The gold price will benefit from either party’s win, but short term, the yellow metal faces bearish pressure, is the conclusion of Gary Wagner, editor of the GoldForecast.com.

“Let’s first look at the scenario if Trump wins. Because he is a Republican, he still will need to pass fiscal stimulus in terms of an aid package. He has agreed to $1.8 trillion while the House has been fighting for $2.2 trillion. Although they’re not that far apart, I would expect them to dig in fairly deeply. On the other hand, if we see a Democrat win for the presidential election, I think that fiscal spending will be much larger because of the reforms of the Democrats seem to favor big government spending,” he said.

Either way, gold is set to rise should there be a fiscal stimulus package, Wagner said.

Short-term, the moving average trends are pointing to bearish action for gold.“Based […]

Gold Price Analysis: XAU/USD steadies near $1,910 as risk rally remains intact

XAU/USD is rising for the third straight day on Tuesday.

Wall Street’s main indexes are posting impressive gains.

USD is struggling to find demand as focus shifts to US election.

The XAU/USD pair gained nearly 1% on Monday and has continued to push higher on Tuesday with the greenback facing a heavy selling pressure ahead of the US presidential election. As of writing, the pair was up 0.65% on a daily basis at $1,908.The risk-on market environment on Tuesday seems to be weighing on the USD more than it does on the precious metal. The US Dollar Index , which touched its best level in more than a month above 94 on Monday, was last seen losing 0.7% at 93.38.Reflecting the upbeat market mood, Wall Street’s main indexes are posting impressive gains on Tuesday. At the moment, the S&P 500 and the Dow Jones Industrial Average […]

Gold Price Prediction – Gold Hits 2-week High as Dollar Slides

Gold prices rose for a 3rd consecutive trading session, to the highest levels since October 21. This comes as the dollar dropped and US yields moved higher. Riskier surged ahead of the US election results, which helped buoy the yellow metal. US factory orders increased for the 5 th straight month.

Trade gold with FXTM Technical analysis

Gold prices moved higher on Tuesday testing resistance near the 50-day moving average at 1,914. Support on the yellow metal is seen near the 10-day moving average at 1,896. Short-term momentum is positive as the fast stochastic generated a crossover buy signal. The current reading on the fast stochastic is 48, up from 28 which reflects accelerating positive momentum. Medium-term momentum has turned positive as the MACD (moving average convergence divergence) index generated a crossover buy signal. This occurs as the MACD line (the 12-day moving average minus the 26-day moving average) crosses […]

CORO Global Brings Gold Payment App To Alabama

The future is looking a bit more golden for CORO Global.

The company – and its gold trading app – just expanded its reach in the United States with the addition of a license to operate in Alabama.

The Alabama Securities Commission on Tuesday (Nov. 3) granted the Miami-based CORO a money transmitter license, giving it a green light to do business in the state.

The license approval comes along with a rise in gold prices amid anxiety over the election and a spike in coronavirus cases across the country. The precious metal has long been seen by enthusiasts as a hedge against uncertain times.CORO’s app is all about gold. App users can trade in U.S. dollars for gold, save it up or send it to other users through Coro’s app.With the approval in Alabama, CORO is now available in the Apple App Store and Google Play store to residents in 13 […]

2016 election gold price shocker, can it happen again?

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! Looking at the same chart over 90 days

( Kitco News ) – Gold market has been treading water, stuck in a consolidation pattern for more than a month as political uncertainty has dominated the marketplace.

Gold prices have been tightly tethered to the $1,900 an ounce level as investors have been reluctant to take any significant bets ahead of the U.S. general election. According to analysts, memories of the 2016 election night remain extremely vivid on the eve of what is expected to be an unprecedented event.

"I think a lot of investors want to be bullish on gold but they can’t forget what happened four years ago," said Charlie Nedoss, senior market strategist with LaSalle Futures Group, […]

Gold: is the reaction over?

> It appears that both gold and stock market investors believe the winner of the US election (held today) will be more money printing and debt.

That’s almost certainly true, but what happens if the fed becomes less keen to continue its accommodation?

Double-click to enlarge this US stock market daily chart.

