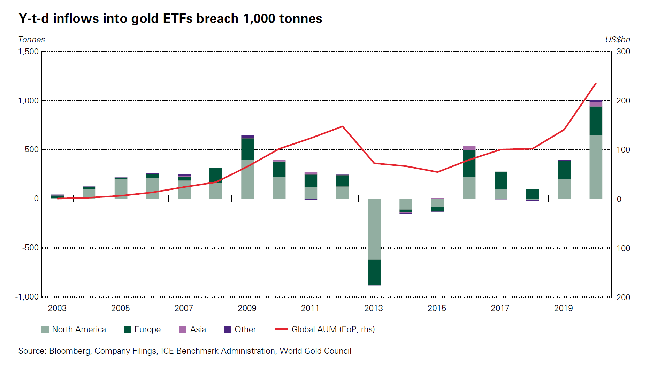

While inflows into exchange-traded funds have driven gold’s advance in 2020, buying by central banks has helped underpin bullion in recent years. Citigroup Inc. last month predicted that central bank demand would rebound in 2021, after slowing this year from near-record purchases in both 2018 and 2019.

“It’s not surprising that in the circumstances banks might look to their gold reserves,” said Louise Street, lead analyst at the WGC. “Virtually all of the selling is […]

Gold, silver see some price pressure ahead of key U.S. data

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are weaker in early U.S. trading Thursday. The precious metals have been hit by a stronger U.S. dollar index this week. The precious metals have not seen much safe-haven demand amid a U.S. stock market that has become wobbly this week. December gold futures were last down $4.50 at $1,874.40 and December Comex silver was last down $0.194 at $23.16 an ounce.

There is important U.S. economic data due for release Thursday morning, including the weekly jobless claims report, which is forecast to show a rise of around 780,000 claims. The advance third-quarter GDP estimate is forecast up a record 32% from the second quarter. Pending home sales […]

Why Australia Is The World’s Most Exciting Gold Frontier

LONDON, Oct. 29, 2020 /PRNewswire/ — Since the middle of 2019, we have been in a precious metals bull market , with gold prices hitting a new all-time high of $2079 on August 3, 2020. And silver prices have also been climbing steadily since the beginning of 2Q 2020, sending investors on the search for the best way to play this precious metals bull run for maximum upside potential. Mentioned in today’s commentary includes: Kirkland Lake Gold (NYSE: KL ), Great Panther Mining Limited (NYSE: GPL ), Alamos Gold Inc (NYSE: AGI ), Osisko Gold Royalties Ltd (NYSE: OR ), Sandstorm Gold Ltd (NYSE: SAND ).

In the search for high upside in this bull market, many investors smartly turn to the junior exploration sector, as companies in that space tend to offer the biggest potential bang for the buck. But it’s important to understand that not all junior exploration […]

Newmont 3Q Revenue Rises on Higher Gold Prices

Newmont Corp. Thursday recorded higher revenue in the latest quarter as gold production declined but the average price per ounce climbed.

The Greenwood Village, Colo.-based mining company logged a third-quarter profit of $839 million, or $1.04 a share, compared with a profit of $2.18 billion, or $2.65 a share, in the same three-month period a year earlier.

On an adjusted basis, Newmont’s profit was 86 cents a share. Analysts polled by FactSet were expecting an adjusted profit of 84 cents a share.

Revenue was $3.17 billion, up from $2.71 billion in the same three-month period a year earlier. Analysts had forecast revenue of $3.25 billion.Attributable gold production declined 6% year over year to 1.5 million ounces due to coronavirus-related effects at three mining sites, Newmont said. The average realized price of gold rose to $1,913 an ounce, an increase of $437 an ounce compared with the price in the year-ago period.The company […]

How to trade gold during the US election [Video]

The countdown has begun for what is expected to be ‘the most controversial U.S Presidential election’ ever in history.

With only six days to go, U.S President Donald Trump and Democratic challenger Joe Biden are now down to the final full week of campaigning before the November 3rd election.

Traders everywhere are preparing for the contingency of a contested result in the most crucial election in generations.

