Uranium mines can’t keep up with global demand And that has been the case during the pandemic. Cameco in Canada, the world’s second-largest producer, has shut every one of its uranium mines in Canada. Output at Kazatomprom, the world’s biggest producer, is at a multi-year low. The US produced a negligible amount of uranium in 2020. This sort of backdrop can trigger sudden surges: in 2007 prices increased fivefold in one year to $140 a pound (lb) as utilities panicked about scarcity of supply after a mine called Cigar Lake was flooded and another, Ranger, was damaged by a cyclone. More bullish news

There is one other issue worth mentioning. The increasing cost of supply has not necessarily been reflected in spot market prices. A recent panel of experts at an event hosted by investment bank Canaccord Genuity (CG) argued that marginal costs are well above current spot prices.

According […]

Top Stories This Week: Powell Compares Gold to Crypto, Uranium Companies Get Physical

Market watchers were eyeing this week’s testimonies from US Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, but ultimately their words did little to move gold.

The metal spent the week fairly rangebound , trading between about US$1,725 and US$1,745 per ounce.

More intriguing for some industry participants were Powell’s comments on gold and cryptocurrencies. Gold Outlook 2021! Introducing Our NEW Gold Outlook Report

BURSTING With Exclusive Information Not Found Anywhere Else. Don’t Get Left Behind! Grab Your FREE Gold Report Today! In a Monday (March 22) panel discussion hosted by the Bank for International Settlements, he described cryptocurrencies as “highly volatile” and therefore not a useful store of value; Powell added that they are “essentially a substitute for gold,” not the dollar. “(Cryptocurrencies are) highly volatile … and therefore not really useful as a store of value, and they’re not backed by anything. They’re more of […]

Denison Announces Closing of US$86.3 Million Financing in Support of Strategic Acquisition of Physical Uranium

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES Denison Mines Corp. is pleased to announce that it has closed its previously announced bought deal public offering of units . The Company issued 78,430,000 units of the Company at US$1.10 per unit for aggregate gross proceeds of …

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES /

Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML) (NYSE American: DNN) is pleased to announce that it has closed its previously announced bought deal public offering of units (the “Offering”). The Company issued 78,430,000 units of the Company at US$1.10 per unit for aggregate gross proceeds of US$86,273,000 which included 10,230,000 units […]

The REE Business Of Energy Fuels Seems Inconsequential To Challenge The Bear Case

Photo by Antoine2K/iStock via Getty Images Introduction

Earlier this month, I wrote an article about U.S. uranium company Energy Fuels (NYSEMKT: UUUU ), and one of the major criticisms in the comments was that I didn’t talk much about its new rare earth elements (REE) business.

Several people even argued that REE is the company’s main business now and its high valuation reflects this. Well, I’ve taken a look at this new venture of Energy Fuels, and I think it’s too small to make a difference. Overview of the REE operations of Energy Fuels

In February 2020, the company announced that it was approached by several parties to evaluate the potential to produce REE at its White Mesa uranium in Utah. In April 2020, Energy Fuels announced that it decided to enter the REE sector.White Mesa has a license to produce uranium and vanadium as well as other […]

Emerging Trends of Uranium Market with Growth Strategies, Market Dynamics and Competitive Landscape 2026

Uranium Market report examines all the essential factors promoting the growth of the global market, involving pricing structure, profit margins, value chain assessment, production value, demand as well as supply scenario, and various other significant parameters. Regional evaluation of the global Uranium market demonstrates a series of opportunities in regional as well as domestic industry places. Furthermore, this report makes use of graphical presentation techniques such as graphs, charts, tables, and pictures for better understanding.

The report has been separated into different categories, such as product type, application, end-user, and region. It also offers a deep analysis of the potential product segment that is expected to lead in the forthcoming years. Also, information on other product segments is given in the market report to help the competitors and customers get a clear picture of the market and details on the upcoming product. Every segment is evaluated based on the CAGR, […]

Uranium Mining Market to Make Great Impact in Forecast Period 2021-2026

Uranium Mining Market report examines all the essential factors promoting the growth of the global market, involving pricing structure, profit margins, value chain assessment, production value, demand as well as supply scenario, and various other significant parameters. Regional evaluation of the global Uranium Mining market demonstrates a series of opportunities in regional as well as domestic industry places. Furthermore, this report makes use of graphical presentation techniques such as graphs, charts, tables, and pictures for better understanding.

