Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $4.82 to be very precise. The Stock rose vividly during the last session to $5.05 after opening rate of $5.05 while the lowest price it went was recorded $4.79 before closing at $4.88.Recently in News on March 17, 2022, Uranium Energy Corp Files Fiscal 2022 Q2 Quarterly Report. Uranium Energy Corp (NYSE American: UEC) the “Company” or “UEC”) is pleased to report, in accordance with NYSE American requirements, the filing of the Company’s quarterly report on Form 10-Q for the six months ended January 31, 2022 with the U.S. Securities and Exchange Commission (the “SEC”). This Form 10-Q filing, which includes the Company’s condensed consolidated financial statements, related notes thereto and management’s discussion and analysis, is available for viewing on the SEC’s website at http://www.sec.gov/edgar.shtml or on the Company’s website at www.uraniumenergy.com. You can […]

Tag: uranium

Expertise. Vision. Location. Catching Up with Canada’s Premier Uranium Project Generator

When Stockhouse Editorial last caught up with Fission 3.0 Corp. ( TSX-V.FUU , OTC: FISOF , Forum ) and its Chief Executive Officer and Chairman, Dev Randhawa back in October , we discussed the company’s unique uranium project generator and property bank business model…with the right projects in the right place. Fission 3.0 currently boasts 16 projects in the Athabasca Basin.

Fast-forward to Spring 2022, and Stockhouse Media’s Dave Jackson was joined, once again, by Mr. Randhawa to get our investor audience up-to-date with all things Fission 3.0. (CLICK IMAGE TO PLAY VIDEO)

TRANSCRIPT BELOW:

SH: So, can you update us on your any new company developments, especially your just-announced granting of stock options? DR: As you know, the hardest thing these days is to find people and keep them. So, we set some stock options for some of our new members. That’s the hardest thing, not just COVID, […]

The Zacks Analyst Blog Highlights VanEck Vectors Oil Services ETF, SPDR S&P Metals & Mining ETF, VanEck Vectors Steel ETF, SonicShares Global Shipping ETF and North Shore Global Uranium Mining ETF

For Immediate Release

Chicago, IL – March 28, 2022 – Zacks.com announces the list of stocks and ETFs featured in the Analyst Blog. Every day the Zacks Equity Research analysts discuss the latest news and events impacting stocks and the financial markets. ETFs recently featured in the blog include: VanEck Vectors Oil Services ETF OIH , SPDR S&P Metals & Mining ETF XME , VanEck Vectors Steel ETF SLX , SonicShares Global Shipping ETF BOAT and North Shore Global Uranium Mining ETF URNM . Here are highlights from Friday’s Analyst Blog:

5 Sector ETFs That Crushed the Market in Q1

The first quarter of 2022 has been marked by huge uncertainty and volatility in the stock markets. The Ukraine conflict coupled with inflationary pressures and the Fed’s tightening policy has made investors jittery. Additionally, a resurgence of virus cases in China that has sparked global economic growth concerns […]

Global Uranium Ore Market Size, Share, Types, Products, Trends, Growth, Applications and Forecast 2021 to 2026

The Uranium Ore market study provides a comprehensive analysis of the industry vertical. As per the report, this market is poised to acquire commendable returns and record a significant growth rate during the estimated timeframe.

The report exemplifies industry tendencies as well as presents revenue forecast, sales volume, market size and upcoming opportunities. In addition, information pertaining to the market drivers that will positively affect the profitability graph and the respective segmentations influencing the market size during the study period is delivered in the report.

Major takeaways from the Uranium Ore market report on the basis of geographical landscape: The Uranium Ore market report provides an in-depth analysis of the regional contribution. The report divides geographical terrain of market into North America, Europe, Asia-Pacific, South America, Middle East & Africa.

Crucial information concerning the sales garnered by each region and their respective market share is stated in the report. Estimated […]

