mohamed_hassan / Pixabay Commodities are on fire.

The price of oil has soared 43% since the start of the year.

Palladium – a metal most often used in catalytic converters – has increased 28% over the same period, while wheat has spiked 39%…

George Soros’s Early CareerGeorge Soros is one of the most (in)famous figures in the world of finance. Known as ‘the man who broke the Bank of England’, thanks to his $10 billion bet against the British pound in 1992, Soros is one of the most successful hedge fund managers ever. While at the helm of the Quantum Fund Read More Get The Full Ray Dalio Series in PDFGet the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues Q4 2021 hedge fund letters, conferences and more These are major moves. But I see commodity prices […]

Tag: uranium

New $658m uranium major emerges as Deep Yellow ties the knot with Vimy Resources

Deep Yellow Vimy Resources uranium merger ASX DYL VMY Knocked back in November, merged in March — advanced uranium plays Deep Yellow (ASX: DYL) and Vimy Resources (ASX: VMY) have at last found common ground in a merger of their Australian and Namibia projects in a deal that creates a $658 million operation.

Deep Yellow is to acquire 100% of Vimy under a scheme of arrangement.

Vimy shareholders will receive 0.294 Deep Yellow stock for every 1 Vimy share, with Vimy shareholders representing 47% of the new Deep Yellow.

The new entity will own two advanced projects expected to begin the development pipeline voyage later this year or in 2023.At Mulga Rock in Western Australia Vimy has completed a definitive feasibility study and the merged group will look to produce a revised DFS that increases the value of the project by undertaking additional work.The existing Deep Yellow team will lead the studies […]

More for You

This Thursday, March 31, at 10 a.m., the Senate Energy and Natural Resources Committee will hold a hearing examining the country’s supply of critical minerals. The hearing should be an opportunity for Congress to determine how we can safely and sustainably secure minerals needed to power American’s transition to a clean energy economy. At top of mind should be reform of our antiquated mining law, which is more than 150 years-old.

So, you might be surprised to see that one of the invited witnesses comes from the Uranium Producers of America -a trade organization for the uranium industry. As trade representatives are apt to do, we fully expect them to use this hearing and the ongoing crisis in Ukraine to plead for more taxpayer-funded subsidies, so they can ramp up production quickly and cheaply.

This may sound like an opportunistic ploy to use a brutal war as a profit-making scheme. Make […]

Global Uranium Production Could More Than Double by 2040, According to Kinvestor Research Report

The Kinvestor Report on the global uranium industry covers its history and uses, analysis of current market data, and an outlook for the future of uranium.

VANCOUVER, BC, CANADA, March 30, 2022 / EINPresswire.com / — The latest Kinvestor Report on the global uranium industry covers the history and uses of uranium, analysis of current market data, and an outlook for the future of uranium exploration and production. The report also looks at factors of supply and demand and outlines major players in the industry.

Download the free Kinvestor Research report here for a full analysis of the global uranium industry.

BackgroundUsed as a nuclear energy source for over 60 years, uranium is a naturally-occuring heavy metal that can be found in rocks and seawater. As of 2020, nuclear power and other sources of renewable energy made up one third of the global electricity mix.The uranium market can be segmented into […]

Uranium Energy Corp. (AMEX: UEC) Stock: Investors Need To Know This

The trading price of Uranium Energy Corp. (AMEX:UEC) closed lower on Tuesday, March 29, closing at $4.54, -4.02% lower than its previous close.

Traders who pay close attention to intraday price movement should know that it fluctuated between $4.32 and $4.76. In examining the 52-week price action we see that the stock hit a 52-week high of $5.79 and a 52-week low of $1.89. Over the past month, the stock has gained 13.78% in value.

Uranium Energy Corp., whose market valuation is $1.34 billion at the time of this writing, is expected to release its quarterly earnings report Dec 14, 2021. Investors’ optimism about the company’s current quarter earnings report is understandable. Analysts have predicted the quarterly earnings per share to grow by $0 per share this quarter, however they have predicted annual earnings per share of $0 for 2022 and -$0.03 for 2023. It means analysts are expecting annual earnings […]

Boiling and ready to burst as Uranium Royalty Corp. (UROY) last month performance was -6.07%

