There’s no arguing with the numbers.

The past year (and then some) has seen the leading ASX uranium shares truly light up.

The Paladin Energy Ltd (ASX: PDN) share price, for example, is up 415% over the past 12 months. ASX uranium miner Deep Yellow Ltd (ASX: DYL) ’s share price is up 246% over that same time.

Things have continued apace in 2021, with Deep Yellow shares up 24% in the calendar year and Paladin shares up 54%.That more than handily outpaces the one-year 7% gains posted by the broader All Ordinaries Index (ASX: XAO), not to mention the 0.4% loss on the All Ords so far in 2021.But the run higher for ASX uranium shares like these could only just be getting started. Why ASX uranium shares may have a bright future Australia may not opt to use uranium for its own power sources. Though Australia – both fortuitously and […]

Western Uranium & Vanadium : Closes Final Tranche of Non-Brokered Private Placement

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado – Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) ("Western" or the "Company") is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the "Private Placement") (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the "Units") at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a "Share") plus one common […]

Click here to view original web page at m.marketscreener.com

Uranium Mining Market Share, Growth, Size 2021 by Top Manufacturers, Regional Market, Type and Application, Forecast 2025

The MarketWatch News Department was not involved in the creation of this content.

Mar 11, 2021 (The Expresswire) — Global Uranium Mining Market (2021 -2025) status and position of worldwide and key regions, with perspectives of manufacturers, regions, product types and end industries. This report also Uranium Mining Market Size, states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins, Uranium Mining Market Share Analysis. this report analyses the topmost companies in worldwide and main regions, and splits the Uranium Mining market by product type and applications/end industries. This Report provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector for Uranium Mining Market Growth.

Uranium Mining Market 2021 Research report contains a qualified and in-depth examination of Uranium Mining Industry. At first, the report provides the current business situation along with a valid assessment of the Uranium Mining Market Analysis. This […]

NexGen Announces Closing of $150 Million Bought Deal Financing

NexGen Energy Ltd. is pleased to announce that it has closed its previously announced bought deal financing . Pursuant to the Offering, the Company issued 33,400,000 common shares of the Company at a price of $4.50 per Common Share for gross proceeds of approximately $150 million . NexGen has granted the Underwriters a 30-day option to purchase up to an additional 5,010,000 Common Shares. The Offering was completed …

NexGen Energy Ltd. (“NexGen” or the “Company”) (TSX: NXE) (NYSE: NXE) is pleased to announce that it has closed its previously announced bought deal financing (the “Offering”). Pursuant to the Offering, the Company issued 33,400,000 common shares of the Company (the “Common Shares”) at a price of $4.50 per Common Share for gross proceeds of approximately $150 million . NexGen has granted the Underwriters (as defined below) a 30-day option to purchase up to an additional 5,010,000 Common Shares. NexGen Energy […]

Energy Fuels (UUUU) to Report Q4 Earnings: What’s in Store?

Energy Fuels Inc. UUUU is expected to report fourth-quarter 2020 results on Mar 15. Q4 Estimates

The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $0.55 million, indicating a decline of 21.4% from the prior-year quarter. The company is expected to report a loss per share of 3 cents compared with a loss of 10 cents per share in the year-ago quarter. The estimates have been remained stable over the past 30 days. Q3 Results

In the last reported quarter, Energy Fuels reported revenues of $0.5 million, which improved 15% year over year but fell short of the Zacks Consensus Estimate of $2 million. The company reported a loss per share of 8 cents, wider than the year-ago quarter’s loss of 7 cents per share and the Zacks Consensus Estimate of a loss of 5 cents.

The company has a trailing four-quarter negative earnings surprise of 73.3%, on […]

Appia Energy Proposes Corporate Name Change to Highlight Its Rare Earth Element and Uranium Focus

Toronto, Ontario–(Newsfile Corp. – March 3, 2021) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") today announced that it will seek shareholder approval to change its name to "APPIA RARE EARTHS & URANIUM CORP." in order to better identify the Company’s focus on the Alces Lake Project and the Athabasca Basin uranium prospects. The Property hosts some of the highest-grade total and critical rare earth elements (" CREE ") and gallium mineralization in the world. CREE is defined here as those rare earth elements that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines, (i.e: neodymium (Nd), praseodymium (Pr) dysprosium (Dy), and terbium (Tb)).

