Agnico-Eagle Gold Mines (TSX:AEM) (NYSE:AEM) is a top gold stock that is firing on all cylinders. This means production growth, cash flow growth, and dividend growth. It also means stock price performance. Agnico-Eagle stock rallied almost 5% yesterday. It has a one-year return of 33% and a three-year return of 82%.

But what are the forces that are driving Agnico-Eagle’s strong growth today? Gold stocks rule in a crisis

In today’s environment, dividend cuts and economic troubles have been the norm. But gold stocks have been one of the exceptions. The price of gold is rapidly closing in on $2,000 per ounce. Prices have surpassed 2011 peak levels and appear to be headed higher. This is predicted by increasing global economic troubles, a falling U.S. dollar, and gold’s place as a safe haven.

In this pandemic crisis, one thing investors can count on is gold as a safe haven. You see, […]

Massive gold news! Investors rush to Gold ETFs, big amounts invested

Gold exchange-traded funds (ETFs) saw staggering net inflows of over Rs 2,400 crore in the three months ended September 30, as investors continued to hedge their exposure to riskier assets due to higher economic uncertainty resulting from COVID-19.

In comparison, investors had infused Rs 172 crore in this asset class in July-September 2019, according to the data available with the Association of Mutual Funds in India (Amfi).

The category has been among the better-performing ones so far this year and received a net inflow of Rs 5,957 crore.

As per the data, a net sum of Rs 2,426 crore was pumped into gold-linked ETFs in three months ended September 30, 2020.Divam Sharma, co-founder at Green Portfolio, said returns generated by gold ETF’s over the last one year have increased number of investors buying the asset."Gold investment picked up due to higher economic uncertainty resulting from COVID-19," said Harsh Jain, co-founder of Groww.Investors […]

Gold Price Analysis: XAU/USD bounces-back towards $1910 amid growing coronavirus woes

Gold attempts bids amid coronavirus woes-led risk-aversion.

US dollar’s haven demand returns, likely to cap gold’s upside.

Focus on virus updates and sentiment on global markets.

Gold (XAU/USD) has bounced-off daily lows near $1902, as the bulls fight back control amid a sell-off in the US Treasury yields, triggered by the coronavirus concerns-induced risk-aversion.The benchmark US 10-year Treasury yields drop further below the key 0.80% level, now trading at 0.768%, down 1.40% on a daily basis. The pessimism surrounding the American fiscal stimulus, election uncertainty and dwindling economic recovery weigh negative on the higher-yielding US rates and benefit the non-yielding gold.However, the further upside could remain elusive in the spot, as haven demand for the US dollar has returned in the overnight trades, with investors seeking safety in the buck ahead of next week’s US Presidential election.In the day ahead, the focus will remain on the […]

Barrick Gold (GOLD) Earnings Expected to Grow: What to Know Ahead of Next Week’s Release

The market expects Barrick Gold (GOLD) to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended September 2020. This widely-known consensus outlook is important in assessing the company’s earnings picture, but a powerful factor that might influence its near-term stock price is how the actual results compare to these estimates.

The stock might move higher if these key numbers top expectations in the upcoming earnings report, which is expected to be released on November 5. On the other hand, if they miss, the stock may move lower.

While the sustainability of the immediate price change and future earnings expectations will mostly depend on management’s discussion of business conditions on the earnings call, it’s worth handicapping the probability of a positive EPS surprise.

Zacks Consensus Estimate This gold and copper mining company is expected to post quarterly earnings of $0.32 per share in its […]

Koenigsegg Regera And Agera RS With Blue Carbon Finish, Gold Accents Meet

In 2016, Koenigsegg showcased its first production Agera RS for its European customer. Named the Agera RS Naraya, the owner specced the supercar with a high-level of customization, including a blue-tinted clear-carbon finish, with 18-karat gold leaf highlights on both the exterior and interior of the car.