A rectangle pattern is in play. That’s theoretically bullish, but the rectangle is formed with lower lows and lower highs. That’s a concern, and it may reflect institutional money manager worry about a lack of Fed action in 2021. The Fed’s actions over the past decade have been good for government bonds and the stock market, but they have come at a horrifying expense for Main Street.In contrast, the government’s Corona crisis handouts in 2020 have helped both Wall Street and Main Street.That’s because handouts to regular people have enabled them to […]

Gold Price Futures (GC) Technical Analysis – Bullish Over $1917.40, Bearish Under $1889.70

Gold prices rose on Tuesday as the U.S. Dollar fell against a basket of major currencies as investors bet on increased stimulus if Joe Biden wins the U.S. presidential election against President Donald Trump.

The dollar slid on the notion a Biden victory would weaken the greenback as the former Democratic vice president is expected to spend big on stimulus and take a more market-friendly approach to trade boosting other currencies at the dollar’s expense.

On Tuesday, December Comex gold futures settled at $1910.50, up $18.00 or +0.95%.

Gains may have been capped by the possibility that there is going to be chaos and controversy surrounding the U.S. election results. These include predictions of lawsuits and recounts. If this is the case then investors could jump into the safe-haven U.S. Dollar, driving down gold prices.Daily December Comex Gold Daily Swing Chart Technical Analysis The main trend is down according to the daily […]

Jim Cramer: Gold is flashing signs ‘you want to see in a chart’

watch now

Investors may have an opportune time to start a position on gold or gold securities as the precious metal could be on an upswing, CNBC’s Jim Cramer said Tuesday.

After reviewing chart analysis from Carolyn Boroden, a commodities expert and Fibonacci analyst, he suggested that bullion, the SPDR Gold Shares , or GLD, exchange-traded fund and Barrick Gold are ripe for holding.

“The charts, as interpreted by Carolyn Boroden, suggest that gold prices could have a lot more room to run and that certainly fits with the current backdrop that we see in the news,” the “ Mad Money ” host said.Gold investments can serve investors as insurance against inflation and general economic chaos, Cramer said.Gold futures have risen about 25% year to date, and the price for the precious metal is down 8% from its peak close in early August. It rose about 17 points to $1,909.70 as of […]

Gold Price Setup Ahead of US Presidential Election, Swing State Outlook

2020 Election, Analysis, 2020 Polls, Biden-Trump Spread – Talking Points

Biden is leading in swing states though sudden surge in votes for Trump could rattle markets

{{ADD}} US PRESIDENTIAL ELECTION

It is finally here. To borrow from an Avengers quote: “We’re in the endgame now”. RealClearPolitics polls for November 3 show Democratic nominee Joe Biden in the lower bound of the rough 7-point average he’s held over incumbent President Donald Trump for a few months. The average is composed of a range of polling agencies that are known for right and left-leaning biases like Rasmussen Reports and Quinnipiac, respectively. As I noted in prior reports, statistically speaking, Democrats as a group are more likely to vote by mail than their Republican counterparts. As a result, the perception of a so-called “blue wave” might give markets a false sense of certainty. Consequently, the spread between Biden and Trump could significantly […]

Daily Gold News: Gold Price vs. U.S. Presidential Election

The gold futures contract gained 0.67% on Monday, as it retraced more of its recent declines after bouncing from $1,860 price level. Gold continues to fluctuate following September’s decline off August 7 record high at $2,089.20 to around $1,850. The yellow metal has been bouncing from the support level marked by mid-August local low of around $1,875, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 0.2% higher this morning, as it is further extending its short-term advance. What about the other precious metals? Silver gained 1.64% on Monday and today it is 0.5% higher. Platinum gained 1.31% and today it is 1.9% higher. Palladium gained 0.14% yesterday and today it’s 2.2% lower. So precious metals are advancing this morning .

Yesterday’s ISM Manufacturing PMI number release has been better than expected. This week, the markets will await the U.S. Presidential Election’s […]

The WWII Memorial and the role of Gold Star families

MIGHTY CULTURE Since its opening in 2004, the World War II memorial had consistently been one of the top sites visited by those exploring the National Mall. More than 4.6 million people visited the site in 2018. It was designed by Friedrich St. Florian, the former chief of the Rhode Island School of Design.

The WWII memorial is full of metaphors and helps illustrate the relationship between the home front and the battlefront. It showcases not just the sacrifices of service members but also Americans at home and illustrates the defining years of the 20th century. The memorial consists of 56 pillars and a pair of triumphal arches, all of which surround a square and fountain. It sits on the former site of the Rainbow Pool at the eastern end of the Reflecting Pool between the Lincoln Memorial and the Washington Monument.

