Share on Facebook

Tweet on Twitter

An Emerging Markets Sponsored Commentary

ORLANDO, Fla., May 26, 2022 (GLOBE NEWSWIRE) — There’s a funny thing about resource companies, particularly those who mine the dirt beneath their feet.Sometimes that earth moves on its own, figuratively of course, but it moves.This virtual movement can be good or bad. Gold buyers saw crypto siphon off investors at one point and the metal didn’t appreciate like most other assets in the recent bull market. The cost of mining gold was likely unchanged, but the spot price in the market wasn’t rising due to external, global factors.But that door of impact swings both ways as we begin to introduce Laramide Resources Ltd. (TSX: LAM) (ASX: LAM) (OTCQX: LMRXF), an exploration and development company, which holds diversified uranium assets strategically positioned in the United States and Australia that have been chosen for their low-cost production potential. […]

Tag: uranium

Uranium Energy Corp.’s (UEC) Stock Is Harder To Predict Than You Think

Uranium Energy Corp. (AMEX:UEC) price on Thursday, May 26, rose 4.75% above its previous day’s close as an upside momentum from buyers pushed the stock’s value to $3.75.

A look at the stock’s price movement, the close in the last trading session was $3.58, moving within a range at $3.54 and $3.81. The beta value (5-Year monthly) was 2.07. Turning to its 52-week performance, $6.60 and $1.89 were the 52-week high and 52-week low respectively. Overall, UEC moved -12.79% over the past month.

Here’s Your FREE Report on the #1 Small-Cap Uranium Stock of ’22.

Small-cap Uranium stocks are booming in 2022! The company we’re about to show you is the ONLY small-cap stock in the space that benefits from ALL aspects of the global Uranium industry with none of the risks of running a mine. Smart investors will not be hesitating on this one!

Get the FREE […]

Traction Uranium Announces Appointment of New Chairman and Management Change

VANCOUVER, British Columbia, May 27, 2022 (GLOBE NEWSWIRE) — Traction Uranium Corp. (the “Company” or “Traction”) (CSE: TRAC) (OTC: TRCTF) (FRA: Z1K), a mineral exploration issuer focusing on the development of discovery prospects in Canada, including its two flagship uranium projects in the world-renowned Athabasca Region, is pleased to announce effective June 1st, 2022 the appointments of Mr. Blair Way, current director of Traction Uranium Corp (see Press Release dated November 5th, 2021) to Chairman of the Board of Directors and the appointment of Tasheel Jeerh as Chief Financial Officer of the Company.

Mr. Way is an experienced international executive with over 35 years experience in the resources and construction industries. Mr. Way’s experience spans the complete mineral development cycle from early-stage exploration to project definition and studies culminating in implementation, commissioning and operations. He spent his early career with large scale resource companies advancing major projects, however the last […]

Click here to view original web page at www.juniorminingnetwork.com

DBRS Morningstar Confirms Ratings on Cameco Corporation at BBB and R-2 (middle), Maintains Stable Trends

DBRS Limited (DBRS Morningstar) confirmed the Issuer Rating and Senior Debt rating of Cameco Corporation (Cameco or the Company) at BBB and the Commercial Paper rating at R-2 (middle).

All trends remain Stable.

The rating confirmations were based on Cameco’s (1) decision to restart its McArthur River/Key Lake complex, which should reduce the higher-cost open market purchases with incremental low-cost production and (2) strong business risk profile because of the Company’s long-life reserves, low operating cost structure, integration across the nuclear fuel cycle, and a portfolio of long-term contractual commitments. The Stable trends were maintained because of the Company’s attractive liquidity profile with $2.5 billion of liquidity available as at March 31, 2022, with no debt maturities until June 2024 and positive pricing momentum for uranium.

While the Coronavirus Disease (COVID-19) pandemic has continued to cause disruptions to global supply chains and an acceleration in inflation, the unrest in Kazakhstan in January […]

Click here to view original web page at www.marketscreener.com

Laramide Resources Commences 2022 Drilling Program at Westmoreland Uranium Project, Queensland, Australia

TORONTO, May 25, 2022 /CNW/ – Laramide Resources Ltd. ("Laramide" or the "Company") is pleased to announce the commencement of a diamond drill program at its Westmoreland Uranium Project in Queensland, Australia ("Westmoreland").