Click here to view original web page at www.runningafrica.com

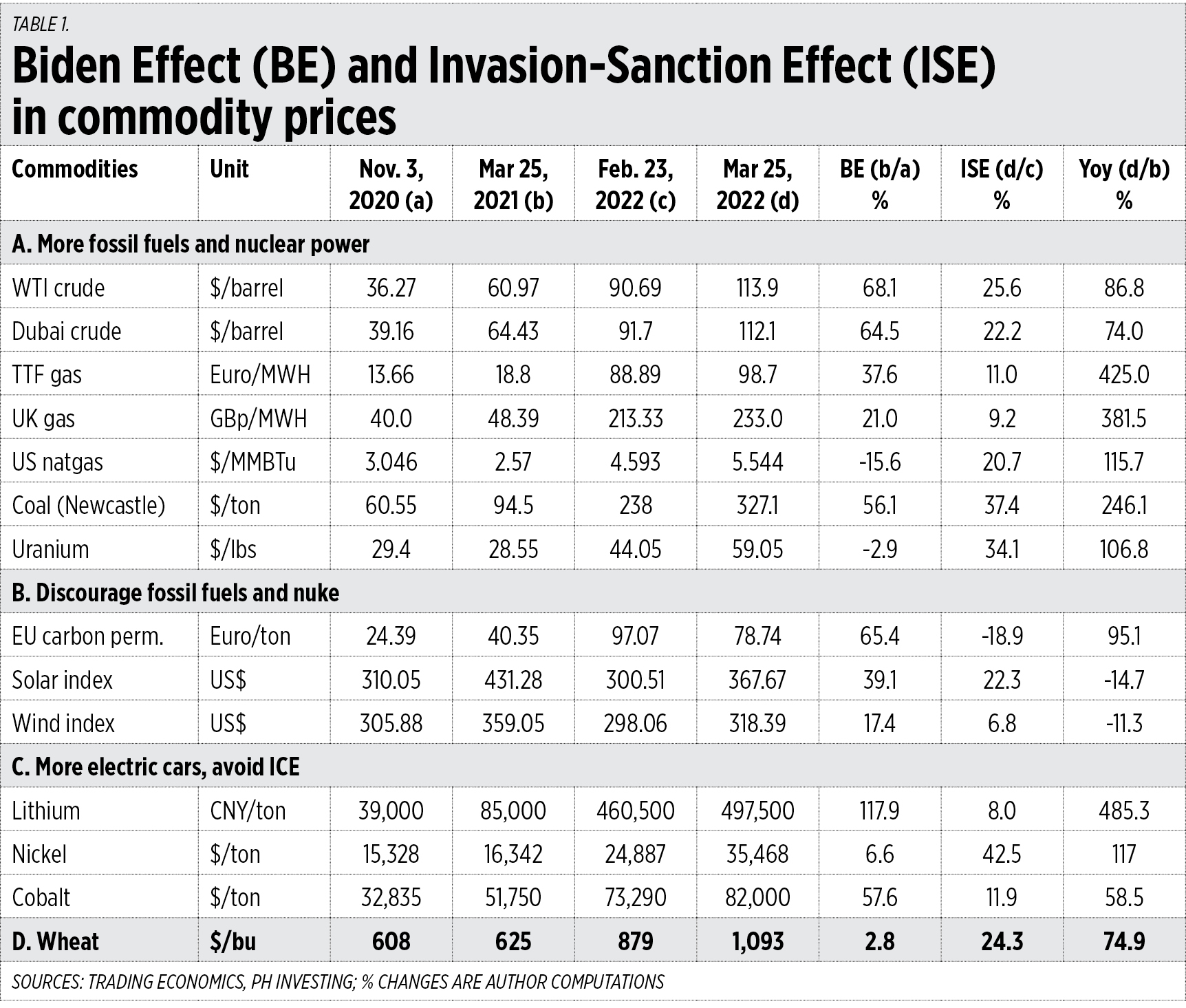

The effects of Biden and sanctions on energy and commodity prices

US President Joe Biden has already been in the White House for 14 months, and Russia’s invasion of Ukraine and the US-led economic sanctions against it have just marked one month, and things are worsening. Here are 10 emerging trends, global and national.

BIDEN’S EFFECT ON FOSSIL FUEL PRICES AND SUPPLY

One: Biden and the US Democrat Party campaigned, among other issues, for a war on fossil fuels. And on Day 1 of his administration, Jan. 20, 2021, he announced a halt to oil-gas drilling in federal lands, and the killing of the Keystone XL pipeline that would bring some 800,000 barrels per day of Canada crude oil to the US. See these reports:1. “In intimate moment, Biden vows to ‘end fossil fuel’,” AP News, Sept. 7, 2019 (“I guarantee you. We’re going to end fossil fuel.”)

2. “Keystone XL pipeline halted as Biden revokes permit,” AP News, Jan. 21, […]

Click here to view original web page at www.bworldonline.com

Kazatomprom: BMO Lowers Target To $47.50 Following “Erosion of Sentiment”

Last week Kazatomprom (LSE: KAP) , one of the largest uranium producers reported it’s full-year 2021 results and updated investors on the geopolitical event of Russia and Ukraine. For the results, the company reported full-year revenues of US$1.62 billion, up 14% year over year. This was because of a monster fourth quarter, wherein the company saw revenue balloon from US$224.9 million in the third quarter to US$834.2 million, which is up 270% year over year.

