Uranium Energy Corp. (UEC) is priced at $2.19 after the most recent trading session. At the very opening of the session, the stock price was $2.28 and reached a high price of $2.32, prior to closing the session it reached the value of $2.21. The stock touched a low price of $2.21.

Recently in News on June 25, 2021, Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio. NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”. You can read further details here

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off! Get […]

ESA reviews COVID impacts on supply and demand

The COVID-19 pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services, the Euratom Supply Agency (ESA) says in its newly released 2020 Annual Report . The report provides an overview of nuclear fuel supply and demand in the EU. (Image: Pixabay)

"In 2020, in response to the Covid-19 pandemic, nuclear installation operators and national regulatory authorities in the EU implemented exceptional measures to maintain essential operations, whilst prioritising nuclear safety," ESA notes in the report .

"The Coronavirus pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services. Spot U3O8 prices have risen substantially with further upward expectations. The conversion market that experienced price increases in the past two years due to […]

Click here to view original web page at www.world-nuclear-news.org

Western Uranium & Vanadium Announces Mining Restart at the Sunday Mine Complex

Toronto, Ontario and Nucla, Colorado, July 06, 2021 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) (“Western” or the ”Company”) is pleased to announce that it is preparing for the resumption of mining activities at the Sunday Mine Complex (“SMC”). This action is driven by COVID-19 risks declining and the improved fundamentals and outlook for uranium and vanadium commodities. The Sunday Mine, West Sunday Mine, St. Jude Mine, and Carnation Mine, which are interconnected, will be moved into Active Status from Temporary Cessation. This project which began in 2019 will shift its base of operations from the St. Jude Mine to the Sunday Mine. The team will be targeting these different areas with development drilling, development mining, and ore production.

Western is undertaking this project to enhance the value of the SMC by further differentiating the facility among the very few mines in North America that […]

Click here to view original web page at www.globenewswire.com

Uranium Week: Approval For Uranium Investment Fund

As the uranium spot price fell marginally last week, further progress was made to list the first physical uranium fund in both Canada and the US.

-Shareholder approval for creation of uranium investment vehicle

-Bannerman Resources advances project in Namibia

-Uranium spot price falls by less than -1% for the weekShareholders of Canadian-listed uranium investor Uranium Participation Corp (UPC) have approved a proposed plan of arrangement to reorganise UPC into the Sprott Asset Management-run investment-fund listed on the Toronto Stock Exchange. UPC is the world’s largest publicly-traded investment vehicle offering exposure to uranium, outside of traditional mining company shares.In explaining last week’s lack of activity in the spot uranium market, independent consultant TradeTech observed both buyers and sellers were hesitant to commit to transactions immediately before the July 7 vote by UPC shareholders to approve the creation of the Sprott Physical Uranium Trust.Since confirmation of the vote in […]

Uranium Energy Corp. [UEC] gain 30.68% so far this year. What now?

Uranium Energy Corp. [AMEX: UEC] price surged by 4.07 percent to reach at $0.09. The company report on June 25, 2021 that Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio.

NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”.

To hear the AudioPressRelease, please visit: The NetworkNewsAudio News Podcast.

A sum of 4357647 shares traded at recent session while its average daily volume was at 5.52M shares. Uranium Energy Corp. shares reached a high of $2.36 and dropped to a low of $2.19 until finishing in the latest session at $2.30.The one-year UEC stock forecast points to a potential upside of 41.18. The average equity rating for UEC stock is currently 1.70, trading closer to a bullish pattern in the stock market. Guru’s Opinion on Uranium Energy Corp. [UEC]: Based on careful and fact-backed analyses […]

Uranium Mining Market Size 2021: Market Share, Top Companies report covers are Kazatomprom,Cameco,ARMZ,Areva,BHP Billiton,CNNC,Pa

The MarketWatch News Department was not involved in the creation of this content.

Jul 12, 2021 (The Expresswire) — “ Uranium Mining Market “ Size, Status and Market Insights 2021,

,Uranium Mining Market By Type (Granite-Type Uranium Deposits,Volcanic-Type Uranium Deposits,Sandstone-Type Uranium Deposits,Carbonate-Siliceous-Pelitic Rock Type Uranium Deposits,,), By Application ( Military,Electricity,Medical,Industrial,Others, ) Geography (North America (United States, Canada and Mexico), South America (China, Japan, Korea, India and Southeast Asia), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), Middle East and Africa (Saudi Arabia, Egypt, Nigeria and South Africa)) Industry Trends 2021.