In the oxide form, the Shanghai Metals Market quoted February 28 prices per kg in US$ are: Nd $105, up over 100% year over […]

Click here to view original web page at www.juniorminingnetwork.com

Drilling into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

Top Uranium Stocks To Watch

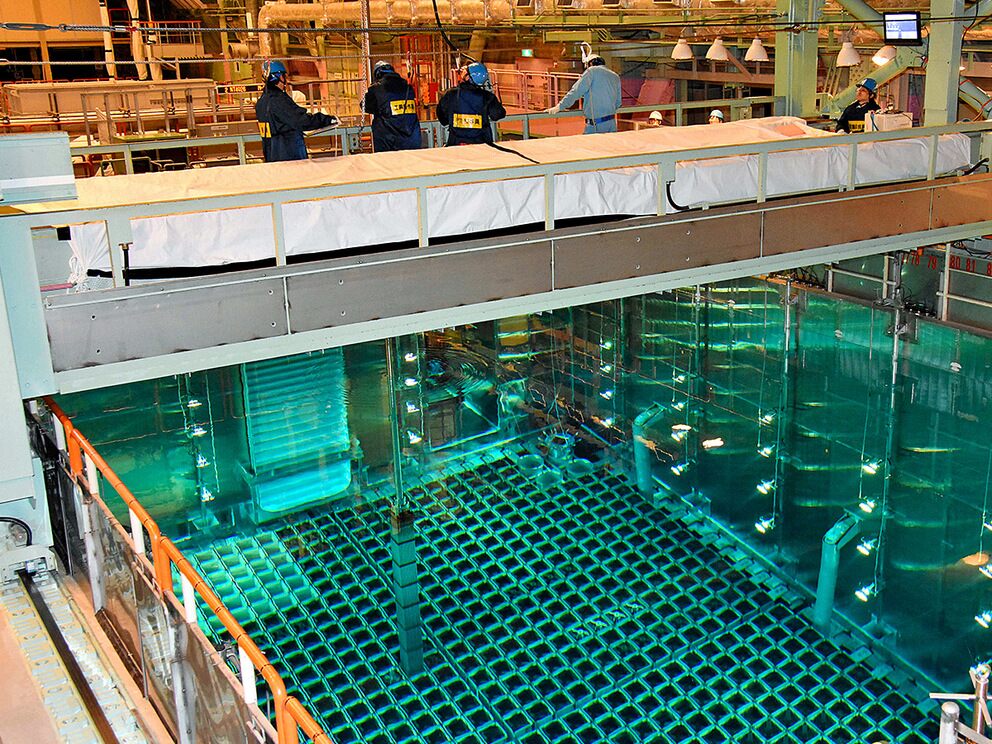

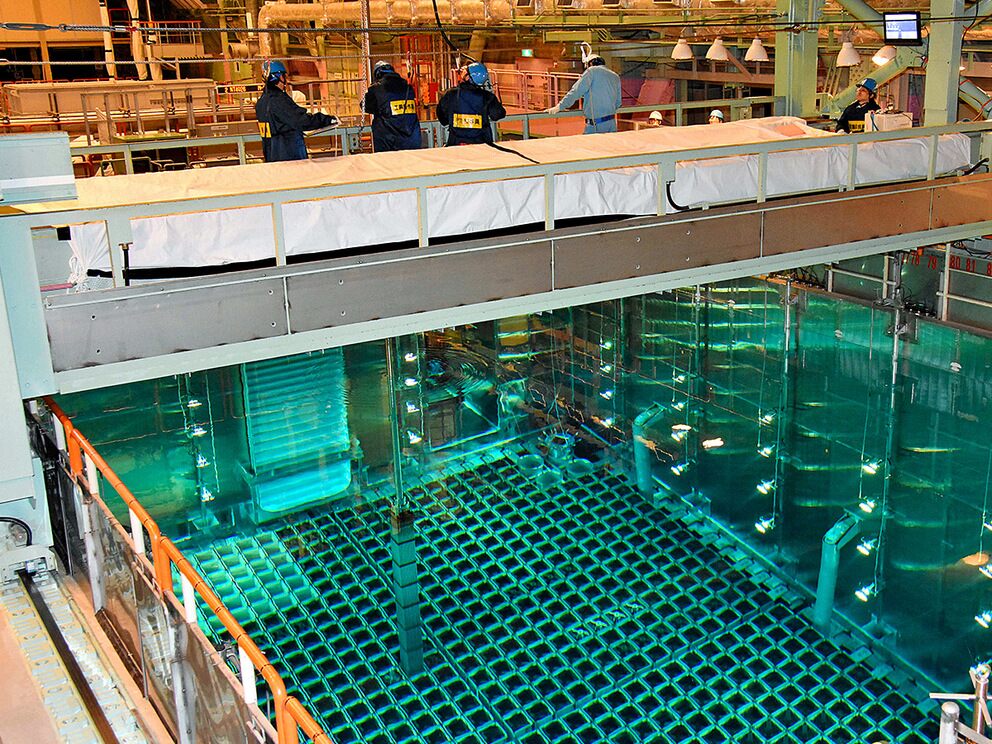

Will These Uranium Stocks Keep Gaining In The Market? One big sector of the market at the moment is Uranium. It’s already a huge industry with mines all over the world. But Uranium is also an industry that has been impacted by COVID-19 as well. COVID caused Uranium stocks to reach levels they had not seen since the 2011 Fukushima Daiichi nuclear disaster in Japan. That event shut down major supply sources. Yet this recent uptick was not caused by changing uranium prices or government related things. One analyst believes that there is a uranium short squeeze happening by Reddit traders. The analysts, Greg Barnes of TD Securities, stated that on February 1 st a subreddit named r/UraniumSqueeze was created. A few days later, the page had more than 686 members. Now the group has reached more than 3,000 members. Uranium investors are unsure how much these retail investors […]

Click here to view original web page at markets.buffalonews.com

Uranium Energy Corp. (NYSE:UEC): Can A Stock Be Up 2.557% YTD, And Still Be A Loser

Uranium Energy Corp. (NYSE:UEC)’s traded shares stood at 4,376,028 during the last session, with the company’s beta value hitting 2.41. At the close of trading, the stock’s price was $2.21, to imply an increase of 3.76% or $0.08 in intraday trading. The UEC share’s 52-week high remains $2.56, putting it -15.84% down since that peak but still an impressive +84.16% since price per share fell to its 52-week low of $0.35. The company has a valuation of $439.92 Million, with an average of 5.14 Million shares in intraday trading volume over the past 10 days and average of 4.83 Million shares over the past 3 months.