The company saw its gross profits grow 4% year over year to US$673.87 million, again thanks to the fourth quarter where gross profits grew 365% year over year to US$394.32 million. Total expenses grew 21% year over year to US$1.06 billion, putting the company’s operating profit at US$561.49 million, an increase of only 3% for the year. The majority of this increase came from the fourth quarter, which grew almost 500% year over year to […]

The West Can’t Decide Who Rules Russia But It Can Choose Where To Buy Its Oil, Gas, And Uranium

A tanker moored in a gas and oil dock at the Port of Constanta in Constanta, Romania, on Tuesday, … [+] © 2022 Bloomberg Finance LP When President Biden appeared in Poland yesterday, he said that the Russian leadership could not remain in power if it continued to brutalize Ukraine. To this end, the global economic sanctions are meant to isolate President Putin not just from the civilized world but also from his people. What’s more likely is that Russia will get gradually elbowed out of the global energy supply chain.

Russia’s economy centers on the sale of oil and natural gas. The country is also a supplier of nuclear energy technologies and the uranium to run those power plants. Pulling the plug will be hard. But it can be jostled loose over a few years. The United States, Australia, and Qatar can supply natural gas while the Middle Eastern […]

How Ukraine War Enriches Uranium Miners

AD

Loading advertisement…

00:00 / 04:24

This article is in your queue.Nuclear and weaponizing are scary words to utter together, even in the context of energy.That fear is behind a rally in a key fuel not yet hit by a physical shortage. Prices of uranium oxide have soared to $57.50 per pound, levels last seen more than a decade ago before the Fukushima disaster turned global sentiment against nuclear energy. They are up more than a third since Russia’s invasion of Ukraine. Shares of Canadian uranium miner Cameco CCJ -0.83% have rallied 29% year to date, while Sprott Physical Uranium Trust , UUT -1.28% a fund that owns physical uranium, is up 31%.Created with Highcharts 9.0.1Share of world’s uranium-enrichment capacity in 2020, operational and plannedSource: World Nuclear AssociationCreated with Highcharts 9.0.1RusssiaGermany, Netherlands, U.K.ChinaFranceU.S.0%5101520253035404550The immediate catalyst is fear that uranium supply out of Russia might be disrupted. Thursday, a group of U.S. senators […]

All You Need to Know About Uranium Stocks in 2022

Uranium stocks have been buzzing hot since the Russia-Ukraine war broke out. They were rising even before the war as uranium prices surged in August 2021. What caused this surge? Should you buy uranium stocks at their high? How to trade in commodity stocks?

Uranium is a commodity. Its price is determined by demand and supply forces. The price is around $50, a level last seen in 2012. This is the second straight year of price surges for this commodity.

When there is an under-supply, commodity prices start rising. But there comes a point when the price surges to a level where the producer gets an incentive to boost output to meet demand. At that point, the commodity price witnesses a correction and the price stabilizes. Hence, commodities are cyclical and are sensitive to demand and supply.

With uranium, there are several other complexities attached. Utilities are a major consumer […]

5 Sector ETFs That Crushed the Market in Q1

The first quarter of 2022 has been marked by huge uncertainty and volatility in the stock markets. The Ukraine conflict coupled with inflationary pressures and the Fed’s tightening policy has made investors jittery. Additionally, a resurgence of virus cases in China that has sparked global economic growth concerns added to the chaos.

While most corners of the market are in the red from a year-to-date look, a few have performed well. VanEck Vectors Oil Services ETF OIH, SPDR S&P Metals & Mining ETF XME, VanEck Vectors Steel ETF SLX, SonicShares Global Shipping ETF BOAT and North Shore Global Uranium Mining ETF URNM have gained in double-digits so far this year.

These funds have been the quarter’s star performers and could also be winners next quarter if the current trends continue. First-Quarter Market Trend

The ongoing Russia-Ukraine war has led to supply disruption fears in an already-tight commodity market. As Russia is […]

Uranium Exploration in Canada’s Athabasca Basin Holds Enormous Growth Potential

Although Canada is mostly known for its wealth of gold, copper and nickel, it is also the second largest global uranium producer, accounting for approximately 15 percent of global production.