Global Uranium Mining market size will increase to Million USD by 2025, from Million USD in 2018, at a CAGR of during the forecast period. In this study, 2018 has been considered as the base year and 2019 to 2025 as the forecast period to estimate the market size for Uranium Mining.This report […]

Okapi Resources lands ‘transformational’ US uranium deal

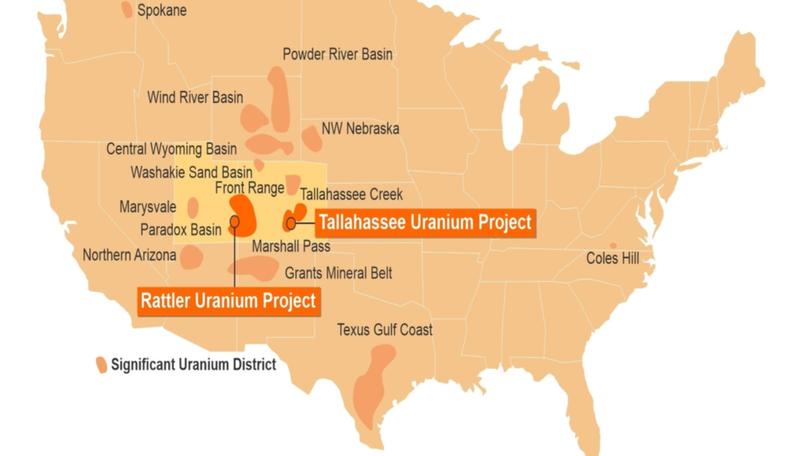

Location map of Okapi Resources’ new US uranium project areas. Credit: File ASX-listed junior explorer Okapi Resources has scored a potentially company-making package of high-grade brownfields uranium assets in the uranium friendly jurisdiction of the US via an all-scrip acquisition of private Australian outfit Tallahassee Resources.

The Perth-based company will pay the vendors of Tallahassee Resources 33.5 million new Okapi shares and 16.75 million options as consideration for the deal, subject to shareholder and statutory approvals.

Okapi will assume 100 per cent ownership of the mineral rights over the Tallahassee uranium project tenure spanning about 7,500 acres in central Colorado’s prolific Tallahassee Creek uranium district about 140km south-west of Denver.

Also included in the newly acquired Tallahassee Resources portfolio of properties is an option for Okapi to acquire 100 per cent of the Rattler uranium project, including the historical high-grade Rattlesnake open-cut mine in north-eastern Utah.In tandem with what Okapi management describes […]

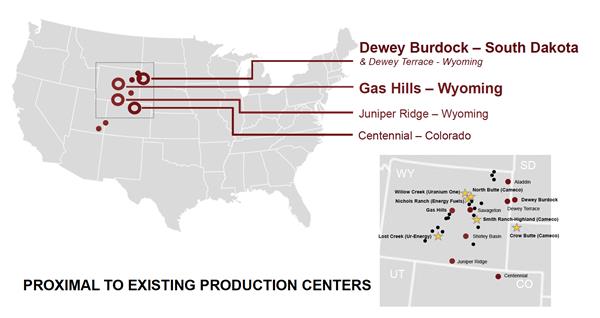

America’s Next Uranium Developer Scores BUY Ratings from Analysts

(Image via Azarga Uranium) The COVID-19 pandemic has put a lot of markets to the test, but one commodity that has performed quite well since the beginning of last year is uranium – growing more than $7 (USD) or 32% in value to $32.70 (USD) / lb.

According to analysts, this trend is expected to continue upward. A top player in this space – Azarga Uranium ( TSX: AZZ , OTCQB: AZZUF , Forum ) released positive results of an independent Preliminary Economic Assessment (PEA) in late June 2021 on its Gas Hills In-situ recovery (ISR) Uranium Project in Wyoming, following an increased mineral resource estimate announced by the Company in March.

