Gold (XAU/USD) wavers in a familiar range on the US election day this Tuesday, as a sense of caution sets amid a tighter presidential race in key six swing states. The US dollar remains on the back foot amid the upbeat market mood, fuelled by the stronger-than-expected US and Chinese Manufacturing PMIs.

The bull-bear tug-of-war could likely extend, as investors will refrain from placing any directional bets on gold ahead of the election outcome. A ‘blue sweep’ is the only thing the gold buyers could ask for. In the meantime, the risk of a contested election keeps the upside in check. Let’s take a look at the key technical levels in the run-up to the election showdown. Gold: Key resistances and supports

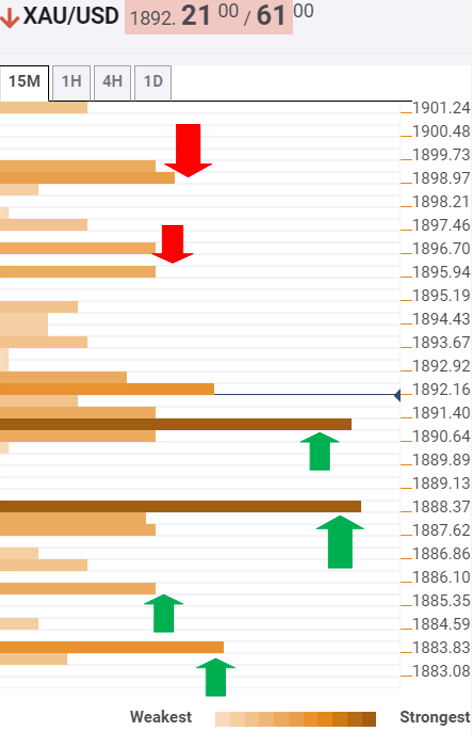

The Technical Confluences Indicator shows that the yellow metal is likely to face an uphill battle to take on the upside, with the immediate barrier seen around $1896, […]

Gold dips as investors await U.S. election outcome

A mark of 999.9 fine sits on hallmarked one kilogram gold bullion bars at the Valcambi SA precious metal refinery in Lugano, Switzerland, on April 24, 2018.

Stefan Wermuth | Bloomberg | Getty Images

Gold prices edged down on Tuesday, as cautious investors awaited the outcome of the U.S. presidential election with President Donald Trump closely trailing Democrat Joe Biden in national opinion polls.

Spot gold fell 0.1% to $1,892.73 per ounce by 0533 GMT.U.S. gold futures were little changed at $1,893.20 per ounce.“Sentiment is hanging by a thread at the moment … Everybody is quite unsure where the election is headed to, given the number of possible outcomes,” said Howie Lee, economist at OCBC Bank.As long as there isn’t a Democrat sweep, there will be questions on fiscal stimulus, while an uncertain or contested result will likely favor the dollar and weaken gold, he added.Election polls show Biden with an […]

Gold to race higher towards $2300 in the long-term – Credit Suisse

Strategists at Credit Suisse remain long-term gold bulls and a potential bullish “wedge” continuation pattern looks to be forming to add weight to this view. Key quotes

“Gold extends its consolidation from our $2075 target hit in August and we maintain our core view this is a temporary and corrective pause in the broader uptrend. Indeed, price action is beginning to increasingly look like a bullish ‘wedge’ continuation pattern, adding weight to our view.”

“Key support stays seen intact at $1837 – the 38.2% retracement of the 2020 rally – and our bias remains for this to continue to hold. Above $1933 would now suggest the “wedge” has been completed for strength back to $2016, then the $2075 high.”

“Big picture, we continue to look for $2300.”“Below $1837 would curtail thoughts of a “wedge” and would suggest we should see a deeper setback to price and 200-day average support at $1775/65.”Information […]

Gold traders set their bets, U.S election in play

Gold prices were fast approaching the 1,900/ounce, amid global investors and gold traders setting their bets out on the outcome of the U.S. election and other prevailing macros, like the rising COVID-19 caseloads disrupting financial markets. What we know

At about 7.05 GMT, Gold futures traded at around $1,891/ounce as the weaker dollar helped move prices upward.