This year, one of the 80 Regera units was delivered to a YouTuber named Zach Lewis – a one-of-a-kind Koenigsegg Regera that’s supposedly inspired by the Agera RS Naraya. Lewis took three years waiting for the custom Regera, which also came with exposed carbon in a blue hue and lined with 24-karat gold. And, for the first time as caught in the video embedded on top, these two special supercars meet. Priced at around $5-million each, this union counts as one of the most expensive and most exotic two-car meetups we’ve seen so far, with power outputs reaching almost 3,000 horsepower.

As seen in […]

Green pot of gold at bottom of the barrel

Alberta is setting its sights on non-transportation markets for oil-sands bitumen that could drive a vast increase in the value of production by 2035 – assuming that major technological hurdles can be overcome.

Alberta Innovates – a Crown agency – says the biggest opportunity lies in the production of carbon fibre, a high-strength material that can be used in wind turbines, automotive applications and the aerospace industry. The agency has launched a $15-million “Grand Challenge” in which 20 laboratories around the world are participating in research to commercialize the production of carbon fibre from the heavy asphaltenes contained in bitumen, in the so-called bottom of the barrel.

“We are finding new ways to use bitumen not as transportation fuel but as value-added non-combustion materials that are worth more than transportation fuel but with a low GHG emissions – products like carbon fibre,” said John Zhou, vice-president of clean resources at Alberta […]

Click here to view original web page at www.corporateknights.com

Dollar and not gold is a safe haven as US Presidential elections approach

A Joe Biden win matched by further gains for the Democrats in Senate elections should help gold recover lost ground. For now, it is staring at a third straight monthly drop. Also in this package

New York: Gold headed for a third monthly drop – the longest run since 2019 – as investors favored the dollar as a haven in the final days before next week’s pivotal US presidential election, a contest that coincides with a wave of coronavirus cases ripping through the top economy and Europe.

Uncertainty remains high before the November 3 vote, lifting the dollar’s appeal as a safe asset over bullion. The spread of COVID-19 is intensifying in the US, where new cases topped 86,000 to set a fresh daily record, as well as right across Europe’s leading nations.

Since hitting a record in August, gold’s advance has faltered, with prices losing their upward momentum as investors […]

Gold to continue rally regardless of US election outcome – analysts

Gold prices could perform well regardless of who wins the US Presidential election, says research and data company Standard & Poor’s Global Market Intelligence (S&P GMI) and analysts it has consulted with, pointing to low interest-rate policy and potential pandemic-related stimulus.

“While there are many arguments over who will be the next US President, one thing most analysts appear to agree on is that the price of gold will be higher no matter who is in office,” said investment firm Haywood Securities analysts in an October 23 research note. Gold has been on the rise this year, reaching record levels and catching widespread attention as it rallied to a record-breaking $2 000/oz earlier this year. Though the gold price has since pulled back to around $1 900/oz, it has remained at historically high levels amid low to negative interest rates and economic uncertainty related to the ongoing Covid-19 pandemic.

Making a […]

Click here to view original web page at www.miningweekly.com

Australia Is Set To See Another Major Gold Rush

LONDON, Oct. 30, 2020 On a nearly 1,000-square-kilometer property in New South Wales, a team of top geologists is in the midst of an exploration project. The project’s goal is to identify and exploit unmined potential gold resources on properties that may contain hundreds of thousands of ounces of gold. The starting point for this gold exploration is the 198 historic gold mines and showings on the property, many of them high-grade, dating from the 1880’s to the 2000’s. Mentioned in today’s commentary includes: Corvus Gold Inc (NASDAQ: KOR ), Freeport-McMoRan (NYSE: FCX ), Gold Fields (NYSE: GFI ), Compania de Minas Buenaventura (NYSE: BVN ), Harmony Gold (NYSE: HMY ).

All 198 of these abandoned gold mines and showings are on 8 NSW concessions, recently acquired by junior Canadian mining company Sentinel Resources Corp (SNL; SNLRF), on 945 square kilometers of land.