At the end of the latest market close, Uranium Royalty Corp. (UROY) was valued at $4.13. In that particular session, Stock kicked-off at the price of $4.13 while reaching the peak value of $4.16 and lowest value recorded on the day was $3.85. The stock current value is $3.87.Recently in News on March 28, 2022, Uranium Royalty Corp. Expands Physical Uranium Holdings. Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (“URC” or the “Company”) announces that it has made additional uranium concentrate purchase commitments totaling 200,000 lbs U3O8 at an average cost of US$58.40 per pound. Deliveries will be made in April/May 2022 to URC’s storage account with Cameco Corporation in Ontario, Canada. The purchase will be funded with cash on hand and available credit. You can read further details here

Uranium Royalty Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price […]

Lawmakers see alternatives to Russian energy in their districts

With gas prices high and the world looking for alternatives to Russian oil and gas because of its invasion of Ukraine, some lawmakers are finding solutions in their own districts.

Russia’s incursion and the linked disruption of energy markets highlighted a long-running debate in Washington over the vulnerability of the U.S. and many of its allies to potential adversaries that feed the industrial world’s appetite for energy from oil and gas.

Republicans and fossil-fuel advocates have responded with calls to increase domestic oil and gas production by rolling back Biden administration policies that aim to wean the economy off of energy sources that contribute to climate change.

Democrats and environmentalists mark the invasion as a violent warning that it is time to shed the world’s reliance on fossil fuels not only because of climate change but because of the wealth and leverage it provides to oil- and gas-rich countries that don’t share […]

FIRST URANIUM RESOURCES LTD. ANNOUNCES FURTHER INCREASE TO THE PRIVATE PLACEMENT FINANCING TO $10M

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Vancouver, British Columbia, March 29, 2022 (GLOBE NEWSWIRE) — First Uranium Resources Ltd. (the “ Company ” or “ First Uranium ”) (CSE: URNM) (OTCPK:KMMIF) (FSE:5KA0) is pleased to announce it has further increased the size of the brokered private placement announced on March 9, 2022 and upsized on March 24, 2022 and March 25, 2022 to an aggregate total of $10,000,000 due to significant institutional demand.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or applicable state securities laws, and may not be offered or sold to persons in the United States absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall […]

Click here to view original web page at www.globenewswire.com

Here’s why the Alligator Energy (ASX:AGE) share price was snapping higher today

Shares in Alligator Energy Ltd (ASX: AGE) are on the move today following a positive company announcement to the ASX.

At one point, the uranium miner’s shares surged 15% to an intraday high of 11 cents before retracing during midday trade.

Currently, Alligator shares are 1.04% lower at 9.5 cents. “Exceptional high-grade uranium results”

Investors were bidding up the Alligator Energy share price this morning after the company reported “exceptional high-grade uranium results” from the Samphire Uranium Project in South Australia.According to the company’s release, Alligator Energy advised it has received strong results from resource infill drilling, a downhole prompt fission neutron (PFN) logging program, and further sonic core results.The company noted a rotary mud (infill) drilling program in the Blackbush deposit has concluded ahead of schedule. All holes were successfully logged with PFN, three-arm caliper, resistivity, neutron porosity, and natural gamma.Some of the results included: Hole 021 at 3.44 […]

Skyharbour’s Partner Company Azincourt Energy Completes Drill Program at the East Preston Uranium Project with Assays Pending

Vancouver, BC, March 29, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt), is pleased to announce that the 2022 exploration program has been completed at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada. Drilling for the 2022 winter season at the East Preston Project commenced in late January and a total of 5,004 metres were completed in 19 drill holes, which was cut slightly short due to the onset of warm weather. Drilling was focused on the G-, K-, and H-Zones with prior progress reported in news releases dated February 14th, 2022, March 1st, 2022, and March 16th, 2022. Packing up and demobilizing of the drill equipment and camp is underway with decommissioning of the road expected to be completed in early April.

Project Location – Western Athabasca Basin, […]

Skyharbour’s Partner Company Azincourt Energy Completes Drill Program at the East Preston Uranium Project with Assays Pending

Vancouver, BC, March 29, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt), is pleased to announce that the 2022 exploration program has been completed at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada. Drilling for the 2022 winter season at the East Preston Project commenced in late January and a total of 5,004 metres were completed in 19 drill holes, which was cut slightly short due to the onset of warm weather. Drilling was focused on the G-, K-, and H-Zones with prior progress reported in news releases dated February 14 th , 2022, March 1 st , 2022, and March 16 th , 2022. Packing up and demobilizing of the drill equipment and camp is underway with decommissioning of the road expected to be completed in early April.