With an important political event coming to play, gold traders and global investors flock to gold, in taking advantage of the myriad uncertainties that can occur, on the basis that the race looks like a tough call by independent political strategists. What this means

Should the result bring a blue party presidency, the bias is that gold bulls would have enough gas to reach at least $2,000/ounce, on the bias that a substantial COVID-19 stimulus program would weaken the dollar and boost the precious metal value. What they are saying […]

Gold And The U.S. Election: Here’s What To Look For

Jeffrey Gundlach, founder and CEO of hedge fund DoubleLine, told a U.S. pre-election webcast on Monday that gold remains an ideal hedge for inflation, is a “good holding for tail risk ahead” and “will go up very substantially over time.”

What he did not say was for how long a timeframe.

The uncertainty over the outcome to Vote 2020—shaped by polls shifting by the hour and President Donald Trump’s apparent urge to legally challenge every unfavorable outcome—has made gold a tricky bet.

In Tuesday’s early Asian trade, U.S. gold futures for December delivery hovered at $1,893, up 50 cents, or nearly 0.3%—extending Monday’s gain of 0.7%. December gold came within striking distance of $1,900 in the previous session—a level gold bugs had been trying to return to since Oct. 29. Gold 60 Mins As everyone and their grandmother probably knows, gold is a hedge against both political troubles and fiscal expansion.But the […]

Sprott Physical Gold and Silver Trust Expands Its “At-the-Market” Equity Program

TORONTO, Nov. 02, 2020 (GLOBE NEWSWIRE) — Sprott Asset Management LP ("Sprott"), on behalf of the Sprott Physical Gold and Silver Trust (NYSE: CEF) (TSX: CEF) (TSX: CEF.U) (the "Trust"), a closed-ended mutual fund trust created to invest and hold substantially all of its assets in physical gold and silver bullion, today announced that it has established an at-the-market equity program for sales of trust units of the Trust ("Units") in Canada. The existing at-the-market equity program in the United States remains in place.

In connection with the at-the-market equity programs in Canada and the United States (together, the "ATM Program"), Sprott (as the manager of the Trust) and the Trust, entered into an amended and restated sales agreement (the "Sales Agreement") with Cantor Fitzgerald & Co. ("CF&Co"), Virtu Americas LLC ("Virtu" and together with CF&Co, the "U.S. Agents") and Virtu ITG Canada Corp. (the "Canadian Agent" and together with […]

Click here to view original web page at www.globenewswire.com

Are Gold Prices Headed for a Roller Coaster Ride This Week?

Gold investors need to ensure their safety belts are buckled tight this week, especially since the forthcoming election could give them a stomach-churning roller coaster ride of volatility. Other key movers for gold will only add to the dips and dives.

“The first week of November will not only see the most anticipated event of the year — the U.S. election, but also the Federal Reserve interest rate decision and some key datasets, including the U.S. employment figures from October,” a Kitco News article explained.

So what’s the best strategy when it comes to gold? Some market experts advise to refrain from being a seller amid all the market uncertainty.

“People that are holding metals absolutely should not be selling into the election,” said Kitco Metals Global Trading Director Peter Hug. “People not holding the metals and who wish to diversify 10%, I would be of the mindset that you would want […]

Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

Gold prices heavily depend on the fate of fiscal stimulus.

A blue wave could unleash a golden age for the precious metal.

If Trump remains is reelected, the reaction could be mixed.

President Biden with a Republican Senate would cause a meltdown. Gold could power up if the government prints more money – that is the simple logic that has been rocking the precious metal in recent months. XAU/USD soared to new highs as central banks enhanced their bond-buying programs and as authorities used the funds to shore up the economies amid the coronavirus crisis.The Federal Reserve, the European Central Bank , and even European governments did "whatever it takes." The US government also played its part early in the crisis with the CARES Act – but most programs have lapsed. Now, markets and gold bulls want more of what Uncle Sam can give .Democrats […]

Gold: Ready To Rumble

Summary

The upcoming US election is adding uncertainty to an economy already reeling from damage triggered by the coronavirus pandemic.

Unemployment remains high, businesses are closing and layoffs continue.