The report has been separated into different categories, such as product type, application, end-user, and region. It also offers a deep analysis of the potential product segment that is expected to lead in the forthcoming years. Also, information on other product segments is given in the market report to help the competitors and customers get a clear picture of the market and details on the upcoming product. Every segment is evaluated based on […]

CanAlaska Announces Second & Final Tranche Closing of $3,000,000 Private Placement Financing

CanAlaska Uranium Ltd. announces that further to its March 12, 2021 and March 15, 2021 news releases, it has now completed the second and final tranche of its non-brokered private placement . Under the Second Tranche, the Company has issued 1,165,000 flow-through units for gross proceeds of $745,600 and 2,488,800 non-flow-through units for gross proceeds of $1,244,400. In connection with the Second Tranche, the …

CanAlaska Uranium Ltd. ( TSXV: CVV ) (FSE: DH7N) (“CanAlaska” or the “Company”) announces that further to its March 12, 2021 and March 15, 2021 news releases, it has now completed the second and final tranche (the “Second Tranche”) of its non-brokered private placement (the “Offering”). Under the Second Tranche, the Company has issued 1,165,000 flow-through units for gross proceeds of $745,600 and 2,488,800 non-flow-through units for gross proceeds of $1,244,400. In connection with the Second Tranche, the Company paid a total of $144,644 […]

CanAlaska Uranium Announces Second & Final Tranche Closing of $3,000,000 Private Placement Financing

Vancouver, British Columbia–(Newsfile Corp. – March 26, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV ) (FSE: DH7N ) ("CanAlaska" or the "Company") announces that further to its March 12, 2021 and March 15, 2021 news releases, it has now completed the second and final tranche (the " Second Tranche ") of its non-brokered private placement (the " Offering "). Under the Second Tranche, the Company has issued 1,165,000 flow-through units for gross proceeds of $745,600 and 2,488,800 non-flow-through units for gross proceeds of $1,244,400. In connection with the Second Tranche, the Company paid a total of $144,644 and issued a total of 263,192 warrants as finder’s fees. Each finder’s warrant is exercisable for one common share at a price of $0.75 for two years. All securities issued under the Second Tranche are subject to a hold period expiring July 27, 2021 in accordance with applicable securities laws and the […]

Click here to view original web page at www.juniorminingnetwork.com

Orano Canada Inc. Completes First Earn-In Option and Forms Joint Venture with Skyharbour at the Preston Uranium Project

Skyharbour Resources Ltd. announces that Orano Canada Inc. has completed the first earn-in option of a 51% interest in the Preston Uranium Project located in the western Athabasca Basin, Saskatchewan, Canada. Orano previously held an option to acquire the interest through an option agreement entered into with Skyharbour and Dixie Gold Inc. . Project Location – Western Athabasca Basin, Saskatchewan, Canada: Orano …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company or Skyharbour”) announces that Orano Canada Inc. (“Orano”) has completed the first earn-in option of a 51% (fifty-one percent) interest in the Preston Uranium Project (“Project”), located in the western Athabasca Basin, Saskatchewan, Canada. Orano previously held an option to acquire the interest through an option agreement entered into with Skyharbour and Dixie Gold Inc. (“Dixie Gold”).

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdf

Orano has fulfilled their first earn-in […]

Orano Canada Inc. (“Orano”) Completes First Earn-In Option and Forms Joint Venture with Skyharbour at the Preston Uranium Project

VANCOUVER, British Columbia, March 26, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company or Skyharbour”) announces that Orano Canada Inc. (“Orano”) has completed the first earn-in option of a 51% (fifty-one percent) interest in the Preston Uranium Project (“Project”), located in the western Athabasca Basin, Saskatchewan, Canada. Orano previously held an option to acquire the interest through an option agreement entered into with Skyharbour and Dixie Gold Inc. (“Dixie Gold”).

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdfOrano has fulfilled their first earn-in option interest in the project by completing CAD $2.8 million in staged exploration expenditures and making a total of CAD $200,000 in cash payments over the previous three years, divided evenly between Skyharbour and Dixie Gold. Orano has spent a total of CAD $4.8 million on the Project to date.

Following acquisition of the […]

Click here to view original web page at www.globenewswire.com

Canaccord Genuity slashes price target on Uranium Energy Corp. [UEC] – find out why.

Uranium Energy Corp. [AMEX: UEC] stock went on an upward path that rose over 1.15% on Wednesday, amounting to a one-week price decrease of less than -10.17%. The company report on March 22, 2021 that Uranium Energy Corp Completes Financing to Expand Physical Uranium Initiative.