Analysts have given a consensus recommendation of Buy for Uranium Energy Corp. (UEC), translating to a mean rating of 1.7. Of 5 analyst(s) looking at the stock, none analyst(s) give UEC a Sell rating. None of those analysts rate the stock as Overweight while […]

Click here to view original web page at marketingsentinel.com

GoviEx buoyed by prospects of a uranium uptrend, nuclear energy expansion

TSX-V-listed GoviEx Uranium reports that, with nuclear energy having shown resilience in 2020, the spot uranium price has been in a “gentle uptrend” for the last four years after having reached its cyclical low of $18/lb of U 3 O 8 in December 2016.

The company notes that despite 2020 having been strongly dominated by the Covid-19 pandemic, the company nonetheless adapted to this challenging environment and made progress by improving its financial position, advancing its pipeline of uranium mine development plans, specifically in Niger, and beginning the assessment of “compelling” gold prospects in Mali. In addition, GoviEx says the positive momentum of its activities in 2020 has continued into this year.

During 2020, the spot uranium price rose from $25/lb at the start of the year to $30/lb at the end – a 20% increase. GoviEx states that the increase in prices is being supported by progressively stronger demand for […]

Click here to view original web page at www.miningweekly.com

Appia appoints Frederick Kozak as President as they progress the Alces Lake high-grade rare earths monazite project