Most of these historical mines, all predating the […]

Price gains for gold, silver as safe-haven bids return

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are moderately higher in early U.S. trading Friday, as some safe-haven demand has finally surfaced just days before the U.S. presidential elections. Much of this week the precious metals had been hit by a stronger U.S. dollar index . December gold futures were last up $11.60 at $1,879.60 and December Comex silver was last up $0.335 at $23.695 an ounce.

Global stock markets were mostly down overnight. U.S. stock indexes are set to open the New York day session solidly lower. It’s a risk-off trading day Friday, on this last trading day of the week and of the month. Some mostly as-expected but still uninspiring high-technology stocks’ earnings […]

EUR/USD, AUD/USD, Gold – Charts for Next Week

Charts for Next Week:

EUR /USD was holding up ok not long ago after breaking down in September, but the recent channel was snapped, and with it another wave of selling looks to be underway.A breakdown below 11612, a lower low from last month, will have in play the support zone from just under 11500 to around 11375. The 200-day is rising up not too far below there, currently at 11313. Also a possible form of support on further weakness could be the lower parallel tied to the trend-line of the August high; this line clocks in around the 11500-mark, or the March spike-high. While a big down-move may not develop, it does appear we will see more selling in the sessions ahead to at least the aforementioned levels. To flip the script towards a long bias we will need to see some work done before gaining any clarity […]

Sell rallies in gold, silver and platinum

Platinum has now joined gold and silver in breaking its major support levels. Much lower prices are coming; however, bottom pickers will attempt to buy and rallies will start to show after the recent selling pressure. When they do, they are opportunities to sell.

Metals are in a significant downtrend; in other words, the path of least resistance is lower. As traders, the best side of the market to be on is the one with the easiest path. Until proven otherwise, the move is down. This is where many make mistakes by exiting too early, trying to predict, or trying to guess the bottoms.

There is no doubt that gold, silver and platinum will go higher at some point. However, for now, everything suggests that they continue down. We remain short and will not cover until the markets show us that the current pattern has changed.

Futures and Commodities with Andy […]

Gold price holding steady gains below $1,900 following muted U.S. PCE inflation data

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold prices remain under $1,900 an ounce but holding on to some gains as inflation pressures rise in line with expectations.

Friday, the Department of Commerce said that its Core Personal Consumption Expenditures Index, increased 0.2% in September, up from August’s 0.3% increase; the data was in line with economists’ consensus forecasts.

For the year, inflation is up 1.5%; however the rise was slightly weaker than expected.The gold market is not seeing much reaction to the latest consumer inflation data. December gold futures last traded at $1,881.80, up 0.74% on the day.While inflation remains fairly muted, the report noted that consumers saw their income rise after significant drop in August. The report said that […]