Uranium Energy Corp (NYSE: UEC), (the “Company” or “UEC”) is pleased to announce the closing of its previously announced offering of an aggregate of 10,000,000 shares of common stock of the Company (each, a “Share”) at a purchase price of $3.05 per Share and for gross proceeds of $30,500,000 in a registered direct offering (the “Offering”).

Even if you’re not actively in crypto, you deserve to know what’s actually going on…

Because while leading assets such as Bitcoin (BTC) and Ethereum (ETH) are climbing in value, a select group of public “crypto stocks” are surging right along with them. More importantly, these stocks are outpacing the returns […]

Uranium provides climate-friendly energy

Receive up-to-date information about the company directly via push notification

The earth’s population quadrupled between 1900 and 2000. At the same time, the demand for energy increased about tenfold. The use of fossil fuels also led to a massive increase in greenhouse gases. To ensure that greenhouse gas emissions do not continue to grow, climate-friendly energy generation that is not based on fossil fuels is needed.

This is where wind and hydroelectric power, as well as nuclear power plants, come into play. The world’s first nuclear power plant was commissioned in 1954 in Russia, in Obninsk. A year later, a power plant went into operation in England, which is considered the world’s first commercial nuclear power plant. Submarines and aircraft carriers were then also nuclear powered.

Enriched uranium is used as fuel in the nuclear power plants. The initial investment for a power plant and the dismantling costs are very high, […]

Click here to view original web page at www.resource-capital.ch

Denison Mines Announces Closing of US$86.3 Million Financing in Support of Strategic Acquisition of Physical Uranium

US$86,273,000, which included 10,230,000 units through the full exercise of the underwriters’ over-allotment option.

Each unit consists of one common share and one-half of one transferable common share purchase warrant of the Company. Each full warrant is exercisable to acquire one Company common share at an exercise price of US$2.25 for 24 months after issuance. The warrants are not listed.

The Offering was completed through a syndicate of underwriters co-led by Cantor Fitzgerald Canada Corporation, as sole-bookrunner, and Haywood Securities Inc., and including Scotia Capital Inc., Canaccord Genuity Corp., TD Securities Inc., BMO Nesbitt Burns Inc., Cormark Securities Inc., Raymond James Ltd. and Paradigm Capital Inc.

Net proceeds of the Offering are anticipated to be used to fund the strategic purchase of uranium concentrates ("U 3 O 8 ") to be held by Denison as a long-term investment, intended to support the potential future financing of the advancement and/or construction of the […]

Click here to view original web page at www.juniorminingnetwork.com

After Financing Close, Texas Company Now Cashed Up to Expand Uranium Inventory News Update

In a news release , Uranium Energy Corp. (UEC:NYSE AMERICAN) announced it closed on March 17, 2021, its registered direct offering, generating gross proceeds of $30.5 million.

The company stated that the funds will be used for additional uranium purchases and general corporate and working capital purposes. "Uranium Energy Corp.’s physical uranium initiative is fully funded with cash on hand," the release noted.

Uranium Energy reported that, following the close of financing, it has about $95 million in cash and equity holdings, $61 million of it in cash. It intends to use the monies to continue building its uranium stockpile and as general corporate and working capital.

For the financing, the energy company issued 10 million Uranium Energy common shares at a purchase price of $3.05 apiece.UEC reported that physical uranium initiative "now includes 1.4 million pounds of U.S. warehoused uranium with 1,000,000 pounds delivered by May 2021 and another 400,000 pounds […]

Click here to view original web page at www.streetwisereports.com

With uranium for energy production and vanadium for energy storage, WSTRF’s focus is in their 100% owned Sunday Mine Complex in Colorado

US uranium miners look set to prosper in 2021 if President Biden can successfully legislate his plan for 100% carbon free electricity by 2035. That is because the US currently gets about 55% of its carbon-free electricity from nuclear power which relies on uranium as its feed source. 100% carbon free US electricity will mean a massive boost towards solar, wind, and nuclear energy. Another boost for US uranium producers will be the US$150M pa proposed for the next 10 years to build a US uranium reserve. Combine all this with a global deficit of uranium (constrained supply and growing demand) and we get the perfect tailwind for US uranium miners in 2021.

Clearly, the market is already seeing this with leading US uranium miners such as Energy Fuels Inc. (NYSE American: UUUU | TSX: EFR) ( +471% ) and Ur‐Energy Inc. (NYSE American: URG | TSX: URE) ( +238% […]

TNT Mines set to drill US uranium targets

The entry gate to a uranium prospecting area in the Uravan mineral belt in Utah, in the western USA. Credit: File TNT Mines is preparing to drill test its key, high-grade uranium targets at the East Canyon project in Utah. The company is in the process of paying the requisite bonds to the US government and entering the final phase of the drill permitting process. Exploration is currently being designed to test various targets across the company’s holdings, with initial drilling likely to focus on a nest of historical workings in the north of TNT’s tenure, including the None Such and Bonanza targets.