It opened on April 29, 2004, and was formally […]

Click here to view original web page at www.wearethemighty.com

Oil and gold head to higher ground

Oil stages an impressive rally

The tail-chasing noise was there for all to see overnight, reaching eardrum splitting decibels. The robust US Manufacturing PMI triggered a squeeze of recent short positions. Brent crude rose 3.67% to USD39.25 a barrel overnight, all the more impressive after probing USD36.00 a barrel earlier in the session. WTI rose 3.80% to USD37.10 a barrel, having tested USD34.00 a barrel earlier in the session.

From a technical perspective, both contracts traced out bullish outside reversal days, making new lows before tracing out a higher close than the day before. WTI is testing its 200-DMA at USD37.00 a barrel, with Brent’s 200-DMA resting at USD40.40 a barrel.

The sentiment was assisted by stories circulating that Russian producers are reconsidering the scale of production increases scheduled for January. Although ignoring the fact that the government makes those decisions has certainly helped the oil rally along.In Asia, oil has […]

Gold within a whisker of $US1,900/oz as America goes to the polls

US president Donald Trump gets into the groove at a campaign rally. Image: Getty share

Delayed or uncertain US election outcome could play into gold prices

‘Gold has unwound its oversold position of late last week’

ASX Gold stocks guide : Everything you need to know Gold’s price moved closer to $US1,900 per ounce in Tuesday trade as the US presidential election cast a long shadow over the market and its near-term direction.In early trade, gold touched $US1,895/oz ($2,685/oz), nearly matching its August 2011 high, but off from its all-time high of $US2,070/oz in early August, according to Kitco data.“Gold has unwound its oversold position of late last week and is moving up to test dual resistance at $US1,900 [per ounce] from the 10-day and 20-day moving averages,” Rhona O’Connell, head of market analysis at StoneX Group told Kitco .“As uncertainty fades going forward, we expect that investment demand […]

Gold steady as investors eye race for Oval Office

(Reuters) – Gold prices held steady on Tuesday as a jump in riskier assets offset the impact of strict lockdowns across Europe and with wary markets awaiting results of the U.S. presidential election. A saleswoman displays a gold necklace inside a jewellery showroom in Kolkata, India, May 7, 2019. REUTERS/Rupak De Chowdhuri/Files Spot gold was up 0.1% at $1,896.77 per ounce by 1059 GMT, while U.S. gold futures rose 0.3% to $1,898.90 per ounce.

Quantitative Commodity Research analyst Peter Fertig said stock market gains were indicative of improved risk appetite and a weaker U.S. dollar index.

“Not to forget we have election day today, so nobody is really willing to take stronger positions now and are just waiting for the results.”

President Donald Trump and Democratic rival Joe Biden made a last-ditch push for votes in battleground states on Monday as their campaigns prepared for post-election disputes that could prolong the election […]

$1 PER WEEK FOR THE FIRST 12 WEEKS

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Yamana Gold Inc. Earnings Missed Analyst Estimates: Here’s What Analysts Are Forecasting Now

The analysts might have been a bit too bullish on Yamana Gold Inc. ( TSE:YRI ), given that the company fell short of expectations when it released its third-quarter results last week. It wasn’t a great result overall – while revenue fell marginally short of analyst estimates at US$439m, statutory earnings missed forecasts by an incredible 29%, coming in at just US$0.06 per share. Earnings are an important time for investors, as they can track a company’s performance, look at what the analysts are forecasting for next year, and see if there’s been a change in sentiment towards the company. Readers will be glad to know we’ve aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Yamana Gold after the latest results.

Taking into account the latest results, the current consensus from Yamana Gold’s 13 analysts is for revenues of US$2.01b in 2021, which […]

Gold Resource Corporation Reports Third Quarter Net Income of $5.0 Million, or $0.07 Per Share

COLORADO SPRINGS, CO, Nov. 02, 2020 (GLOBE NEWSWIRE) — via NewMediaWire — Gold Resource Corporation (NYSE American: GORO) (the “Company”, “We”, “Our” or “GRC”) reported consolidated production results for the third quarter ended September 30, 2020 of 12,575 gold ounces and 333,761 silver ounces. In addition to precious metals, the Company produced base metals resulting in consolidated net revenue of $42.3 million for the quarter. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company has returned $115 million to its shareholders in consecutive monthly dividends since July 2010 and offers its shareholders the option to convert their cash dividends into physical gold and silver and take delivery.