The base case economic assessment results in a pre-income tax internal rate of return (IRR) of 116% and a pre-income tax net present value (NPV) of $120.9 million (USD) when applying an 8% discount rate. Using the same […]

Okapi steps into uranium space with Tallahassee acquisition

Okapi Resources will jump into the budding uranium sector with an agreement to acquire a portfolio of large, high-grade assets in the US. Okapi (ASX:OKR) has reached a binding agreement to acquire Tallahassee Resources, which owns the Tallahassee Uranium Project in Colorado and also holds an option to acquire the Rattler Uranium Project in Utah. The Tallahassee Uranium Project was previously part of former ASX listed company Black Range Minerals and has a JORC 2004 Mineral Resource estimate of 26 million pounds of U3O8 at a grade of 540ppm U3O8, with significant exploration upside.

Black Range had a market capitalisation in excess of $180 million in 2007, before the existing resource was defined. Okapi’s market capitalisation prior to announcing the transaction was just $11.7 million.

An assessment of the market capitalisation of Okapi’s ASX-listed uranium developer industry peers measured against their defined mineral resources delivered a mean valuation $2.17 per pound.

Against […]

RBC Says Social Media Activity Is Boosting Uranium Prices

Growing social media attention on uranium is surely playing a role in the latest surge in its equity valuations . According to the study “Uranium Outlook” by RBC Elements, the 230% increase in monthly mentions since December 2020 concurs with the recent valuation run-up. Is this something investors should keep track of if they are interested in dabbling into the radioactive metal’s sector? This certainly is a trillion-dollar question. Social Media Activity Bolsters Uranium Valuations

RBC Elements has been tracking the activity of uranium equities on social media over the last 10 years, and it has come to some pretty interesting conclusions.

“As uranium market fundamentals have improved only modestly in the past 6 months compared to the sharp rise in equity values, we believe increased social media attention may be contributing to higher valuations,” according to the report

RBC analysts agree that continuing social media activity could keep uranium valuations […]

ESA reviews COVID impacts on supply and demand

The COVID-19 pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services, the Euratom Supply Agency (ESA) says in its newly released 2020 Annual Report . The report provides an overview of nuclear fuel supply and demand in the EU. (Image: Pixabay)

"In 2020, in response to the Covid-19 pandemic, nuclear installation operators and national regulatory authorities in the EU implemented exceptional measures to maintain essential operations, whilst prioritising nuclear safety," ESA notes in the report .

"The Coronavirus pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services. Spot U3O8 prices have risen substantially with further upward expectations. The conversion market that experienced price increases in the past two years due to […]

Click here to view original web page at www.world-nuclear-news.org

Why Uranium Energy Corp. (NYSE:UEC) Stock Might Be A Good Investment

Uranium Energy Corp. (NYSE:UEC) at last check was buoying at $2.26 on Friday, Jul 09 with a rise of 2.26% from its closing price on previous day.

Taking a look at stock we notice that its last check on previous day was $2.21 and 5Y monthly beta was reading 2.43 with its price kept floating in the range of $2.1900 and $2.2900 on the day. Company’s P/E ratio for the trailing 12 months is 0. Considering stock’s 52-week price range provides that UEC hit a high price of $3.67 and saw its price falling to a low level of $0.82 during that period. Over a period of past 1-month, stock came losing -32.83% in its value.

With its current market valuation of $529.54 Million, Uranium Energy Corp. is set to declare its quarterly results on December 15, 2020. UEC Stock’s Forward Dividend of 0 and its yield of 0% are making […]

RBC Says Social Media Activity Is Boosting Uranium Prices

Growing social media attention on uranium is surely playing a role in the latest surge in its equity valuations. According to the study “Uranium Outlook” by RBC Elements, the 230% increase in monthly mentions since December 2020 concurs with the recent valuation run-up. Is this something investors should keep track of if they are interested in dabbling into the radioactive metal’s sector? This certainly is a trillion-dollar question. Social Media Activity Bolsters Uranium Valuations

RBC Elements has been tracking the activity of uranium equities on social media over the last 10 years, and it has come to some pretty interesting conclusions.