As the world continues to stare down an impending climate crisis, nuclear power has emerged as a compelling and reliable source of clean energy . Because of this, demand for uranium — a crucial nuclear fuel source — is expected to increase considerably in the coming years.

According to the International Energy Agency, nuclear power generation grew in 2021, with output rising to 8 percent above 2019 levels . Although early 2022 was marked by the shutdown of three German plants , the overall outlook for nuclear energy nevertheless remains positive, buoyed considerably by the global focus on climate change .

Case in point, there are currently 440 operable reactors worldwide and a total of 55 reactors being constructed in […]

Sulliden Mining Capital Inc. Announces Agreement to Acquire Quebec Uranium Mining Concessions

Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here .

TORONTO, March 23, 2022 (GLOBE NEWSWIRE) — Sulliden Mining Capital Inc. (TSX: SMC ) (“Sulliden” or the “Company”) is pleased to announce it has entered into a share exchange agreement dated March 23, 2022, pursuant to which the Company has agreed to acquire all of the issued and outstanding common shares of a private Ontario company (“Privco”) from its shareholders, subject to the terms and conditions set out in the agreement.

Privco holds 965 uranium claims representing 51,035 hectares of concessions in the mining-friendly jurisdiction of Quebec. Most of the property is located in the Proterozoic Otish Supergroup. The claims represent a significant land position. Two of the three claim blocks surround the most advanced project in the district, the Matoush Deposit (owned by Consolidated Uranium Inc. (“Consolidated”)), that displays a […]

Click here to view original web page at www.streetinsider.com

Uranium Ore Market 2022 High Demand Trends – Cameco, BHP Billiton Ltd., Rio Tinto Group, Energy Resources of Australia and Paladin Energy

The Uranium Ore market study offers a thorough overview of the major factors impacting the global economy, including prospects, development trends, industrial technologies, risks, and other factors. The Uranium Ore report includes detailed detail on critical factors, prospects, and drawbacks, as well as a cost-benefit analysis. A comparative study of Uranium Ore market predictions is also provided for the proposed timeline to illustrate a global financial appetite for the Uranium Ore industry. The analysis includes micro and macroeconomic statistics, parent market trends, governing points, and sector attractiveness.

A number of demand factors have a significant impact on different consumer groups and regions, which is also looked into. This research emphasizes the necessity of being aware of pricing patterns, exploring opportunities, and evaluating competition performance. Furthermore, this study develops new logistical networks and expands global Uranium Ore markets. The competition in the regional sector contributes to increased Uranium Ore market visibility, […]

In 2022 Uranium Price Projected To Reach Multi-Year Highs, As Nuclear Interests May Be Back On The Table

PALM BEACH, Fla., March 23, 2022 /PRNewswire/ — FinancialNewsMedia.com News Commentary – Uranium is in the spotlight again as the world may be doing an about-face in turning to favor nuclear power plants again. A recent article from a financial media portal, ProactiveInvestors.com focused on policy makers in governments, saying that recent world circumstances may give those parties more ammunition. It said that: "some of the more thoughtful figures on the right wing of North American and European politics have been advocating a major re-focusing of attention on nuclear power for some years now. The pitch has always been simple enough – nuclear is clean, relative to coal, oil and natural gas, and you can produce it at a competitive price. Or to put it another way, if you want to accommodate the climate change lobby without breaking the bank on renewables subsidies, nuclear is the way to go. […]

FIRST URANIUM RESOURCES LTD. ANNOUNCES UPSIZE PRIVATE PLACEMENT FINANCING TO $8M

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Vancouver, British Columbia, March 24, 2022 (GLOBE NEWSWIRE) — First Uranium Resources Ltd. (the “ Company ” or “ First Uranium ”) (CSE: URNM) (OTCPK: KMMIF) (FSE:5KA0) is pleased to announce it has increased the size of the previously announced financing to C$8,000,000. The Company will issue subscription receipts of up to $8,000,000 gross proceeds at a price of $0.35 per subscription receipt for a total of up to 22,857,150 subscription receipts. Each subscription receipt is convertible into one common share and one half of a share purchase warrant, each whole warrant being exercisable into a common share for a price of $0.50 per share. The proceeds of the subscription private placement will be utilized for exploration work, and acquisition and development work on the Company’s Arkansas project described herein. Conversion of the […]