Debt is increasing around the world as governments print more money to attempt to stimulate their economies.With every piece of currency printed, each dollar is worth less. All of which is bullish for gold, silver and other precious metals. Looking for a portfolio of ideas like this one? Members of Mean Reversion Trading get exclusive access to our model portfolio. Get started today » Fundamentals Gold represents today a major economic indicator in several ways: as a commodity, as a safe haven, and since March as a currency. Gold came down from the $2089 high, which showed that the market was anticipating the damage caused back in March by the pandemic. Therefore, there was a $600 premium per ounce in gold. In […]

Daily Gold News: Gold Gaining Ahead of U.S. Presidential Election

The gold futures contract gained 0.64% on Friday, as it retraced some of its recent declines after bouncing from $1,860 price level. Gold continues to fluctuate following September’s decline off August 7 record high at $2,089.20 to around $1,850. The yellow metal has been bouncing from the support level marked by mid-August local low of around $1,875, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 0.6% higher this morning, as it is extending Friday’s advance. What about the other precious metals? Silver gained 1.22% on Friday and today it is 1.6% higher. Platinum lost 0.13% and today it is 1.2% higher. Palladium gained 0.85% on Friday and today it’s 0.3% lower. So precious metals’ prices are generally higher this morning .

Friday’s Personal Income/ Personal Spending releases have been better than expected at +0.9%/ +1.4%. The Chicago PMI and Consumer Sentiment […]

Gold Price Forecast – Gold Markets Grind Higher

Gold markets have rallied a bit to kick off the week on Monday, reaching towards the $1890 level rather early. That makes quite a bit of sense, considering that the week is fraught with all kinds of headline risks. The most obvious one of course is the US election, but quite frankly we have the RBA kicking things off late Monday night, early morning in Asia. After that, we have the elections, and then of course we have the Federal Reserve and jobs numbers later in the week. In other words, I expect a lot of volatility and high potential for trouble. In that scenario, gold makes quite a bit of sense. Gold Price Predictions Video 03.11.20

That being said, we could also see the US dollar drive down the value of gold, but that will more than likely be more or less a short-term phenomenon. I do believe […]

Exposed: Vile crimes of Gold Coast adult sex offenders

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend […]

Click here to view original web page at www.couriermail.com.au

Gold will resume its 2020 rally once US election noise dies down – Royal Bank of Canada

Traders will be looking to “stimulus legislation, inflationary prices [and] large debts, so gold can resume the upward trend towards $2,000,” said George Gero, managing director at RBC Wealth Management, as quoted by MarketWatch.

The precious metal was trading at $1,887 per ounce on Monday, well below the $2,075 level reached in August. Analysts pointed to a stronger US dollar, lower equities and options expiration as the main reasons for the drop.

READ MORE: UBS ‘very bullish’ on gold as bank expects bullion price to surge higher

Gold rallied from $1,450 to a record high of $2,075 in the 4.5-months to August 7. Analysts project that, once the election noise passes, it could be one of the biggest asset winners. Some forecasts vary from $2,100 to $2,500 by early 2021. For more stories on economy & finance visit RT’s business section

Gold demand plunges to 11-year low – World Gold Council

Demand for gold slipped by 10 percent from the beginning of the year and plunged to 892.3 tons in the period July-September, according to the WGC data. This is the lowest quarterly total since 2009, the report states, explaining the decline by the impact of the Covid-19 outbreak on investors and consumers.

Meanwhile, central banks have started to tap their gold stockpiles as governments are trying to offset the impact of the virus. Net sales, primarily driven by Uzbekistan and Turkey, amounted to 12 tons over the third quarter, marking the first such move since 2010, according to the WGC. The banks are still expected to resume gold buying before the end of the year, but at a slower pace than in 2018 and 2019. US dollar will continue to lose against ‘real money, which is gold’ – Peter Schiff “Uncertainty has been elevated by the pandemic, motivating many investors […]

India’s gold demand fell 30%, but ‘cautious optimism’ may be returning

An employee arranges one kilogram gold bars for a photograph in Bangkok, Thailand, on January 13, 2016.

Dario Pignatelli | Bloomberg | Getty Images

SINGAPORE — Gold demand in India fell 30% in the previous quarter, but a sense of “cautious optimism” has returned to the market, according to the World Gold Council.

India is one of the largest markets for gold.Jewelry demand in India between July to September fell 48% year-on-year to 52.8 tonnes from around 101.6 tonnes a year earlier, the organization said in a report. But demand for gold as an investment rose 52% to 33.8 tonnes on-year.Overall gold demand — which includes jewelry and investment — fell in the quarter ending September, but the decline was less severe than the 70% drop seen in the previous three months, Somasundaram PR, managing director for India at the World Gold Council, said in a statement.“This has been partially due to […]

Price of Gold Fundamental Daily Forecast – Early Strength Suggests Bets are on Biden

Gold futures are trading higher on Monday as investors react to a weaker U.S. Dollar and a rise in demand for higher risk assets. We’re not going to try to read into the move, but we suspect it’s tied to position-squaring ahead of Tuesday U.S. presidential elections since there were no major events over the weekend.