“As uranium market fundamentals have improved only modestly in the past 6 months compared to the sharp rise in equity values, we believe increased social media attention may be contributing to higher valuations,” according to the report

RBC analysts agree that continuing social media activity could keep uranium valuations high […]

GTI connecting the dots on its Utah uranium middle ground

When GTI Resources struck a deal in October last year to secure the land between its Rats Nest and Jeffrey uranium projects in Utah, it took hold of a prospective uranium canvas. The package of land, acquired from Anfield Energy , consolidated GTI’s (ASX:GTR) landholding over a contiguous 5.5km interpreted mineralised trend at its Utah projects – a means by which the company could look to connect the dots between the promising signs at its already-held projects on either side. Home to some substantial historic workings, the ground in the middle had some serious claim to exploration in its own right – work currently being undertaken by the GTI team.

“The package of land we bought has quite a significant underground development on it – it’s probably one of the most recently mined parts of that area,” GTI executive director Bruce Lane told Stockhead .

“Section 36 was mined in the […]

Top Stories This Week: Price Potential for Uranium, Rob McEwen on Gold’s Breakout Point

2021 is now half over, and so far the second part of the year has been positive for the gold price. The yellow metal has been on the rise since the start of July, moving from around the US$1,770 per ounce level to just above US$1,800 at the time of this writing on Friday (July 9).

Despite that increase, many market participants believe gold should be higher. This week I heard from Rob McEwen of McEwen Mining (TSX: MUX ,NYSE:MUX) on why he thinks gold hasn’t broken out.

Uranium Soared Last Year While Other Resources Tumbled

What’s In Store For Uranium This Year? Find Out In Our Exclusive FREE 2021 Uranium Outlook Report featuring trends, forecasts, expert interviews and more! Rob is well known for his US$5,000 gold prediction, and in his opinion, there are a few factors holding the precious metal back. Those are the belief that inflation is […]

GTI connecting the dots on its Utah uranium middle ground

When GTI Resources struck a deal in October last year to secure the land between its Rats Nest and Jeffrey uranium projects in Utah, it took hold of a prospective uranium canvas. The package of land, acquired from Anfield Energy , consolidated GTI’s (ASX:GTR) landholding over a contiguous 5.5km interpreted mineralised trend at its Utah projects – a means by which the company could look to connect the dots between the promising signs at its already-held projects on either side.

Home to some substantial historic workings, the ground in the middle had some serious claim to exploration in its own right – work currently being undertaken by the GTI team.

“The package of land we bought has quite a significant underground development on it – it’s probably one of the most recently mined parts of that area,” GTI executive director Bruce Lane told Stockhead .

“Section 36 was mined in the 1970s […]

Sprott’s uranium ETF aims to provide liquidity

Sprott currently manages four different commodity stockpiling funds, with more than $12 billion in assets, including: the Sprott Physical Gold Trust (PHYS), one of the world’s largest physical gold vehicles; and the Sprott Physical Silver Trust (PSLV), the fastest-growing silver bullion fund.

These physical-metal strategies are listed on both the Toronto and New York stock exchanges and boast a global client base of more than 200,000 investors. Now, Sprott is creating the Sprott Physical Uranium Trust (SPUT), an entity that has agreed to a transaction with Uranium Participation Corporation (UPC), the world’s first and largest publicly-traded physical uranium investment vehicle.

UPC has a diverse shareholder base ranging from individual investors to institutions, hedge funds and family offices.

The company holds its uranium at licensed storage locations in Canada, the US and Europe, and at the end of May 2021 held 19.3 million pounds of U 3 O 8 and other products with […]

Standard Uranium Ltd. Announces Brokered Private Placement for Up to C$4.0 Million

a minimum of 4,166,667 units of the Company (each, a “ Unit ”) at a price of C$0.24 per Unit for minimum gross proceeds of C$1,000,000;

flow-through units of the Company (each, a “ FT Unit ”) at a price of C$0.265 per FT Unit; and

flow-through units of the Company sold to charitable buyers (each, a “ Charity FT Unit ”, and collectively with the FT Units and Units, the “ Offered Securities ”) at a price of C$0.32 per Charity FT Unit.