How Ukraine War Enriches Uranium Miners

AD

Loading advertisement…

00:00 / 04:24

This article is in your queue.Nuclear and weaponizing are scary words to utter together, even in the context of energy.That fear is behind a rally in a key fuel not yet hit by a physical shortage. Prices of uranium oxide have soared to $57.50 per pound, levels last seen more than a decade ago before the Fukushima disaster turned global sentiment against nuclear energy. They are up more than a third since Russia’s invasion of Ukraine. Shares of Canadian uranium miner Cameco CCJ -0.51% have rallied 29% year to date, while Sprott Physical Uranium Trust , UUT -1.02% a fund that owns physical uranium, is up 31%.Created with Highcharts 9.0.1Share of world’s uranium-enrichment capacity in 2020, operational and plannedSource: World Nuclear AssociationCreated with Highcharts 9.0.1RusssiaGermany, Netherlands, U.K.ChinaFranceU.S.0%5101520253035404550The immediate catalyst is fear that uranium supply out of Russia might be disrupted. Thursday, a group of U.S. senators […]

Resources Top 5: Battered graphite, uranium stocks catch a bid; phosphate hopeful in the spotlight as prices soar

share

Volt Resources forced to mothball Ukraine graphite mine; progresses plans to supply graphite product to a US gigafactory

Uranium stock Berkeley Energia has gained 170% since start of March on no news

Boadicea Resources preps lithium drilling; Kalamazoo (gold, lithium) and Avenira (phosphates) up on no news Here are the biggest small cap resources winners in early trade, Thursday March 24. Last year, VRC recently acquired of a 70% controlling interest in the Ukraine graphite producer ZG Group, which help “deliver on its strategy to become a key supplier of natural flake graphite products and battery anode material to the growing EV and other graphite markets”.But Russia’s invasion has disrupted these best laid plans, with the operation currently suspended.The graphite mine and processing facilities are located adjacent to the town of Zavallya, approximately 280 kilometres south of the Ukrainian capital Kyiv and 230 kilometres north […]

This ASX uranium share has rocketed 157% in a month. What’s the deal?

The Berkeley Energia Ltd (ASX: BKY) share price has exploded in the past month to its highest price since July 2021.

The company’s shares have skyrocketed nearly 157% since the market close on 24 February. The shares were swapping hands at 56 cents, up 21.74% at the close of trading today.

Let’s take a look at what has been going on with this ASX uranium miner. This ASX uranium share is surging

The Berkeley share price has soared amid rising uranium prices. Trading economics data reveals the uranium price has surged 34% in a month and 97% in a year. Uranium futures hit more than US$59 a pound amid concerns over Russian supplies.Berkeley has also explained possible reasons for the share price gains. On 17 March, the company responded to a price and volume query from the ASX.The company said it noted recent rises in the trading of its shares […]

Kiplin Metals Looks To Expand Uranium Project Portfolio Athabasca, Saskatchewan, Canada

March 23rd, 2022 – TheNewswire – Kiplin Metals Inc. (TSXV:KIP) (OTC:ALDVF) (the “Company” or “Kiplin”) announces that its board of directors has commenced a strategic review of several uranium projects near the Company’s CLR Uranium Project with the plan to expand the Company’s portfolio. The Company has engaged Grander Exploration to assist in the assessment and acquisition of prospective uranium projects.

Gil Schneider, Chief Executive Officer of the Company commented; “based on the encouraging initial results on the Company’s CLR Uranium Project, the Company is excited to assess other highly prospective uranium projects in Athabasca, Saskatchewan, that the board feels would enhance the Company’s project portfolio. The board of directors feels the timing is ideal for expansion as the price of uranium is rising and projections are for significant growth in demand for the coming decade. It seems the world is waking up to the idea that nuclear power is […]

Top Catalysts Driving Uranium Stocks to Higher Highs

Uranium prices are up about 40% since Russia invaded Ukraine. While the war has no immediate impact on global supplies of uranium, there are “signs a few countries in Europe may shift their stance on nuclear power and maintain existing reactors longer, or possibly build new ones sooner as they look to diversify away from Russian [natural] gas,” said Jonathan Hinze, president at UxC, as quoted by Barron’s. Moreover, the world’s dependence on Russian uranium, and the uranium of those countries in Russia’s orbit of influence such as Kazakhstan and Uzbekistan – representing about 50% of production – is potentially at risk through the prospect of retaliatory sanctions. Finally, President Biden’s Administration supports nuclear energy to help the country achieve net-zero carbon goals. Even Japan just said it wants to get nuclear reactors back online to meet green targets. All could continue to be beneficial for companies such as […]