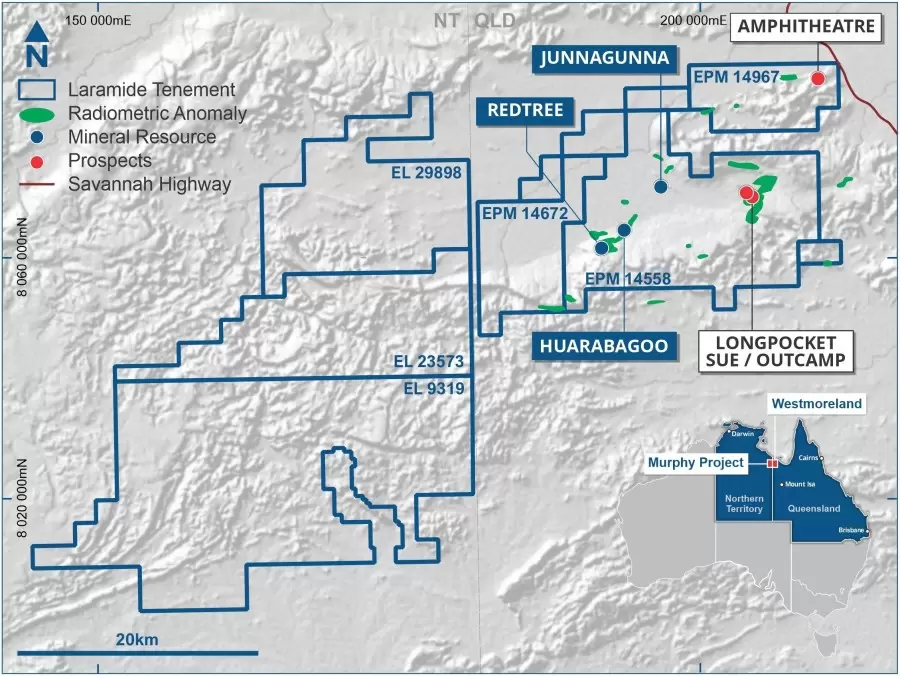

The current phase of the Australian 2022 drilling program is focused on an initial test of a potential satellite deposit called the Amphitheatre prospect ("Amphitheatre"), which is located approximately 16.5km NE of the Junnagunna deposit, one of the three mineralized zones comprising the Westmoreland mineral resource.

Amphitheatre is situated entirely within EPM 14558 (see map below Figure 1) and within an area of previously identified radiometric anomalies but was not considered a priority target by Laramide during their previous drill campaigns at Westmoreland, which were principally focused on converting historical resources to the measured and indicated category in anticipation of the ultimate development of Westmoreland as a large-scale open pit uranium mine.

Figure 1: Current phase will focus […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium for the energy of the future

Receive up-to-date information about the company directly via push notification

Some 325 nuclear reactors are in the planning stage, which would almost double the amount of uranium needed, and 51 nuclear facilities are under construction. These are expected to enter service in the next five years. Investments are focused on energy independence in the wake of current events, and this trend could intensify. Two years of pandemics have led to more attention to the health of the planet. And the Russian invasion and its many consequences show how critical the energy supply situation can become when dependencies exist. For a long time, not least because of the Chernobyl disaster, nuclear energy was demonized, and the price of uranium fell sharply.

Today, the situation looks different. Fukushima has rekindled the fear of nuclear energy, but the taboo of nuclear power seems to have been overcome. Today, nuclear power plants have become […]

Click here to view original web page at www.resource-capital.ch

3 lithium stocks and 1 uranium play on investor radars as the sell-off creates opportunity

It’s the most enduring thematic of our times, and now investors can get exposure at a significantly lower price thanks to the recent impact of rising rates and global strife.

Lithium stocks are already showing the first signs of recovery, while Boss prepares for FID as uranium outlook charges up.

The global decarbonisation thematic is none too worried about the shakedown in equity markets over China’s slowdown and the impact of rising inflation/interest rates in the major economies.

The thematic is alive and well. And it’s here to stay for decades to come, as governments and companies alike combine forces to rein in global carbon emissions from the (renewable and sustainable) electrification of everything.It means decarbonisation is pushing through the current equity market concerns. And because decarbonisation is metals-intensive (including uranium), the thematic acts as a long-term differentiator for mining equity values.That’s not to say that mineral commodities and the equity values […]

Click here to view original web page at www.livewiremarkets.com

Blue Sky Uranium Applies to Extend Warrants

4,203,182 unexercised warrants (4,528,182 original granted) that are set to expire on June 4 and July 11, 2022 to be extended to June 4 and July 11, 2024 respectively. These warrants were originally issued under a private placement completed by the Company in 2 Tranches in June and July 2019.