Each Unit will consist of one common share of the Company (each a “ Unit Share ”) and one half of one common share purchase warrant (each whole warrant, a “ Warrant ”). Each FT Unit will consist of one common share of the Company to be issued as a “flow-through share” within the meaning of the Income Tax Act (Canada) (each, a “ FT […]

Click here to view original web page at www.juniorminingnetwork.com

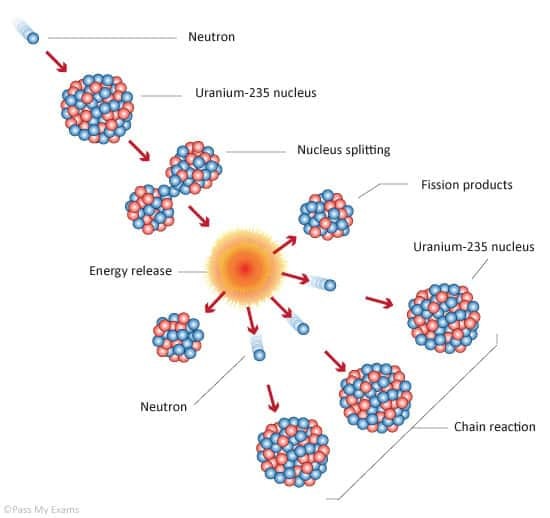

How to Invest in the Best Uranium Mining Stocks

Nuclear energy is having a resurgence lately, thanks to advanced nuclear technologies and an increased investor interest in clean energy sources. Nuclear power is not strictly renewable – it uses uranium as its fuel – but it is certainly green. Currently, nuclear power provides about 10% of the world’s electricity , and 18% of electricity in OECD countries. While the bulls believe technology will increase nuclear capacity, the bears point to a dismal growth forecast. The International Atomic Energy Agency expects nuclear capacity to grow by 82% over the coming 30 years – a meager 2% c ompound a nnual g rowth r ate ( CAGR ).

For those who are bullish on the growth of nuclear energy, there aren’t many pure-play nuclear energy stocks out there. An alternative approach might be a pick-and-shovel play on nuclear energy – uranium stocks – since existing power plants will need fuel indefinitely. […]

Yellowcake Towns: Uranium Mining Communities in the American West

Table of Contents

> Introduction Introduction (pp. xv-xxvi) Since the end of the Cold War in 1989, Americans have begun to consider seriously the social costs exacted by the development of the atom. Recent disclosures have revealed radiation tests conducted on unknowing children. Similar studies have probed cancer rates in the intermontane West presumably caused by nuclear testing. Still others have examined the survival of cities such as Hanford, Washington, and Los Alamos, New Mexico, where the first bombs and reactors were manufactured.¹ But little scholarly attention has been directed to the supply side of the industry. Although some recent works have examined the environmental consequences of uranium…

Chapter 1 From Weed to Weapon: U.S. Uranium, 1898–1945 Chapter 1 From Weed to Weapon: U.S. Uranium, 1898–1945 (pp. 1-16) In the early days of World War II, Cliff Hiett, a young vanadium mill worker from the small Western Slope […]

ESA reviews COVID impacts on supply and demand

The COVID-19 pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services, the Euratom Supply Agency (ESA) says in its newly released 2020 Annual Report . The report provides an overview of nuclear fuel supply and demand in the EU. (Image: Pixabay)

"In 2020, in response to the Covid-19 pandemic, nuclear installation operators and national regulatory authorities in the EU implemented exceptional measures to maintain essential operations, whilst prioritising nuclear safety," ESA notes in the report .

"The Coronavirus pandemic has significantly influenced the uranium market as several companies announced in the second quarter of 2020 measures leading to an important decrease of uranium production and related services. Spot U3O8 prices have risen substantially with further upward expectations. The conversion market that experienced price increases in the past two years due to […]

Click here to view original web page at world-nuclear-news.org

Understanding Global X Uranium ETF’s Unusual Options Activity

Thousands of traders just like you are using Benzinga Options to learn the formula that Nic Chahine uses to earn a full-time living. Click here to see how you can learn while you earn.