U.S President Donald Trump has been furiously sowing distrust of the legitimacy of the electoral process and especially of postal votes, calling this “the most corrupt Election in American History”.Given that more Democrat than Republican voters are requesting mail in ballots, it is quite possible that Mr Trump could be leading on the night and then Mr Biden moves ahead as postal votes are counted. That “blue shift” scenario could mean days and even weeks of furious disputes, from polling stations, through county, city […]

Investors still see value in gold as physical demand drops 19% in Q3 – World Gold Council

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! ( Kitco News ) – Investment demand continues to dominate the gold market as the World Gold Council (WGC) reports a second consecutive quarterly drop in physical demand.

In its quarterly demand trends report, published Thursday, the WGC said that physical gold demand totaled 892.3 tonnes in the first quarter. The report said that physical demand saw an annual drop of 19%, compared to the second-quarter decline of 11%.

In the first nine months of the year, physical gold demand has dropped 10%, compared to the same time period in 2019, the report said.

The one pillar of strength in the gold market remains investment demand — particularly growing holdings in gold-backed exchange-traded products. The WGC said that gold holdings […]

Gold Forecast – Gold Prices Approaching Major Cycle Target

The terminal decline usually lasts between 3 to 8-trading days; a bottom is expected next week. GOLD DAILY

The final breakdown is underway, and gold should bottom in the opening weeks of November. Minimum target $1820. Prices could test the lower price objective near $1765 with a decisive Trump victory.

Our gold cycle indicator supports a cycle bottom when it drops below 100 and enters minimum cycle bottoming. It reached just 171 in September and never supported a bottom. Consequently, we continued to predict one final decline in precious metals.

The GCI closed at 142 and should drop below 100 in the coming days. We are likely approaching a significant low in precious metals.AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more information, visit here .

Gold drops to 7oz per BTC as Peter Schiff calls Bitcoin ‘biggest bubble’

Bitcoin ( BTC ) hit seven ounces of gold for the first time in over a year this week as the precious metal comes off all-time highs.

Data from CoinGecko showed BTC/XAU returning to the pivotal 7 ounce mark on Oct. 25, continuing to edge up to press-time levels of 7.02 ounces. Gold hits one-year lows in BTC

Despite Bitcoin losing ground after challenging $14,000, the gains against gold remained on Thursday, as the traditional safe haven felt the pressure of Coronavirus tensions and U.S. election uncertainty.

The last time that BTC/XAU broke 7 ounces was in September 2019.Commenting on the latest events, quant analyst PlanB , creator of the stock-to-flow family of Bitcoin price models, called the move “significant.”“It looks like #Bitcoin is getting ready to conquer a larger portion of the gold market cap,” data monitor Ecoinometrics responded on Twitter. “Right now #BTC is at about 2.4% of the […]

REPEAT – African Gold Group Forges Ahead With Corporate Social Responsibility Programme

TORONTO, Oct. 29, 2020 (GLOBE NEWSWIRE) — African Gold Group, Inc. (TSX-V: AGG) (“ AGG ” or the “ Company ”) is pleased to announce its corporate social responsibility program (“ CSR ”) as it prepares for the start of construction of its flagship Kobada Mine. As a mining company operating in Africa, AGG recognizes its responsibility to adhere to the highest standards and is committed to creating sustainable long-term value for all of its stakeholders.

AGG is guided by the United Nations Sustainable Development Goals (“ UN SDGs ”) at all stages of its decision making and will work towards aligning our operations towards the following goals as Kobada moves towards production: Goal 3: Good health and well-being

Goal 4: Quality education

Goal 5: Gender Equality Goal 6: Clean water and sanitization Goal 8: Decent work and economic growth Goal 9: Industry, innovation and infrastructure Goal 12: Responsible consumption […]

Click here to view original web page at www.globenewswire.com

Gold Price Analysis: XAU/USD breaches 100-day SMA for first since March

Gold has found acceptance below the 100-day SMA support.

The breakdown is backed by bearish readings on key indicators.

A bigger decline may be in the offing.