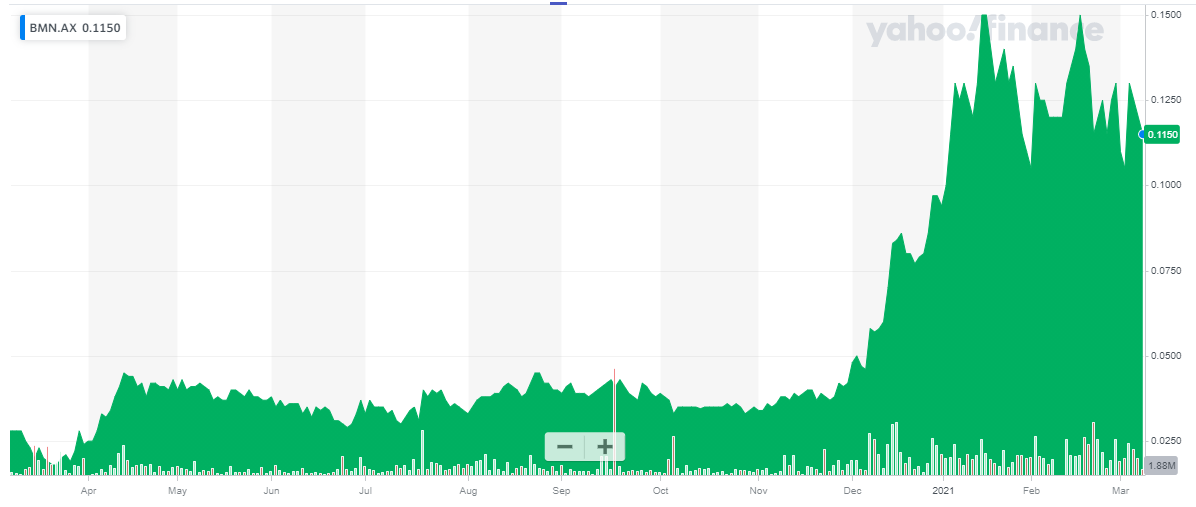

Appia Energy Corp. ‘s (CSE: API | OTCQB: APAAF) (‘Appia’) stock price has been on a tremendous run the past year, up 364%, as shown below. Today I take a look at why the stock has done so well, and what’s next for Appia Energy, potentially soon to be renamed Appia Rare Earths & Uranium Corp. (retaining the same stock tickers).

Appia Energy Corp. 1 year stock price performance Source

The reasons why Appia has had a great past year are multiple but would include:

> Rising prices for rare earths, and to a lesser degree uranium. Greater recognition by investors on Appia’s potential. Successful exploration by Appia on their Alces Lake project and progress towards next stage development. Regarding higher rare earth prices, on March 3, 2021 Appia stated :“In the oxide form, the Shanghai Metals Market quoted February 28 prices per kg in US$ are: Nd $105, […]

Centrus Energy: An Interesting Play On Uranium

Summary

Being the sole supplier of nuclear fuel puts Centrus in a unique position.

Centrus will benefit from lower raw material costs.

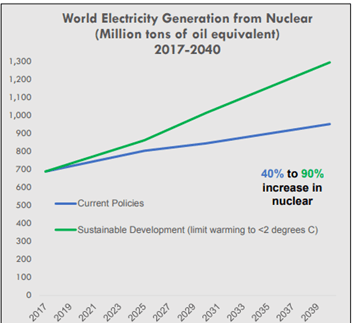

Cash flow should be positive throughout the year. About: Centrus Energy ( LEU ) is an American company that supplies nuclear fuel for use in nuclear plants. It provides LEU’s and plans to provide High Essay Low Enriched Uranium (HALEU), to nuclear power plants due to deals with the Department of Energy, with whom it has contracts. It is currently the sole supplier of nuclear fuel in the U.S. It also provides a range of technical and engineering capabilities, such as – turnkey engineering, design, and advanced manufacturing solutions for advanced reactors, aerospace, and chemical companies. Nuclear Energy Outlook: Nuclear Energy as of 2019 accounted for around 809 TWh, accounting for nearly 20% of U.S. electricity. It also compromised around 50% of all emission-free energy. The United […]

Top Uranium Stocks To Watch

Will These Uranium Stocks Keep Gaining In The Market? One big sector of the market at the moment is Uranium. It’s already a huge industry with mines all over the world. But Uranium is also an industry that has been impacted by COVID-19 as well. COVID caused Uranium stocks to reach levels they had not seen since the 2011 Fukushima Daiichi nuclear disaster in Japan. That event shut down major supply sources. Yet this recent uptick was not caused by changing uranium prices or government related things. One analyst believes that there is a uranium short squeeze happening by Reddit traders. The analysts, Greg Barnes of TD Securities, stated that on February 1 st a subreddit named r/UraniumSqueeze was created. A few days later, the page had more than 686 members. Now the group has reached more than 3,000 members. Uranium investors are unsure how much these retail investors […]

Click here to view original web page at finance.dailyherald.com

GoviEx Uranium Letter to Stakeholders and Market Update

Vancouver, British Columbia–(Newsfile Corp. – March 10, 2021) – GoviEx Uranium Inc. ( TSXV: GXU ) ( OTCQB: GVXXF ) (" GoviEx " or " Company ") today provides a Letter to Stakeholders and Market Update from the Executive Chairman, Govind Friedland and the Chief Executive Officer, Daniel Major.