How Ukraine War Enriches Uranium Miners

AD

Loading advertisement…

00:00 / 04:24

This article is in your queue.Nuclear and weaponizing are scary words to utter together, even in the context of energy.That fear is behind a rally in a key fuel not yet hit by a physical shortage. Prices of uranium oxide have soared to $57.50 per pound, levels last seen more than a decade ago before the Fukushima disaster turned global sentiment against nuclear energy. They are up more than a third since Russia’s invasion of Ukraine. Shares of Canadian uranium miner Cameco CCJ -0.51% have rallied 29% year to date, while Sprott Physical Uranium Trust , UUT -1.02% a fund that owns physical uranium, is up 31%.Created with Highcharts 9.0.1Share of world’s uranium-enrichment capacity in 2020, operational and plannedSource: World Nuclear AssociationCreated with Highcharts 9.0.1RusssiaGermany, Netherlands, U.K.ChinaFranceU.S.0%5101520253035404550The immediate catalyst is fear that uranium supply out of Russia might be disrupted. Thursday, a group of U.S. senators […]

Climate protection urgently needed – uranium would help

Themen

[PDF] Press Release: Climate protection urgently needed – uranium would help Herisau, 23.03.2022 (PresseBox) – .

In Germany, 2021 climate targets were missed, and greenhouse gas emissions increased.

Many countries have recognized that achieving climate targets is not possible without nuclear power plants, so new power plants are being built eagerly and many are in the planning stage. Unlike in this country. In 2021, 4.5 percent more greenhouse gases were blown into the air in Germany than the year before. With gas prices so high, there was an increased reliance on hard coal and lignite. Work is now underway on an emergency climate protection program. The expansion of renewable energies takes time, and our country in particular lacks wind and sun. Germany wants to be greenhouse gas neutral by 2045, which is no easy task.Compared to all other energy sources, uranium is very cheap. When electricity suppliers’ supply contracts […]

Top Catalysts Driving Uranium Stocks to Higher Highs

Uranium prices are up about 40% since Russia invaded Ukraine. While the war has no immediate impact on global supplies of uranium, there are “signs a few countries in Europe may shift their stance on nuclear power and maintain existing reactors longer, or possibly build new ones sooner as they look to diversify away from Russian [natural] gas,” said Jonathan Hinze, president at UxC, as quoted by Barron’s. Moreover, the world’s dependence on Russian uranium, and the uranium of those countries in Russia’s orbit of influence such as Kazakhstan and Uzbekistan – representing about 50% of production – is potentially at risk through the prospect of retaliatory sanctions. Finally, President Biden’s Administration supports nuclear energy to help the country achieve net-zero carbon goals. Even Japan just said it wants to get nuclear reactors back online to meet green targets. All could continue to be beneficial for companies such as […]

In 2022 Uranium Price Projected To Reach Multi-Year Highs, As Nuclear Interests May Be Back On The Table

BASIN URANIUM CORP. (CSE: NCLR.CN) (OTCPK: BURCF) BREAKING NEWS: BASIN URANIUM COMMENCES CAMP CONSTRUCTION AT MANN LAKE – BASIN URANIUM CORP. ("Basin Uranium" or the "Company") is pleased to announce it has mobilized to site with initial preparations for camp construction ahead of a comprehensive geophysical and diamond drill program at its Mann Lake uranium project in Saskatchewan’s prolific Athabasca Basin. The Mann Lake project is located 25km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

BASIN URANIUM CORP . (CSE: NCLR.CN) (OTCPK: BURCF) BREAKING NEWS: BASIN URANIUM COMMENCES CAMP CONSTRUCTION AT MANN LAKE – BASIN URANIUM CORP. ("Basin Uranium" or the "Company") is pleased to announce it has mobilized to site with initial preparations for camp construction ahead of a comprehensive geophysical and diamond drill program at its Mann […]

Climate protection urgently needed – uranium would help

Many countries have recognized that achieving climate targets is not possible without nuclear power plants, so new power plants are being built eagerly and many are in the planning stage. Unlike in this country. In 2021, 4.5 percent more greenhouse gases were blown into the air in Germany than the year before. With gas prices so high, there was an increased reliance on hard coal and lignite. Work is now underway on an emergency climate protection program. The expansion of renewable energies takes time, and our country in particular lacks wind and sun. Germany wants to be greenhouse gas neutral by 2045, which is no easy task.

Compared to all other energy sources, uranium is very cheap. When electricity suppliers’ supply contracts are nearing the end, demand for uranium increases. New contracts are then based on significantly higher prices. The fact that uranium is in demand can be seen from […]

Click here to view original web page at www.resource-capital.ch