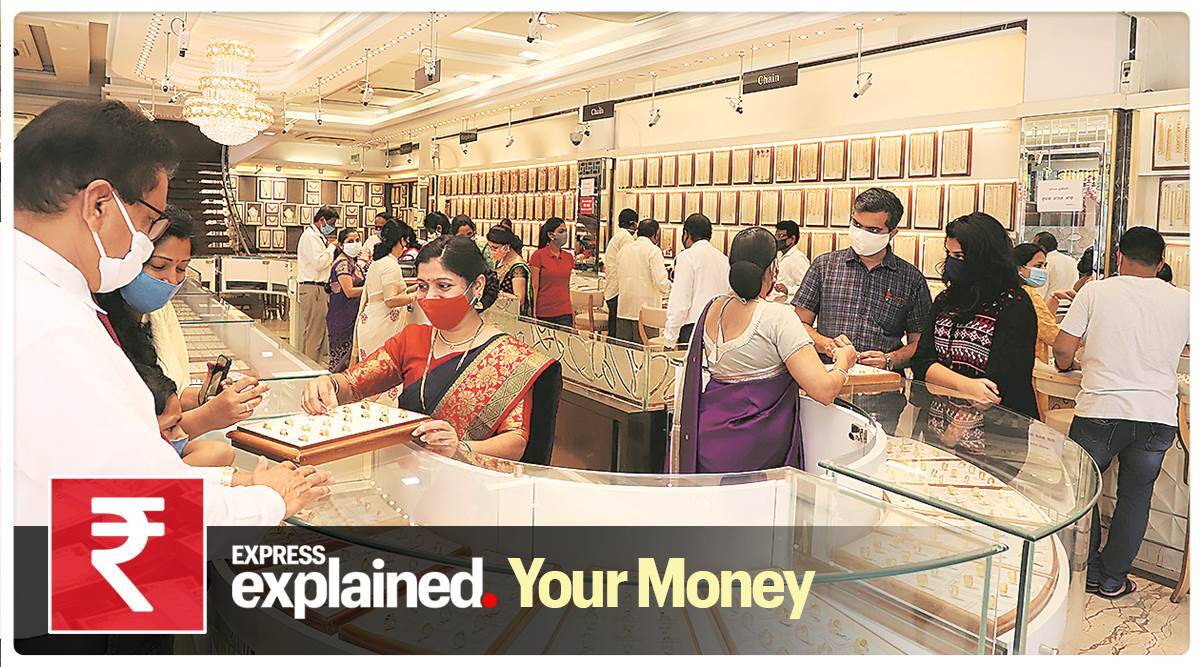

Indian jewellers gear up for next festival as gold sales pick pace

BENGALURU/MUMBAI (Reuters) – Healthy sales during a recent festival encouraged Indian jewellers to continue stocking up this week, while more supply started to make its way into Singapore and Hong Kong as dealers navigate around COVID-19-led bottlenecks. A salesman shows a gold necklace to customers at a jewellery showroom in Ahmedabad, Oct. 25, 2019. REUTERS/Amit Dave Indians celebrated the Dussehra festival on Sunday, and now await Diwali and Dhanteras in November.

“Dussehra sales gave confidence to jewellers. They’re now buying for Diwali,” said a Mumbai-based dealer with a bullion importing bank.

Premiums of $1 an ounce were charged over official domestic prices, including 12.5% import and 3% sales levies, from $5 premiums last week. Local gold futures were trading around 50,500 rupees ($682.96) per 10 grams.

“Retail consumers are slowly adjusting to higher prices,” said Aditya Pethe, director at Waman Hari Pethe Jewellers.In Singapore, premiums of $0.80-$1.30 an ounce were charged over […]

$1 PER WEEK FOR THE FIRST 12 WEEKS

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

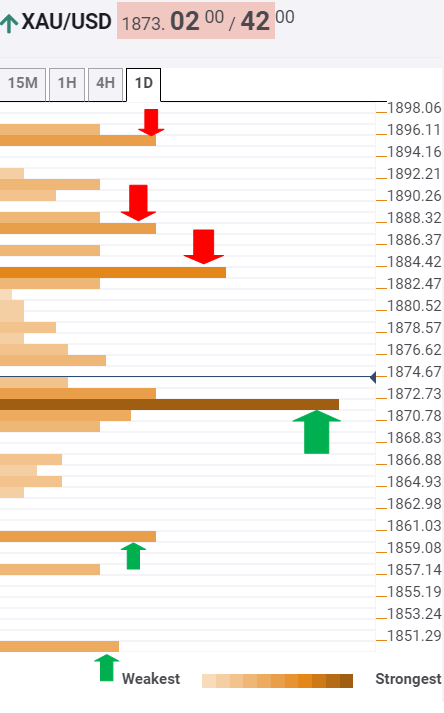

Gold Price Analysis: XAU/USD still eyes $1849 amid covid, election jitters – Confluence Detector

Growing fears over the second-wave of the coronavirus globally combined with pre-US election jitters will continue to underpin the haven demand for the US dollar, keeping the bearish bias intact in gold (XAU/USD) going forward.