To Our Fellow Stakeholders,

When we reflect on 2020, it will likely be remembered as the year strongly dominated by the COVID pandemic. Yet despite 2020 being a year like no other, GoviEx was able to adapt to this challenging environment and made progress by improving our financial position, advancing our pipeline of uranium mine development plans, specifically in Niger, and beginning the assessment of our compelling gold prospects in Mali. The positive momentum of our activities in 2020 has continued into 2021.

Commodities Backdrop The spot uranium price has been in a gentle uptrend for past four years after […]

Click here to view original web page at www.juniorminingnetwork.com

Amber Reimondo: Taxpayer dollars shouldn’t keep uranium mill afloat

A strategic uranium reserve has no place in Joe Biden’s Build Back Better agenda.

(Corey Robinson | Tribune file photo) Protesters from White Mesa, Utah, march against the White Mesa Mill, the last conventional uranium mill still operating in the U.S. on May 14, 2017.

In late December, as Congress debated how much to spend on COVID-19 relief for Americans struggling to make ends meet, something else was flying under the radar that has serious implications for Utah’s clean water and public health.

In the same package that funded $600 stimulus checks hid a sizable handout for the uranium industry that could pad the pockets of Energy Fuels Resources, the uranium company that has already made millions by welcoming low-level radioactive waste to its White Mesa uranium mill in southeastern Utah.Congress appropriated $75 million to start a “strategic uranium reserve.” This means using your taxpayer dollars to pay uranium companies above-market […]

Why This $1 Uranium Stock Rocketed 59.6% in February

What happened

Shares of uranium company Denison Mines (NYSEMKT: DNN) soared a whopping 59.6% in the month of February, according to data provided by S&P Global Market Intelligence . That handily outran the Global X Uranium ETF ‘s (NYSEMKT: URA) 20.5% gain in the month, suggesting there was more to Denison’s rally than just industry-specific news. So what

Denison Mines, and several other uranium stocks , soared on the very first day of February after Bank of America speculated that global demand for uranium could be as much as 26 million pounds more if the U.S. postponed closure of its aging nuclear plants due 2021 to 2030. Nuclear reactors run on uranium fuel.

By the second week of February, Denison shares were rallying to dizzying heights backed by several developments. To start, on Feb. 8, Denison approved a $24 million budget for 2021 to resume the environmental assessment process at […]

Bannerman Resources: An Interesting Uranium Project, But It Will Need Much Higher Prices

Summary

Bannerman’s share price has recently tripled, but this is not backed by fundamental value.

The Etango flagship project has a breakeven price of $46/pound, and this excludes project financing expenses.

Bannerman could be seen as a call option on a high double-digit uranium price, but in that scenario, you may as well buy any other uranium company out there. At the current valuation, Bannerman’s market capitalization may have gotten ahead of itself, and I’m not interested in a long position at this time. Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More » Introduction Bannerman Resources ( OTCQB:BNNLF ) has been working on its Namibian uranium portfolio for over a decade now, but as the uranium price hasn’t really been cooperating, the flagship Etango uranium project isn’t being built anytime soon. […]

Appia Announces Acceleration of Expiry Date of 2017 Warrants to April 8, 2021

March 9, 2021 ( Source ) — Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) wishes to announce that expiry dates of the remaining 5,130,000 warrants exercisable at $0.30 issued pursuant to the private placements that closed on January 20, 2017 and January 30, 2017 (the “ 2017 Warrants “) (see press releases dated January 23, 2017 and January 27, 2017) have been accelerated to the earlier of January 20 and 30, 2022 to April 8, 2021 as a result of the fact that the Company’s common shares closed at a price of at least $0.60 for twenty (20) consecutive trading days as of March 8, 2021. The remaining 2017 Warrants will expire if they are not exercised by April 8, 2021.

The Company is fully funded and committed to completing the largest exploration and diamond drilling program to date during […]

Uranium Participation Corporation Reports Estimated Net Asset Value at February 28, 2021

TSX Trading symbol: U

TORONTO, March 8, 2021 /CNW/ – Uranium Participation Corporation ("UPC") (TSX: U ) reports its estimated net asset value at February 28, 2021 was CAD$623.0 million or CAD$4.62 per share. As at February 28, 2021, UPC’s uranium investment portfolio consisted of the following: View PDF (CNW Group/Uranium Participation Corporation) On the last trading day of February 2021, the common shares of UPC closed on the TSX at a value of CAD$4.95, which represents a 7.14% premium to the net asset value of CAD$4.62 per share.