The company says despite the outstanding results from sampling and the broad zones of uranium mineralisation outlined across its East Canyon holdings, the move to drilling has taken longer than expected due to the approvals process. TNT is now in the final stages of receiving its permits […]

Skyharbour’s Partner Company Azincourt Energy Reports 2021 Winter Drill Program Shut Down Due to Warm Weather on The East Preston Uranium Project

VANCOUVER, British Columbia, March 23, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy Corp. (“Azincourt”) is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdfUnseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of the diamond drill program approximately two weeks earlier than expected. Daytime temperatures above zero with only mild freezing temperatures at night is resulting in the rapid deterioration of ice crossings over rivers and swamps. In the interest of crew safety and environmental responsibility, the decision was taken to defer the remaining meterage in the program until later in the year.

The 2021 exploration program was planned […]

Click here to view original web page at www.globenewswire.com

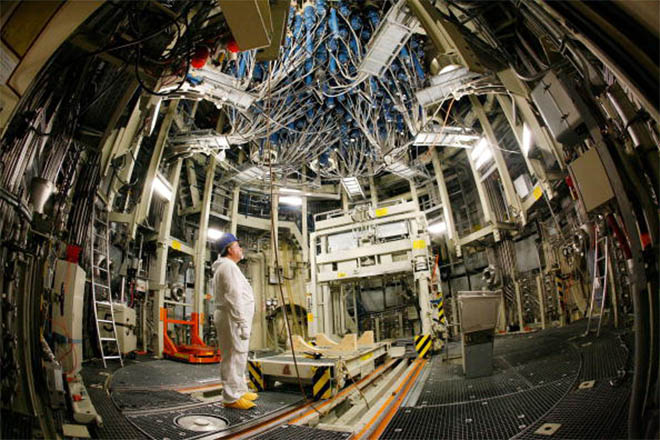

Smaller uranium companies buy up material atop global hype for nuclear power

An employee assesses the control rods unit for fuel elements while the reactor is turned off for a routine inspection at a nuclear power plant in Kruemmel, Germany, on Aug. 15, 2007. Recent plays in the uranium spot market have occurred amid a torrent of change in the nuclear power space.

Source: Krafft Angerer /Getty Images News via Getty Images Uranium juniors faced with the prospects of a nuclear renaissance and prices below the cost of production are trying to capitalize on their dilemma with a simple strategy: buy, buy, buy.U.K.-based uranium purchaser Yellow Cake PLC elected March 15 to fully exercise its $100 million uranium purchase option for 2021 with JSC National Atomic Co. Kazatomprom and agreed to purchase another 440,000 pounds from the Kazakh uranium major. The move may prompt Kazatomprom, which is the largest uranium producer in the world, to purchase material on the spot […]

Skyharbour’s Partner Company Azincourt Energy Reports 2021 Winter Drill Program Shut Down Due to Warm Weather on The East Preston Uranium Project

Skyharbour Resources Ltd. partner company Azincourt Energy Corp. is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada. Project Location – Western Athabasca Basin, Saskatchewan, Canada: Unseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy Corp. (“Azincourt”) is announcing that the 2021 winter exploration program has been shut down at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada.

Project Location – Western Athabasca Basin, Saskatchewan, Canada:

https://skyharbourltd.com/_resources/maps/SYH-Patterson-Lake.pdf

Unseasonably warm weather during the first two weeks of March and rapid snow melt has forced the termination of the diamond drill program approximately two weeks earlier than expected. Daytime temperatures above […]

Denison Mines Is a Uranium Mining Stock That Requires Too Much Care

Denison Mines (NYSEAMERICAN: DNN ) is a Canadian uranium mining company with an outsized valuation and penny stock status. As such, investors should be careful about investing in DNN stock, as it is likely to be quite volatile. The Toronto-based company has a major prospective uranium mining project in northern Saskatchewan called the Wheeler River project . A Seeking Alpha analyst says that this project has a “ positive net present value at the current spot uranium prices .” However, he believes that DNN stock is still overvalued. Recent Capital Raises

Nevertheless, Denison Mines has astutely raised capital at several price points recently. On Feb. 11, the company raised $25 million before broker greenshoe options, as well as 8 million CAD in “flow-through” shares and warrants with a $2.00 per share exercise price.