Of the 325,000 warrants that have been exercised, 100,000 have been exercised by one shareholder within the past 6 months. The Company notes that, at the request of the TSXV, it has received a Consent from this shareholder for this application to extend the expiry date of the remaining warrants.

The exercise price of the warrants will remain at $0.25. Each warrant, when exercised, will be exchangeable for one common share of the Company.

If the volume weighted average price for the Company’s shares is $0.50 or greater for a period of 5 consecutive trading days, then the Company may deliver […]

Click here to view original web page at www.juniorminingnetwork.com

Thorium Market to Witness Growth Acceleration – ARAFURA Resources, Blackwood, Crossland Uranium Mines

“ New Jersey (United States) – Thorium Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Get the PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report @:

https://www.a2zmarketresearch.com/sample-request/101187

Some of the Top companies Influencing this Market include: ARAFURA Resources, Blackwood, Crossland Uranium Mines, Kimberley Rare Earths Metal, Navigator Resources, Western Desert Resources, Steenkampskraal Thorium, Namibia Rare Earth.Various factors are responsible for the market’s growth trajectory, which are studied at length in the report. In addition, the report lists down the restraints that are posing threat […]

Emerging Markets Report: A Case for Uranium

Laramide Resources Ltd. and Emerging Markets Consulting, LLC. Supply Security Among Other Factors Driving Demand for Yellowcake

ORLANDO, Fla., May 26, 2022 (GLOBE NEWSWIRE) — There’s a funny thing about resource companies, particularly those who mine the dirt beneath their feet.

Sometimes that earth moves on its own, figuratively of course, but it moves.

This virtual movement can be good or bad. Gold buyers saw crypto siphon off investors at one point and the metal didn’t appreciate like most other assets in the recent bull market. The cost of mining gold was likely unchanged, but the spot price in the market wasn’t rising due to external, global factors.But that door of impact swings both ways as we begin to introduce Laramide Resources Ltd. (TSX: LAM) (ASX: LAM) (OTCQX: LMRXF), an exploration and development company, which holds diversified uranium assets strategically positioned in the United States and Australia that have been chosen […]

Click here to view original web page at nz.finance.yahoo.com

Uranium price high in the long term

Themen

[PDF] Press Release: Uranium price high in the long term Herisau, 26.05.2022 (PresseBox) – In the long term, experts are talking about a uranium price of $65 per pound or even more.

In many regions, the entry or expansion of nuclear energy is being pursued. Even celebrities like Bill Gates (Microsoft founder) or Warren Buffet want to build hundreds of nuclear power plants. Because climate protection does not work without them. Thus, uranium could develop into an extremely sought-after raw material and offer investors some lucrative opportunities. According to industry insiders, the price of uranium may return to triple digits in the coming years. This is because there is a threat of a supply deficit.

The fact that Russia is a major player in the uranium business is often overlooked. According to the World Nuclear Association, Russia supplies around 35 percent of global demand. Incidentally, the state-owned company Rosatom […]

Future Fuel Completes Acquisition of Cebolleta Uranium Project

VANCOUVER, British Columbia, May 25, 2022 (GLOBE NEWSWIRE) — Future Fuel Corporation (formerly, Evolving Gold Corp.) (the “ Company ”) (CSE: AMPS ) is pleased to announce that it has completed the acquisition (the “ Transaction ”) of all of the outstanding share capital of the privately held Elephant Capital Corp. (“ ECC ”) and has changed its name to “Future Fuel Corporation”. The Transaction proceeded pursuant to a definitive share purchase agreement (the “ Agreement ”) dated April 14, 2022 among the Company, ECC and the former shareholders of ECC (the “ Vendors ”). Following completion of the Transaction, it is anticipated that the common shares of the Company will resume trading on the Canadian Securities Exchange (the “ CSE ”) at the open of markets on May 26, 2022 under the symbol “AMPS” (the “ Listing ”).