“Our successful third quarter demonstrates our strength and determination,” stated Gold Resource Corporation’s CEO and President, Mr. Jason Reid. “Despite the mandatory two-month shutdown in Mexico during the second quarter, […]

Click here to view original web page at www.globenewswire.com

Outlook, trading strategies for gold & silver

MCX gold price is swinging in the range of Rs 51,100-51,450 levels with a flattened Bollinger band indicating a sideways trend. Gold

MCX NSE 1.08 % gold price is swinging in the range of Rs 51,100-51,450 levels with a flattened Bollinger band indicating a sideways trend. Immediate resistance is at Rs 51,400, followed by Rs 51,650. Meanwhile, support holds around Rs 50,650, followed by Rs 50,350. Stochastic works as a cashing machine in the sideways trend supporting the bears over bulls.Strategy Sell MCX Gold Dec at Rs 51,250

Target at Rs 50,650; Stop loss at Rs 51,500

Silver MCX silver price volatility (ATR) has expanded suggesting bigger moves. Supply zone is at Rs 64,000-64,200 levels, likewise, immediate support is at Rs 61,300, followed by Rs 60,100. However, the momentum indicator (RSI) is hovering below 50 signifying a weaker trend. A close above Rs 64,200 will […]

Click here to view original web page at economictimes.indiatimes.com

Gold Price Analysis: XAU/USD treads water on US election day, levels to watch – Confluence Detector

Gold (XAU/USD) wavers in a familiar range on the US election day this Tuesday, as a sense of caution sets amid a tighter presidential race in key six swing states. The US dollar remains on the back foot amid the upbeat market mood, fuelled by the stronger-than-expected US and Chinese Manufacturing PMIs.

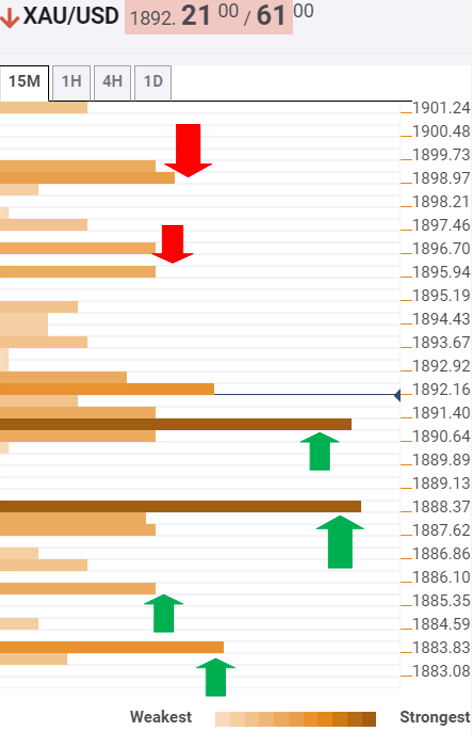

The bull-bear tug-of-war could likely extend, as investors will refrain from placing any directional bets on gold ahead of the election outcome. A ‘blue sweep’ is the only thing the gold buyers could ask for. In the meantime, the risk of a contested election keeps the upside in check. Let’s take a look at the key technical levels in the run-up to the election showdown. Gold: Key resistances and supports

The Technical Confluences Indicator shows that the yellow metal is likely to face an uphill battle to take on the upside, with the immediate barrier seen around $1896, […]

Gold dips as investors await U.S. election outcome

A mark of 999.9 fine sits on hallmarked one kilogram gold bullion bars at the Valcambi SA precious metal refinery in Lugano, Switzerland, on April 24, 2018.

Stefan Wermuth | Bloomberg | Getty Images

Gold prices edged down on Tuesday, as cautious investors awaited the outcome of the U.S. presidential election with President Donald Trump closely trailing Democrat Joe Biden in national opinion polls.

Spot gold fell 0.1% to $1,892.73 per ounce by 0533 GMT.U.S. gold futures were little changed at $1,893.20 per ounce.“Sentiment is hanging by a thread at the moment … Everybody is quite unsure where the election is headed to, given the number of possible outcomes,” said Howie Lee, economist at OCBC Bank.As long as there isn’t a Democrat sweep, there will be questions on fiscal stimulus, while an uncertain or contested result will likely favor the dollar and weaken gold, he added.Election polls show Biden with an […]

Gold to race higher towards $2300 in the long-term – Credit Suisse

Strategists at Credit Suisse remain long-term gold bulls and a potential bullish “wedge” continuation pattern looks to be forming to add weight to this view. Key quotes

“Gold extends its consolidation from our $2075 target hit in August and we maintain our core view this is a temporary and corrective pause in the broader uptrend. Indeed, price action is beginning to increasingly look like a bullish ‘wedge’ continuation pattern, adding weight to our view.”