[…]

Click here to view original web page at www.marketscreener.com

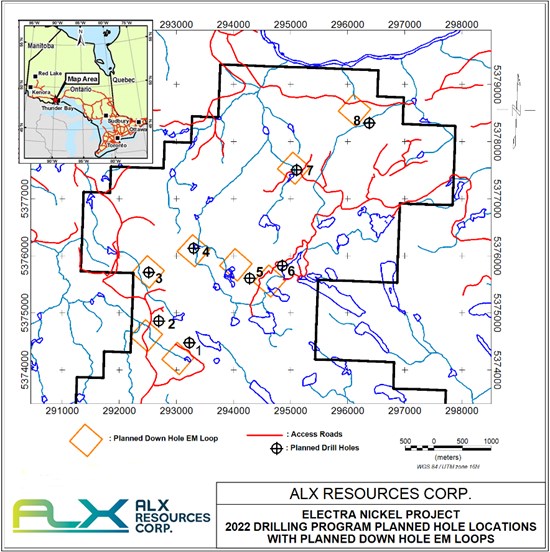

ALX Resources Corp. Begins Drilling Program at Electra Nickel Project, Ontario

ALX Resources Corp. is pleased to announce that a diamond drilling program is underway at its Electra Nickel Project located 35 kilometres northwest of Thunder Bay, Ontario, Canada.2022 Exploration ProgramOn March 10, 2022 ALX received an exploration permit from the Ontario Ministry of Energy, Northern Development and Mines for a diamond drilling program consisting of eight holes totaling approximately 1,750 metres, …

ALX Resources Corp. ( TSXV: AL ) (FSE: 6LLN) (OTC: ALXEF) ("ALX" or the "Company") is pleased to announce that a diamond drilling program is underway at its Electra Nickel Project located 35 kilometres northwest of Thunder Bay, Ontario, Canada.

2022 Exploration Program

On March 10, 2022 ALX received an exploration permit from the Ontario Ministry of Energy, Northern Development and Mines for a diamond drilling program consisting of eight holes totaling approximately 1,750 metres, good until March 2025. The duration of the 2022 winter drilling program […]

Skyharbour’s Partner Company Azincourt Energy Completes Drill Program at the East Preston Uranium Project with Assays Pending

Vancouver, BC, March 29, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Azincourt Energy (“Azincourt), is pleased to announce that the 2022 exploration program has been completed at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada. Drilling for the 2022 winter season at the East Preston Project commenced in late January and a total of 5,004 metres were completed in 19 drill holes, which was cut slightly short due to the onset of warm weather. Drilling was focused on the G-, K-, and H-Zones with prior progress reported in news releases dated February 14 th , 2022, March 1 st , 2022, and March 16 th , 2022. Packing up and demobilizing of the drill equipment and camp is underway with decommissioning of the road expected to be completed in early April.

[…]

Questor: we made easy money on this property developer – and now is right time to sell

When this column first looked at Harworth in June 2020 , shares in the land regeneration and property development specialist were trading at a 37pc discount to their net asset value of 156p a share.

That looked like good value and the shares have advanced smartly.

But the gain means that the shares, at 185p at last night’s close, now stand almost in line with their NAV of 178p.

While there is clearly long-term potential in Harworth’s portfolio of assets, it feels as if the easy money has been made and the cold, hard mathematics of valuation suggest it is time to (reluctantly) take profits.Harworth Group PLCFrom 1 Mar ’20 to 27 Mar20212022-40.0%-20.0%0.0%20%40%60% ⬤ Harworth Group PLC: 126.9 → 185.045.8% More share information on Make no mistake, last week’s full-year results from the Rotherham-headquartered firm were very good. In 2021 Harworth continued to actively manage its portfolio as it progressed planning permissions, […]

3 Reasons Canada Is Attracting Investors’ Attention

There is chaos in global stock markets. The Russia-Ukraine war has indirectly impacted Europe and the U.S., which depend on Russia for commodities like oil, natural gas, and uranium. But the western countries took a bold step and imposed sanctions on Russian oil and natural gas. Now, Russia is reportedly considering banning uranium supply to the United States. This war and the resulting sanctions disrupted the global supply chain and boosted commodity prices. All this uncertainty has made Canada an attractive avenue for risk-averse investors. Three reasons to invest in Canada

Oil prices

Uranium prices

House prices Canada benefits from rising oil prices Canada has the world’s third-largest oil sands reserves. It is the fifth-largest oil producer after the U.S., Saudi Arabia, Russia, and Iraq. At present, Russia and Iraq face sanctions, and a missile attack on Saudi Arabia’s fuel depot has raised fears of […]