ECC is an arms-length resource exploration company, established under the laws […]

Click here to view original web page at www.digitaljournal.com

Analysts’ Recent Ratings Changes for Cameco (CCJ)

→ Goldman Sachs Alum Sounds Alarm on "Next US Crisis" (Ad) A number of firms have modified their ratings and price targets on shares of Cameco (NYSE: CCJ) recently: 5/12/2022 – Cameco was upgraded by analysts at StockNews.com from a “sell” rating to a “hold” rating.

5/11/2022 – Cameco was downgraded by analysts at Zacks Investment Research from a “buy” rating to a “hold” rating. According to Zacks, “Cameco Corporation is one of the world’s largest uranium producers, a significant supplier of conversion services and one of two CANDU fuel manufacturers in Canada. Their competitive position is based on their controlling ownership of the world’s largest high-grade reserves and low-cost operations. Their uranium products are used to generate clean electricity in nuclear power plants around the world. They also explore for uranium in the Americas, Australia and Asia. Their shares trade on the Toronto and New York stock exchanges. […]

Click here to view original web page at www.defenseworld.net

Increased Nuclear Energy Generation Capacity Around The World Having Beneficial Effect On Value of Uranium

Palm Beach, FL – May 25, 2022 FinancialNewsMedia.com News Commentary Uranium is one of the few commodities that has seen two years of solid gains in the midst of the coronavirus pandemic, which most analysts believe indicates that the metal’s price is not dropping any time soon. However, on the supply side, current supply of the metal cannot meet demand. It is expected that constrained supply will push the price of uranium even higher this year. Last year, the price of uranium rose by 45%, going from about $29 per pound at the start of the year to $50 per pound in September. This increase followed growth in 2020, which saw uranium go from $24 in January to $30 by year’s end. Despite not being able to maintain that $50 level, the value of the energy fuel has remained at about $40 since then. An article in Mining News […]

Click here to view original web page at www.digitaljournal.com

Laramide Resources Commences 2022 Drilling Program at Westmoreland Uranium Project, Queensland, Australia

TORONTO, May 25, 2022 /CNW/ – Laramide Resources Ltd. ("Laramide" or the "Company") is pleased to announce the commencement of a diamond drill program at its Westmoreland Uranium Project in Queensland, Australia ("Westmoreland"). Figure 1: Current phase will focus on target area Amphitheatre (CNW Group/Laramide Resources Ltd.) The current phase of the Australian 2022 drilling program is focused on an initial test of a potential satellite deposit called the Amphitheatre prospect ("Amphitheatre"), which is located approximately 16.5km NE of the Junnagunna deposit, one of the three mineralized zones comprising the Westmoreland mineral resource.

Amphitheatre is situated entirely within EPM 14558 (see map below Figure 1) and within an area of previously identified radiometric anomalies but was not considered a priority target by Laramide during their previous drill campaigns at Westmoreland, which were principally focused on converting historical resources to the measured and indicated category in anticipation of the ultimate development […]

FinancialNewsMedia.com: Increased Nuclear Energy Generation Capacity Around The World Having Beneficial Effect On Value of Uranium

FinancialNewsMedia.com News Commentary

PALM BEACH, Fla., May 25, 2022 /PRNewswire/ — Uranium is one of the few commodities that has seen two years of solid gains in the midst of the coronavirus pandemic, which most analysts believe indicates that the metal’s price is not dropping any time soon. However, on the supply side, current supply of the metal cannot meet demand. It is expected that constrained supply will push the price of uranium even higher this year. Last year, the price of uranium rose by 45%, going from about $29 per pound at the start of the year to $50 per pound in September. This increase followed growth in 2020, which saw uranium go from $24 in January to $30 by year’s end. Despite not being able to maintain that $50 level, the value of the energy fuel has remained at about $40 since then. An article in Mining […]

Click here to view original web page at www.finanznachrichten.de

Bellavista IPO sees highly successful mining execs emerge with major stakes

share

Two leading lights of the WA resources industry have emerged as major shareholders of battery minerals explorer Bellavista Resources (BVR) , which makes its eagerly-awaited share market debut today.

Capricorn Resources (ASX: CMM) executive chairman Mark Clark and Bellevue Gold (ASX: BGL) managing director Steve Parsons have each acquired a 10 per cent stake in Bellavista while Capricorn CEO Kim Massey and Bellevue non-executive director, Michael Naylor, will each have a 6 per cent stake.