Gold is set to test the September low of $1849, having breached the critical 100-DMA earlier this week. US fiscal stimulus package remains elusive and offsets the optimism over the record US Q3 GDP rebound, as all eyes shift towards next week’s Presidential election.

See Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

How is gold positioned on the charts? Gold: Key resistances and supports The Technical Confluences Indicator shows that the yellow metal has managed to recapture powerful resistance at $1872, which is the confluence of the SMA5 four-hour and Fibonacci 161.8% one-week.The next relevant upside barrier awaits at $1883, where the Fibonacci 23.6% one-month lies.Further up, the […]

SNB: Valuation Gain on Gold Price Surge

The Swiss central bank posted a more than handsome profit for the first three quarters of the year, largely thanks to a surge in the valuation of its gold reserves.

The Swiss National Bank (SNB) recorded a profit of 15.1 billion Swiss francs ($16.5 billion) for the nine months through September, according to a statement released on Friday. The main driver of the profit, which was less than a third of what the bank generated in the same period of 2019 ($51.5 billion), was the price of gold.

A kilogram of gold was worth 55,989 francs at the end of the reporting period, up from 47,222 francs at the end of 2019. The valuation gain amounted to 9.1 billion francs.

Exchange Rate-Related Losses Foreign currency positions added a further 5.3 billion francs, with interest and dividend income amounting to 6.1 billion and 2.6 billion francs respectively. Interest-bearing paper and […]

Should you buy gold this Diwali?

Unless gold is being bought for jewellery consumption, the nvestment should be through sovereign gold bonds, experts advise. (Express Photo: Pavan Khengre) On Wednesday, the number of new Covid-19 cases around the world crossed 5 lakh in a day for the first time. The fresh spike in cases and deaths and growing uncertainty about controlling Covid-19 has not only brought equities back under pressure but also reinforced the case for investment in gold. If hopes of a vaccine have now spilled over to the second half of 2021, there is also anxiety over the time it may take to vaccinate the entire world population. While this is ample cause to worry investors, low interest rates and high inflation are other factors that would keep gold prices firm until a vaccine is in sight.

With the Diwali festive season round the corner, many feel the high prices should not come in […]

Cofounder of True Religion, Kym Gold, Brings Fashion Home with the Launch of Style Union Home

LOS ANGELES, Oct. 30, 2020 /PRNewswire/ — After selling her denim empire for $835M, style icon Kym Gold is bringing her disheveled sexy aesthetic to the home with the launch of a luxury line of entertaining, décor and petware called Style Union Home. The line of ceramics, lovingly designed and fancifully named by Gold herself, is handmade in Los Angeles. During a time in which our homes are so much more than just a home, Style Union Home launches in Q4 at StyleUnionHome.com and is soon to roll out in independent luxury retailers and e-tailers nationally.

Continue Reading

Kym Gold Style Union Home is the birth of yet another iconic style statement by Gold, whose headline contribution to the fashion world includes True Religion, the iconic thick white thread-stitched, tab-pocketed designer jeans with the immediately recognizable jolly Buddha logo. Since True Religion, Gold has been flipping homes. For […]

Daily Gold News: Thursday, October 29 – Gold Broke Below $1,900

The gold futures contract lost 1.71% on Wednesday, as it broke below $1,900 price level. It has also broken below its multi-week consolidation. In September the market was retracing a rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar advance. Then gold has bounced from the support level marked by mid-August local low of around $1,875, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is unchanged this morning, as it is trading along yesterday’s daily close. What about the other precious metals? Silver lost 4.93% on Wednesday and today it is 0.4% lower. Platinum lost 1.33% and today it is 0.8% lower. Palladium lost 4.39% yesterday and today it is 1.0% lower. So precious metals’ prices are mixed this morning .