Take note of this Trade Activity: Uranium Energy Corp. (UEC)

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $4.82 to be very precise. The Stock rose vividly during the last session to $5.05 after opening rate of $5.05 while the lowest price it went was recorded $4.79 before closing at $4.88.Recently in News on March 17, 2022, Uranium Energy Corp Files Fiscal 2022 Q2 Quarterly Report. Uranium Energy Corp (NYSE American: UEC) the “Company” or “UEC”) is pleased to report, in accordance with NYSE American requirements, the filing of the Company’s quarterly report on Form 10-Q for the six months ended January 31, 2022 with the U.S. Securities and Exchange Commission (the “SEC”). This Form 10-Q filing, which includes the Company’s condensed consolidated financial statements, related notes thereto and management’s discussion and analysis, is available for viewing on the SEC’s website at http://www.sec.gov/edgar.shtml or on the Company’s website at www.uraniumenergy.com. You can […]

Expertise. Vision. Location. Catching Up with Canada’s Premier Uranium Project Generator

When Stockhouse Editorial last caught up with Fission 3.0 Corp. ( TSX-V.FUU , OTC: FISOF , Forum ) and its Chief Executive Officer and Chairman, Dev Randhawa back in October , we discussed the company’s unique uranium project generator and property bank business model…with the right projects in the right place. Fission 3.0 currently boasts 16 projects in the Athabasca Basin.

Fast-forward to Spring 2022, and Stockhouse Media’s Dave Jackson was joined, once again, by Mr. Randhawa to get our investor audience up-to-date with all things Fission 3.0. (CLICK IMAGE TO PLAY VIDEO)

TRANSCRIPT BELOW:

SH: So, can you update us on your any new company developments, especially your just-announced granting of stock options? DR: As you know, the hardest thing these days is to find people and keep them. So, we set some stock options for some of our new members. That’s the hardest thing, not just COVID, […]

The Zacks Analyst Blog Highlights VanEck Vectors Oil Services ETF, SPDR S&P Metals & Mining ETF, VanEck Vectors Steel ETF, SonicShares Global Shipping ETF and North Shore Global Uranium Mining ETF

For Immediate Release

Chicago, IL – March 28, 2022 – Zacks.com announces the list of stocks and ETFs featured in the Analyst Blog. Every day the Zacks Equity Research analysts discuss the latest news and events impacting stocks and the financial markets. ETFs recently featured in the blog include: VanEck Vectors Oil Services ETF OIH , SPDR S&P Metals & Mining ETF XME , VanEck Vectors Steel ETF SLX , SonicShares Global Shipping ETF BOAT and North Shore Global Uranium Mining ETF URNM . Here are highlights from Friday’s Analyst Blog:

5 Sector ETFs That Crushed the Market in Q1

The first quarter of 2022 has been marked by huge uncertainty and volatility in the stock markets. The Ukraine conflict coupled with inflationary pressures and the Fed’s tightening policy has made investors jittery. Additionally, a resurgence of virus cases in China that has sparked global economic growth concerns […]

Global Uranium Ore Market Size, Share, Types, Products, Trends, Growth, Applications and Forecast 2021 to 2026

The Uranium Ore market study provides a comprehensive analysis of the industry vertical. As per the report, this market is poised to acquire commendable returns and record a significant growth rate during the estimated timeframe.

The report exemplifies industry tendencies as well as presents revenue forecast, sales volume, market size and upcoming opportunities. In addition, information pertaining to the market drivers that will positively affect the profitability graph and the respective segmentations influencing the market size during the study period is delivered in the report.

Major takeaways from the Uranium Ore market report on the basis of geographical landscape: The Uranium Ore market report provides an in-depth analysis of the regional contribution. The report divides geographical terrain of market into North America, Europe, Asia-Pacific, South America, Middle East & Africa.