Gold looks south, having breached the widely-tracked 100-day simple moving average (SMA) support for the first time since March 23.The yellow metal fell by 1.67% on Wednesday and closed below the 100-day SMA, flipping the long-term technical support into resistance. The SMA is currently located at $1,887, and the metal is trading at $1,878 per ounce.Wednesday’s drop also marked a downside break of the ascending channel represented by trendlines connecting Sept. 28 and Oct. 14 lows and Oct. 2 and Oct. 12 highs.The rising channel breakdown and the 100-day SMA violation are backed by a below-50 or bearish reading on the 14-day relative strength index. Further, the MACD histogram has crossed below zero, indicating a bearish reversal.As such, gold […]

New Dimension Provides Update on Scandinavian Gold and Copper Projects

TSX-V: NDR

VANCOUVER, BC, Oct. 28, 2020 /PRNewswire/ – New Dimension Resources Ltd. (TSXV: NDR) (the "Company", New Dimension" or "NDR") is pleased to report that it has successfully completed its on-site due diligence on the Løkken and Kjøli base metal projects in Norway and the Southern Gold Line project in Sweden (collectively, the "Scandinavian Projects"). The Company holds the right to acquire 100% interests in the Scandinavian Projects pursuant to an option and purchase agreement with EMX Royalty Corporation (NYSE American: EMX; TSXV: EMX)(Figure 1) (refer to the Company’s press release dated August 11, 2020). The Company is also pleased to report that field crews have been mobilized to all three projects with the objective of advancing priority targets to drilling.

Project Highlights New Dimension has successfully completed on-site due diligence on the district-scale land holdings optioned from EMX around the past-producing Løkken and Kjøli copper-zinc(-silver-gold) deposits in […]

Gold Price Forecast – Gold Markets Break Down

Gold markets have been greatly influenced by the US dollar during the trading session on Wednesday, as the market has seen quite a bit of selling. The market has broken down towards the $1875 level by the time the Americans came on board, and quite frankly that is not a huge surprise considering all of the damage being done to global economies via the coronavirus. Furthermore, it is now reported that France is likely to lock the economy back down, perhaps even Germany will follow. That being said, the market is likely to see that the economic conditions are going to get worse before they get better, so it could continue to filter into the idea of a stronger greenback. That will continue to put negativity into the gold market. Gold Price Predictions Video 29.10.20

Having said that, the reality is that eventually central bank printing of currency will […]

A new gold standard is coming, brace for ‘monetary reset’ – Jan Nieuwenhuijs

Excessive monetary stimulus, a by-product of an “undisciplined” fiat money system, will create problems for our economy as well as financial distortions, and the long-term solution is a monetary “reset,” whereby economies move away from this system and re-adopt a gold standard, said Jan Nieuwenhuijs, gold analyst at The Gold Observer.

“There are a lot of financial bubbles, there are excessive debt levels, inequality is rising, you’ve got moral hazards, all these side effects of a fiat money standard are not really what we want, and eventually we get a lot of monetary instability and I think then at that point we have to get back to a gold standard,” Nieuwenhuijs told Kitco News.

The transition from the current fiat monetary system to a gold standard has to first address the debt overhang in our economy, Nieuwenhuijs said.

“The main problem we have in the economy right now is the massive debt […]

Go For Gold With Kirkland Lake Gold

Summary

Kirkland Lake Gold is the most well-run mining company on the market.

Conditions are favorable for gold which translates into growth for this miner.

We estimate that the company is trading below intrinsic value based on current market conditions. Investment Thesis When investing in gold miners, it’s more likely that they will burn a hole in your account than be the next big thing. Generally, we are not too fond of companies that are correlated to the price of commodities. However, Kirkland Lake Gold Ltd. ( KL ) is one of the few exceptions in the industry. We believe that its proven track record of operating efficiently combined with a favorable environment for gold will act as tailwinds for the stock price. What We Like About Kirkland Kirkland is the most well-run mining company on the market. This has been reflected in the company’s stock price in the last 5 years. […]

Gold price sheds $40 on COVID restrictions, contested election worries

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) A combination of election and coronavirus jitters is boosting the U.S. dollar and dragging gold down along with equities, according to analysts.

"We are seeing an uptick in coronavirus cases, stocks are down, and the U.S. dollar is up. The markets were anticipating a stimulus deal, but there’s no stimulus coming between now and the election," RJO Futures senior commodities broker Bob Haberkorn told Kitco News on Wednesday.

The pressure on gold saw the precious metal lose $40 on Wednesday morning. Since then, December Comex gold futures began to somewhat recover, last trading at $1,880.50, down 1.64% on the day.