“Key support stays seen intact at $1837 – the 38.2% retracement of the 2020 rally – and our bias remains for this to continue to hold. Above $1933 would now suggest the “wedge” has been completed for strength back to $2016, then the $2075 high.”

“Big picture, we continue to look for $2300.”“Below $1837 would curtail thoughts of a “wedge” and would suggest we should see a deeper setback to price and 200-day average support at $1775/65.”Information […]

Gold traders set their bets, U.S election in play

Gold prices were fast approaching the 1,900/ounce, amid global investors and gold traders setting their bets out on the outcome of the U.S. election and other prevailing macros, like the rising COVID-19 caseloads disrupting financial markets. What we know

At about 7.05 GMT, Gold futures traded at around $1,891/ounce as the weaker dollar helped move prices upward.

With an important political event coming to play, gold traders and global investors flock to gold, in taking advantage of the myriad uncertainties that can occur, on the basis that the race looks like a tough call by independent political strategists. What this means

Should the result bring a blue party presidency, the bias is that gold bulls would have enough gas to reach at least $2,000/ounce, on the bias that a substantial COVID-19 stimulus program would weaken the dollar and boost the precious metal value. What they are saying […]

Gold And The U.S. Election: Here’s What To Look For

Jeffrey Gundlach, founder and CEO of hedge fund DoubleLine, told a U.S. pre-election webcast on Monday that gold remains an ideal hedge for inflation, is a “good holding for tail risk ahead” and “will go up very substantially over time.”

What he did not say was for how long a timeframe.

The uncertainty over the outcome to Vote 2020—shaped by polls shifting by the hour and President Donald Trump’s apparent urge to legally challenge every unfavorable outcome—has made gold a tricky bet.

In Tuesday’s early Asian trade, U.S. gold futures for December delivery hovered at $1,893, up 50 cents, or nearly 0.3%—extending Monday’s gain of 0.7%. December gold came within striking distance of $1,900 in the previous session—a level gold bugs had been trying to return to since Oct. 29. Gold 60 Mins As everyone and their grandmother probably knows, gold is a hedge against both political troubles and fiscal expansion.But the […]

Sprott Physical Gold and Silver Trust Expands Its “At-the-Market” Equity Program

TORONTO, Nov. 02, 2020 (GLOBE NEWSWIRE) — Sprott Asset Management LP ("Sprott"), on behalf of the Sprott Physical Gold and Silver Trust (NYSE: CEF) (TSX: CEF) (TSX: CEF.U) (the "Trust"), a closed-ended mutual fund trust created to invest and hold substantially all of its assets in physical gold and silver bullion, today announced that it has established an at-the-market equity program for sales of trust units of the Trust ("Units") in Canada. The existing at-the-market equity program in the United States remains in place.

In connection with the at-the-market equity programs in Canada and the United States (together, the "ATM Program"), Sprott (as the manager of the Trust) and the Trust, entered into an amended and restated sales agreement (the "Sales Agreement") with Cantor Fitzgerald & Co. ("CF&Co"), Virtu Americas LLC ("Virtu" and together with CF&Co, the "U.S. Agents") and Virtu ITG Canada Corp. (the "Canadian Agent" and together with […]

Click here to view original web page at www.globenewswire.com

Are Gold Prices Headed for a Roller Coaster Ride This Week?

Gold investors need to ensure their safety belts are buckled tight this week, especially since the forthcoming election could give them a stomach-churning roller coaster ride of volatility. Other key movers for gold will only add to the dips and dives.

“The first week of November will not only see the most anticipated event of the year — the U.S. election, but also the Federal Reserve interest rate decision and some key datasets, including the U.S. employment figures from October,” a Kitco News article explained.

So what’s the best strategy when it comes to gold? Some market experts advise to refrain from being a seller amid all the market uncertainty.

“People that are holding metals absolutely should not be selling into the election,” said Kitco Metals Global Trading Director Peter Hug. “People not holding the metals and who wish to diversify 10%, I would be of the mindset that you would want […]