Crucial information concerning the sales garnered by each region and their respective market share is stated in the report. Estimated […]

Click here to view original web page at www.runningafrica.com

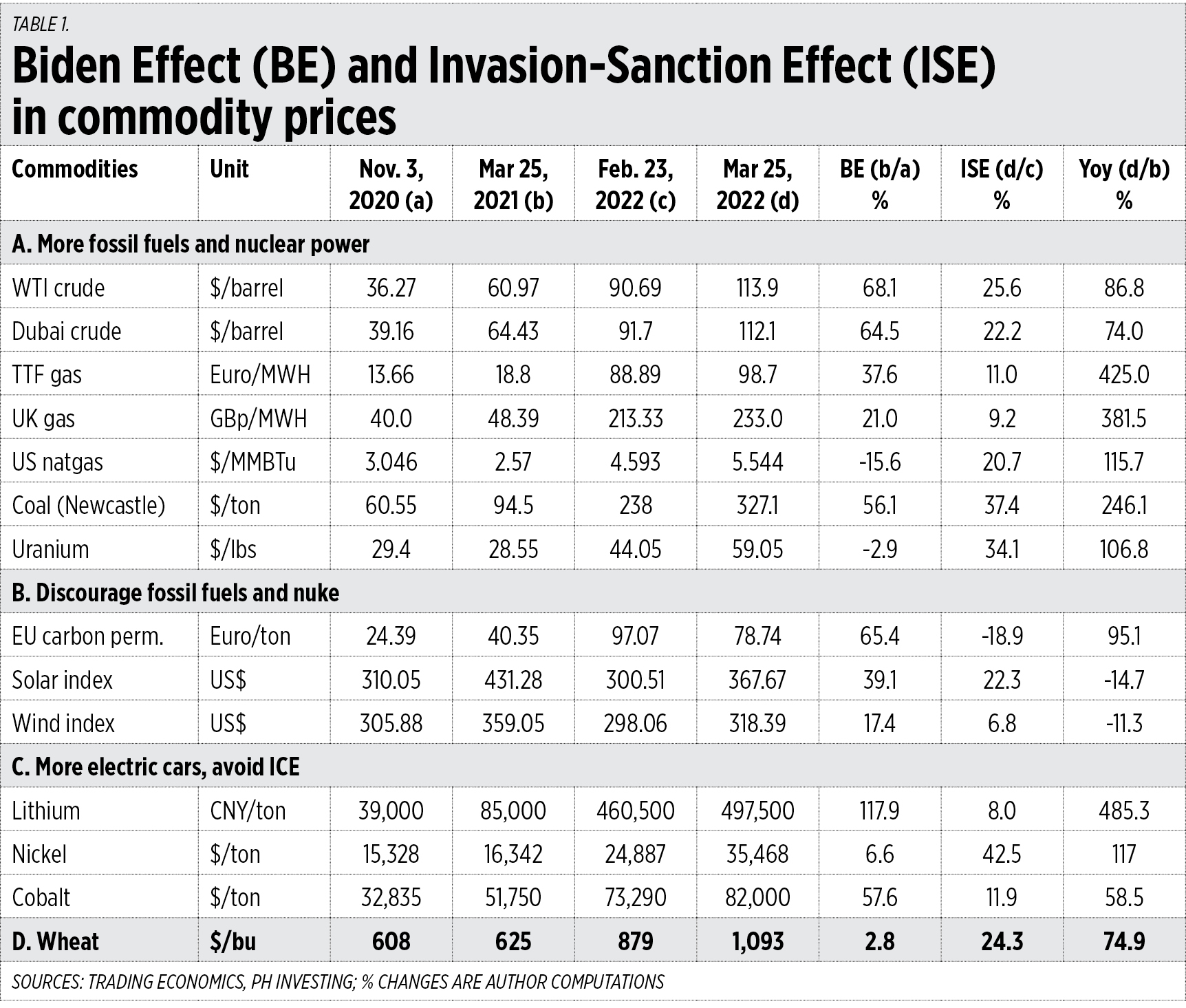

The effects of Biden and sanctions on energy and commodity prices

US President Joe Biden has already been in the White House for 14 months, and Russia’s invasion of Ukraine and the US-led economic sanctions against it have just marked one month, and things are worsening. Here are 10 emerging trends, global and national.

BIDEN’S EFFECT ON FOSSIL FUEL PRICES AND SUPPLY

One: Biden and the US Democrat Party campaigned, among other issues, for a war on fossil fuels. And on Day 1 of his administration, Jan. 20, 2021, he announced a halt to oil-gas drilling in federal lands, and the killing of the Keystone XL pipeline that would bring some 800,000 barrels per day of Canada crude oil to the US. See these reports:1. “In intimate moment, Biden vows to ‘end fossil fuel’,” AP News, Sept. 7, 2019 (“I guarantee you. We’re going to end fossil fuel.”)