More volatility is the most likely scenario as the U.S. election approaches, analysts told Kitco News."Without a doubt, this is […]

These Gold Mining Stocks Are Getting Crushed Today

What happened

In a brutal day for most stocks, gold and precious metals mining stocks are getting hit particularly hard. The following group of precious metals miners in particular are seeing their stocks fall sharply: Stock Name Silvercorp Metals (NYSEMKT: SVM) (11.8%) So what

At this writing, the S&P 500 ( SNPINDEX:^GSPC ) is down more than 3% and every sector of stocks is down. Gold prices are down almost 2%, crude oil prices have plummeted more than 5%, and investors are moving aggressively out of equities and speculative investments today. The likely reason is the spiking cases of COVID-19 in the U.S. and abroad, as we head into the U.S. election next week and elected officials put off any fiscal stimulus until after the election. Image source: Getty Images. Simply put, investors tend to react to fear and greed, and right now fear has its hands solidly on […]

Gold Price Prediction – Prices are Poised to Test the September Lows

Gold prices moved lower as it has become viewed as a riskier asset during the most recent sell-off. The dollar moved higher and benefited from the risk-off trade, as US treasury yields broke down below support near the 50-day moving average. As the spread of COVID-19 makes its way through the US and Europe, riskier assets have been sold. Volatility is also perking up. The GVZ which trades on the COBE and measures the “at the money” implied volatility on Gold, rose 7% to 22%.

Trade gold with FXTM Technical analysis

Gold prices moved lower but remain rangebound. Prices are poised to test support is seen near the October lows at 1,872. Resistance is seen near the 10-day moving average at 1,904. Short-term momentum has whipsawed turning negative as the fast stochastic generated a crossover sell signal on the upper end of the neutral range. Medium-term momentum has turned negative […]

Golden Star Resources Reports Results for the Three and Nine Months Ended September 30, 2020

Operational Delivery Continues as Prestea Sale Unlocks Investment Capacity

TORONTO, Oct. 28, 2020 /PRNewswire/ – Golden Star Resources Ltd. (NYSE American: GSS) (TSX: GSC) (GSE: GSR) ("Golden Star" or the "Company") reports its financial and operational results for the third quarter ended September 30, 2020. All references herein to "$" are to United States dollars.

Q3 2020 AND YEAR TO DATE HIGHLIGHTS: On September 30, 2020 the Company completed the previously announced sale of the Bogoso-Prestea gold mine to Future Global Resources ("FGR"). As a result Prestea performance is now reported as a discontinued operation.

The Bogoso-Prestea disposal removed $24m of negative working capital and the $53m rehabilitation provision from the Company’s balance sheet, transitioning the group to a positive net asset position. Q3 2020 production totaled 41.6 thousand ounces ("koz") from continuing operations (Wassa). The underground mining rate was successfully increased to a record quarterly average […]

Alamos Gold Reports Third Quarter 2020 Results

Record free cash flow of $76 million support s 33% increase in dividend

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Oct. 28, 2020 (GLOBE NEWSWIRE) — Alamos Gold Inc. ( TSX:AGI ; NYSE:AGI) (“Alamos” or the “Company”) today reported its financial results for the quarter ended September 30, 2020.

“We had an excellent third quarter financially and operationally with strong performances at all three operations driving costs significantly lower. This included another record quarter at Island Gold, and Young-Davidson starting to demonstrate its full potential following the completion of the lower mine expansion. We previously outlined our expectation to transition to strong free cash flow generation in the second half of 2020, and we delivered with record free cash flow of $76 million in the quarter,” said John A. McCluskey, President and Chief Executive Officer.“We remain focused on operating a sustainable business model that can support growing […]

Click here to view original web page at www.globenewswire.com

Miner Agnico beats quarterly profit on gold price surge, raises capex

(Reuters) – Canada’s Agnico Eagle Mines AEM.TO reported a better-than-expected quarterly profit on Wednesday, benefiting from a surge in gold prices and sales volume, and raised its capex forecast for the year as it spends on several sites to boost production.

Agnico now expects total capital expenditure for the year to range between $720 million and $740 million, higher than earlier forecast of $690 million, as it develops its Kittila mine in northern Finland, its first to open outside of Canada.

The increased capital spending also includes development cost for its Amaruq underground project and Meliadine mine in Canada.