Global X Uranium ETF (NYSE: URA ) shares experienced unusual options activity on Wednesday. The stock price moved down to $20.7 following the option alert. Sentiment: BULLISH

Option Type: SWEEP

Trade Type: PUT Expiration Date: 2021-10-15 Strike Price: $19.00 Volume: 1647 Open Interest: 14213 Three Indications Of Unusual Options Activity Exceptionally large volume (compared to historical averages) is one reason for which options market activity can be considered unusual. The volume of options activity refers to the number of contracts traded over a given time period. The number of contracts that have been traded, but not yet closed by either counterparty, is called open interest. A contract cannot be considered closed until there exists […]

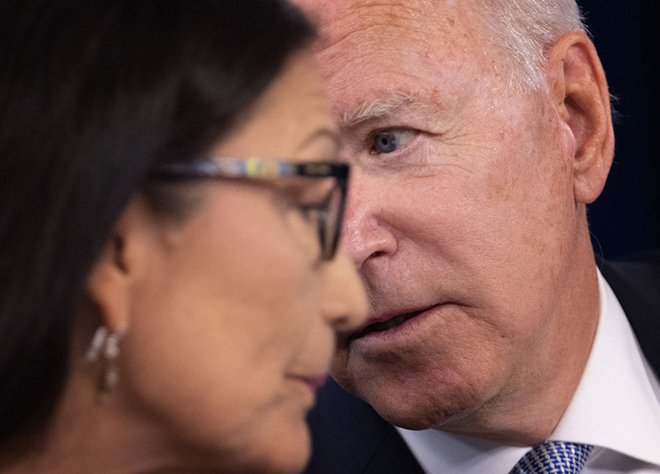

Uranium not a ‘critical mineral’ according to law, US minerals agency says

U.S. President Joe Biden confers with Interior Secretary Deb Haaland during an event with governors of western states and members of his cabinet June 30, 2021 in Washington, DC. Haaland previously cosponsored legislation that would have removed uranium from the federal list of critical minerals. Source: Win McNamee/Getty Images News via Getty Images The leading U.S. minerals science agency said uranium is not qualified for inclusion on the federal list of commodities essential to national and economic security, though it did not state whether it should be removed from that list.

The Critical Minerals List is a record of which minerals the U.S. government considers essential to its security. Created under the Trump administration, the list has been cited in policy actions focused on permitting, grant funding and research and development. Congress passed pandemic stimulus legislation in December 2020 that required the U.S. Geological Survey, which oversees the list, […]

VIDEO — Lobo Tiggre: What Does (and Doesn’t) Matter for Uranium Right Now

There have been a number of interesting announcements in the uranium space so far this year. But which ones are important and what news may be overhyped? Speaking to the Investing News Network, Lobo Tiggre, founder and CEO of IndependentSpeculator.com , shared his thoughts on where uranium investors should direct their attention right now.

One factor that’s made headlines in recent months is physical uranium purchases from companies in the space. As Tiggre explained, this activity initially spurred expectations for upward price momentum. Uranium Price Forecasts and Top Uranium Stocks to Watch Uranium Soared Last Year While Other Resources Tumbled

What’s In Store For Uranium This Year? Find Out In Our Exclusive FREE 2021 Uranium Outlook Report featuring trends, forecasts, expert interviews and more!

Although uranium is having a good month (and a good year), so far a larger price rise hasn’t materialized.“I wish it had had a bigger impact […]

Bacchus Capital’s Uranium Venture, Yellow Cake plc Reaches Significant Milestone as Market Capitalisation Exceeds US$500 million

LONDON, July 8, 2021 /PRNewswire/ — Bacchus Capital Advisers ("Bacchus Capital"), the independent London-based investment and merchant bank specialising in cross border public market M&A and natural resource and technology sector ventures, is pleased to advise that Yellow Cake plc, a company founded and listed by Bacchus Capital, has achieved and exceeded the milestone market capitalisation of US$500 million. Yellow Cake was listed by Bacchus Capital on the London Stock Exchange in July 2018 with an associated capital raising of US$200 million.

Yellow Cake was established by Bacchus Capital in 2018 on the fundamental premise that uranium ("U 3 O 8 ") as a commodity, is structurally mispriced. Bacchus Capital believes that the central source of this mispricing is the potential significant emerging supply gap, as demand for nuclear power as a low-carbon baseload source continues to increase, while a lack of investment in new supply sees existing mines reaching […]