This is after DNN stock shot up from 33 cents per share in November 2020, to as […]

Centrus Provides Update on Construction of America’s First HALEU Production Facility

BETHESDA, Md., March 23, 2021 /PRNewswire/ — Centrus Energy Corp. (NYSE American: LEU) is providing an update on construction of the nation’s first production facility for High-Assay, Low-Enriched Uranium (HALEU) in Piketon, Ohio.

"Despite the impact of the pandemic and the extraordinary steps we have taken to protect our workforce – including limiting the number of people who can be on the construction site at any one time – we have kept construction on track and expect to begin producing HALEU by next year," said Centrus President and CEO Daniel B. Poneman. "We believe this first-of-a-kind facility can play a critical role in meeting both government and commercial requirements for HALEU, powering America’s nuclear leadership as the world turns to a new generation of advanced reactors and advanced nuclear fuels."

Under a 2019 contract with the U.S. Department of Energy’s Office of Nuclear Energy, Centrus is licensing and constructing a cascade […]

Uranium Has That Healthy Glow Again

The last time Cameco saw year-over-year net income growth was 2015, when the spot price of uranium oxide hovered above $35 a pound for most of the year. Since then, the commodity’s price has mostly stayed below $30 a pound, though it seems to be recovering quickly. As of Monday, the spot price was $29.60 a pound, up 7.3% in one week, according to data from nuclear fuel market research firm UxC. Uranium is mostly sold on contracts with utilities rather than via the spot market. Jonathan Hinze, president of UxC, notes that among nonsubsidized mines, the all-in cost of production can range anywhere from $10 a pound up to $38 a pound.

The supply-demand picture appears unchanged from last year, but this masks the underlying dynamics of an opaque and long-cycle industry . In 2021 global uranium demand is expected to shrink slightly to 178 million pounds from 2020’s […]

What’s going on with ASX uranium share Marenica Energy’s (ASX:MEY) share price today?

The Marenica Energy Ltd (ASX: MEY) share price was on the move earlier today. However, after posting gains of 3.3% in afternoon trading, the share price is currently flat. This comes after the ASX uranium explorer reported successful early results at one of its projects in Namibia. In addition, Marenica currently holds the largest area of uranium exploration leases in the African nation. What uranium exploration results did Marenica Energy report?

Marenica’s shares moved higher earlier today after the company reported it had discovered an extensive palaeochannel system during its maiden geophysical exploration program at its Namib IV prospect.

The exploration program is intended to reveal uranium mineralisation zones. Additionally, the company said the system it has discovered extends for more than 19 kilometres. Management commentary

Commenting on the exploration results, Marenica’s managing director, Murray Hill said: The structure of this palaeochannel system at Namib IV is extremely promising […]

Energy Fuels helping to restore US rare earth production

The company supplies uranium (U3O8) to major nuclear utilities and can also produce vanadium from some projects as market conditions allow → Largest producer of uranium in the US

Leading producer of vanadium used in batteries, steel, and chemical industries

Recovering rare earth elements (REEs) at White Mesa mill in Utah

What Energy Fuels does: Energy Fuels Inc ( TSE:EFR ) ( NYSEMKT:UUUU ), headquartered in Colorado, is a fully integrated producer of both uranium and vanadium, and owner of the only operating conventional uranium mill at White Mesa in Utah.It supplies uranium (U3O8) to major nuclear utilities and can also produce vanadium from some projects as market conditions allow.The firm’s White Mesa mill has a licensed capacity to produce over eight million pounds of uranium a year, and can generate vanadium when market conditions warrant. The mill is also licensed for the production of other minerals, including tantalum, […]

Click here to view original web page at www.proactiveinvestors.com

MiningNewsBreaks – Uranium Energy Corp. (NYSE American: UEC) Secures $30.5M in Registered Direct Offering

Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here .

Uranium Energy (NYSE American: UEC) , a Corpus Christi, Texas-based uranium mining and exploration company, has closed its previously announced offering of an aggregate of 10,000,000 shares of common stock of the company. Per an update released today, Uranium Energy secured gross proceeds of $30,500,000 in the registered direct offering, with each of the shares sold at a purchase price of $3.05. The company offered and sold the shares per a securities purchase agreement, dated March 17, 2021, with certain institutional investors. UEC intends to use the net proceeds for additional uranium purchases and for general corporate and working capital purposes. The company has approximately $95 million in cash and equity holdings, which includes $61M in cash, following the closing of this offering. In addition, UECs physical uranium initiative […]

Click here to view original web page at www.streetinsider.com