2. “Keystone XL pipeline halted as Biden revokes permit,” AP News, Jan. 21, […]

Click here to view original web page at www.bworldonline.com

Kazatomprom: BMO Lowers Target To $47.50 Following “Erosion of Sentiment”

Last week Kazatomprom (LSE: KAP) , one of the largest uranium producers reported it’s full-year 2021 results and updated investors on the geopolitical event of Russia and Ukraine. For the results, the company reported full-year revenues of US$1.62 billion, up 14% year over year. This was because of a monster fourth quarter, wherein the company saw revenue balloon from US$224.9 million in the third quarter to US$834.2 million, which is up 270% year over year.

The company saw its gross profits grow 4% year over year to US$673.87 million, again thanks to the fourth quarter where gross profits grew 365% year over year to US$394.32 million. Total expenses grew 21% year over year to US$1.06 billion, putting the company’s operating profit at US$561.49 million, an increase of only 3% for the year. The majority of this increase came from the fourth quarter, which grew almost 500% year over year to […]

The West Can’t Decide Who Rules Russia But It Can Choose Where To Buy Its Oil, Gas, And Uranium

A tanker moored in a gas and oil dock at the Port of Constanta in Constanta, Romania, on Tuesday, … [+] © 2022 Bloomberg Finance LP When President Biden appeared in Poland yesterday, he said that the Russian leadership could not remain in power if it continued to brutalize Ukraine. To this end, the global economic sanctions are meant to isolate President Putin not just from the civilized world but also from his people. What’s more likely is that Russia will get gradually elbowed out of the global energy supply chain.

Russia’s economy centers on the sale of oil and natural gas. The country is also a supplier of nuclear energy technologies and the uranium to run those power plants. Pulling the plug will be hard. But it can be jostled loose over a few years. The United States, Australia, and Qatar can supply natural gas while the Middle Eastern […]

How Ukraine War Enriches Uranium Miners

AD

Loading advertisement…

00:00 / 04:24

This article is in your queue.Nuclear and weaponizing are scary words to utter together, even in the context of energy.That fear is behind a rally in a key fuel not yet hit by a physical shortage. Prices of uranium oxide have soared to $57.50 per pound, levels last seen more than a decade ago before the Fukushima disaster turned global sentiment against nuclear energy. They are up more than a third since Russia’s invasion of Ukraine. Shares of Canadian uranium miner Cameco CCJ -0.83% have rallied 29% year to date, while Sprott Physical Uranium Trust , UUT -1.28% a fund that owns physical uranium, is up 31%.Created with Highcharts 9.0.1Share of world’s uranium-enrichment capacity in 2020, operational and plannedSource: World Nuclear AssociationCreated with Highcharts 9.0.1RusssiaGermany, Netherlands, U.K.ChinaFranceU.S.0%5101520253035404550The immediate catalyst is fear that uranium supply out of Russia might be disrupted. Thursday, a group of U.S. senators […]

All You Need to Know About Uranium Stocks in 2022

Uranium stocks have been buzzing hot since the Russia-Ukraine war broke out. They were rising even before the war as uranium prices surged in August 2021. What caused this surge? Should you buy uranium stocks at their high? How to trade in commodity stocks?

Uranium is a commodity. Its price is determined by demand and supply forces. The price is around $50, a level last seen in 2012. This is the second straight year of price surges for this commodity.

When there is an under-supply, commodity prices start rising. But there comes a point when the price surges to a level where the producer gets an incentive to boost output to meet demand. At that point, the commodity price witnesses a correction and the price stabilizes. Hence, commodities are cyclical and are sensitive to demand and supply.

With uranium, there are several other complexities attached. Utilities are a major consumer […]

5 Sector ETFs That Crushed the Market in Q1

The first quarter of 2022 has been marked by huge uncertainty and volatility in the stock markets. The Ukraine conflict coupled with inflationary pressures and the Fed’s tightening policy has made investors jittery. Additionally, a resurgence of virus cases in China that has sparked global economic growth concerns added to the chaos.

While most corners of the market are in the red from a year-to-date look, a few have performed well. VanEck Vectors Oil Services ETF OIH, SPDR S&P Metals & Mining ETF XME, VanEck Vectors Steel ETF SLX, SonicShares Global Shipping ETF BOAT and North Shore Global Uranium Mining ETF URNM have gained in double-digits so far this year.

These funds have been the quarter’s star performers and could also be winners next quarter if the current trends continue. First-Quarter Market Trend

The ongoing Russia-Ukraine war has led to supply disruption fears in an already-tight commodity market. As Russia is […]