At 12:30 GMT, December Comex gold is trading $1892.10, up $12.20 or +0.65%. Downturn in US Dollar Driving Price Action

Earlier in the session, dollar-denominated gold was pressured by firmer demand for the safe-haven U.S. Dollar and Japanese Yen as tensions grew before Tuesday’s presidential election.

The reversal in the price action came as no surprise as expected swings in the major currencies climbed to their highest since April as investors waited for the outcome of an election that will have serious implications for the dollar’s outlook over the coming months.“Volatility is rising because liquidity […]

Gold, silver and platinum higher in volatile markets

Gold , silver and platinum have seen a volatile start to the week, opening lower Sunday night. But they are now working higher. With the election tomorrow, market conditions promise to be explosive. As the winds blow on the politicians, market will move quickly in both directions.

The exchanges and brokerage firms have been hiking margins for the past couple of weeks. They are making special margin arrangements for the next couple of days, which will push many day traders out of the markets. The increased margins may also cause some forced liquidations creating even more volatility.

However, the metals remain in a downtrend. Volatile markets do not change the overall trend. We will stay short gold, silver and platinum until the trend changes. Do not get yourself trapped, trying to guess the election results or where the bottoms are. Only price action can change the trend and until then, do […]

Yamana Gold buying out Northern Quebec’s Monarch Gold in C$152 million deal

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – Mining activity in Northern Quebec continues to heat up, with Yamana Gold increasing its footprint in the Abitibi region after it announced it would buy Monarch Gold’s Wasamac property and the Camflo property and mill.

Announced Monday, under the agreements of the friendly takeover, Yamana will purchase all outstanding Monarch shares in a cash and equity deal valued at approximately C$152 million.

“The acquisition provides Yamana with a high-quality project with a significant mineral reserve and mineral resource base and excellent potential for further expansion. The acquisition adds to the company’s footprint in the Abitibi region, which is consistent with Yamana’s strategy to build on its existing presence in established mining jurisdictions where it has deep technical, geological, […]

Lupaka Gold is seeking compensation from the Peruvian government

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Lupaka Gold has submitted a $100 million request for arbitration before the World Bank’s International Centre for Settlement of Investment Disputes. The claim is in relation to a lack of support from the Peruvian government in a social conflict that has halted all work at the Invicta mine over the past two years.

The compensation claim is based on Article 36 of the Convention on the Settlement of Investment Disputes between States and Nationals of Other States, known as the ICSID Convention, and Article 824 of the Free Trade Agreement between Canada and the Republic of Peru.

The company said “The dispute arises out of Peru’s breaches of the FTA in relation to Lupaka’s […]

Election 2020: Gold the Real Winner

Red or blue, you know what wins…

CEO and chief investment officer of US Global Investors, Frank Holmes says it doesn’t matter if the US sees a Red victory or a Blue victory in the presidential election, says Streetwise Reports, publishers of The Gold Report .

In this far-ranging interview with Streetwise Reports, Holmes discusses gold’s prospects post-election, inflation, stock market performance, and criteria to evaluate mining companies.

Streetwise Reports: Frank, let’s begin with gold. After a substantial rise in the price of the metal earlier this year, which went as high as $2,036 an ounce in early August, it has since been trading sideways, consolidating roughly around the $1,900 mark. What effect do you think the US presidential election will have on the price of gold? Do you see different scenarios based on which candidate wins?Frank Holmes: Well, you can hit the red button or the blue button, […]

Click here to view original web page at www.bullionvault.com

Gold prices holding on to gains despite strong rise in U.S. ISM manufacturing sentiment

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – The gold market is holding on to gains but is seeing little reaction to significantly better-than-expected sentiment in the U.S. manufacturing sector, according to the latest data from the Institute for Supply Management (ISM).

Monday, the ISM said its manufacturing index showed a reading of 59.3% for October, up from September’s reading of 55.4% and beating expectations. According to consensus forecasts, economists were expecting to see a reading of 55.6%.