In addition to these high-profile shareholders, a number of globally significant institutions have invested and will own approximately 12 per cent of the company.On listing, the top 20 shareholders will account for 59 per cent of the company.The Bellavista Prospectus closed heavily over-subscribed on its first day after the company raised $6.5 million in its Initial Public Offering.Bellavista will have a market capitalisation of $13.3 million based on its IPO price of 20c a […]

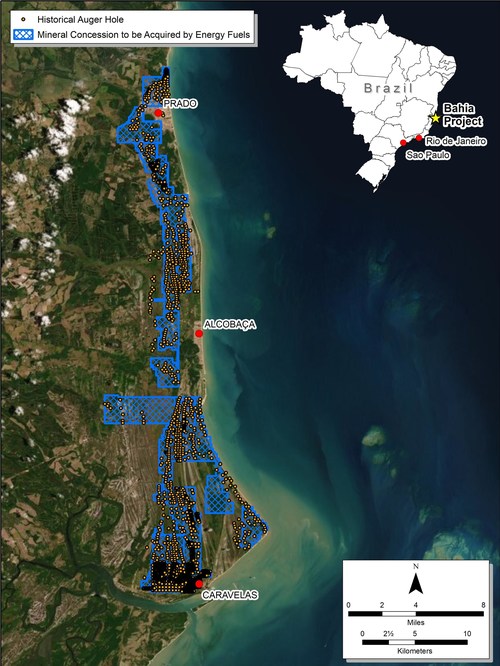

Energy Fuels Secures Major Rare Earth Land Position in Brazil

~58.3 square mile (~37,300 acre) heavy mineral sand position has potential to feed the Company’s White Mesa Mill with rare earth element and uranium bearing natural monazite sand for decades

LAKEWOOD, Colo., May 19, 2022 /CNW/ – Energy Fuels Inc. ( NYSE American: UUUU ) ( TSX: EFR ) ( "Energy Fuels" or the "Company" ) is pleased to announce that it has entered into binding agreements (the " Purchase Agreements ") to acquire seventeen (17) mineral concessions (the " Transaction ") between the towns of Prado and Caravelas in the State of Bahia, Brazil totaling 15,089.71 hectares (approximately 37,300 acres or 58.3 square miles) (the " Bahia Project "). The Bahia Heavy Mineral Sand & Rare Earth Project (CNW Group/Energy Fuels Inc.) Based on significant historical drilling performed to date, it is believed that the Bahia Project holds significant quantities of heavy minerals, including monazite, that will feed […]

Uranium Week: Taking Advantage

Largely absent from the spot market in 2022, utilities last week decided volatility had led the uranium spot price down far enough.

-Spot uranium price falls again on general market volatility

-Utilities pop their heads up

-Activity in term markets remains buoyantHaving all but abandoned a uranium spot market beholden to wider financial market volatility, utilities took advantage of yet another big swoon on markets last week, specifically on Wall Street, which had the spot uranium price tumbling once more.One might be drawing a long bow to connect earnings results from a US grocery chain and a discount retail chain with the demand/supply fundamentals of the nuclear energy industry, but having been sucked into the black hole of financial speculation, the spot uranium market is now but another financial plaything.Industry consultant TradeTech’s weekly spot price indicator fell another -US$4.50 to US$45.50/lb last week in transactions totalling 600,000lbs U3O8 […]

Enriched Uranium Market 2022 Development Stat– Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum

Enriched Uranium Market 2022

The Global Enriched Uranium Market report provides information about the Global industry, including valuable facts and figures. This research study explores the Global Market in detail such as industry chain structures, raw material suppliers, with manufacturing The Enriched Uranium Sales market examines the primary segments of the scale of the market. This intelligent study provides historical data from 2015 alongside a forecast from 2022 to 2026.

Results of the recent scientific undertakings towards the development of new Enriched Uranium products have been studied. Nevertheless, the factors affecting the leading industry players to adopt synthetic sourcing of the market products have also been studied in this statistical surveying report. The conclusions provided in this report are of great value for the leading industry players. Every organization partaking in the global production of the Enriched Uranium market products have been mentioned in this report, in order to study […]

Rising Uranium Prices Precursor to Demand for US Nuclear Products

US Nuclear Corp. (OTC-QB: UCLE) stands to benefit dramatically from today’s unprecedented challenges in energy production. Big investors and government entities are buying up uranium mines, uranium metal, and investing in the new SMR Small Nuclear Reactors, because they sense an upcoming nuclear power renaissance as the world tries to pivot away from climate changing carbon fuels, especially Russian oil, gas, and coal, while at the same time fearing skyrocketing fuel prices. The last solution remaining to fill this vital gap is nuclear power.