Massive stimulus packages to aid economies reeling from coronavirus-driven woes and a low interest rate environment have helped drive about 25% increase in prices of gold this year as the metal is seen as an inflation hedge.Agnico said average realized price for gold jumped about 29% to $1,911 per ounce in the reported […]

Gold Selloff to Accelerate With Less Than a Week Until Election Day?

2020 Election, Gold Price Analysis, 2020 Polls, Biden-Trump Spread – Talking Points

6 DAYS UNTIL THE US PRESIDENTIAL ELECTION

It is less than a week to go until the US presidential election. Market volatility has been picking up, but that appears to be less the function of politically-related factors and more the jump in Covid-19 cases; more on that later. For now, betting odds and polling data from various agencies have Democratic nominee Joe Biden in the lead while incumbent President Donald Trump lags behind. Having said that, investors should be careful not to get too comfortable with polling data after the 2016 election resulted in the unexpected victory of Mr. Trump. Mail-in votes have primarily come from Democrats, who as a group are more likely to cast the ballot this way than their Republican counterparts. This statistical phenomenon came from the findings of a poll conducted by NBCLX/YouGov […]

Vista Gold Corp. Reports Third Quarter 2020 Cash plus Short-Term Investments of $10.2 Million and Provides an Update on Mt Todd

DENVER, Oct. 28, 2020 (GLOBE NEWSWIRE) — Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today reported its unaudited financial results for the quarter ended September 30, 2020 and provided an update on the Company’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) located in the Tier 1 mining jurisdiction of Northern Territory, Australia. Vista’s third quarter net income was $4.2 million or $0.05 per share, and cash plus short-term investments totaled $10.2 million.

Frederick H. Earnest, President and Chief Executive Officer of Vista, stated, “We are extremely pleased with our third quarter financial results. We believe our strong balance sheet provides a solid foundation as we continue to methodically advance and de-risk the world-class Mt Todd gold project and seek a strategic partner.”

With respect to exploration activities at Mt Todd, Mr. Earnest continued, “We believe that the higher-grade core zone of the […]

Click here to view original web page at www.globenewswire.com

Yamana Gold Provides an Update on Exploration Activities at Canadian Malartic; Announces Positive Drill Results From East Gouldie

Canadian Malartic Location Map. Canadian Malartic long section looking north, highlighting 2020 drilling results for the East Gouldie zone. Drilling intercepts presented include those greater than 25.0 gram*metres (Gold g/t (uncapped) multiplied by estimated true width in metres). Download a PDF of detailed drill hole results for Canadian Malartic

TORONTO, Oct. 28, 2020 (GLOBE NEWSWIRE) — YAMANA GOLD INC. (TSX:YRI; NYSE:AUY; LSE:AUY) (“Yamana” or “the Company”) provides an exploration update for the Canadian Malartic mine, announcing exceptional drill results that provide further support for the development of a future underground operation at the East Gouldie, Odyssey, and East Malartic zones with significant additional mineral resources and extended life of mine.

HIGHLIGHTS An ongoing C$24 million drill program has added 44 new pierce points this year within the mineral envelope at East Gouldie, providing data for a rapidly growing mineral resource model with spacing between pierce points of 150 metres […]

Click here to view original web page at www.globenewswire.com

B2Gold (BTG) Aims to Produce 1,055,000 Ounces of Gold in 2020

B2Gold Corp ’s BTG total gold production in the first nine months of the year was a record 738,939 ounces from all of its operating mines, 4% above the budget, reflecting year-over-year growth of 19%. Backed by the better-than-expected performance of its operating mines, B2Gold expects total consolidated gold production to come in toward the mid-point of its guided range of 1,000,000 and 1,055,000 ounces for the current year. A Sneak Peak at Q3 Output & Revenues

B2Gold recorded consolidated gold production of 248,733 ounces during the September-end quarter, 1% above the budget level, marking a year-over-year increase of 17%. The company witnessed solid performances across its Fekola, Masbate and Otjikoto mine operations in the third quarter, outpacing the respective targeted production for the quarter. The significant increase in gold production was primarily driven by the Fekola Mine in Mali.

Consolidated gold revenues in third-quarter 2020 were a record $487 […]

![How to trade gold during the US election [Video]](https://stockmarket.ezistreet.com/wp-content/uploads/2020/10/stacked-gold-bars-13094022_Large.jpeg)