According to reports, this is the highest positive reading in the survey since December 2018."“The manufacturing economy continued its recovery in October. Survey Committee members reported that their companies and suppliers continue to operate in reconfigured factories; with every month, they are becoming more […]

Gold Price Forecast – Gold Markets Grind Higher

Gold markets have rallied a bit to kick off the week on Monday, reaching towards the $1890 level rather early. That makes quite a bit of sense, considering that the week is fraught with all kinds of headline risks. The most obvious one of course is the US election, but quite frankly we have the RBA kicking things off late Monday night, early morning in Asia. After that, we have the elections, and then of course we have the Federal Reserve and jobs numbers later in the week. In other words, I expect a lot of volatility and high potential for trouble. In that scenario, gold makes quite a bit of sense. Gold Price Predictions Video 03.11.20

That being said, we could also see the US dollar drive down the value of gold, but that will more than likely be more or less a short-term phenomenon. I do believe […]

Safe-haven buying boosts gold, silver just ahead of U.S. elections

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are solidly higher in midday U.S. trading Monday, on safe-haven demand just one day before the U.S. elections and all of the uncertainty and anxiousness surrounding the matter. December gold futures were last up $15.00 at $1,894.90 and December Comex silver was last up $0.474 at $24.12 an ounce.

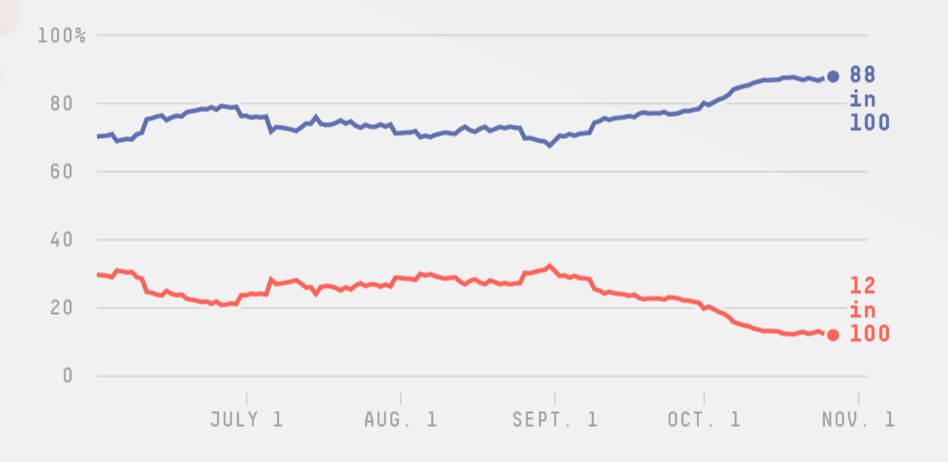

It’s a huge trading week as the U.S. election is Tuesday. Joe Biden has a sizeable lead over President Donald Trump in most polls. However, the polls were wrong in the last U.S. presidential election in 2016. Also, Covid-19 cases continue to rise in the U.S. and Europe, with the U.K. joining France in having to lock down many […]

Investors holding record levels of gold for fifth consecutive month – LBMA

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – Gold maybe be caught in a tightening consolidation pattern around $1,900 an ounce, but according to the latest trade data from the London Bullion Market Association (LBMA), investors continue to see value in precious metals.

For the fifth consecutive month, a record amount of gold was held in London vaults in September, the LBMA said in its monthly clearing statistics report. As of the end of September, there were a record 9,069 tonnes of gold held in London, valued at $550.2 billion. Meanwhile, UK vaults held 33,508 tonnes of silver, valued at $25.6 billion.

Although gold investors continue to increase their holding in gold and silver, trading activity actually slowed in September.

According to the report, the volume of […]

Gold Price Futures (GC) Technical Analysis – Facing Wall of Resistance Between $1889.70 and $1917.40

Gold futures are holding steady late in the session on Monday despite a firmer U.S. Dollar and strong demand for higher risk assets. Some traders are saying a spike in global coronavirus cases is helping to underpin the dollar-denominated assets because of their potential to weaken the global economic recovery. This could lead to additional monetary stimulus from the central banks and fore fiscal stimulus from the U.S. government.

At 18:53 GMT, December Comex gold futures are trading $1893.30, up $13.40 or +0.71%.

Traders are also monitoring the polls before the U.S. presidential election on Tuesday. Democrat Joe Biden is leading U.S. President Donald Trump in national opinion polls, but the race is tight in several battleground states, with mounting fears the results may not be clear on Tuesday night as ballot counting could take days.

Daily December Comex Gold Daily Swing Chart Technical Analysis The main trend is down according to […]