Yesterday’s Wholesale Inventories release has been slightly lower than expected at -0.1%. Today we […]

Gold Price News and Forecast: XAU/USD attempting to bounce up from one-month lows at $1860

Gold Price Analysis: XAU/USD stays depressed around five-week bottom above $1,850

Gold prices drop to $1, 866.36 amid the initial Asian session trading on Friday. The bullion dropped to the fresh low since September 28 on Thursday as the King dollar benefited from the upbeat US data and risk-off mood. However, a lack of major catalysts after the US session pushed the metal traders to look for extra hints before stretching the two-day downtrend towards challenging the monthly low of $1,860.

Read more … Gold Price Analysis: XAU/USD attempting to bounce up from one-month lows at $1860

Gold futures are attempting to bounce up after having depreciated more than 2% over the last two days. The yellow metal has picked up after hitting one-month lows at $1,860 although the upside moves are finding sellers at the $1,875 region.XAU/USD’s bearish reversal from mid-October highs above $1,930 accelerated on […]

Gold Stocks’ Bullish Decline

I previously wrote that practically nothing happened on the gold market , which is bearish since gold should be rallying or trading at higher levels, given the pre-election uncertainty. However, gold didn’t wait for the elections to begin with its decline – it plunged yesterday, taking silver and mining stocks along with it.

To be more precise, it was the mining stocks sector that brought down the rest. Miners moved and closed the day below their previous September and October lows, and therefore anyone who joined us recently is now gaining profits.

But, is every factor truly bearish for the miners? It is not the case!

Miners have been undermining gold, which is bearish, and they have also broken below the recent lows, which is also bearish. Moreover, miners have just declined on strong volume after opening the day with a price gap, which at first sight, is bearish.The theory is that […]

Gold, silver and platinum breaking down again

We witnessed a panic sell-off on equities, grains, and Metals Wednesday. Gold and silver broke hard, violating and closing below significant support. Our new targets are no longer in play and all rallies are meant to be sold. Platinum has been weak but has not violated the critical support level yet.

The selling should continue; there will be sharp rallies, which will be an opportunity to sell more. Based on the current price action, we could see gold and silver could accelerate through our next targets: $1,850 December Gold and $23.00 December Silver. January Platinum remains in a range between $860 and $900.

Many will be trying to bottom pick these markets, which is a fool’s game. Until the trend changes, there is no reason to be long the metals as a trader. Remember, investors should not worry day to day and understand that the selling will eventually end, and the […]

Gold bulls can’t escape grip of rallying USDX

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold futures prices are lower in midday U.S. trading Thursday. The precious metals have been hit by a stronger U.S. dollar index this week, and now the slumping crude oil market is also working against the metals market bulls, as well as most of the raw commodity sector. December gold futures were last down $9.00 at $1,870.20 and December Comex silver was last up $0.126 at $23.49 an ounce.

There was important U.S. economic data due for release Thursday morning, including the weekly jobless claims report that was a big more upbeat as expected, and the advance third-quarter GDP estimate that was up a record 33.1% from the second quarter.

Global stock markets were […]

Gold price to climb regardless of election result, analysts say

Image courtesy of the Federal Reserve Bank of Atlanta. Gold has been on the rise in 2020, catching widespread attention as it rallied to a record-breaking $2,000 per ounce earlier this year.

Though its price has since pulled back to around $1,900, it has remained at historically high levels amid low to negative interest rates and economic uncertainty related to the ongoing covid-19 pandemic, the analysts wrote in a note.

Making a bull case, Haywood analysts pointed to a “fragile” US economy and ongoing central bank “money printing” to lift expectations for inflation and put pressure on the US dollar. With that in mind, they suggested investors buy dips in both gold and silver equities.

Analysts at UBS took a similar view in a recent note outlining their thoughts on factors supporting gold and how it may trade into 2021. One clear driver has been investment demand, UBS analysts said, with cash […]