Global demand for oil and gas is challenging capacity and creating unprecedented need for nuclear energy. Wind and solar are major energy providers, but their energy density is far too low to fill the gap

In addition to being a powerful and reliable energy source, nuclear energy is carbon-free

Uranium price has been rising sharply for the past year which tends to […]

Click here to view original web page at www.globenewswire.com

Is It Worth Investing in Uranium Energy Corp. (AMEX :UEC) Right Now?

Uranium Energy Corp. (AMEX:UEC) went down by -1.46% from its latest closing price compared to the recent 1-year high of $6.60. The company’s stock price has collected -2.03% of loss in the last five trading sessions.

Plus, the 36-month beta value for UEC is at 2.04. Opinions of the stock are interesting as 3 analysts out of 4 who provided ratings for Uranium Energy Corp. declared the stock was a “buy,” while 0 rated the stock as “overweight,” 1 rated it as “hold,” and 0 as “sell.”

Here’s Your FREE Report on the #1 Small-Cap Uranium Stock of ’22.

Small-cap Uranium stocks are booming in 2022! The company we’re about to show you is the ONLY small-cap stock in the space that benefits from ALL aspects of the global Uranium industry with none of the risks of running a mine. Smart investors will not be hesitating on this one! […]

Unloved since Fukushima, uranium is hot again for miners

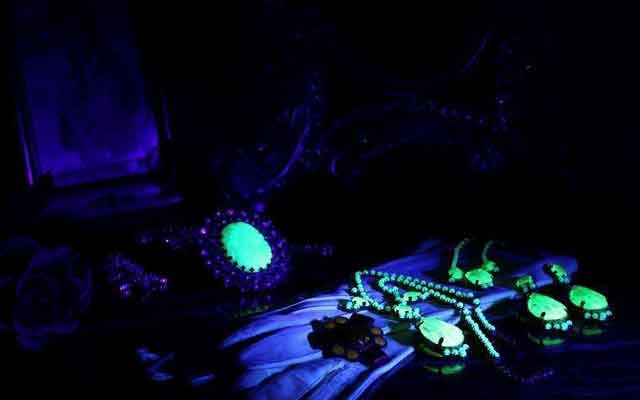

Uranium glass has a soft colour and distinctive glow that comes from the uranium added as the glass was created. It’s slightly radioactive, enough to register on Geiger counters. But the levels are about the same as electrical appliances like microwave ovens emit, so they represent no threat to health. Miners are racing to revive projects mothballed after the Fukushima disaster spurred by a leap in yellowcake prices after Russia’s invasion of Ukraine. Credit: Reuters Pictures/Facebook Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

"Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business," Tim Gitzel, CEO […]

NexGen Files Management Information Circular in Connection with Annual General and Special Meeting of Shareholders

VANCOUVER, BC, May 19, 2022 /PRNewswire/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE MKT: NXE) (ASX: NXG) is pleased to announce it has mailed the Notice of Meeting and Management Information Circular to shareholders of record as of May 9, 2022 in connection with the Annual General and Special Meeting to be held on Thursday, June 23, 2022, at 2:00 p.m. (Pacific Time).

Your vote is important – please vote today.

NexGen encourages shareholders to read the meeting materials, which have been filed on SEDAR ( www.sedar.com ) and ASX ( www.asx.com.au ) and are on our website at www.nexgenenergy.ca .

Shareholders will be asked to vote on the following matters: > Set the number of directors at nine; Elect directors for the ensuing year; Re-appoint the auditors for the ensuing year; and Re-approve the current stock option plan Meeting Access and Location: […]

FOCUS-Unloved since Fukushima, uranium is hot again for miners

Credit: REUTERS/Sonali Paul By Praveen Menon and Sonali Paul

SYDNEY/MELBOURNE, May 20 (Reuters) – Uranium miners are racing to revive projects mothballed after the Fukushima disaster more than a decade ago, spurred by renewed demand for nuclear energy and a leap in yellowcake prices after Russia’s invasion of Ukraine.

Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

"Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business," Tim Gitzel, CEO of Canada’s Cameco CCO.TO, which mothballed four of its mines after Fukushima, said on a May 5 earnings call .Uranium prices began to rise in mid-2021 as several countries […]