About Uranium Participation Corporation

Uranium Participation Corporation is a company that invests substantially all of its assets in uranium oxide in concentrates ("U 3 O 8 ") and uranium hexafluoride ("UF 6 ") (collectively "uranium"), with the primary investment objective of achieving appreciation in the value of its uranium holdings through increases in the uranium price. UPC provides investors with a […]

Digging into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

Why This $1 Uranium Stock Rocketed 59.6% in February

What happened

Shares of uranium company Denison Mines (NYSEMKT: DNN) soared a whopping 59.6% in the month of February, according to data provided by S&P Global Market Intelligence . That handily outran the Global X Uranium ETF ‘s (NYSEMKT: URA) 20.5% gain in the month, suggesting there was more to Denison’s rally than just industry-specific news. So what

Denison Mines, and several other uranium stocks , soared on the very first day of February after Bank of America speculated that global demand for uranium could be as much as 26 million pounds more if the U.S. postponed closure of its aging nuclear plants due 2021 to 2030. Nuclear reactors run on uranium fuel.

By the second week of February, Denison shares were rallying to dizzying heights backed by several developments. To start, on Feb. 8, Denison approved a $24 million budget for 2021 to resume the environmental assessment process at […]

A Unique Uranium Project and One-of-a-Kind Business Model

In Part 1 of our 3-part series, we examined the history and overview of a company making waves in the global uranium sector and how sentiment has pivoted driven by changes in the market and government. Because of changing sentiment in the green efficacy of nuclear power (i.e. zero CO2 emissions), in 4 to 5 years, new sources of uranium will be needed en masse. This, despite some of the big producers stating that they will not restart production until prices are higher.

This is where smaller but more efficient companies like BC-based Fission Uranium Corp. (FCU) ( TSX.FCU , OTCMKTS: FCUUF , Forum ) are filling the void. And for investors – both retail, institutional, and private equity – the sky’s the limit for this renewable energy resource.

INVESTOR ALERT: Fission may possess one of the best inferred and indicated, highest-grade, and largest near-surface uranium deposits in the world. […]

Digging into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

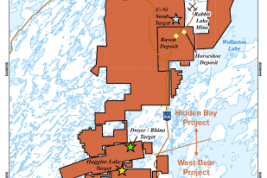

New High-Grade Cobalt-Nickel Discovered at Michael Lake

Hole grades 2.08% Co and 3.58% Ni over 4.5 metres within broader interval UEX Corporation is pleased to announce that a new zone of cobalt-nickel mineralization was intersected at Michael Lake with the fourth hole of its 2021 winter uranium-cobalt exploration drill program on the West Bear Property . Drill hole MIC-004 intersected mineralization that grades 0.52% Co and 1.01% Ni over 23.5 m from 44.0 to 67.5 m …

(TheNewswire) Hole grades 2.08% Co and 3.58% Ni over 4.5 metres within broader interval

UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that a new zone of cobalt-nickel mineralization was intersected at Michael Lake with the fourth hole of its 2021 winter uranium-cobalt exploration drill program on the West Bear Property (see Figure 1) . Drill hole MIC-004 intersected mineralization that grades 0.52% Co and 1.01% Ni over 23.5 m from 44.0 to 67.5 […]

Cameco Stock is the Real Deal Uranium Play

Uranium producer Cameco Corporation (NYSE: CCJ) stock has been breaking out through multi-year highs on the renewed interest in clean energy spurring uranium demand. Uranium is used to fuel nuclear power plants that provide 20% of the electricity and up to 55% of all clean energy in the U.S. The U.S. uranium reserves plan coupled with the Biden administration’s clean energy agenda has changed the sentiment for nuclear energy. Nuclear is clean but not renewable like solar or wind , thus require a continued source of uranium . Unlike junior and developmental companies like Energy Fuels (NASDAQ: UUUU) and Dennison Mines (NYSE: DNN) , Cameco is already processing and selling uranium, making them the real deal for investors looking for exposure in this industry. Cameco has 43 projects in the works and will implement those that enable them to capture demand and provide leverage for higher prices in 2021. […]